Physical Security Market Report

Published Date: 22 January 2026 | Report Code: physical-security

Physical Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Physical Security market, covering key insights, market size, trends, segmentation, and forecasts from 2023 to 2033. It delves into regional performances and industry leaders shaping the future landscape of physical security solutions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

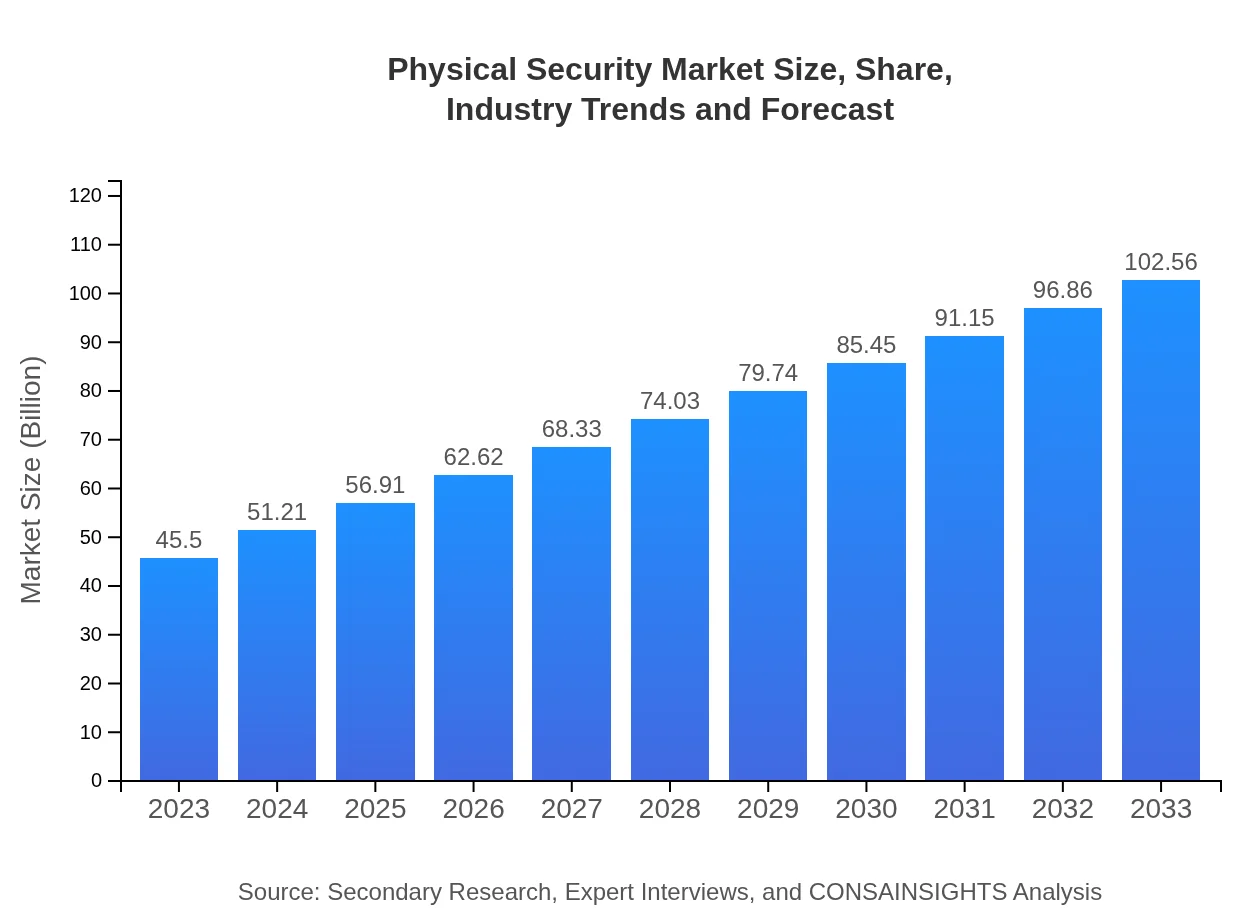

| 2023 Market Size | $45.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $102.56 Billion |

| Top Companies | Honeywell International Inc., Tyco International plc., ADT Inc. |

| Last Modified Date | 22 January 2026 |

Physical Security Market Overview

Customize Physical Security Market Report market research report

- ✔ Get in-depth analysis of Physical Security market size, growth, and forecasts.

