Pneumatic Equipment Market Report

Published Date: 22 January 2026 | Report Code: pneumatic-equipment

Pneumatic Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pneumatic Equipment market, including market trends, size, segmentation, and future forecasts from 2023 to 2033. Insights into regional dynamics, industry leaders, and technological evolution are also discussed.

| Metric | Value |

|---|---|

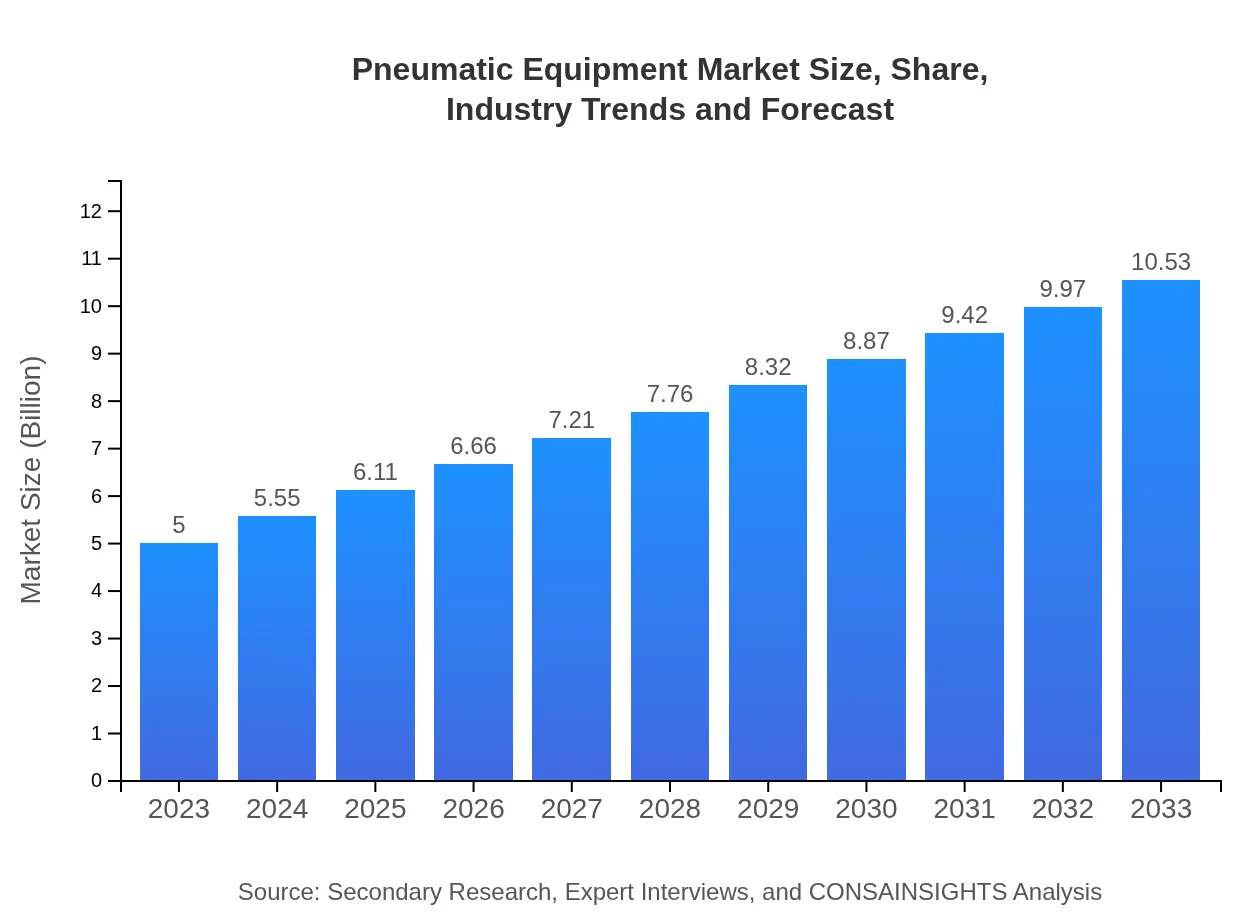

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Atlas Copco, Festo AG, Parker Hannifin |

| Last Modified Date | 22 January 2026 |

Pneumatic Equipment Market Overview

Customize Pneumatic Equipment Market Report market research report

- ✔ Get in-depth analysis of Pneumatic Equipment market size, growth, and forecasts.

