Physical Security Information Management Market Report

Published Date: 31 January 2026 | Report Code: physical-security-information-management

Physical Security Information Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Physical Security Information Management market, covering insights into market size, growth forecasts, segmentation, and detailed regional analyses from 2023 to 2033.

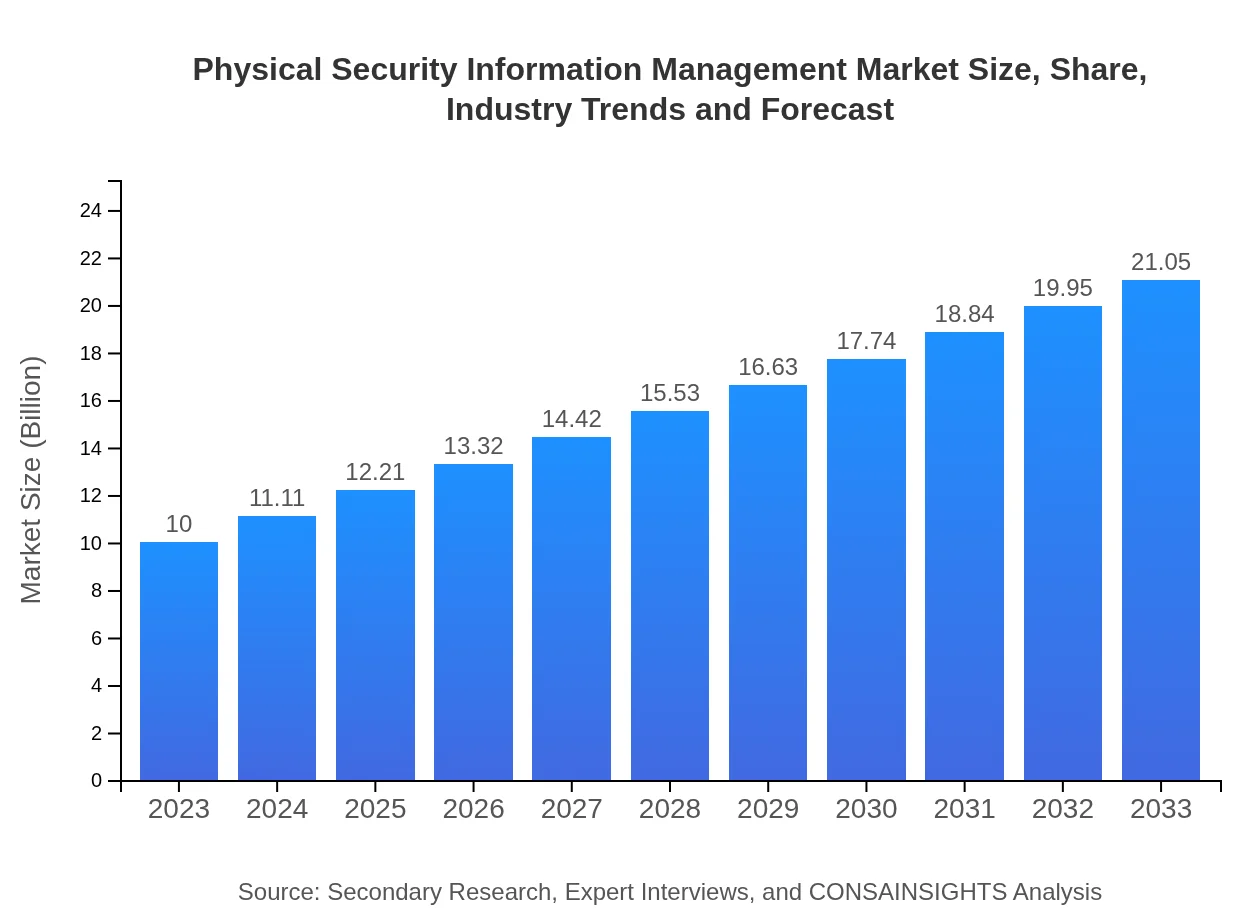

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $21.05 Billion |

| Top Companies | Tyco Integrated Security (Johnson Controls), Genetec, Honeywell Security, Milestone Systems, Axis Communications |

| Last Modified Date | 31 January 2026 |

Physical Security Information Management Market Overview

Customize Physical Security Information Management Market Report market research report

- ✔ Get in-depth analysis of Physical Security Information Management market size, growth, and forecasts.

