Point Of Care Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: point-of-care-diagnostics

Point Of Care Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Point Of Care Diagnostics market, covering market size, growth projections, regional insights, technological advancements, and key players from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

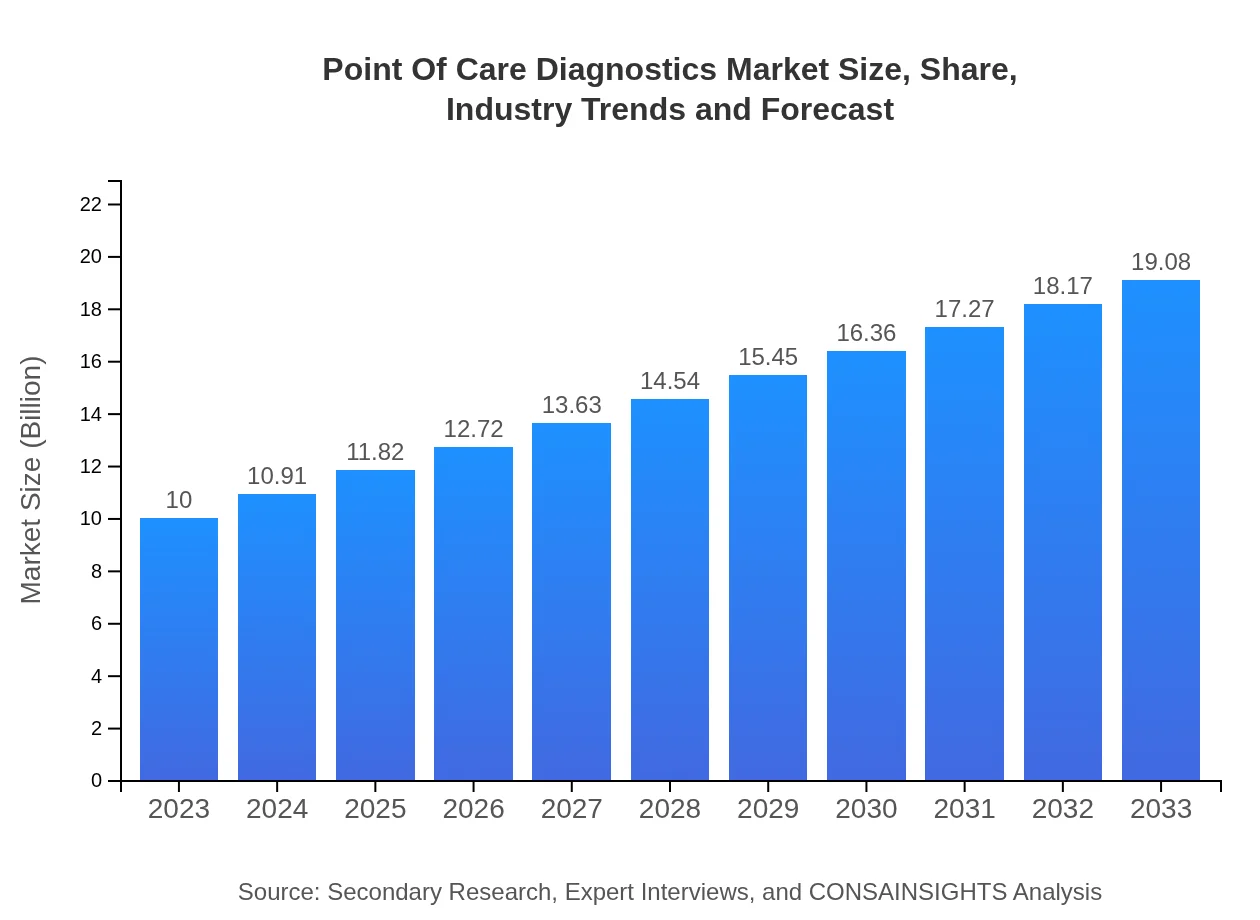

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

Point Of Care Diagnostics Market Overview

Customize Point Of Care Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Point Of Care Diagnostics market size, growth, and forecasts.

- ✔ Understand Point Of Care Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Point Of Care Diagnostics

What is the Market Size & CAGR of Point Of Care Diagnostics market in 2023?

