Planting Equipment Market Report

Published Date: 22 January 2026 | Report Code: planting-equipment

Planting Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Planting Equipment market from 2023 to 2033, providing insights on market size, trends, segments, regional analysis, and key players shaping the industry landscape.

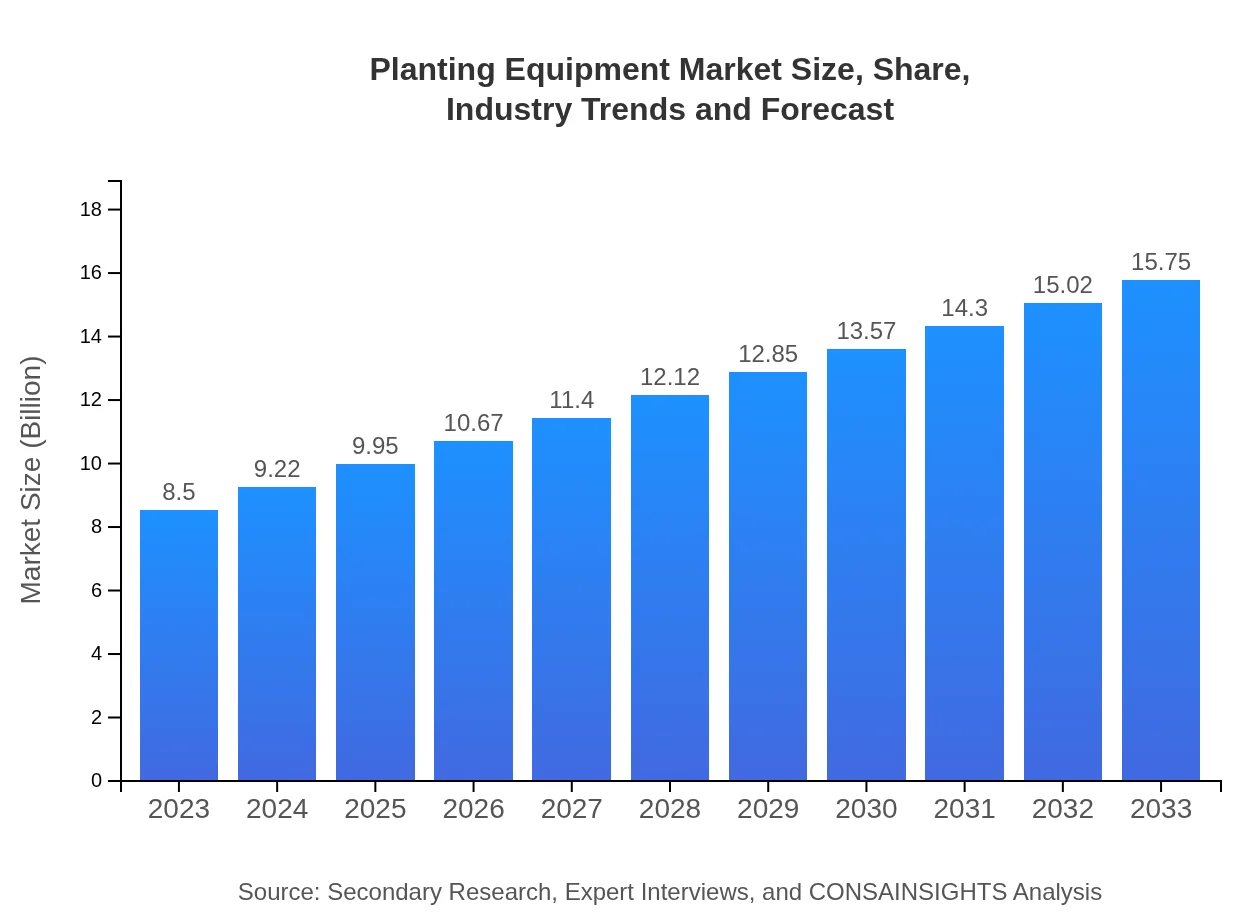

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | John Deere, AGCO Corporation, CNH Industrial, Yamaha Motor Corporation, Kubota Corporation |

| Last Modified Date | 22 January 2026 |

Planting Equipment Market Overview

Customize Planting Equipment Market Report market research report

- ✔ Get in-depth analysis of Planting Equipment market size, growth, and forecasts.

