Plant Phenotyping Market Report

Published Date: 02 February 2026 | Report Code: plant-phenotyping

Plant Phenotyping Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Plant Phenotyping market, covering insights into market size, trends, and forecasts spanning from 2023 to 2033, providing detailed analysis across various segments and regions.

| Metric | Value |

|---|---|

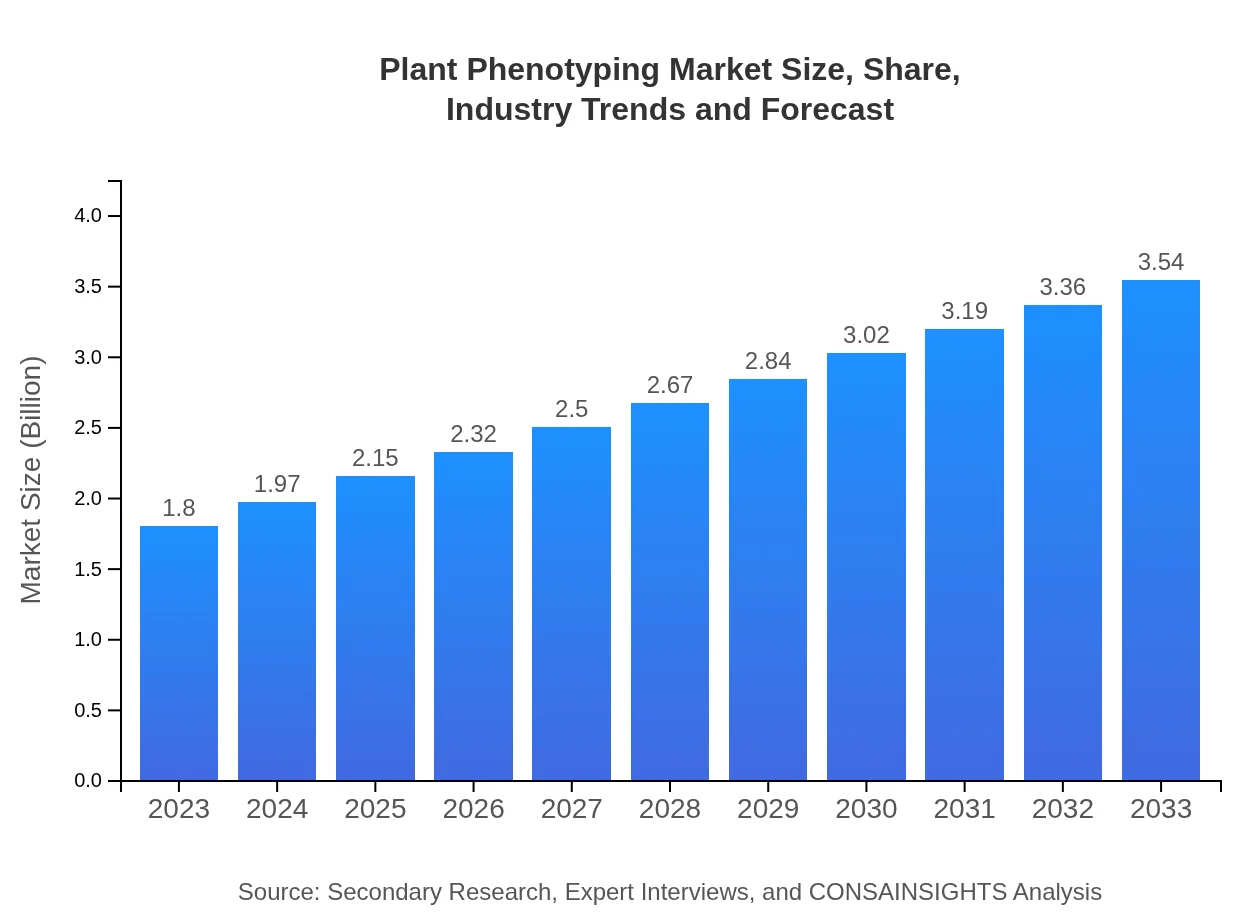

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $3.54 Billion |

| Top Companies | Phenotera, PlantVision, Fluorescence Technologies, LGC Science |

| Last Modified Date | 02 February 2026 |

Plant Phenotyping Market Overview

Customize Plant Phenotyping Market Report market research report

- ✔ Get in-depth analysis of Plant Phenotyping market size, growth, and forecasts.

