Point Of Care Molecular Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: point-of-care-molecular-diagnostics

Point Of Care Molecular Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Point Of Care Molecular Diagnostics market, covering market trends, size, growth forecasts from 2023 to 2033, and competitive landscape insights to help stakeholders make informed decisions.

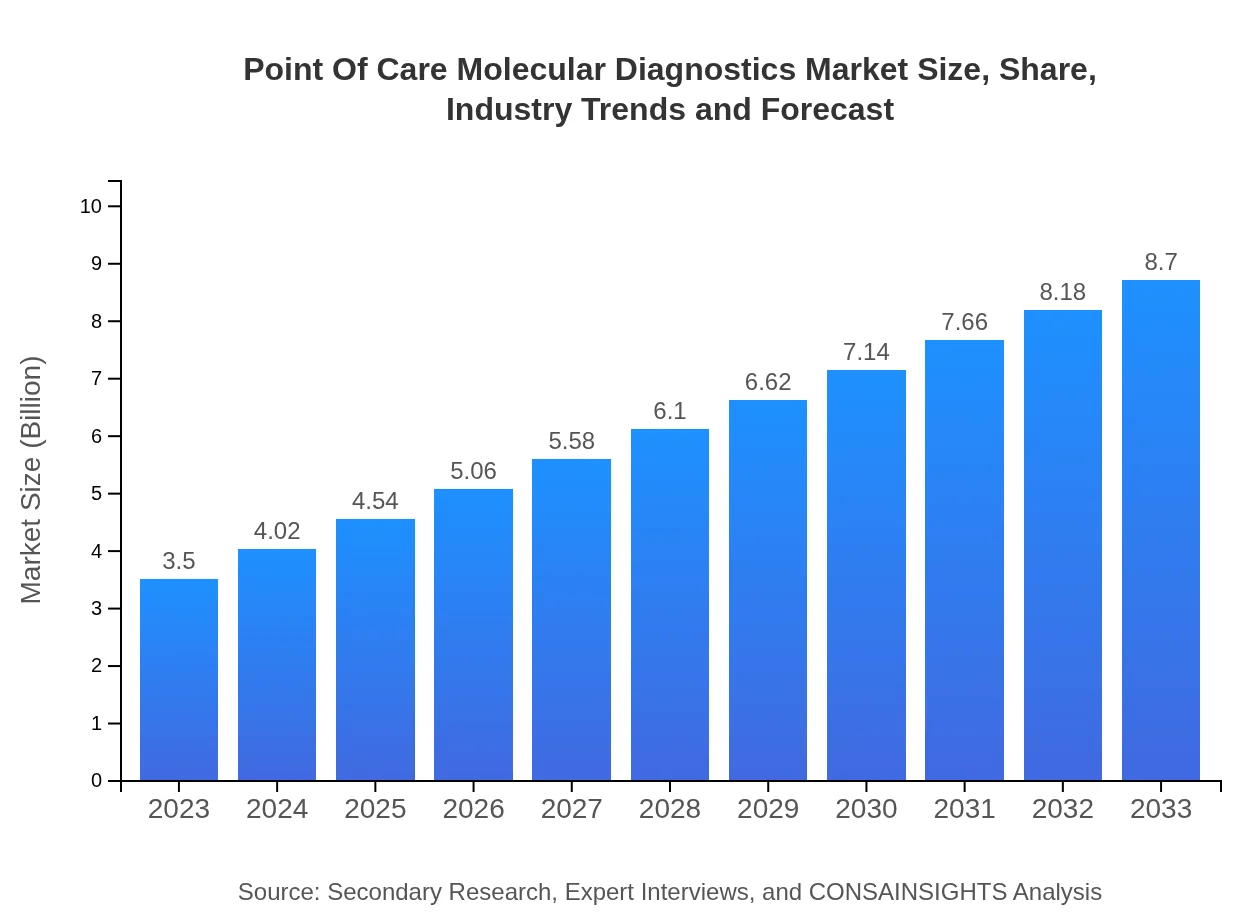

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Cepheid, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Point Of Care Molecular Diagnostics Market Overview

Customize Point Of Care Molecular Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Point Of Care Molecular Diagnostics market size, growth, and forecasts.

