Plant Asset Management Market Report

Published Date: 22 January 2026 | Report Code: plant-asset-management

Plant Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Plant Asset Management market, focusing on market trends, size, and growth forecasts from 2023 to 2033. It explores key segments, regional insights, and the impact of technological advancements.

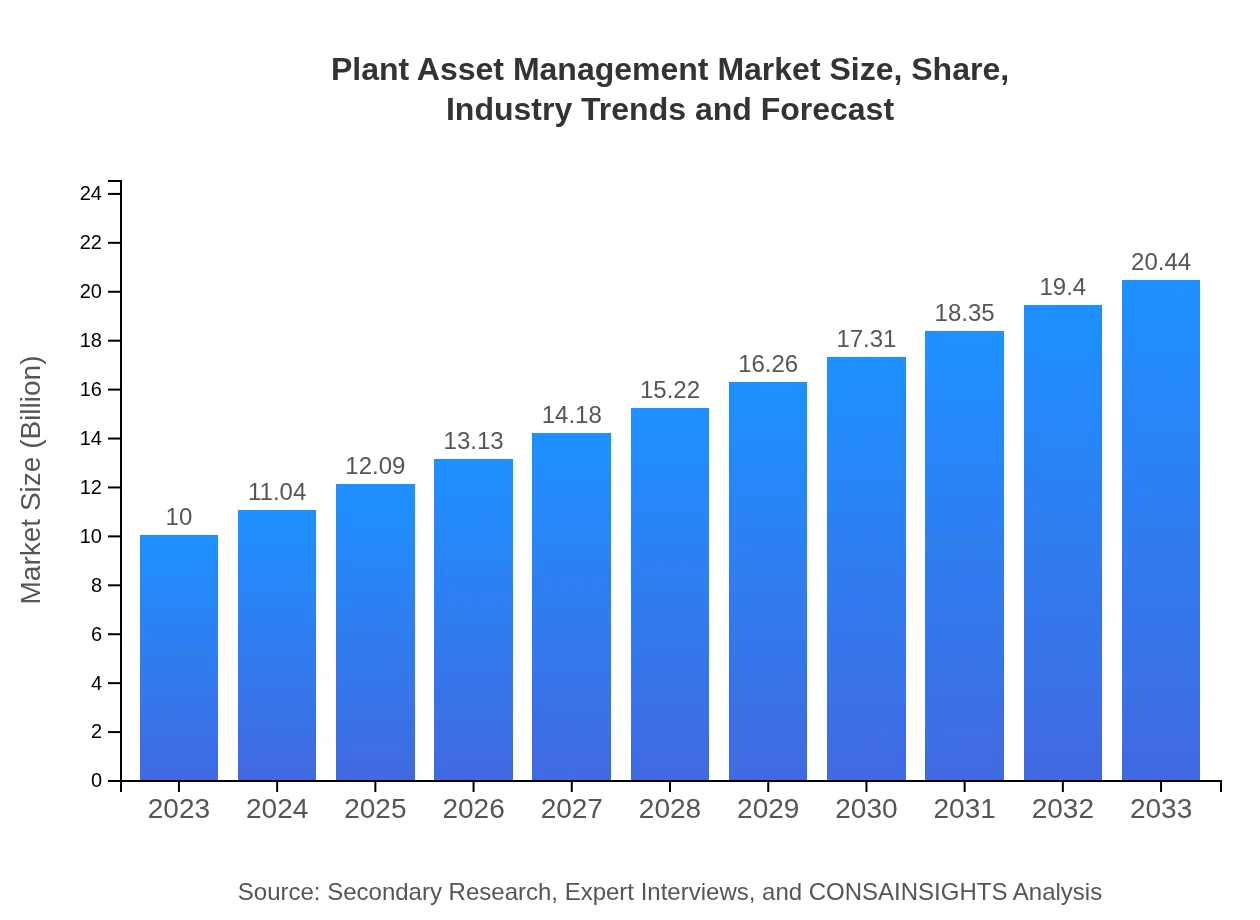

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $20.44 Billion |

| Top Companies | IBM, Siemens , SAP, GE Digital |

| Last Modified Date | 22 January 2026 |

Plant Asset Management Market Overview

Customize Plant Asset Management Market Report market research report

- ✔ Get in-depth analysis of Plant Asset Management market size, growth, and forecasts.