- ✔ Understand Plant Phenotyping's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plant Phenotyping

What is the Market Size & CAGR of Plant Phenotyping Market in 2023 and Beyond?

Plant Phenotyping Industry Analysis

Plant Phenotyping Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plant Phenotyping Market Analysis Report by Region

Europe Plant Phenotyping Market Report:

Europe's market for Plant Phenotyping is expected to increase from $0.57 billion in 2023 to $1.12 billion by 2033. This growth can be largely credited to stringent regulatory frameworks promoting sustainable agriculture and increased research funding in countries like Germany, France, and the UK.Asia Pacific Plant Phenotyping Market Report:

The Asia Pacific market for Plant Phenotyping is projected to grow from $0.31 billion in 2023 to $0.62 billion by 2033, showcasing a robust CAGR of 7.2%. The rise in agricultural activities and investments in research initiatives across countries like China and India are key growth drivers in this region.North America Plant Phenotyping Market Report:

North America's Plant Phenotyping market is set to grow from $0.65 billion in 2023 to $1.28 billion by 2033, with a significant CAGR of 7%. The United States, being a leader in agricultural technology, is heavily investing in innovative phenotyping solutions to advance its crop production strategies and sustainability efforts.South America Plant Phenotyping Market Report:

In South America, the Plant Phenotyping market is anticipated to expand from $0.02 billion in 2023 to $0.04 billion by 2033. Despite being a smaller market segment, the agricultural modernization efforts in Brazil and Argentina are increasingly adopting phenotyping technologies to enhance productivity.Middle East & Africa Plant Phenotyping Market Report:

The Middle East and Africa market is projected to grow from $0.25 billion in 2023 to $0.48 billion by 2033. Increasing awareness about food security and climate adaptation strategies is driving investments in agricultural technologies within this region.Tell us your focus area and get a customized research report.

