Point Of Sale Pos Terminal Market Report

Published Date: 31 January 2026 | Report Code: point-of-sale-pos-terminal

Point Of Sale Pos Terminal Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Point of Sale (POS) Terminal market, covering key insights, market conditions, and forecasts from 2023 to 2033. It includes market size, growth trends, segmentation, and regional analyses, offering valuable data for industry stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Square, Inc., Clover Network, Inc., Toast POS, Lightspeed POS, Verifone Systems, Inc. |

| Last Modified Date | 31 January 2026 |

Point Of Sale Pos Terminal Market Overview

Customize Point Of Sale Pos Terminal Market Report market research report

- ✔ Get in-depth analysis of Point Of Sale Pos Terminal market size, growth, and forecasts.

- ✔ Understand Point Of Sale Pos Terminal's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Point Of Sale Pos Terminal

What is the Market Size & CAGR of Point Of Sale Pos Terminal market in 2023 and 2033?

Point Of Sale Pos Terminal Industry Analysis

Point Of Sale Pos Terminal Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Point Of Sale Pos Terminal Market Analysis Report by Region

Europe Point Of Sale Pos Terminal Market Report:

The European market stands out with a projected increase from $2.55 billion in 2023 to $5.52 billion by 2033. Strong growth in sectors like retail and hospitality, along with stringent regulations on cash transactions, are major factors contributing to this market’s growth.Asia Pacific Point Of Sale Pos Terminal Market Report:

The Asia Pacific region is anticipated to witness significant growth in the POS terminal market, with a projected increase from $2.02 billion in 2023 to $4.37 billion by 2033. This growth is driven by rapid urbanization, increasing consumer spending, and a sharp rise in e-commerce activities. Countries like China and India are at the forefront due to their massive retail sectors and technological advancements.North America Point Of Sale Pos Terminal Market Report:

North America remains a major market for POS terminals, with expected growth from $3.75 billion in 2023 to $8.14 billion by 2033. The shift towards cashless transactions and advanced payment technologies drives this market expansion. Additionally, the high penetration of smartphones enhances mobile payment adoption.South America Point Of Sale Pos Terminal Market Report:

In South America, the market is expected to grow from $1.01 billion in 2023 to $2.18 billion by 2033. The growth can be attributed to increasing foreign investments and the need for enhanced retail payment systems. Countries like Brazil and Argentina are likely to lead this growth due to their expanding retail landscape.Middle East & Africa Point Of Sale Pos Terminal Market Report:

In the Middle East and Africa, the POS terminal market is expected to grow from $1.18 billion in 2023 to $2.55 billion by 2033. Rapid advancements in financial technology, coupled with increases in payment security measures, are propelling market growth in this region.Tell us your focus area and get a customized research report.

