Piston Engine Aircraft Market Report

Published Date: 03 February 2026 | Report Code: piston-engine-aircraft

Piston Engine Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Piston Engine Aircraft market, detailing market size, growth trends, and regional insights from 2023 to 2033. It encompasses the technological advancements, industry dynamics, and competitive landscape affecting the market.

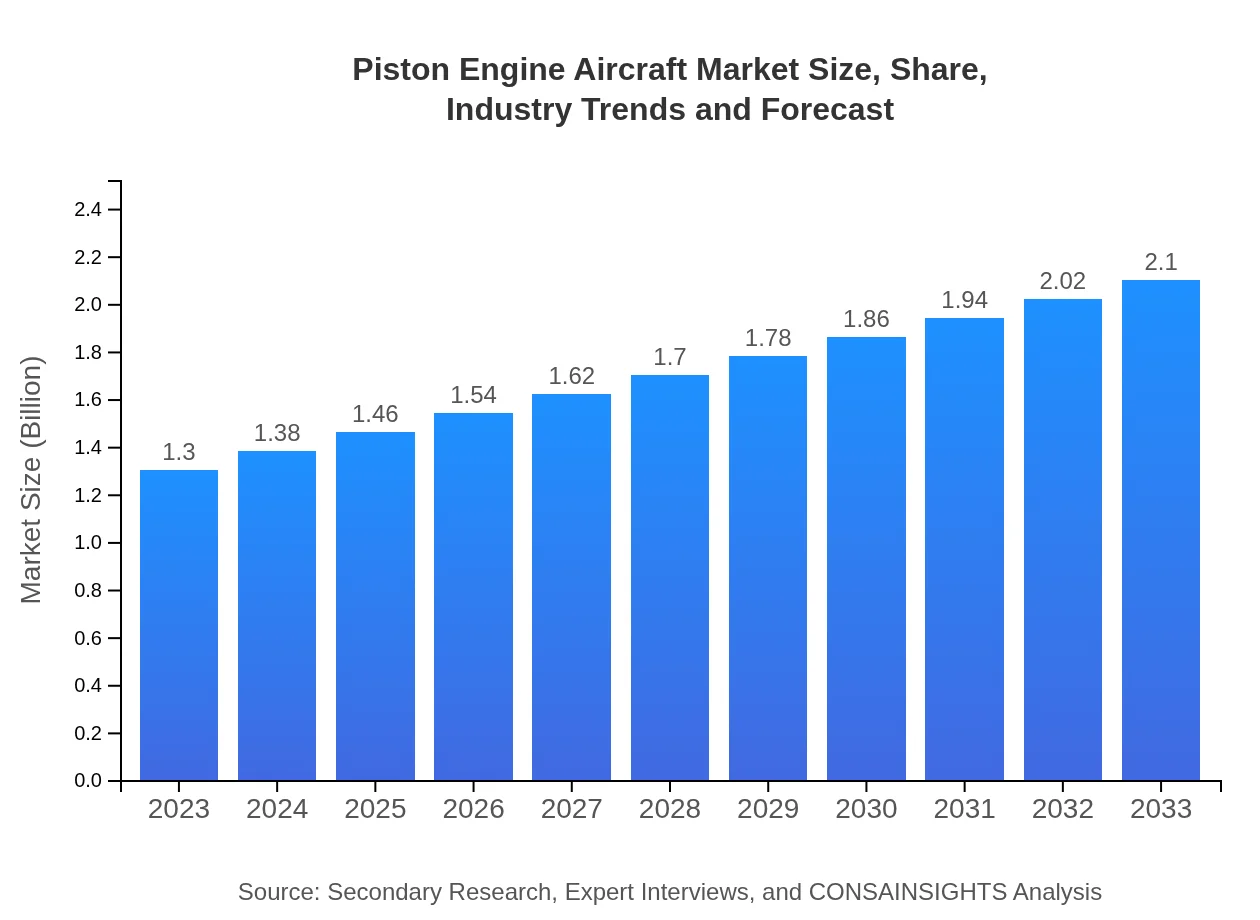

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.30 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.10 Billion |

| Top Companies | Cessna Aircraft Company, Piper Aircraft, Inc., Cirrus Aircraft, Diamond Aircraft Industries, Textron Aviation |

| Last Modified Date | 03 February 2026 |

Piston Engine Aircraft Market Overview

Customize Piston Engine Aircraft Market Report market research report

- ✔ Get in-depth analysis of Piston Engine Aircraft market size, growth, and forecasts.

