Plastic Bottles And Containers Market Report

Published Date: 01 February 2026 | Report Code: plastic-bottles-and-containers

Plastic Bottles And Containers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Plastic Bottles and Containers market, covering insights on market size, growth trends, industry challenges, and forecasts for 2023 to 2033.

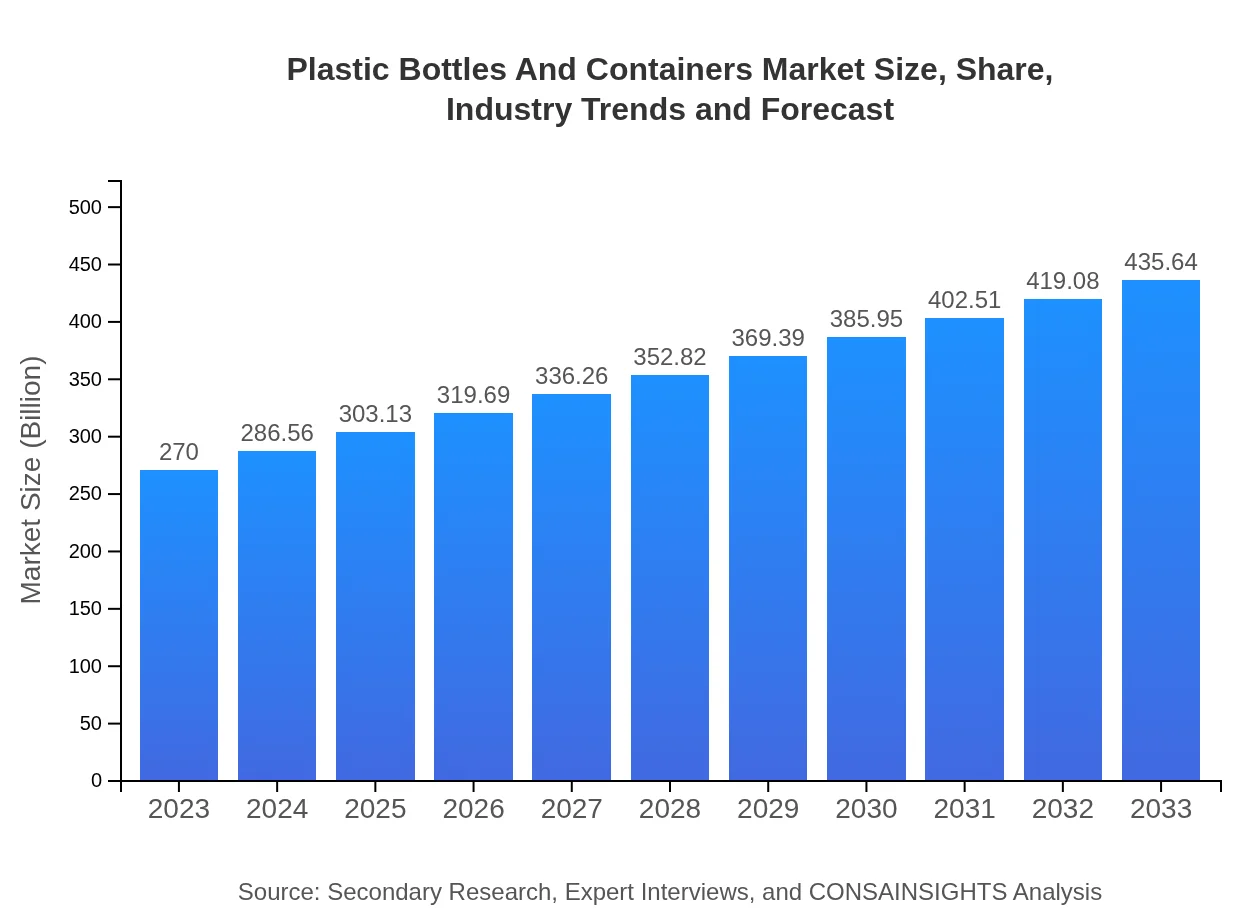

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $270.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $435.64 Billion |

| Top Companies | Amcor plc, Ball Corporation, Plastipak Holdings, Inc. |

| Last Modified Date | 01 February 2026 |

Plastic Bottles And Containers Market Overview

Customize Plastic Bottles And Containers Market Report market research report

- ✔ Get in-depth analysis of Plastic Bottles And Containers market size, growth, and forecasts.