- ✔ Understand Plant Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plant Asset Management

What is the Market Size & CAGR of Plant Asset Management market in 2023?

Plant Asset Management Industry Analysis

Plant Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plant Asset Management Market Analysis Report by Region

Europe Plant Asset Management Market Report:

The European PAM market is projected to expand from $2.82 billion in 2023 to $5.77 billion by 2033. The rise is fueled by stringent regulations regarding asset safety and an ongoing shift towards sustainability across industrial operations.Asia Pacific Plant Asset Management Market Report:

In the Asia Pacific region, the PAM market is projected to grow from $1.89 billion in 2023 to $3.86 billion by 2033. This growth can be attributed to rapid industrialization, investments in infrastructure, and a growing emphasis on asset reliability in sectors such as manufacturing and energy.North America Plant Asset Management Market Report:

North America is anticipated to surge from $3.88 billion in 2023 to $7.93 billion by 2033, propelled by technological advancements and the region's strong emphasis on safety and compliance regulations in sectors like oil and gas and utilities.South America Plant Asset Management Market Report:

The South American PAM market is expected to rise from $0.49 billion in 2023 to $1.00 billion in 2033. Factors like heightened focus on enhancing operational efficiency and the adoption of digital technologies in industries such as mining and agriculture will drive this growth.Middle East & Africa Plant Asset Management Market Report:

The Middle East and Africa market is estimated to grow from $0.92 billion in 2023 to $1.89 billion by 2033. The increased focus on modernization and the transition to smart facilities are key drivers influencing this growth in the region.Tell us your focus area and get a customized research report.