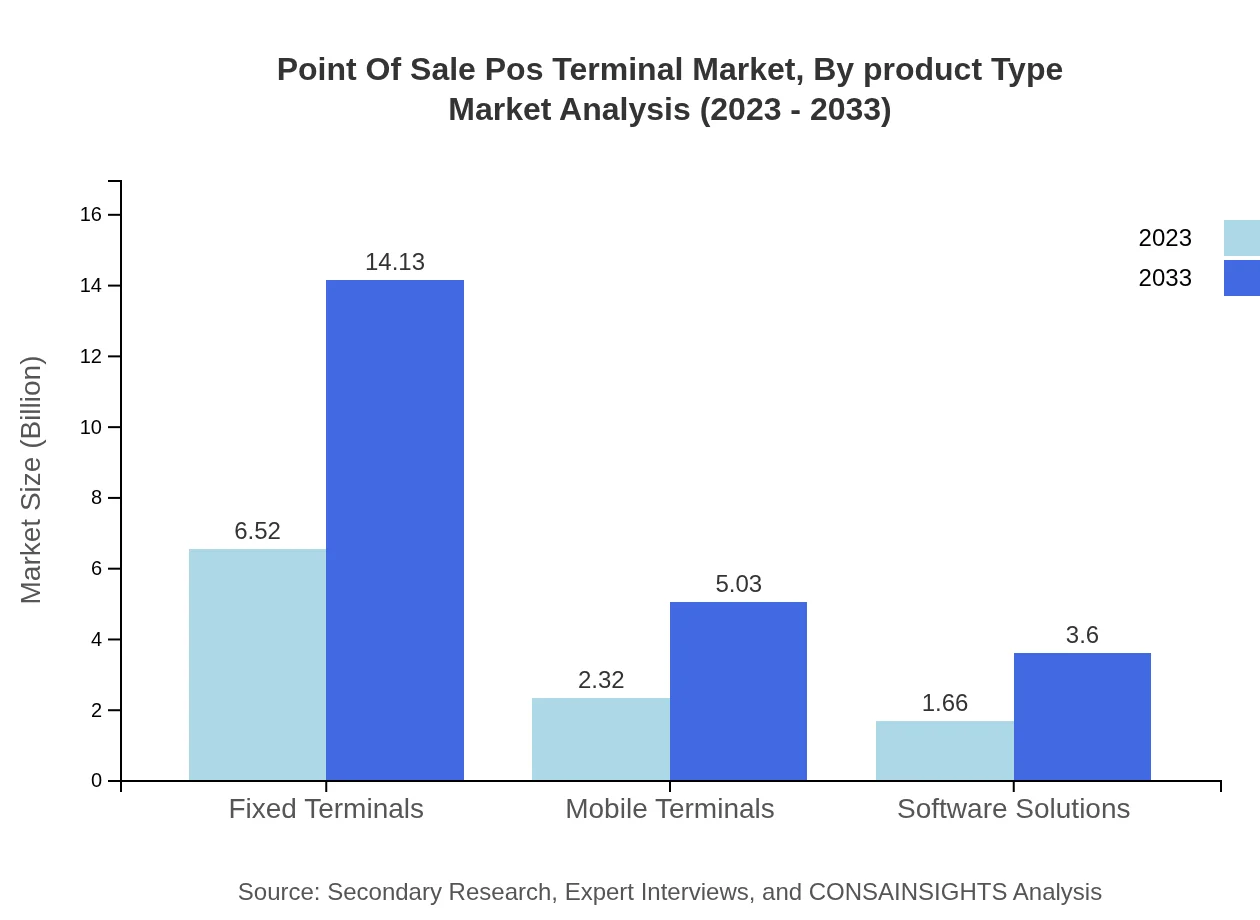

Point Of Sale Pos Terminal Market Analysis By Product Type

The point-of-sale terminal market is segmented into fixed terminals and mobile terminals. Fixed terminals dominate the market, making up approximately 62.08% of the total market share in 2023, with a market size of $6.52 billion. Mobile terminals are also growing, representing 22.12% of the market. Innovations in mobile payment solutions are augmenting the growth of mobile terminal adoption.