- ✔ Understand Planting Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Planting Equipment

What is the Market Size & CAGR of Planting Equipment market in {Year}?

Planting Equipment Industry Analysis

Planting Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Planting Equipment Market Analysis Report by Region

Europe Planting Equipment Market Report:

In Europe, the market will grow from $2.27 billion in 2023 to $4.21 billion by 2033, attributed to strict regulations on agriculture promoting mechanization, and increased investments in eco-friendly farming solutions. Countries such as Germany and France are leading in the adoption of innovative farming equipment.Asia Pacific Planting Equipment Market Report:

In Asia Pacific, the Planting Equipment market is projected to grow from $1.79 billion in 2023 to $3.32 billion by 2033, driven by increasing agricultural productivity and government incentives for mechanization. Countries like India and China are significant contributors owing to their vast agricultural lands and focus on enhancing food production efficiency.North America Planting Equipment Market Report:

The North American market is expected to witness substantial growth through 2033, with the market size increasing from $2.83 billion in 2023 to $5.25 billion by 2033. High adoption of advanced machinery along with significant investments in smart agriculture technologies are contributing factors, primarily in the United States and Canada.South America Planting Equipment Market Report:

South America has shown robust growth in its Planting Equipment market, from $0.81 billion in 2023 to $1.51 billion by 2033. Brazil and Argentina are key players due to their extensive farming sectors, with a substantial emphasis on soybean and corn cultivation driving investment in planting technologies.Middle East & Africa Planting Equipment Market Report:

The Middle East and Africa Planting Equipment market is set to expand from $0.79 billion in 2023 to $1.46 billion by 2033, driven by improving agricultural practices and investment in sustainable farming technologies. Emerging economies in this region are increasingly focusing on boosting food production efficiency to meet local demands.Tell us your focus area and get a customized research report.

