Physical Vapor Deposition Pvd Equipment Market Report

Published Date: 31 January 2026 | Report Code: physical-vapor-deposition-pvd-equipment

Physical Vapor Deposition Pvd Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Physical Vapor Deposition (PVD) Equipment market from 2023 to 2033, including market trends, size, segmentation, regional insights, technology advancements, and future forecasts.

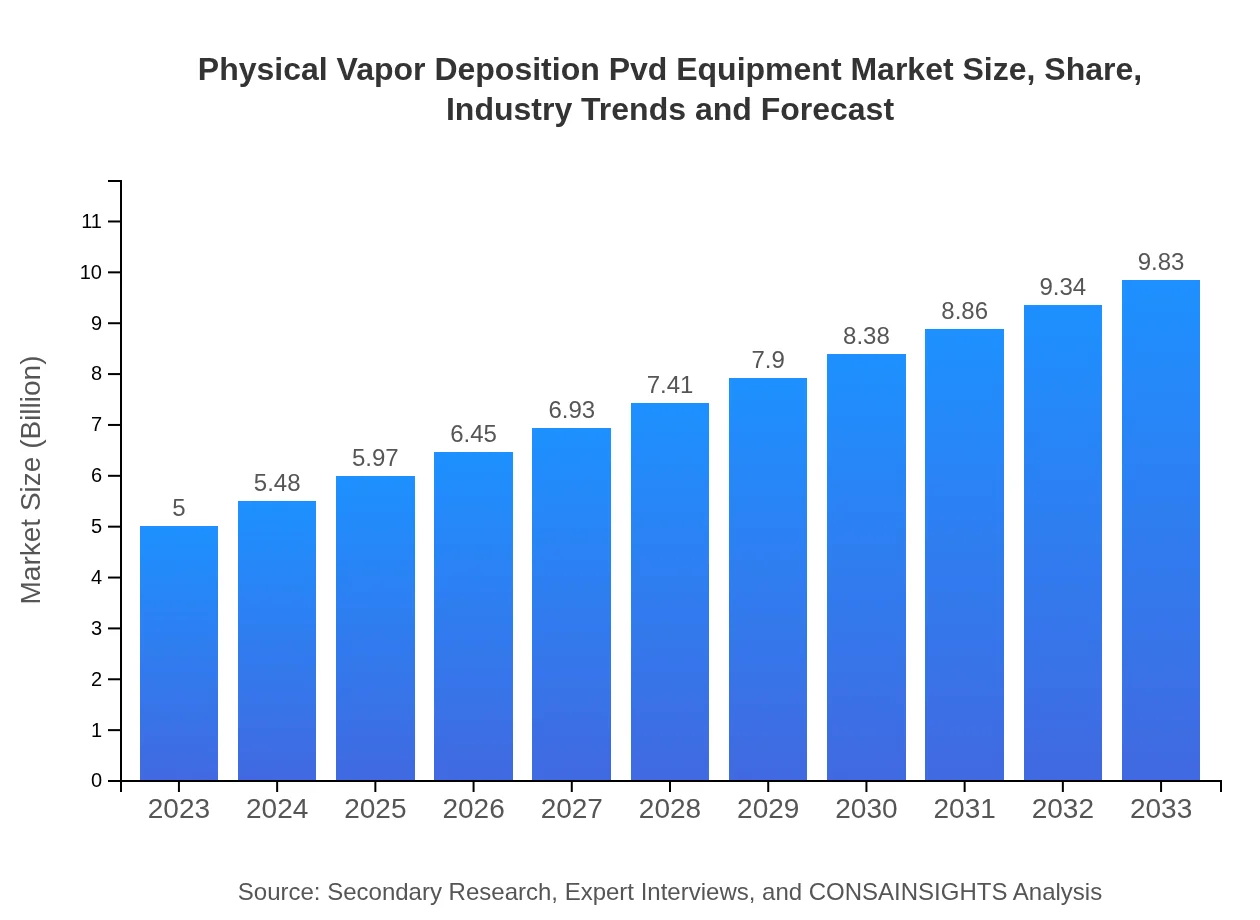

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $9.83 Billion |

| Top Companies | Applied Materials, Inc., ULVAC, Inc., Oerlikon Balzers Coating AG, Kurt J. Lesker Company, Buhler Leybold Optics GmbH |

| Last Modified Date | 31 January 2026 |

Physical Vapor Deposition Pvd Equipment Market Overview

Customize Physical Vapor Deposition Pvd Equipment Market Report market research report

- ✔ Get in-depth analysis of Physical Vapor Deposition Pvd Equipment market size, growth, and forecasts.