- ✔ Understand Pneumatic Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pneumatic Equipment

What is the Market Size & CAGR of Pneumatic Equipment market in 2023?

Pneumatic Equipment Industry Analysis

Pneumatic Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pneumatic Equipment Market Analysis Report by Region

Europe Pneumatic Equipment Market Report:

The European Pneumatic Equipment market is also on the rise, expected to grow from $1.54 billion in 2023 to $3.25 billion by 2033. The region’s strong manufacturing base and emphasis on automation technologies are key drivers of this growth.Asia Pacific Pneumatic Equipment Market Report:

The Asia Pacific region is anticipated to witness significant growth in the Pneumatic Equipment market, with a market size projected to increase from $0.88 billion in 2023 to $1.84 billion by 2033. Key contributing factors include rapid industrialization, a growing automotive sector, and increased investments in manufacturing automation.North America Pneumatic Equipment Market Report:

North America shows a robust market size expansion, projected to increase from $1.84 billion in 2023 to $3.88 billion by 2033. This growth is fueled by advancements in industrial automation, demand for energy-efficient systems, and increasing investments in technology.South America Pneumatic Equipment Market Report:

In South America, the market size for Pneumatic Equipment is expected to grow from $0.14 billion in 2023 to $0.29 billion by 2033. Factors driving this growth include the expansion of the manufacturing sector and improving infrastructure.Middle East & Africa Pneumatic Equipment Market Report:

The Middle East and Africa market for Pneumatic Equipment is set to grow from $0.60 billion in 2023 to $1.27 billion by 2033, driven by infrastructural developments and increasing industrial activities within the region.Tell us your focus area and get a customized research report.

