Pipeline Security Systems Market Report

Published Date: 31 January 2026 | Report Code: pipeline-security-systems

Pipeline Security Systems Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Pipeline Security Systems market from 2023 to 2033, covering market sizes, growth rates, regional insights, key players, and prevailing trends shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

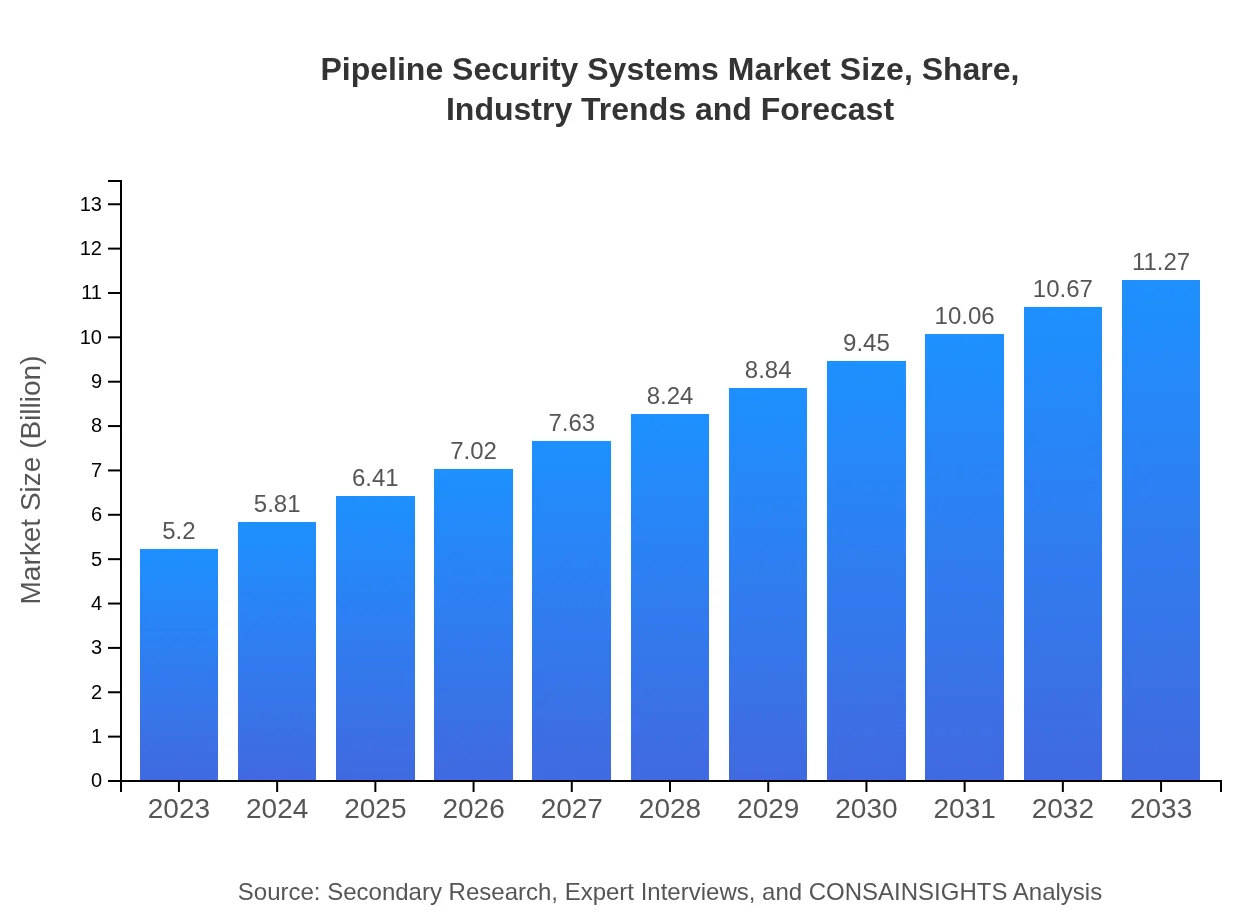

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Honeywell , Siemens , Schneider Electric |

| Last Modified Date | 31 January 2026 |

Pipeline Security Systems Market Overview

Customize Pipeline Security Systems Market Report market research report

- ✔ Get in-depth analysis of Pipeline Security Systems market size, growth, and forecasts.