- ✔ Understand Physical Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Physical Security

What is the Market Size & CAGR of the Physical Security market in 2023?

Physical Security Industry Analysis

Physical Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Physical Security Market Analysis Report by Region

Europe Physical Security Market Report:

Europe's Physical Security market is expected to grow from $11.63 billion in 2023 to $26.21 billion by 2033. Heightened security concerns stemming from geopolitical issues and stringent regulations drive substantial investments in physical security technologies.Asia Pacific Physical Security Market Report:

In 2023, the Asia Pacific region's Physical Security market is valued at approximately $9.44 billion, expected to grow to $21.28 billion by 2033. This growth is driven by rising urbanization, increased security concerns, and government initiatives promoting infrastructure development.North America Physical Security Market Report:

The North American Physical Security market is valued at $15.84 billion in 2023, projected to reach $35.71 billion by 2033. The region leads in technology adoption, with advanced surveillance systems and regulatory frameworks spurring growth.South America Physical Security Market Report:

The Physical Security market in South America is projected to move from $4.32 billion in 2023 to $9.74 billion by 2033. Growing security needs and investment in public safety enhance market prospects, despite economic challenges.Middle East & Africa Physical Security Market Report:

In the Middle East and Africa, the Physical Security market is estimated at $4.27 billion in 2023, projected to grow to $9.62 billion by 2033. Growing security threats and major events, such as international exhibitions, fuel the expansion of physical security investments.Tell us your focus area and get a customized research report.