- ✔ Understand Point Of Care Molecular Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Point Of Care Molecular Diagnostics

What is the Market Size & CAGR of Point Of Care Molecular Diagnostics market in 2023?

Point Of Care Molecular Diagnostics Industry Analysis

Point Of Care Molecular Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Point Of Care Molecular Diagnostics Market Analysis Report by Region

Europe Point Of Care Molecular Diagnostics Market Report:

The European market is anticipated to expand from $1.04 billion in 2023 to $2.57 billion by 2033, driven by increasing public health awareness, technological advancements, and an aging population necessitating advanced diagnostic solutions.Asia Pacific Point Of Care Molecular Diagnostics Market Report:

In the Asia Pacific region, the Point Of Care Molecular Diagnostics market is projected to grow from $0.69 billion in 2023 to $1.71 billion by 2033. Factors contributing to this growth include increasing healthcare expenditure, a rising disease burden, and rapid technological adoption. Countries like China and India are at the forefront, driven by increasing investments in healthcare infrastructure.North America Point Of Care Molecular Diagnostics Market Report:

North America leads the global market, with the size expected to rise from $1.24 billion in 2023 to $3.08 billion by 2033. The region's dominance is attributed to extensive research and development activities, high prevalence of diseases, and favorable reimbursement policies that drive the adoption of molecular diagnostic techniques.South America Point Of Care Molecular Diagnostics Market Report:

The market in South America is forecasted to grow from $0.11 billion in 2023 to $0.27 billion by 2033. Although it represents a smaller percentage of the global market, the demand for POCD is increasing, especially for controlling infectious diseases.Middle East & Africa Point Of Care Molecular Diagnostics Market Report:

The Middle East and Africa's market, although smaller, is expected to grow from $0.43 billion in 2023 to $1.07 billion by 2033. The region's increasing focus on healthcare infrastructure and rising healthcare expenditure will fuel this growth.Tell us your focus area and get a customized research report.

