Photoresist And Photoresist Ancillaries Market Report

Published Date: 02 February 2026 | Report Code: photoresist-and-photoresist-ancillaries

Photoresist And Photoresist Ancillaries Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Photoresist and Photoresist Ancillaries market, focusing on market trends, technological advancements, regional dynamics, and future forecasts for the period 2023 to 2033.

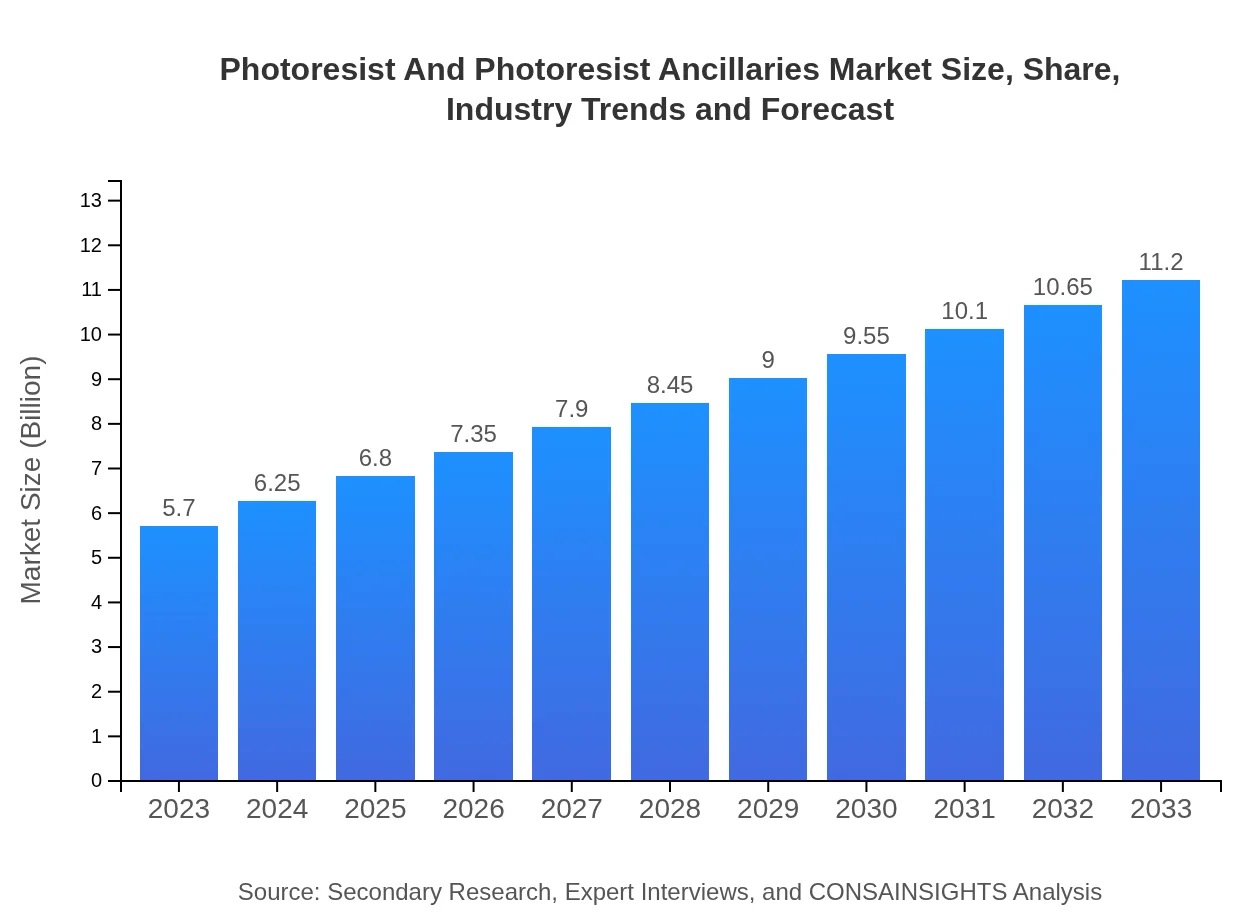

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.20 Billion |

| Top Companies | Dow Inc., Tokyo Ohka Kogyo Co., Ltd., JSR Corporation, Shin-Etsu Chemical Co., Ltd., Merck Group |

| Last Modified Date | 02 February 2026 |

Photoresist And Photoresist Ancillaries Market Overview

Customize Photoresist And Photoresist Ancillaries Market Report market research report

- ✔ Get in-depth analysis of Photoresist And Photoresist Ancillaries market size, growth, and forecasts.