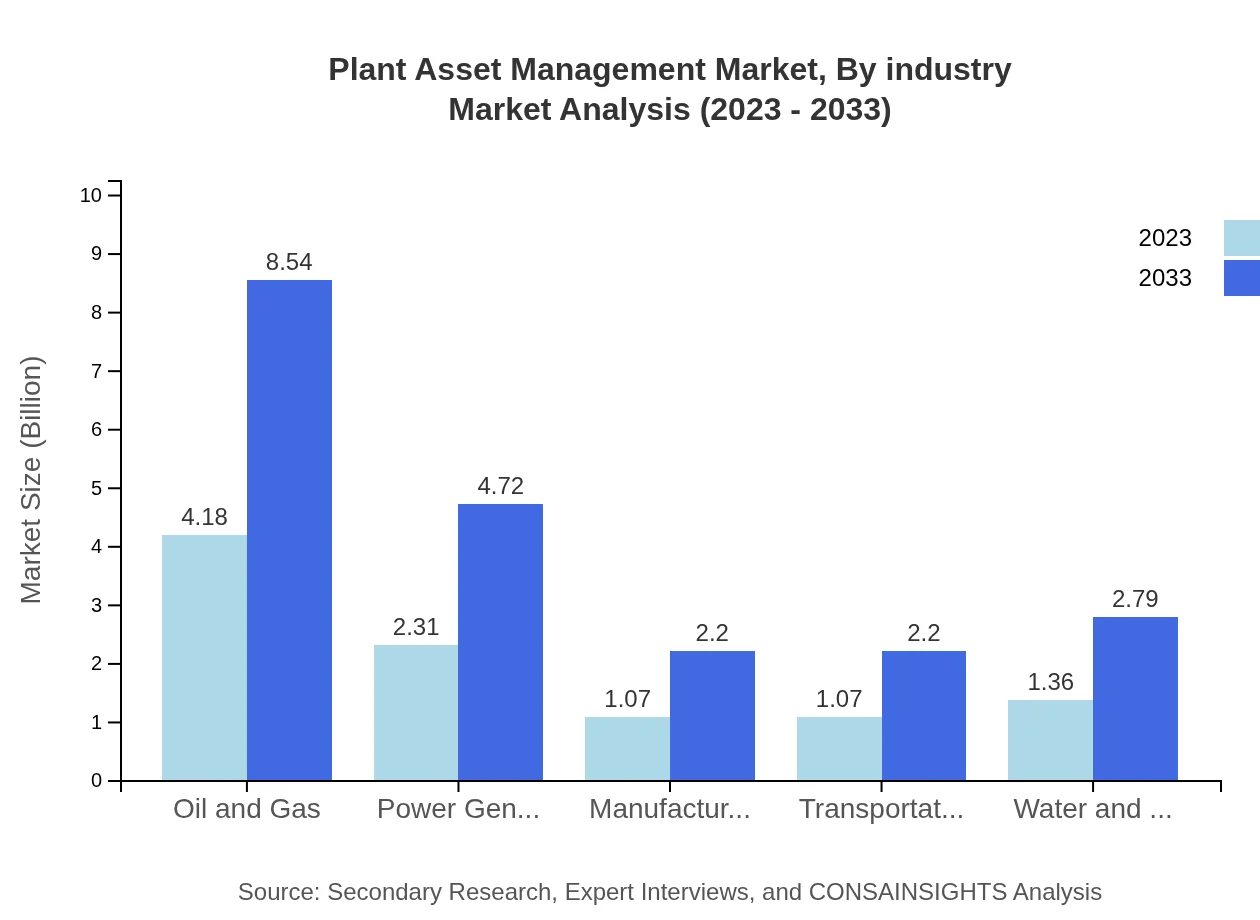

Plant Asset Management Market Analysis By Industry

The Plant Asset Management market is significantly influenced by various industries. In the oil and gas sector, the market is valued at $4.18 billion in 2023 and is projected to reach $8.54 billion by 2033, holding a 41.78% market share. Similarly, the power generation segment will see growth from $2.31 billion to $4.72 billion (23.1% share). Manufacturing and transportation both start at $1.07 billion and grow to $2.20 billion, maintaining a 10.74% share throughout the forecast period. Water and wastewater management will increase from $1.36 billion to $2.79 billion, holding a 13.64% market share, while the Industrial Internet of Things (IIoT) will dominate with a forecast increase from $6.40 billion to $13.08 billion, commanding a remarkable 64.01% share, reflecting its critical importance in modern asset management.

