Plasma Etching Equipment Market Report

Published Date: 31 January 2026 | Report Code: plasma-etching-equipment

Plasma Etching Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Plasma Etching Equipment market from 2023 to 2033, focusing on market size, segmentation, regional insights, industry leaders, and future trends.

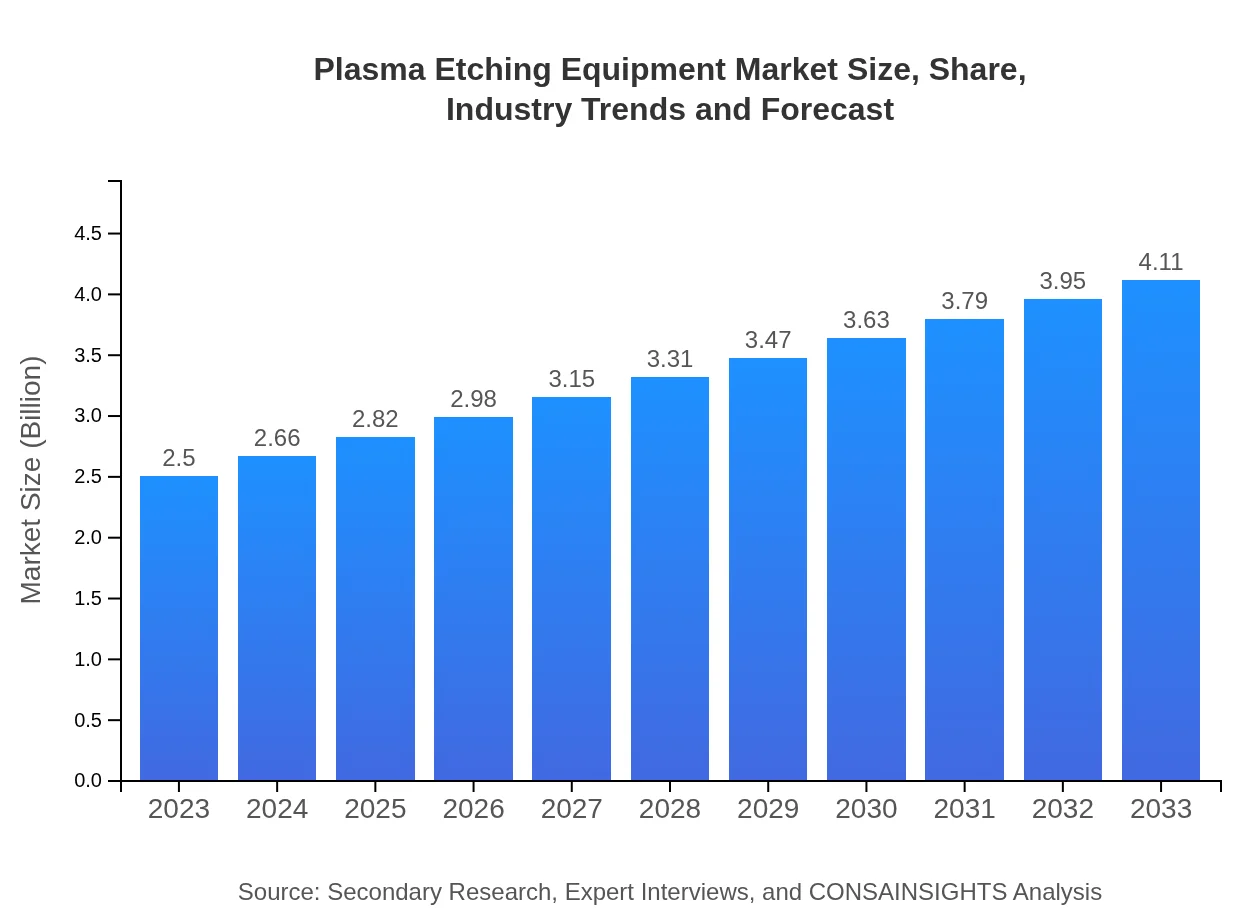

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $4.11 Billion |

| Top Companies | Applied Materials, Inc., LAM Research Corporation, Tokyo Electron Limited, Oxford Instruments, Nikon Corporation |

| Last Modified Date | 31 January 2026 |

Plasma Etching Equipment Market Overview

Customize Plasma Etching Equipment Market Report market research report

- ✔ Get in-depth analysis of Plasma Etching Equipment market size, growth, and forecasts.