- ✔ Understand Photoresist And Photoresist Ancillaries's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Photoresist And Photoresist Ancillaries

What is the Market Size & CAGR of Photoresist And Photoresist Ancillaries market in 2023?

Photoresist And Photoresist Ancillaries Industry Analysis

Photoresist And Photoresist Ancillaries Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Photoresist And Photoresist Ancillaries Market Analysis Report by Region

Europe Photoresist And Photoresist Ancillaries Market Report:

The European market stands at USD 1.80 billion in 2023 and is expected to reach USD 3.55 billion by 2033. The ongoing trend of miniaturization in electronic components is stimulating demand for high-performance photoresists in advanced manufacturing processes.Asia Pacific Photoresist And Photoresist Ancillaries Market Report:

In 2023, the Photoresist market in the Asia Pacific is valued at USD 1.06 billion, with anticipated growth to USD 2.08 billion by 2033. This region is driven by high demand from semiconductor manufacturers in countries like China, Taiwan, and South Korea, as they adopt cutting-edge technologies to enhance production efficiency.North America Photoresist And Photoresist Ancillaries Market Report:

North America’s market is set at USD 1.98 billion in 2023, projected to increase to USD 3.89 billion by 2033. The region's robust semiconductor landscape and focus on technological innovation are prime drivers for market expansion.South America Photoresist And Photoresist Ancillaries Market Report:

The South American market is relatively nascent, estimated at USD 0.54 billion in 2023, expected to grow to USD 1.06 billion by 2033. Growth factors include increased investment in telecommunications and electronics sectors, which are gradually adopting modern manufacturing techniques.Middle East & Africa Photoresist And Photoresist Ancillaries Market Report:

The Middle East and Africa exhibit a modest market of USD 0.32 billion in 2023, projected to grow to USD 0.62 billion by 2033. Growth is driven by expanding telecommunications networks and efforts to boost local manufacturing in response to global supply chain dynamics.Tell us your focus area and get a customized research report.

