Phosphine Fumigation Market Report

Published Date: 02 February 2026 | Report Code: phosphine-fumigation

Phosphine Fumigation Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Phosphine Fumigation market, providing insights on market size, segmentation, regional dynamics, technological advancements, and future forecasts through 2033.

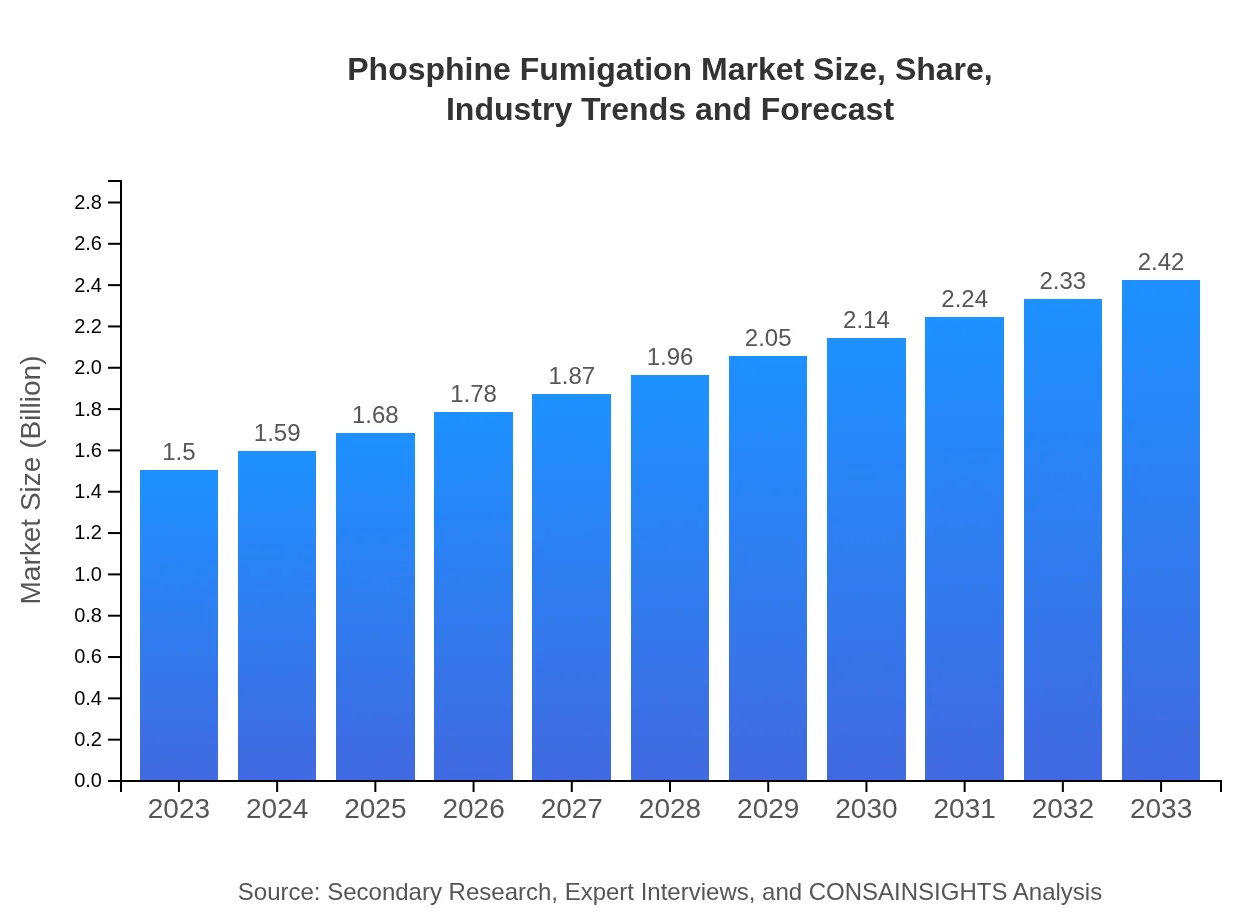

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.42 Billion |

| Top Companies | BASF SE, ZETAGI, Control Solutions, Inc., Syngenta AG |

| Last Modified Date | 02 February 2026 |

Phosphine Fumigation Market Overview

Customize Phosphine Fumigation Market Report market research report

- ✔ Get in-depth analysis of Phosphine Fumigation market size, growth, and forecasts.

