Plasma Fractionation Market Report

Published Date: 31 January 2026 | Report Code: plasma-fractionation

Plasma Fractionation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Plasma Fractionation market, covering market size, trends, technology advancements, and forecasts from 2023 to 2033. It offers insights into regional dynamics, industry leaders, and market segmentation.

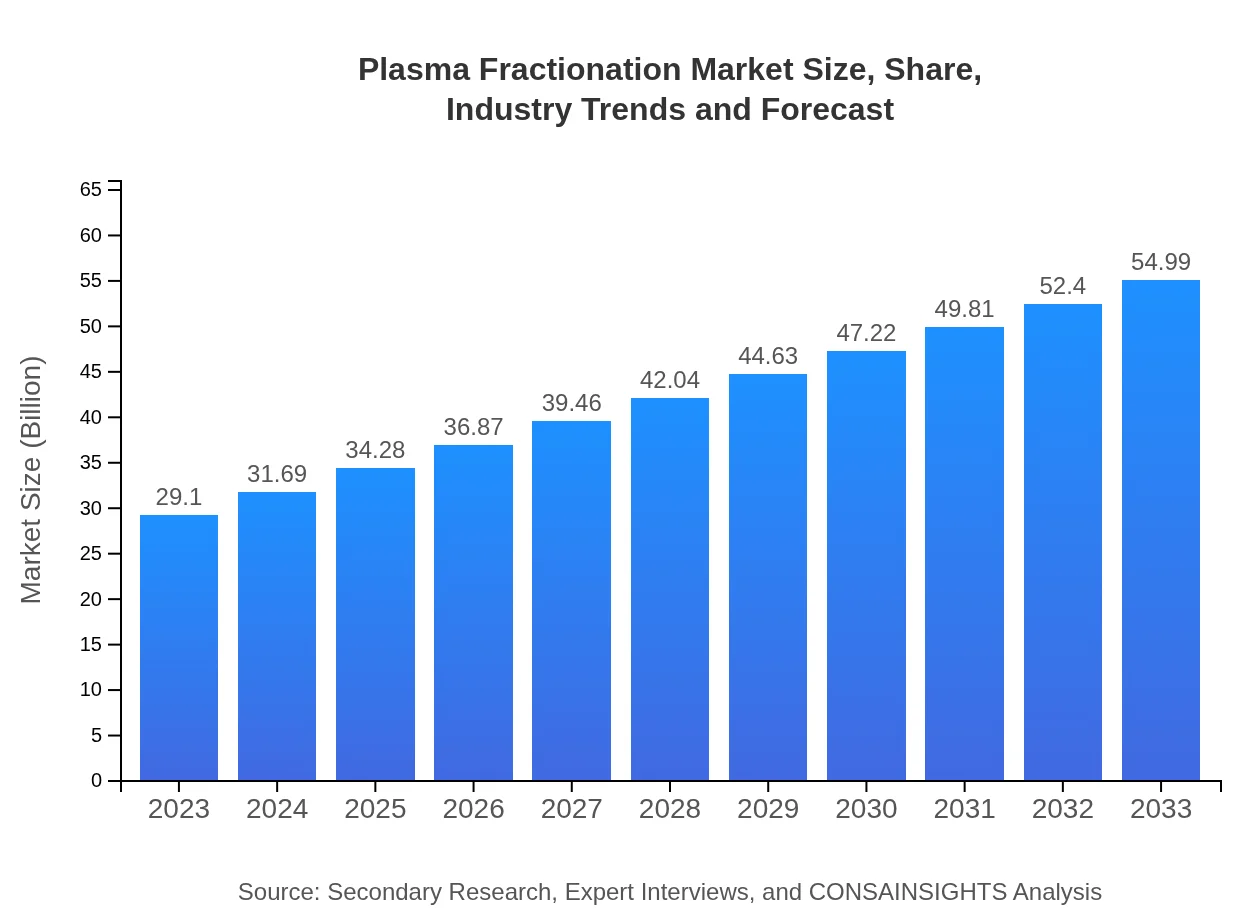

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $29.10 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $54.99 Billion |

| Top Companies | Grifols, CSL Behring, Octapharma, Kedrion Biopharma |

| Last Modified Date | 31 January 2026 |

Plasma Fractionation Market Overview

Customize Plasma Fractionation Market Report market research report

- ✔ Get in-depth analysis of Plasma Fractionation market size, growth, and forecasts.