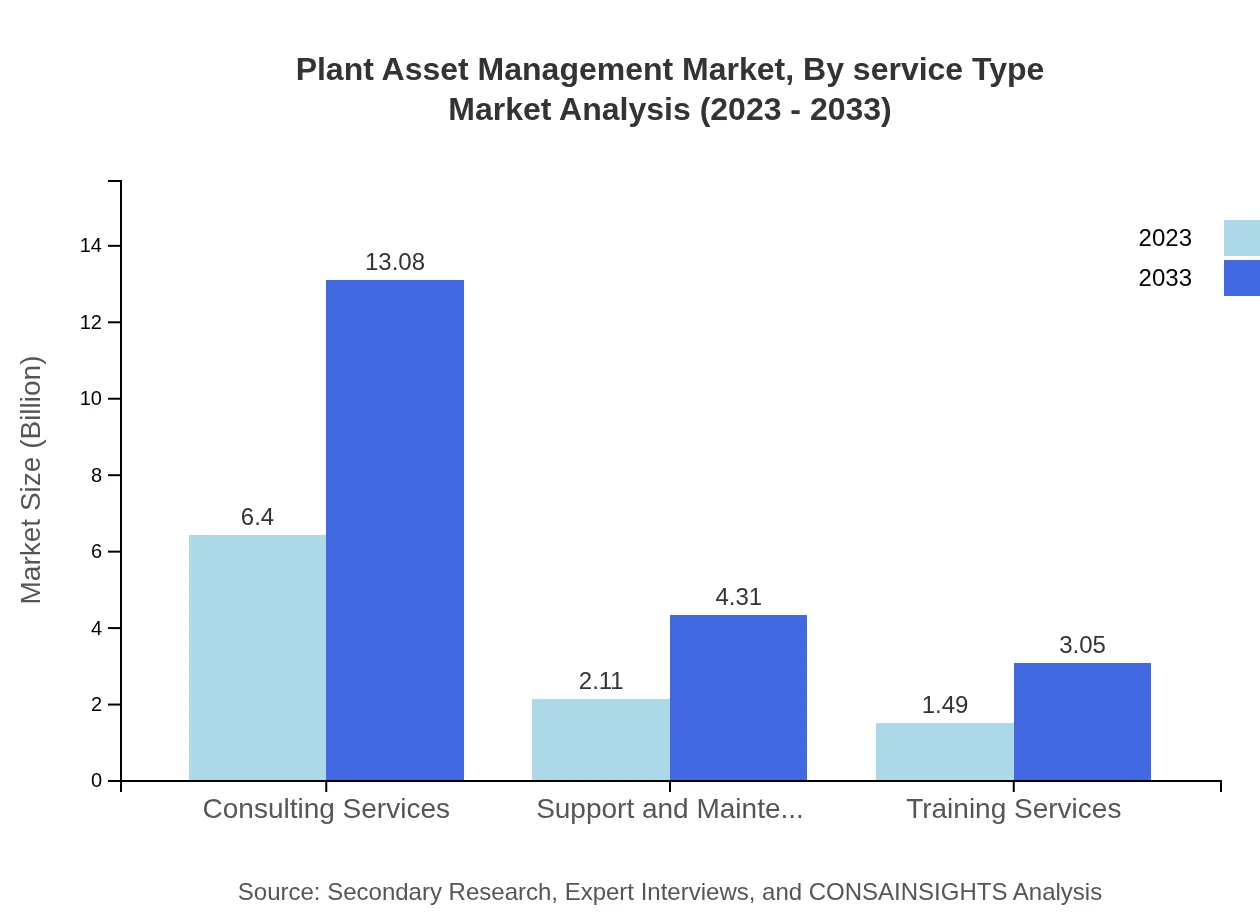

Plant Asset Management Market Analysis By Service Type

Service types like consulting services and support services play pivotal roles in the PAM industry. Consulting services alone are projected to grow from $6.40 billion in 2023 to $13.08 billion by 2033, accounting for a substantial 64.01% market share, indicative of the increasing need for strategic asset management advice. Meanwhile, support and maintenance services will see a rise from $2.11 billion to $4.31 billion, with a 21.07% market share, highlighting their critical function in sustaining asset performance over time.