- ✔ Understand Phosphine Fumigation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Phosphine Fumigation

What is the Market Size & CAGR of Phosphine Fumigation market in 2023?

Phosphine Fumigation Industry Analysis

Phosphine Fumigation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Phosphine Fumigation Market Analysis Report by Region

Europe Phosphine Fumigation Market Report:

Europe presents a unique situation, with the market size increasing from $0.40 billion in 2023 to $0.65 billion by 2033. Key advancements in sustainable pest management solutions, along with tightening EU regulations on chemical usage, are propelling the sector towards safer fumigation practices.Asia Pacific Phosphine Fumigation Market Report:

In 2023, the Asia Pacific region holds a market value of approximately $0.30 billion, projected to expand to $0.48 billion by 2033. Rapid industrialization and increasing agricultural exports are driving demand in countries like India and China, leading to heightened adoption of phosphine fumigation practices for enhanced grain storage methods.North America Phosphine Fumigation Market Report:

North America is a robust market, expected to grow from $0.51 billion in 2023 to $0.82 billion by 2033. The emphasis on food security and stringent phytosanitary regulations compel the adoption of effective pest treatment methods, supporting strong growth prospects in the region.South America Phosphine Fumigation Market Report:

South America is anticipated to see market growth from $0.13 billion in 2023 to $0.21 billion by 2033. The agricultural sector's growth, particularly in Brazil and Argentina, contributes to rising awareness and application of phosphine fumigation for pest management in extensive grain production areas.Middle East & Africa Phosphine Fumigation Market Report:

The Middle East and Africa region is projected to expand from $0.16 billion in 2023 to $0.26 billion by 2033. Growing agricultural initiatives and investments in pest management technology help bolster market presence, making efficient fumigation essential for tackling agricultural challenges.Tell us your focus area and get a customized research report.