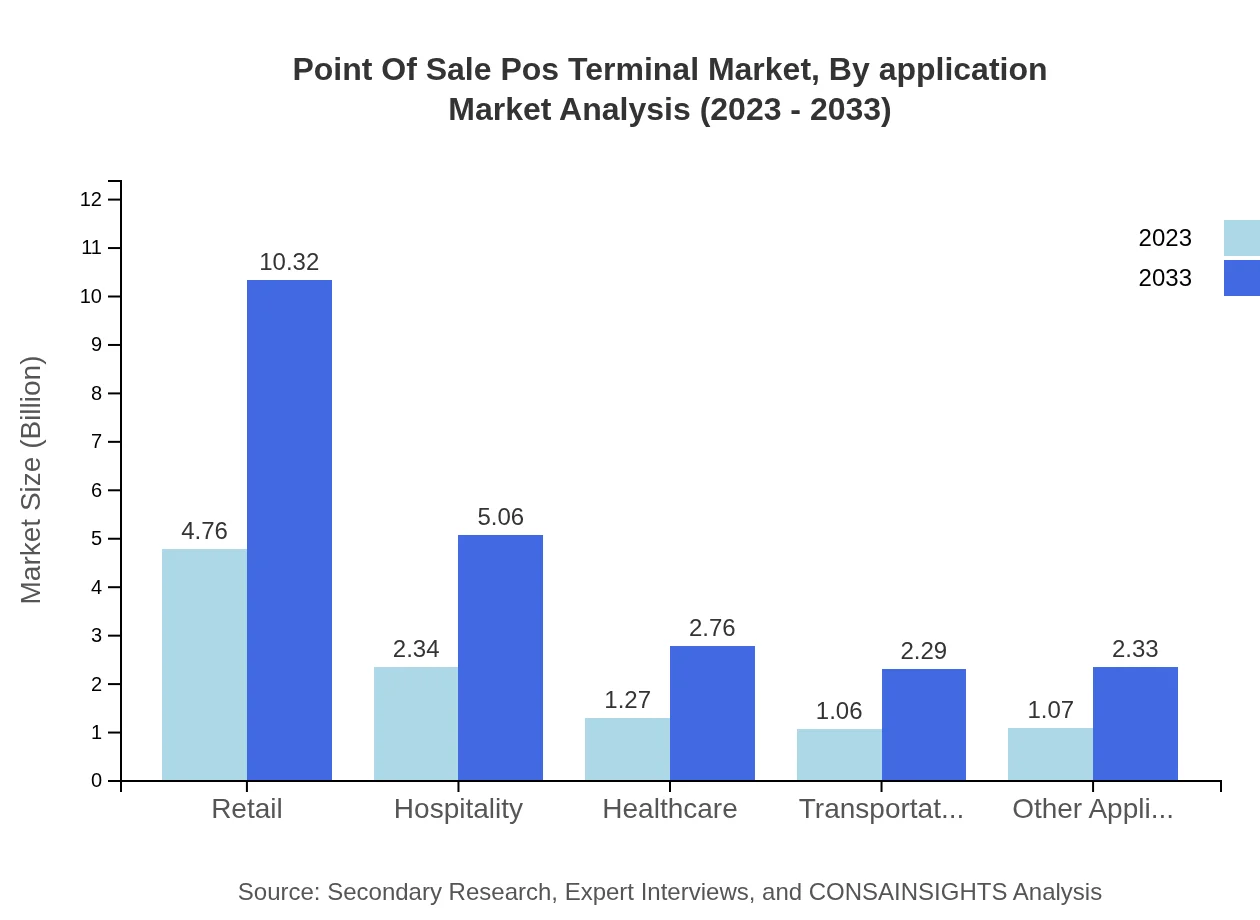

Point Of Sale Pos Terminal Market Analysis By Application

The application segment of the POS terminal market includes retail, hospitality, healthcare, and others. Retail holds the largest market share of 45.35% in 2023, with a market size of $4.76 billion, expected to grow significantly by 2033. The hospitality sector, with its increasing emphasis on customer experience, currently holds a share of 22.25%.