- ✔ Understand Physical Vapor Deposition Pvd Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Physical Vapor Deposition Pvd Equipment

What is the Market Size & CAGR of Physical Vapor Deposition Pvd Equipment market in 2023?

Physical Vapor Deposition Pvd Equipment Industry Analysis

Physical Vapor Deposition Pvd Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Physical Vapor Deposition Pvd Equipment Market Analysis Report by Region

Europe Physical Vapor Deposition Pvd Equipment Market Report:

Europe is characterized by its advanced manufacturing capabilities, with the PVD Equipment market expected to reach USD 2.64 billion by 2033, increasing from USD 1.34 billion in 2023. Industrial growth is fueled by stringent environmental regulations promoting sustainable manufacturing processes.Asia Pacific Physical Vapor Deposition Pvd Equipment Market Report:

The Asia Pacific region is set to witness robust growth, projected to reach USD 2.02 billion by 2033, up from USD 1.03 billion in 2023. The surge is primarily due to rising demand for consumer electronics and advancing manufacturing sectors in countries like Japan, China, and South Korea, coupled with increased investment in R&D.North America Physical Vapor Deposition Pvd Equipment Market Report:

The North American market is projected to grow from USD 1.60 billion in 2023 to USD 3.15 billion by 2033, highlighting a significant development driven by the aerospace and telecommunications sectors’ increased demand for high-performance coatings and surfaces.South America Physical Vapor Deposition Pvd Equipment Market Report:

In South America, the market for PVD Equipment is expected to grow steadily from USD 0.40 billion in 2023 to USD 0.79 billion by 2033. This growth is driven by the rising adoption of PVD technology in the automotive and electronics industries, as manufacturers explore efficient and sustainable production methods.Middle East & Africa Physical Vapor Deposition Pvd Equipment Market Report:

The Middle East and Africa are forecasted to see the market grow from USD 0.63 billion in 2023 to USD 1.23 billion by 2033, with expanding manufacturing sectors investing in advanced technologies to boost production efficiency.Tell us your focus area and get a customized research report.

