Platform As A Service Market Report

Published Date: 31 January 2026 | Report Code: platform-as-a-service

Platform As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Platform as a Service (PaaS) market, including market size, trends, and forecasts for 2023-2033. It highlights key insights into market dynamics, regional performances, competitive landscape, and future growth opportunities.

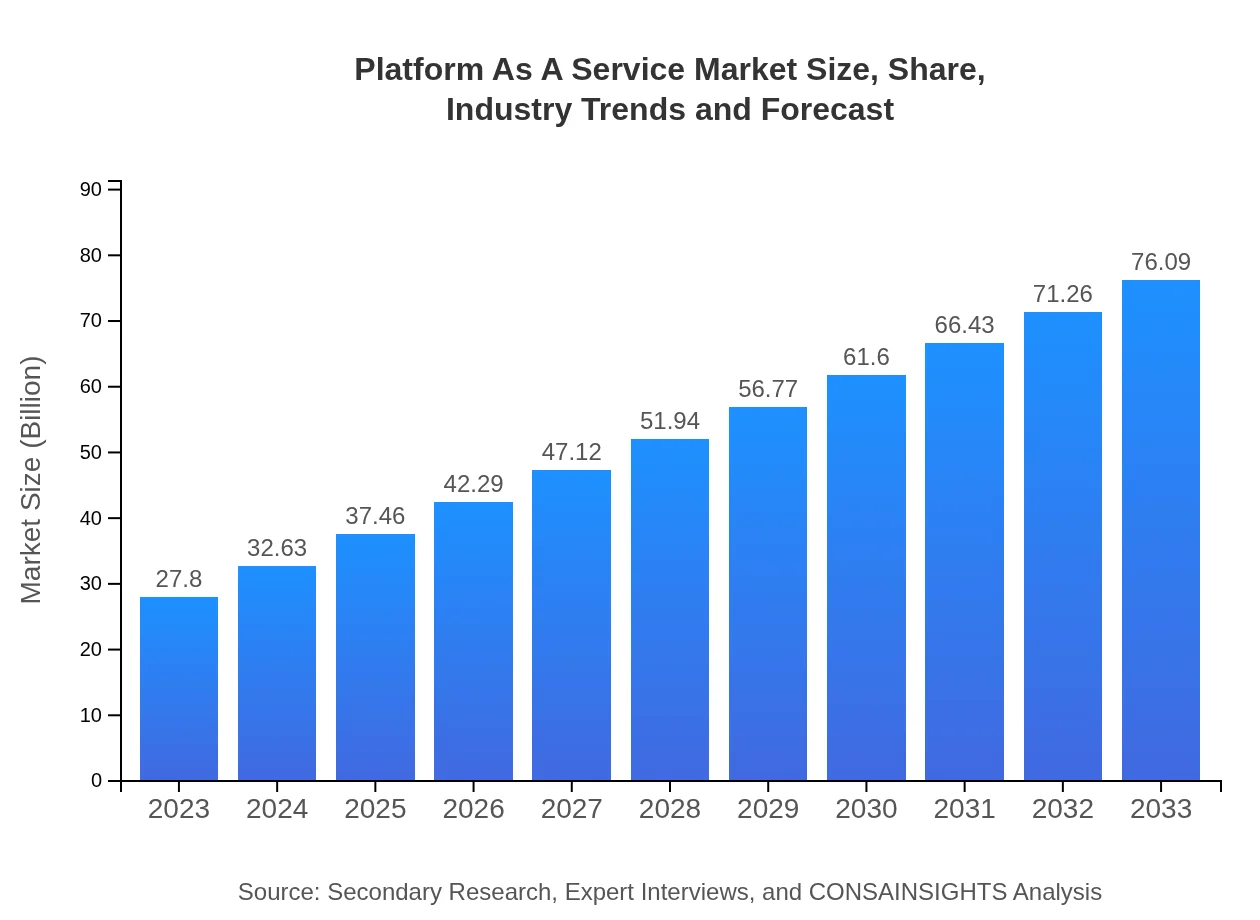

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.80 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $76.09 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM Cloud, Salesforce |

| Last Modified Date | 31 January 2026 |

Platform As A Service Market Overview

Customize Platform As A Service Market Report market research report

- ✔ Get in-depth analysis of Platform As A Service market size, growth, and forecasts.