- ✔ Understand Physical Security Information Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Physical Security Information Management

What is the Market Size & CAGR of Physical Security Information Management market in 2023?

Physical Security Information Management Industry Analysis

Physical Security Information Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Physical Security Information Management Market Analysis Report by Region

Europe Physical Security Information Management Market Report:

Europe’s PSIM market is valued at $3.29 billion in 2023 and expected to grow to $6.92 billion by 2033. The region is characterized by increasing investment in physical security systems and an integrated approach to managing security incidents, influenced by legislation focusing on data protection and security.Asia Pacific Physical Security Information Management Market Report:

In 2023, the Asia Pacific PSIM market is valued at approximately $1.65 billion and is projected to grow to $3.47 billion by 2033. The region is witnessing increased adoption of PSIM solutions due to urbanization and an upsurge in manufacturing industries prioritizing security investment. Improved infrastructure and rising threats in countries like India and China further drive market growth.North America Physical Security Information Management Market Report:

North America, the largest market, begins at $3.58 billion in 2023, projected to hit $7.54 billion by 2033. The robust demand stems from stringent regulations, a high focus on safety, and the presence of leading technology providers improving PSIM solutions.South America Physical Security Information Management Market Report:

The South American market, starting at $0.89 billion in 2023 and expected to reach $1.87 billion by 2033, is gaining traction due to an increase in public safety initiatives and the need for advanced surveillance systems. Countries are investing in smart city projects that are expected to leverage PSIM capabilities.Middle East & Africa Physical Security Information Management Market Report:

The Middle East and Africa region has a market size of $0.59 billion in 2023, projected to grow to $1.25 billion by 2033. Ongoing geopolitical tensions and rising urban crime rates are significant drivers, with countries enhancing their infrastructure and striving to ensure safety and security.Tell us your focus area and get a customized research report.