- ✔ Understand Pipeline Security Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pipeline Security Systems

What is the Market Size & CAGR of Pipeline Security Systems market in 2023?

Pipeline Security Systems Industry Analysis

Pipeline Security Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pipeline Security Systems Market Analysis Report by Region

Europe Pipeline Security Systems Market Report:

In Europe, the market is expected to increase from $1.32 billion in 2023 to $2.87 billion by 2033. The region is focusing on sustainable practices, making investment in pipeline security systems a priority to safeguard critical assets.Asia Pacific Pipeline Security Systems Market Report:

In 2023, the Asia Pacific Pipeline Security Systems market is valued at approximately $1.06 billion, expected to grow to $2.30 billion by 2033, driven by infrastructure development and rising energy demands in countries like India and China.North America Pipeline Security Systems Market Report:

The North American market is set to dominate the sector, projected to grow from $2.01 billion in 2023 to $4.36 billion by 2033. High investments in the oil and gas sector, along with stringent regulations, are driving security system adoption.South America Pipeline Security Systems Market Report:

The South America segment is estimated to reach $0.28 billion in 2023, with potential growth to $0.61 billion by 2033. Increasing investment in energy infrastructure and regulatory frameworks enhances demand for effective pipeline security solutions.Middle East & Africa Pipeline Security Systems Market Report:

The Middle East and Africa market is projected to grow from $0.52 billion in 2023 to $1.14 billion by 2033, driven by increasing investments in energy security, particularly in oil and gas-rich nations.Tell us your focus area and get a customized research report.