- ✔ Understand Platform As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Platform As A Service

What is the Market Size & CAGR of Platform As A Service market in 2023?

Platform As A Service Industry Analysis

Platform As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Platform As A Service Market Analysis Report by Region

Europe Platform As A Service Market Report:

The European PaaS market is expected to grow from $7.73 billion in 2023 to $21.16 billion by 2033, fueled by stringent regulatory compliance requirements and growing demand for cloud security solutions among enterprises. The United Kingdom, Germany, and France are leading contributors to this growth.Asia Pacific Platform As A Service Market Report:

In the Asia Pacific region, the PaaS market is projected to grow from $6.01 billion in 2023 to $16.45 billion by 2033. This growth is driven by the increasing investments in cloud computing technologies and the rise of digital transformation initiatives across countries like China and India. Furthermore, the proliferation of startups and technological innovations enhances competition and service offerings in the market.North America Platform As A Service Market Report:

North America will continue to dominate the PaaS market, projected to increase from $9.57 billion in 2023 to $26.19 billion by 2033. The significant presence of major tech companies and continual innovations in the sector, coupled with the high adoption rate of cloud services by enterprises, positions this region for substantial growth.South America Platform As A Service Market Report:

The South American PaaS market is set to expand from $0.83 billion in 2023 to $2.27 billion in 2033. This growth is attributed to the increasing internet penetration and the growing adoption of cloud solutions to streamline operations among local enterprises, especially in Brazil and Argentina.Middle East & Africa Platform As A Service Market Report:

In the Middle East and Africa, the PaaS market is forecasted to grow from $3.66 billion in 2023 to $10.02 billion by 2033. The growth is driven by increasing investments in technology infrastructure and the rising trend of smart cities, combined with the proliferation of cloud services.Tell us your focus area and get a customized research report.