- ✔ Understand Piston Engine Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Piston Engine Aircraft

What is the Market Size & CAGR of Piston Engine Aircraft market in 2023?

Piston Engine Aircraft Industry Analysis

Piston Engine Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Piston Engine Aircraft Market Analysis Report by Region

Europe Piston Engine Aircraft Market Report:

Europe's market, valued at $0.37 billion in 2023, is expected to grow to $0.60 billion by 2033. Increased environmental regulations and a shift towards sustainable aviation practices are influencing market dynamics.Asia Pacific Piston Engine Aircraft Market Report:

In the Asia-Pacific region, the market is growing, with a valuation of $0.25 billion in 2023 projected to reach $0.40 billion by 2033. The growth is propelled by increased investments in aviation infrastructure and rising interest in general aviation among emerging economies.North America Piston Engine Aircraft Market Report:

North America remains the largest market for piston engine aircraft, with an estimated size of $0.48 billion in 2023 growing to $0.78 billion by 2033. The region benefits from a robust general aviation sector and strong pilot training programs.South America Piston Engine Aircraft Market Report:

South America exhibits moderate growth with a market size of $0.09 billion in 2023, anticipated to rise to $0.15 billion by 2033. The expansion of regional air transport services and improving economic conditions are key factors.Middle East & Africa Piston Engine Aircraft Market Report:

The Middle East and Africa region is experiencing growth from $0.11 billion in 2023 to $0.17 billion by 2033, driven by a developing aviation sector and a rise in recreational flying activities.Tell us your focus area and get a customized research report.

