Plant Extracts Market Report

Published Date: 31 January 2026 | Report Code: plant-extracts

Plant Extracts Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Plant Extracts market from 2023 to 2033, focusing on market size, trends, and regional insights, alongside a detailed breakdown of various segments within the industry.

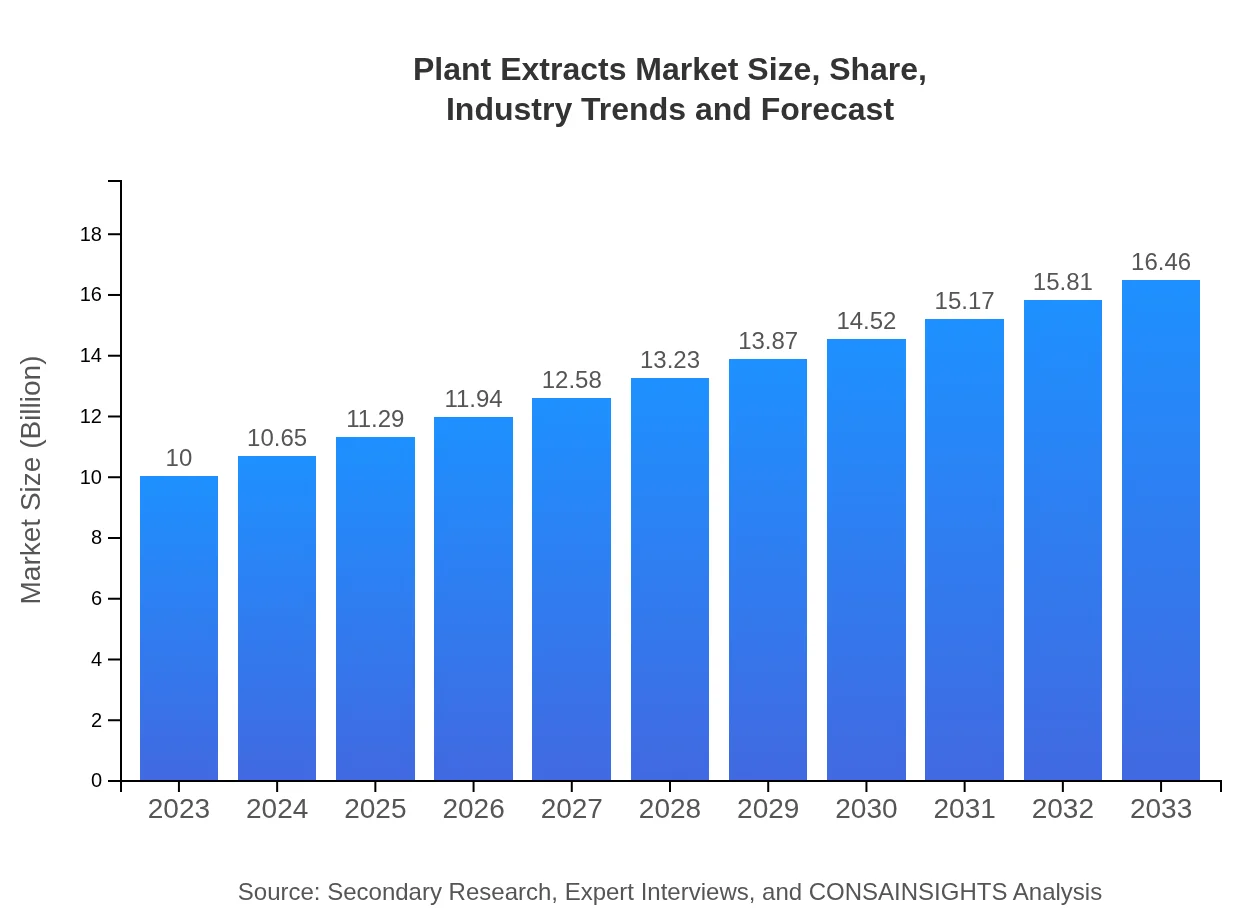

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Givaudan, Symrise AG, Sensient Technologies Corporation, The D. M. H. Damascus Co. |

| Last Modified Date | 31 January 2026 |

Plant Extracts Market Overview

Customize Plant Extracts Market Report market research report

- ✔ Get in-depth analysis of Plant Extracts market size, growth, and forecasts.