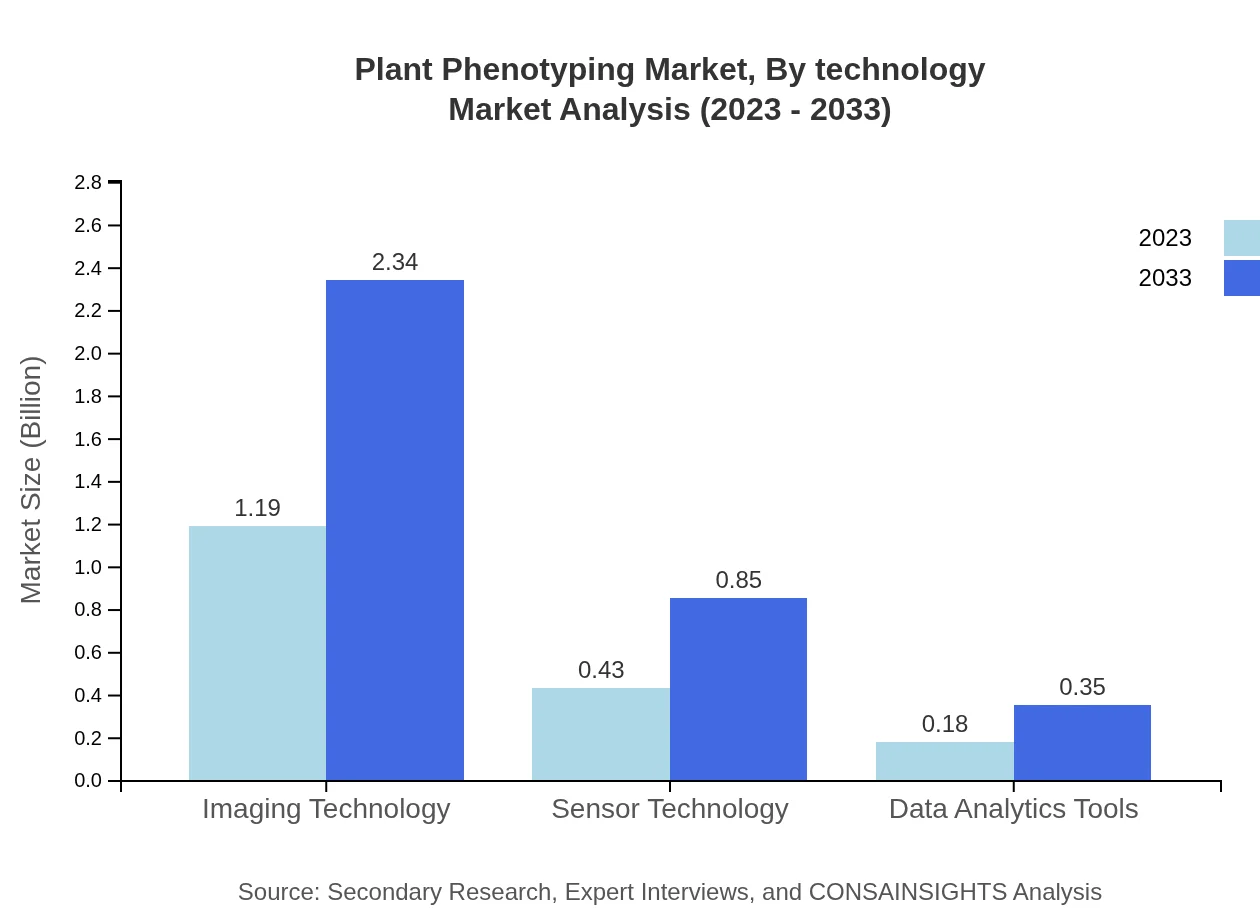

Plant Phenotyping Market Analysis By Technology

Technologically, imaging technology dominates the market, valued at $1.19 billion in 2023 and projected to double by 2033. Sensor technology holds a significant position with a size of $0.43 billion expected to grow over the forecast period. Data analytics tools, while currently a smaller segment at $0.18 billion, are becoming increasingly crucial for interpreting complex phenotyping data.