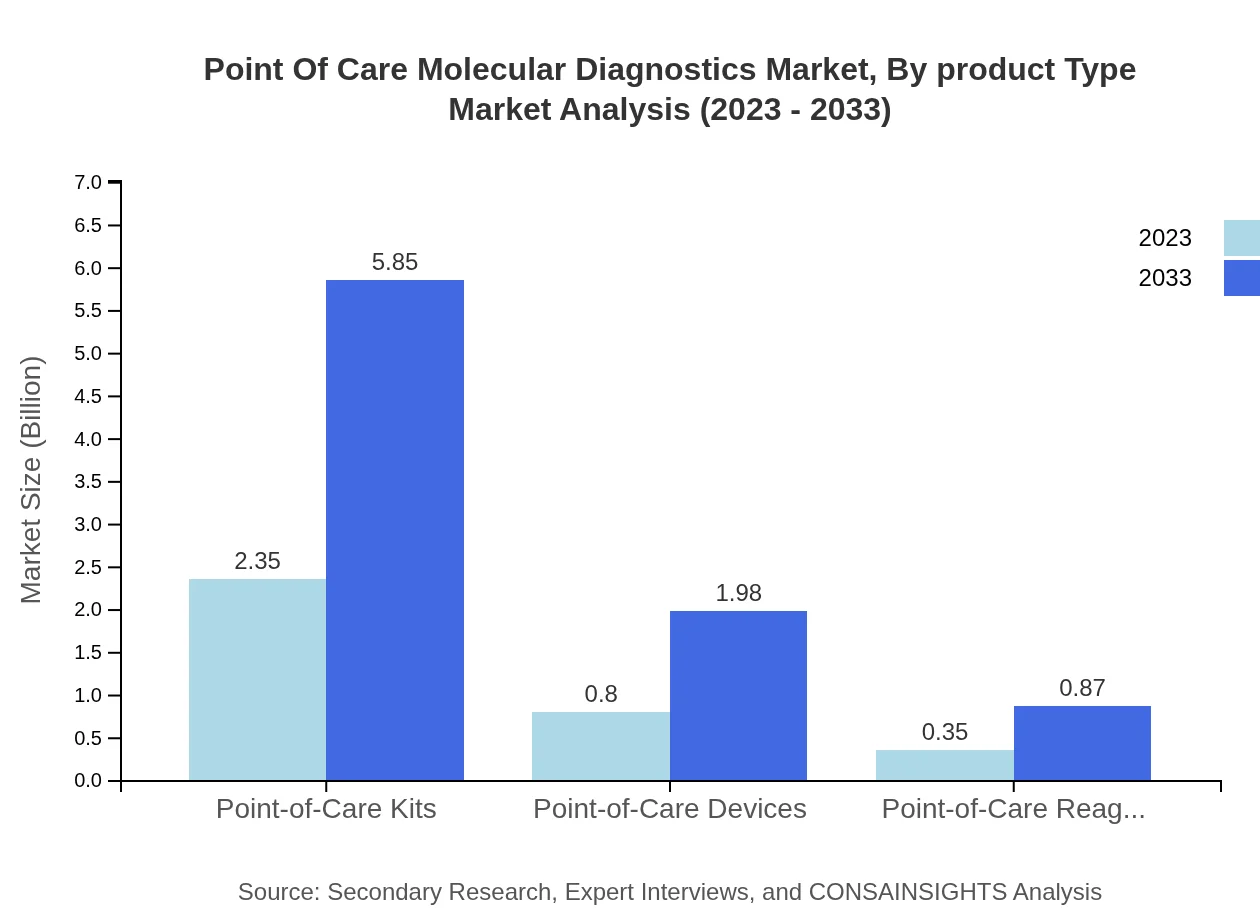

Point Of Care Molecular Diagnostics Market Analysis By Product Type

The Point-of-Care Molecular Diagnostics market by product type includes Point-of-Care Kits, Point-of-Care Devices, and Point-of-Care Reagents. In 2023, Point-of-Care Kits dominate the market with a size of $2.35 billion, accounting for 67.22% of the market share. By 2033, the segment will grow to $5.85 billion. Point-of-Care Devices and Reagents follow, accounting for 22.72% and 10.06% of the market share respectively. The robust demand for these products is indicative of the growing trend towards decentralized healthcare.