- ✔ Understand Plant Extracts's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plant Extracts

What is the Market Size & CAGR of Plant Extracts market in 2023?

Plant Extracts Industry Analysis

Plant Extracts Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plant Extracts Market Analysis Report by Region

Europe Plant Extracts Market Report:

The European Plant Extracts market, valued at USD 3.39 billion in 2023, is forecasted to grow to USD 5.58 billion by 2033. The stringent regulations regarding chemical ingredients and a high demand for organic products drive the market's growth, with countries like Germany and France leading in consumption.Asia Pacific Plant Extracts Market Report:

In the Asia-Pacific region, the Plant Extracts market size was USD 1.77 billion in 2023 and is expected to reach USD 2.92 billion by 2033. Key drivers include the region's rich biodiversity, a growing population, and increasing disposable incomes leading to higher demand for personal care and health products.North America Plant Extracts Market Report:

North America, with a market size of USD 3.39 billion in 2023, is anticipated to reach USD 5.58 billion by 2033. Increasing health-conscious consumer behavior and a rise in personal care products containing plant extracts significantly contribute to this market's success.South America Plant Extracts Market Report:

The South American market for Plant Extracts stood at USD 0.49 billion in 2023, projected to grow to USD 0.80 billion by 2033. This growth is supported by a burgeoning interest in natural remedies and the region's strong agricultural base that provides raw materials for the industry.Middle East & Africa Plant Extracts Market Report:

In the Middle East and Africa region, the market size of Plant Extracts was USD 0.96 billion in 2023 and is expected to reach USD 1.58 billion by 2033, fueled by increasing investments in cosmetic and personal care sectors.Tell us your focus area and get a customized research report.

