Polishing Powder Market Report

Published Date: 02 February 2026 | Report Code: polishing-powder

Polishing Powder Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Polishing Powder market from 2023 to 2033, focusing on market trends, sizes, growth rates, key segments, regional dynamics, and insights into leading players in the industry.

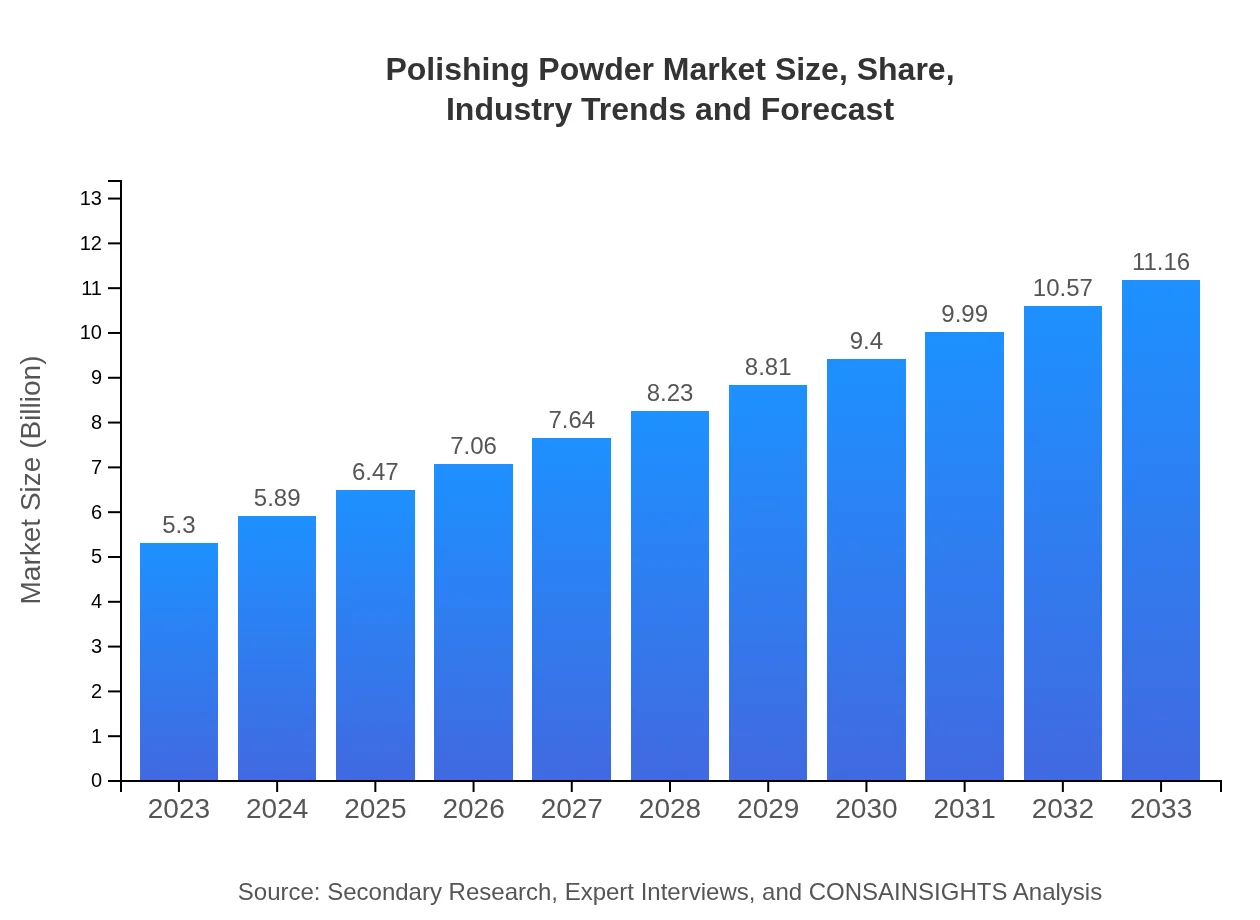

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $11.16 Billion |

| Top Companies | 3M Company, Saint-Gobain, DuPont, Carborundum Universal Limited |

| Last Modified Date | 02 February 2026 |

Polishing Powder Market Overview

Customize Polishing Powder Market Report market research report

- ✔ Get in-depth analysis of Polishing Powder market size, growth, and forecasts.

