Polymer Coated Urea Market Report

Published Date: 02 February 2026 | Report Code: polymer-coated-urea

Polymer Coated Urea Market Size, Share, Industry Trends and Forecast to 2033

This report evaluates the Polymer Coated Urea market, presenting crucial insights and data forecasts from 2023 to 2033. It encompasses market size, industry analysis, technology advancements, regional breakdowns, and future trends to guide stakeholders in this evolving landscape.

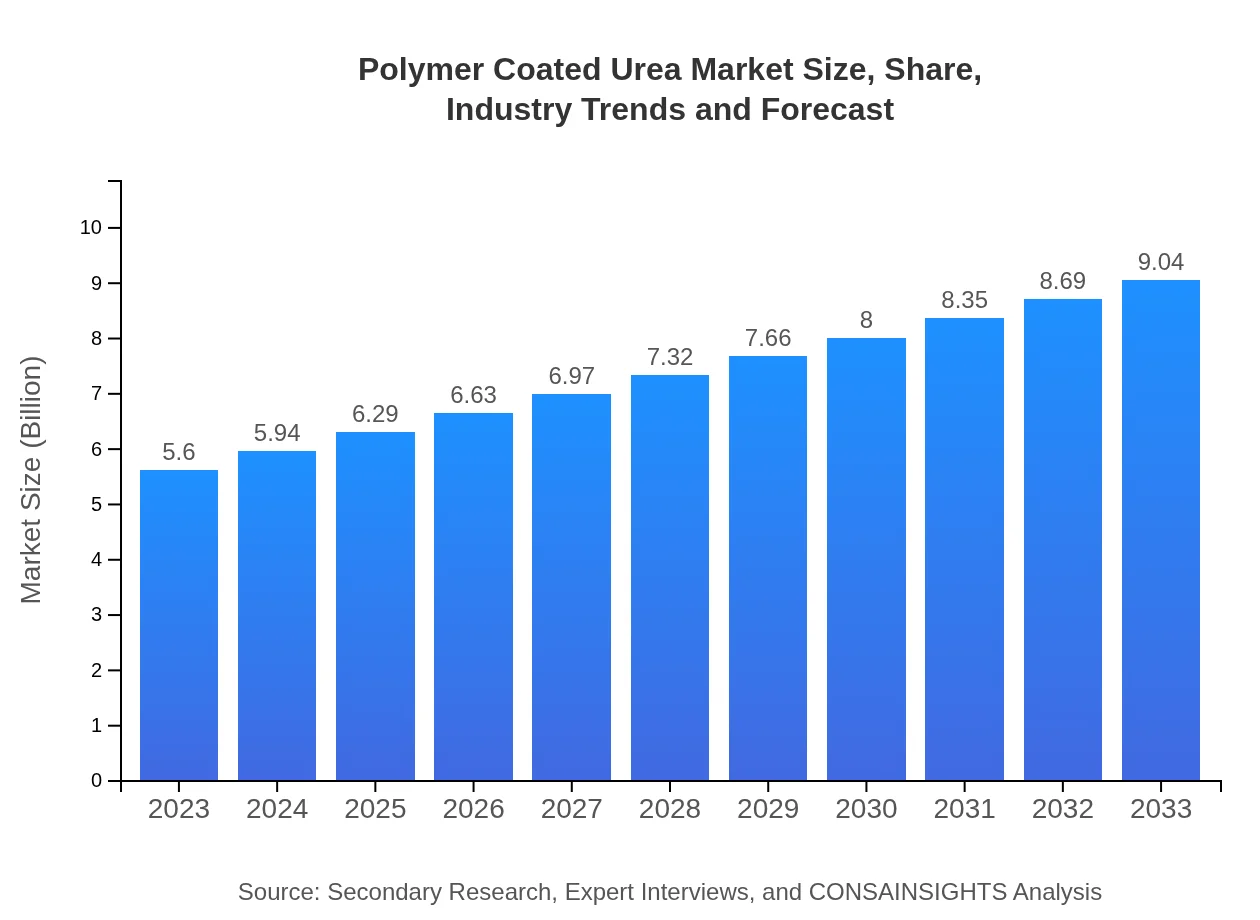

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $9.04 Billion |

| Top Companies | Nutri-Tech Solutions, Yara International, Haifa Group, OCI Nitrogen |

| Last Modified Date | 02 February 2026 |

Polymer Coated Urea Market Overview

Customize Polymer Coated Urea Market Report market research report

- ✔ Get in-depth analysis of Polymer Coated Urea market size, growth, and forecasts.