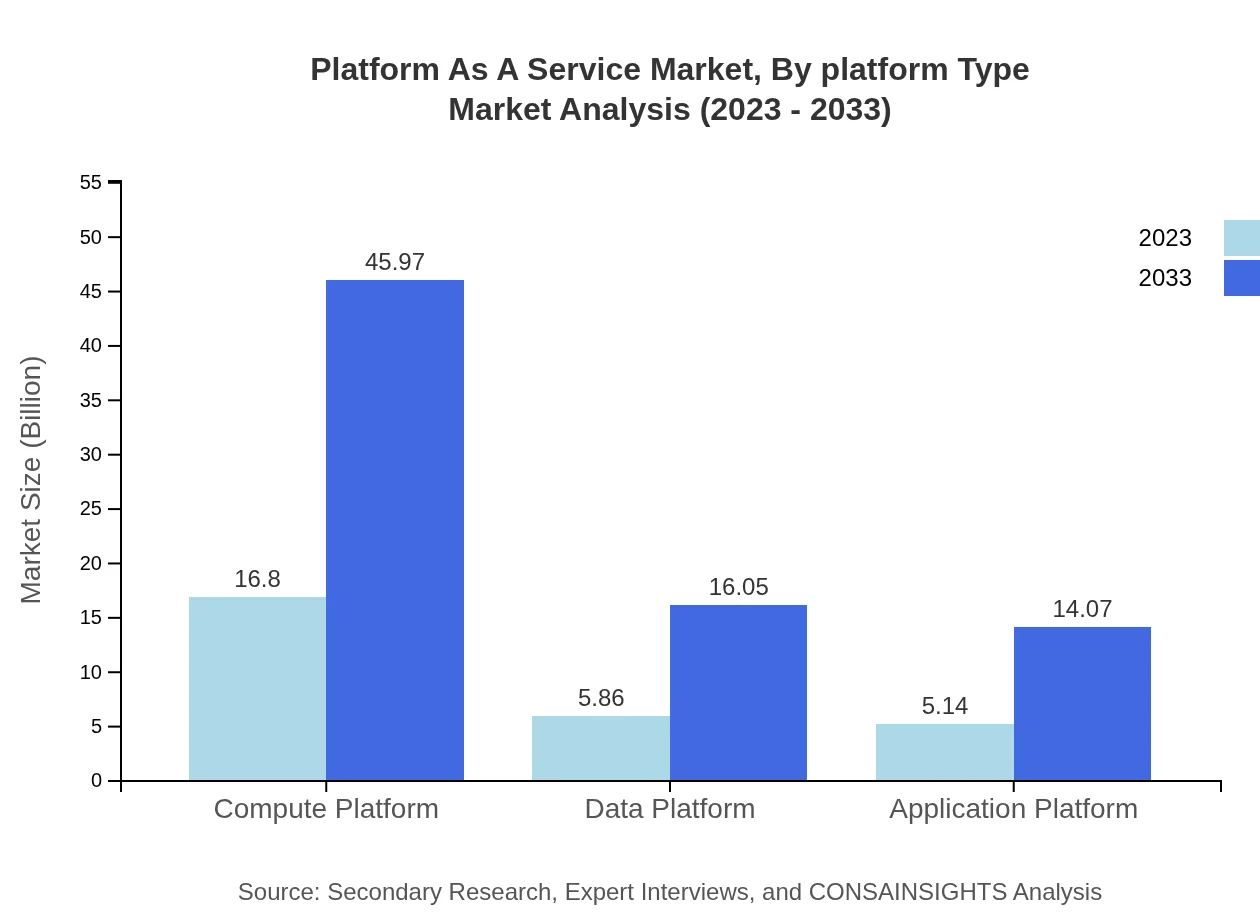

Platform As A Service Market Analysis By Platform Type

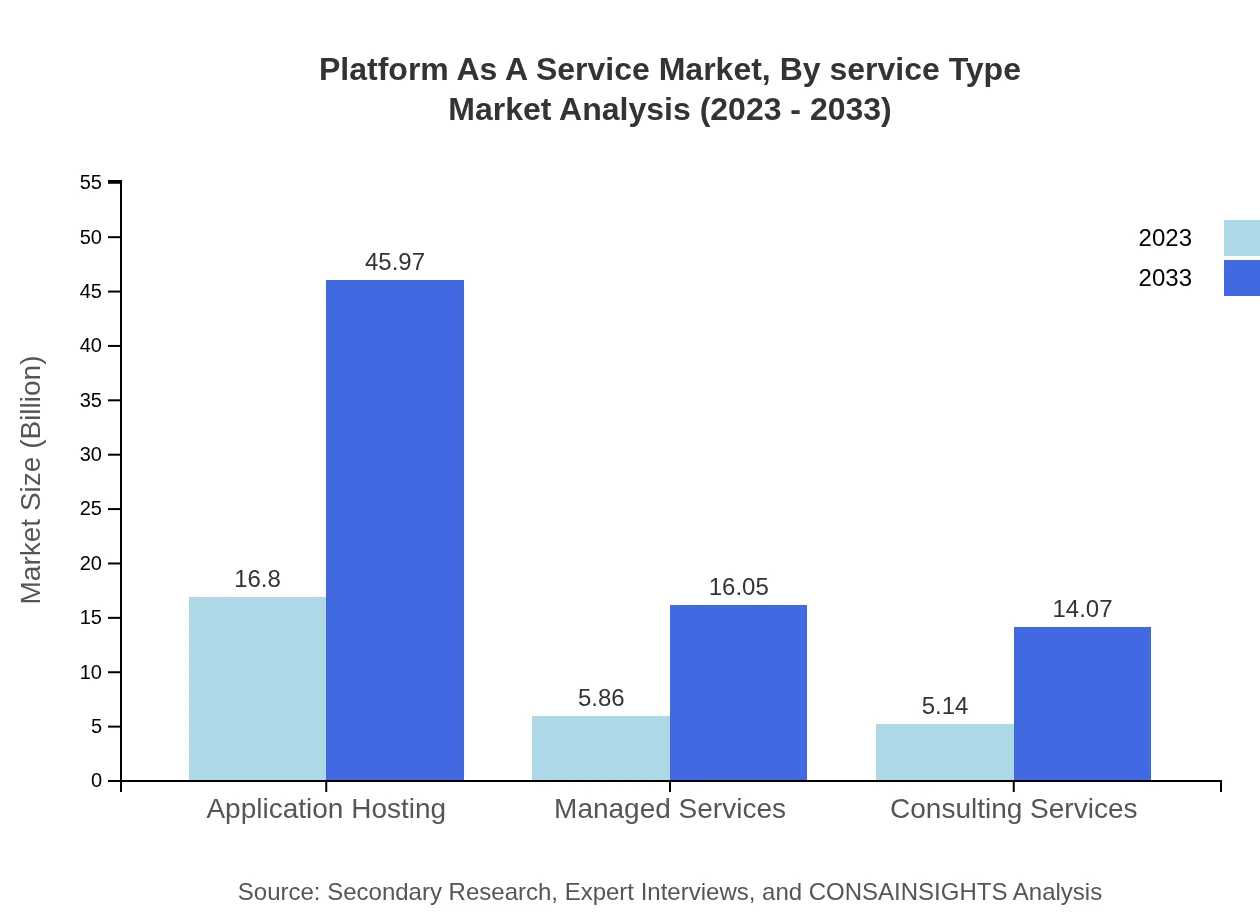

The application hosting segment represents a significant portion of the PaaS market, with revenues projected to rise from $16.80 billion in 2023 to $45.97 billion by 2033. Managed services and consulting services are also crucial, contributing $5.86 billion and $5.14 billion, respectively, in 2023 with projected growth to $16.05 billion and $14.07 billion by 2033.