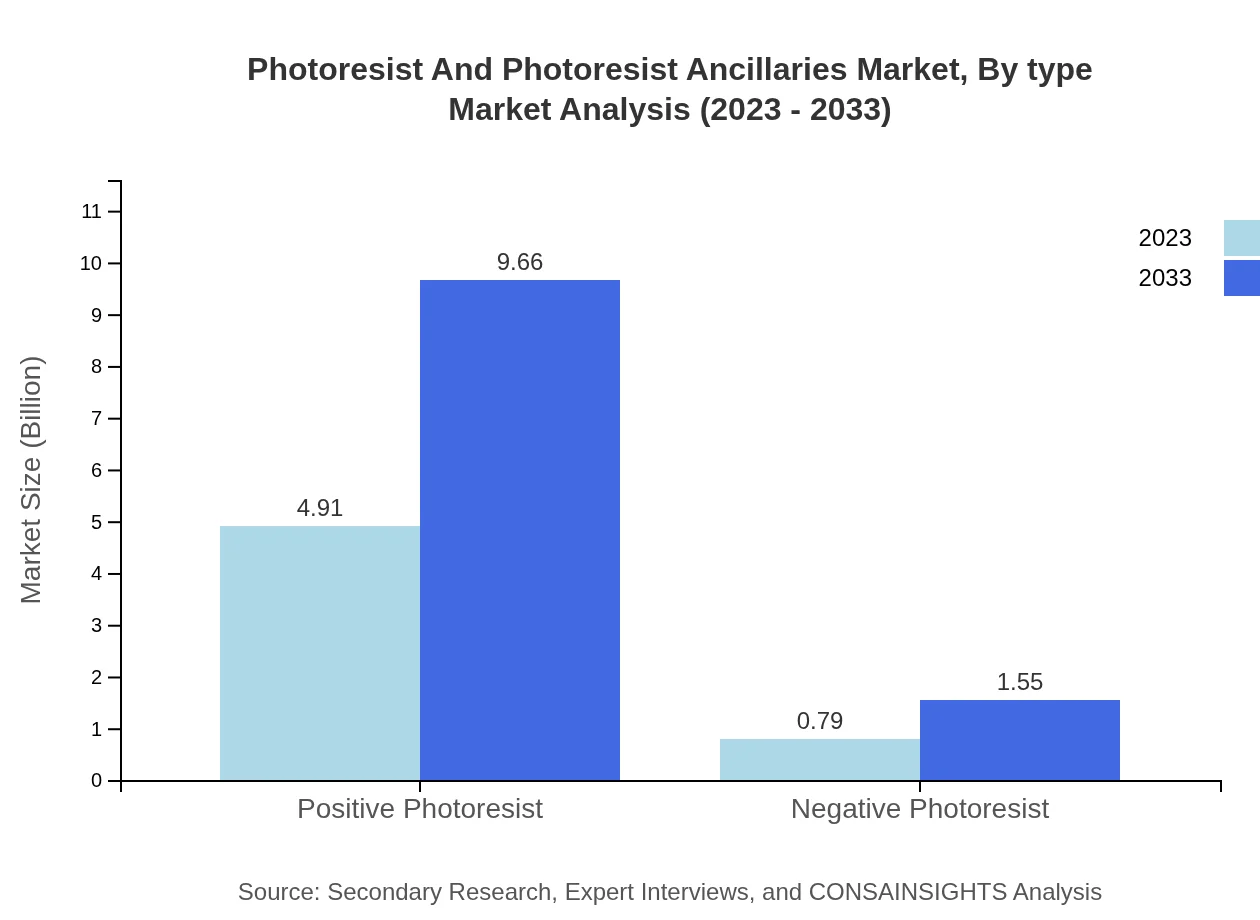

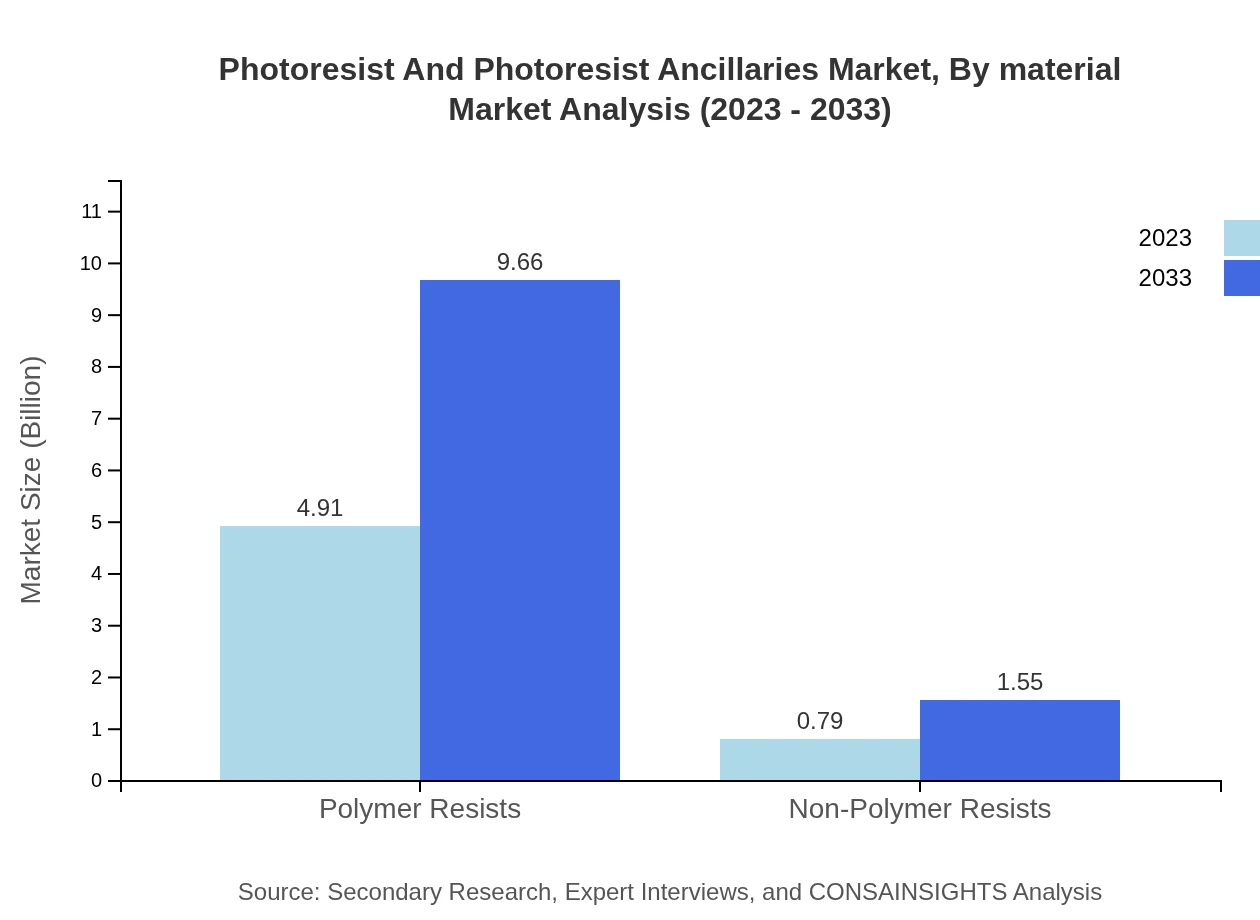

Photoresist And Photoresist Ancillaries Market Analysis By Type

The market for Positive Photoresist is forecasted to grow from USD 4.91 billion in 2023 to USD 9.66 billion by 2033, accounting for a dominant market share of 86.19%. In contrast, Negative Photoresist is expected to grow from USD 0.79 billion in 2023 to USD 1.55 billion with a share of 13.81%.