- ✔ Understand Polymer Coated Urea's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polymer Coated Urea

What is the Market Size & CAGR of the Polymer Coated Urea market in 2023?

Polymer Coated Urea Industry Analysis

Polymer Coated Urea Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polymer Coated Urea Market Analysis Report by Region

Europe Polymer Coated Urea Market Report:

Europe's Polymer Coated Urea market is valued at USD 2.04 billion in 2023 and will likely expand to USD 3.29 billion by 2033, propelled by stringent regulations driving the demand for environmentally friendly fertilizer products.Asia Pacific Polymer Coated Urea Market Report:

In the Asia Pacific region, the Polymer Coated Urea market is valued at approximately USD 1.01 billion in 2023 and is expected to grow to USD 1.62 billion by 2033. This growth is driven by rapid agricultural developments and a shift towards modern farming techniques in countries like India and China.North America Polymer Coated Urea Market Report:

North America, with a market size of USD 1.87 billion in 2023, is anticipated to grow to USD 3.01 billion by 2033. The region benefits from advanced agricultural technologies and significant investments in fertilizer innovations.South America Polymer Coated Urea Market Report:

South America currently holds a market size of USD 0.53 billion in 2023, projected to reach USD 0.85 billion by 2033. The increasing need for food security and sustainable agricultural solutions in this region significantly contributes to market growth.Middle East & Africa Polymer Coated Urea Market Report:

In the Middle East and Africa, the market holds a modest size of USD 0.16 billion in 2023, with an expectation to reach USD 0.25 billion by 2033. The growth in this region is underscored by increasing agricultural investments and initiatives for sustainable practices.Tell us your focus area and get a customized research report.