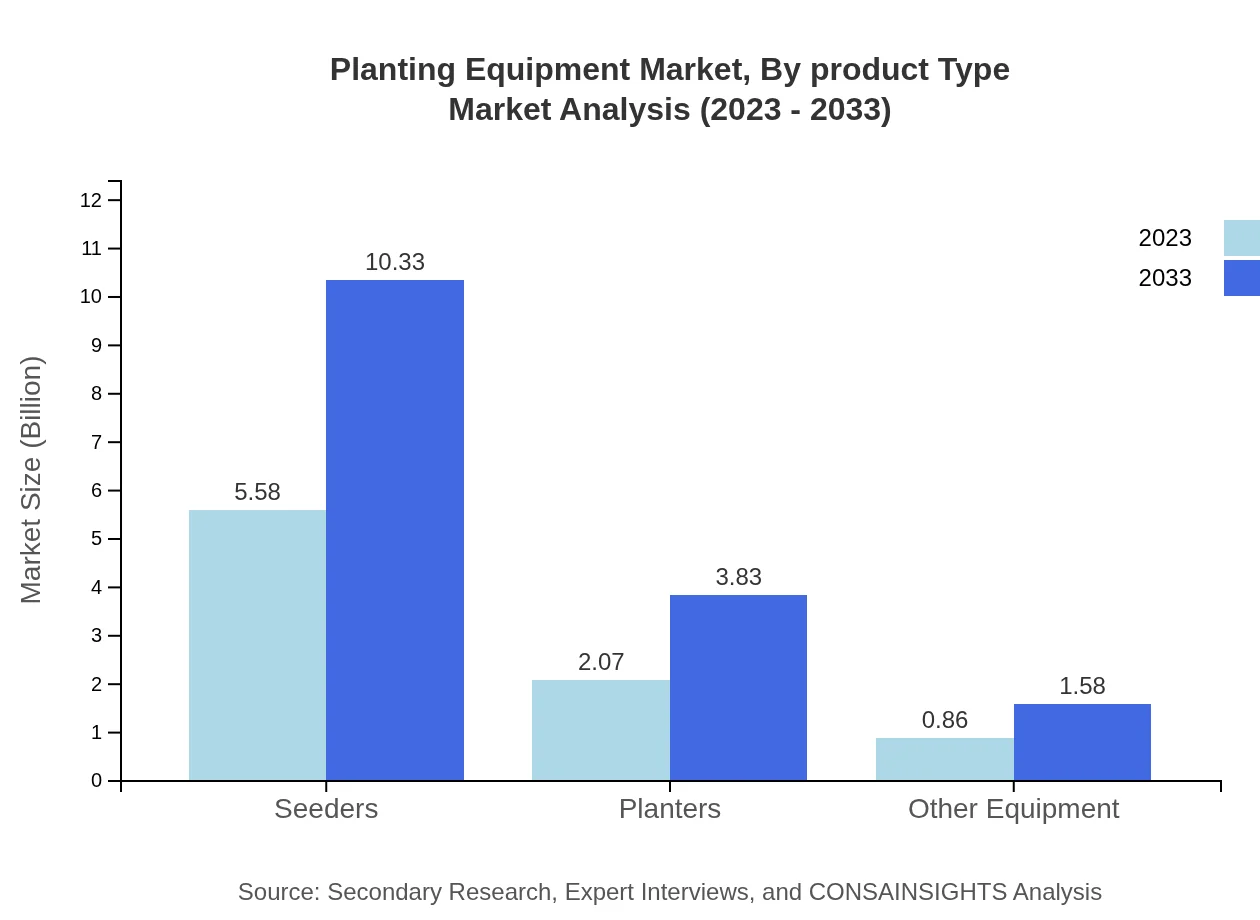

Planting Equipment Market Analysis By Product Type

In the Planting Equipment market, seeders hold a significant market share, showing a size of $5.58 billion in 2023 and expected to reach $10.33 billion by 2033. Planters follow with a size of $2.07 billion in 2023, projected to grow to $3.83 billion by 2033. Other equipment like precision planters and mechanical seeders are gaining traction due to their enhanced efficiency and effectiveness in sowing.