- ✔ Understand Polishing Powder's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polishing Powder

What is the Market Size & CAGR of Polishing Powder market in 2023?

Polishing Powder Industry Analysis

Polishing Powder Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polishing Powder Market Analysis Report by Region

Europe Polishing Powder Market Report:

The European market for Polishing Powder was valued at USD 1.56 billion in 2023 and is projected to expand to USD 3.28 billion by 2033. The growing emphasis on eco-friendly products and stringent quality regulations fosters a progressive market environment.Asia Pacific Polishing Powder Market Report:

The Asia Pacific region accounted for a market size of approximately USD 1.07 billion in 2023, projected to grow to USD 2.25 billion by 2033. The steady industrialization and increasing automotive production in countries like China and India are critical drivers of this growth.North America Polishing Powder Market Report:

North America stands as a significant market, valued at USD 1.88 billion in 2023 and expected to reach USD 3.95 billion by 2033. The region benefits from advanced industrialization and a robust automotive sector, propelling the polishing powder demand.South America Polishing Powder Market Report:

In South America, the Polishing Powder market is estimated at USD 0.06 billion in 2023, with expectations to rise to USD 0.13 billion by 2033. Growth is anticipated through increasing construction activities and demand in the cosmetics sector.Middle East & Africa Polishing Powder Market Report:

In the Middle East and Africa, the market is valued at USD 0.74 billion in 2023, with growth to USD 1.55 billion expected by 2033. Increased focus on manufacturing and construction sectors will drive demand in this region.Tell us your focus area and get a customized research report.