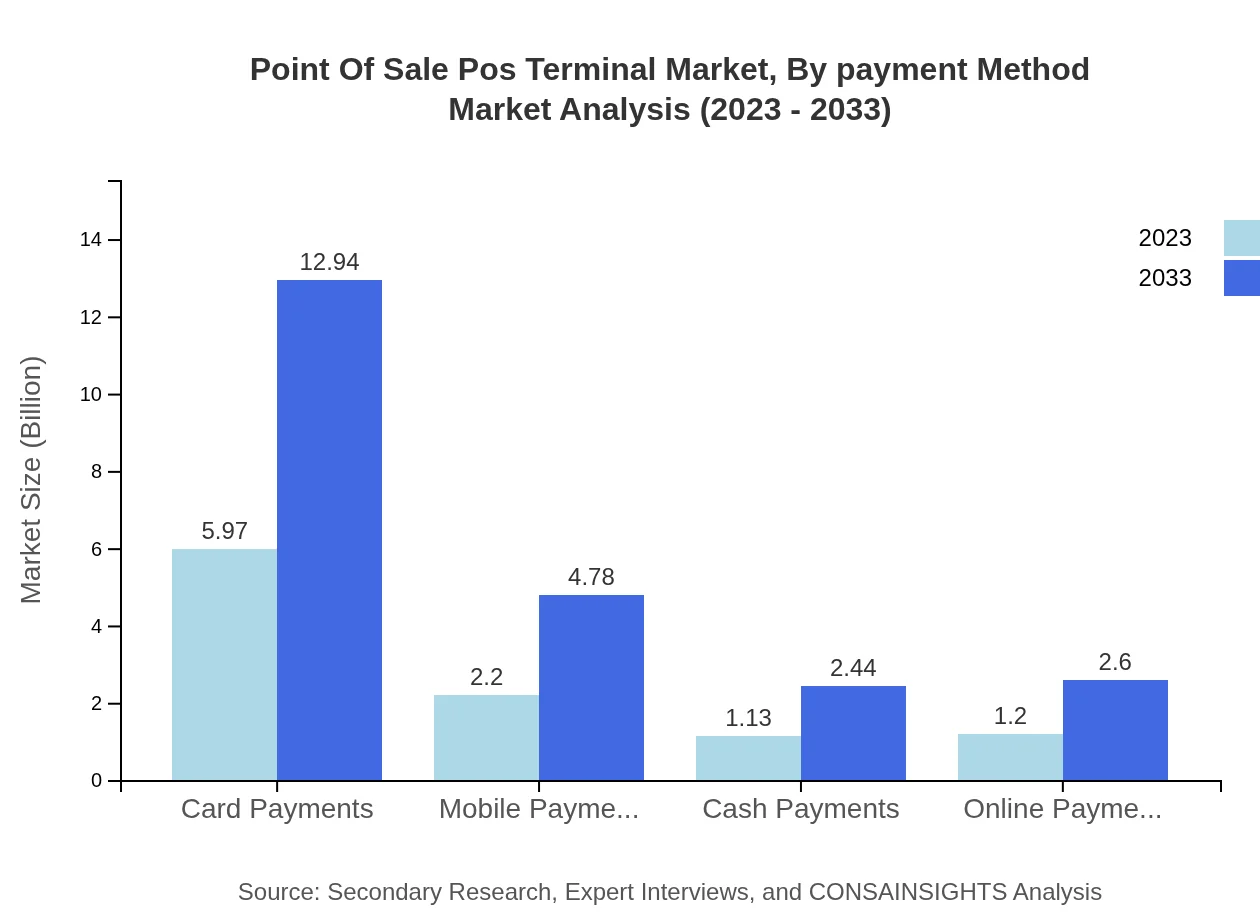

Point Of Sale Pos Terminal Market Analysis By Payment Method

Payment methods include card payments, mobile payments, cash payments, and online payments. Card payments lead the market with a share of 56.85%, amounting to $5.97 billion in 2023, while mobile payments capture 20.99% of the market. The evolution and acceptance of various digital payment methods continue to shape the industry landscape.

