Plating On Plastics Market Report

Published Date: 31 January 2026 | Report Code: plating-on-plastics

Plating On Plastics Market Size, Share, Industry Trends and Forecast to 2033

This report encompasses a thorough analysis of the Plating On Plastics market from 2023 to 2033, providing insights into market trends, size, segment performance, and regional developments tailored for stakeholders in the industry.

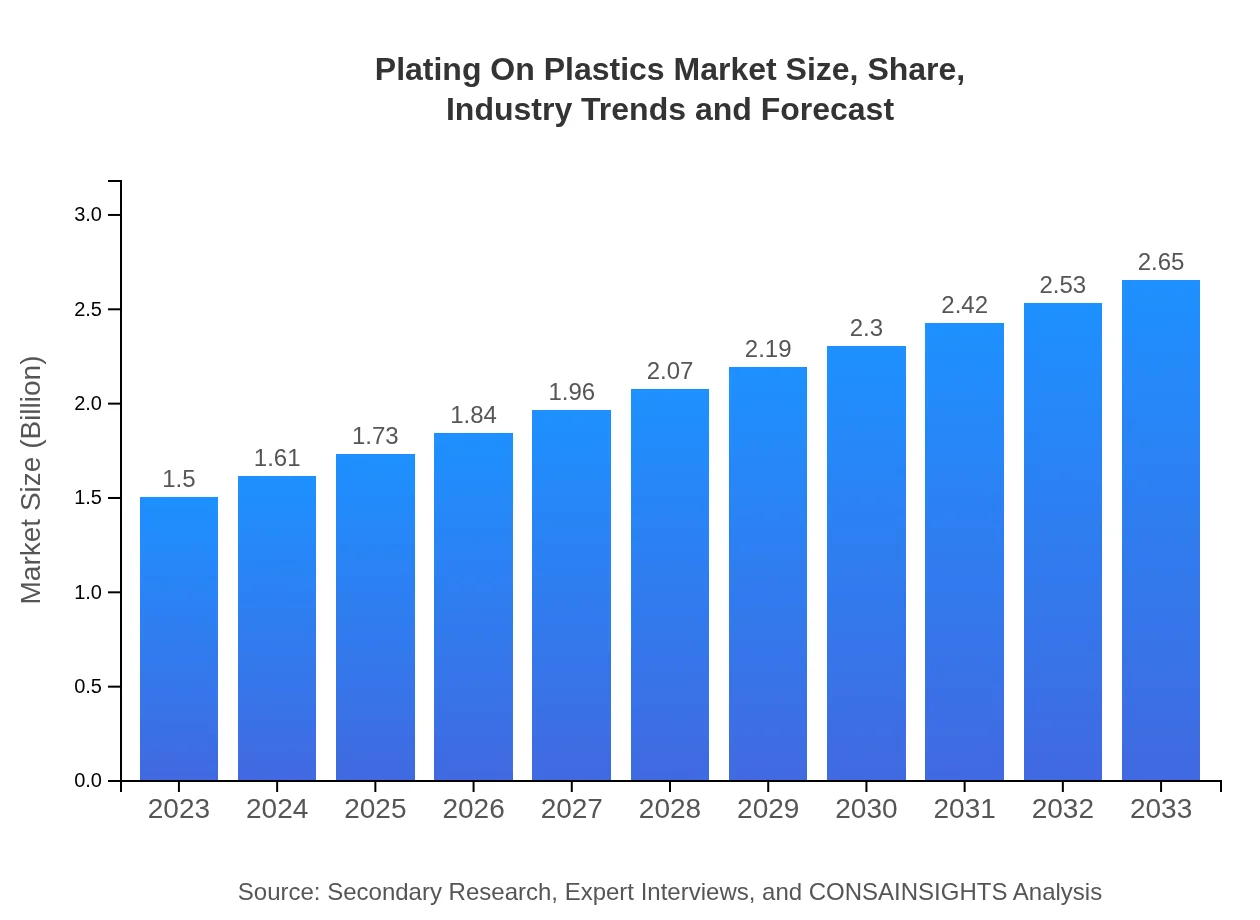

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $2.65 Billion |

| Top Companies | KraussMaffei Group, Atotech, PPG Industries, MacDermid Performance Solutions |

| Last Modified Date | 31 January 2026 |

Plating On Plastics Market Overview

Customize Plating On Plastics Market Report market research report

- ✔ Get in-depth analysis of Plating On Plastics market size, growth, and forecasts.