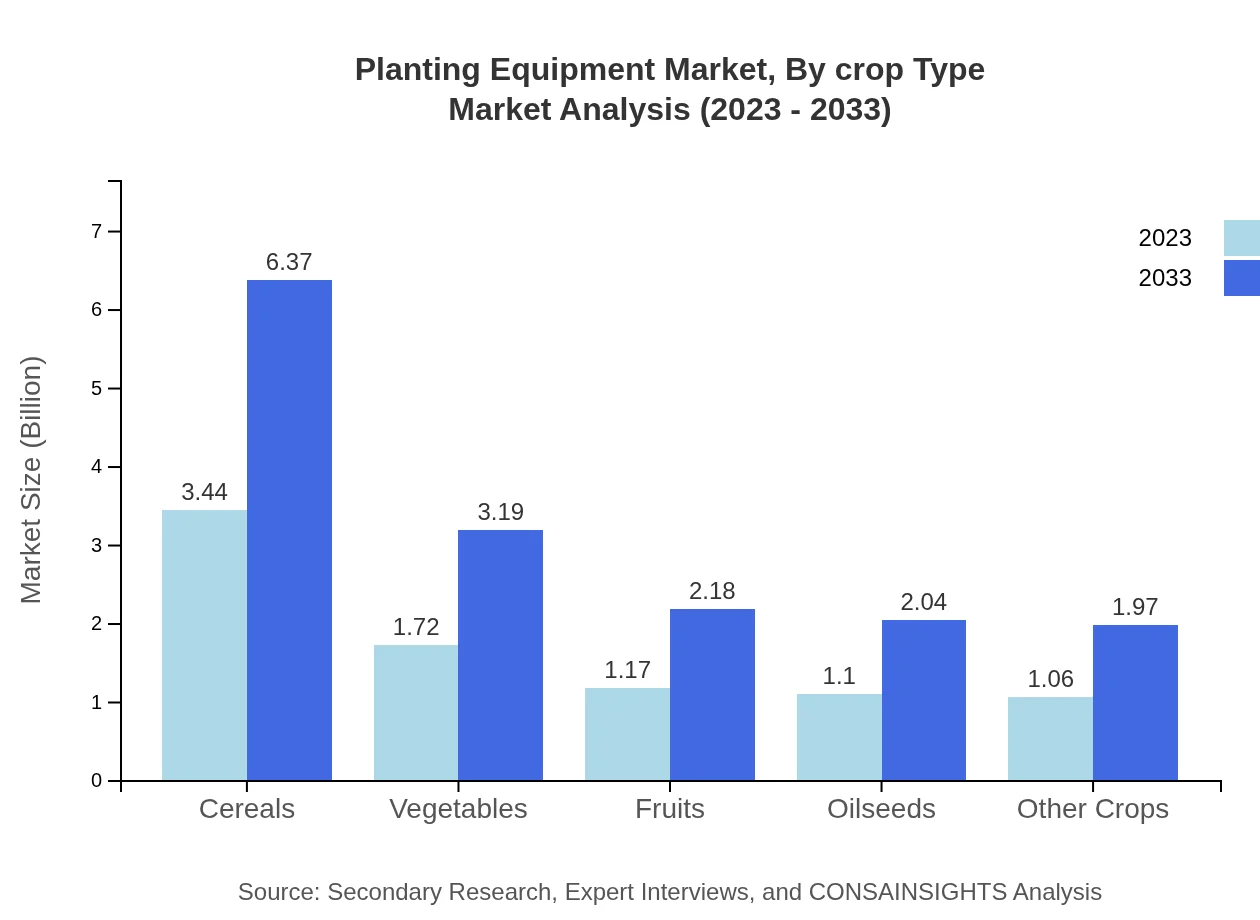

Planting Equipment Market Analysis By Crop Type

Cereals dominate the crop type segment in the Planting Equipment market, with a size of $3.44 billion in 2023 and an anticipated growth to $6.37 billion by 2033. Vegetables and fruits also account for a substantial share, emphasizing the importance of diverse agricultural practices in the market. The growing trend towards healthy eating is driving the performance of vegetable and fruit planting equipment.

