Physical Identity And Access Management Market Report

Published Date: 31 January 2026 | Report Code: physical-identity-and-access-management

Physical Identity And Access Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Physical Identity and Access Management market from 2023 to 2033, including insights on current market trends, size, growth forecasts, and competitive dynamics.

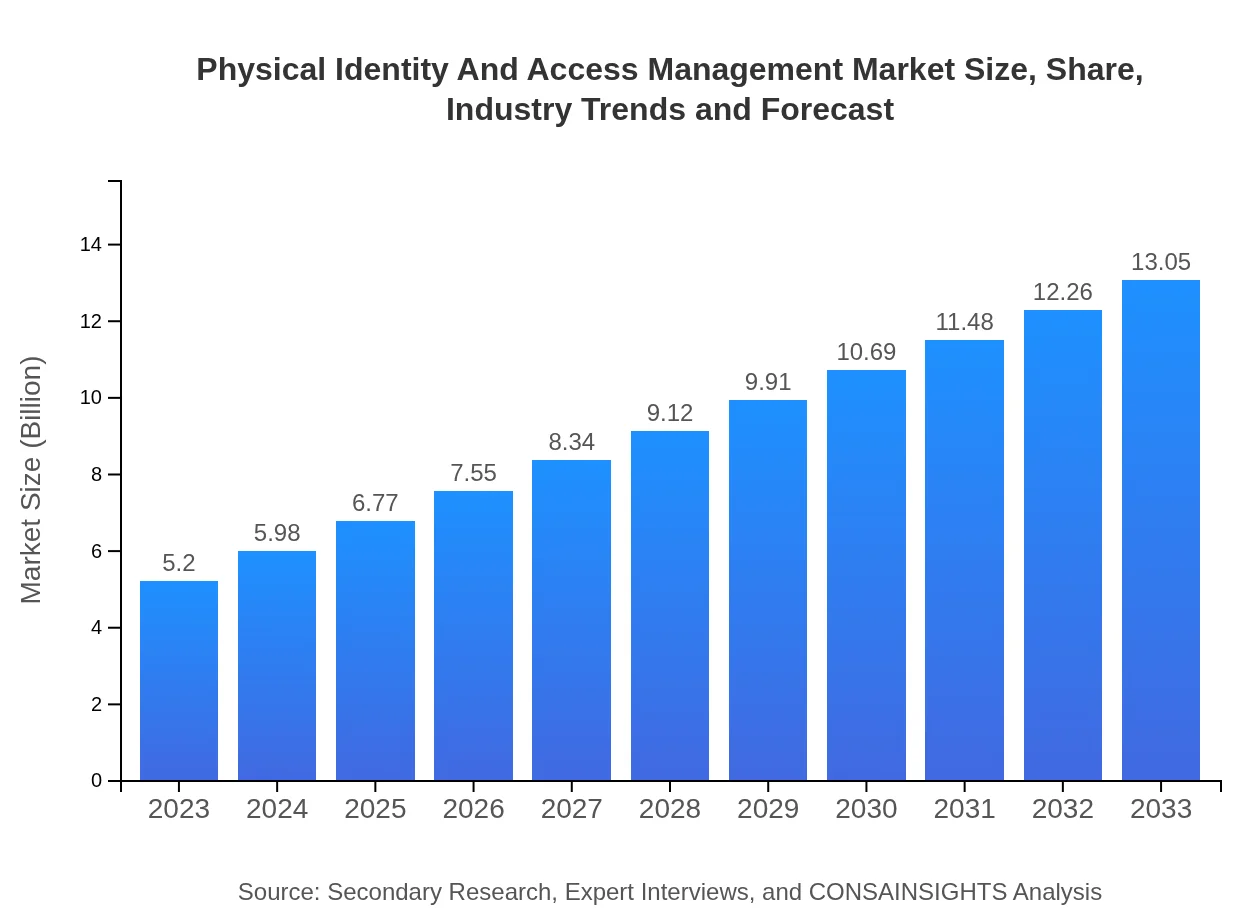

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $13.05 Billion |

| Top Companies | HID Global, Gemalto, IDEMIA, Cisco Systems, Inc. |

| Last Modified Date | 31 January 2026 |

Physical Identity And Access Management Market Overview

Customize Physical Identity And Access Management Market Report market research report

- ✔ Get in-depth analysis of Physical Identity And Access Management market size, growth, and forecasts.