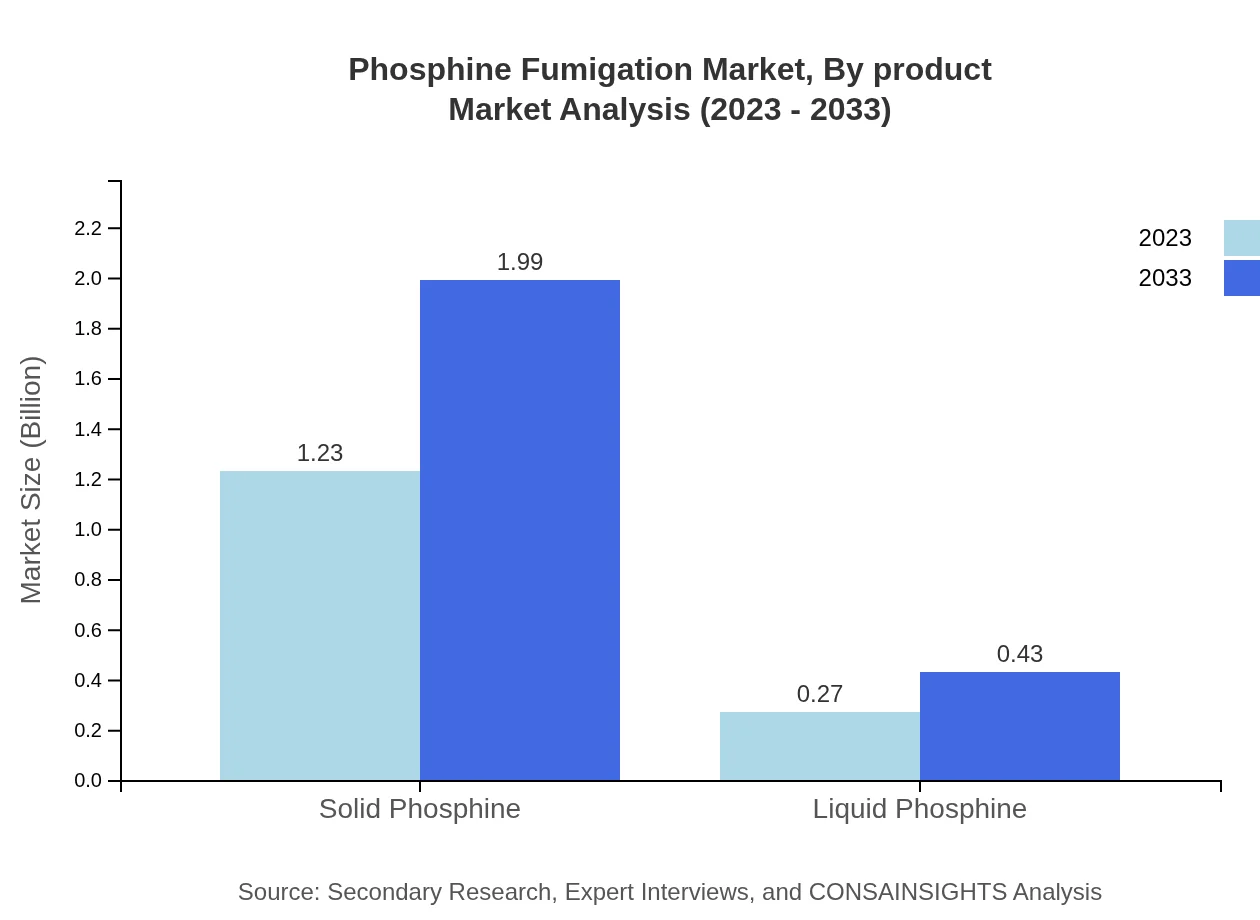

Phosphine Fumigation Market Analysis By Product

The market is predominantly segmented into solid and liquid phosphine. The solid phosphine segment leads the market with a size of $1.23 billion in 2023, potentially reaching $1.99 billion by 2033, commanding 82.21% market share. Liquid phosphine, while smaller at $0.27 billion in 2023 growing to $0.43 billion by 2033, has a share of 17.79%. The efficacy of solid phosphine in pest control applications is a critical success factor.