- ✔ Understand Plating On Plastics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Plating On Plastics

What is the Market Size & CAGR of Plating On Plastics market in 2023?

Plating On Plastics Industry Analysis

Plating On Plastics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Plating On Plastics Market Analysis Report by Region

Europe Plating On Plastics Market Report:

The European Plating On Plastics market is projected to grow from $0.54 billion in 2023 to $0.95 billion by 2033. The region's robust automotive industry, coupled with a strong emphasis on sustainability, propels the demand for plated plastics. Additionally, favorable government initiatives towards environmentally friendly production processes also play a significant role.Asia Pacific Plating On Plastics Market Report:

In the Asia Pacific region, the Plating On Plastics market size is expected to grow from $0.27 billion in 2023 to $0.48 billion by 2033. The rapid industrialization and increasing consumer electronics manufacturing in countries like China and Japan are key drivers for this growth. Additionally, the automotive sector's expansion, especially in electric vehicles, is anticipated to bolster demand significantly.North America Plating On Plastics Market Report:

North America is anticipated to see its market size rise from $0.51 billion in 2023 to $0.89 billion in 2033. The United States, being a leader in the automotive and aerospace sectors, contributes significantly to this growth. Furthermore, increasing regulations favoring lightweight materials in vehicle manufacturing alongside advancements in technology are poised to enhance market opportunities.South America Plating On Plastics Market Report:

The South American market for Plating On Plastics is projected to expand gradually from $0.07 billion in 2023 to $0.13 billion in 2033. Growth is primarily driven by the rising automotive sector and the expanding consumer goods market, although competition and economic fluctuations may pose challenges.Middle East & Africa Plating On Plastics Market Report:

The market in the Middle East and Africa is estimated to increase from $0.11 billion in 2023 to $0.19 billion by 2033. Key growth drivers include the expanding consumer electronics sector and increasing automotive production in various countries. However, political and economic uncertainties may pose challenges to sustained growth.Tell us your focus area and get a customized research report.