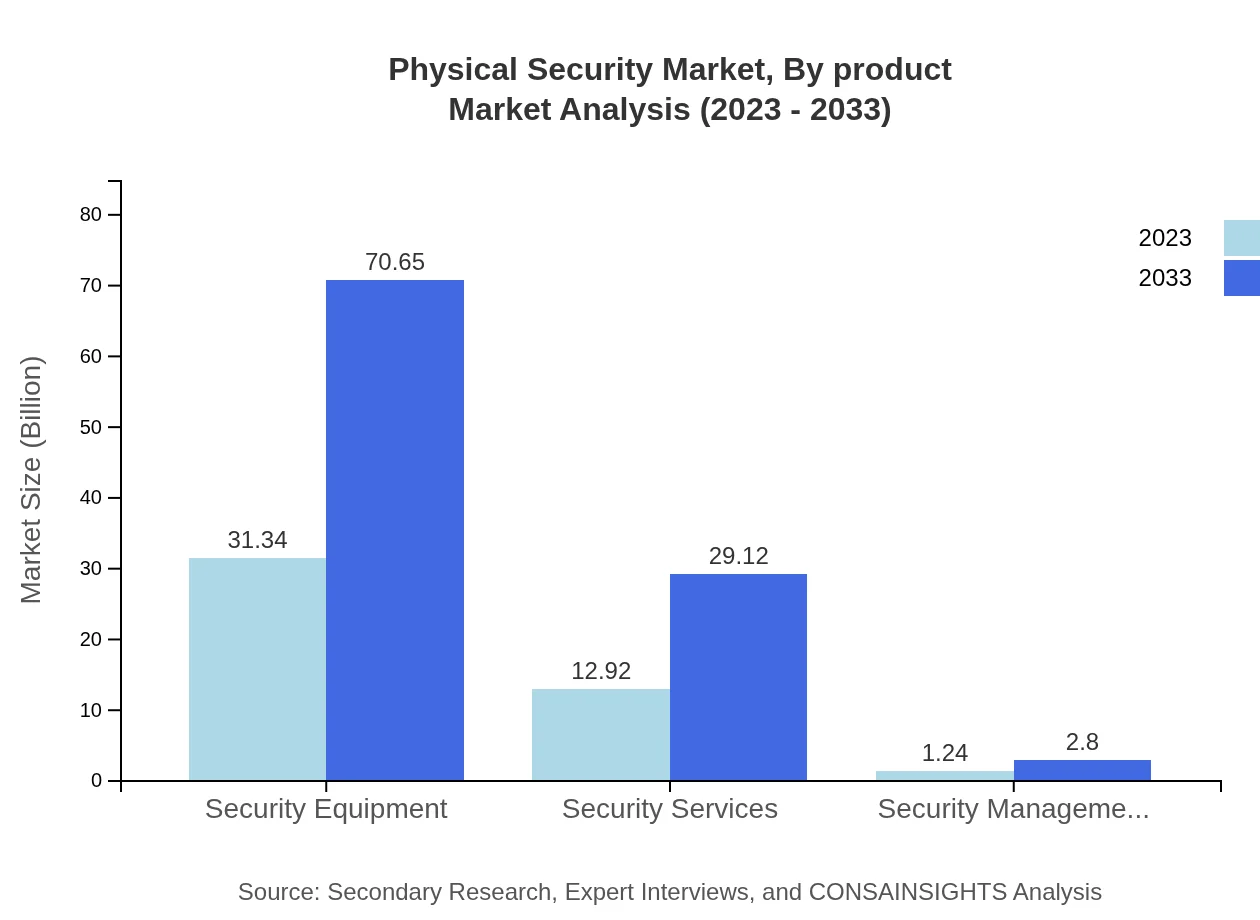

Physical Security Market Analysis By Product

The Physical Security Market by Product is dominated by Security Equipment, which is expected to grow from $31.34 billion in 2023 to $70.65 billion in 2033, showing a significant market share. This includes solutions like access control systems, surveillance cameras, and alarm systems. Security Services also depict substantial growth, moving from $12.92 billion in 2023 to $29.12 billion by 2033, which includes services such as monitoring and investigative services.