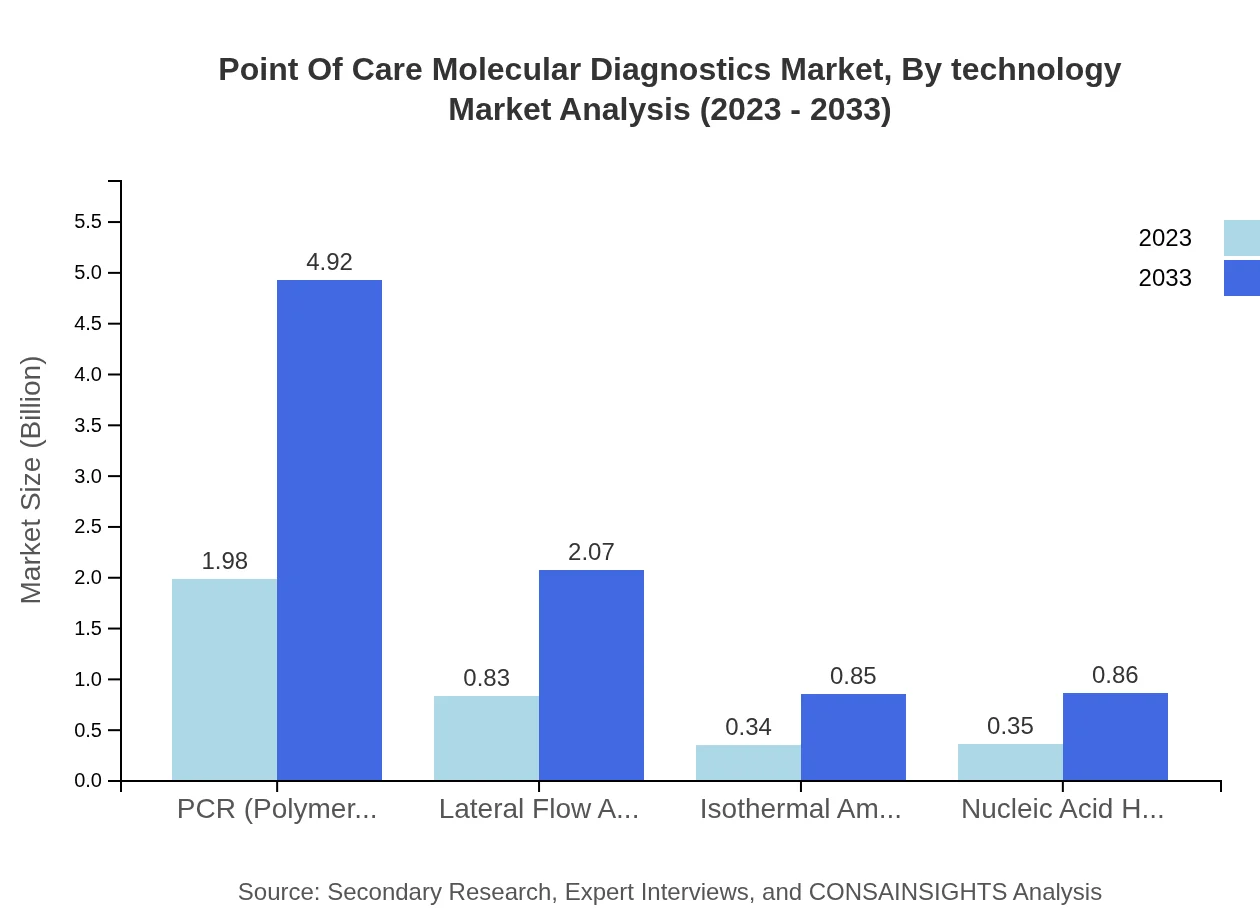

Point Of Care Molecular Diagnostics Market Analysis By Technology

The market divided by technology includes PCR (Polymerase Chain Reaction), Lateral Flow Assays, Isothermal Amplification, and Nucleic Acid Hybridization. PCR is the leading technology with an expected market size of $1.98 billion in 2023, remaining dominant by 2033 at $4.92 billion. Lateral Flow Assays and Isothermal Amplification are also significant, reflecting the trend towards rapid testing techniques that provide expedited results directly at the point of care.