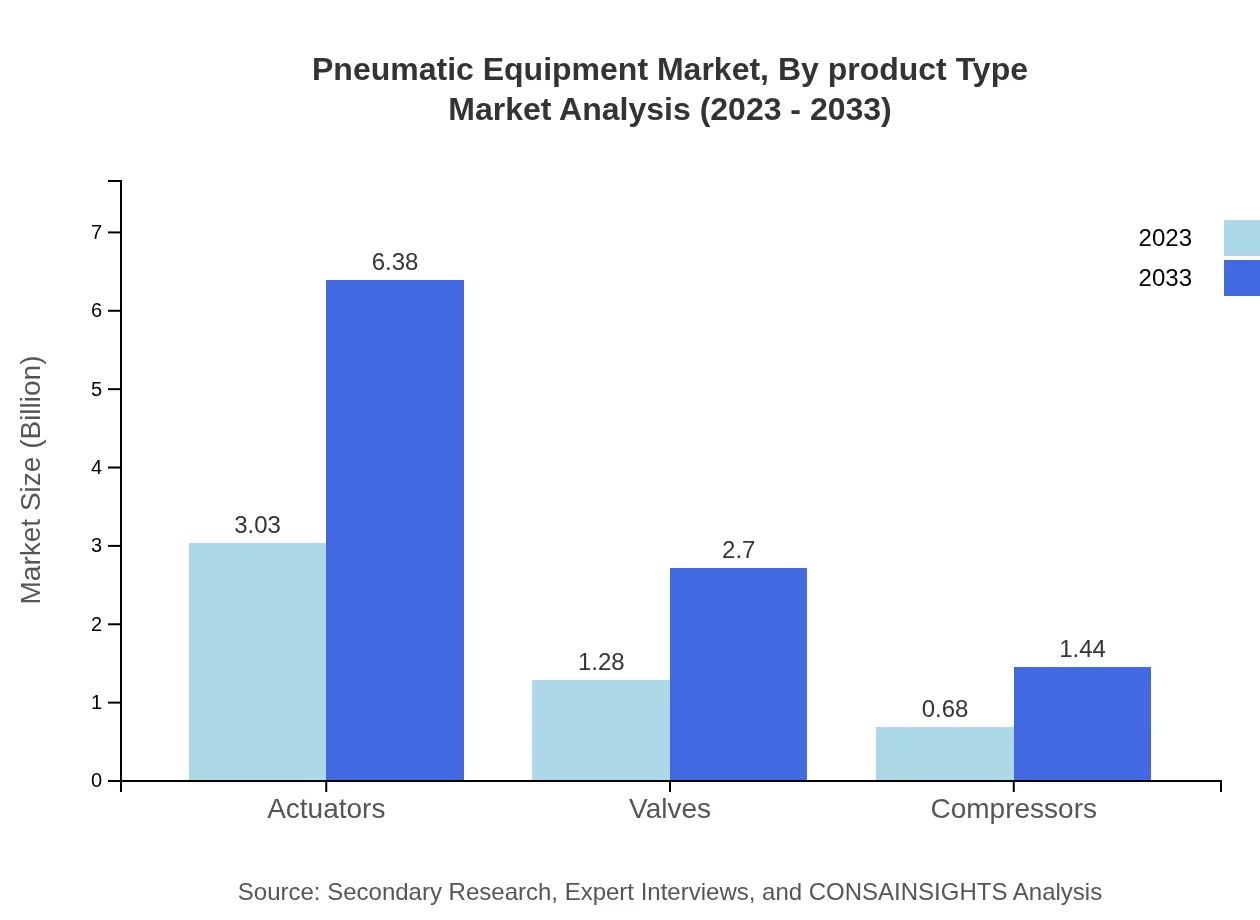

Pneumatic Equipment Market Analysis By Product Type

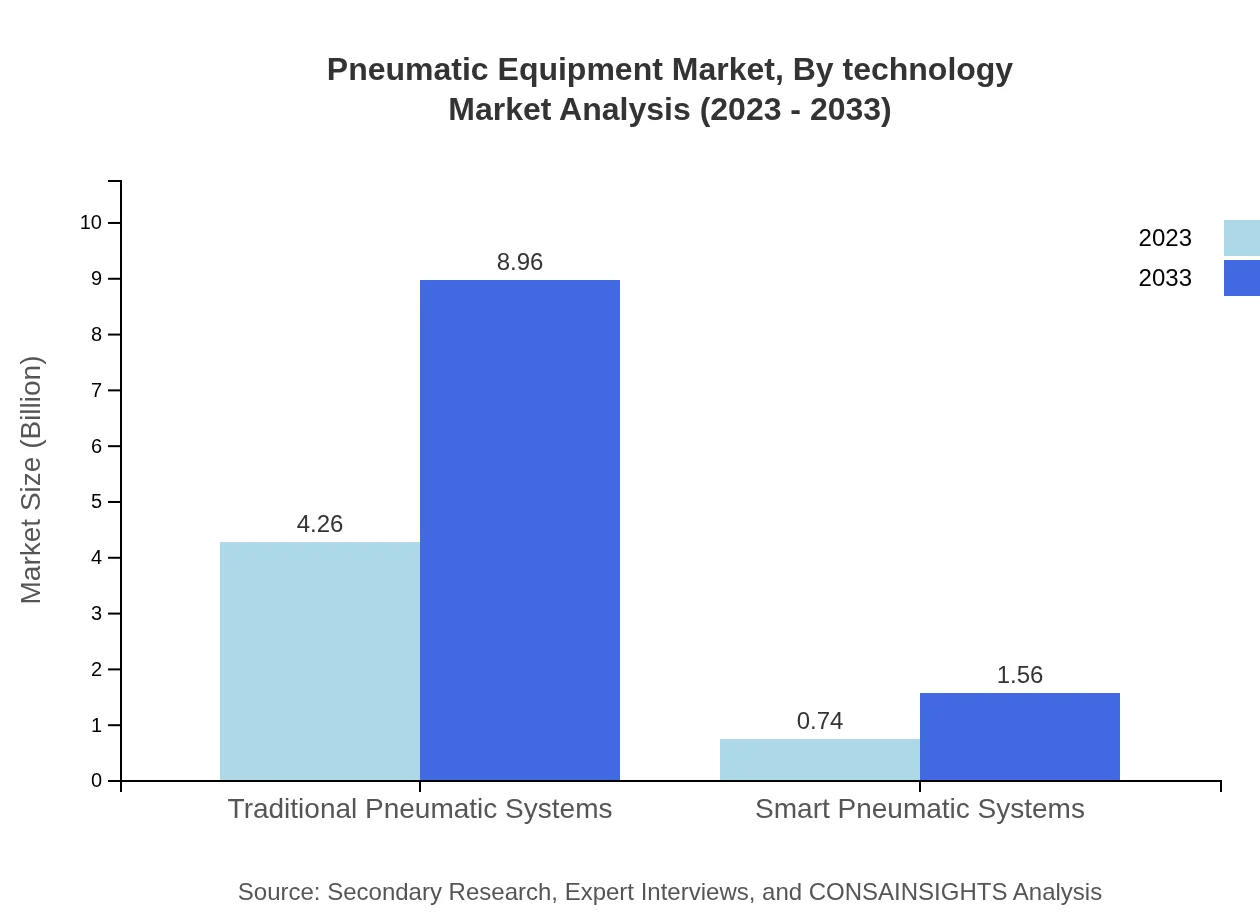

The market for Pneumatic Equipment can be segmented into traditional pneumatic systems and smart pneumatic systems. Traditional systems are dominant, expected to account for 85.16% share in 2023 while their projected size grows from $4.26 billion to $8.96 billion by 2033. However, smart pneumatic systems are attracting attention with their features, growing from $0.74 billion to $1.56 billion and taking 14.84% share by 2033.