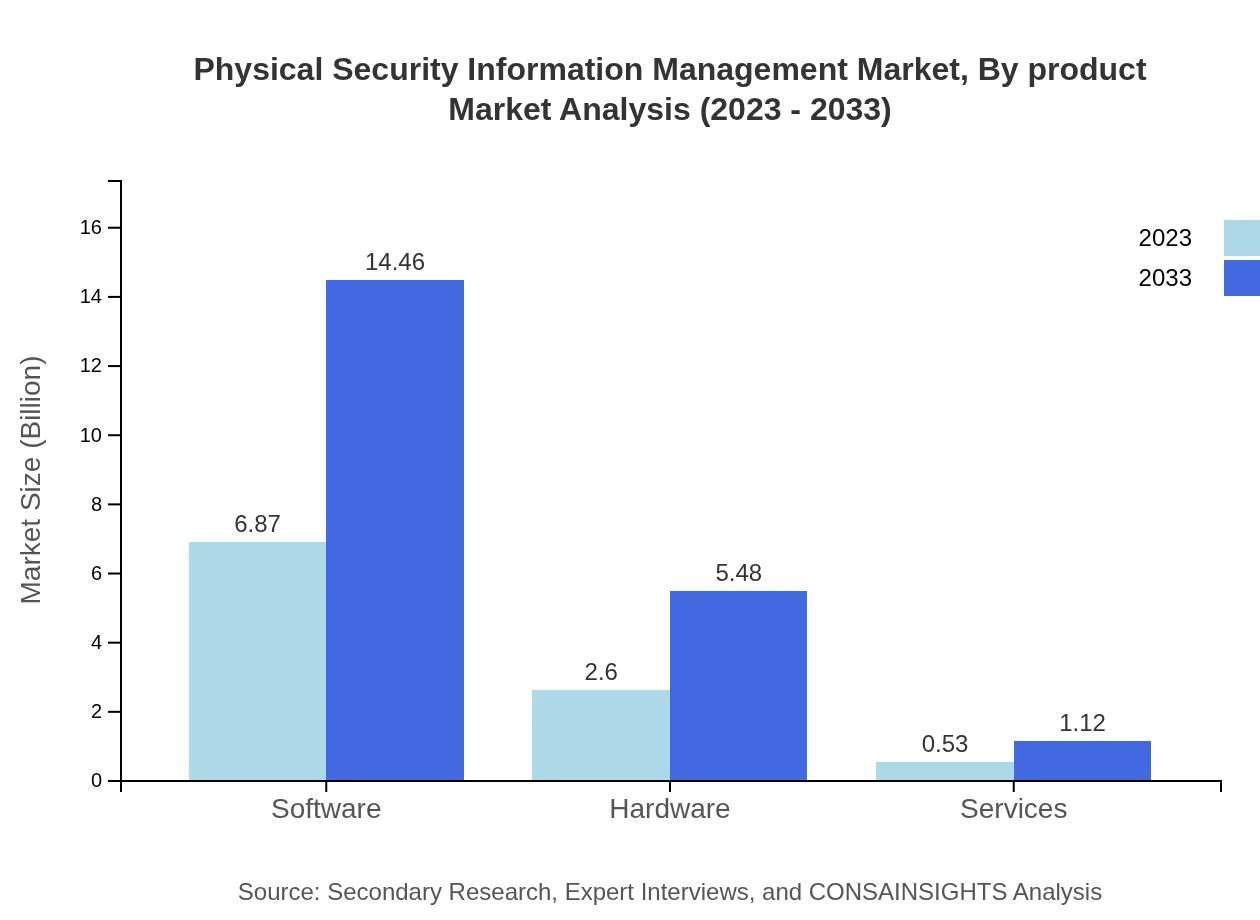

Physical Security Information Management Market Analysis By Product

Software remains the leading segment in the PSIM market, starting at $6.87 billion in 2023 and expected to double to $14.46 billion by 2033. Hardware and services contribute significantly, showcasing how comprehensive PSIM solutions are crucial for effective security management.