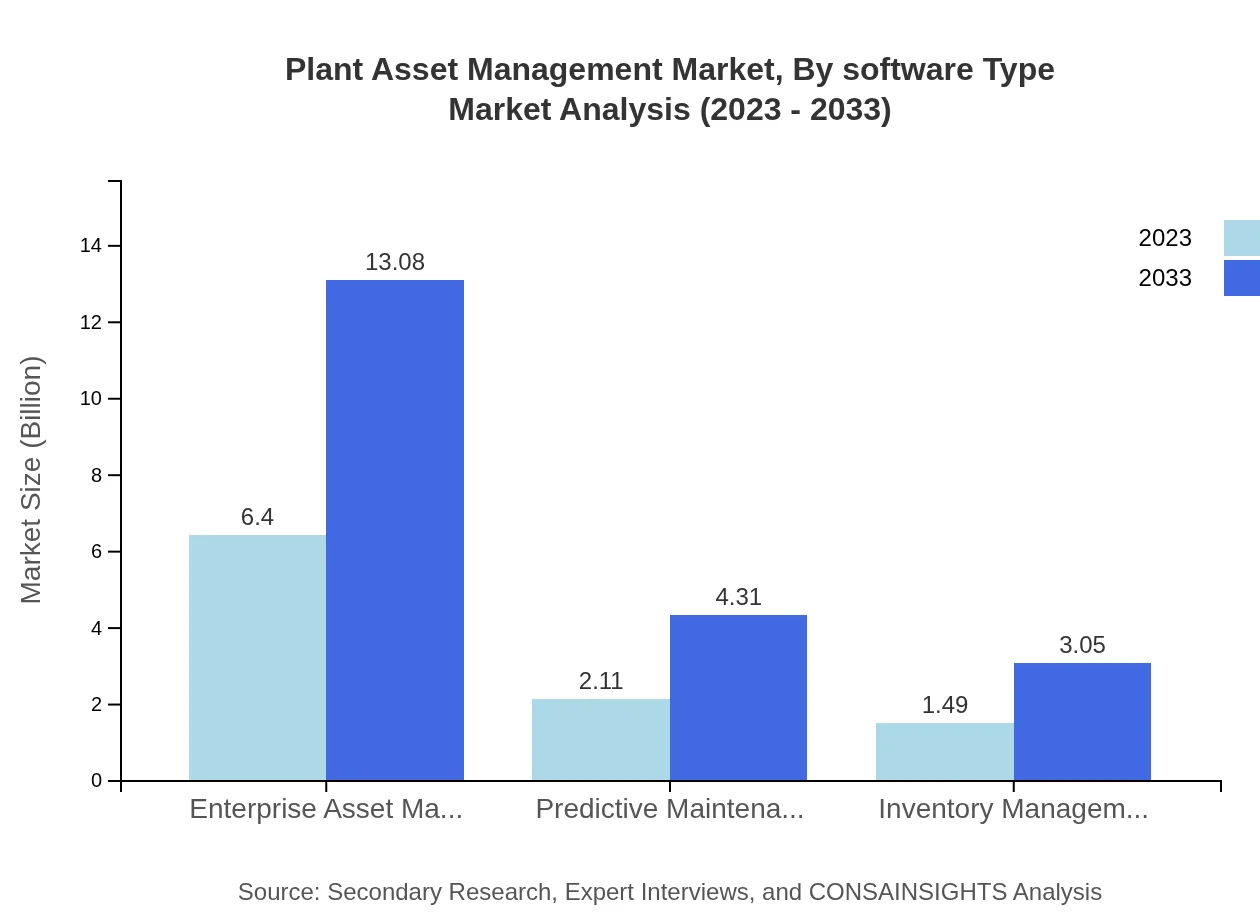

Plant Asset Management Market Analysis By Software Type

Software types driving the PAM market growth include Enterprise Asset Management (EAM) software, which grows from $6.40 billion in 2023 to $13.08 billion by 2033, holding a leading 64.01% share. Predictive maintenance software also plays a vital role, increasing from $2.11 billion to $4.31 billion, maintaining a 21.07% share. Additionally, big data technologies, starting at $1.49 billion in 2023, are expected to climb to $3.05 billion by 2033 (14.92% share), emphasizing the data-driven approach in optimizing asset performance.