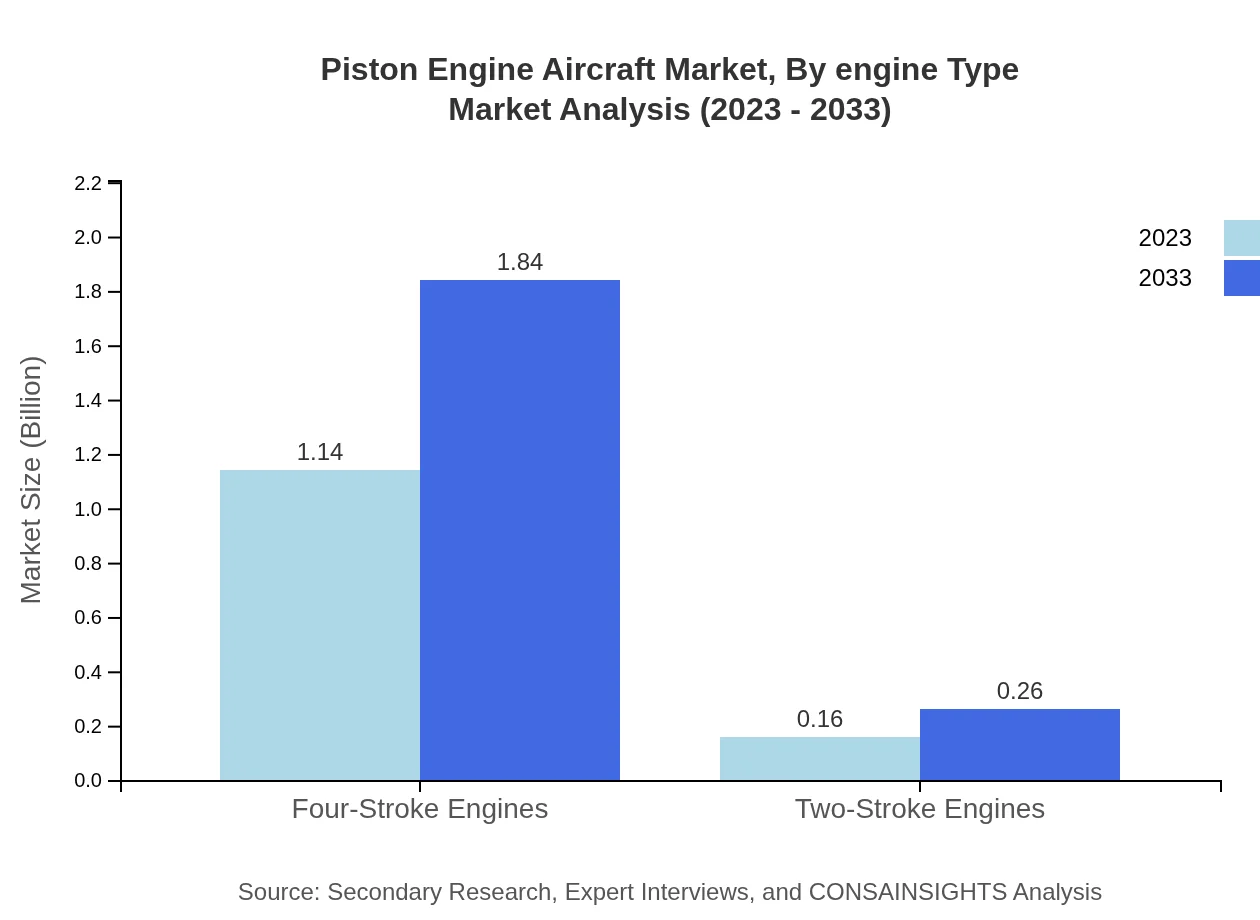

Piston Engine Aircraft Market Analysis By Engine Type

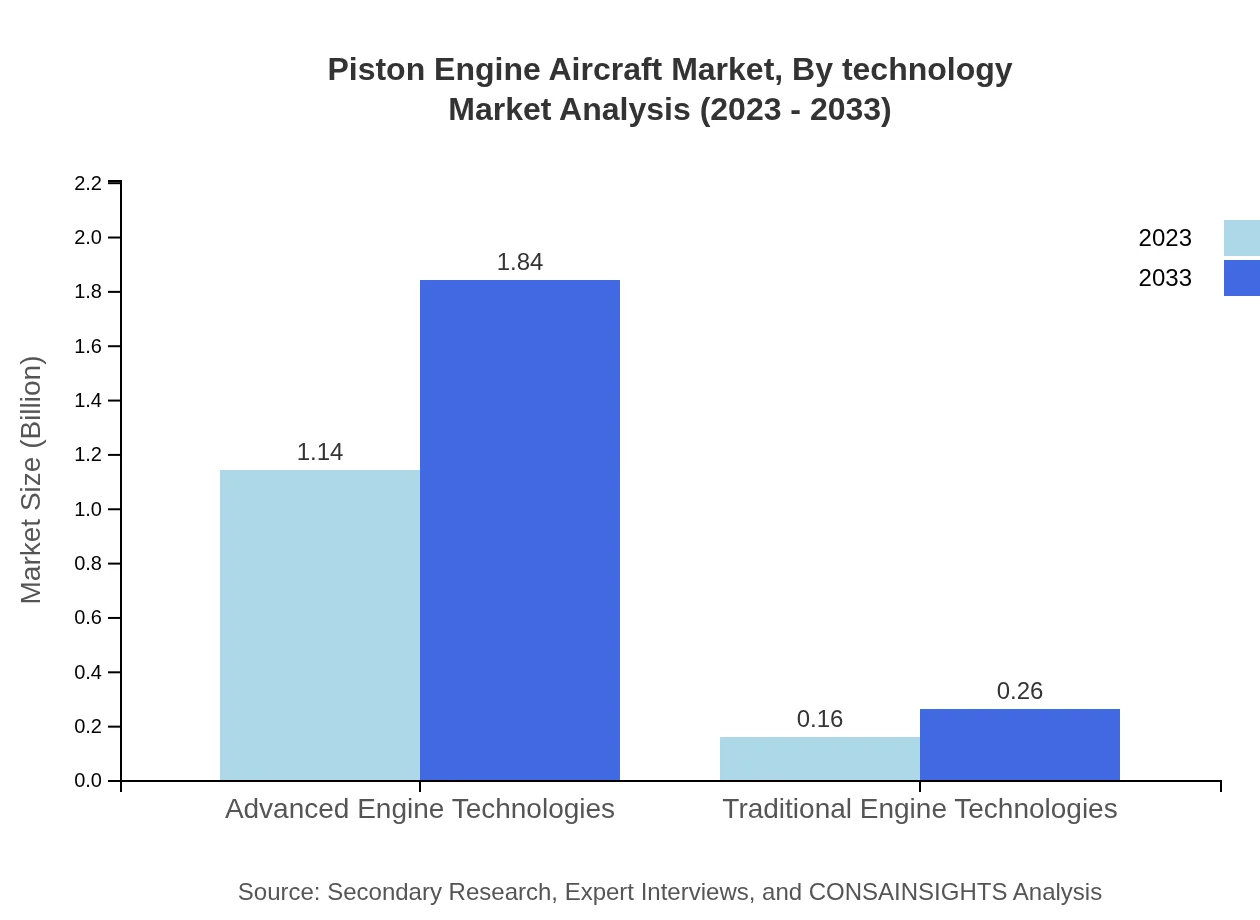

The Piston Engine Aircraft market by engine type is divided into 'Advanced Engine Technologies' and 'Traditional Engine Technologies.' In 2023, advanced engine technologies dominate the market with $1.14 billion, expected to grow to $1.84 billion by 2033, representing an 87.66% market share. In contrast, traditional technologies show a smaller market of $0.16 billion in 2023, anticipated to expand to $0.26 billion by 2033, holding a 12.34% share.

