Polyol Sweeteners Market Report

Published Date: 31 January 2026 | Report Code: polyol-sweeteners

Polyol Sweeteners Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Polyol Sweeteners market, exploring its dynamics, size, segmentation, technological advancements, and regional analysis, alongside a forecast for growth from 2023 to 2033.

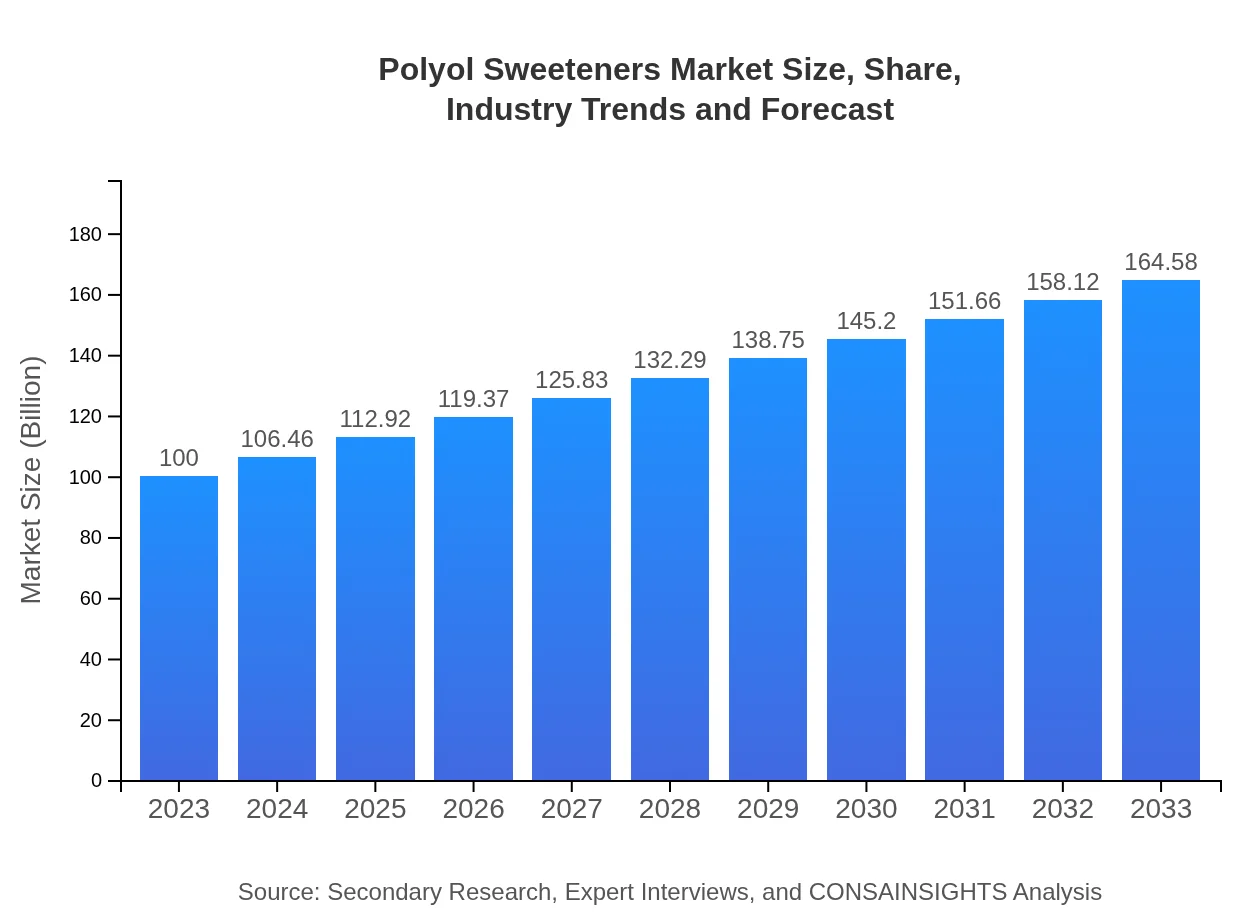

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Archer Daniels Midland Company (ADM), Cargill, Incorporated, Daesang Corporation, Mitsubishi Shoji Foodtech Co. Ltd., Tate & Lyle PLC |

| Last Modified Date | 31 January 2026 |

Polyol Sweeteners Market Overview

Customize Polyol Sweeteners Market Report market research report

- ✔ Get in-depth analysis of Polyol Sweeteners market size, growth, and forecasts.

- ✔ Understand Polyol Sweeteners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polyol Sweeteners

What is the Market Size & CAGR of Polyol Sweeteners market in 2023?