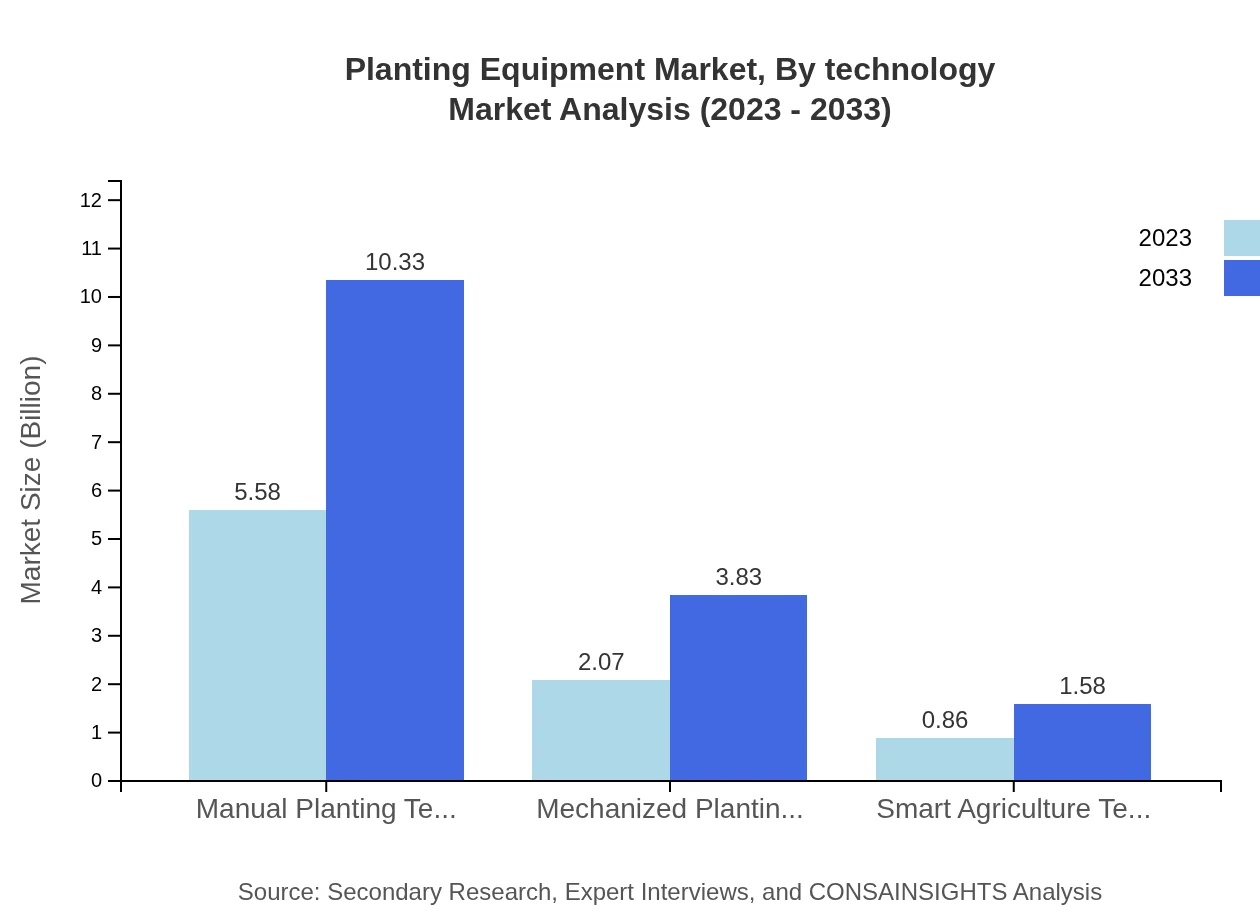

Planting Equipment Market Analysis By Technology

The market for manual planting technology is expected to maintain a strong presence, sized at $5.58 billion in 2023 and increasing to $10.33 billion by 2033. Mechanized planting technology, although smaller, is growing steadily from $2.07 billion to $3.83 billion in the same timeframe. Smart agriculture technologies are emerging rapidly, currently valued at $0.86 billion and expected to hit $1.58 billion, reflecting a growing preference for precision and efficiency.