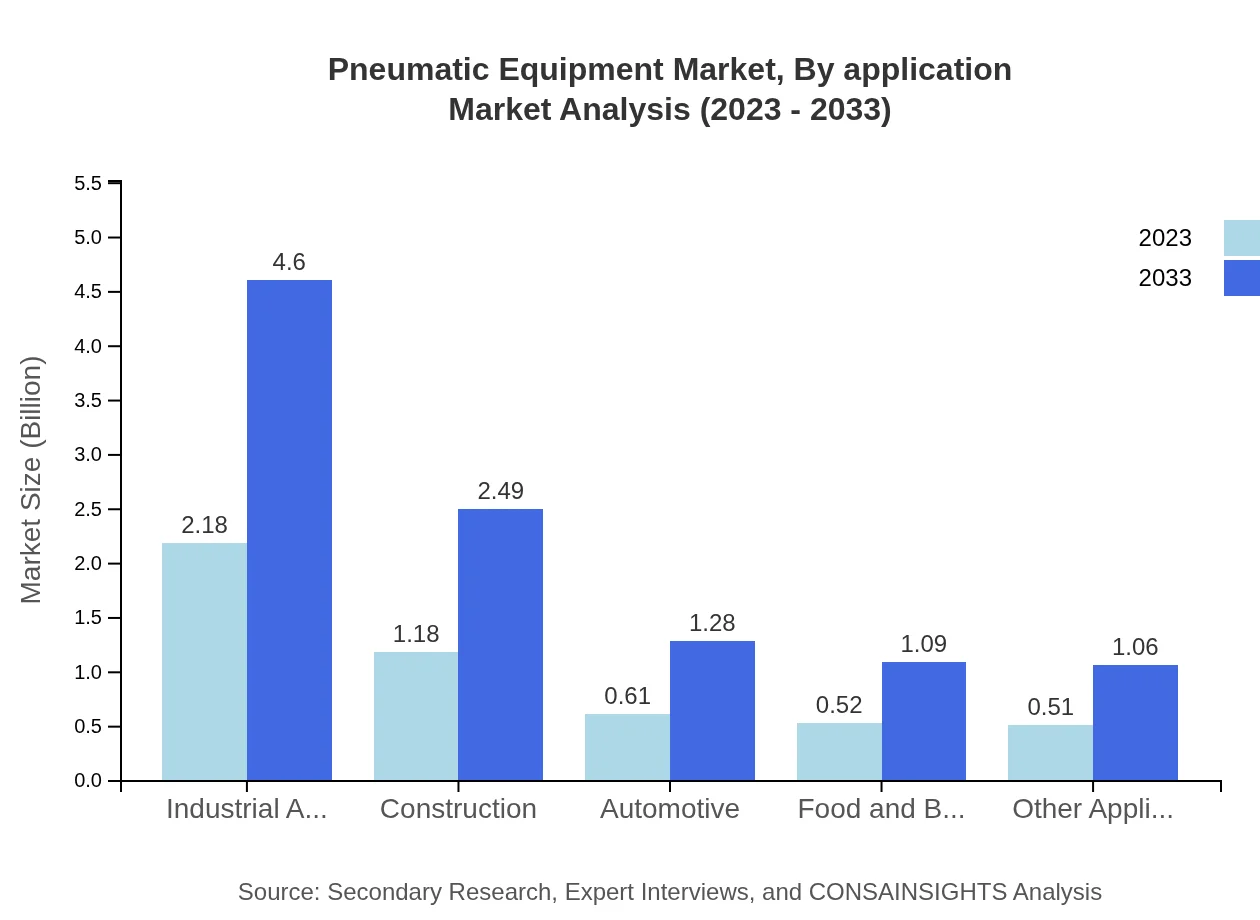

Pneumatic Equipment Market Analysis By Application

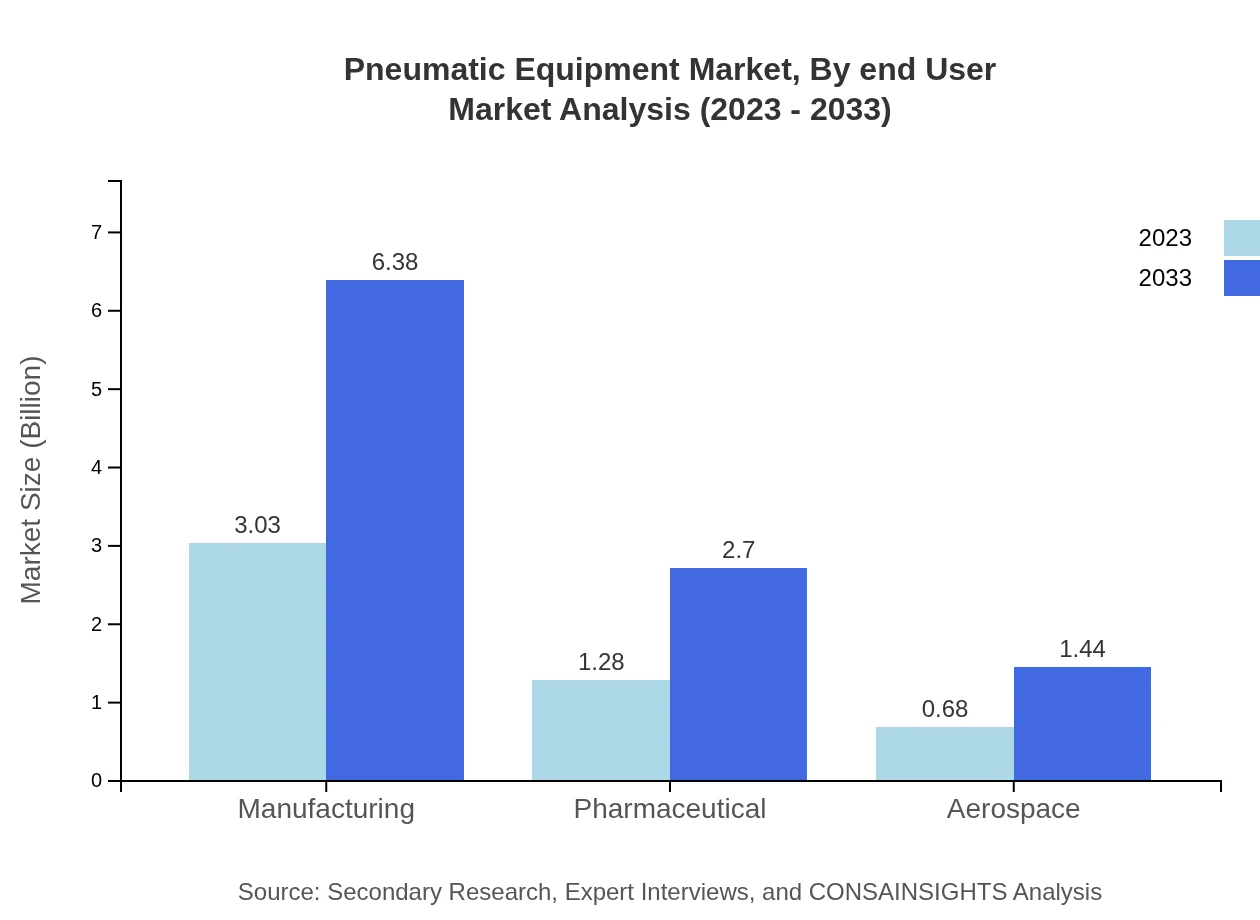

Industries utilizing Pneumatic Equipment include manufacturing ($3.03 billion to $6.38 billion), pharmaceuticals ($1.28 billion to $2.70 billion), and aerospace ($0.68 billion to $1.44 billion). Manufacturing remains the largest application with a stable market share, while the aerospace sector is anticipated to see heightened growth due to increasing demand.

Pneumatic Equipment Market Analysis By Technology

Technologically, pneumatic equipment can be categorized into traditional and smart systems. The traditional systems still dominate the market, but smart systems are gaining traction, addressing needs for better automation and control, thus pushing growth figures upward over the forecast period.

Pneumatic Equipment Market Analysis By End User

Key end-user industries include manufacturing (60.66%), industrial automation (43.69%), and construction (23.62%). Manufacturing remains the leading end-user, but the construction sector is experiencing growth as projects adopt automation swiftly.