Point Of Care Diagnostics Industry Analysis

Point Of Care Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Point Of Care Diagnostics Market Analysis Report by Region

Europe Point Of Care Diagnostics Market Report:

In Europe, the market is anticipated to grow from USD 3.20 billion in 2023 to USD 6.10 billion by 2033. With a strong focus on precision medicine and established healthcare systems, countries like Germany, the UK, and France are spearheading innovations in diagnostics. An increasing prevalence of chronic illnesses contributes to rising demand for POCD solutions.Asia Pacific Point Of Care Diagnostics Market Report:

In the Asia Pacific region, the Point Of Care Diagnostics market is projected to grow from USD 1.91 billion in 2023 to USD 3.65 billion by 2033. An increasing focus on improving healthcare infrastructure and the rising prevalence of infectious diseases are significant drivers. Countries like China and India are rapidly adopting POCD technologies, spurred by government initiatives.North America Point Of Care Diagnostics Market Report:

North America dominates the Point Of Care Diagnostics market, with a projected increase from USD 3.38 billion in 2023 to USD 6.46 billion by 2033. The region's well-established healthcare infrastructure, high healthcare expenditure, and great emphasis on early disease detection are critical factors leading to market growth. The presence of major players further cements its leadership in the POCD field.South America Point Of Care Diagnostics Market Report:

The South American market is expected to expand from USD 0.79 billion in 2023 to USD 1.50 billion by 2033. Key growth factors are the rising prevalence of chronic diseases and growing investments in healthcare infrastructure. The demand for portable diagnostic devices is also expected to propel market expansion as healthcare accessibility improves.Middle East & Africa Point Of Care Diagnostics Market Report:

The Middle East and African markets for Point Of Care Diagnostics are projected to grow from USD 0.72 billion in 2023 to USD 1.38 billion by 2033. Growing healthcare investments, alongside increasing incidences of diseases like diabetes and cancer, augment this market's growth. Enhanced focus on healthcare logistics and distribution networks is also noted.Tell us your focus area and get a customized research report.