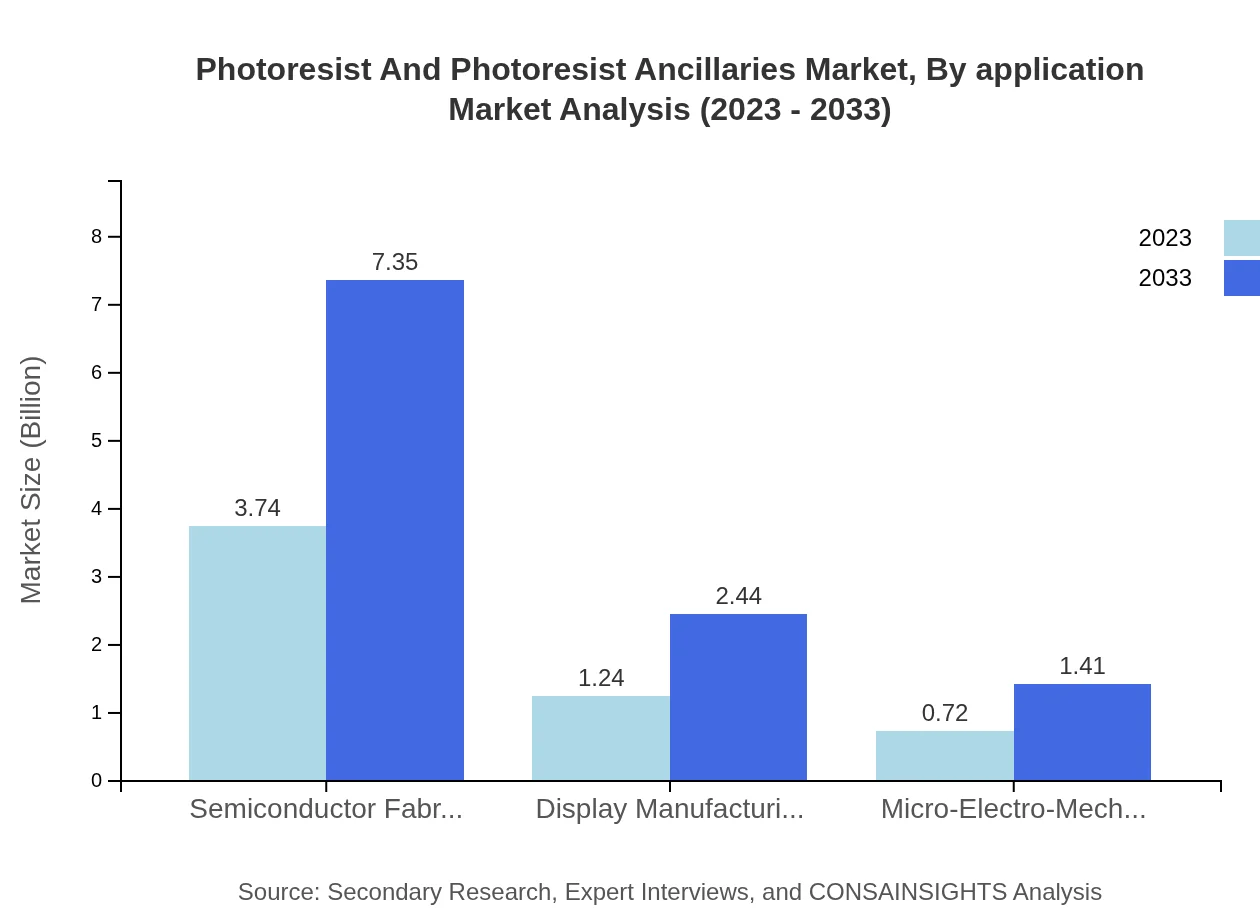

Photoresist And Photoresist Ancillaries Market Analysis By Application

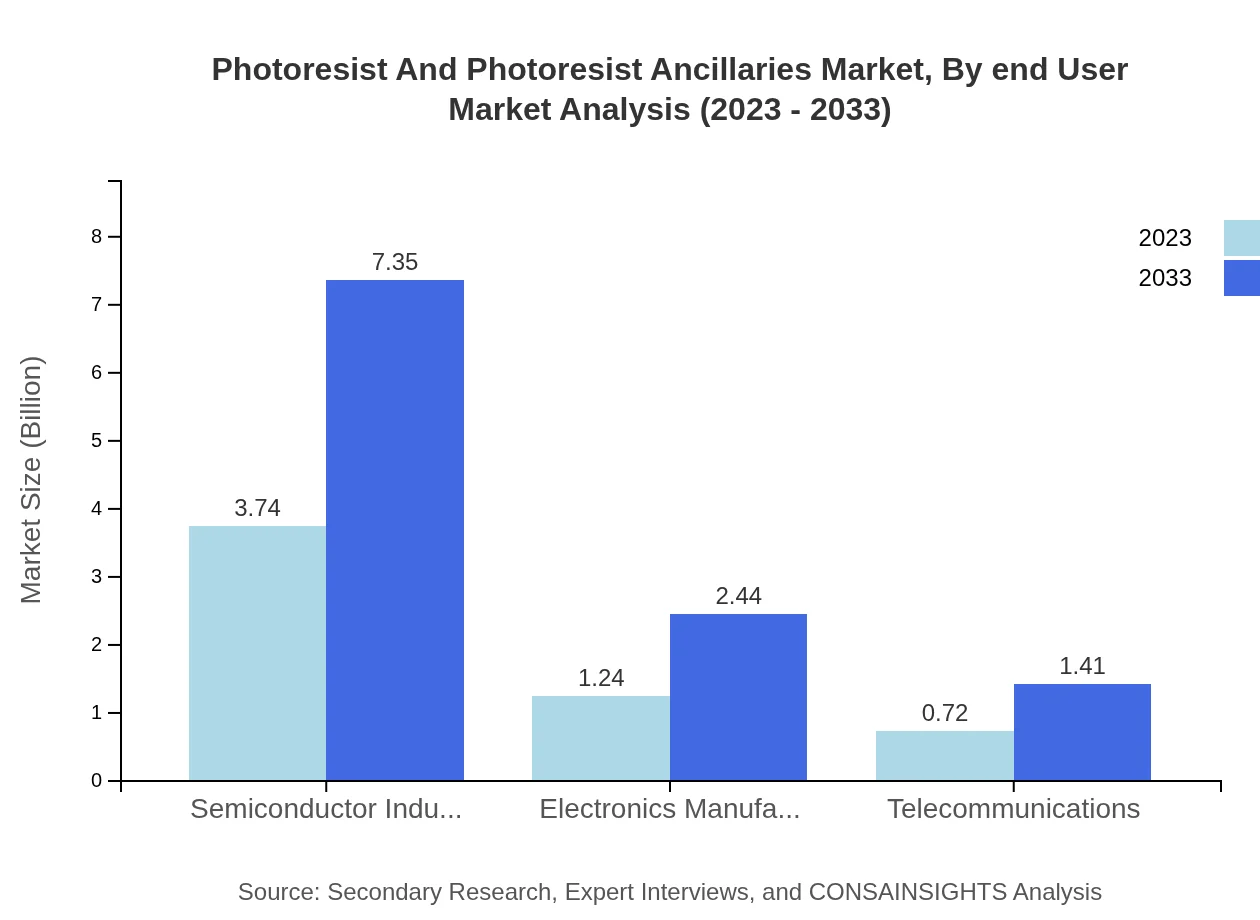

Key applications include the Semiconductor Industry with a current market size of USD 3.74 billion, growing to USD 7.35 billion by 2033 and representing 65.58% share. Electronics Manufacturing follows with USD 1.24 billion and anticipated growth to USD 2.44 billion. Telecommunications and Display Manufacturing also show growth potential.