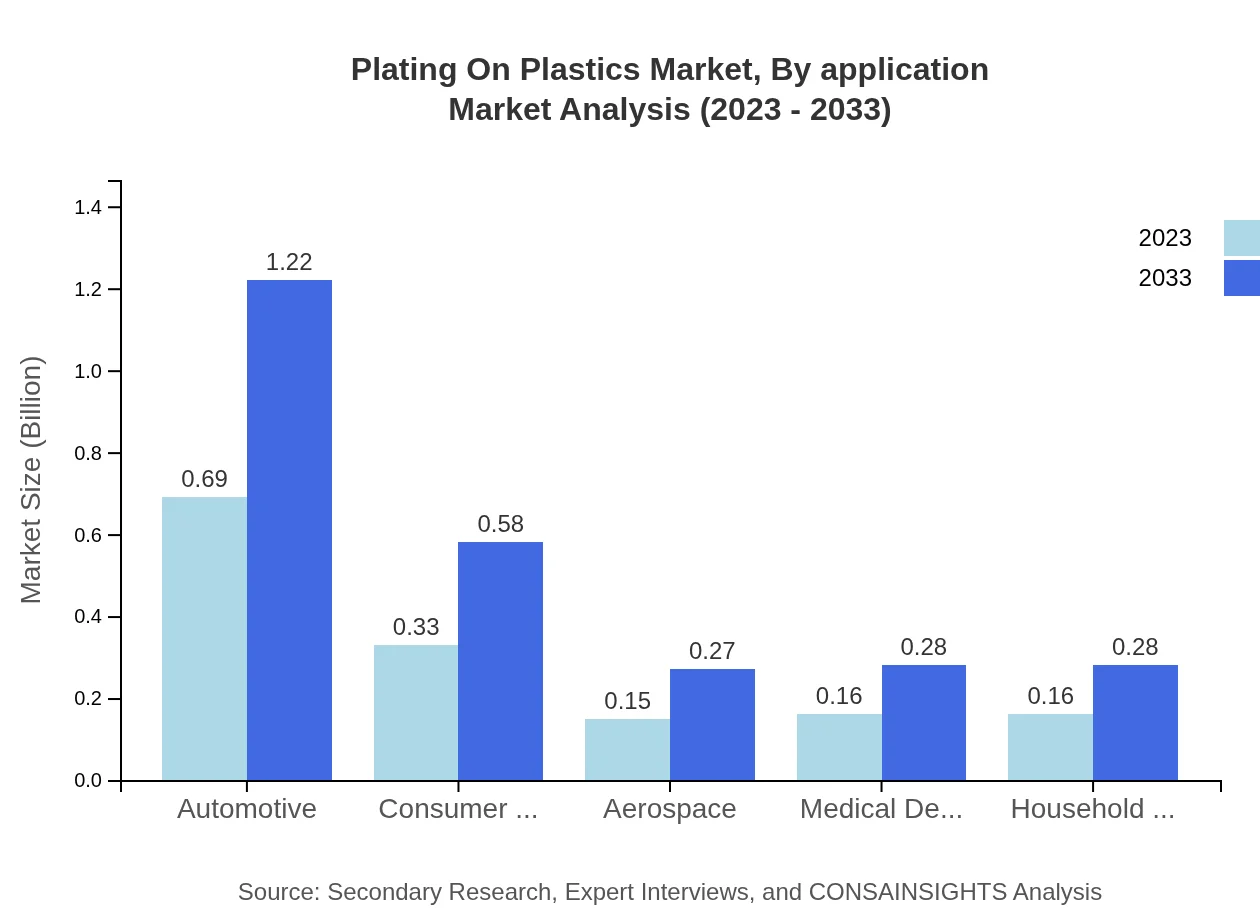

Plating On Plastics Market Analysis By Application

The application segment in the Plating-on-Plastics market is notably diverse, with automotive leading the domain, which makes up approximately 46.15% of the market in 2023 and is expected to rise to 46.15% by 2033. This sector’s demands for enhanced aesthetics and functionality in lightweight components drive growth. Furthermore, the consumer electronics segment accounts for a share of 22.1% and is projected to expand due to rising disposable income and technology integration.