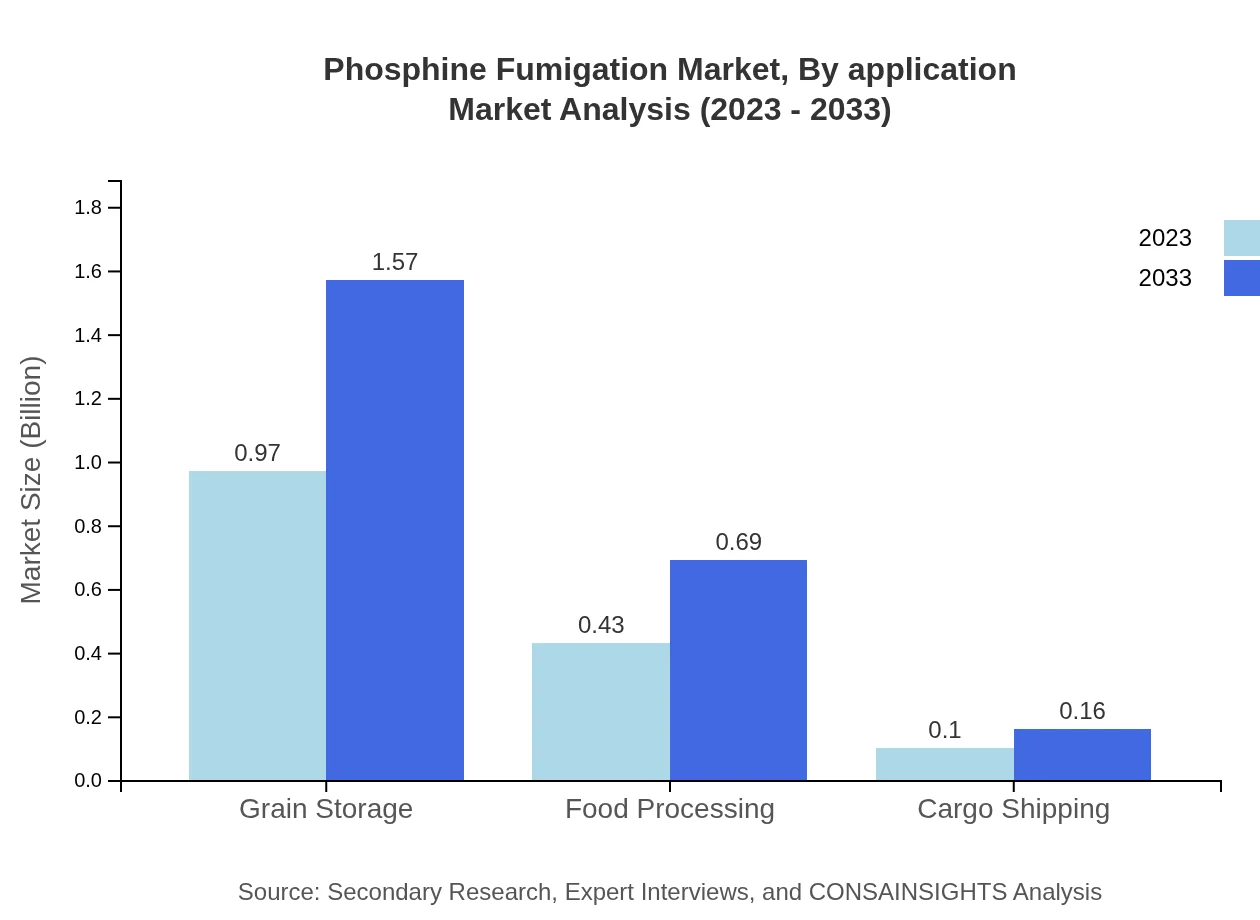

Phosphine Fumigation Market Analysis By Application

The applications include agriculture, warehousing, food retail, grain storage, food processing, and cargo shipping. The agricultural segment is leading with $0.97 billion in 2023 and is expected to grow to $1.57 billion by 2033, representing a 64.76% share. Warehousing follows closely with $0.43 billion in 2023, expected to reach $0.69 billion by 2033, representing 28.6%. These segments reflect the necessity of fumigation for preserving stored agricultural products.