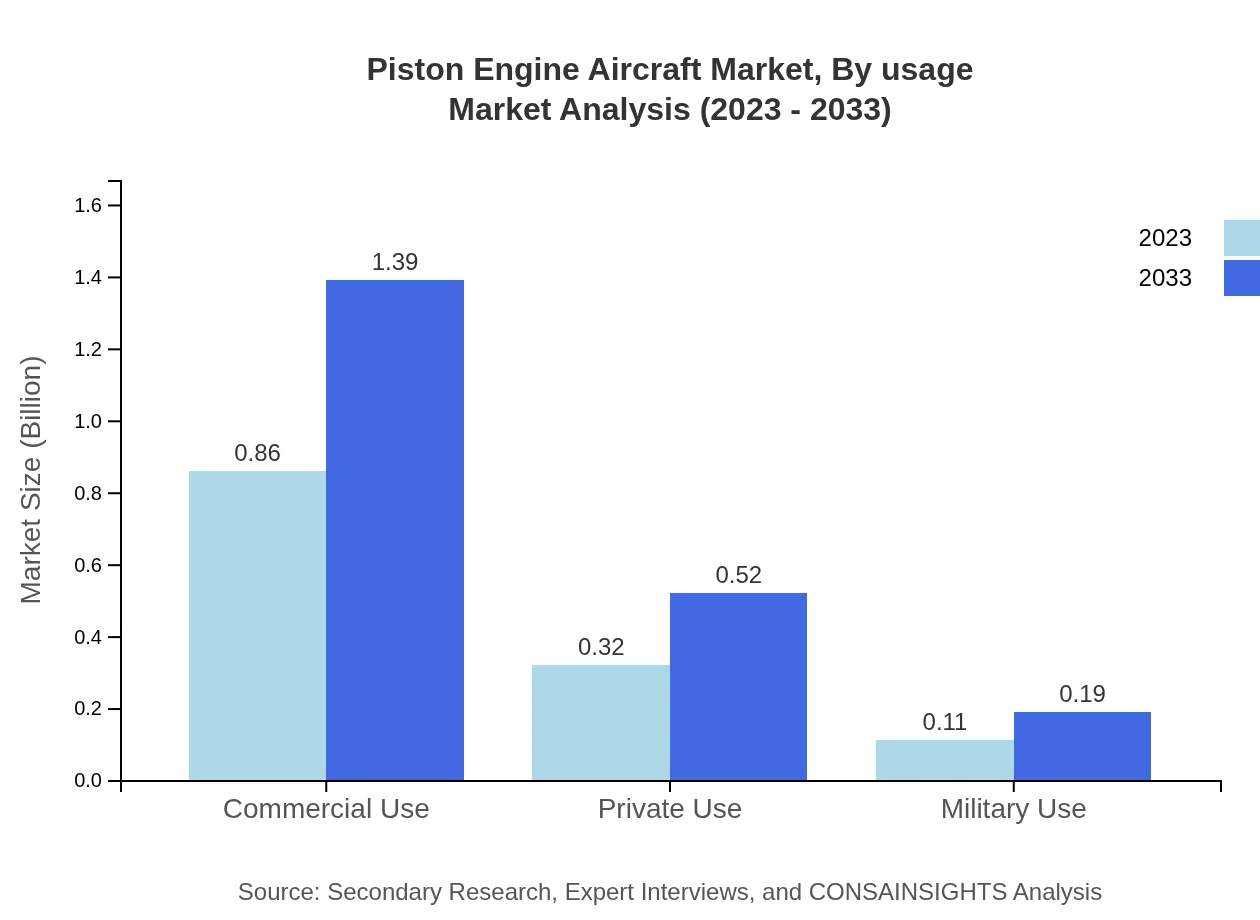

Piston Engine Aircraft Market Analysis By Usage

The market by usage segments shows that the commercial usage stands as the most significant segment, with a size of $0.86 billion in 2023 and projected to grow to $1.39 billion by 2033, representing a 66.45% market share. Private use follows with a market size of $0.32 billion, projected to grow to $0.52 billion by 2033, accounting for 24.71% of the market. Military usage remains at a smaller segment with $0.11 billion in 2023 expected to reach $0.19 billion by 2033, holding an 8.84% market share.