- ✔ Understand Plasma Fractionation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plasma Fractionation

What is the Market Size & CAGR of Plasma Fractionation market in 2023?

Plasma Fractionation Industry Analysis

Plasma Fractionation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plasma Fractionation Market Analysis Report by Region

Europe Plasma Fractionation Market Report:

The European market is projected to grow from $7.32 billion in 2023 to $13.83 billion by 2033. The region benefits from a strong regulatory environment and a robust healthcare infrastructure, fostering innovations and the introduction of new products.Asia Pacific Plasma Fractionation Market Report:

The Asia Pacific region is showing promising growth in the Plasma Fractionation market, with an estimated market size of $6.17 billion in 2023 and projected to reach $11.65 billion by 2033. The region's growth is driven by rising healthcare expenditures, and an increasing aging population, prompting greater demand for plasma-derived products.North America Plasma Fractionation Market Report:

North America remains a dominant market for Plasma Fractionation, with a size of $9.75 billion in 2023. Forecasts suggest an increase to $18.43 billion by 2033, predominantly driven by advanced healthcare systems, investments in research and development, and the high prevalence of chronic diseases.South America Plasma Fractionation Market Report:

In South America, the market size for Plasma Fractionation is anticipated to grow from $2.74 billion in 2023 to $5.17 billion in 2033. Factors such as improving healthcare infrastructure and access to treatment options are significantly contributing to market growth.Middle East & Africa Plasma Fractionation Market Report:

The Middle East and Africa show a growth trajectory from $3.12 billion in 2023 to $5.90 billion by 2033. Increased collaboration with global pharmaceutical companies and rising healthcare investments are key contributors to this market segment's growth.Tell us your focus area and get a customized research report.