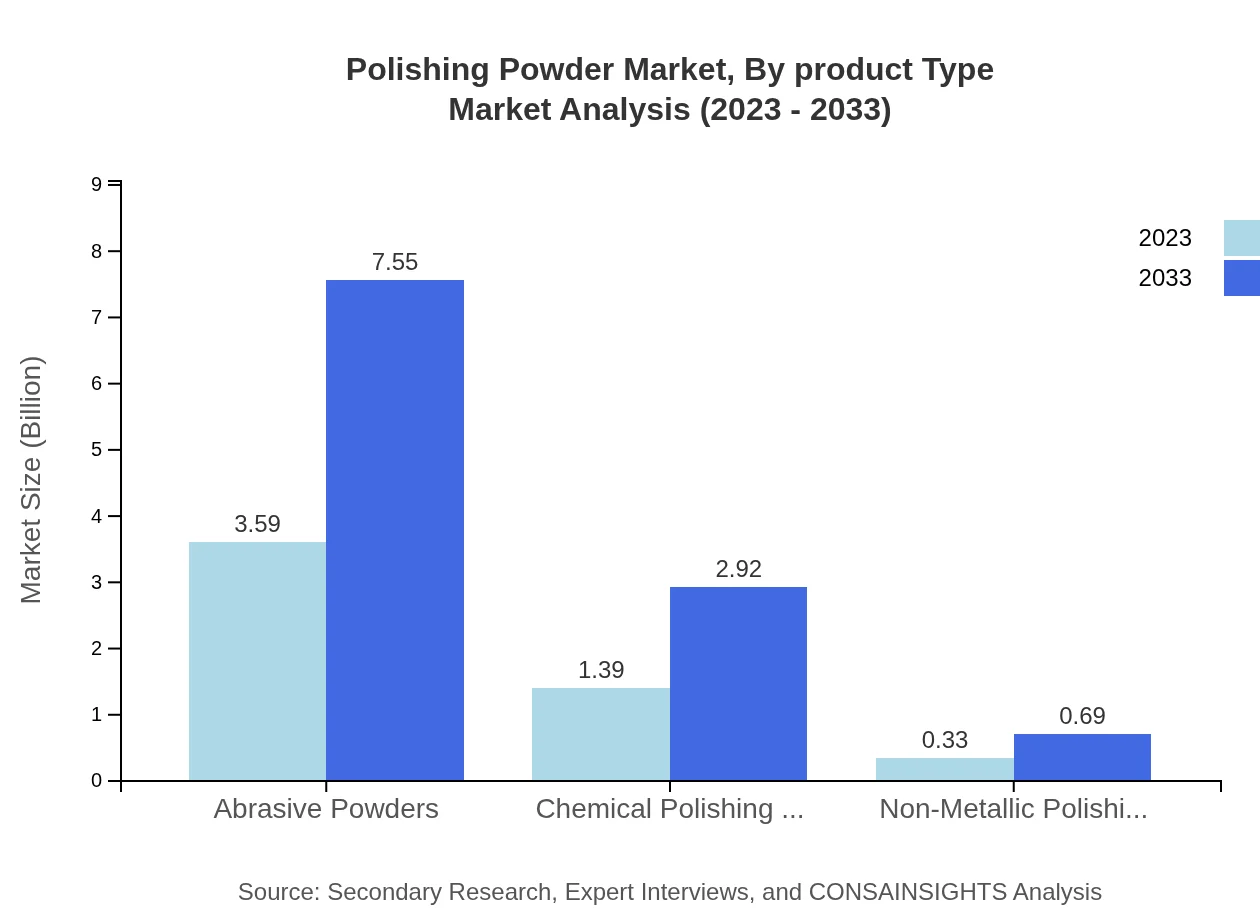

Polishing Powder Market Analysis By Product Type

The Polishing Powder Market by Product Type showcases significant differentiation, with Abrasive Powders capturing the largest share, valued at USD 3.59 billion in 2023, and projected to grow to USD 7.55 billion by 2033, indicating a robust growth trajectory. Chemical and Non-Metallic Polishing Powders are also notable segments, with strong performance driven by increasing applications across industries.