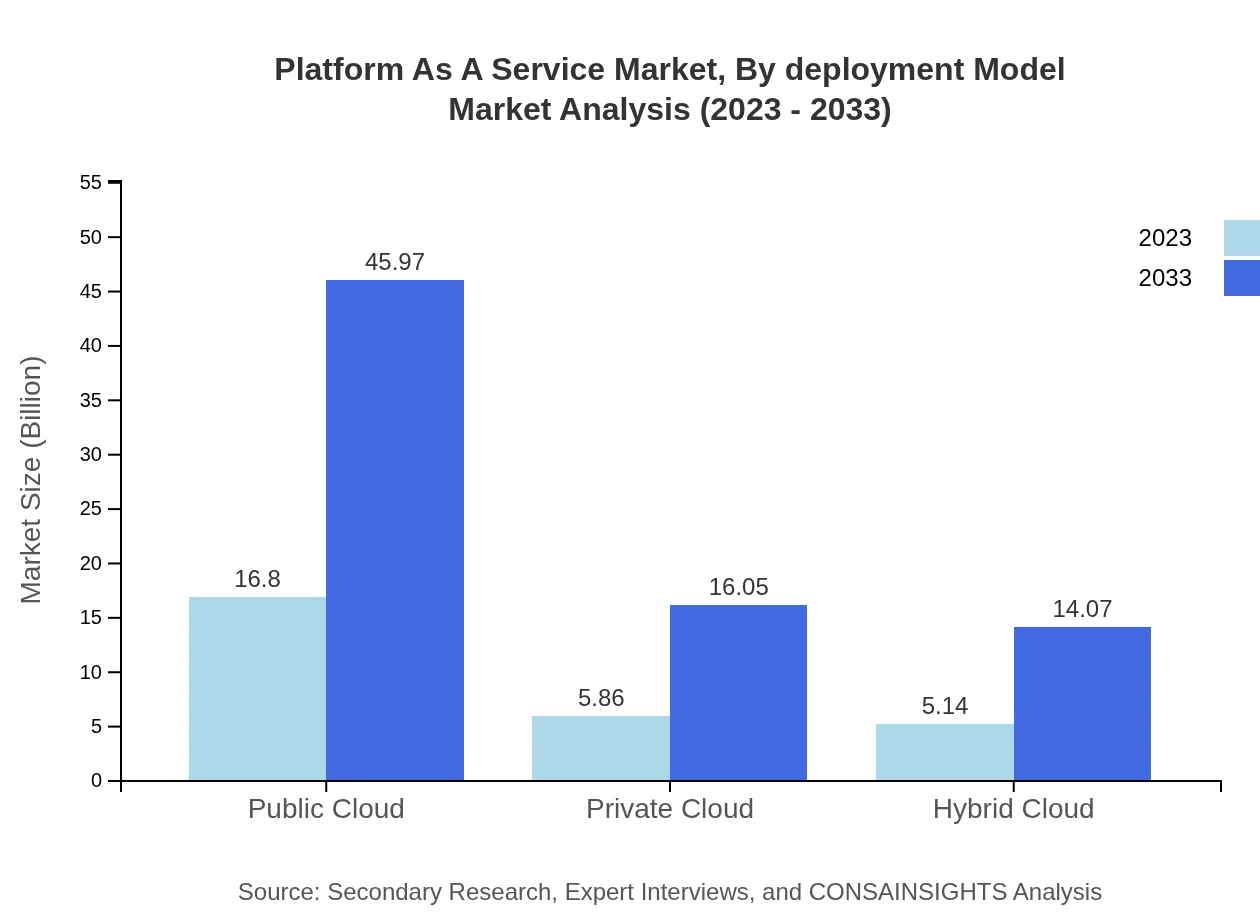

Platform As A Service Market Analysis By Deployment Model

Public cloud deployment continues to lead the market, commanding a share of 60.42% in both 2023 and 2033. Private and hybrid cloud models also hold notable shares, supported by increasing preference for flexible deployment options, which are projected to grow significantly over the forecast period.