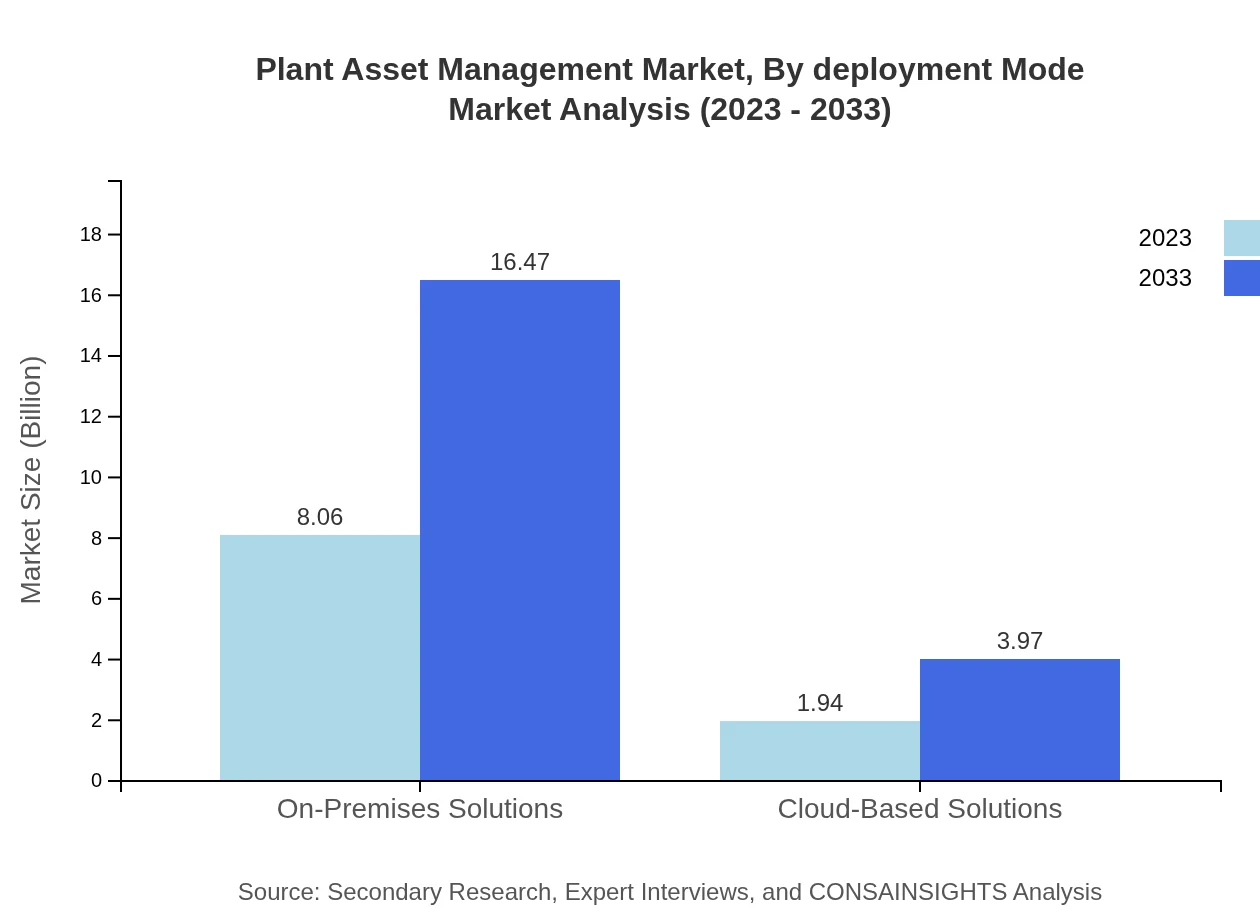

Plant Asset Management Market Analysis By Deployment Mode

The plant asset management market is segmented by deployment modes including on-premises solutions and cloud-based solutions. On-premises solutions currently dominate with a market size of $8.06 billion in 2023, projected to reach $16.47 billion by 2033, representing an 80.59% market share throughout the period. Cloud-based solutions, now at $1.94 billion, are also witnessing growth and are expected to reach $3.97 billion, capturing a 19.41% market share, reflecting a gradual shift towards digital platforms.