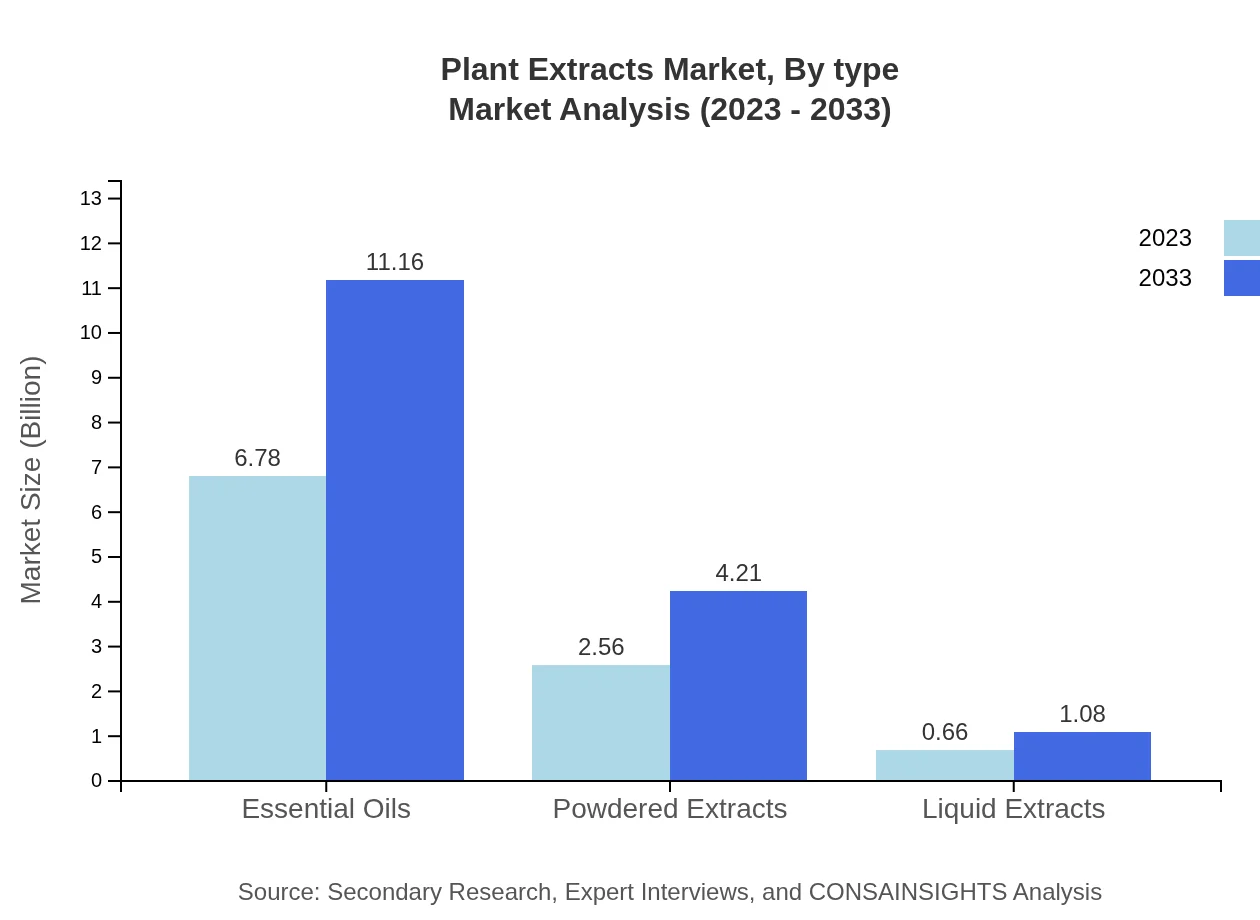

Plant Extracts Market Analysis By Type

Essential Oils lead the market with a size of USD 6.78 billion in 2023, projected to grow to USD 11.16 billion by 2033, dominating the market share at 67.82%. Following closely are Powdered Extracts, valued at USD 2.56 billion in 2023, expected to expand to USD 4.21 billion. Liquid Extracts, albeit smaller, plays a role too, with a market size of USD 0.66 billion in 2023, projected to increase to USD 1.08 billion.