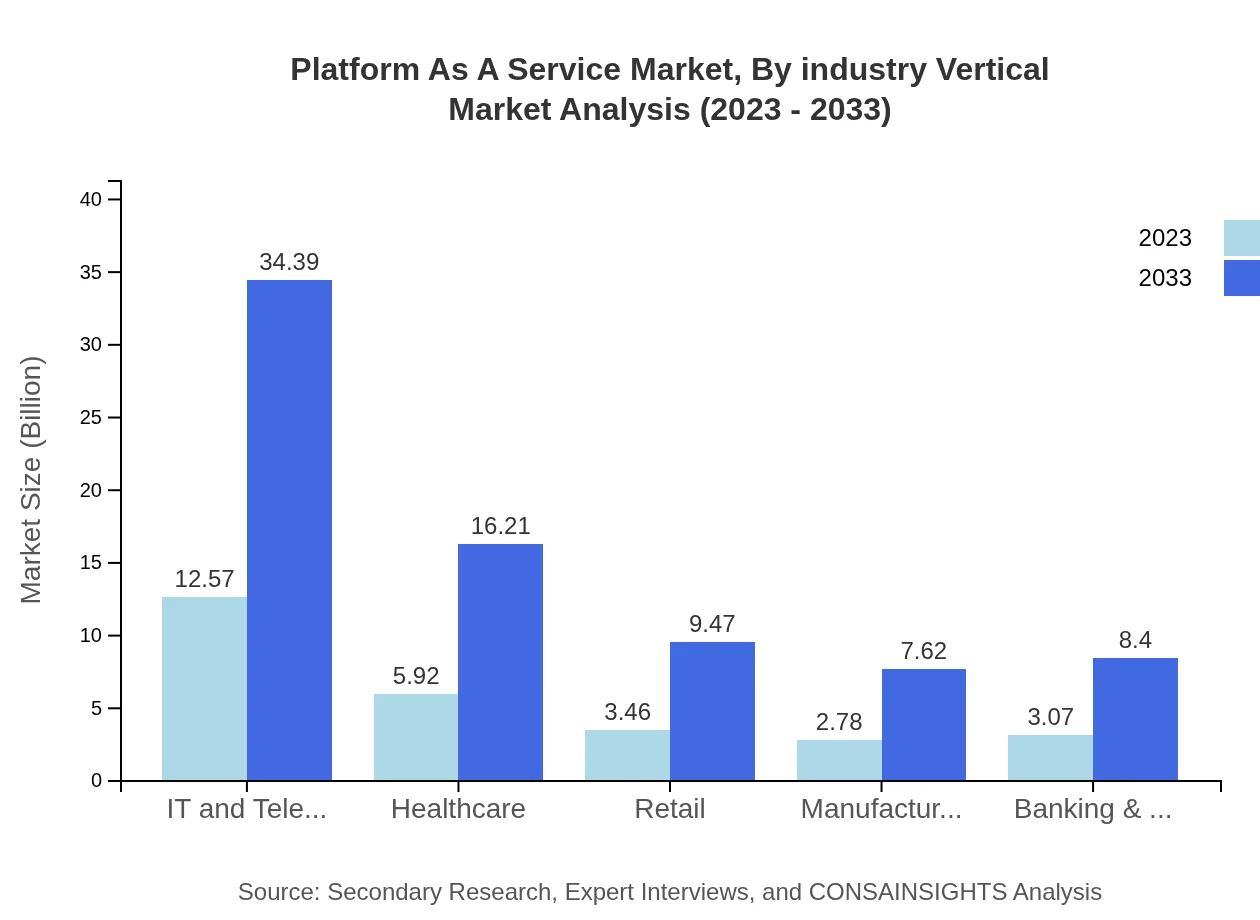

Platform As A Service Market Analysis By Industry Vertical

The IT and telecom sector is the largest contributor to the PaaS market, projected to reach $34.39 billion by 2033, followed closely by healthcare at $16.21 billion and retail at $9.47 billion. Each industry vertical will continue to harness PaaS solutions for improved operational efficiency and innovation.

Platform As A Service Market Analysis By Service Type

The service types reveal varied contributions, with application hosting dominating the share at 60.42%. Managed services account for 21.09%, while consulting services also hold a share of 18.49%. These figures reveal the importance of comprehensive service offerings within the PaaS environment.

Platform As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Platform As A Service Industry

Amazon Web Services (AWS):

AWS is a frontrunner in the PaaS market, offering a plethora of solutions including application hosting and managed services, known for its robust security and scalability.Microsoft Azure:

Microsoft Azure has established itself as a leader in cloud services, providing a comprehensive PaaS platform that supports a range of programming languages, frameworks, and tools.Google Cloud Platform:

Google Cloud offers powerful PaaS capabilities focusing on application development and deployment, leveraging its strength in data analytics and machine learning.IBM Cloud:

IBM’s PaaS solutions are tailored towards enterprise clients, integrating advanced analytics and AI capabilities to enhance the development process.Salesforce:

Salesforce leads in CRM solutions but also provides PaaS functionalities, enabling businesses to create custom applications effectively.We're grateful to work with incredible clients.

FAQs

What is the market size of Platform As A-Service?

The Platform-as-a-Service (PaaS) market is projected to grow from $27.8 billion in 2023 to significant levels by 2033, with a CAGR of 10.2%. This growth underscores the increasing demand for cloud-based application development and deployment solutions.

What are the key market players or companies in this Platform As A-Service industry?

Key players in the PaaS industry include major cloud providers like Amazon Web Services, Microsoft Azure, Google Cloud Platform, IBM, and Heroku. These companies lead the market by offering comprehensive solutions and infrastructure to support application development.

What are the primary factors driving the growth in the Platform As A-Service industry?

The growth of the PaaS industry is driven by factors such as accelerated cloud adoption, the necessity for agile software development, and the demand for scalable application hosting solutions. Companies seek to reduce overhead costs and increase efficiency, fueling this trend.

Which region is the fastest Growing in the Platform As A-Service?

The fastest-growing region in the PaaS market is North America, with a market size projected to rise from $9.57 billion in 2023 to $26.19 billion by 2033. Europe and Asia Pacific also show robust growth, emphasizing varied regional needs.

Does ConsaInsights provide customized market report data for the Platform As A-Service industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications within the Platform-as-a-Service industry. This service helps businesses gain insights and make informed decisions based on unique market dynamics.

What deliverables can I expect from this Platform As A-Service market research project?

Expect detailed market analysis reports, regional breakdowns, segment data, competitive landscapes, and trends analysis as primary deliverables from the PaaS market research project, providing a comprehensive understanding of the market dynamics.

What are the market trends of Platform As A-Service?

Current trends in the PaaS market include the rise of hybrid and multi-cloud environments, a focus on security and compliance, and the increasing use of AI and machine learning in application development. These trends highlight the industry's evolving landscape.