- ✔ Understand Plastic Bottles And Containers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plastic Bottles And Containers

What is the Market Size & CAGR of Plastic Bottles And Containers market in 2023?

Plastic Bottles And Containers Industry Analysis

Plastic Bottles And Containers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plastic Bottles And Containers Market Analysis Report by Region

Europe Plastic Bottles And Containers Market Report:

Europe's Plastic Bottles and Containers market is projected to increase from $84.40 billion in 2023 to $136.18 billion by 2033. Strict regulations regarding plastic waste management and an increasing trend towards sustainable packaging solutions are shaping the market landscape.Asia Pacific Plastic Bottles And Containers Market Report:

The Asia Pacific region is expected to witness substantial growth in the Plastic Bottles and Containers market, with an estimated market size of $72.19 billion by 2033, up from $44.74 billion in 2023. This growth is driven by increasing urbanization, rising disposable incomes, and a burgeoning food and beverage industry.North America Plastic Bottles And Containers Market Report:

In North America, the market is set to grow significantly from $100.84 billion in 2023 to $162.71 billion by 2033. The presence of major beverage companies and increasing environmentally-friendly packaging initiatives are essential growth drivers in this region.South America Plastic Bottles And Containers Market Report:

The South American market for Plastic Bottles and Containers is projected to grow from $18.60 billion in 2023 to $30.02 billion by 2033. Enhancements in the local manufacturing capabilities and rising demand for consumer goods are key contributors to this market escalation.Middle East & Africa Plastic Bottles And Containers Market Report:

The Middle East and Africa region is anticipated to grow from $21.41 billion in 2023 to $34.55 billion by 2033, supported by growth in various sectors including construction, healthcare, and food and beverage.Tell us your focus area and get a customized research report.