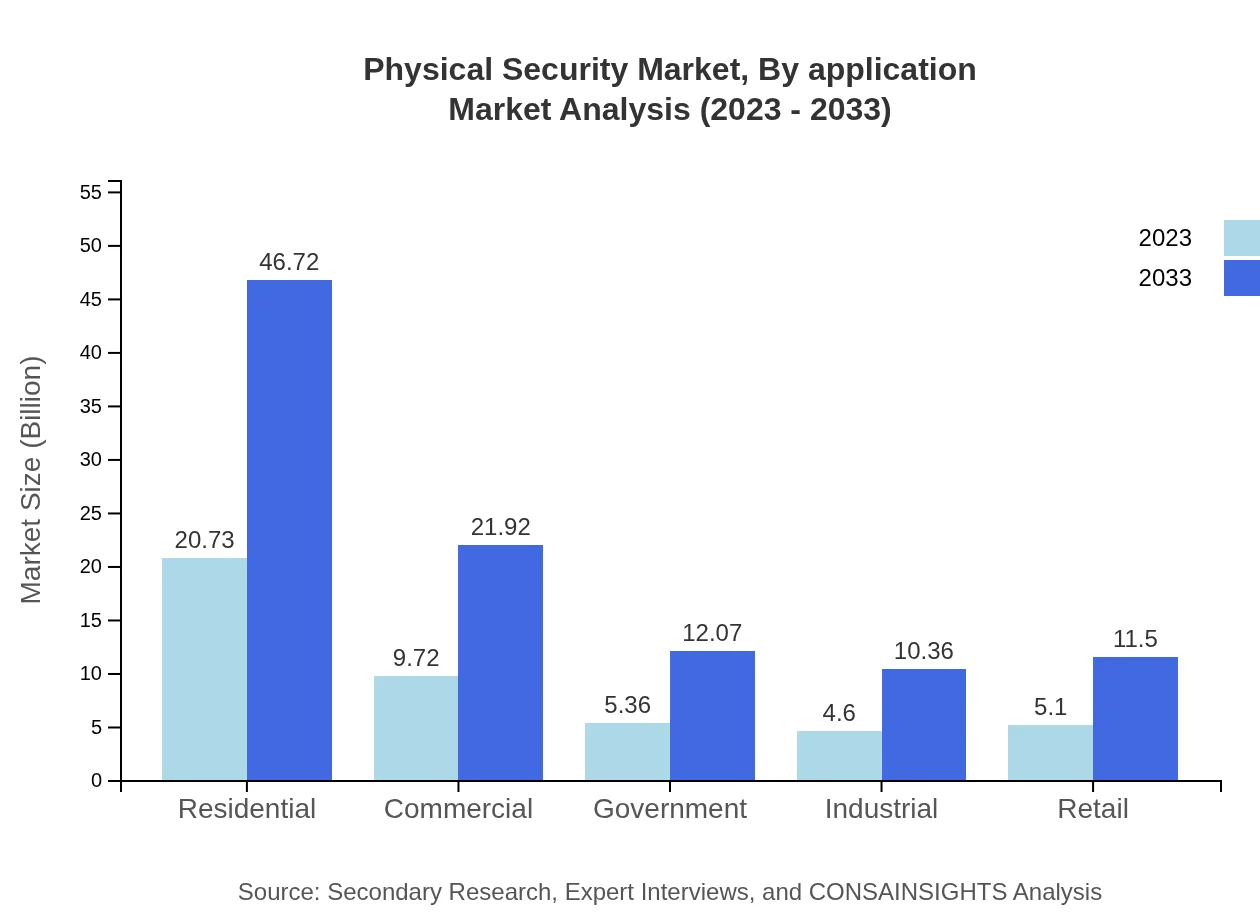

Physical Security Market Analysis By Application

By Application, the Residential segment shows remarkable growth, expanding from $20.73 billion in 2023 to $46.72 billion in 2033, reflecting growing consumer investment in home security. The Commercial sector is also gaining traction, moving from $9.72 billion to $21.92 billion, encouraged by businesses focusing on enhancing their security frameworks.