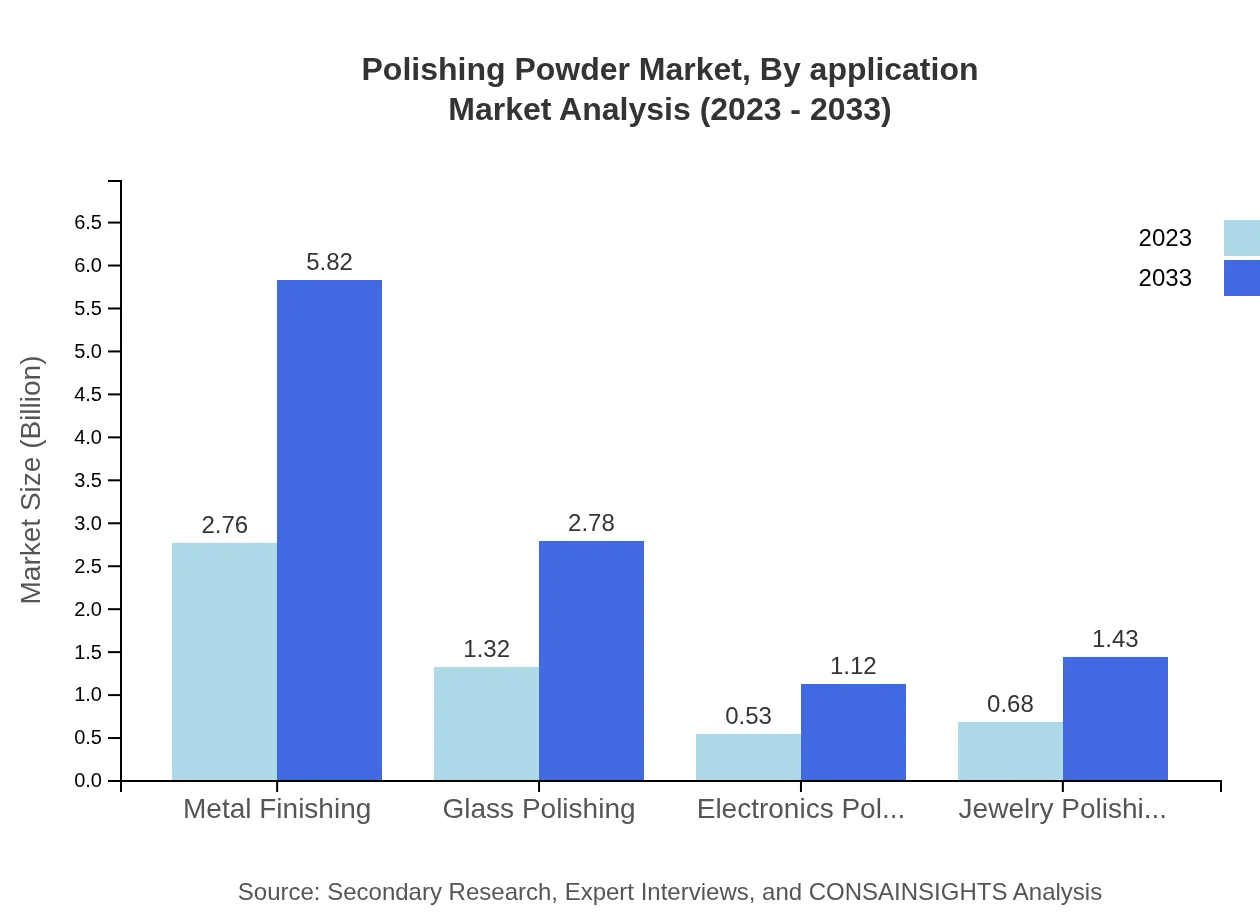

Polishing Powder Market Analysis By Application

By Application, the Metal Finishing segment dominates, amounting to USD 2.76 billion in 2023, and expected to reach USD 5.82 billion by 2033. Construction and Electronics segments also contribute significantly, pushed by advancements in technology and consumer preferences for superior finishing.