Plant Asset Management Market Analysis By Technology

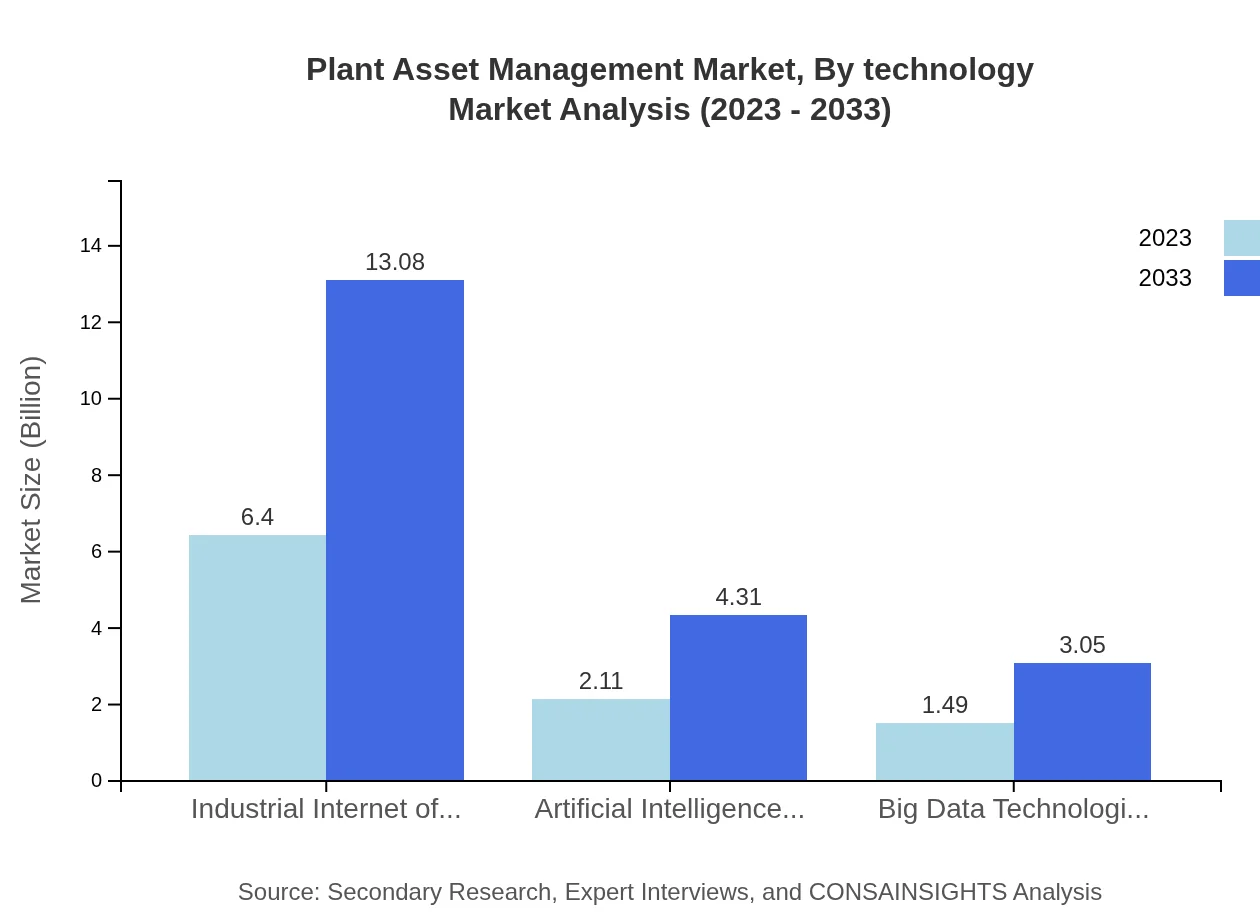

The adoption of technologies such as the Industrial Internet of Things (IIoT), artificial intelligence, and big data analytics is reshaping the PAM landscape. IIoT is expected to dominate with a growth from $6.40 billion to $13.08 billion (64.01% share) by 2033. AI and machine learning technologies will also see an increase from $2.11 billion in 2023 to $4.31 billion (21.07% share), emphasizing their role in predictive maintenance.

Plant Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plant Asset Management Industry

IBM:

IBM offers a comprehensive suite of PAM solutions tailored to various industries, leveraging its advanced analytics and cognitive computing capabilities to improve asset efficiency and decision-making.Siemens :

Siemens is a global leader in automation and digitalization, providing innovative PAM solutions that enhance operational performance and promote sustainable industrial practices.SAP:

SAP specializes in integrated enterprise solutions including PAM, enabling organizations to align their asset management strategies with their overall business objectives through powerful data analytics.GE Digital:

GE Digital focuses on industrial IoT and analytics to drive efficiency in asset management, providing solutions that utilize real-time data to optimize performance.We're grateful to work with incredible clients.

FAQs

What is the market size of plant Asset Management?

The global plant asset management market is valued at approximately $10 billion in 2023, with a projected CAGR of 7.2% expected through 2033, indicating robust growth in the industry over the next decade.

What are the key market players or companies in this plant Asset Management industry?

Key players in the plant asset management industry include major companies such as Siemens AG, IBM, Schneider Electric, and General Electric, known for their innovative solutions and large market shares.

What are the primary factors driving the growth in the plant asset management industry?

Growth factors include increasing adoption of advanced technologies like IoT and AI, rising need for operational efficiency, and the growing focus on predictive maintenance and sustainability in industrial operations.

Which region is the fastest Growing in the plant asset management?

North America is currently the fastest-growing region in the plant asset management market, with a market size projected to grow from $3.88 billion in 2023 to $7.93 billion by 2033.

Does ConsaInsights provide customized market report data for the plant asset management industry?

Yes, ConsaInsights offers tailored market reports that can be customized according to specific requirements for businesses interested in the plant asset management industry.

What deliverables can I expect from this plant Asset Management market research project?

Expect comprehensive reports detailing market trends, regional analysis, competitive landscape, and segmented data, ensuring actionable insights for strategic decision-making.

What are the market trends of plant asset management?

Prominent trends include the integration of AI and machine learning, the growth of cloud-based solutions, and a shift towards predictive maintenance, which enhance operational efficiencies.