- ✔ Understand Physical Identity And Access Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Physical Identity And Access Management

What is the Market Size & CAGR of Physical Identity And Access Management market in 2023?

Physical Identity And Access Management Industry Analysis

Physical Identity And Access Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Physical Identity And Access Management Market Analysis Report by Region

Europe Physical Identity And Access Management Market Report:

The European market is valued at $1.42 billion in 2023 and is expected to grow to $3.56 billion by 2033. Major investments in smart infrastructure and compliance with data protection regulations are driving growth.Asia Pacific Physical Identity And Access Management Market Report:

In the Asia Pacific region, the market value is estimated at $1.06 billion in 2023, projected to grow to $2.67 billion by 2033. The rise in urbanization and smart city initiatives is expected to drive the adoption of security solutions, particularly in countries like China and India.North America Physical Identity And Access Management Market Report:

North America commands a significant share of the market, estimated at $1.69 billion in 2023, growing to $4.24 billion by 2033. High security threats and stringent regulations fuel the demand for comprehensive access management solutions in this region.South America Physical Identity And Access Management Market Report:

The South American market is valued at $0.37 billion in 2023 and is expected to reach $0.94 billion by 2033. Government initiatives aimed at improving public safety and the proliferation of smart technology are key growth factors.Middle East & Africa Physical Identity And Access Management Market Report:

The Middle East and Africa market stands at $0.65 billion in 2023, with projections of reaching $1.64 billion by 2033. The increasing emphasis on national security and the advent of new technologies are pivotal in the region's market expansion.Tell us your focus area and get a customized research report.