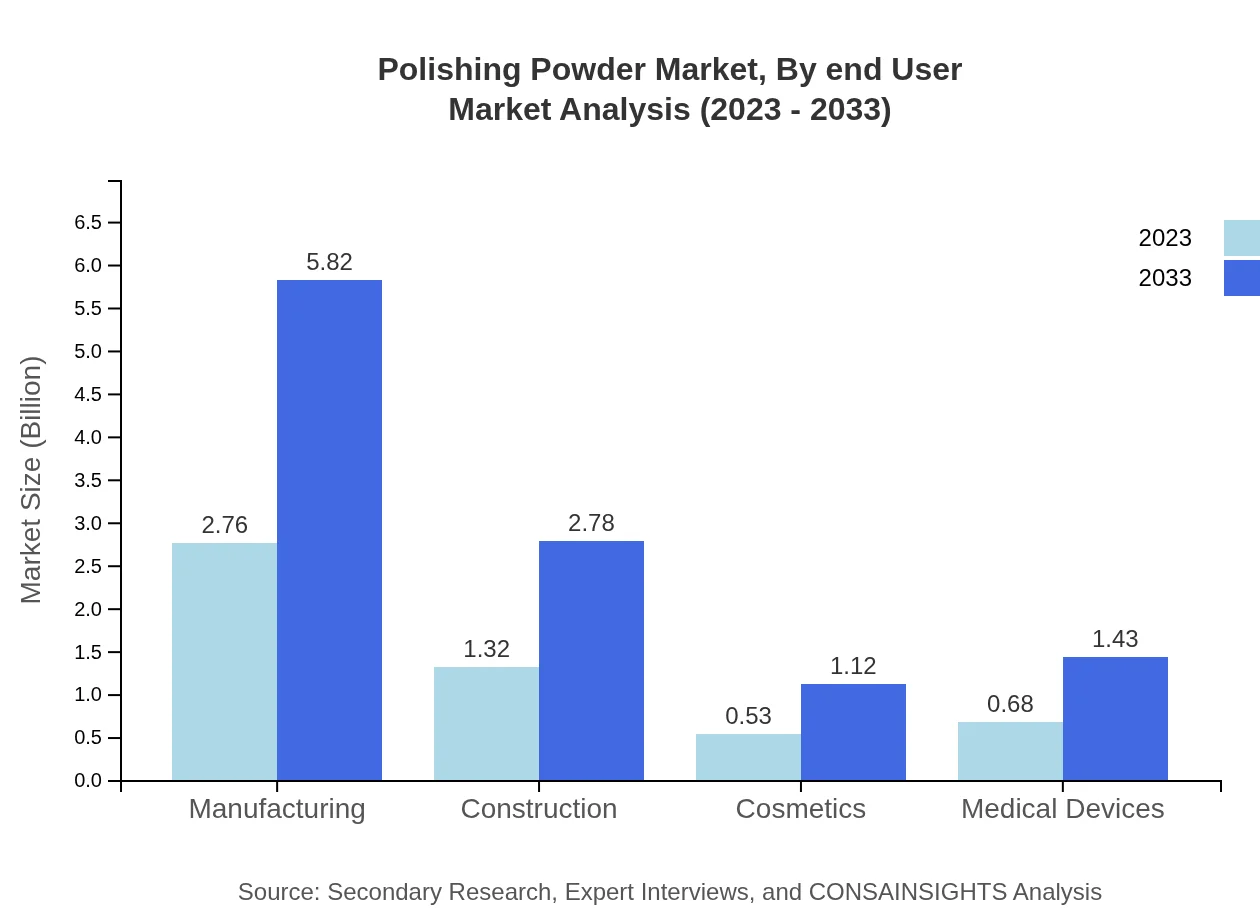

Polishing Powder Market Analysis By End User

The Manufacturing sector remains the largest end-user for polishing powders, indicating a substantial market share of around 52.16%. The Construction industry contributes significantly as well, leveraging polishing powders for enhanced surface aesthetics and durability.