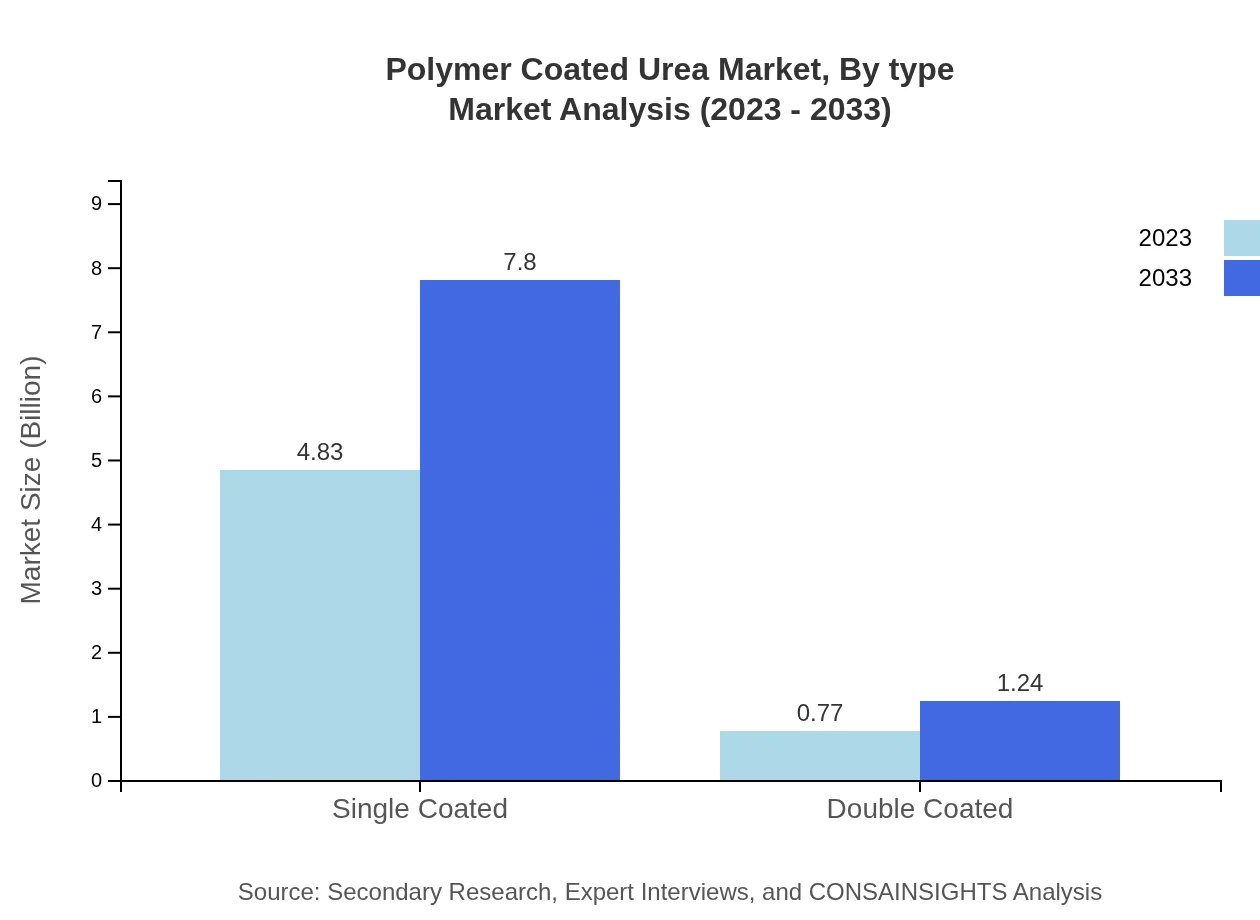

Polymer Coated Urea Market Analysis By Type

The Polymer Coated Urea market is significantly dominated by single-coated urea, accounting for a market size of USD 4.83 billion in 2023, which is set to increase to USD 7.80 billion by 2033. Double-coated urea, while smaller, is also poised for growth, from USD 0.77 billion in 2023 to USD 1.24 billion by 2033.