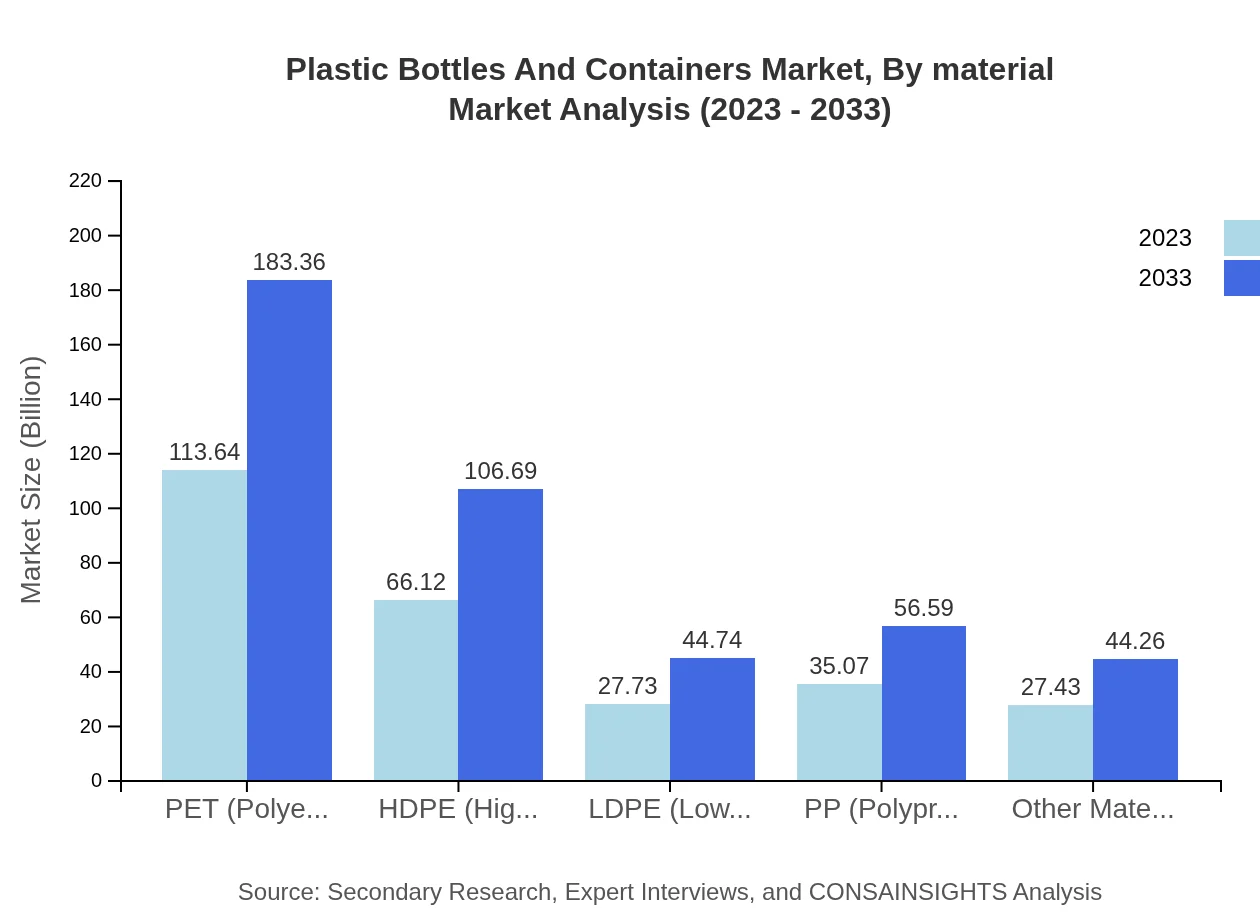

Plastic Bottles And Containers Market Analysis By Material

The market segmented by material shows PET as a leading material with a size of $113.64 billion in 2023 and projected to reach $183.36 billion by 2033. Other notable materials include HDPE at $66.12 billion and LDPE at $27.73 billion, indicating diverse applications across various sectors.