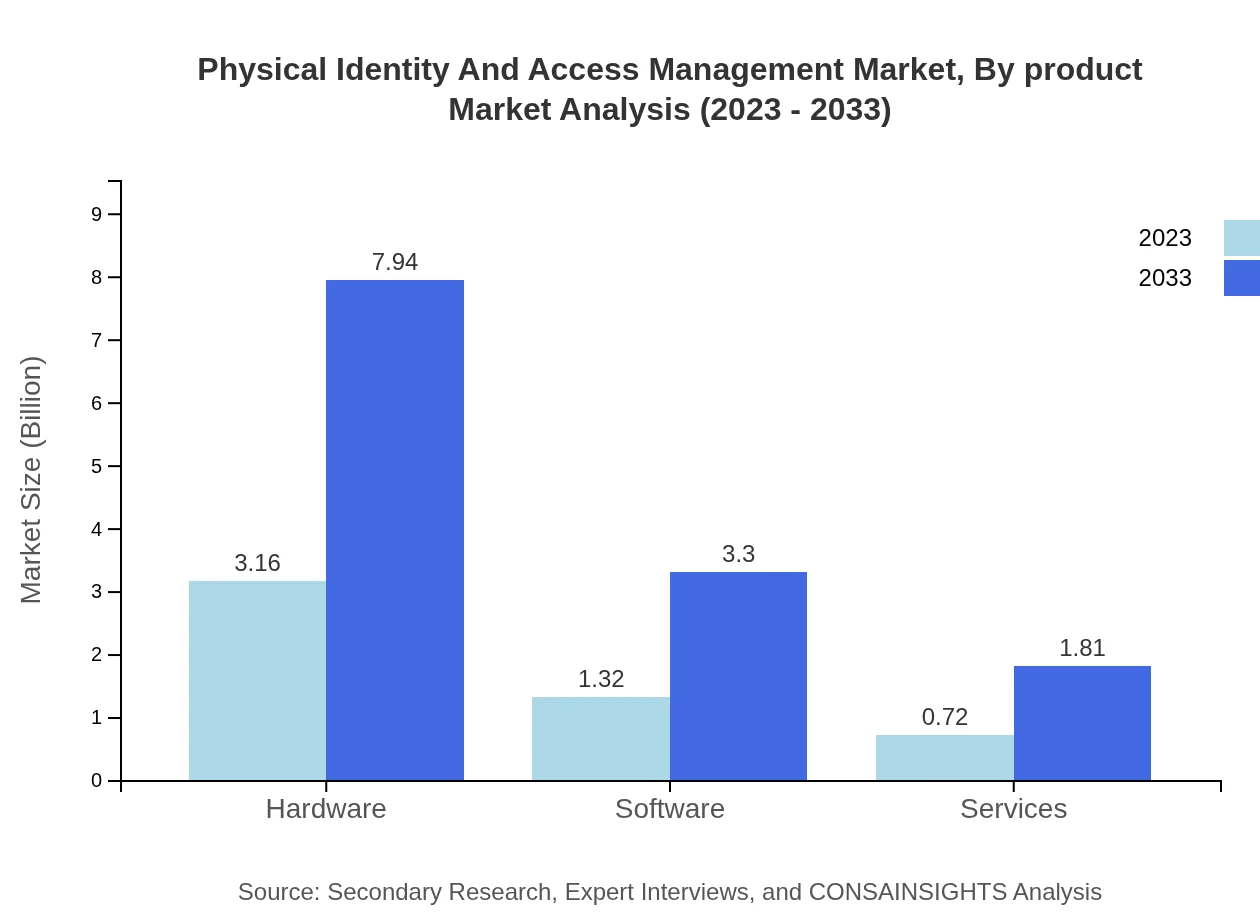

Physical Identity And Access Management Market Analysis By Product

The product segment includes hardware with a market size of $3.16 billion in 2023, projected to grow to $7.94 billion by 2033. Software is anticipated to grow from $1.32 billion to $3.30 billion in the same period, while services will increase from $0.72 billion to $1.81 billion, indicating a robust demand across all fronts.