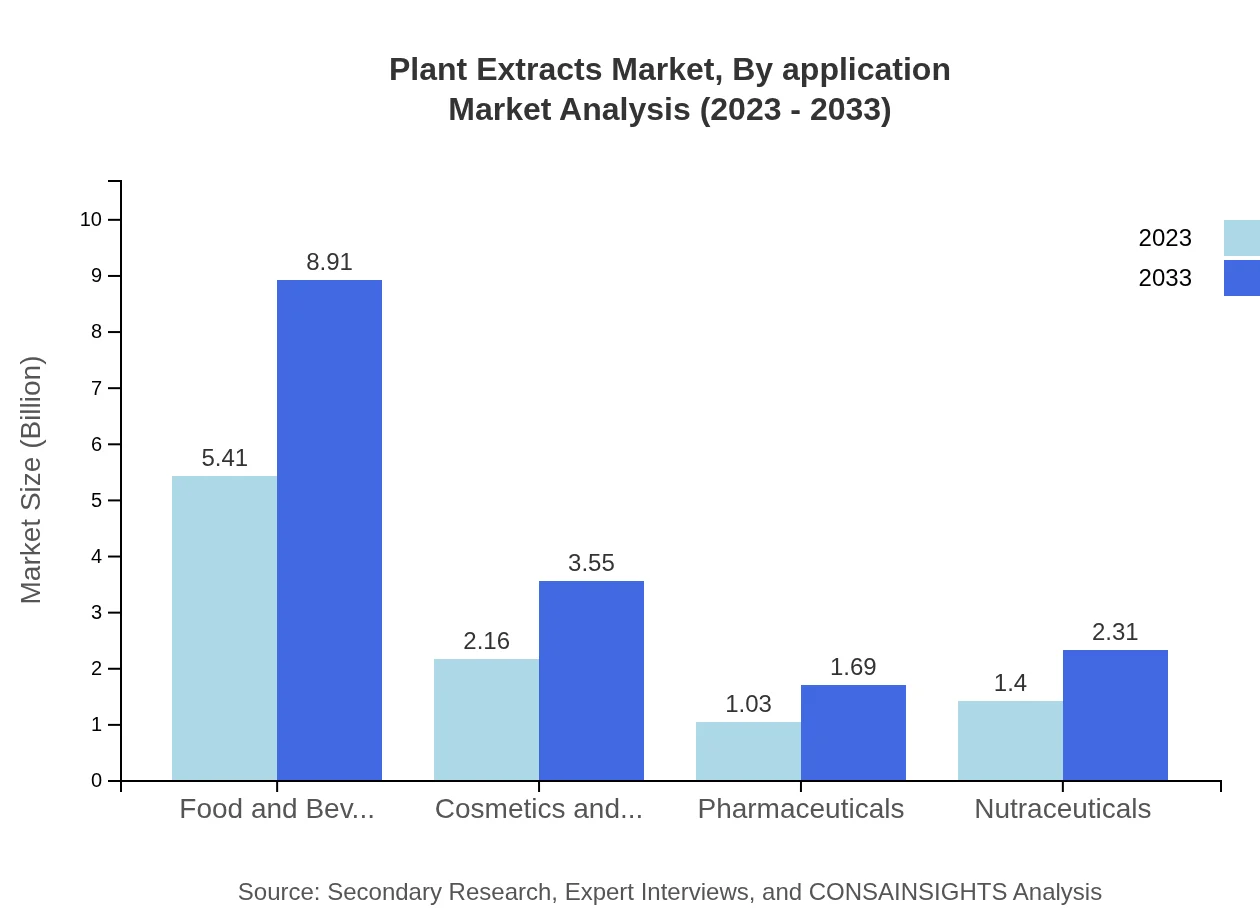

Plant Extracts Market Analysis By Application

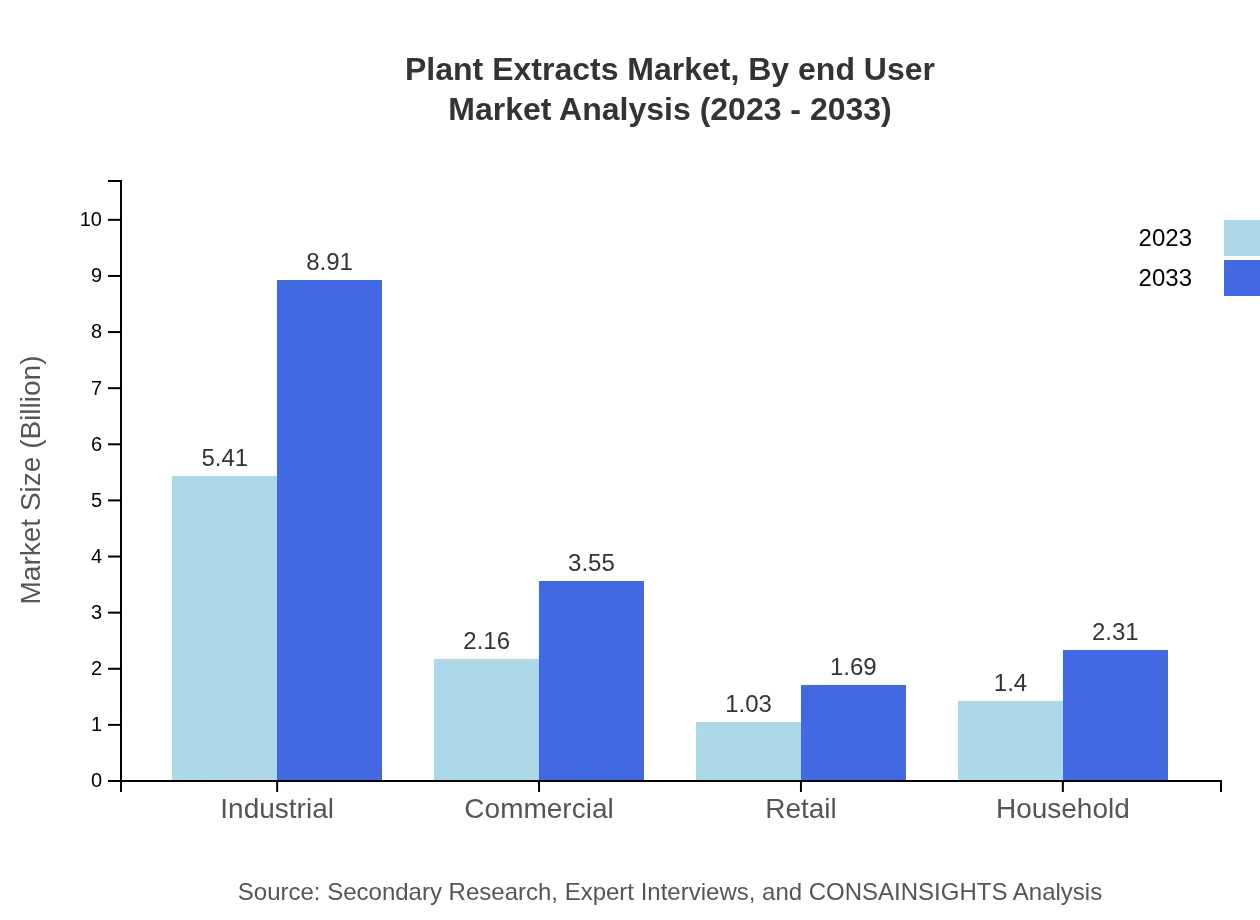

The Food and Beverages sector dominates the application segment with a market size of USD 5.41 billion in 2023, anticipated to reach USD 8.91 billion by 2033. Cosmetics and Personal Care follow with a revenue of USD 2.16 billion and a forecast of USD 3.55 billion, supported by consumer trends favoring natural ingredients.