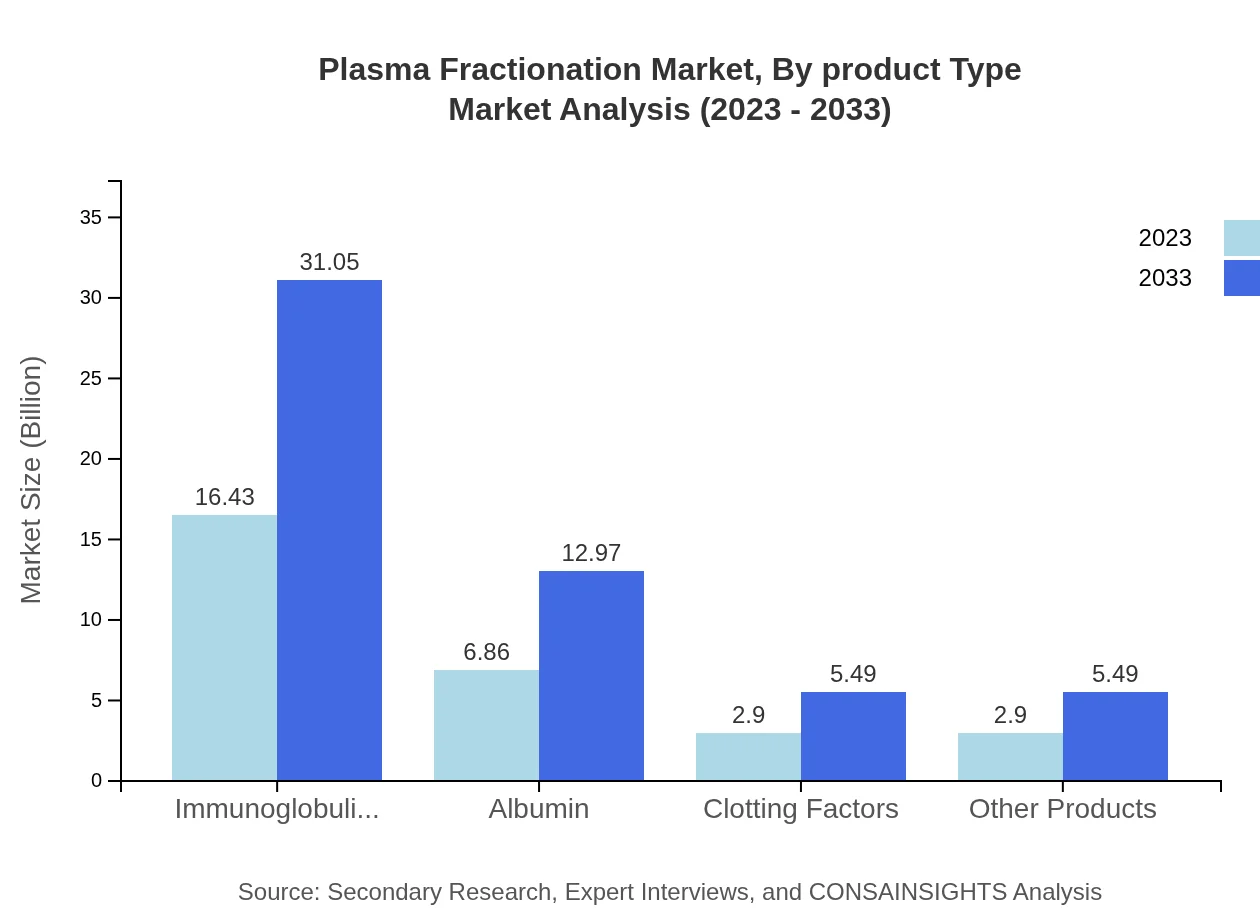

Plasma Fractionation Market Analysis By Product Type

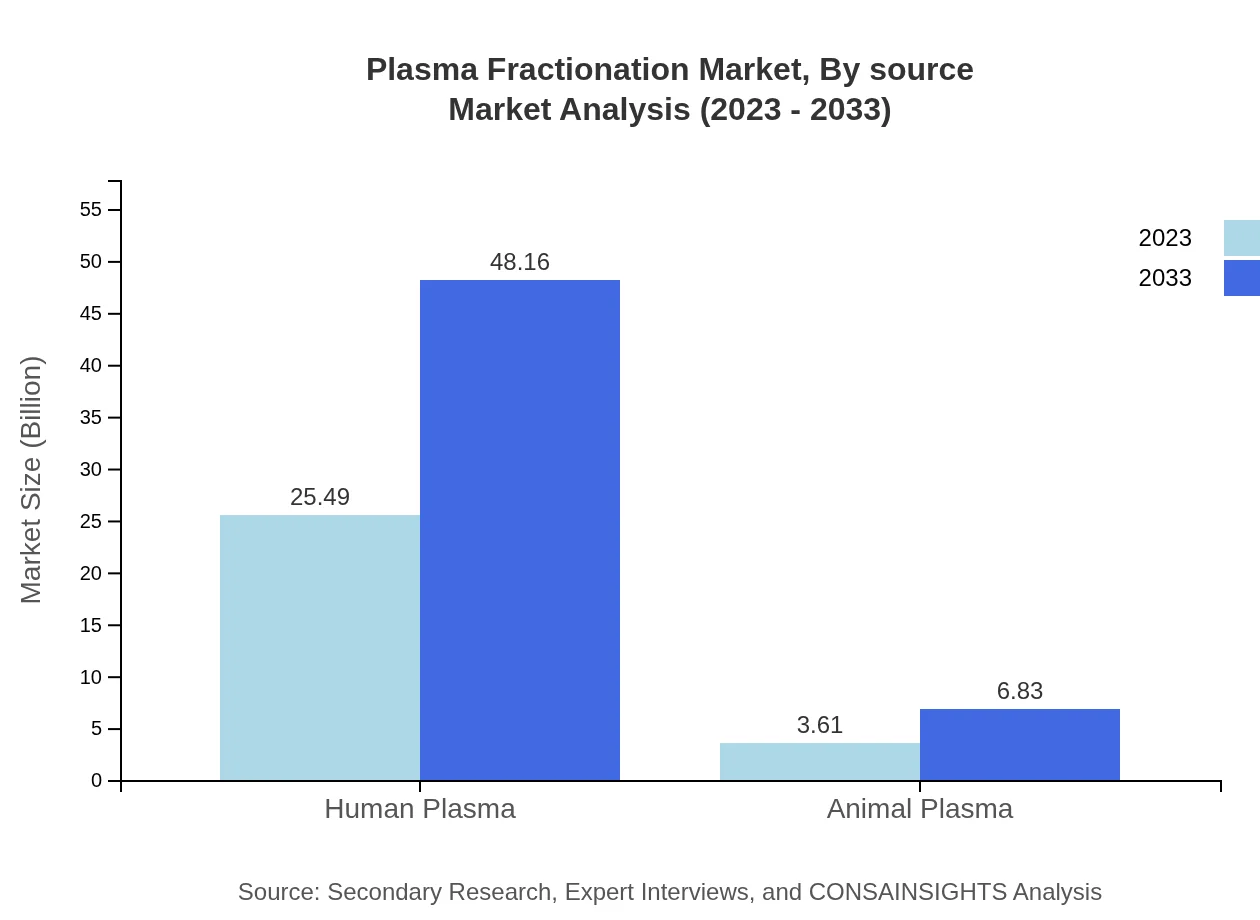

The market for plasma-derived products is predominantly composed of Human Plasma, projected to expand from $25.49 billion in 2023 to $48.16 billion by 2033, holding a market share of 87.58%. Animal Plasma is expected to grow from $3.61 billion to $6.83 billion in the same period, making up 12.42% of the market.