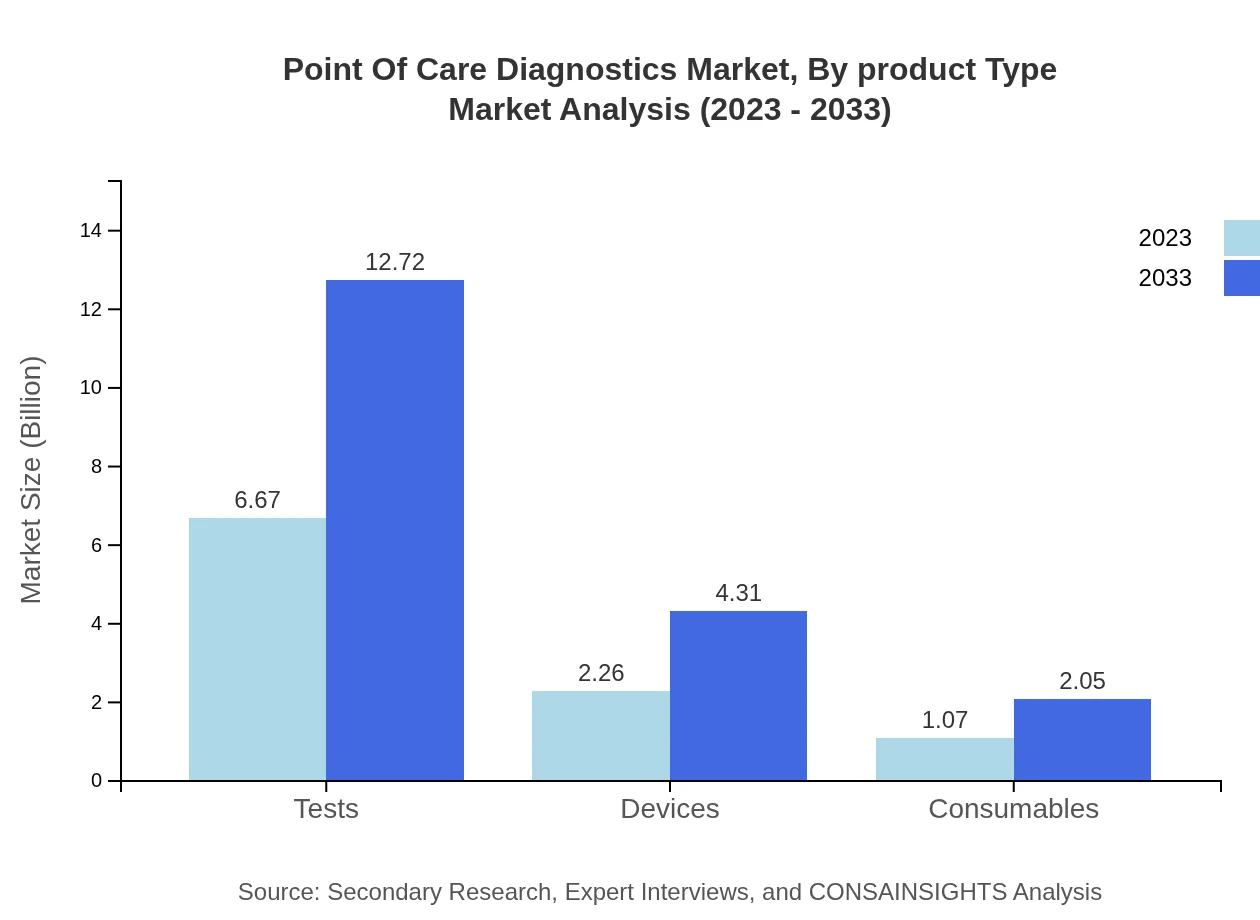

Point Of Care Diagnostics Market Analysis By Product Type

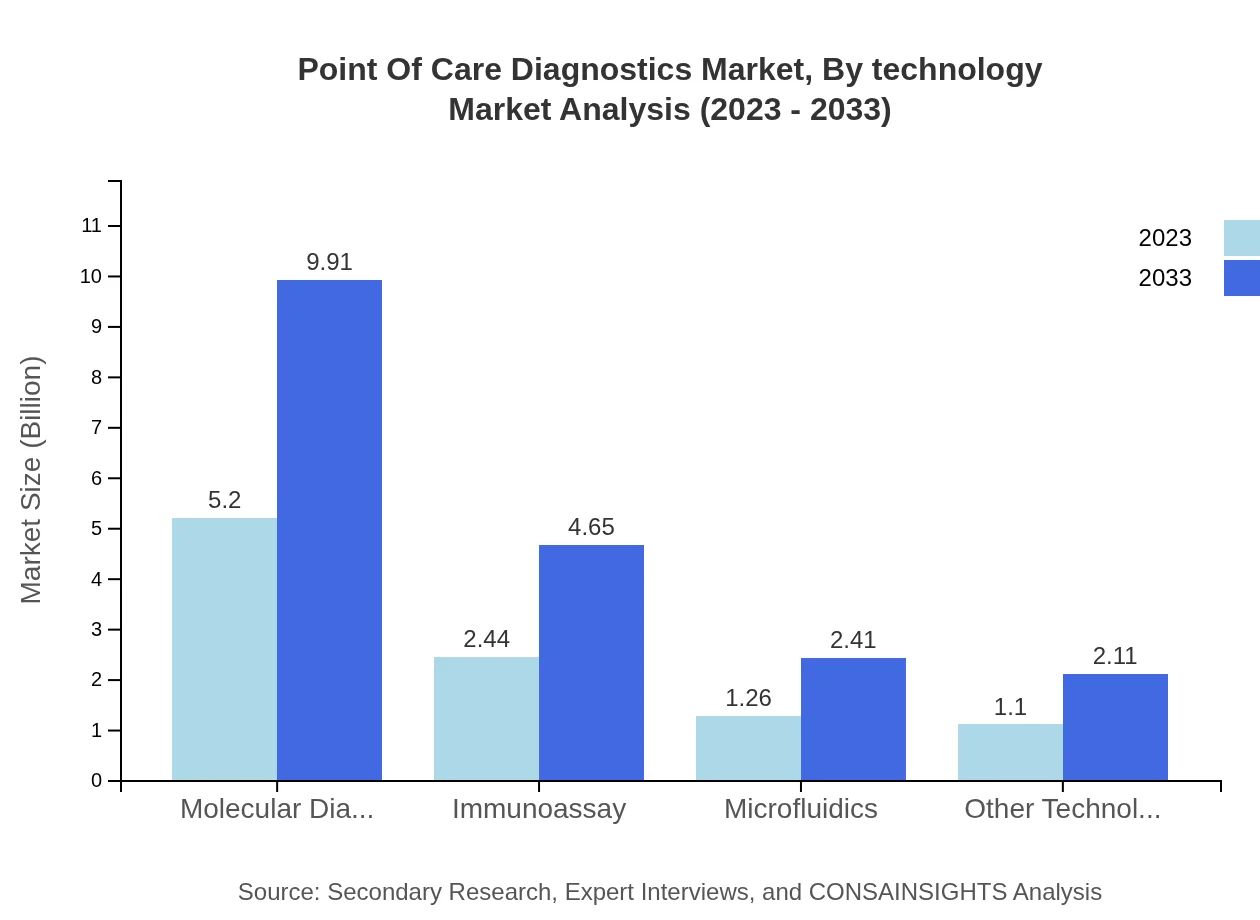

The product type segmentation highlights key areas such as Molecular Diagnostics, Immunoassays, Microfluidics, and Other Technologies. Molecular Diagnostics represents the largest share of the market, with a size reaching approximately USD 5.20 billion in 2023, expected to grow to USD 9.91 billion by 2033, reflecting an increasing reliance on genetic testing and personalized medicine.