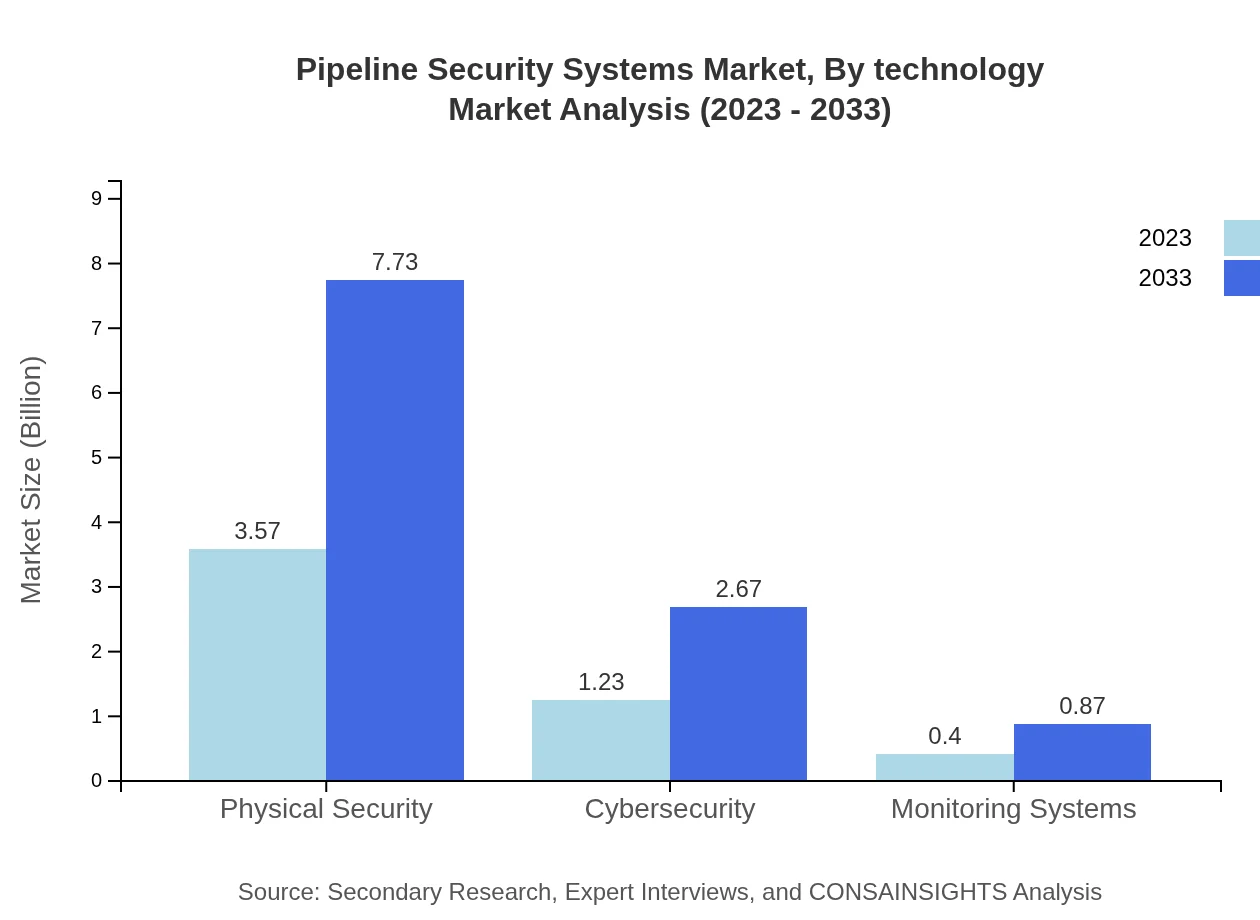

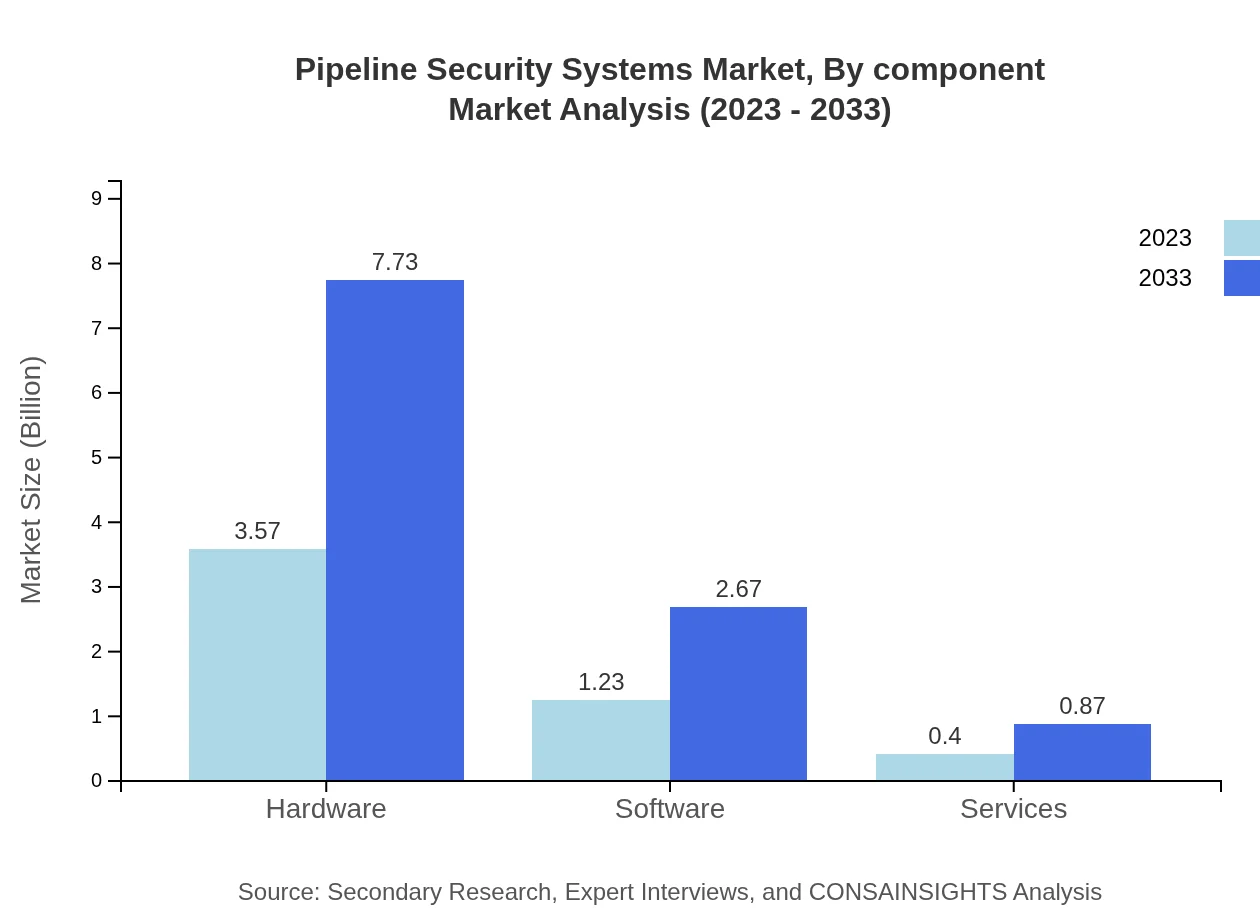

Pipeline Security Systems Market Analysis By Technology

The technology segment includes hardware and software solutions, where hardware accounts for 68.61% of the market share in 2023, growing significantly to $7.73 billion in 2033. Software and services are also witnessing growth with increasing integration of cybersecurity measures.