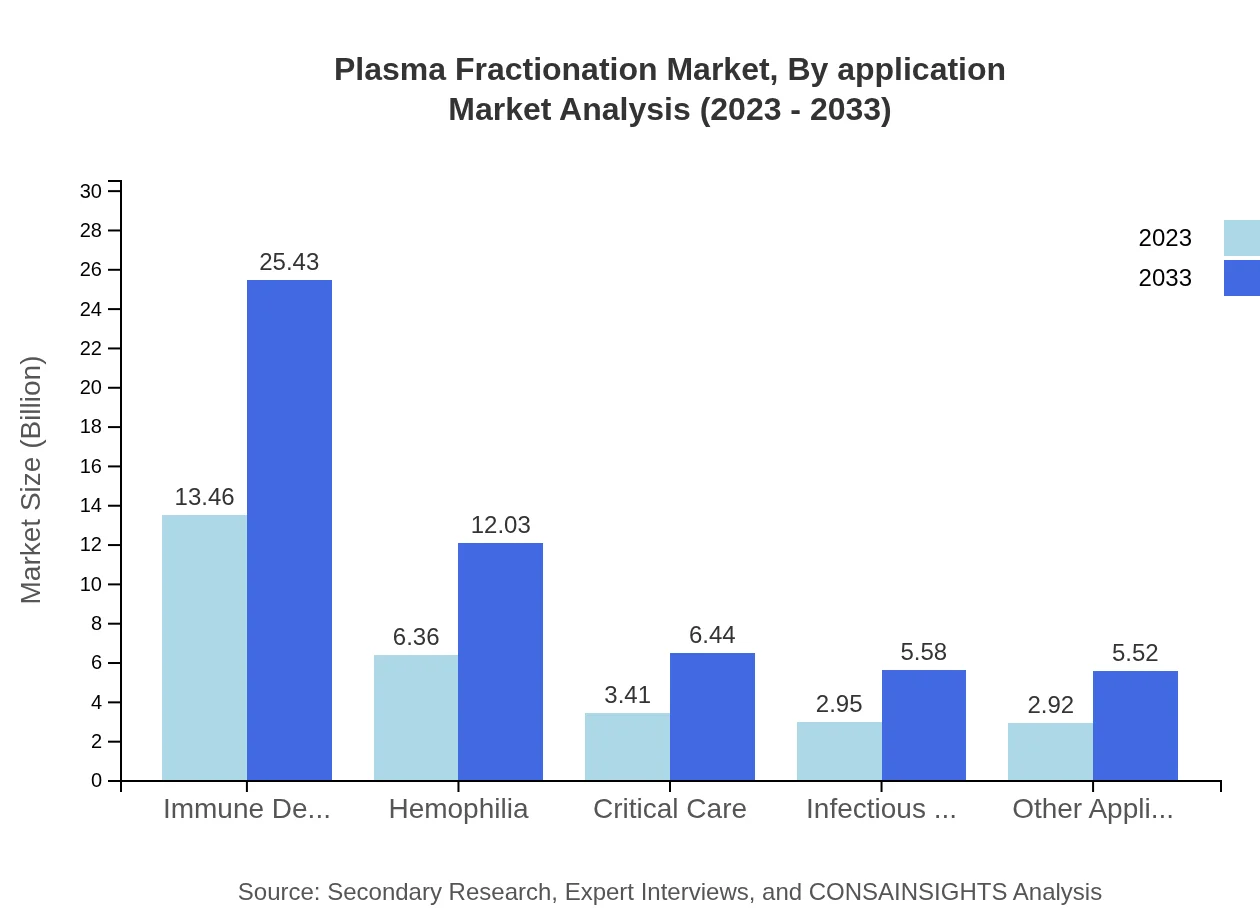

Plasma Fractionation Market Analysis By Application

In applications, immune deficiencies and hemophilia constitute major areas of focus, with human plasma treatments estimated at $13.46 billion and $6.36 billion respectively in 2023. These numbers are expected to rise to $25.43 billion and $12.03 billion by 2033.