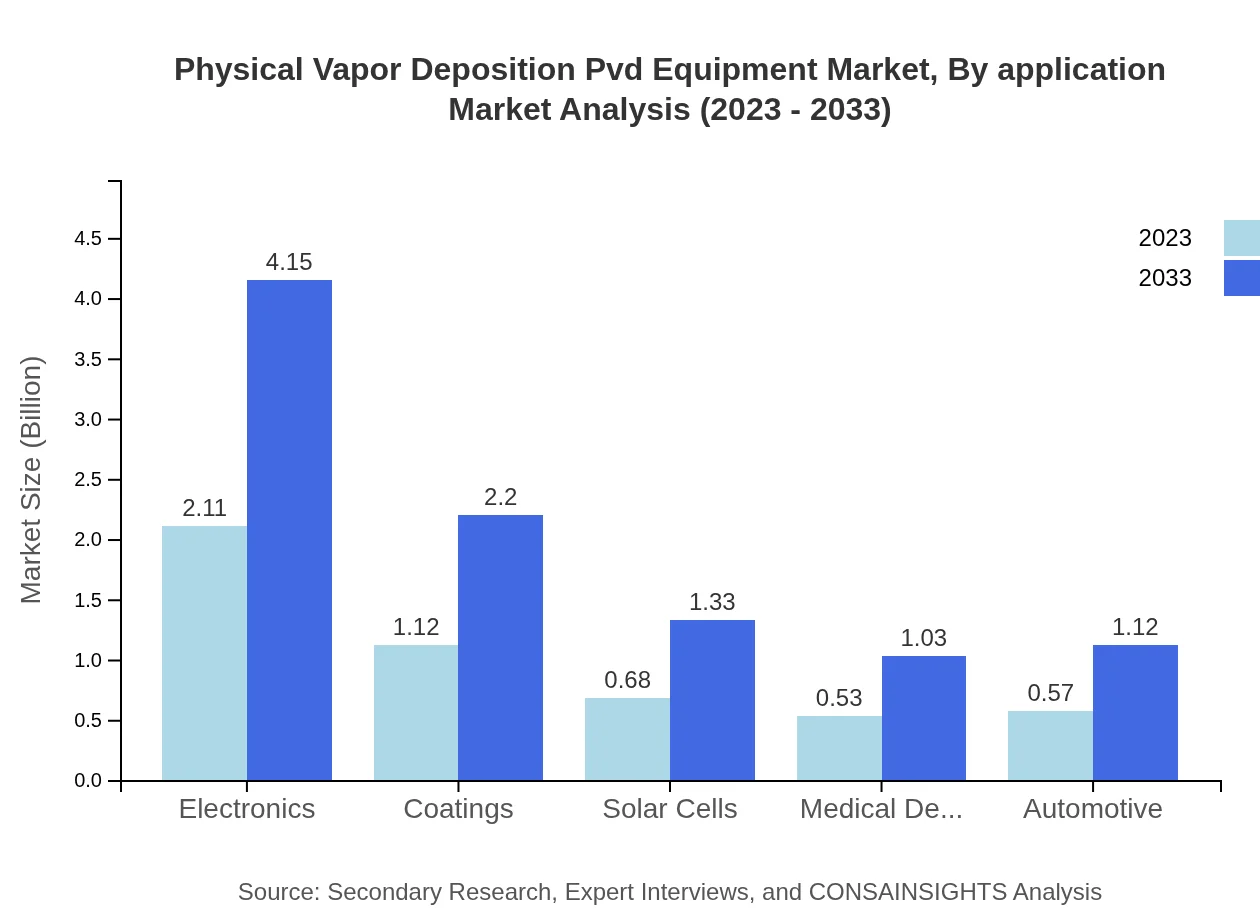

Physical Vapor Deposition Pvd Equipment Market Analysis By Application

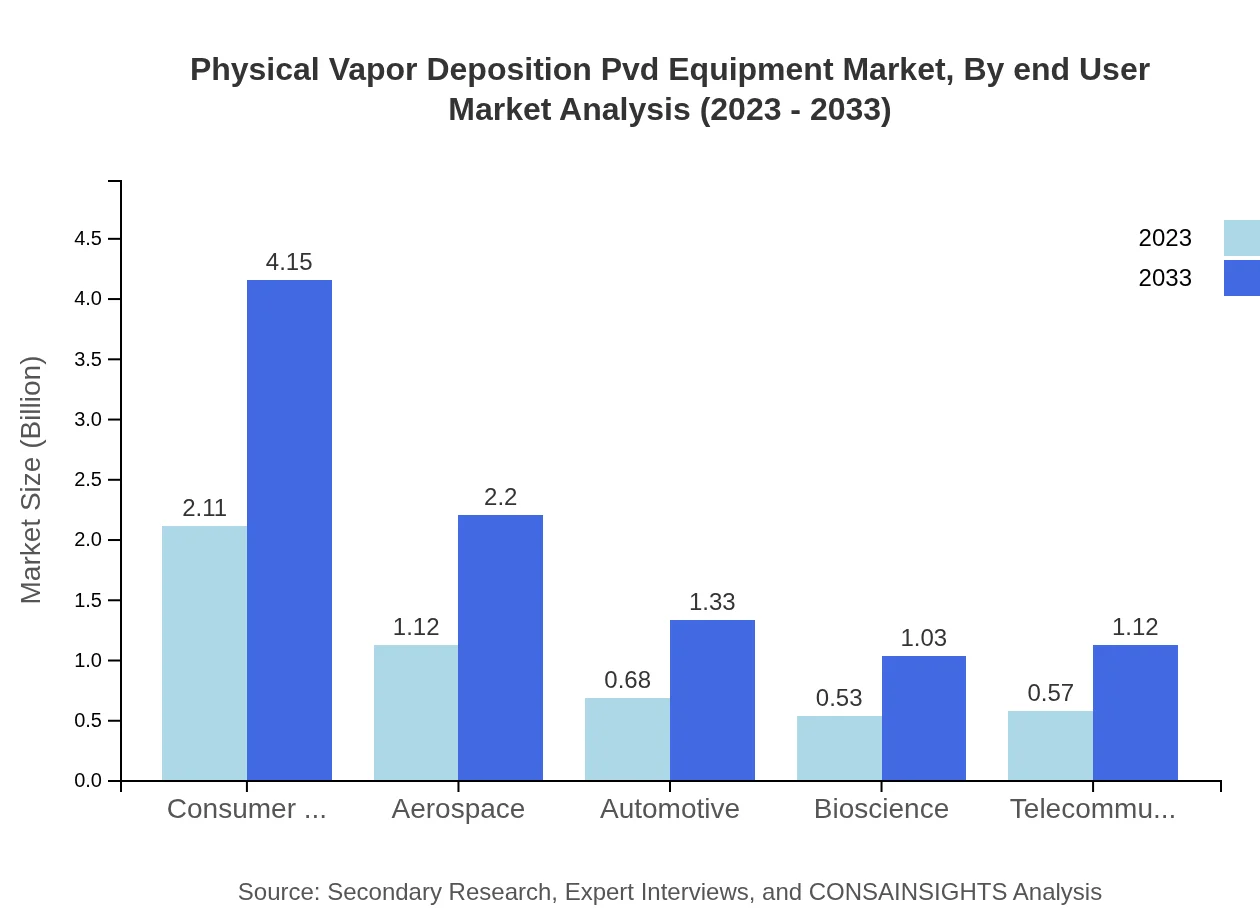

In 2023, the Consumer Electronics segment leads the market with a value of USD 2.11 billion, expected to double to USD 4.15 billion by 2033. Aerospace follows, starting at USD 1.12 billion and projected to reach USD 2.20 billion by 2033. The Automotive segment is anticipated to grow from USD 0.68 billion in 2023 to USD 1.33 billion by 2033. Other significant segments include Bioscience, Telecommunications, and Medical Devices, all showing steady growth due to increasing applications of advanced coatings.

Physical Vapor Deposition Pvd Equipment Market Analysis By End User

The end-user segments reveal the significance of Electronics, Coatings, and Aerospace in driving market value. Notably, the Electronics sector will maintain around 42.2% market share over the forecast period, thanks to the persistent demand for consumer electronics. The Aerospace industry remains vital at 22.38%, reflecting the need for high-performance materials in aircraft manufacturing. Moreover, the Automotive segment demonstrates a consistent 13.55% share, emphasizing the role of PVD in enhancing automotive components.