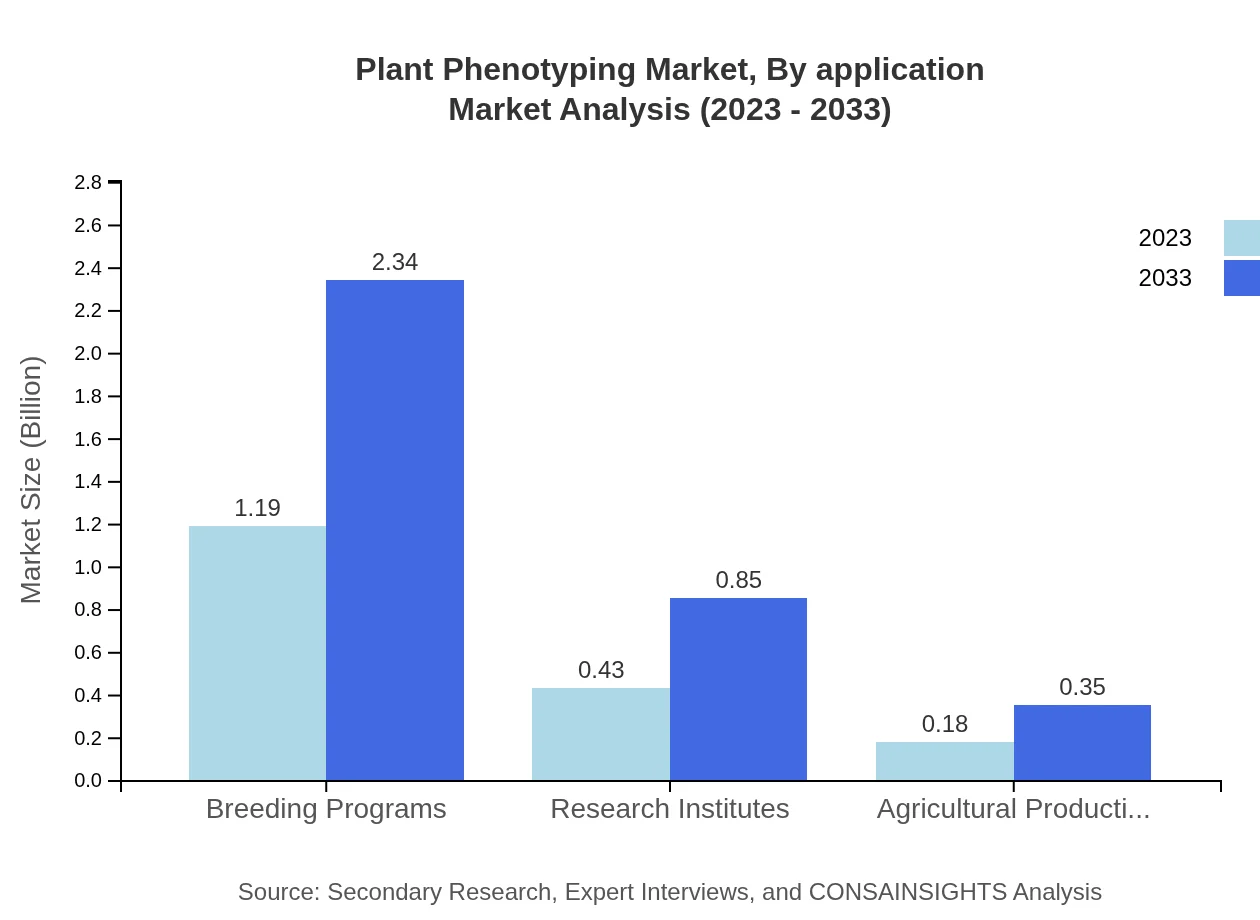

Plant Phenotyping Market Analysis By Application

In applications, academic research is the leading segment with a market size of $1.19 billion in 2023 and projected to reach $2.34 billion by 2033. Private farms and government agencies also represent important sectors, focusing on improving agricultural practices and outcomes through advanced phenotyping.