Pneumatic Equipment Market Analysis By Distribution Channel

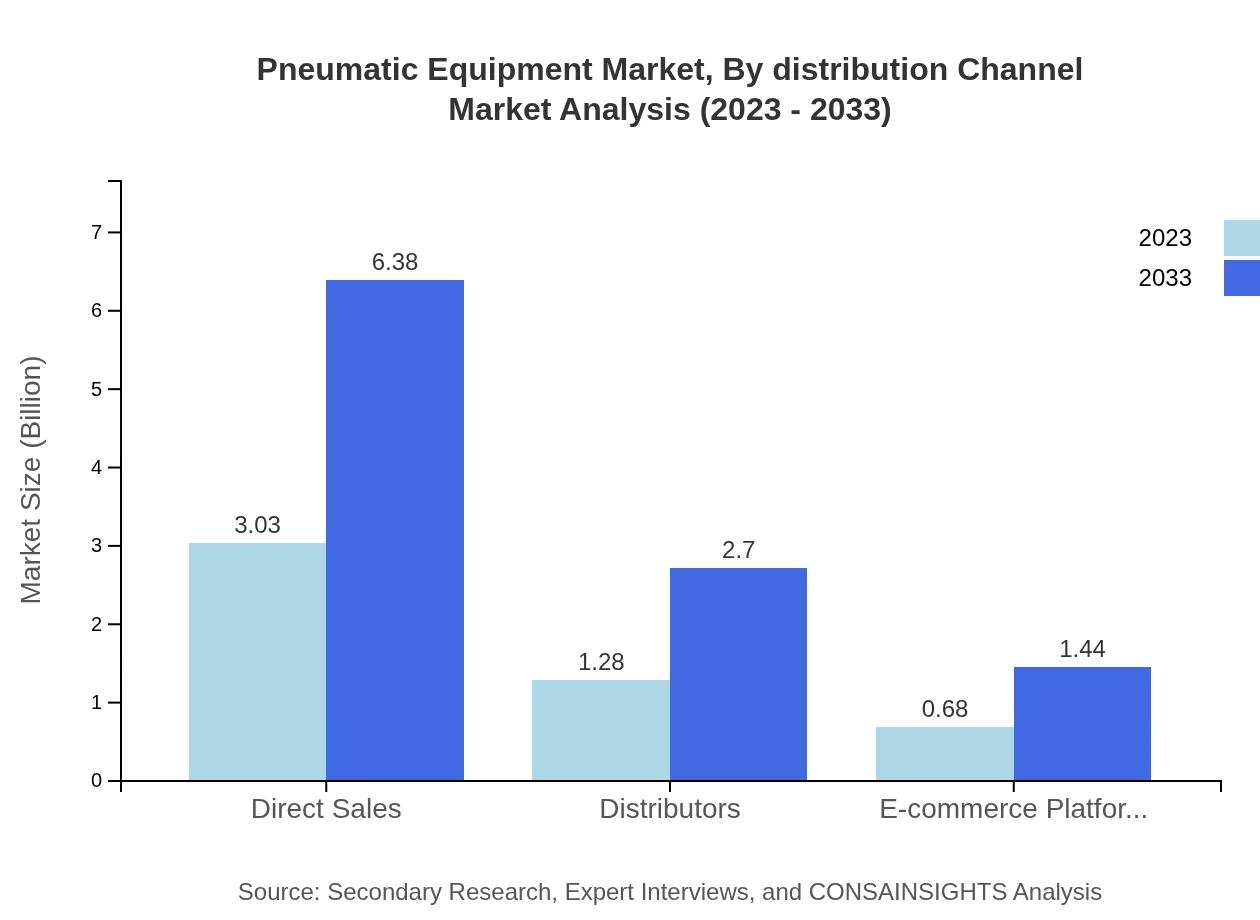

Distribution channels consist of direct sales (60.66%), distributors (25.67%), and e-commerce platforms (13.67%). Direct sales continue to be the primary channel for Pneumatic Equipment, supported by the growth in online purchasing.

Pneumatic Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pneumatic Equipment Industry

Atlas Copco:

A pioneer in providing air compressor solutions, Atlas Copco specializes in pneumatic equipment for industrial applications, significantly contributing to global market standards.Festo AG:

Festo AG is known for its advanced automation technology and pneumatic systems, playing a vital role in developing efficient and effective solutions for a variety of industries.Parker Hannifin:

Parker Hannifin delivers comprehensive fluid power and motion control technologies, extensively serving the pneumatic equipment market with a range of products.We're grateful to work with incredible clients.

FAQs

What is the market size of pneumatic equipment?

The pneumatic equipment market is projected to reach $5 billion by 2033, growing at a CAGR of 7.5% from 2023. This robust growth reflects increasing demand across various industries, driving advancements in technology and applications.

What are the key market players or companies in this pneumatic equipment industry?

Key players in the pneumatic equipment industry include major manufacturers and suppliers that specialize in innovative technologies, offering solutions in areas such as actuators, valves, and compressors essential for industrial automation.

What are the primary factors driving the growth in the pneumatic equipment industry?

Primary factors include the rising demand for automation, advancements in smart pneumatic systems, industrial growth across sectors, and the push for efficiency in manufacturing processes, contributing to significant market growth.

Which region is the fastest Growing in the pneumatic equipment?

The fastest growth is expected from North America, expanding from $1.84 billion in 2023 to $3.88 billion by 2033, fueled by technological advancements and increased investment in industrial automation.

Does ConsaInsights provide customized market report data for the pneumatic equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries, providing insights into market trends, forecasts, and competitive landscapes within the pneumatic equipment industry.

What deliverables can I expect from this pneumatic equipment market research project?

Expect a comprehensive report featuring market size, segmentation analysis, regional data, competitor profiling, and strategic recommendations to inform decision-making in the pneumatic equipment sector.

What are the market trends of pneumatic equipment?

Current trends include a shift towards smart pneumatic systems, increased investment in automation, consolidation among key players, and a growing preference for sustainability-driven technologies in manufacturing.