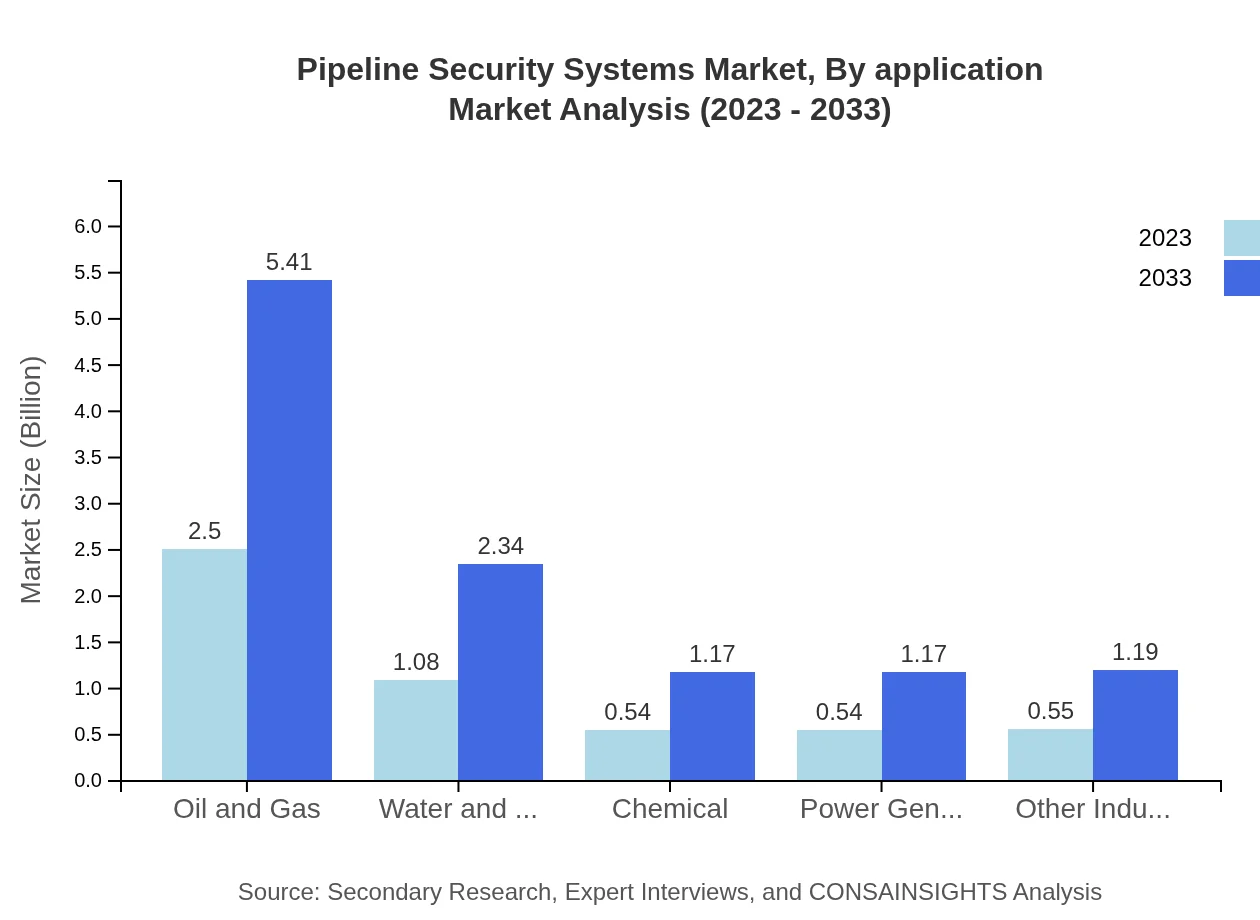

Pipeline Security Systems Market Analysis By Application

The application segment reveals that the oil and gas industry dominates the market, holding a 48% share in 2023, expected to reach $5.41 billion by 2033. Water and wastewater applications are also significant, with a 20.72% market share.