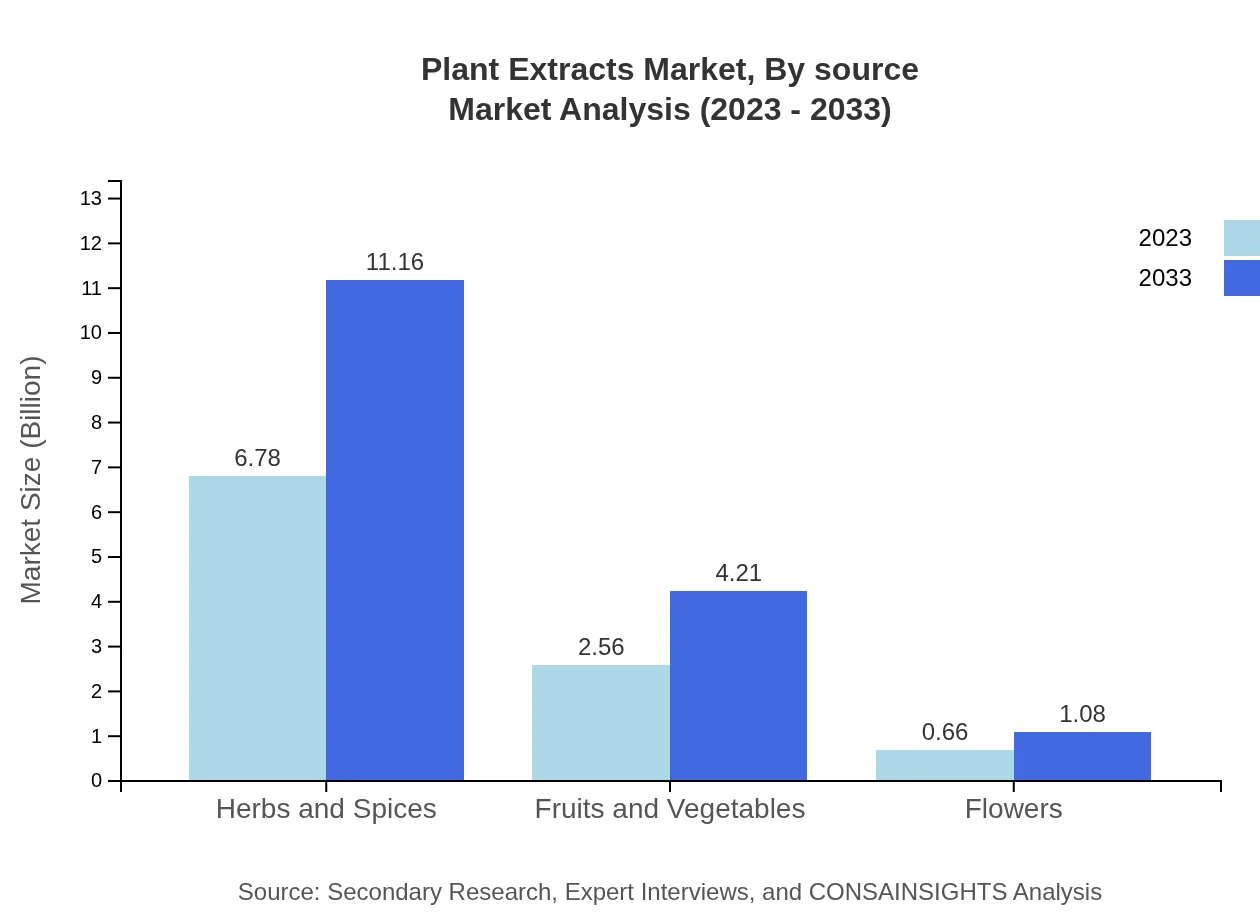

Plant Extracts Market Analysis By Source

Plant extracts derived from herbs and spices hold a substantial market at USD 6.78 billion in 2023, expected to grow to USD 11.16 billion by 2033. They are followed by fruit and vegetable extracts, which showcase a growing interest in healthy and flavorful additions to diets.