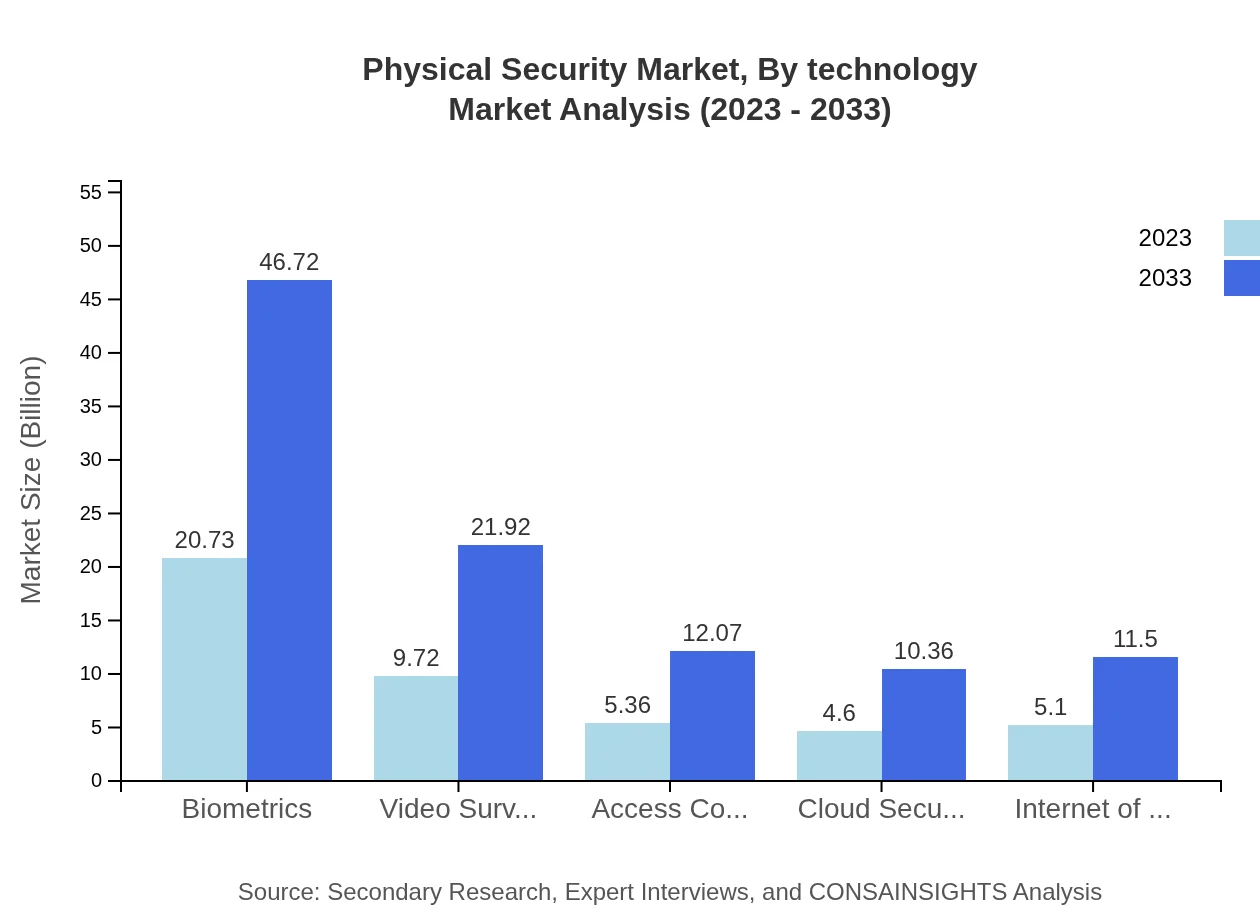

Physical Security Market Analysis By Technology

In terms of technology, the Biometrics segment stands out with market sizes growing from $20.73 billion in 2023 to $46.72 billion by 2033. Other technologies such as Video Surveillance are expected to see growth from $9.72 billion in 2023 to $21.92 billion, highlighting the push towards advanced surveillance systems.