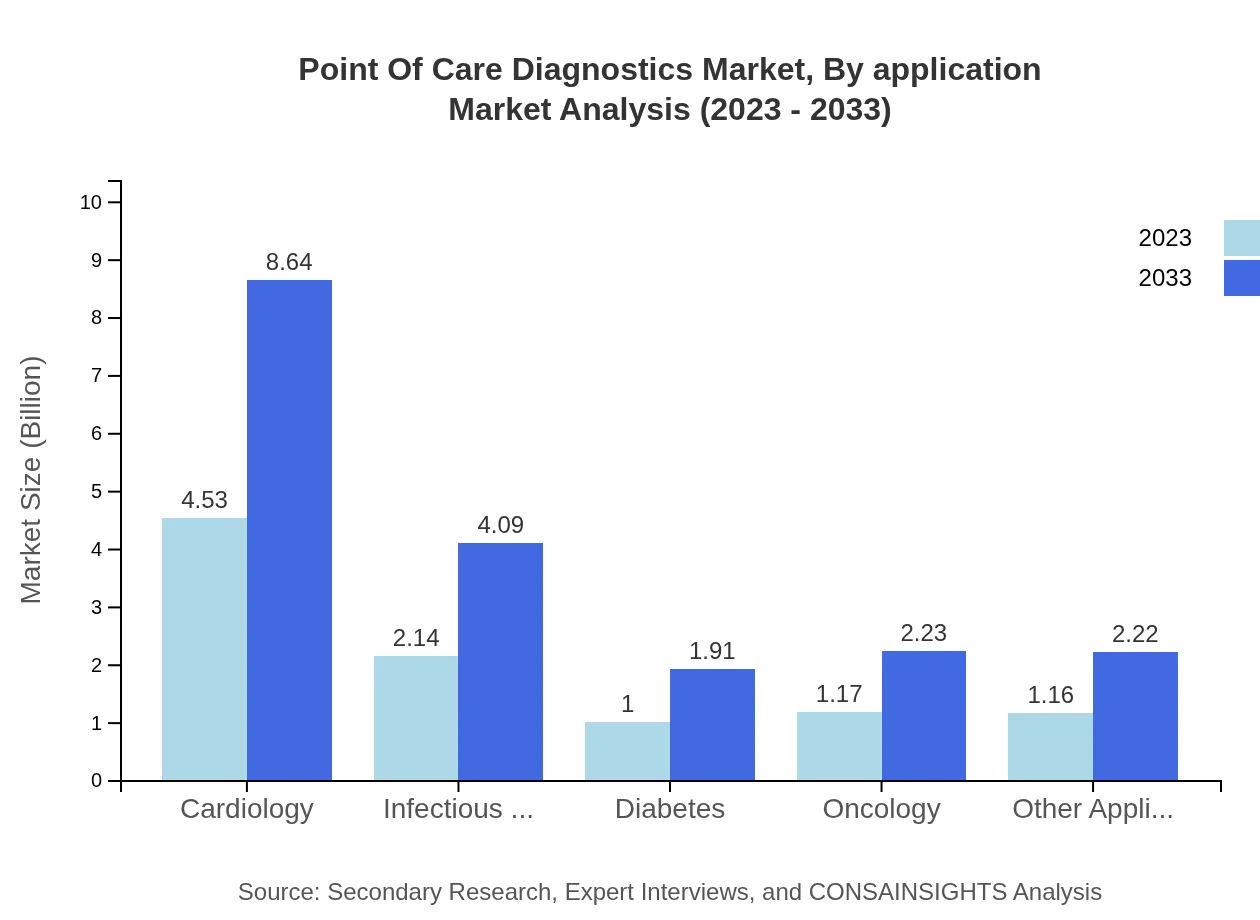

Point Of Care Diagnostics Market Analysis By Application

Applications of POCD include Cardiology, Infectious Diseases, Diabetes, Oncology, and Other Applications. Cardiology dominates this segment with a size of USD 4.53 billion in 2023, projected to rise to USD 8.64 billion by 2033, driven by the rising global prevalence of heart diseases.