- ✔ Understand Plasma Etching Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plasma Etching Equipment

What is the Market Size & CAGR of Plasma Etching Equipment market in 2023?

Plasma Etching Equipment Industry Analysis

Plasma Etching Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plasma Etching Equipment Market Analysis Report by Region

Europe Plasma Etching Equipment Market Report:

Europe's Plasma Etching Equipment market is set to expand from $0.69 billion in 2023 to $1.14 billion by 2033. The growth is primarily driven by increased adoption of advanced semiconductor technologies and a strong presence of key industry players in countries like Germany, France, and the UK.Asia Pacific Plasma Etching Equipment Market Report:

The Asia Pacific region, valued at $0.52 billion in 2023, is expected to grow to $0.85 billion by 2033. This substantial growth is attributed to the presence of major semiconductor manufacturers and increasing investments in electronics manufacturing across countries like China, Japan, and South Korea.North America Plasma Etching Equipment Market Report:

North America holds a strong position in the Plasma Etching Equipment market, with a value of $0.90 billion in 2023, expected to rise to $1.48 billion by 2033. The growth is propelled by advanced technological developments, high investment in R&D, and a robust semiconductor industry, particularly in the United States.South America Plasma Etching Equipment Market Report:

In South America, the Plasma Etching Equipment market is projected to increase from $0.18 billion in 2023 to $0.30 billion by 2033. The growing electronics industry and rising demand for domestic production capabilities contribute to this growth, although it remains relatively smaller compared to other regions.Middle East & Africa Plasma Etching Equipment Market Report:

The Middle East and Africa market for Plasma Etching Equipment is projected to grow from $0.21 billion in 2023 to $0.35 billion by 2033. This growth can be attributed to increasing investments in technology infrastructure and a gradual rise in the electronics segment.Tell us your focus area and get a customized research report.