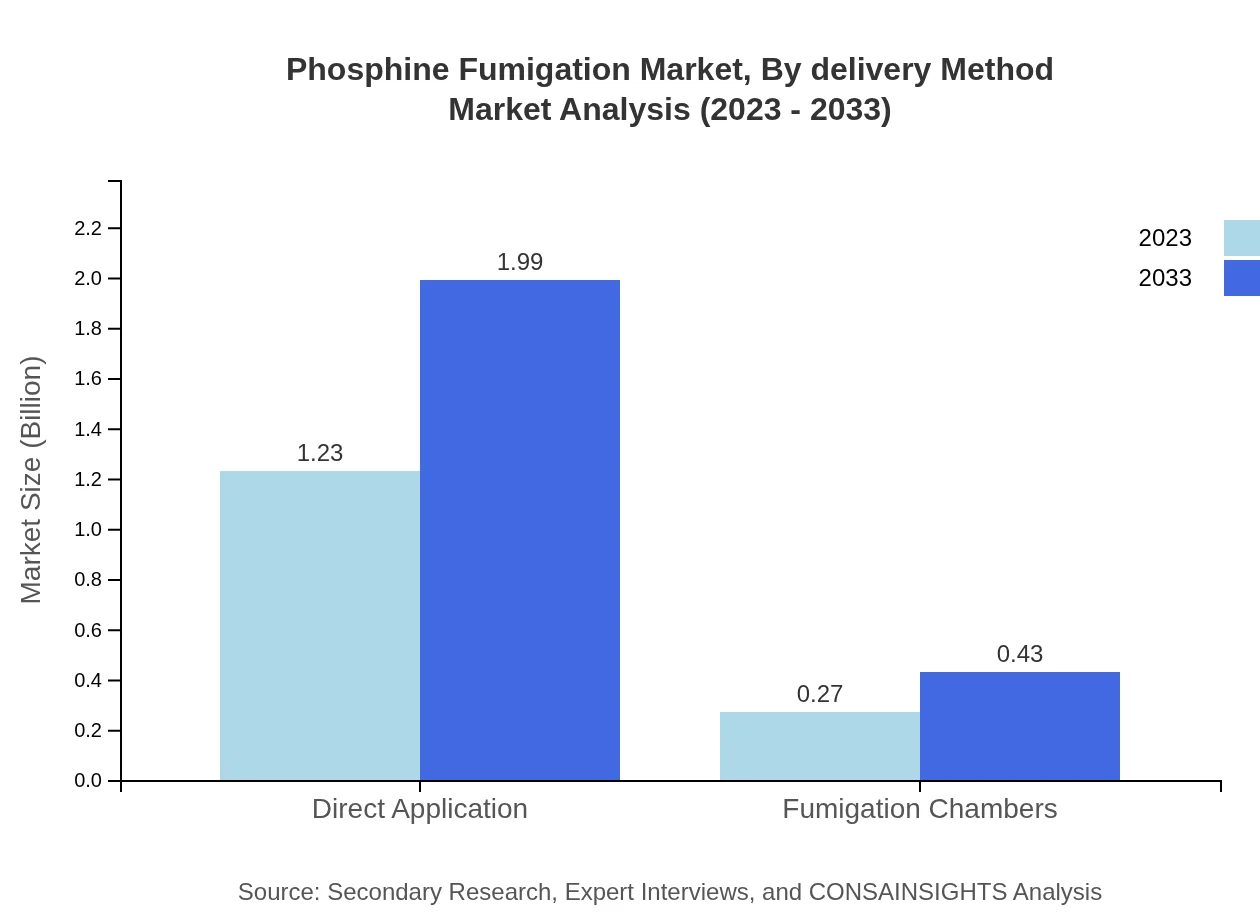

Phosphine Fumigation Market Analysis By Delivery Method

The delivery methods encompass direct application and fumigation chambers. The direct application segment stands dominant at $1.23 billion in 2023, projected to increase to $1.99 billion by 2033, accounting for 82.21%. Fumigation chambers present an emerging niche, growing from $0.27 billion in 2023 to $0.43 billion by 2033, holding 17.79% market share. The growth signifies increasing modernization in fumigation procedures.