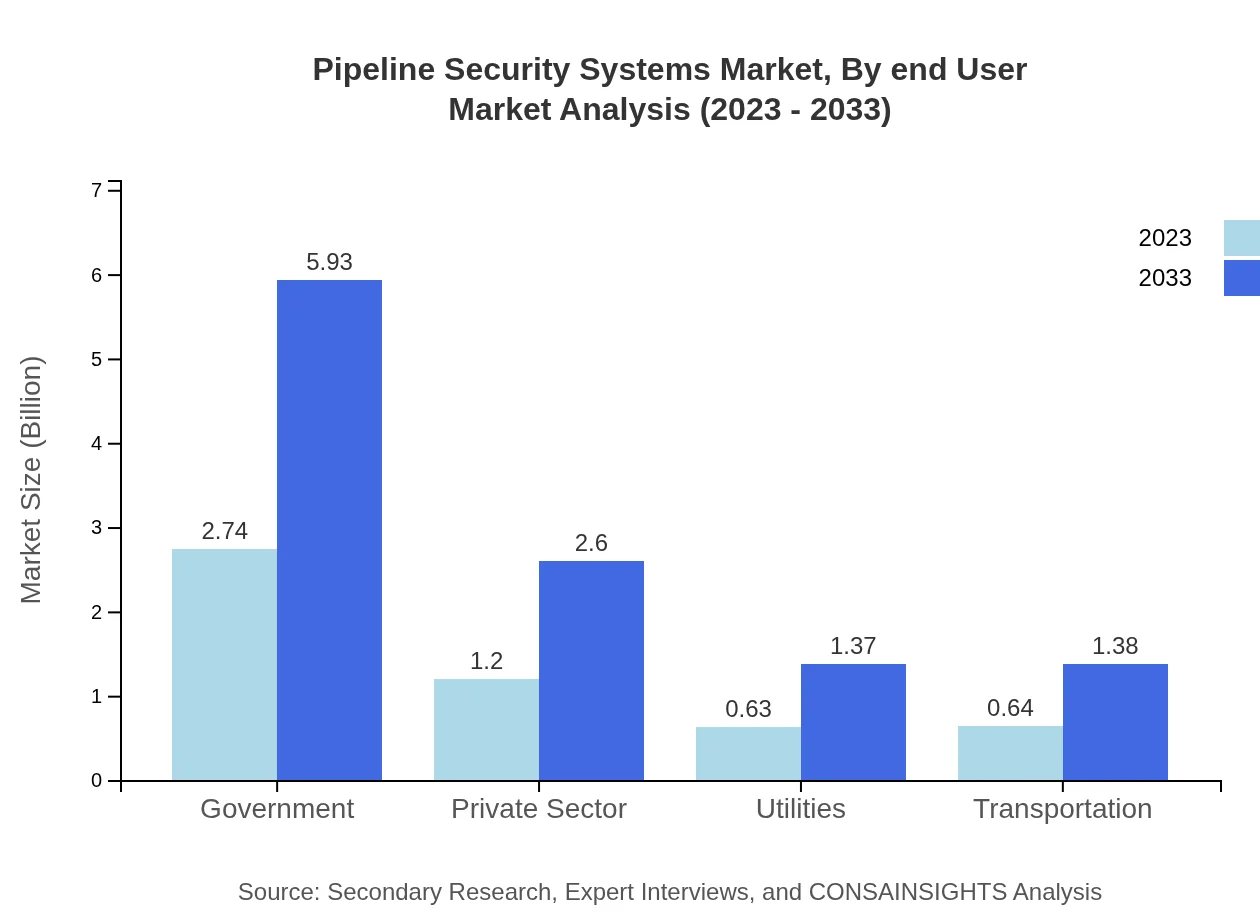

Pipeline Security Systems Market Analysis By End User

The government sector remains the largest end-user, with a market size of $2.74 billion in 2023. Other sectors, such as utilities and transportation, are also expanding, emphasizing heightened security for public services.