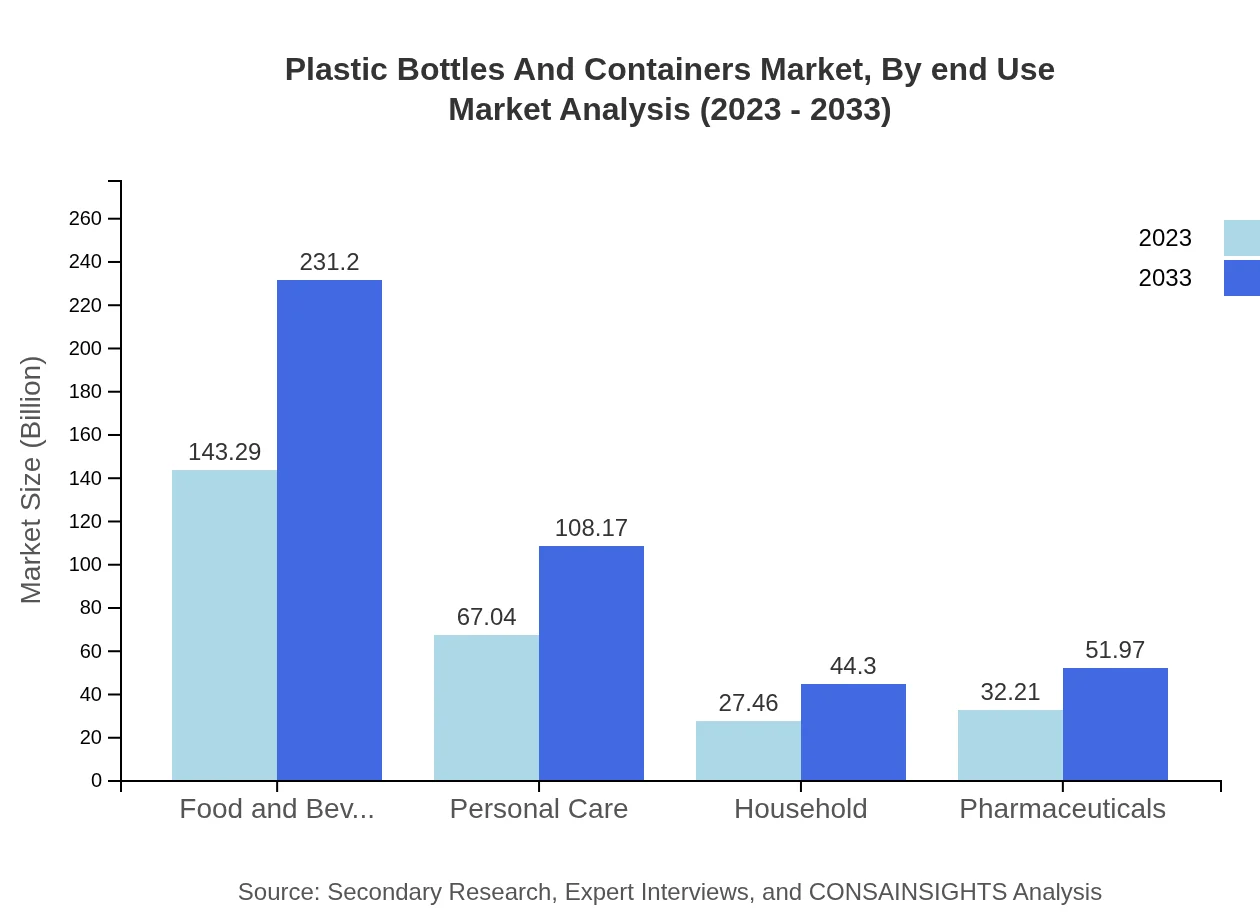

Plastic Bottles And Containers Market Analysis By End Use

The food and beverage sector dominates the end-use segment, with a market size of $143.29 billion expected in 2023, growing to $231.20 billion by 2033. The personal care segment, valued at $67.04 billion in 2023, is also anticipated to grow significantly.