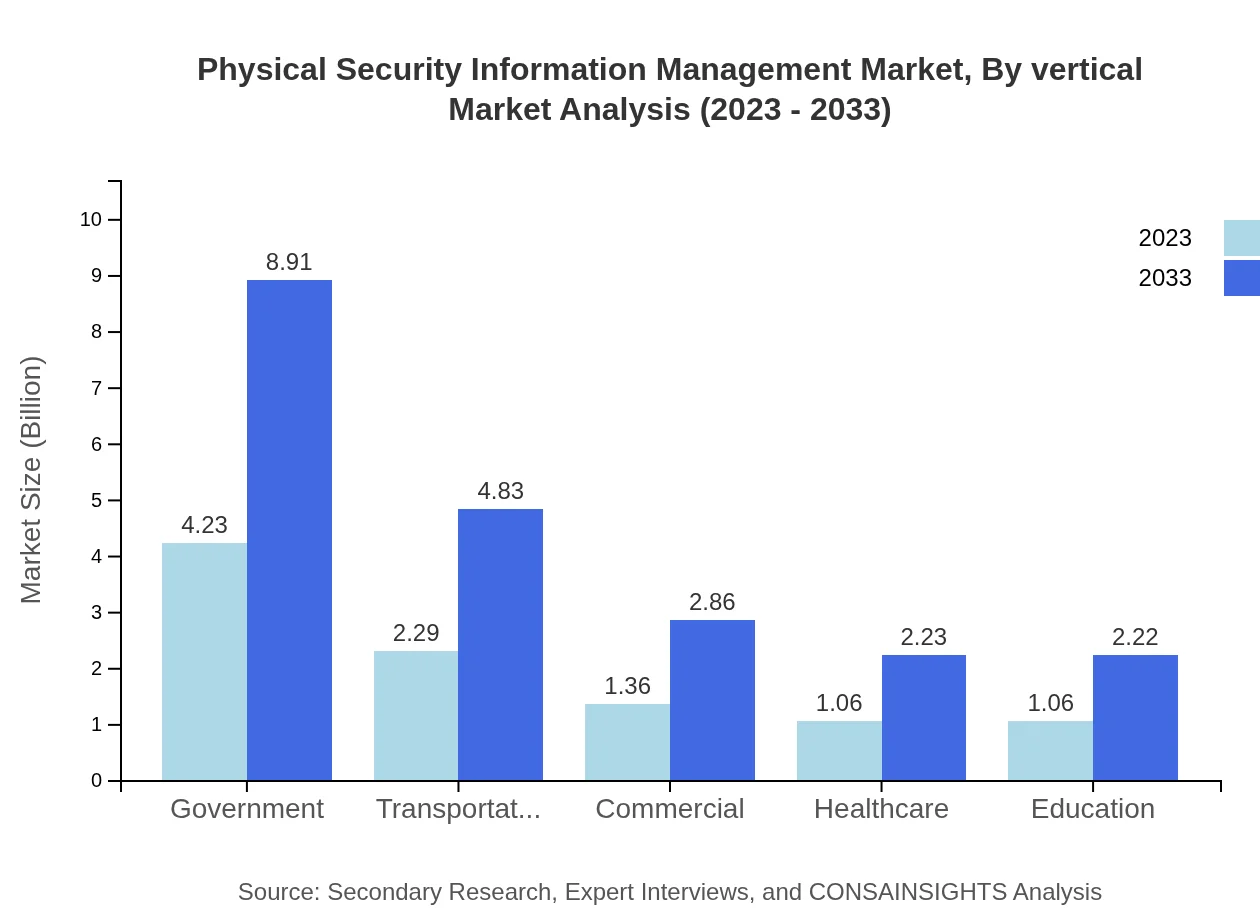

Physical Security Information Management Market Analysis By Vertical

Government agencies lead the vertical market segment with a size of $4.23 billion in 2023 and anticipated growth to $8.91 billion by 2033. The transportation sector and commercial businesses also appear promising, reflecting the need for heightened security measures across industries.