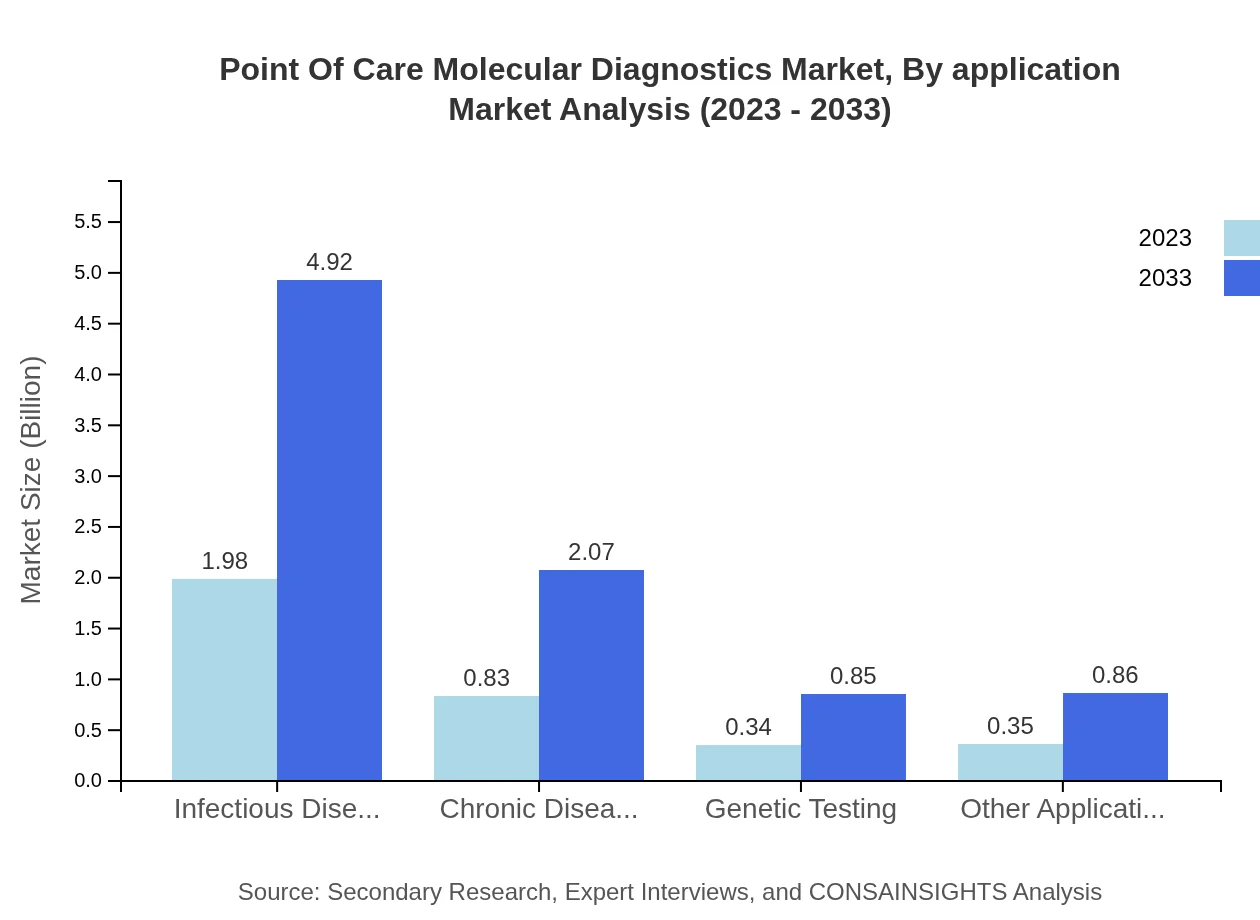

Point Of Care Molecular Diagnostics Market Analysis By Application

Applications of Point-of-Care Molecular Diagnostics include Infectious Diseases, Chronic Diseases, Genetic Testing, and Other Applications. Infectious Diseases lead the segment with a market size of $1.98 billion in 2023, expected to grow to $4.92 billion by 2033. Chronic Diseases and Genetic Testing follow, emphasizing the critical need for timely diagnostics in various medical settings.