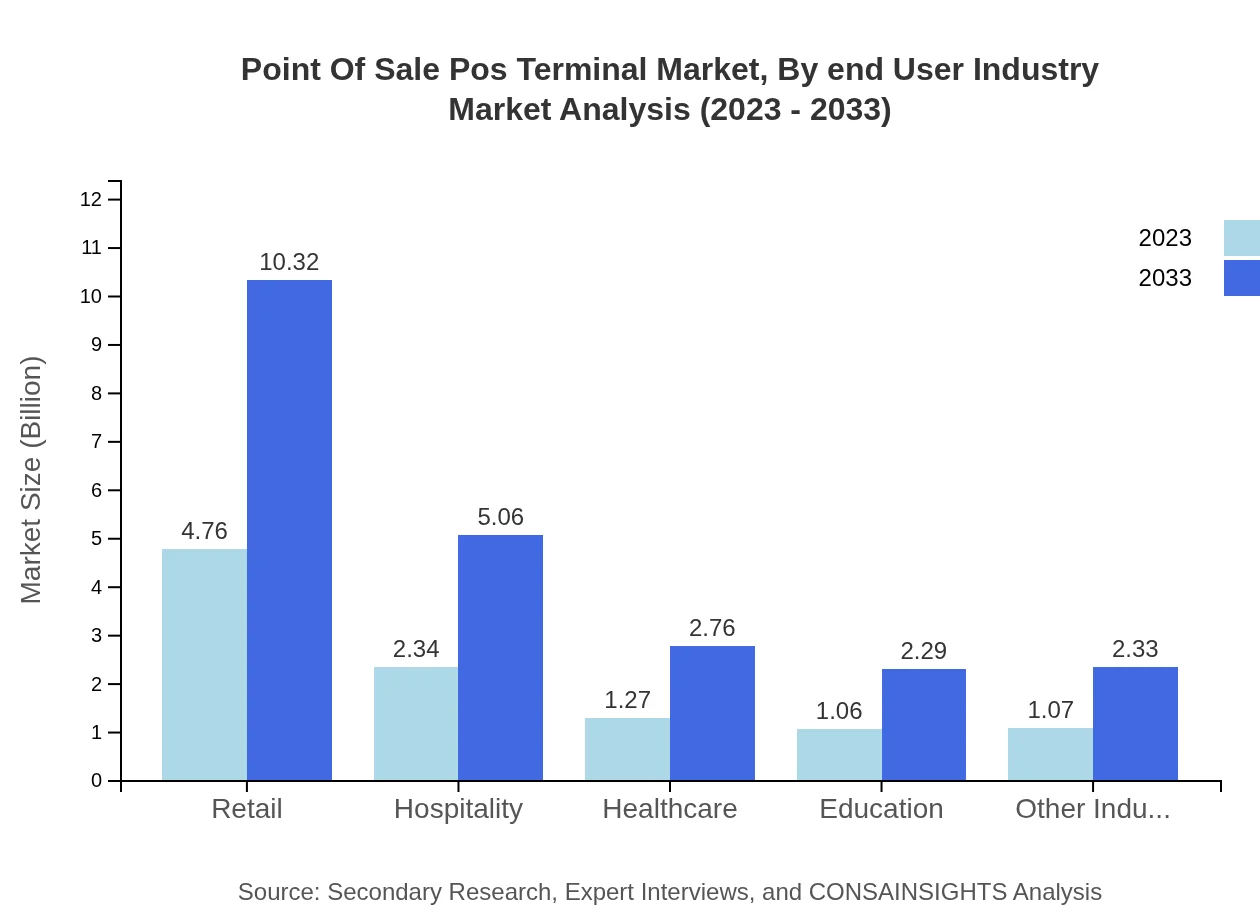

Point Of Sale Pos Terminal Market Analysis By End User Industry

Key end-user industries include retail, hospitality, healthcare, transportation, and others. The retail sector significantly dominates the market, while healthcare is also gaining traction with an expected growth in POS adoption due to increasing data management needs.