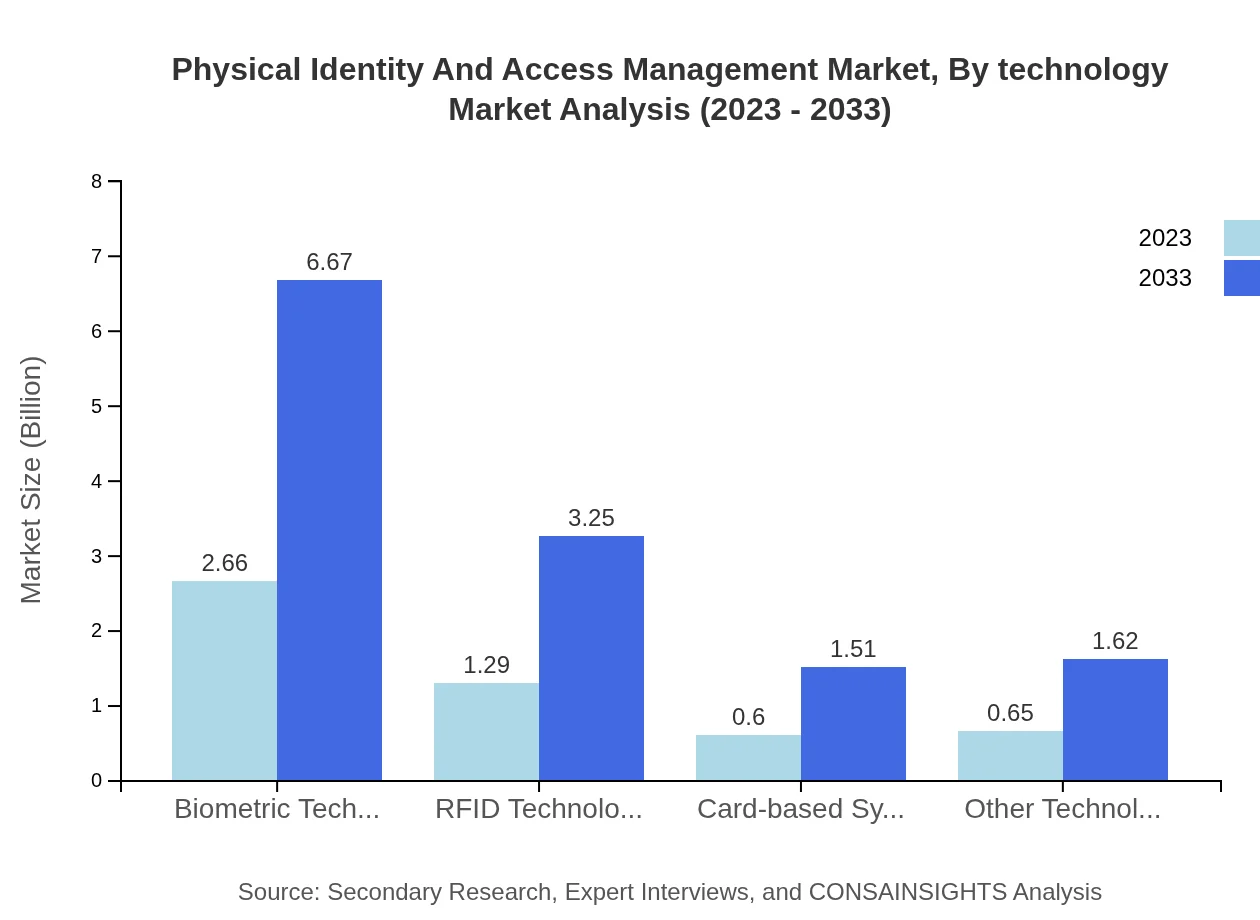

Physical Identity And Access Management Market Analysis By Technology

Biometric technologies dominate the market with a value of $2.66 billion in 2023, forecasted to expand to $6.67 billion by 2033. RFID technology follows with a market size of $1.29 billion in 2023, which will increase to $3.25 billion by 2033, while card-based systems are projected to grow from $0.60 billion to $1.51 billion during the forecast period.