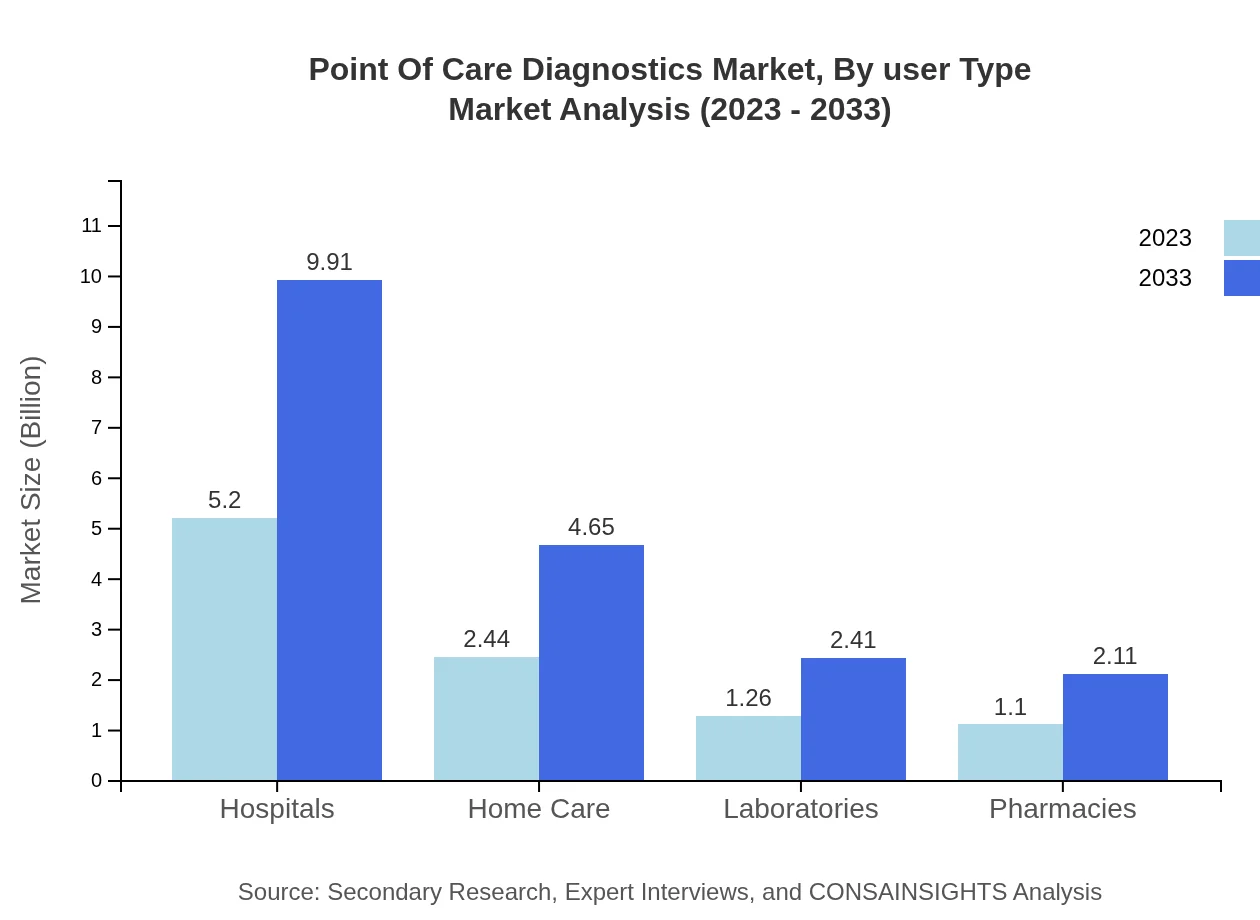

Point Of Care Diagnostics Market Analysis By User Type

The user type segment is composed of Hospitals, Home Care, Laboratories, and Pharmacies. Hospitals exhibit the most substantial market presence, with a size of USD 5.20 billion in 2023, anticipating growth to USD 9.91 billion by 2033, bolstered by the growing need for immediate diagnostic solutions.

Point Of Care Diagnostics Market Analysis By Technology

Technologies utilized in POCD include Molecular Diagnostics, Immunoassays, Microfluidics, and others. Popularity is centered around Immunoassays, marking a size of USD 2.44 billion in 2023 projected to rise to USD 4.65 billion by 2033, facilitated by their simplicity and effectiveness in various diagnostic scenarios.