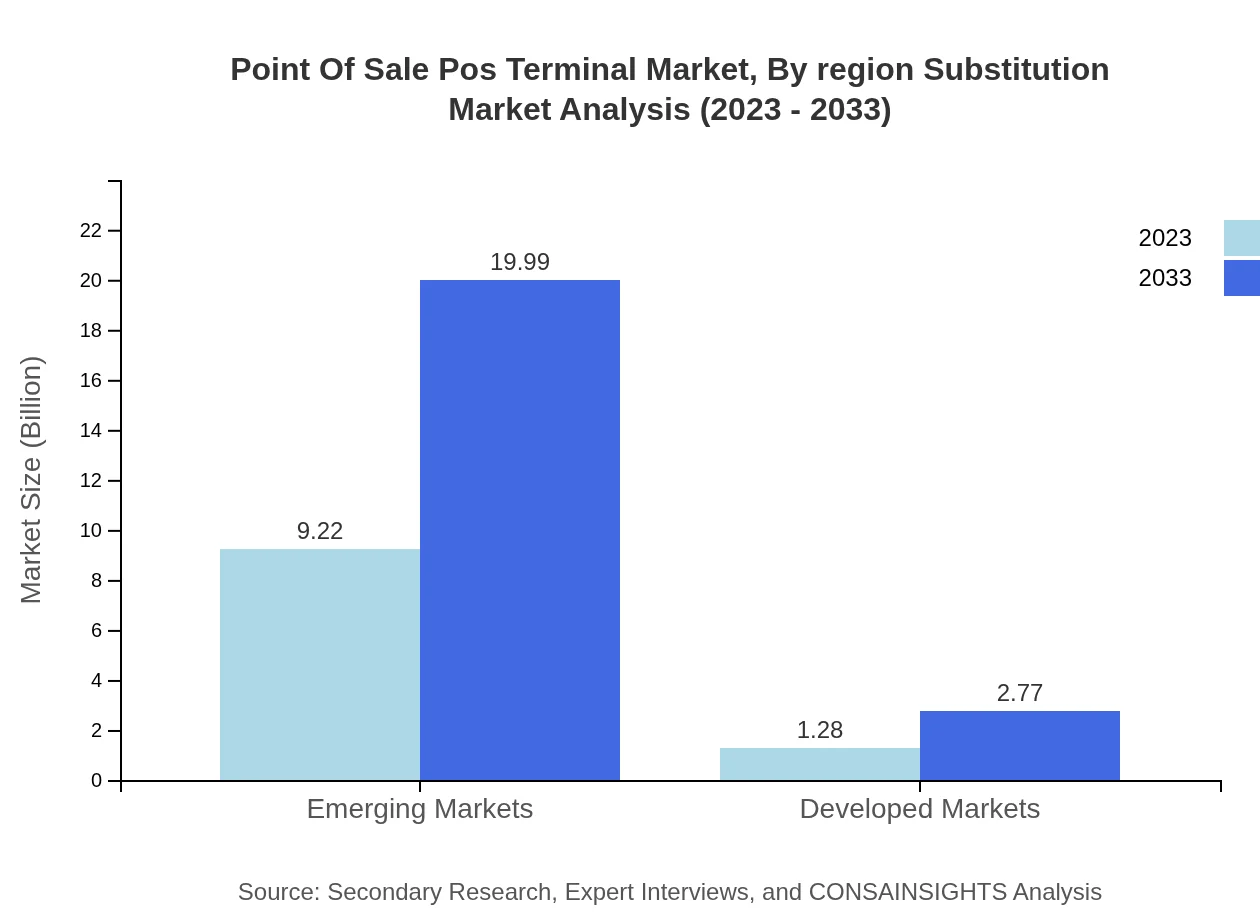

Point Of Sale Pos Terminal Market Analysis By Region Substitution

In terms of substitution by region, emerging markets are projected to experience robust growth due to rising smartphone penetration and favorable government initiatives. Developed markets, while slower in growth due to saturation, continue to innovate to retain market share.

Point Of Sale Pos Terminal Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Point Of Sale Pos Terminal Industry

Square, Inc.:

Offers robust POS solutions for businesses of all sizes, focusing on mobile payments and e-commerce integration.Clover Network, Inc.:

Provides customizable POS systems and payment solutions, widely used in retail and hospitality sectors.Toast POS:

Specializes in restaurants, offering comprehensive solutions that include inventory management and online ordering.Lightspeed POS:

Delivers cloud-based POS solutions geared towards retail and hospitality businesses, emphasizing customer engagement.Verifone Systems, Inc.:

A leading provider of payment systems and technology, Verifone offers both hardware and software solutions for secure transactions.We're grateful to work with incredible clients.

FAQs

What is the market size of point Of Sale (POS) terminals?

The global Point of Sale (POS) terminal market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.8% leading to significant growth by 2033.

What are the key market players or companies in the point Of Sale (POS) terminal industry?

The key players in the POS terminal market include companies like Square, Verifone, Ingenico, PAX Technology, and Toshiba, which offer a range of hardware and software solutions catering to various retail and hospitality needs.

What are the primary factors driving the growth in the point Of Sale (POS) terminal industry?

Growth factors include the increasing adoption of digital payment methods, advancements in cloud computing, the rising demand for mobile payment solutions, and the need for contactless transactions to enhance customer experience and operational efficiency.

Which region is the fastest Growing in the point Of Sale (POS) terminal market?

The Asia-Pacific region is the fastest-growing market for POS terminals, increasing from $2.02 billion in 2023 to approximately $4.37 billion by 2033, driven by rapid technological advancements and urbanization.

Does ConsaInsights provide customized market report data for the point Of Sale (POS) terminal industry?

Yes, ConsaInsights offers customized market report data for the point-of-sale terminal industry, tailored to client-specific needs including market trends, competitive analysis, and forecasts.

What deliverables can I expect from this point Of Sale (POS) terminal market research project?

Deliverables include comprehensive market analysis reports, segmented data by region and application, competitor benchmarking, future growth projections, and actionable insights tailored to your business objectives.

What are the market trends of point Of Sale (POS) terminals?

Key trends include the rise of mobile and contactless payments, integration of AI and machine learning for enhanced security features, and a shift towards all-in-one POS solutions that streamline operations across retail and hospitality sectors.