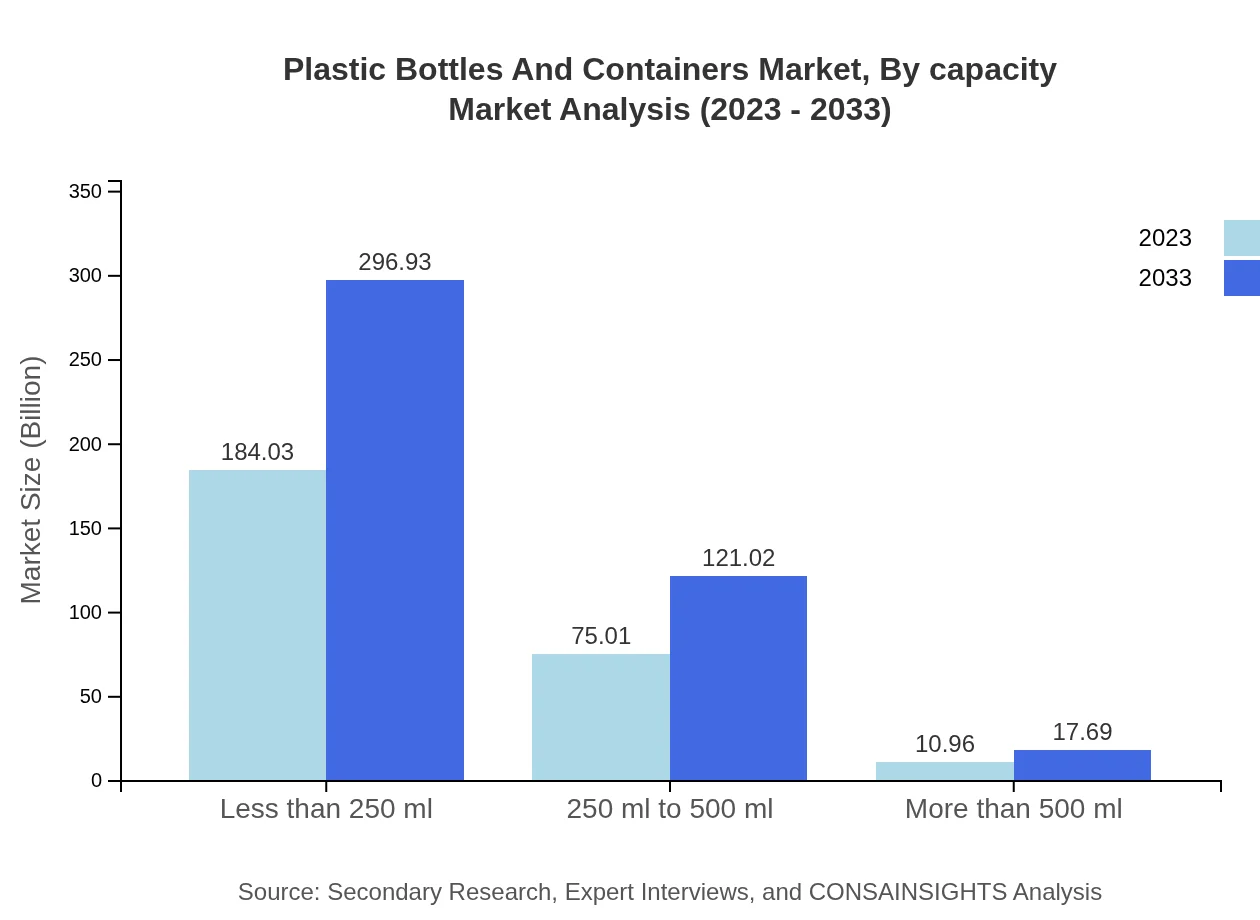

Plastic Bottles And Containers Market Analysis By Capacity

In terms of capacity, products sized less than 250 ml lead this segment with a market size of $184.03 billion in 2023, expected to rise to $296.93 billion by 2033, indicating a strong preference for smaller, portable packaging solutions.