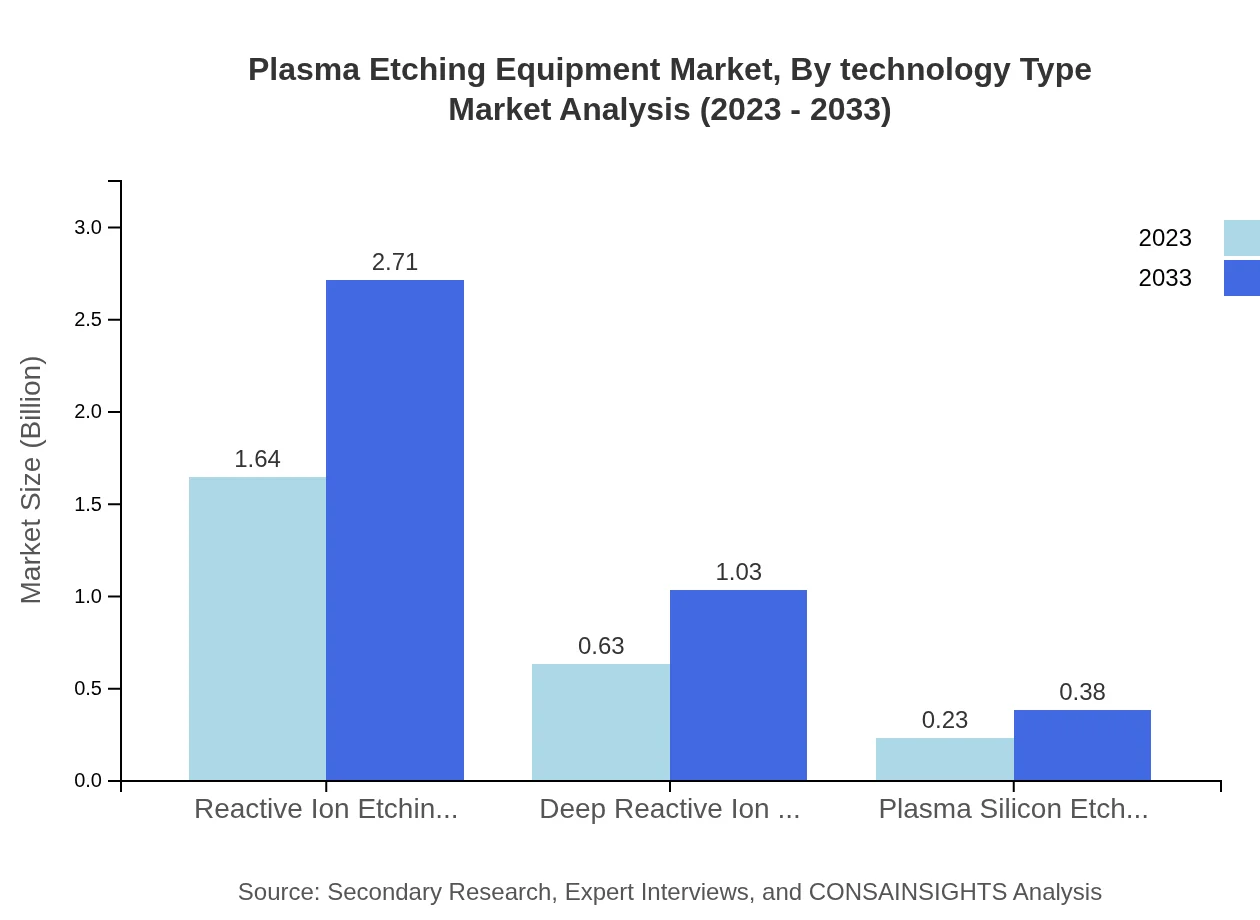

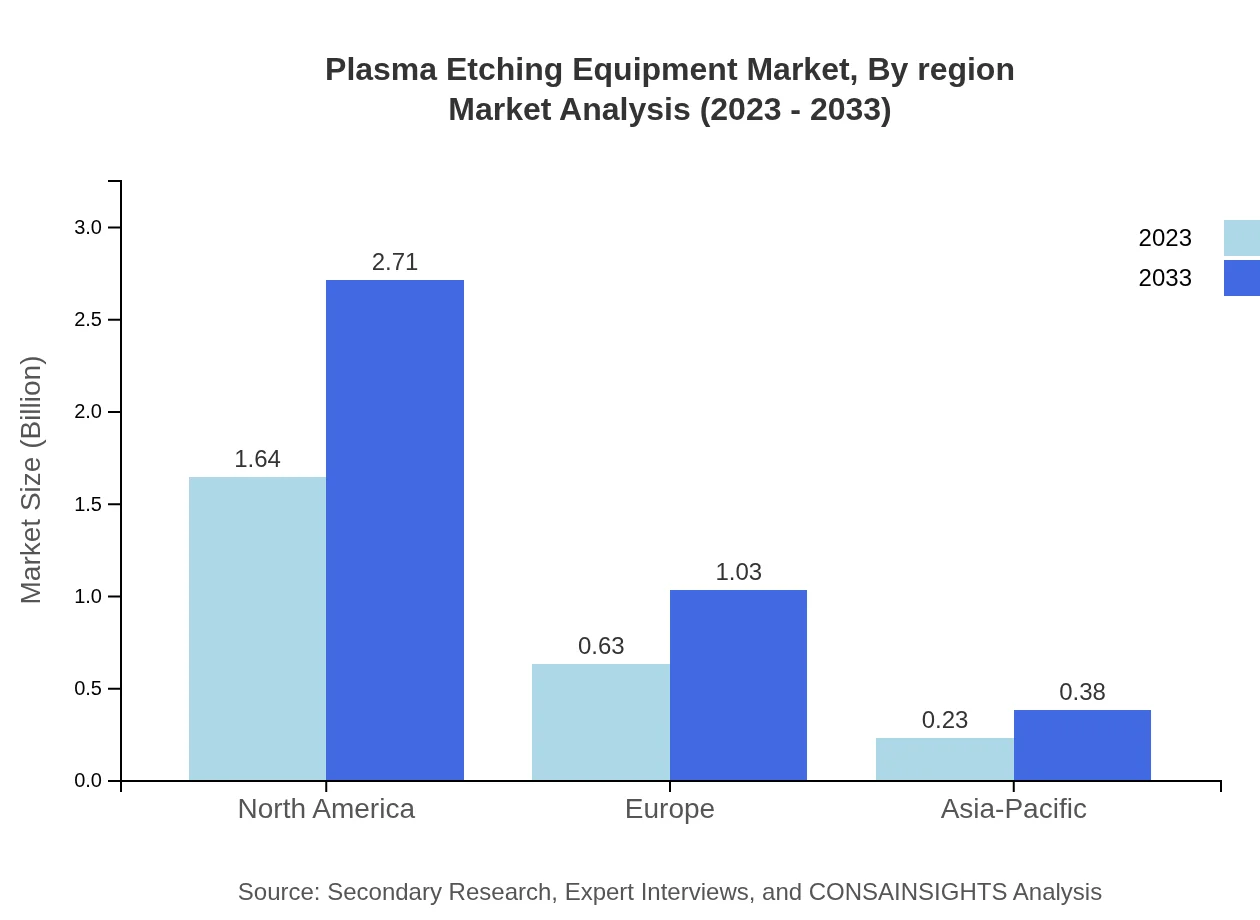

Plasma Etching Equipment Market Analysis By Technology Type

The Plasma Etching Equipment market is distinctly segmented into various technology types. Reactive Ion Etching (RIE) dominates the market with a valuation of $1.64 billion in 2023, expanding to $2.71 billion by 2033. This technology accounts for 65.8% of the overall market share, thanks to its effectiveness in creating highly accurate patterns in semiconductor fabrication. Deep Reactive Ion Etching (DRIE) and Plasma Silicon Etching also hold significant shares, projected at $0.63 billion and $0.23 billion respectively in 2023, showcasing their vital role in niche applications.