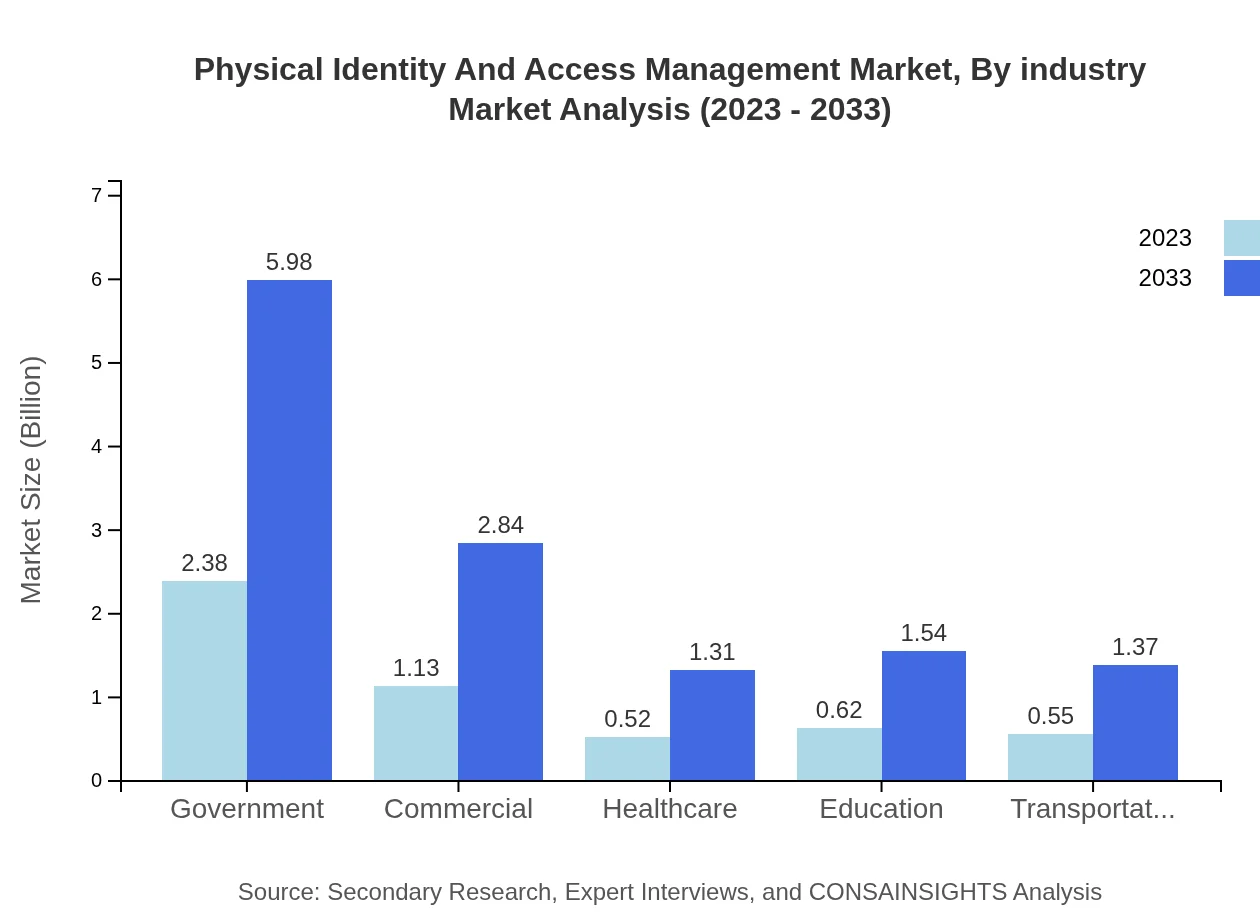

Physical Identity And Access Management Market Analysis By Industry

The government sector leads with a market size of $2.38 billion in 2023, set to rise to $5.98 billion by 2033. The commercial sector accounts for $1.13 billion, expected to grow to $2.84 billion. Other sectors like healthcare, education, and transportation follow with promising growth rates.