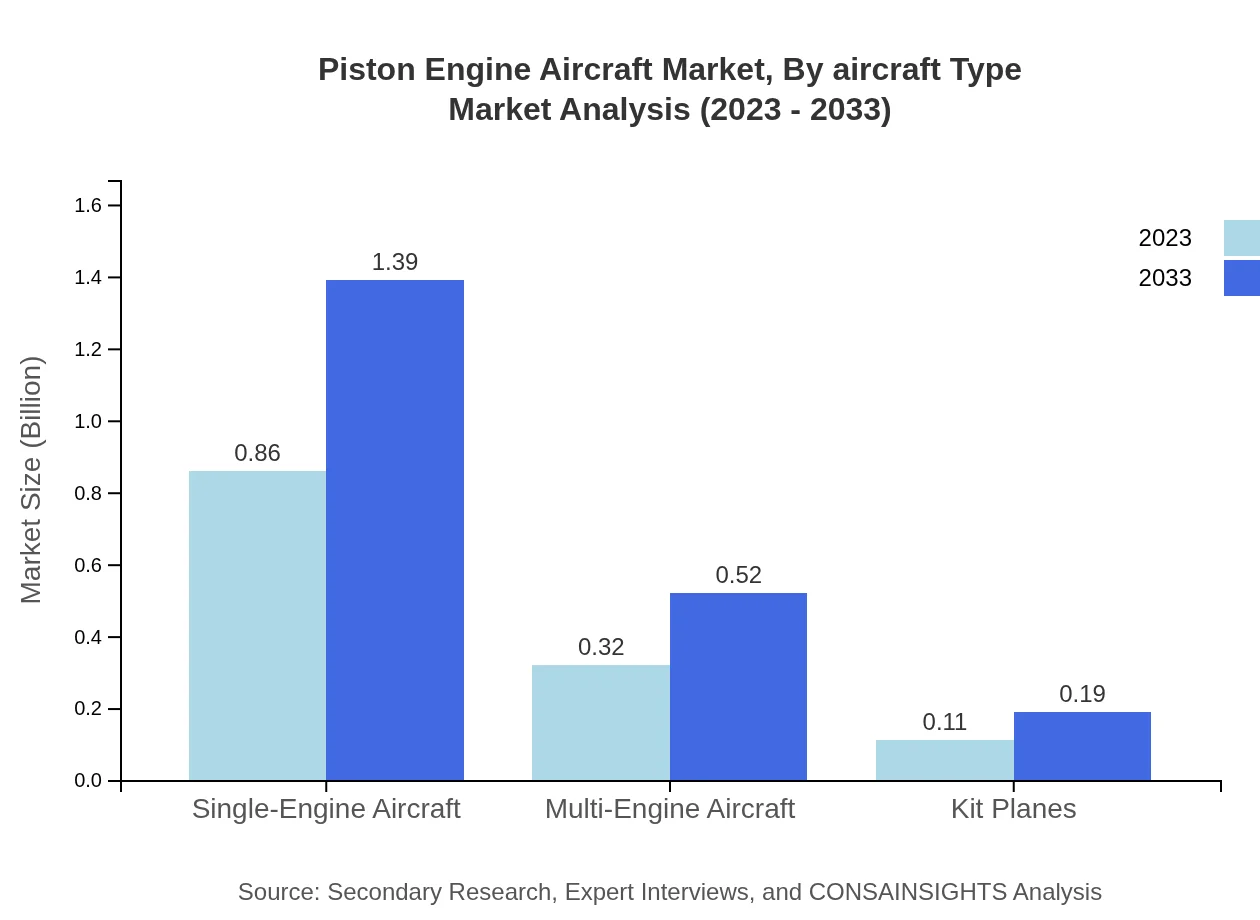

Piston Engine Aircraft Market Analysis By Aircraft Type

In aircraft type categories, single-engine aircraft lead with a market size of $0.86 billion in 2023, rising to $1.39 billion by 2033, reflecting a 66.45% market share. Multi-engine aircraft are expected to grow from $0.32 billion to $0.52 billion across the same period, maintaining a 24.71% market share. Kit planes hold a smaller market of $0.11 billion, anticipated to increase to $0.19 billion, with an 8.84% share.