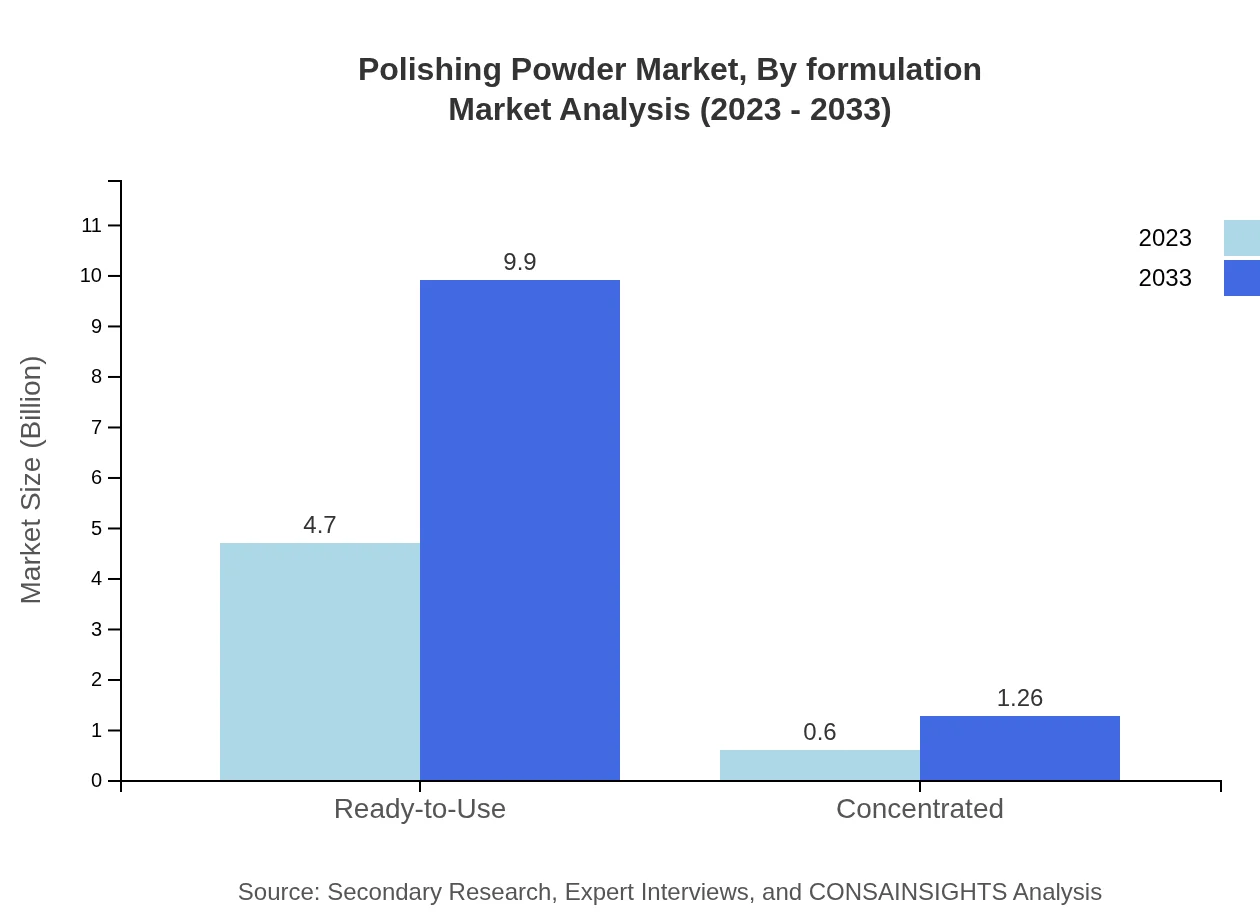

Polishing Powder Market Analysis By Formulation

Within the formulation segment, the Ready-to-Use polishing powders dominate with a market size of USD 4.70 billion in 2023, projected to grow to USD 9.90 billion by 2033. Concentrated formulations also exhibit growth potential, appealing to commercial users looking for efficiency and cost-effectiveness.

Polishing Powder Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polishing Powder Industry

3M Company:

A diversified technology company, 3M develops innovative products including advanced abrasives and polishing powders, catering to various industrial sectors.Saint-Gobain:

A global leader in industrial manufacturing, Saint-Gobain provides a range of polishing solutions and materials essential for various applications across multiple industries.DuPont:

DuPont is known for its advanced materials science, producing high-performance polishing powders used in electronics, automotive, and cosmetic industries.Carborundum Universal Limited:

A leading manufacturer in India, Carborundum Universal Limited specializes in abrasive products, including polishing powders, serving various domestic and international markets.We're grateful to work with incredible clients.

FAQs

What is the market size of polishing Powder?

The global polishing powder market is projected to reach approximately $5.3 billion by 2033, growing at a CAGR of 7.5%. This growth indicates increasing demand across various sectors, reinforcing its substantial economic footprint.

What are the key market players or companies in this polishing Powder industry?

The polishing powder industry features prominent players such as 3M, DuPont, and Saint-Gobain, among others. These companies are instrumental in driving innovation and competition, catering to diverse applications in manufacturing and finishing.

What are the primary factors driving the growth in the polishing powder industry?

Key drivers include the growing manufacturing sector, advancements in polishing technologies, and increasing consumer demand for high-quality finishes in products ranging from electronics to luxury goods, fostering market expansion.

Which region is the fastest Growing in the polishing powder market?

The Asia-Pacific region is the fastest-growing market for polishing powder, projected to grow from $1.07 billion in 2023 to $2.25 billion by 2033, fueled by increased industrial activities and burgeoning cosmetic sectors.

Does ConsaInsights provide customized market report data for the polishing powder industry?

Yes, ConsaInsights offers tailored market report data for the polishing powder industry, providing insights aligned with specific business needs and market segments to support informed decision-making.

What deliverables can I expect from this polishing powder market research project?

Deliverables typically include comprehensive market analysis reports, sector-specific insights, competitor analysis, and forecasting data, ensuring an in-depth understanding of market dynamics and trends.

What are the market trends of polishing powder?

Current trends include an increased focus on eco-friendly materials, automation in polishing processes, and a surge in demand from the electronics and automotive sectors, leading to innovative polishing formulations.