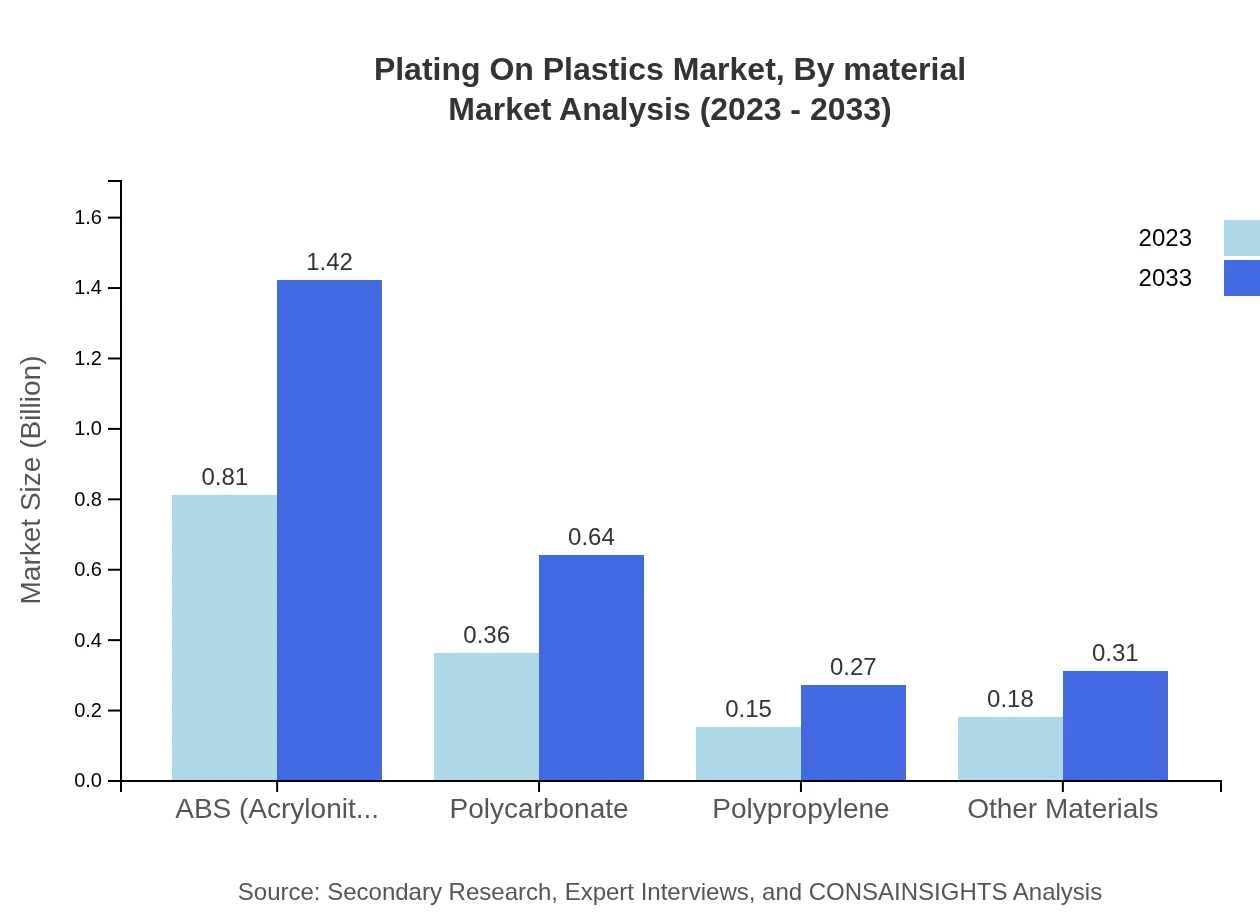

Plating On Plastics Market Analysis By Material

An analysis of the material segment reveals ABS captures the largest market share, approximately 53.79% of total materials in 2023, growing from $0.81 billion in 2023 to $1.42 billion in 2033. Polycarbonate follows with 24.17% in 2023, seeing steady growth due to its application in high-performance environments. The growth of polypropylene, as an alternative material, is also expected owing to its increasing usage across various sectors.