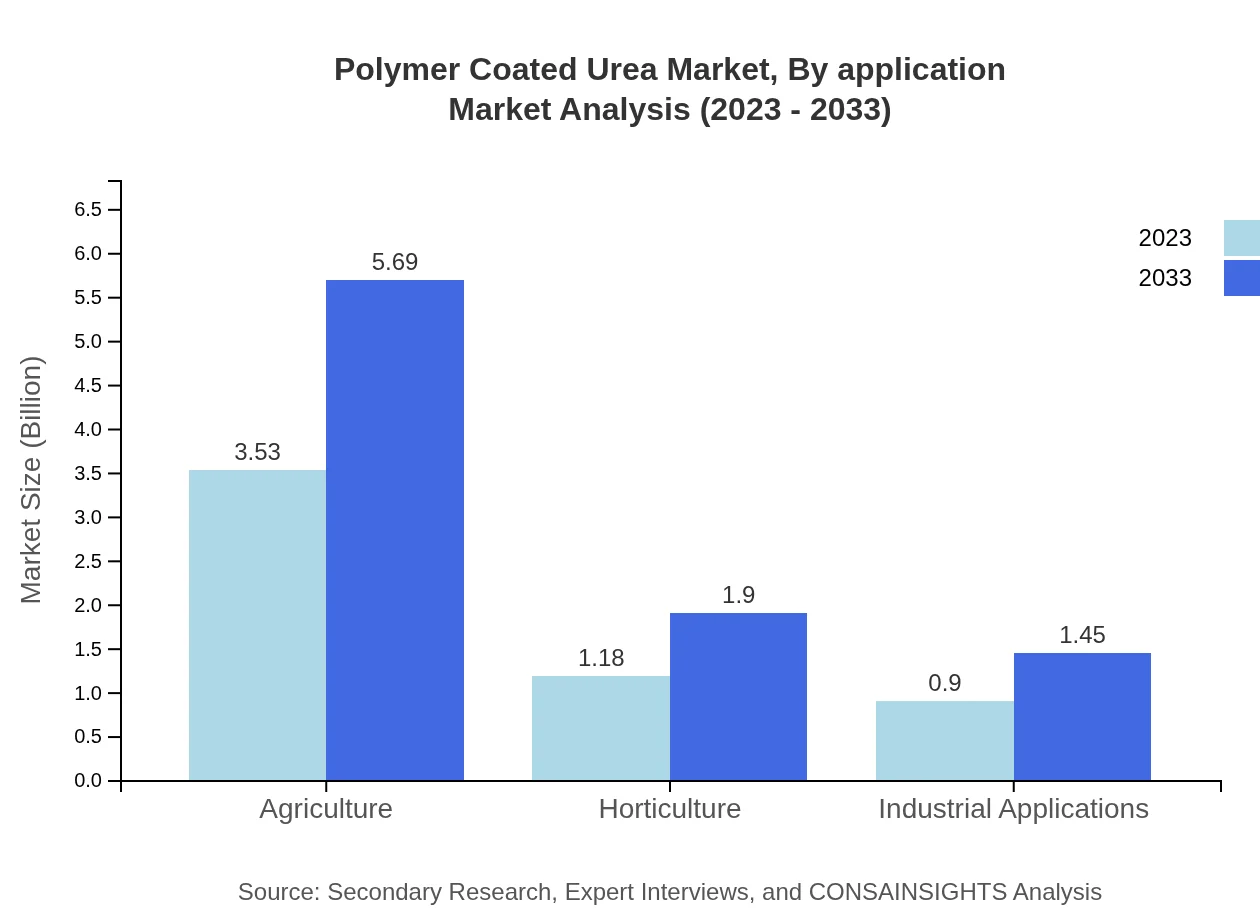

Polymer Coated Urea Market Analysis By Application

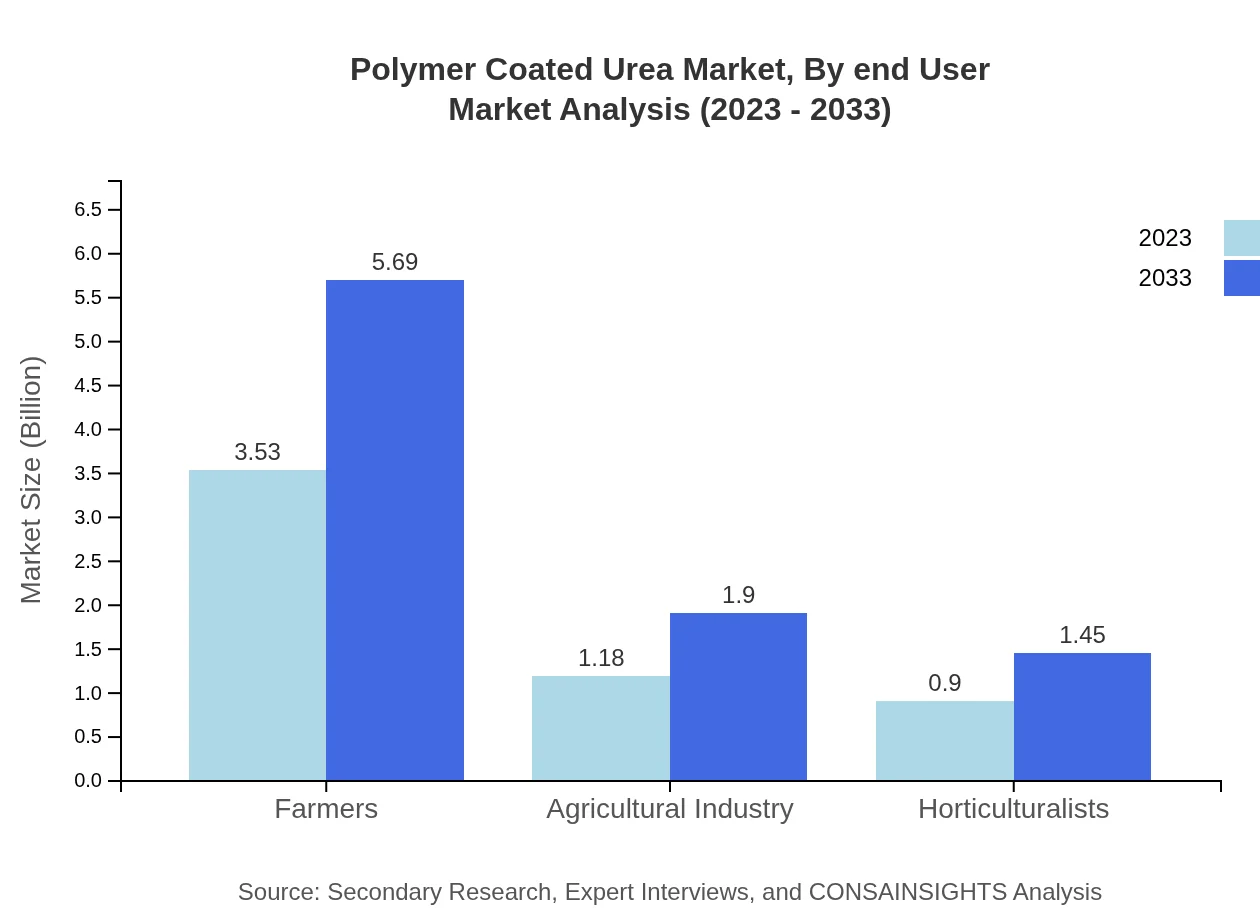

Applications of Polymer Coated Urea include farmers, agricultural industries, and horticulturalists. In 2023, the farmers segment leads with USD 3.53 billion, representing 62.95% of the market, growing to USD 5.69 billion by 2033. It demonstrates the critical role of polymer-coated urea in enhancing agricultural productivity.