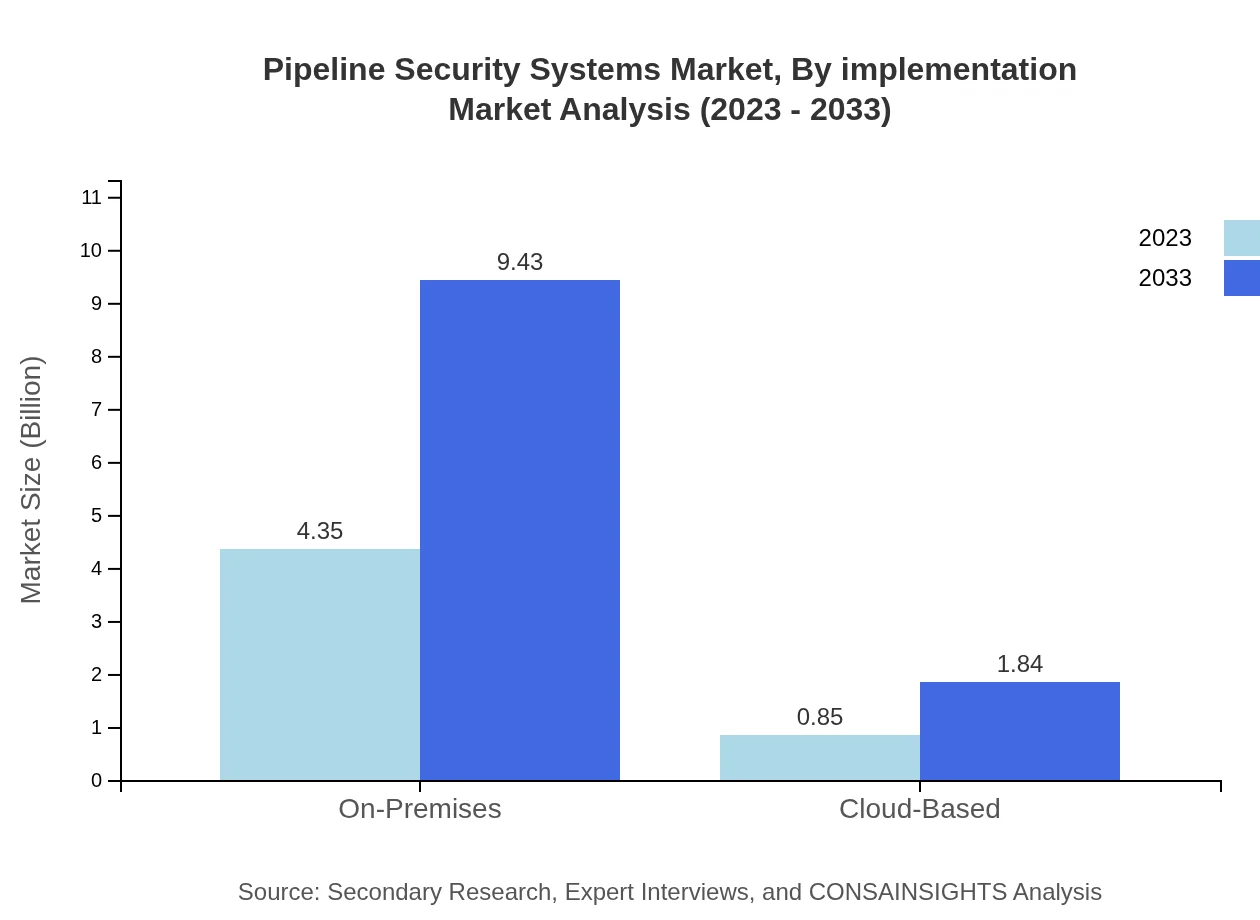

Pipeline Security Systems Market Analysis By Implementation

On-Premises installation dominates the implementation type with an 83.64% market share in 2023, while cloud-based solutions are expected to witness significant growth due to increasing demand for remote management and operational efficiency.

Pipeline Security Systems Market Analysis By Component

The component segment highlights hardware as a significant driver, constituting 68.61% of the total market. This segment reflects ongoing investments in advanced sensor technology and surveillance systems that enhance overall pipeline security.

Pipeline Security Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pipeline Security Systems Industry

Honeywell :

A leading provider of security solutions, Honeywell offers a range of pipeline security systems integrating advanced technology for the oil and gas sectors.Siemens :

Siemens specializes in digital and automated solutions, contributing innovative security technologies essential for protecting pipeline infrastructures.Schneider Electric:

Schneider Electric focuses on critical industrial cybersecurity, providing comprehensive solutions that safeguard pipeline operations.We're grateful to work with incredible clients.

FAQs

What is the market size of pipeline Security Systems?

The pipeline security systems market is currently valued at approximately $5.2 billion and is projected to grow at a CAGR of 7.8% from 2023 to 2033, indicating robust growth prospects driven by increasing security demands.

What are the key market players or companies in this pipeline Security Systems industry?

Key players in the pipeline security systems industry include leading technology companies and specialized security providers that focus on advanced security solutions for oil, gas, water, and other critical pipelines.

What are the primary factors driving the growth in the pipeline Security Systems industry?

The growth in the pipeline security systems industry is primarily driven by increasing concerns over infrastructure security, regulatory compliance, advancements in technology, and the need for effective monitoring and threat detection systems.

Which region is the fastest Growing in the pipeline Security Systems?

The fastest-growing region in the pipeline security systems market is Europe, projected to grow from $1.32 billion in 2023 to $2.87 billion by 2033, followed closely by North America and Asia Pacific.

Does ConsaInsights provide customized market report data for the pipeline Security Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the pipeline security systems industry, allowing clients to gain insights specific to their market segments and operational regions.

What deliverables can I expect from this pipeline Security Systems market research project?

Clients can expect detailed market analysis, growth forecasts, competitor insights, market share breakdowns, and recommendations tailored specifically to enhance operational strategies in the pipeline security systems sector.

What are the market trends of pipeline Security Systems?

Current market trends in the pipeline security systems industry include increasing adoption of cloud-based solutions, integration of AI and IoT technologies, and a growing focus on physical and cyber security to safeguard pipeline infrastructures.