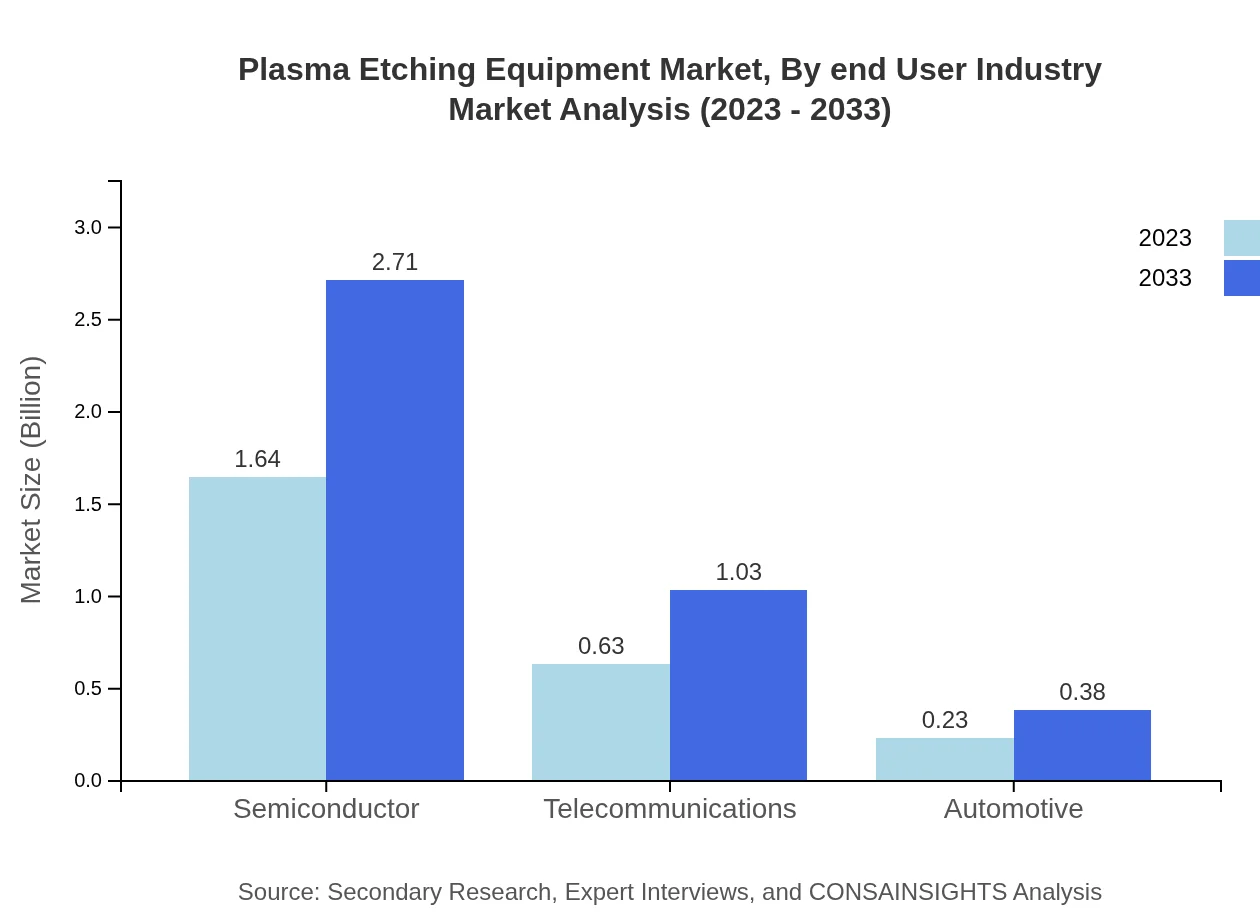

Plasma Etching Equipment Market Analysis By End User Industry

The end-user industry segmentation reveals that semiconductor manufacturing significantly influences market performance, with a size of $1.64 billion in 2023 and maintaining a share of 65.8%. The MEMS manufacturing industry contributes to $0.63 billion with 25% market share, while display technology is valued at $0.23 billion and represents 9.2%. Automotive and telecommunications sectors are projected to expand similarly, providing crucial demand drivers for plasma etching equipment.