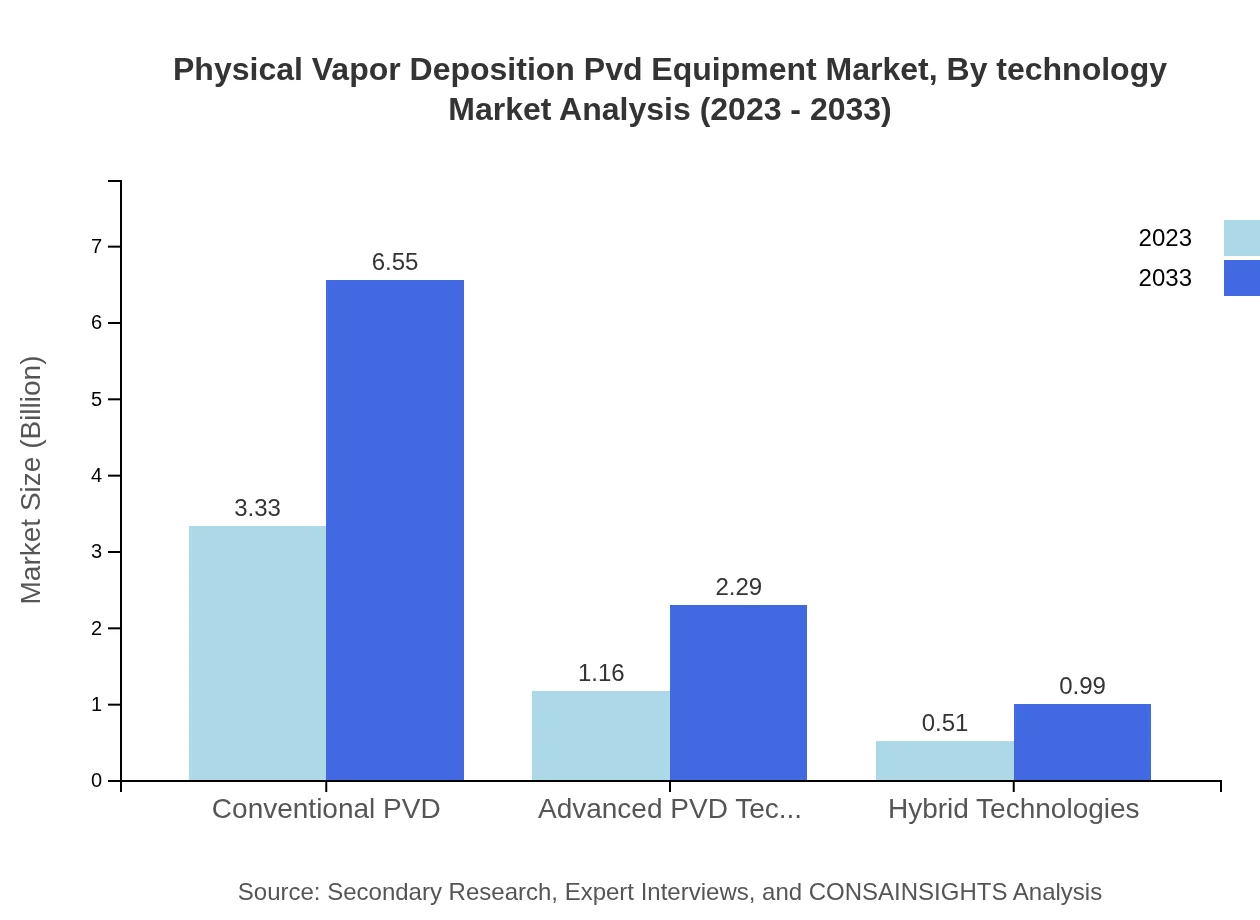

Physical Vapor Deposition Pvd Equipment Market Analysis By Technology

Technologically, Conventional PVD continues to dominate with a market size of USD 3.33 billion in 2023 and forecasted to rise to USD 6.55 billion in 2033. Advanced PVD Techniques are gaining traction with a projected growth from USD 1.16 billion currently to USD 2.29 billion by 2033. Hybrid Technologies, though smaller, are expected to solidify a niche with a market value of USD 0.99 billion by 2033, reflecting ongoing innovation in PVD applications.

Physical Vapor Deposition Pvd Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Physical Vapor Deposition Pvd Equipment Industry

Applied Materials, Inc.:

A leading provider of equipment, services, and software for the semiconductor and display industries, Applied Materials specializes in PVD-based deposition technologies.ULVAC, Inc.:

A pioneer in vacuum technology and equipment manufacturing, ULVAC offers high-quality PVD solutions widely used in electronic components and semiconductor industries.Oerlikon Balzers Coating AG:

Known for surface solutions, Oerlikon Balzers develops innovative PVD coatings that enhance the performance and longevity of components in various industries.Kurt J. Lesker Company:

With a focus on high-tech manufacturing, Lesker is a significant player in the PVD market, offering comprehensive vacuum coating solutions.Buhler Leybold Optics GmbH:

Bühler specializes in optical coating solutions using PVD technologies, particularly for the automotive and consumer electronics sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Physical Vapor Deposition (PVD) Equipment?

The global market size for Physical Vapor Deposition (PVD) equipment is currently estimated at $5 billion with a projected CAGR of 6.8% from 2023 to 2033, indicating robust growth and increasing adoption in various industries.

What are the key market players or companies in the PVD equipment industry?

Key players in the PVD equipment industry include significant organizations such as Applied Materials, DAINIPPON SCREEN MFG, ULVAC, and Veeco Instruments, which dominate the market with their advanced technologies and extensive product offerings.

What are the primary factors driving the growth in the PVD equipment industry?

The growth in the PVD equipment industry is driven by increasing demand from consumer electronics, automotive, and aerospace sectors, coupled with the need for advanced coating technologies and energy-efficient manufacturing processes.

Which region is the fastest Growing in the PVD equipment market?

North America is projected to be the fastest-growing region in the PVD equipment market, with its market size expected to increase from $1.60 billion in 2023 to $3.15 billion by 2033, driven by technological advancements and industrial expansion.

Does ConsaInsights provide customized market report data for the PVD equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the PVD equipment industry, allowing clients to obtain insights that are aligned with their business strategies.

What deliverables can I expect from this PVD equipment market research project?

From a PVD equipment market research project, you can expect detailed reports including market size, segmentation analysis, regional insights, competitive landscape, and trend forecasting, providing comprehensive guidance for decision-making.

What are the market trends of the PVD equipment industry?

Current market trends in the PVD equipment industry indicate a shift towards advanced PVD techniques, increased adoption in emerging sectors like renewable energy, and a focus on sustainability-oriented processes for coating solutions.