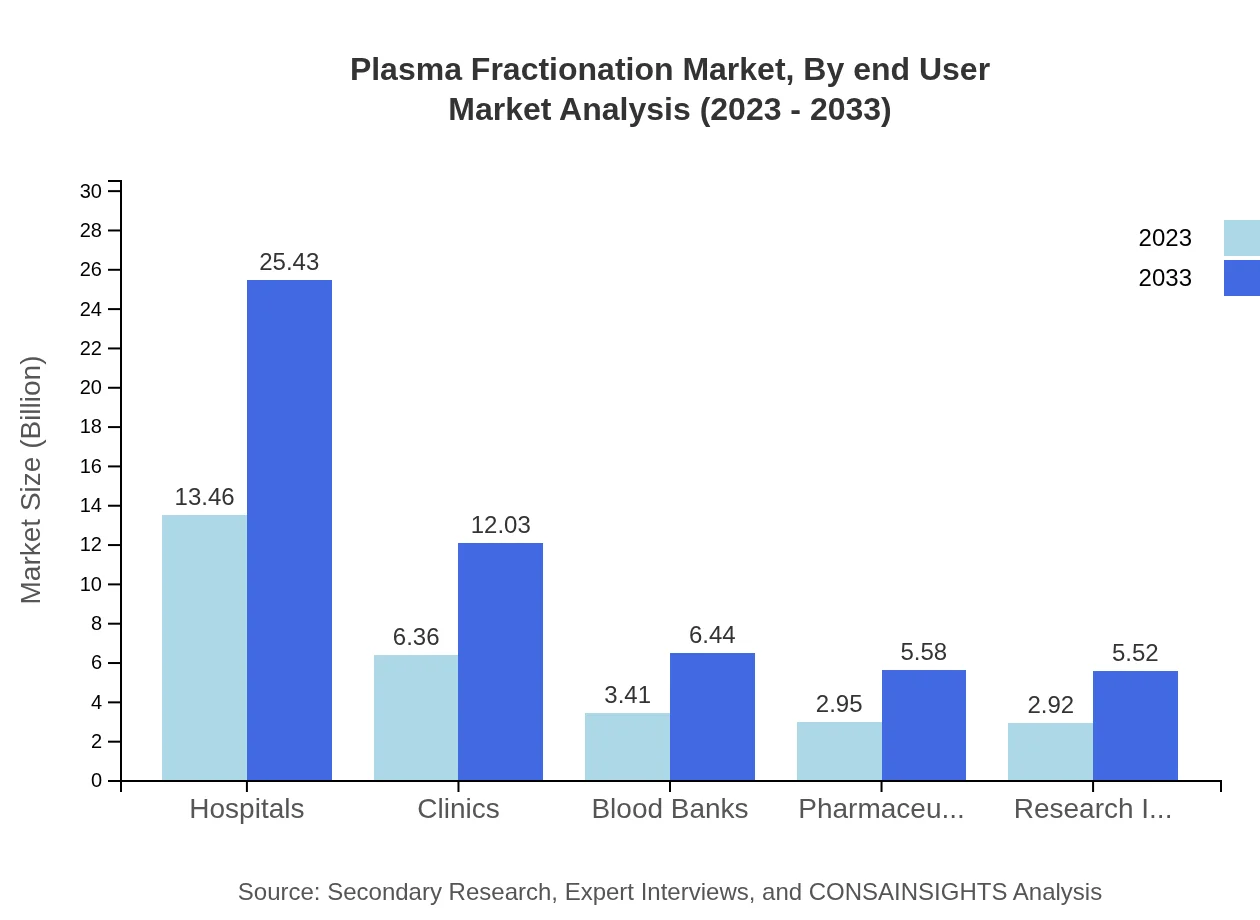

Plasma Fractionation Market Analysis By End User

Hospitals are the largest end-user segment in the Plasma Fractionation market, forecasted to grow from $13.46 billion in 2023 to $25.43 billion by 2033. Clinics and blood banks will also see significant growth in their contributions to the market.