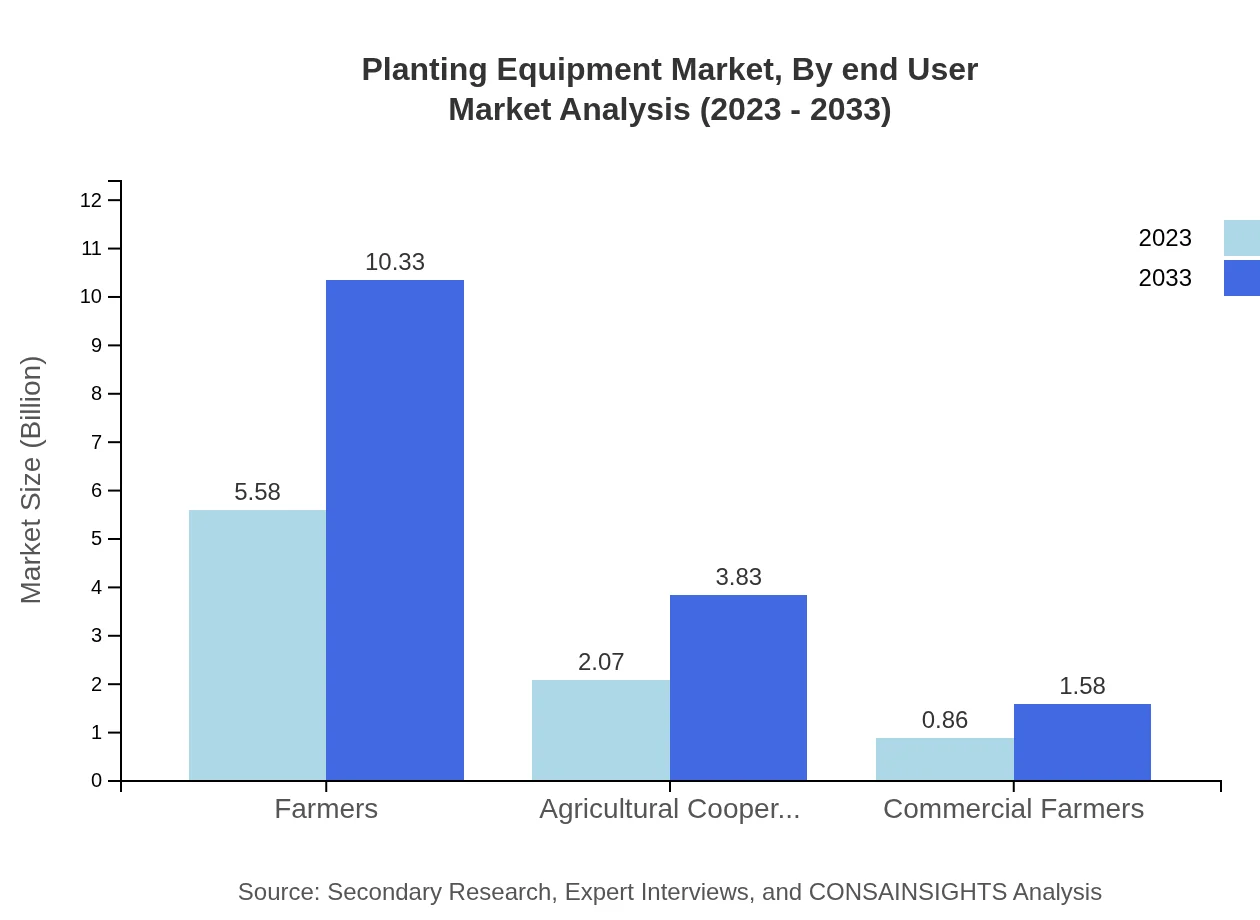

Planting Equipment Market Analysis By End User

Farmers remain the primary end-users of planting equipment, dominating the market with a size of $5.58 billion in 2023, projected to grow to $10.33 billion by 2033. Agricultural cooperatives and commercial farmers are also essential segments, anticipated to rise from $2.07 billion and $0.86 billion respectively, as collaborative farming scales up in response to market demands.