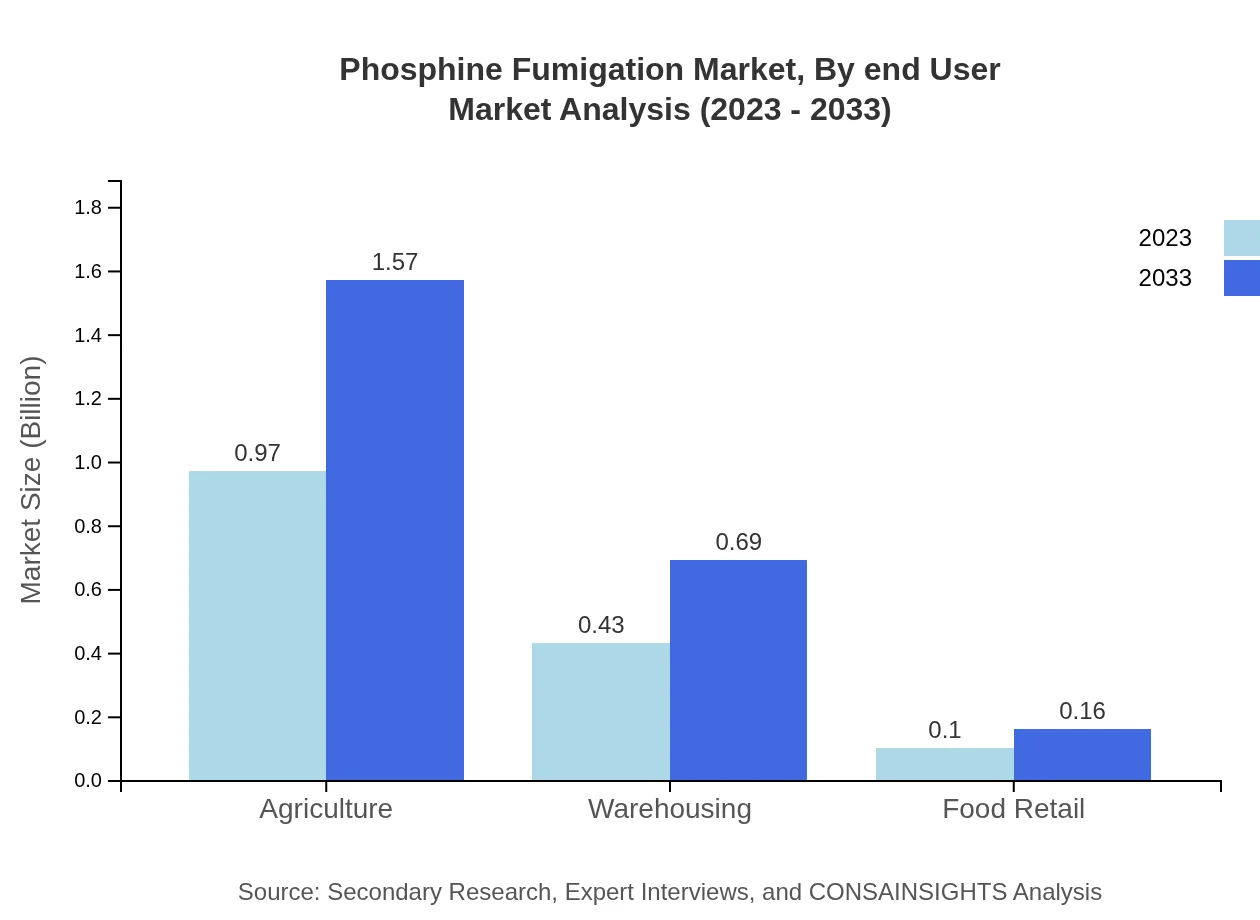

Phosphine Fumigation Market Analysis By End User

This segment highlights applications in agriculture, warehousing, food processing, and shipping. Agriculture is the largest end-user, with $0.97 billion in 2023 and forecasted at $1.57 billion by 2033. Warehousing holds substantial value too, with $0.43 billion in 2023 growing to $0.69 billion, showcasing the importance of pest control in maintaining grain quality.