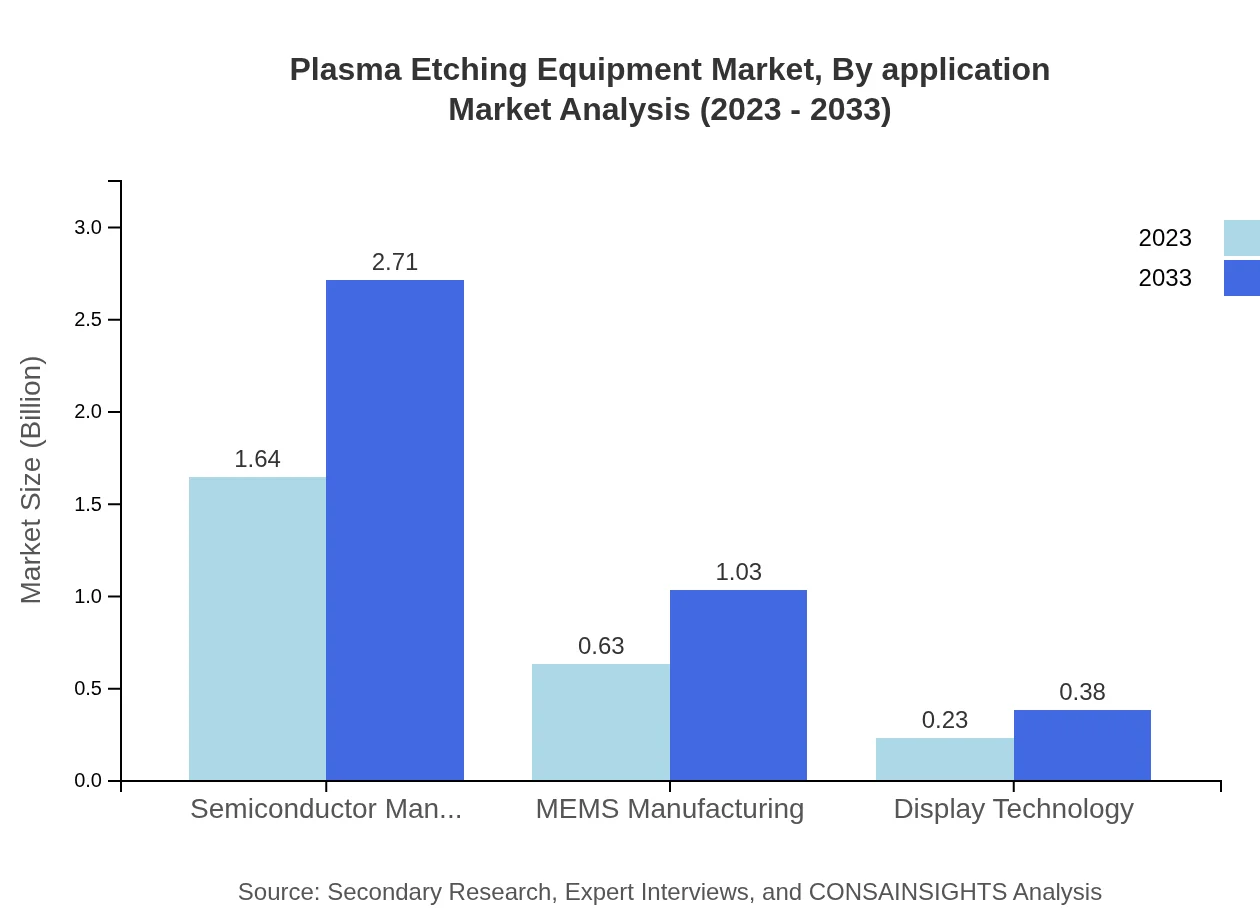

Plasma Etching Equipment Market Analysis By Application

Within the application segment, semiconductor applications lead the market, anticipated to achieve substantial growth due to the demand for smaller, more efficient electronic devices. The telecommunications and automotive applications represent a smaller yet growing market, driven by the increasing incorporation of electronic components in vehicles and telecommunication devices.

Plasma Etching Equipment Market Analysis By Region

The geographical analysis manifests a rapidly expanding market across all various regions. North America maintains the largest market share, followed closely by Europe, which shows promising growth trends. The Asia Pacific region is poised for significant ascendance, with emerging markets showing increasing adoption of plasma etching equipment due to the booming electronics and semiconductor fabrication industries.

Plasma Etching Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plasma Etching Equipment Industry

Applied Materials, Inc.:

A leader in the semiconductor manufacturing industry, Applied Materials provides advanced equipment, services, and software for the manufacturing of semiconductor, flat panel display, and solar photovoltaic products.LAM Research Corporation:

LAM Research is known for its innovative plasma etch and deposition equipment for semiconductor manufacturing, supporting advanced technology nodes and enabling higher yields.Tokyo Electron Limited:

Tokyo Electron plays a crucial role in the global semiconductor market by offering a comprehensive range of etching and deposition equipment to various advanced technology sectors.Oxford Instruments:

With expertise in the manufacturing of precision etching equipment, Oxford Instruments provides solutions for the semiconductor and microelectronics industries.Nikon Corporation:

Nikon is a formidable player in the imaging and precision engineering sectors, notably contributing to advanced semiconductor manufacturing technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of plasma Etching Equipment?

The plasma etching equipment market is valued at approximately $2.5 billion in 2023, with an anticipated CAGR of 5% from 2023 to 2033, indicating robust growth as demand for precision etching in semiconductor and electronics manufacturing rises.

What are the key market players or companies in the plasma Etching Equipment industry?

Key players in the plasma etching equipment market include recognized companies specializing in semiconductor manufacturing technologies. Major participants influence market dynamics through innovation, strategic partnerships, and geographic expansions, striving to capture greater market shares amid increasing competition.

What are the primary factors driving the growth in the plasma Etching Equipment industry?

Growth in the plasma etching equipment market is driven by advancing technologies in semiconductor fabrication, increased demand for smaller electronic devices, and the push for more efficient manufacturing processes that necessitate high-precision etching solutions across various industries.

Which region is the fastest Growing in the plasma Etching Equipment?

North America stands out as the fastest-growing region in the plasma etching equipment market, projected to grow from $0.90 billion in 2023 to $1.48 billion by 2033, owing to a robust semiconductor industry and significant R&D investments.

Does ConsaInsights provide customized market report data for the plasma Etching Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific queries within the plasma etching equipment industry. This enables stakeholders to receive insights that meet their unique needs and strategic objectives, supporting informed decision-making.

What deliverables can I expect from this plasma Etching Equipment market research project?

Deliverables from the plasma etching equipment market research project include detailed reports covering market sizes, growth rates, competitive analyses, segmentation insights, and regional forecasts, providing a comprehensive overview necessary for effective market strategy development.

What are the market trends of plasma Etching Equipment?

Current trends in the plasma etching equipment market include increasing automation in manufacturing, a shift towards eco-friendly etching processes, and the deployment of advanced materials, all contributing to enhanced efficiency and sustainability in the semiconductor supply chain.