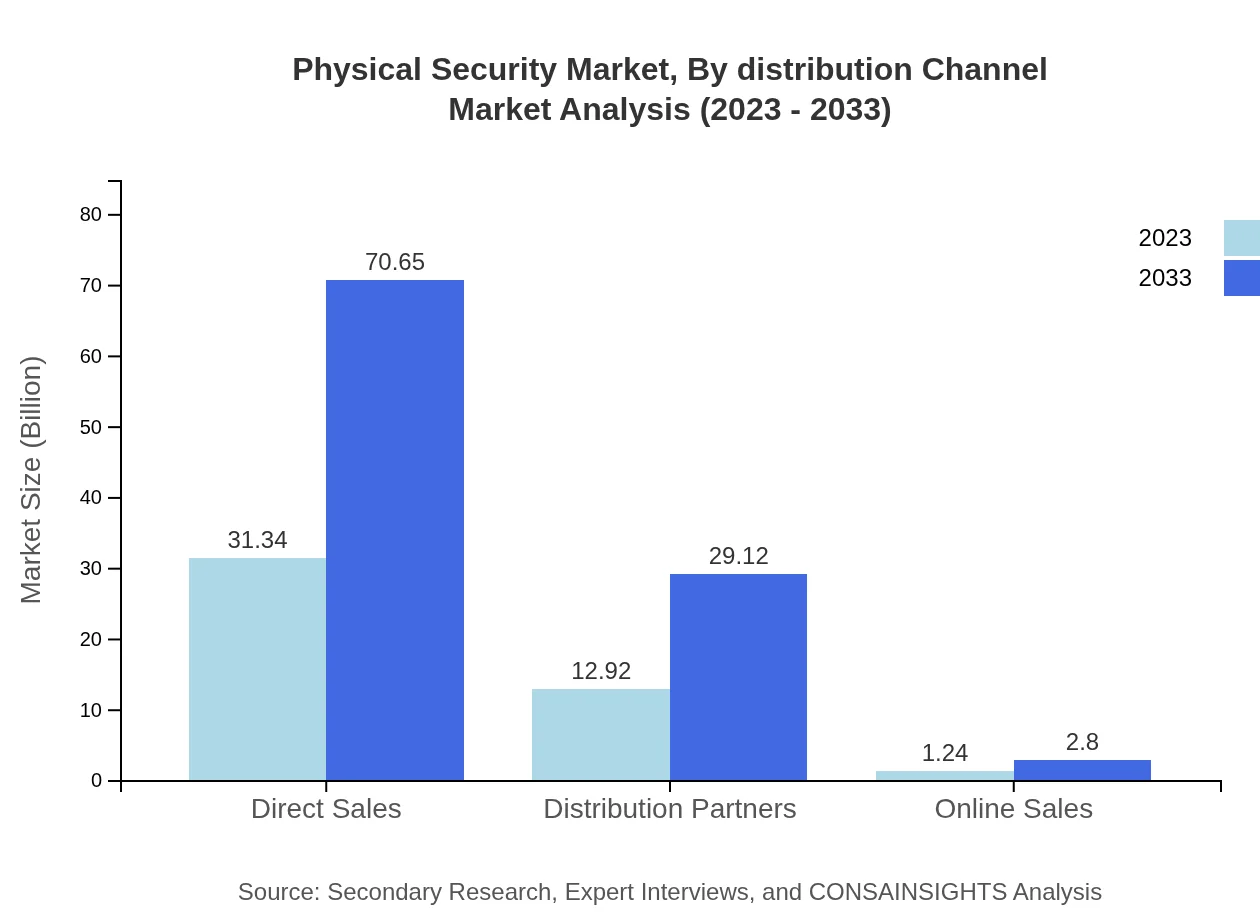

Physical Security Market Analysis By Distribution Channel

The distribution channels for this market include Direct Sales, which dominate with $31.34 billion in 2023 and are expected to grow significantly to $70.65 billion. Distribution partners and online sales channels are also relevant but grow at a slower pace in comparison.

Physical Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Physical Security Industry

Honeywell International Inc.:

A leading global provider of security technologies and services, offering a wide range of physical security systems, including access control and video surveillance solutions.Tyco International plc.:

Specializes in safety and security products, solutions, and services, recognized for its advanced video surveillance and access control technologies.ADT Inc.:

A well-known provider of security systems, primarily for residential and commercial sectors, focusing on innovation and smart home connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of physical Security?

The global physical security market is valued at approximately $45.5 billion in 2023, with a projected CAGR of 8.2%. By 2033, it is expected to grow significantly, highlighting its increasing importance and demand.

What are the key market players or companies in this physical security industry?

Key players in the physical security industry include companies like Adt Inc, Johnson Controls, Honeywell Security, Axis Communications, and Bosch Security Systems, driving innovations and competitive strategies across various security segments.

What are the primary factors driving the growth in the physical security industry?

Factors such as rising security threats, advanced technology integrations, an increase in smart infrastructure, and regulatory compliance demands are major drivers fueling growth in the physical security industry.

Which region is the fastest Growing in the physical security market?

The North American region is anticipated to grow rapidly, with a market size projected to rise from $15.84 billion in 2023 to $35.71 billion by 2033, showcasing a strong demand for physical security solutions.

Does ConsaInsights provide customized market report data for the physical security industry?

Yes, ConsaInsights offers tailored market research services to accommodate specific client requirements, including customized reports that focus on detailed data, trends, and projections within the physical security sector.

What deliverables can I expect from this physical security market research project?

Deliverables include comprehensive market analysis reports, trend insights, competitive landscape evaluations, market forecasts, and strategic recommendations tailored to your organizational needs in the physical security industry.

What are the market trends of physical security?

Emerging trends in the physical security market include increased adoption of biometric systems, enhanced video surveillance technology, integration with IoT solutions, and a shift towards cloud-based security management platforms.