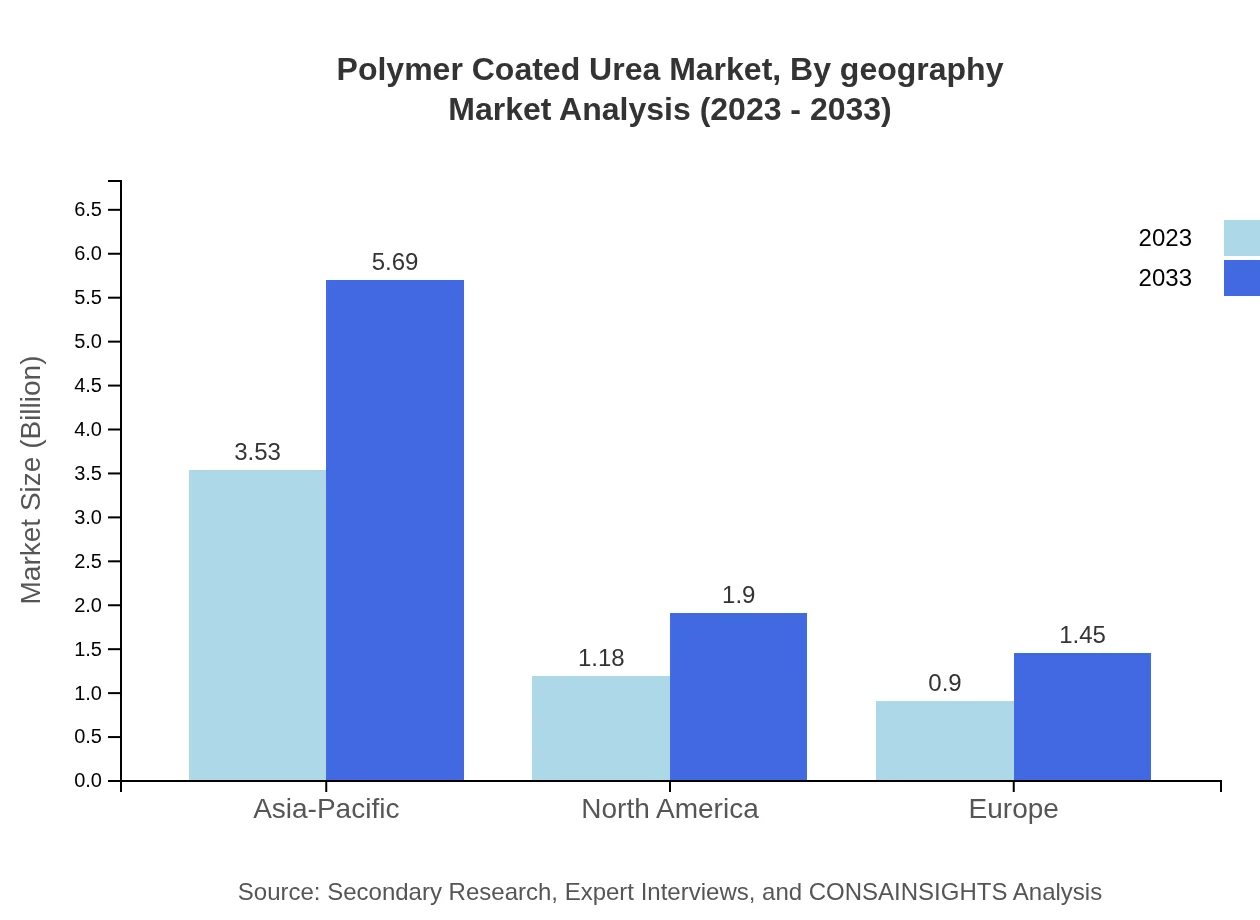

Polymer Coated Urea Market Analysis By Geography

Regional distribution reveals that Asia Pacific dominates with a 62.95% market share, underscoring the importance of this market in future growth prospects. North America and Europe follow with shares of 21.04% and 16.01%, respectively. Future strategies should focus on these geographical insights for effective market penetration.

Polymer Coated Urea Market Analysis By End User

Understanding end-users is crucial as the agricultural segment accounts for the majority of consumption, emphasizing the significance of polymer-coated urea in modern farming practices. Strategies targeting segment growth should leverage expanding agricultural markets.

Polymer Coated Urea Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Polymer Coated Urea Industry

Nutri-Tech Solutions:

A leader in eco-friendly fertilizers, Nutri-Tech Solutions specializes in innovative coated fertilizers that promote sustainable agriculture.Yara International:

Yara International is a global fertilization expert, focusing on sustainable crop nutrition and providing polymer-coated products as part of their agricultural solutions.Haifa Group:

Haifa Group is recognized for developing specialty fertilizers including polymer-coated urea, enhancing nutrient efficiency across various crops.OCI Nitrogen:

OCI Nitrogen offers a broad range of fertilizers including advanced polymer-coated urea solutions, serving agricultural fields worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of polymer Coated Urea?

The polymer-coated urea market is projected to reach $5.6 billion by 2033, growing at a CAGR of 4.8%. This growth reflects increasing agricultural demand and advancements in coated fertilizer technology.

What are the key market players or companies in the polymer Coated Urea industry?

Key players in the polymer-coated urea market include established fertilizer manufacturers and agribusiness stakeholders, focusing on sustainable farming solutions to meet the growing agricultural needs.

What are the primary factors driving the growth in the polymer Coated Urea industry?

Factors driving growth include the increasing demand for efficient fertilizers, advancements in coating technologies, and the rising adoption of precision agriculture practices across the globe.

Which region is the fastest Growing in the polymer Coated Urea market?

The fastest-growing region for polymer-coated urea is Europe, projected to grow from $2.04 billion in 2023 to $3.29 billion by 2033, reflecting a strong focus on sustainable agricultural practices.

Does ConsaInsights provide customized market report data for the polymer Coated Urea industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the polymer-coated urea sector, helping clients navigate market dynamics and strategic decisions.

What deliverables can I expect from this polymer Coated Urea market research project?

Deliverables include detailed market analysis, regional insights, growth forecasts, and competitive landscape assessments concerning polymer-coated urea, aimed at informing strategic planning.

What are the market trends of polymer Coated Urea?

Market trends indicate a shift towards sustainable fertilizers, increased investment in research for enhanced coatings, and growing use of polymer-coated urea in precision agriculture practices.