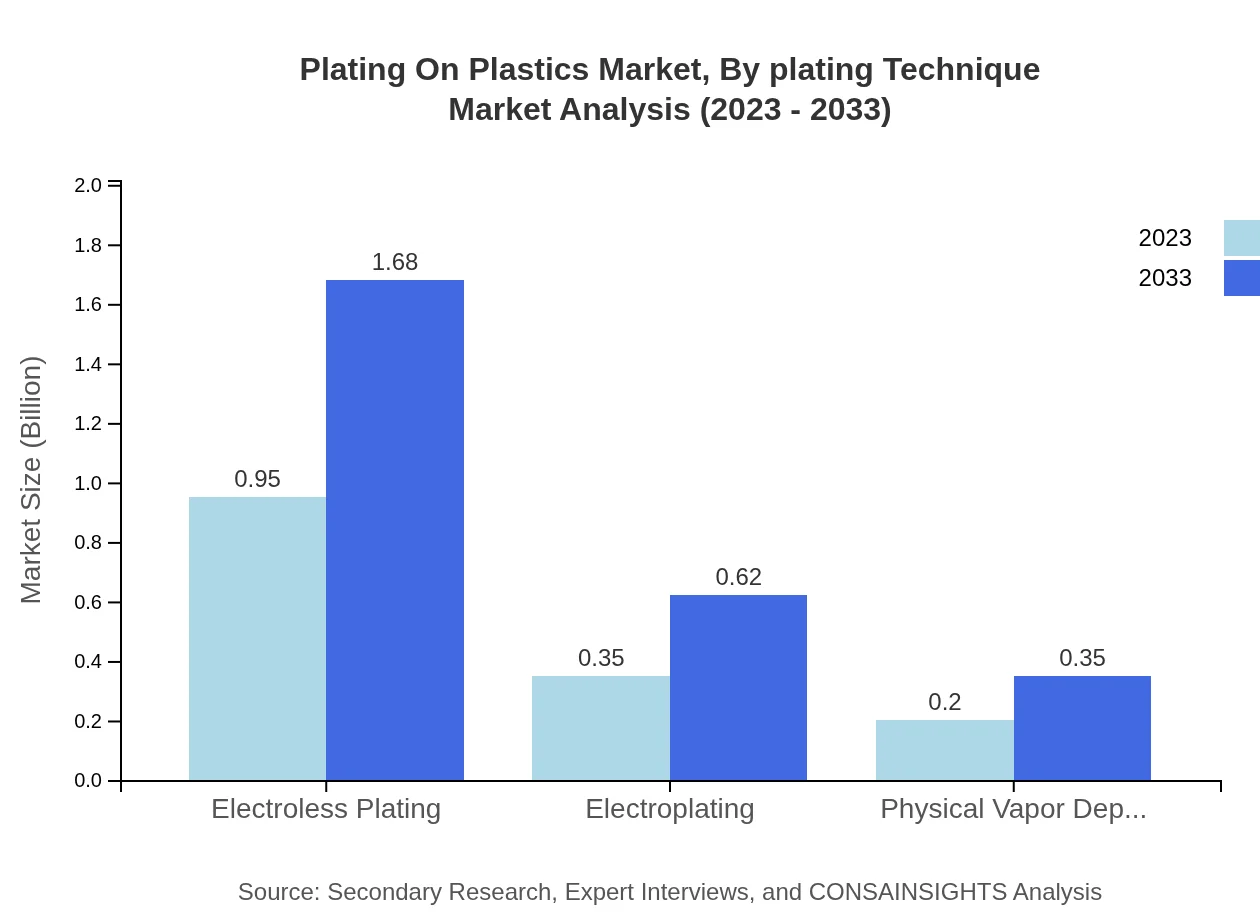

Plating On Plastics Market Analysis By Plating Technique

Among plating techniques, Electroless Plating dominates the market with a 63.56% share in 2023, predicted to grow to 63.56% by 2033. Its ability to uniformly apply coatings on complex geometries makes it a preferred choice in various applications. Electroplating holds a 23.35% share, growing steadily due to advancements in process efficiency, while Physical Vapor Deposition is emerging as a viable option, accounting for a 13.09% share of the market.