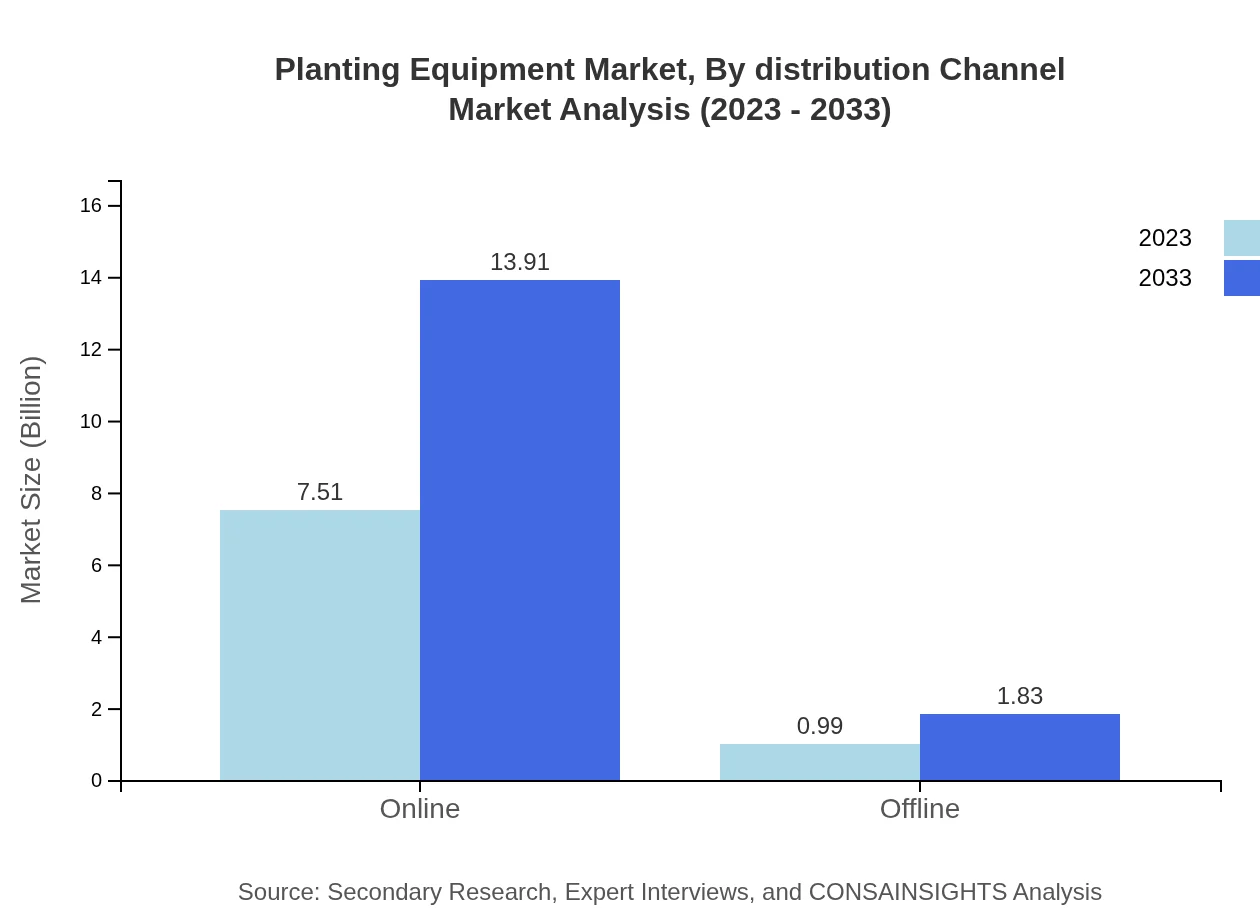

Planting Equipment Market Analysis By Distribution Channel

The online distribution channel is rapidly gaining traction, from $7.51 billion in 2023 to a forecast of $13.91 billion by 2033, reflecting the shift towards digital purchasing habits. Offline channels, although slower in growth, from $0.99 billion to $1.83 billion, continue to play a vital role in regional markets where personal relationships and product demonstrations remain crucial.

Planting Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Planting Equipment Industry

John Deere:

Renowned for high-quality agricultural machinery including planters and seeders, John Deere sets the standard for innovation in farming technology.AGCO Corporation:

A leading manufacturer of agricultural equipment, AGCO provides a wide range of planting equipment solutions to enhance farming productivity globally.CNH Industrial:

Known for its brands such as Case IH and New Holland, CNH Industrial plays a crucial role in the planting equipment market with a focus on technologically advanced solutions.Yamaha Motor Corporation:

Focusing on precision machinery, Yamaha contributes to the planting equipment segment through innovative and advanced technology, particularly in rice planting.Kubota Corporation:

Kubota is notable in the planting equipment market, providing robust machinery suitable for various farming conditions and enhancing agricultural efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of planting Equipment?

The global planting equipment market is sized at approximately $8.5 billion in 2023, with an expected growth rate of 6.2% CAGR up to 2033, indicating a substantial expansion of the industry in the upcoming decade.

What are the key market players or companies in this planting equipment industry?

Key players in the planting equipment industry include John Deere, AGCO Corporation, Kubota Corporation, and CNH Industrial. These companies leverage advanced technology to enhance planting efficiency and cater to evolving agricultural needs.

What are the primary factors driving the growth in the planting equipment industry?

Growth in the planting equipment sector is primarily driven by technological advancements, increasing demand for high-efficiency farming practices, and the growing need for sustainable agricultural solutions amid global food security concerns.

Which region is the fastest Growing in the planting equipment?

The fastest-growing region in the planting equipment market is North America, with a market size projected to grow from $2.83 billion in 2023 to $5.25 billion by 2033, reflecting a significant increase in agricultural investments in the region.

Does ConsaInsights provide customized market report data for the planting equipment industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the planting equipment industry, including detailed analyses, forecasts, and competitive landscapes to support informed decision-making.

What deliverables can I expect from this planting equipment market research project?

From the planting equipment market research project, expect comprehensive reports, including market size, growth forecasts, segment analysis, competitive landscape, and strategic recommendations to enhance your market positioning.

What are the market trends of planting equipment?

Market trends in the planting equipment industry include increased adoption of smart agriculture technologies, a shift towards mechanization, and rising demand for eco-friendly equipment, which collectively enhance productivity and sustainability in agriculture.