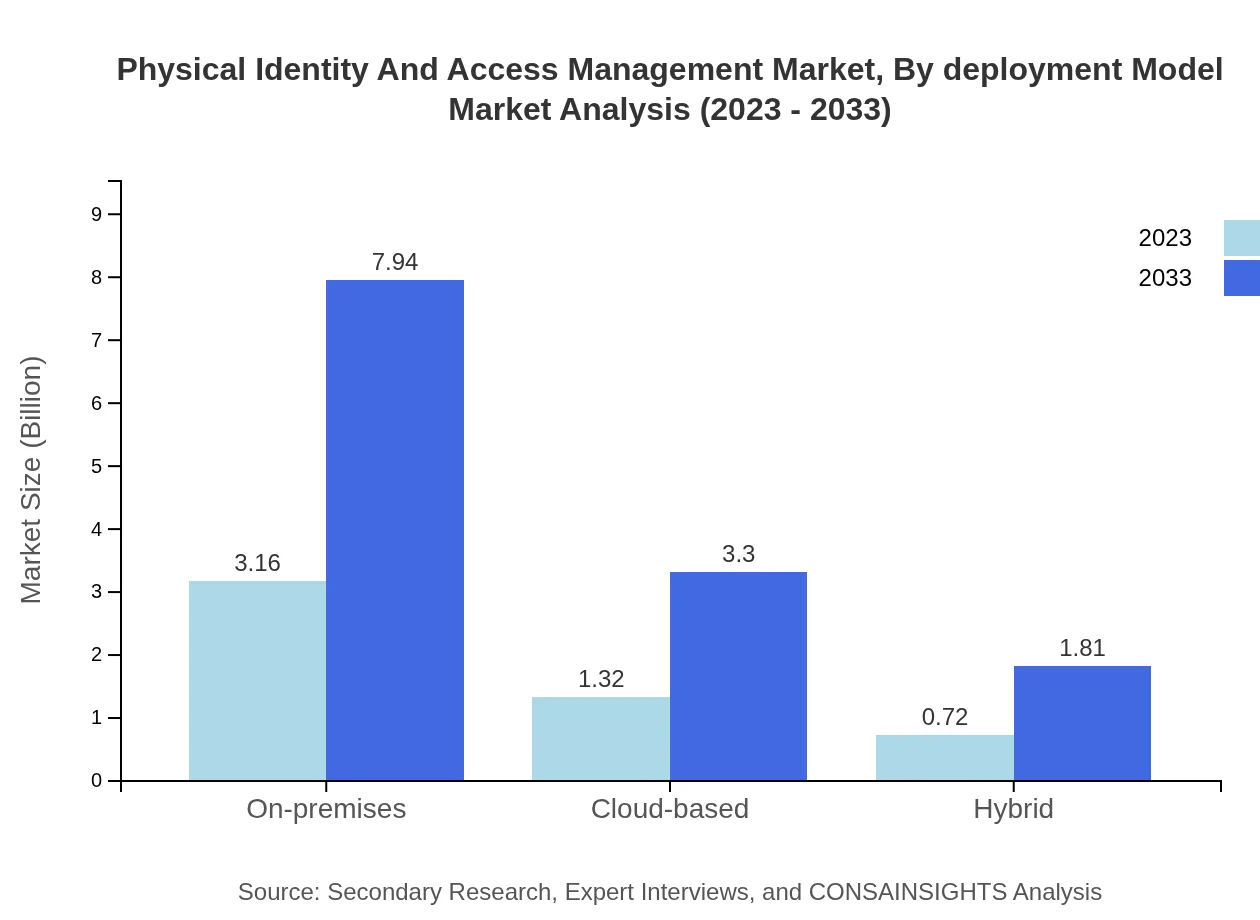

Physical Identity And Access Management Market Analysis By Deployment Model

On-premises solutions currently dominate the market with a size of $3.16 billion in 2023, projected to grow to $7.94 billion by 2033. Cloud-based solutions are also gaining traction, expected to increase from $1.32 billion to $3.30 billion during the same period, while hybrid models show growth from $0.72 billion to $1.81 billion.

Physical Identity And Access Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Physical Identity And Access Management Industry

HID Global:

A leader in secure identity solutions, HID Global provides access control and identification solutions used by organizations worldwide, leveraging innovative technology to deliver enhanced safety and efficiency.Gemalto:

Part of Thales Group, Gemalto specializes in digital security, offering various solutions including PIAM, biometrics, and smart cards, ensuring secure authentication for users globally.IDEMIA:

IDEMIA specializes in augmented identity, providing solutions based on biometric technologies and access management to enhance security and user experience in physical and digital environments.Cisco Systems, Inc.:

Cisco operates in various segments of IT security, including identity management and access control, helping organizations protect their information and physical assets efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of Physical Identity and Access Management?

The Physical Identity and Access Management market is currently valued at approximately $5.2 billion in 2023. It is projected to grow at a CAGR of 9.3%, indicating a robust expansion through 2033.

What are the key market players or companies in the Physical Identity and Access Management industry?

The key players in the Physical Identity and Access Management industry include major security technology firms, leading software developers, and specialized service providers who drive innovation and provide integrated solutions.

What are the primary factors driving the growth in the Physical Identity and Access Management industry?

Key growth factors include increasing security threats, the rising importance of data protection, advancements in biometric technologies, and stringent regulations mandating identity verification in various sectors.

Which region is the fastest Growing in Physical Identity and Access Management?

Asia Pacific is the fastest-growing region in the Physical Identity and Access Management market, with projected growth from $1.06 billion in 2023 to $2.67 billion by 2033, fueled by rapid technological adoption.

Does ConsaInsights provide customized market report data for the Physical Identity and Access Management industry?

Yes, ConsaInsights offers customized market reports tailored to meet specific needs and insights within the Physical Identity and Access Management industry, ensuring relevant and strategic information.

What deliverables can I expect from this Physical Identity and Access Management market research project?

Deliverables from this market research project include comprehensive market analysis, segment profiles, regional insights, forecasts, and strategic recommendations based on thorough industry evaluation.

What are the market trends of Physical Identity and Access Management?

Key market trends include the integration of AI and machine learning in identity management, increasing reliance on cloud solutions, and the growth of mobile identity verification technologies.