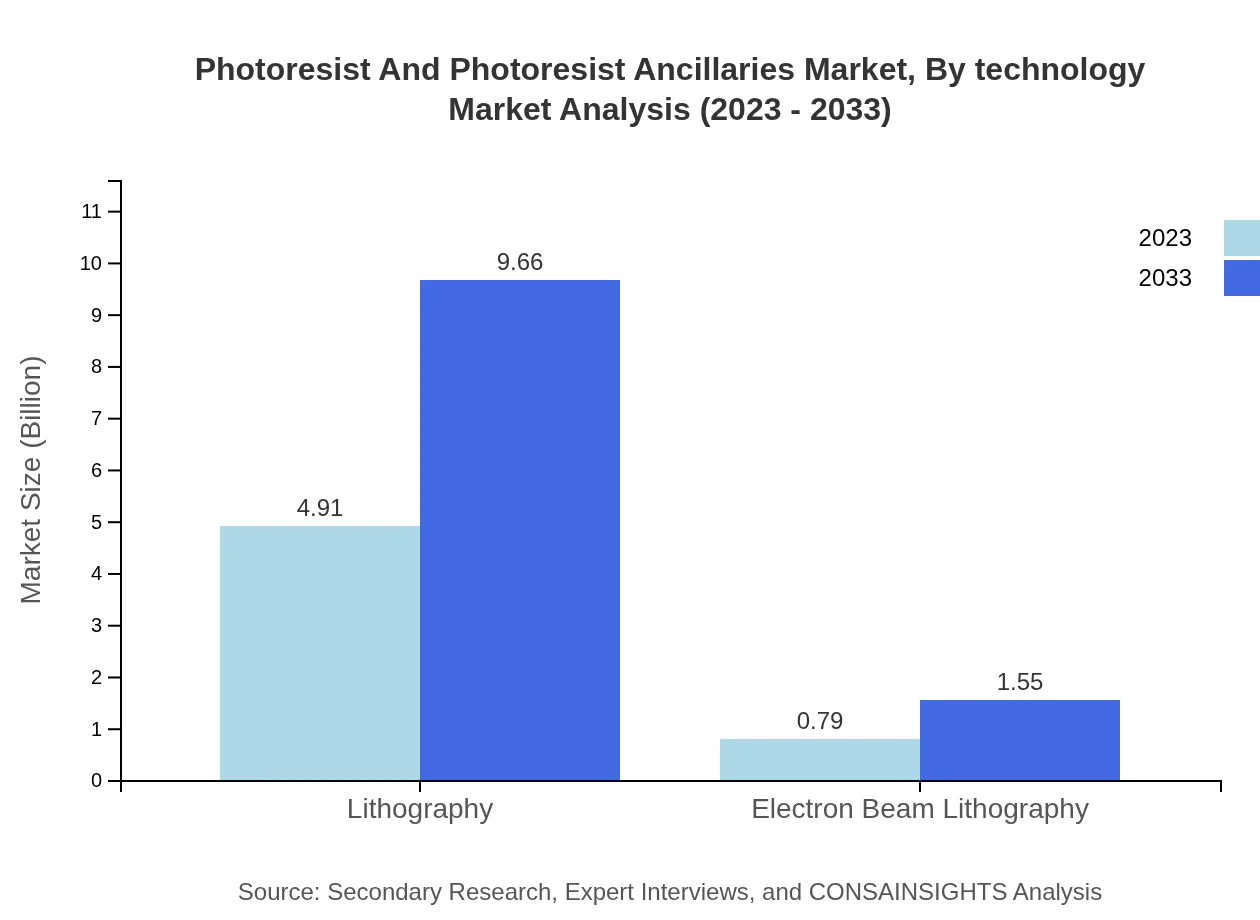

Photoresist And Photoresist Ancillaries Market Analysis By Technology

Technology-wise, advances such as lithography and electron beam lithography are pivotal. The Lithography segment is projected to grow from USD 4.91 billion to USD 9.66 billion over the forecast period, while Electron Beam Lithography is expected to increase from USD 0.79 billion to USD 1.55 billion.

Photoresist And Photoresist Ancillaries Market Analysis By Material

The market is dominated by Polymer Resists, projected to maintain a leading position with a size growth from USD 4.91 billion to USD 9.66 billion, making up 86.19% of the market share. Non-Polymer Resists are at USD 0.79 billion, growing at a slower pace.

Photoresist And Photoresist Ancillaries Market Analysis By End User

Core end-users include the Semiconductor Fabrication sector, with a market size of USD 3.74 billion, alongside the rapidly growing Micro-Electro-Mechanical Systems (MEMS) market, which is expected to rise from USD 0.72 billion to USD 1.41 billion by 2033.

Photoresist And Photoresist Ancillaries Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Photoresist And Photoresist Ancillaries Industry

Dow Inc.:

A leading manufacturer of advanced chemistries for photoresists used in semiconductor processing and other industries.Tokyo Ohka Kogyo Co., Ltd.:

A key player providing innovative photochemical products for semiconductor and electronics applications.JSR Corporation:

Known for its high-performance photoresist materials crucial for the semiconductor and display sectors.Shin-Etsu Chemical Co., Ltd.:

Offers a diverse range of semiconductor materials, including leading photoresist products.Merck Group:

Provides functional materials for electronic applications, focusing on high-tech photolithography solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of photoresist And Photoresist Ancillaries?

The photoresist and photoresist ancillaries market is valued at approximately $5.7 billion in 2023, with a projected CAGR of 6.8%. By 2033, the market is expected to expand significantly, reflecting ongoing advancements in semiconductor and electronics industries.

What are the key market players or companies in this photoresist And Photoresist Ancillaries industry?

Key players in the photoresist market include companies specializing in semiconductor materials and chemical manufacturers. Major companies consistently lead the market due to technology innovations, supply chain capabilities, and strategic collaborations essential for growth.

What are the primary factors driving the growth in the photoresist And Photoresist Ancillaries industry?

Growth drivers include increasing demand for advanced semiconductors, the rise of IoT devices, and innovation in display technologies. Further fueled by technological advancements in photolithography processes, these factors contribute significantly to market expansion.

Which region is the fastest Growing in the photoresist And Photoresist Ancillaries?

Asia-Pacific stands out as the fastest-growing region, with the market projected to grow from $1.06 billion in 2023 to $2.08 billion by 2033, driven by robust semiconductor manufacturing activities and technological upgrades.

Does ConsaInsights provide customized market report data for the photoresist And Photoresist Ancillaries industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the photoresist and ancillary sectors. Clients can request detailed insights and analyses to support strategic decision-making.

What deliverables can I expect from this photoresist And Photoresist Ancillaries market research project?

Deliverables include comprehensive market reports, competitive landscape analysis, regional assessments, and segment-wise insights. Additionally, forecasts and trends will be provided to aid in understanding future market dynamics.

What are the market trends of photoresist And Photoresist Ancillaries?

Current trends include the increasing adoption of advanced materials, rising investments in semiconductor technologies, and growth in end-use applications. A shift towards eco-friendly photoresist materials is also notable, reflecting sustainability initiatives.