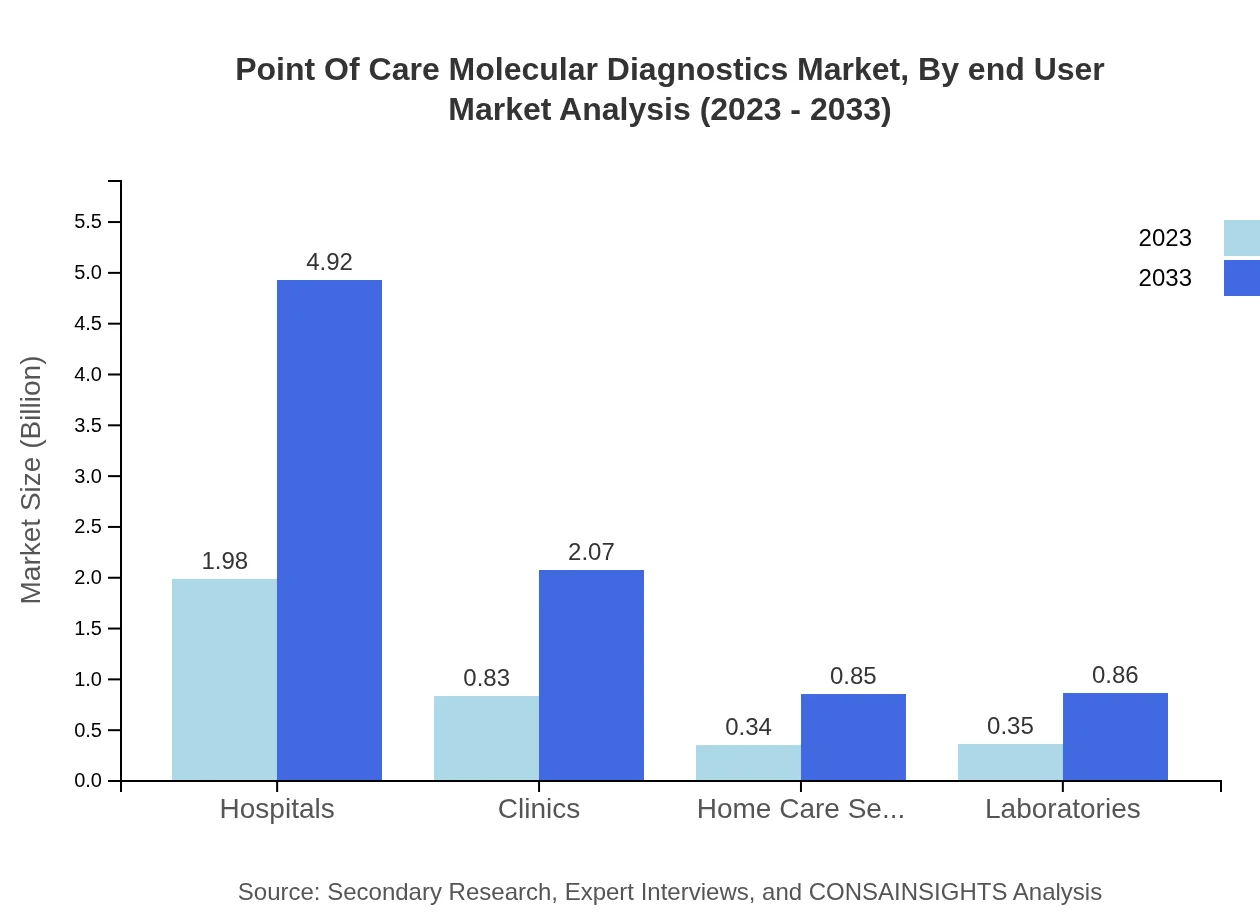

Point Of Care Molecular Diagnostics Market Analysis By End User

The end-user segments for Point-of-Care Molecular Diagnostics comprise Hospitals, Clinics, Home Care Settings, and Laboratories. In 2023, Hospitals account for the largest share at 56.55%, with a market size of $1.98 billion and projected growth to $4.92 billion by 2033. Clinics and Home Care Settings are also crucial segments as healthcare models shift towards more accessible and efficient care.

Point Of Care Molecular Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Point Of Care Molecular Diagnostics Industry

Abbott Laboratories:

Abbott is a global healthcare leader known for its advanced diagnostics solutions, including a broad portfolio of Point Of Care molecular diagnostic tests that enhance patient outcomes through fast and accurate results.Roche Diagnostics:

Roche is a pivotal player in diagnostic technologies, focusing on delivering innovative solutions in molecular diagnostics, including point-of-care products that are integral for infectious disease management.Cepheid:

Part of the Danaher Corporation, Cepheid specializes in molecular diagnostics and is known for its rapid PCR-based urine testing systems that perform well under demanding conditions.Siemens Healthineers:

Siemens Healthineers provides a diverse range of diagnostic solutions, including point-of-care molecular diagnostics, aimed at improving patient management and clinical outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of point Of Care molecular diagnostics?

The global point-of-care molecular diagnostics market is valued at approximately $3.5 billion in 2023, with an anticipated CAGR of 9.2% leading to significant growth by 2033.

What are the key market players or companies in the point Of Care molecular diagnostics industry?

Key players in the point-of-care molecular diagnostics market include Abbott Laboratories, Roche Diagnostics, Cepheid, and Thermo Fisher Scientific, each playing a crucial role in technological advancements and market reach.

What are the primary factors driving the growth in the point Of Care molecular diagnostics industry?

Growth in this sector is driven by the increasing demand for rapid diagnostic tests, advancements in technology, the rise of infectious diseases, and the shift towards decentralization in healthcare delivery.

Which region is the fastest Growing in the point Of Care molecular diagnostics?

The Asia-Pacific region is experiencing the fastest growth, with market projections rising from $0.69 billion in 2023 to $1.71 billion by 2033, highlighting its expanding healthcare infrastructure.

Does ConsaInsights provide customized market report data for the point Of Care molecular diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the point-of-care molecular diagnostics industry to better support strategic decision-making.

What deliverables can I expect from this point Of Care molecular diagnostics market research project?

Expect comprehensive analysis, market forecasts, detailed segment insights, competitor profiling, and actionable recommendations tailored to the point-of-care molecular diagnostics market.

What are the market trends of point Of Care molecular diagnostics?

Key trends include the increasing adoption of digital healthcare solutions, advancements in diagnostic technologies, and a shift towards patient-centered care, enhancing accessibility and efficiency.