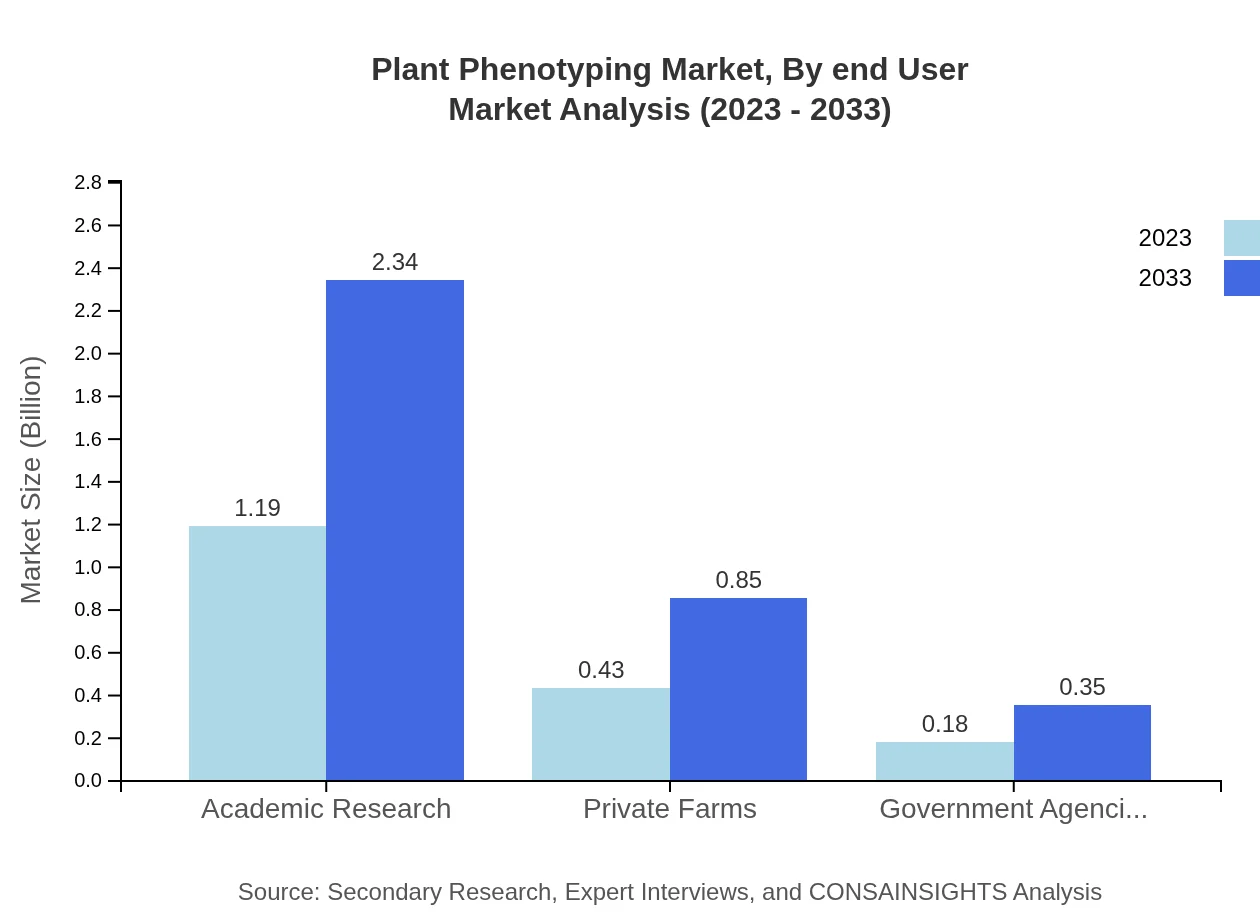

Plant Phenotyping Market Analysis By End User

End-users primarily include research institutes, private farms, and agricultural production entities. Research institutes hold a size of $0.43 billion in 2023 and are expected to increase significantly, while private farms show sustained growth from $0.43 billion to $0.85 billion in the same timeframe.