Plasma Fractionation Market Analysis By Source

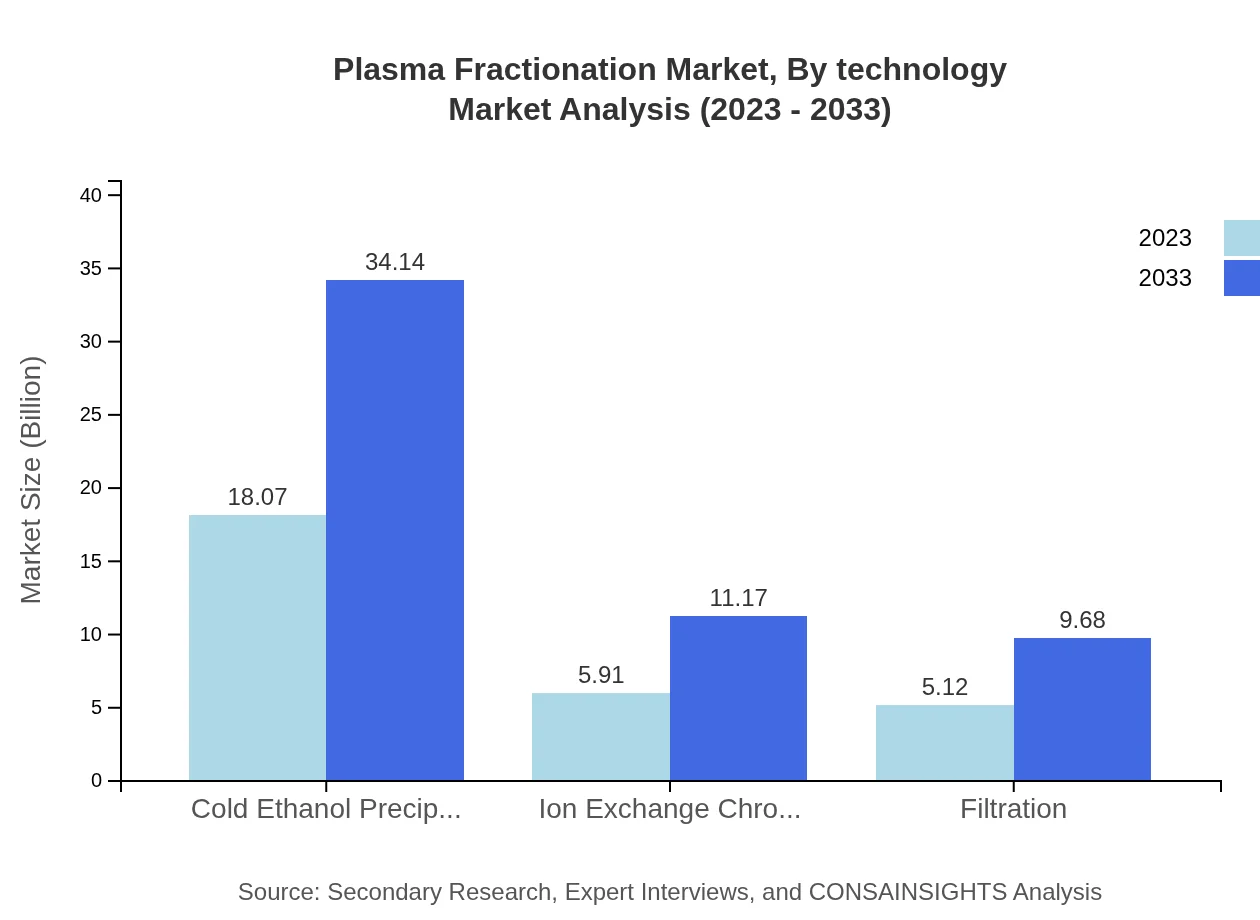

The segmentation by source highlights a leading role of cold ethanol precipitation, expected to grow significantly due to its efficacy and cost-effectiveness. Ion exchange chromatography is also gaining traction, with planned innovations enhancing its application in the fractionation process.

Plasma Fractionation Market Analysis By Technology

Cold ethanol precipitation stands as the most adopted technology, holding a market share of 62.09% in 2023, while ion exchange chromatography follows with a notable presence. As technology evolves, integration of advanced filtration systems is expected to become more prevalent in the industry.

Plasma Fractionation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plasma Fractionation Industry

Grifols:

Grifols is a global healthcare company and a leading producer of plasma-derived medicines, with a strong focus on innovation and expanding their pipeline of therapeutic products.CSL Behring:

CSL Behring specializes in lifesaving biotherapies, dedicated to high-quality standards in developing and manufacturing therapies derived from human plasma.Octapharma:

Octapharma is an international leader in the production of human proteins derived from human plasma, committed to enhancing the quality of life for patients worldwide.Kedrion Biopharma:

Kedrion Biopharma focuses on human plasma-derived therapies, continually investing in the development of innovative solutions for patient care.We're grateful to work with incredible clients.

FAQs

What is the market size of plasma Fractionation?

The plasma-fractionation market size is projected to reach $29.1 billion by 2033, growing at a CAGR of 6.4% from 2023 to 2033. This growth is attributed to increasing demand for plasma-derived therapies.

What are the key market players or companies in the plasma Fractionation industry?

Key players in the plasma-fractionation market include CSL Behring, Grifols, Takeda Pharmaceutical Company, Octapharma AG, and Pfizer. These companies play significant roles in developing and producing plasma-derived products.

What are the primary factors driving the growth in the plasma Fractionation industry?

The growth of the plasma-fractionation industry is driven by a rising prevalence of chronic diseases, increasing demand for immunoglobulin therapies, and advancements in technology that improve plasma processing efficiency and safety.

Which region is the fastest Growing in the plasma Fractionation market?

The Asia-Pacific region is the fastest-growing in the plasma-fractionation market, with a projected increase from $6.17 billion in 2023 to $11.65 billion by 2033, driven by expanding healthcare infrastructures and increasing plasma collection.

Does ConsaInsights provide customized market report data for the plasma Fractionation industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the plasma-fractionation industry, allowing detailed insights into niche segments and regional markets.

What deliverables can I expect from this plasma Fractionation market research project?

Deliverables from the plasma-fractionation market research project include comprehensive market analysis reports, regional insights, segmentation data, trends analysis, and forecasts to guide strategic business decisions.

What are the market trends of plasma Fractionation?

Trends in the plasma-fractionation market include increasing automation in plasma collection, growing interest in personalized medicine, and enhanced public awareness regarding plasma-derived therapies contributing to market expansion.