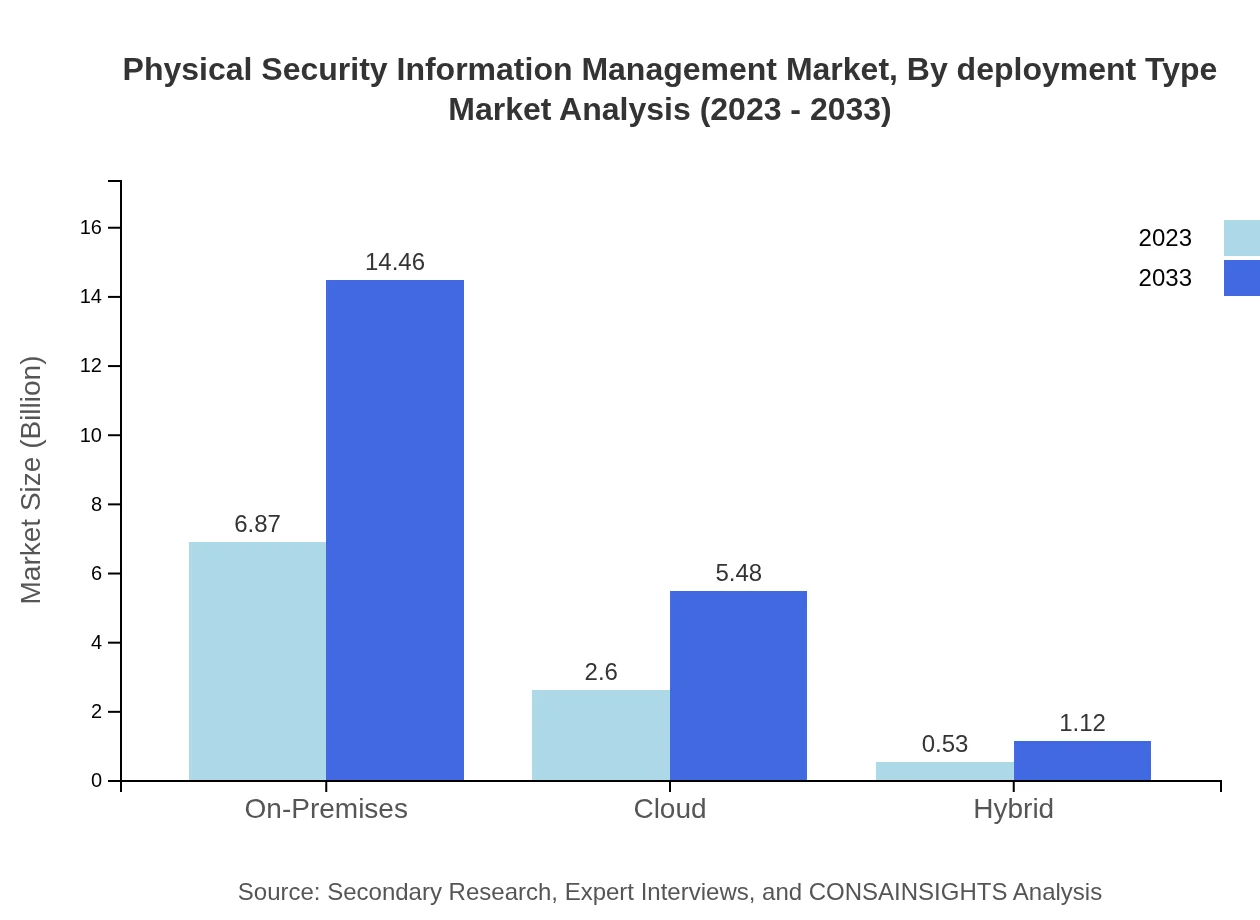

Physical Security Information Management Market Analysis By Deployment Type

On-premises deployment leads the PSIM market. However, a notable shift toward cloud solutions is evident, with significant investments in security-as-a-service models, making PSIM more accessible for various organizations.