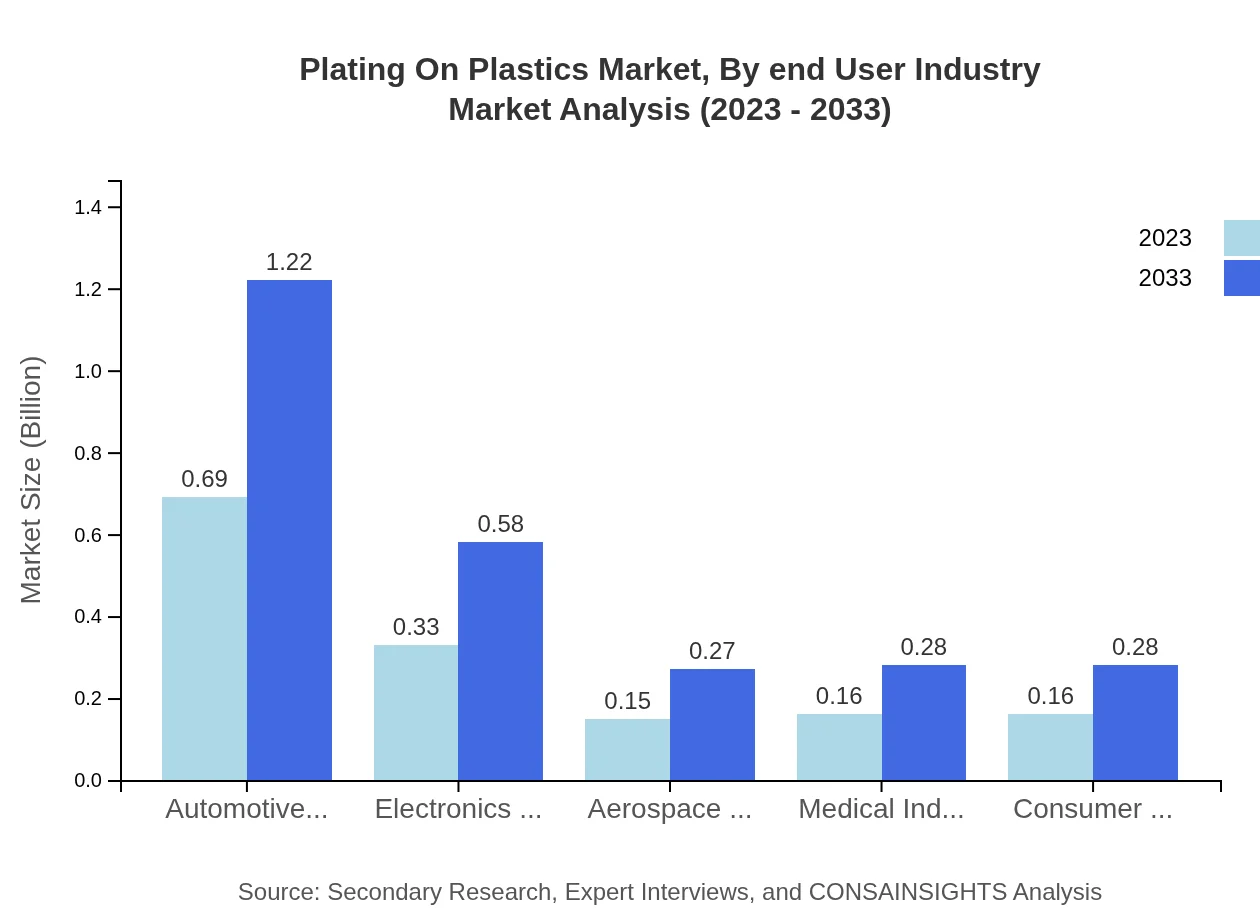

Plating On Plastics Market Analysis By End User Industry

The automotive industry leads the market with a significant share of 46.15% in 2023, projected to maintain this percentage through 2033. Other notable sectors include the consumer electronics industry, medical devices, and aerospace, each accounting for 22.1%, 10.77%, and 10.33% respectively. The increasing inclination towards lightweight, durable, and aesthetically pleasing components in these sectors promotes steady growth in the Plating-on-Plastics market.

Plating On Plastics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Plating On Plastics Industry

KraussMaffei Group:

A leader in advanced plastics processing machinery and equipment, KraussMaffei provides solutions that enhance the efficiency and effectiveness of plating processes.Atotech:

Renowned for its specialty chemicals and equipment for the electronics and PCB markets, Atotech also specializes in solutions that address the unique needs of the Plating On Plastics industry.PPG Industries:

With a long history in coatings, PPG Industries develops innovative coatings and specialty materials to meet modern requirements in the Plating On Plastics sector.MacDermid Performance Solutions:

Part of Element Solutions Inc., MacDermid specializes in surface treatments and plating products, driving growth and innovation in the POP industry.We're grateful to work with incredible clients.

FAQs

What is the market size of plating On Plastics?

The global plating-on-plastics market is projected to reach approximately $1.5 billion by 2033, growing at a CAGR of 5.7%. This growth indicates increasing applications and technological advancements in the industry.

What are the key market players or companies in this plating On Plastics industry?

Key players in the plating-on-plastics market include established chemical manufacturers and coating technology firms. These companies are innovating to enhance their product offerings and meet growing customer demand across various industries.

What are the primary factors driving the growth in the plating On Plastics industry?

Growth factors for the plating-on-plastics industry include rising demand in automotive and consumer electronics sectors, advancements in coating technologies, and the need for lightweight materials that enhance fuel efficiency and sustainability.

Which region is the fastest Growing in the plating On Plastics?

The fastest-growing region in the plating-on-plastics market is Europe, projected to grow from $0.54 billion in 2023 to $0.95 billion by 2033, due to stringent regulations promoting automotive electroless plating.

Does ConsaInsights provide customized market report data for the plating On Plastics industry?

Yes, Consainsights offers customized market report data tailored to specific client needs in the plating-on-plastics industry, ensuring relevant insights that cater to their requirements and target audience.

What deliverables can I expect from this plating On Plastics market research project?

Deliverables from this market research project typically include a comprehensive market report, detailed analysis of trends, competitive landscape insights, and market forecasts segmented by regions and applications.

What are the market trends of plating On Plastics?

Current trends in the plating-on-plastics market include increased adoption of eco-friendly materials, innovation in bonding technologies, and growth in sectors such as automotive, electronics, and consumer goods.