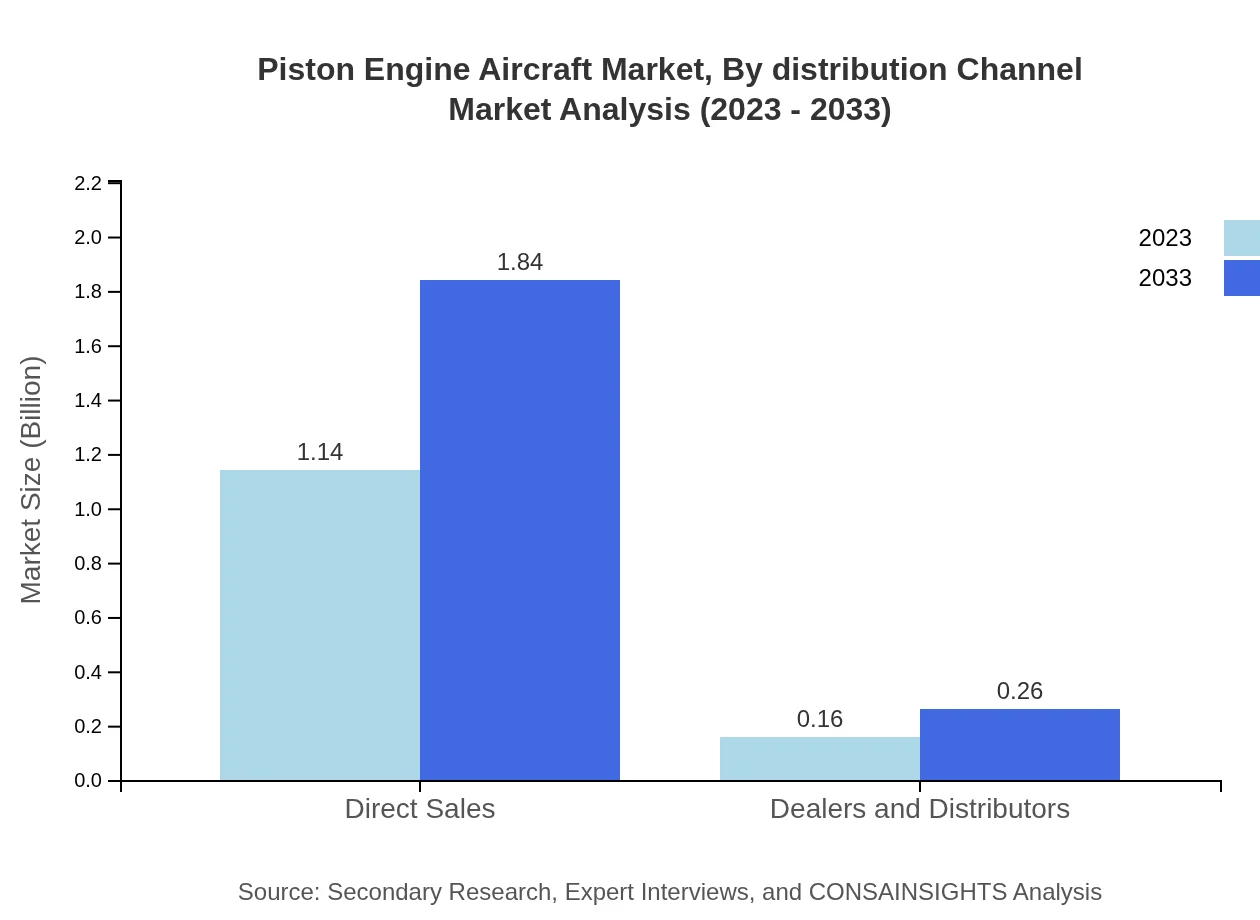

Piston Engine Aircraft Market Analysis By Distribution Channel

The analysis of distribution channels shows direct sales significantly lead with $1.14 billion in 2023, expected to enhance to $1.84 billion by 2033, indicating a strong 87.66% market share. Conversely, dealers and distributors account for $0.16 billion initially, projected to grow to $0.26 billion by 2033, holding a 12.34% share.

Piston Engine Aircraft Market Analysis By Technology

The advancements in technology within the Piston Engine Aircraft market are predominantly in advanced engine technologies, increasingly adopted for their efficiency, with projections showing a rise in market size from $1.14 billion to $1.84 billion by 2033. Traditional engine technologies are expected to see moderate growth, reaching $0.26 billion in the same timeframe.

Piston Engine Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Piston Engine Aircraft Industry

Cessna Aircraft Company:

Cessna, a subsidiary of Textron Aviation, is known for its wide range of single-engine and multi-engine piston aircraft, holding a strong position in the general aviation market.Piper Aircraft, Inc.:

Piper Aircraft specializes in designing and manufacturing light aircraft, primarily focusing on general aviation, flight training, and utility aircraft.Cirrus Aircraft:

Cirrus Aircraft is renowned for its innovative designs and safety features, particularly the Cirrus SR series of piston aircraft, catering to the upscale general aviation sector.Diamond Aircraft Industries:

Diamond Aircraft is recognized for manufacturing composite aircraft featuring advanced technologies and is a leader in providing modern flight training solutions.Textron Aviation:

Textron Aviation, parent company of Cessna and Beechcraft, manufactures a wide variety of piston engine-based aircraft, emphasizing performance and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of piston Engine Aircraft?

The global piston-engine aircraft market is valued at $1.3 billion in 2023, projected to grow at a CAGR of 4.8%, reaching significant market valuations through 2033.

What are the key market players or companies in this industry?

Key players in the piston-engine aircraft market include manufacturers such as Cessna, Piper Aircraft, and Mooney International, each contributing to innovation and market growth.

What are the primary factors driving the growth in the piston Engine Aircraft industry?

Growth is propelled by increasing demand for private flying, improved technology in engine efficiency, and rising air travel, alongside a trend towards general aviation leisure activities.

Which region is the fastest Growing in the piston Engine Aircraft market?

North America is currently the fastest-growing region, with market size projected to expand from $0.48 billion in 2023 to $0.78 billion in 2033, driven by high demand for private aircraft.

Does ConsaInsights provide customized market report data for the piston Engine Aircraft industry?

Yes, ConsaInsights offers customized market reports tailored to client needs in the piston-engine aircraft sector, providing specific data and insights.

What deliverables can I expect from this market research project?

Deliverables include comprehensive market reports, segmented analysis, competitive landscape assessments, trends forecast, and executive summaries, all aimed at strategic planning.

What are the market trends of the piston Engine Aircraft industry?

Trends indicate a shift towards advanced engine technologies, increasing adoption of single-engine aircraft, and enhancements in direct sales models, shaping future market dynamics.