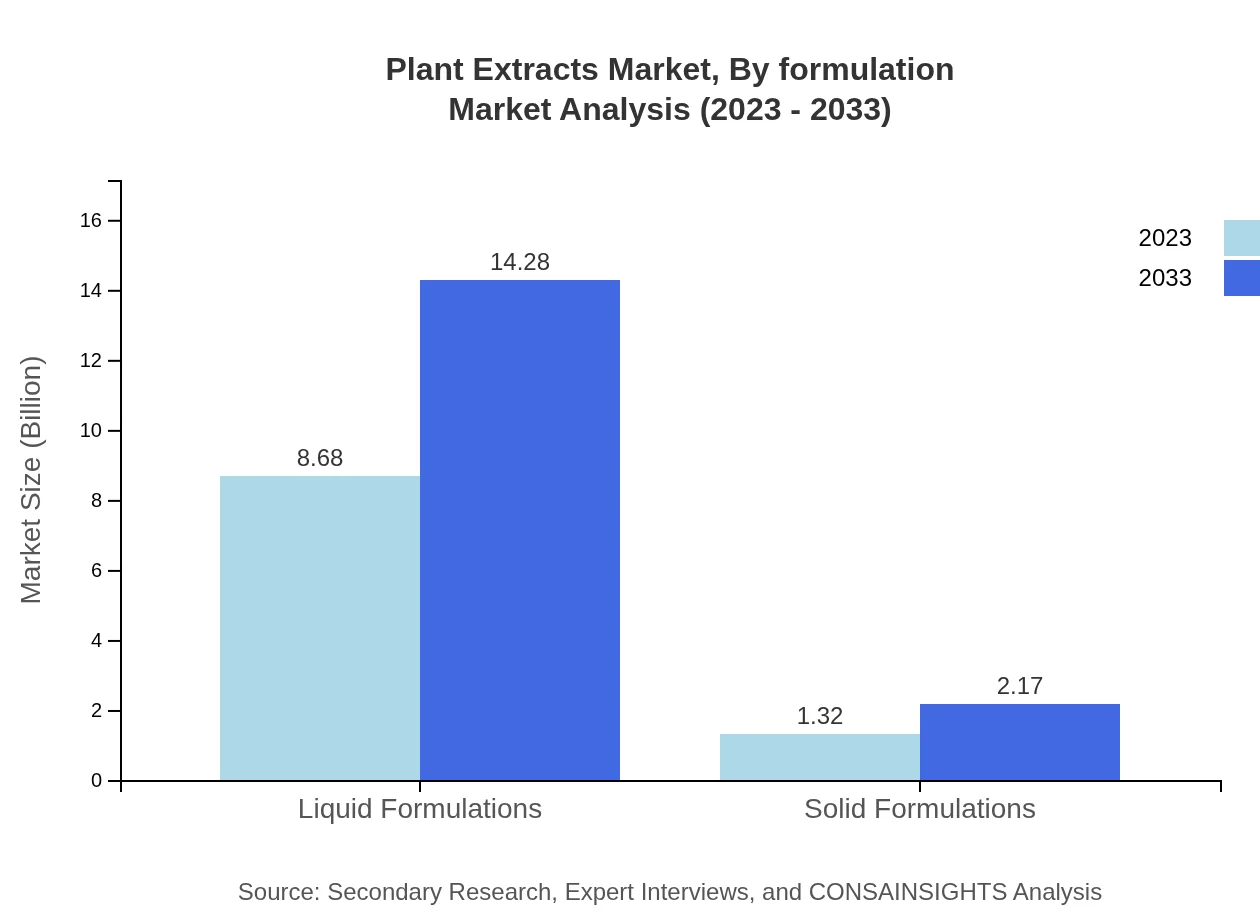

Plant Extracts Market Analysis By Formulation

Liquid formulations dominate, valued at USD 8.68 billion in 2023 and projected to reach USD 14.28 billion by 2033, largely due to their applicability and consumer preference in various products. Solid formulations, while smaller, are growing with expectations of reaching USD 2.17 billion by 2033.

Plant Extracts Market Analysis By End User

Key end-user segments include Industrial applications, which currently account for USD 5.41 billion, and expected to hit USD 8.91 billion. Retail and Household applications also show potential for growth as consumer interest in natural wellness and products continues to rise.

Plant Extracts Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plant Extracts Industry

Givaudan:

A leader in flavor and fragrance, Givaudan is at the forefront of plant extracts in the food, beverage, and cosmetic industries.Symrise AG:

Symrise AG specializes in natural ingredients and is recognized for innovations in plant extract production for various applications including personal care.Sensient Technologies Corporation:

Sensient is known for its extensive portfolio of natural colors, flavors, and fragrances, leveraging plant extracts in its offerings.The D. M. H. Damascus Co.:

A local player specializing in essential oil production from various plant sources, contributing significantly to regional markets.We're grateful to work with incredible clients.

FAQs

What is the market size of plant Extracts?

The plant extracts market is projected to grow from $10 billion in 2023 to substantial growth by 2033, with a CAGR of 5%. This reflects the increasing demand across various industries for natural and organic ingredients.

What are the key market players or companies in this plant Extracts industry?

Key players in the plant-extracts market include reputable companies focused on organic products and innovations in extraction techniques, such as Flavex Naturextrakte GmbH, Indena S.p.A., and Givaudan SA, significantly shaping the industry's landscape.

What are the primary factors driving the growth in the plant Extracts industry?

Factors driving growth in the plant-extracts market include the rising consumer preference for natural ingredients, increased awareness about health benefits, expanded applications in food, cosmetics, and pharmaceuticals, as well as sustainable sourcing practices.

Which region is the fastest Growing in the plant Extracts?

Among the regions, Europe leads with a market size of $3.39 billion in 2023 growing to $5.58 billion by 2033. The Asia Pacific region follows, with growth from $1.77 billion to $2.92 billion during the same period.

Does ConsaInsights provide customized market report data for the plant Extracts industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the plant-extracts industry, ensuring relevant insights and detailed analysis based on individual business requirements or market landscapes.

What deliverables can I expect from this plant Extracts market research project?

Deliverables include comprehensive market reports with insights on market size, growth forecasts, competitive landscape analysis, consumer trends, and segmentation data, providing clients with actionable intelligence for strategic decision-making.

What are the market trends of plant Extracts?

Current trends in the plant-extracts market indicate a shift towards organic and sustainably sourced products, innovations in extraction technologies, increased integration in nutraceuticals, and rising preferences for herbal alternatives among consumers.