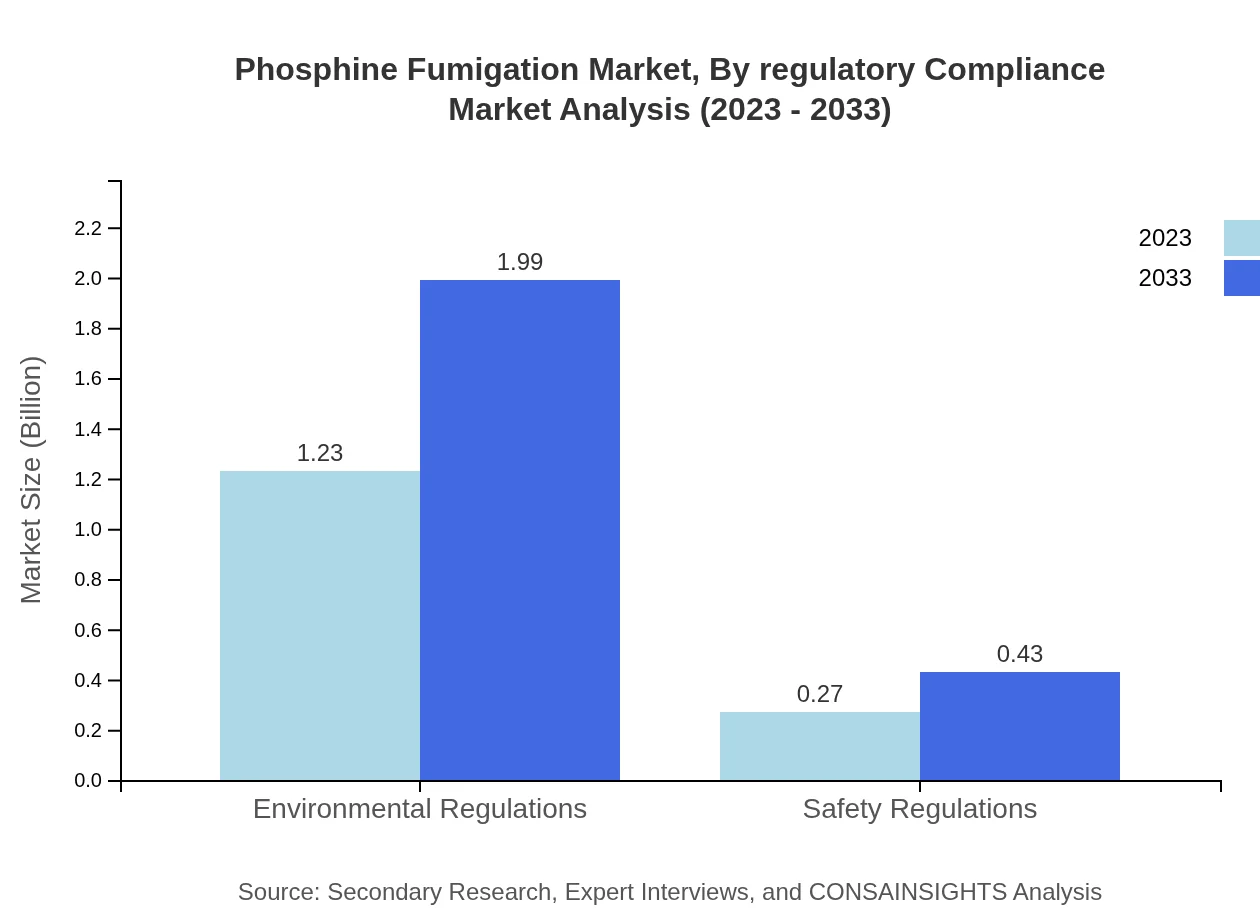

Phosphine Fumigation Market Analysis By Regulatory Compliance

The regulatory landscape significantly affects the market, with a focus on environmental and safety regulations. The segment for environmental regulations is evaluated at $1.23 billion in 2023, projected to rise to $1.99 billion by 2033, while safety regulations follow at $0.27 billion in 2023, expected to grow to $0.43 billion by 2033. Compliance drives the sector towards innovative and safer fumigation technologies.

Phosphine Fumigation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Phosphine Fumigation Industry

BASF SE:

A leading chemical company based in Germany, BASF SE engages in developing innovative agricultural solutions, including phosphine fumigation products that cater to various pest management needs.ZETAGI:

ZETAGI produces high-quality fumigants and provides services related to pest management, playing a significant role in enhancing the effectiveness of phosphine fumigation.Control Solutions, Inc.:

A prominent player providing pest control products and solutions, Control Solutions emphasizes sustainable and effective phosphine fumigation technologies.Syngenta AG:

Syngenta specializes in crop protection products, delivering advanced phosphine formulations to enhance global agricultural productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of phosphine Fumigation?

The phosphine fumigation market is currently valued at approximately $1.5 billion, with a projected CAGR of 4.8% from 2023 to 2033. This growth indicates increasing demand in agricultural and warehousing sectors.

What are the key market players or companies in this phosphine Fumigation industry?

Key players in the phosphine fumigation market include major companies engaged in pest control products, with leading brands focusing on innovative fumigation techniques and environmentally safer alternatives to enhance market competitiveness.

What are the primary factors driving the growth in the phosphine Fumigation industry?

Growth in the phosphine fumigation industry is driven by rising global agricultural output, increasing pest resistance to conventional fumigants, and intensifying regulations favoring phosphine over harmful alternatives.

Which region is the fastest Growing in the phosphine Fumigation?

The fastest-growing region for phosphine fumigation is Europe, projected to increase from $0.40 billion in 2023 to $0.65 billion by 2033, reflecting a robust agricultural market and heightened food safety standards.

Does ConsaInsights provide customized market report data for the phosphine Fumigation industry?

Yes, ConsaInsights specializes in offering customized market reports for the phosphine fumigation industry to cater to specific client requirements and detailed market insights.

What deliverables can I expect from this phosphine Fumigation market research project?

Deliverables from the phosphine fumigation market research project typically include a comprehensive report featuring detailed market analysis, growth projections, segmented data, and competitive landscape analysis.

What are the market trends of phosphine Fumigation?

The phosphine fumigation market is witnessing trends such as increased adoption of solid phosphine applications, enhanced safety protocols, and innovation in fumigation technologies, particularly in agricultural and warehousing sectors.