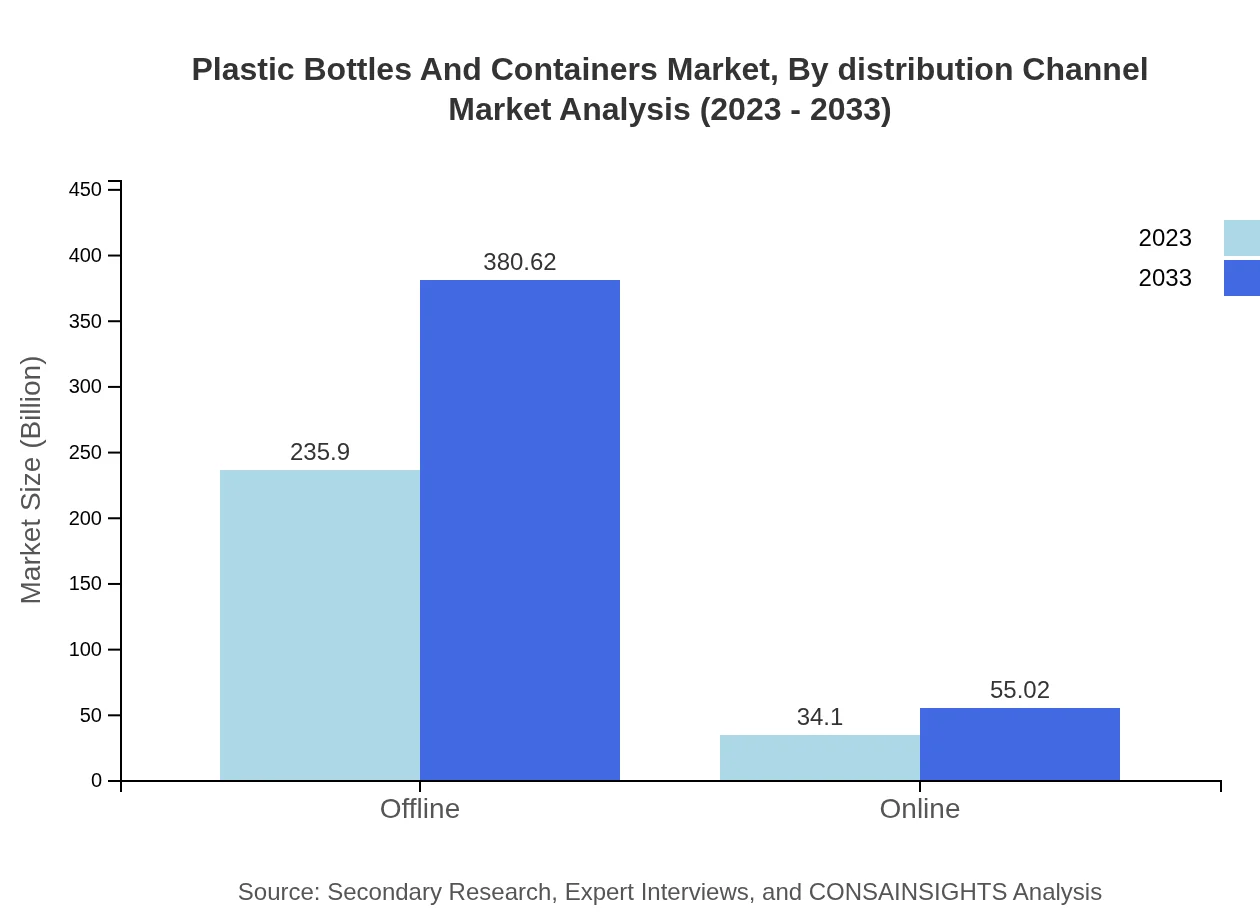

Plastic Bottles And Containers Market Analysis By Distribution Channel

The offline distribution channel currently accounts for the majority of the market at $235.90 billion in 2023, growing to $380.62 billion by 2033. However, the online channel is experiencing rapid growth, projected to increase from $34.10 billion to $55.02 billion in the same period.

Plastic Bottles And Containers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plastic Bottles And Containers Industry

Amcor plc:

A global leader in packaging with a strong focus on sustainable practices, providing innovative plastic solutions for various industries.Ball Corporation:

Specializing in metal packaging but also a significant player in the plastic segment, Ball Corporation emphasizes environmentally responsible manufacturing.Plastipak Holdings, Inc.:

A specialized manufacturer of plastic containers, Plastipak is known for its extensive product range and commitment to sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of plastic bottles and containers?

The global market size for plastic bottles and containers is estimated at approximately $270 billion in 2023, with a projected CAGR of 4.8% from 2023 to 2033. This growth reflects increasing demand across various industries.

What are the key market players or companies in the plastic bottles and containers industry?

Key players in the plastic bottles and containers market include industry giants like Coca-Cola, PepsiCo, Amcor, Berry Global, and Nestlé. These companies dominate the market through innovation, extensive product lines, and global distribution networks.

What are the primary factors driving the growth in the plastic bottles and containers industry?

Growth in the plastic bottles and containers industry is driven by rising consumer demand for packaged goods, sustainability initiatives, and innovations in packaging technology. Additionally, the expanding food and beverage sector significantly propels market expansion.

Which region is the fastest Growing in the plastic bottles and containers market?

North America holds a significant share of the market, with a projected size increase from $100.84 billion in 2023 to $162.71 billion in 2033, making it the fastest-growing region in the plastic bottles and containers market.

Does ConsaInsights provide customized market report data for the plastic bottles and containers industry?

Yes, ConsaInsights offers tailored market reports for the plastic bottles and containers industry. Clients can request customized data and insights to meet their specific business needs and strategic objectives.

What deliverables can I expect from this plastic bottles and containers market research project?

From the plastic bottles and containers market research project, clients can expect detailed reports, market size analysis, growth forecasts, competitive landscape evaluations, and segment-wise breakdowns covering various material types and regions.

What are the market trends of plastic bottles and containers?

Current trends in the plastic bottles and containers market include a shift towards sustainable materials, increased e-commerce distribution strategies, and growing demand for convenience in packaging. Brands are also focusing on recycling and reducing plastic usage.