Point Of Care Diagnostics Market Analysis By Distribution Channel

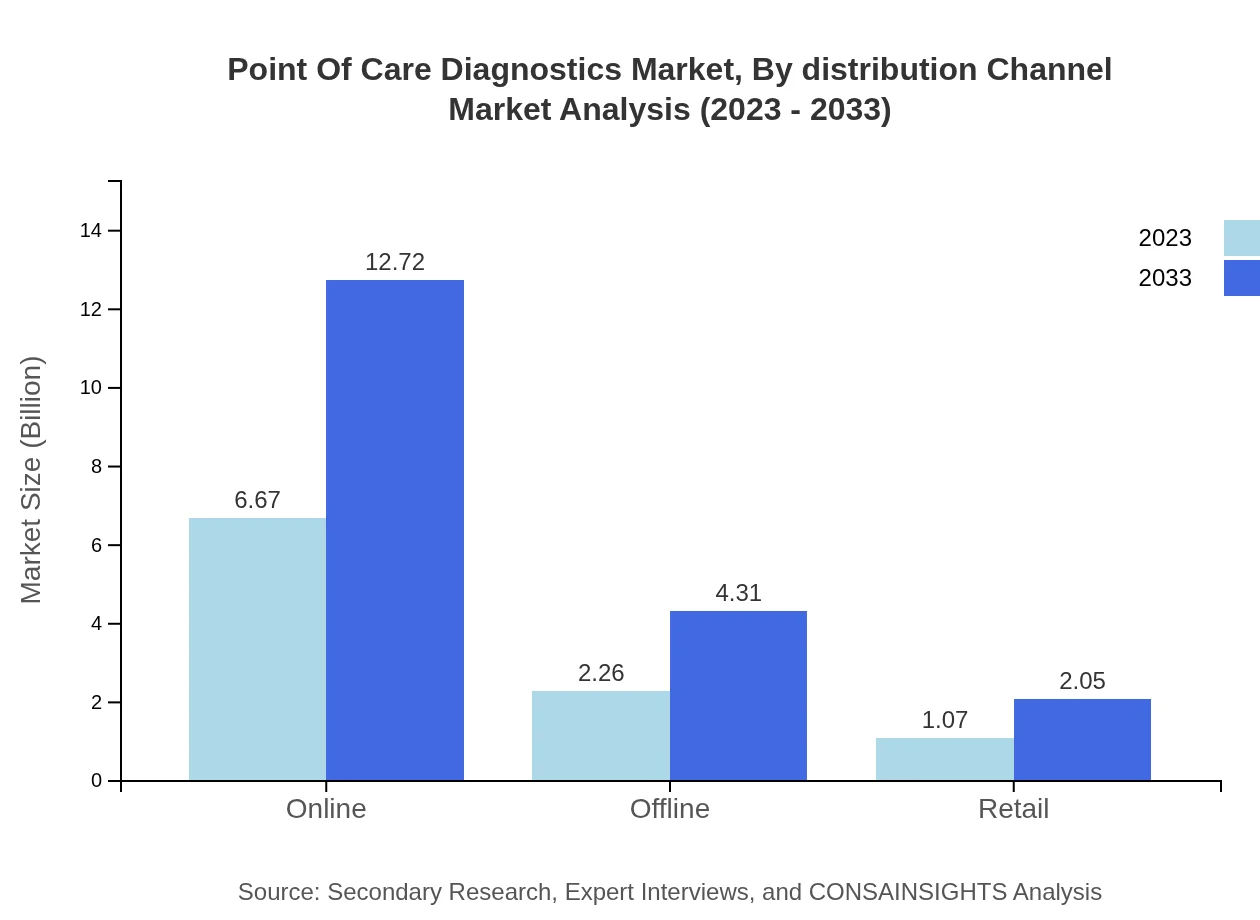

Distribution channels for POCD encompass online, offline, and retail. Online distribution shows significant growth potential, from a market size of USD 6.67 billion in 2023 to an anticipated USD 12.72 billion by 2033, reflecting shifts in shopping habits and increased accessibility to healthcare products.

Point Of Care Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Point Of Care Diagnostics Industry

Abbott Laboratories:

Abbott Laboratories offers a wide array of diagnostic tests, particularly focusing on rapid diagnostic solutions and molecular diagnostics. Their innovative technologies are widely recognized in the POCD realm.Roche Diagnostics:

Roche Diagnostics is a leader in advanced diagnostics, known for its groundbreaking immunoassays and molecular diagnostic systems used in various healthcare sectors.Siemens Healthineers:

Siemens Healthineers develops innovative POCD solutions that integrate with healthcare systems worldwide, focusing on providing rapid and reliable diagnostics.Danaher Corporation:

Danaher Corporation specializes in developing diagnostic and life science tools, playing a significant role in the Point Of Care Diagnostics market through its wide-ranging products.Thermo Fisher Scientific:

Thermo Fisher Scientific is focused on advancing health through innovative diagnostic solutions and integrated systems for various applications in POCD.We're grateful to work with incredible clients.

FAQs

What is the market size of point Of Care diagnostics?

The global Point-of-Care Diagnostics market was valued at approximately $10 billion in 2023, with a projected CAGR of 6.5%. This growth signals a robust expansion anticipated over the next decade, reaching substantial heights by 2033.

What are the key market players or companies in this point Of Care diagnostics industry?

Key market players in the Point-of-Care Diagnostics industry include major medical technology firms that specialize in diagnostic devices, consumables, and related services. Their innovations drive sector advancements and compete in both emerging and established markets.

What are the primary factors driving the growth in the point Of Care diagnostics industry?

Growth in the Point-of-Care Diagnostics industry is primarily fueled by advances in technology, increased demand for rapid testing, a rise in chronic diseases, and the need for enhanced healthcare access. These factors collectively enhance patient outcomes.

Which region is the fastest Growing in the point Of Care diagnostics?

Asia Pacific is the fastest-growing region in the Point-of-Care Diagnostics market, with the market expected to grow from $1.91 billion in 2023 to $3.65 billion by 2033, reflecting increasing healthcare investments and demand for efficient diagnostics.

Does ConsaInsights provide customized market report data for the point Of Care diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the Point-of-Care Diagnostics industry, allowing clients to explore unique insights and tailored data to inform their strategic decisions.

What deliverables can I expect from this point Of Care diagnostics market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, growth forecasts, competitive landscape reviews, and segment-specific insights. These reports are designed to provide actionable intelligence and strategic recommendations.

What are the market trends of point Of Care diagnostics?

Current trends in the Point-of-Care Diagnostics market include increasing adoption of telehealth services, advancements in molecular diagnostics, and a growing focus on home testing solutions, driven by consumer preference for convenient and immediate healthcare access.