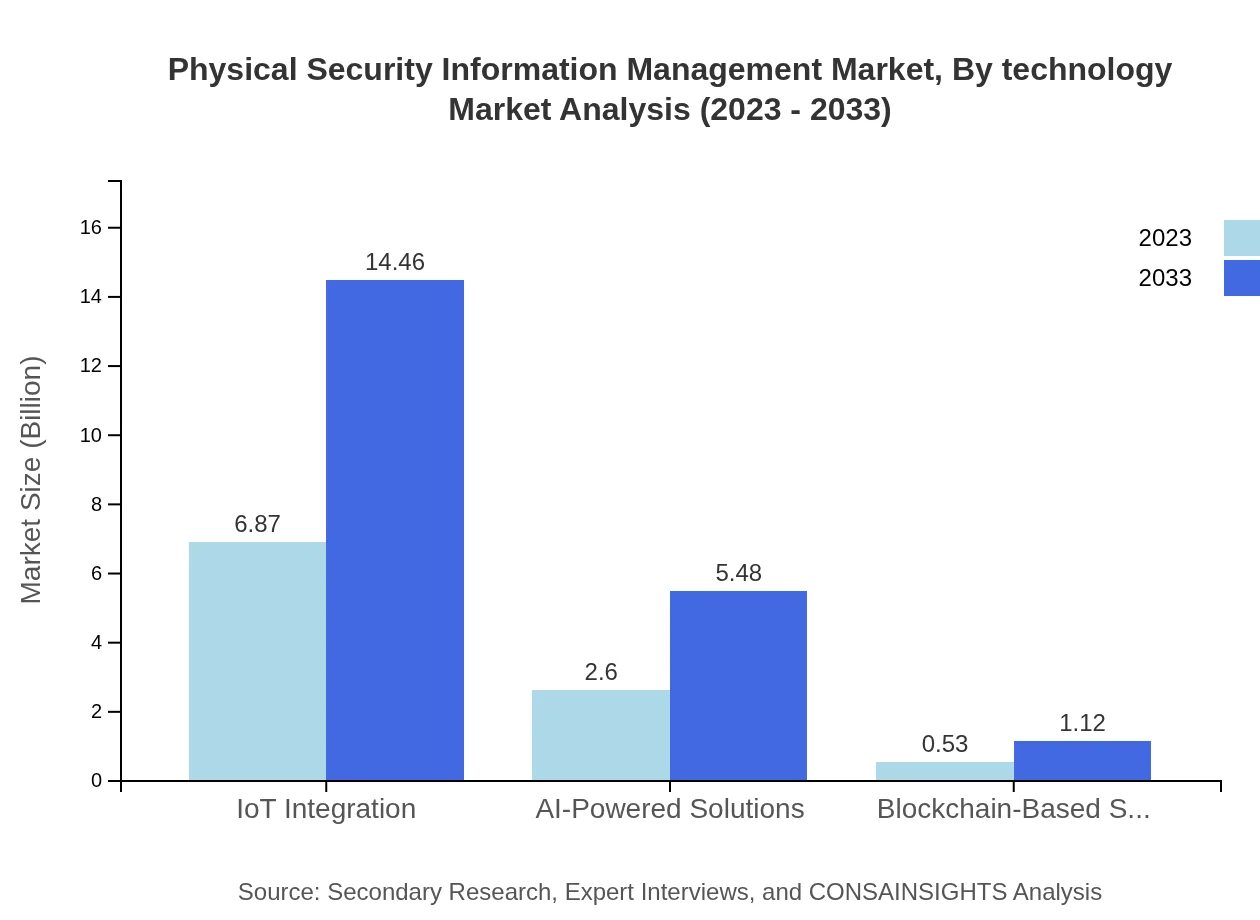

Physical Security Information Management Market Analysis By Technology

IoT integration and AI-powered solutions are revolutionizing the PSIM landscape. In 2023, IoT-focused solutions is projected to be $6.87 billion, doubling by 2033, reflecting a trend towards automation and smarter security systems.