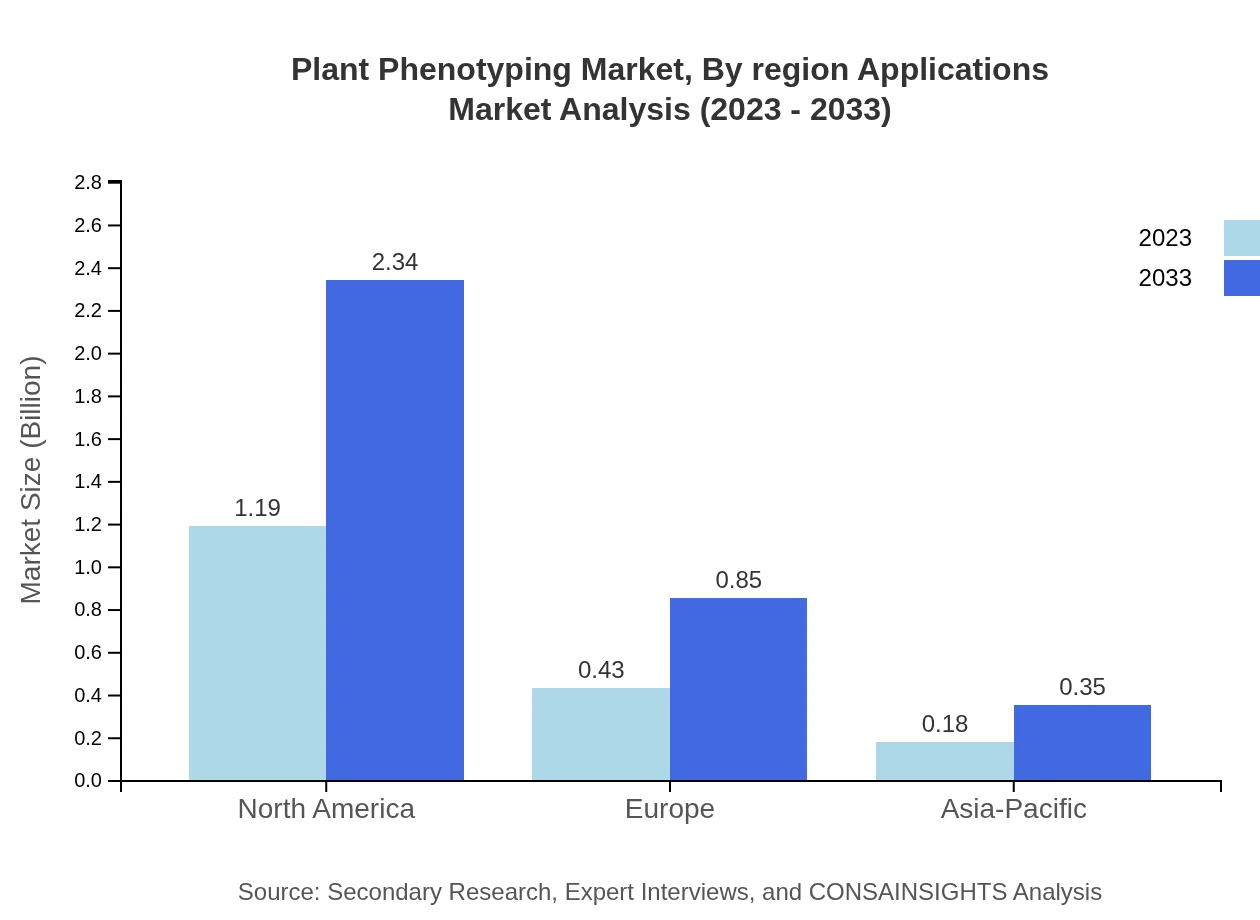

Plant Phenotyping Market Analysis By Region Applications

Regional applications in the Plant Phenotyping market highlight significant growth across North America and Europe due to agricultural innovation investments. Asia Pacific shows potential through increasing research and implementation of new technologies suited to diverse crops and environmental conditions.

Plant Phenotyping Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plant Phenotyping Industry

Phenotera:

A leading innovator in plant phenotyping solutions, specializing in imaging technology and data analytics tools for agricultural research.PlantVision:

Expert in precision agriculture technologies, focusing on sensor-driven phenotyping solutions that enhance agricultural productivity.Fluorescence Technologies:

A known player in the field, providing state-of-the-art fluorescence imaging systems for plant trait analysis.LGC Science:

Offers comprehensive phenotyping services and solutions, aiding both the research and agriculture sectors with advanced genetic analysis.We're grateful to work with incredible clients.

FAQs

What is the market size of plant Phenotyping?

The plant phenotyping market is currently valued at approximately $1.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%. This growth indicates expanding applications and increasing investments in agricultural research and technology.

What are the key market players or companies in the plant Phenotyping industry?

Notable key players in the plant phenotyping industry include major agricultural technology firms and research organizations. These companies are focusing on innovative technology development to enhance plant research and improve agricultural productivity.

What are the primary factors driving the growth in the plant Phenotyping industry?

Key growth factors include advancements in imaging and sensor technologies, increased demand for sustainable agriculture, and the need for enhanced crop yield and quality. Additionally, rising investments in agricultural research significantly fuel market expansion.

Which region is the fastest Growing in the plant Phenotyping?

North America is anticipated to be the fastest-growing region in the plant phenotyping market, with market growth projected to rise from $0.65 billion in 2023 to $1.28 billion by 2033, indicating strong investment and research activities.

Does ConsaInsights provide customized market report data for the plant Phenotyping industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the plant phenotyping industry. Clients can expect insights catered to their unique market requirements, trends, and competitive landscapes.

What deliverables can I expect from this plant Phenotyping market research project?

From this market research project, you can expect comprehensive reports detailing market size, growth trends, competitive analysis, segment performance, and regional insights, enabling strategic decision-making and investment planning.

What are the market trends of plant Phenotyping?

Market trends include increasing integration of AI and machine learning in plant analysis, a shift toward precision agriculture practices, growing partnerships between tech firms and research institutions, and a heightened focus on sustainable farming solutions.