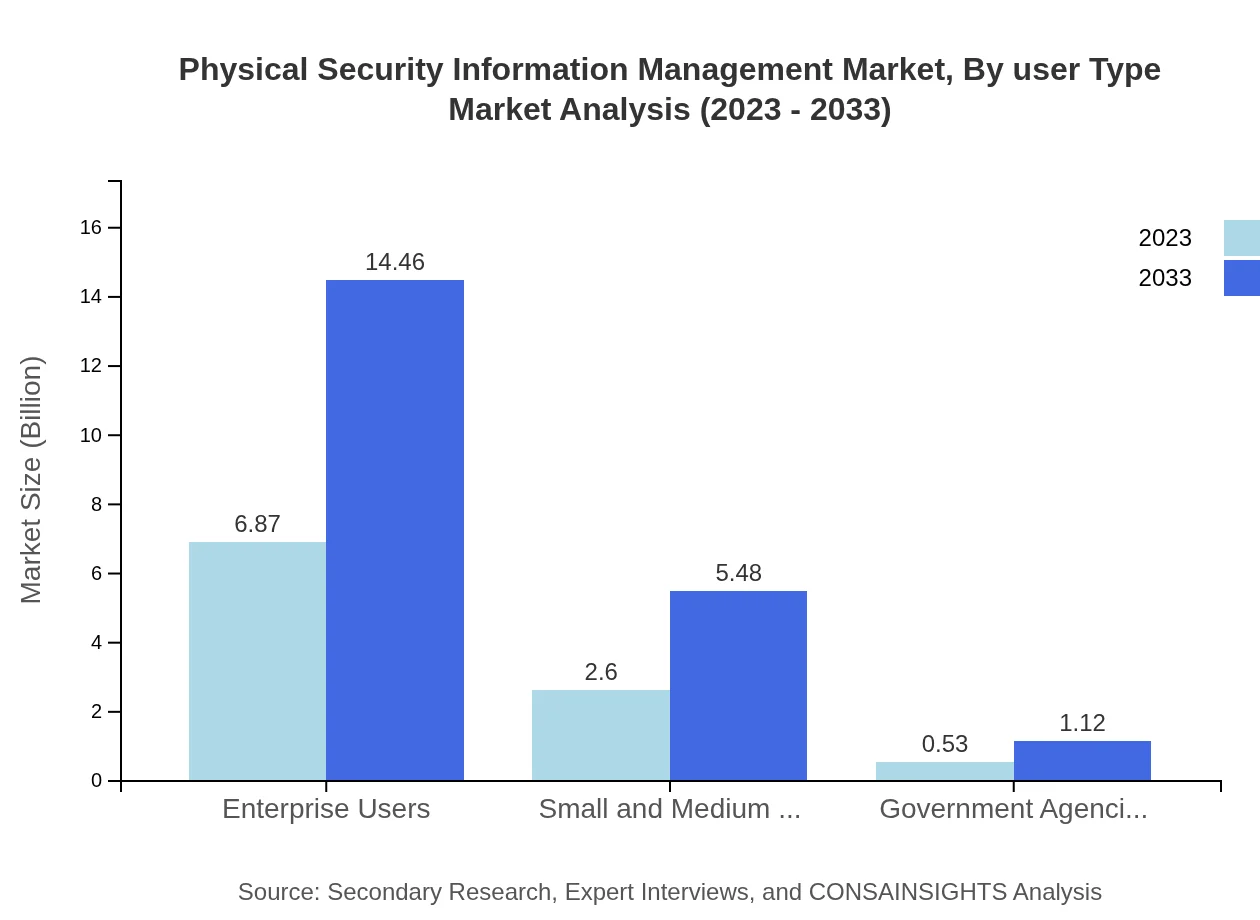

Physical Security Information Management Market Analysis By User Type

Enterprise users dominate the PSIM market, accumulating a substantial market size of $6.87 billion in 2023, driven by extensive security needs across large organizations. Small and mid-sized enterprises show promising growth potential with demanding security requirements.

Physical Security Information Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Physical Security Information Management Industry

Tyco Integrated Security (Johnson Controls):

A leader in security solutions, Tyco Integrated Security offers comprehensive PSIM systems integrated with advanced analytics, catering to diverse sectors globally.Genetec:

Genetec is renowned for its IP video surveillance solutions that integrate well with PSIM technology, providing comprehensive monitoring and management capabilities.Honeywell Security:

Honeywell's PSIM systems are designed for both commercial and governmental applications, focusing on user-friendly interfaces and robust security management.Milestone Systems:

Specializing in open-platform video management software, Milestone's solutions seamlessly integrate with PSIM for improved situational awareness.Axis Communications:

A prominent player in network security cameras, Axis Communications emphasizes security from the ground up, integrating its solutions into PSIM platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of physical Security Information Management?

The global Physical Security Information Management market is expected to reach approximately $10 billion by 2033, growing at a CAGR of 7.5% from its current valuation.

What are the key market players or companies in the physical Security Information Management industry?

Key players include industry leaders involved in providing software, hardware, and services specifically tailored for the physical-security-information-management market, contributing significantly to its growth.

What are the primary factors driving the growth in the physical Security Information Management industry?

Growth drivers include increasing security regulations, rising security threats, demand for integrated systems, and the adoption of IoT and AI technologies to enhance security management.

Which region is the fastest Growing in the physical Security Information Management?

North America is the fastest-growing region, projected to increase from $3.58 billion in 2023 to $7.54 billion by 2033, significantly outpacing other regions.

Does ConsaInsights provide customized market report data for the physical Security Information Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the physical-security-information-management industry, ensuring actionable insights for decision-makers.

What deliverables can I expect from this physical Security Information Management market research project?

Expect comprehensive reports detailing market size, segmentation analysis, trend insights, competitive landscape assessments, and forecasts spanning the next decade.

What are the market trends of physical Security Information Management?

Current trends include growth in software solutions, increased IoT integration, AI-enhanced security, rising demand from government sectors, and innovative cloud-based services.