Polyol Sweeteners Industry Analysis

Polyol Sweeteners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polyol Sweeteners Market Analysis Report by Region

Europe Polyol Sweeteners Market Report:

The European Polyol Sweeteners market is anticipated to increase from $27.11 billion in 2023 to $44.62 billion by 2033. European consumers consistently prioritize low-sugar diets, promoting the consumption of polyol sweeteners. Regulatory initiatives aimed at sugar reduction and health-promoting policies have significantly impacted market expansion.Asia Pacific Polyol Sweeteners Market Report:

In the Asia Pacific region, the Polyol Sweeteners market is projected to grow from $19.13 billion in 2023 to $31.48 billion by 2033. The rise in health consciousness among consumers, coupled with increased production capabilities and technological advancements in food manufacturing, contributes to this growth. The demand for low-calorie snacks and beverages is particularly strong in markets like China and India.North America Polyol Sweeteners Market Report:

North America is expected to maintain its leadership in the Polyol Sweeteners market, growing from $37.92 billion in 2023 to $62.41 billion by 2033. The established food industry, coupled with a growing trend towards healthier food alternatives, continues to foster demand. Innovations and extensive product ranges offered by leading companies also support this growth trajectory.South America Polyol Sweeteners Market Report:

South America's Polyol Sweeteners market is set to expand from $9.84 billion in 2023 to $16.19 billion by 2033. The primary growth drivers are the rising prevalence of diabetes and obesity, leading to higher adoption of sugar substitutes. Urbanization and changing consumer preferences further influence market dynamics in this region.Middle East & Africa Polyol Sweeteners Market Report:

In the Middle East and Africa, the market for Polyol Sweeteners is expected to see growth from $6.00 billion in 2023 to $9.87 billion by 2033. Factors such as increasing awareness of healthy lifestyles and the rising demand for processed foods are pivotal. The region’s evolving retail landscape and improvements in food safety standards are also likely to bolster this market.Tell us your focus area and get a customized research report.

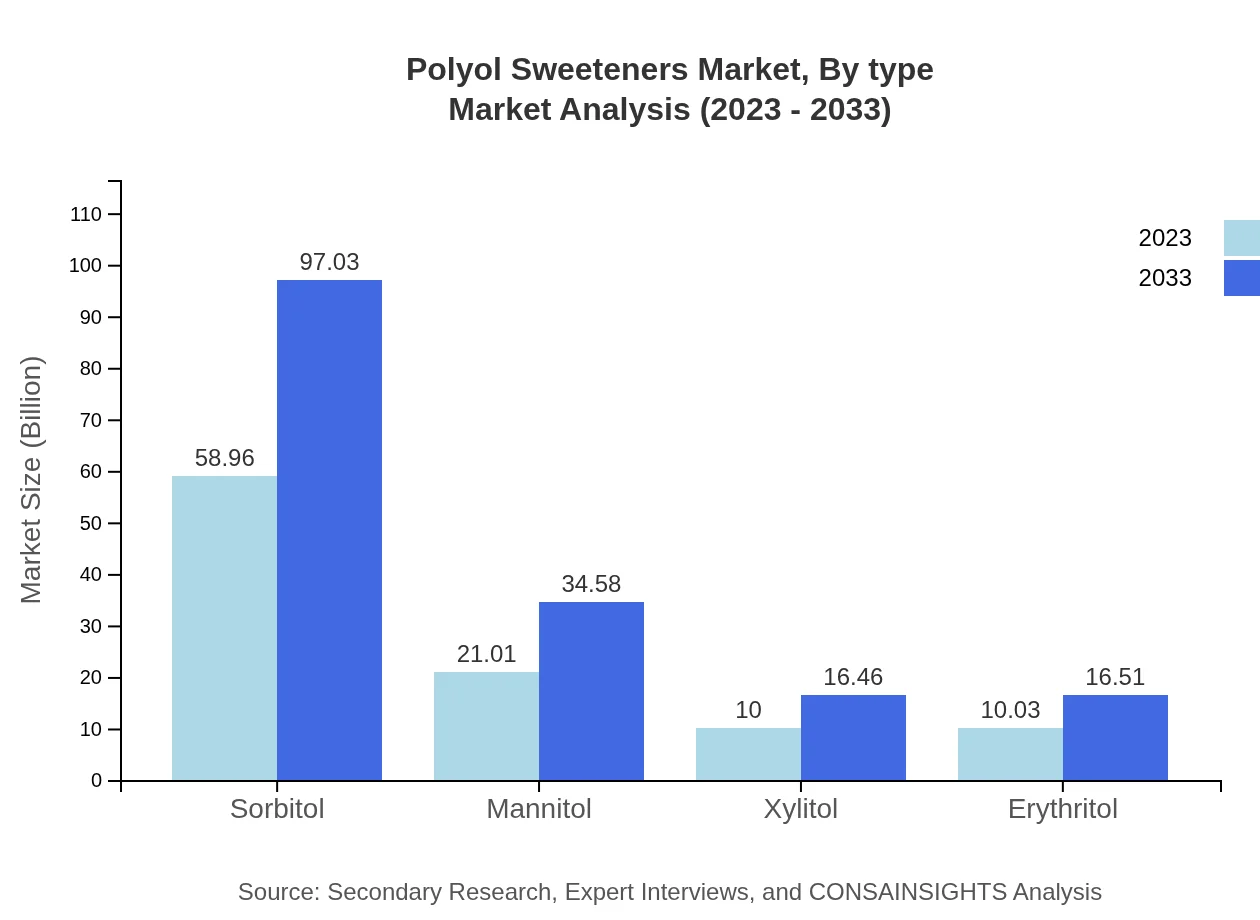

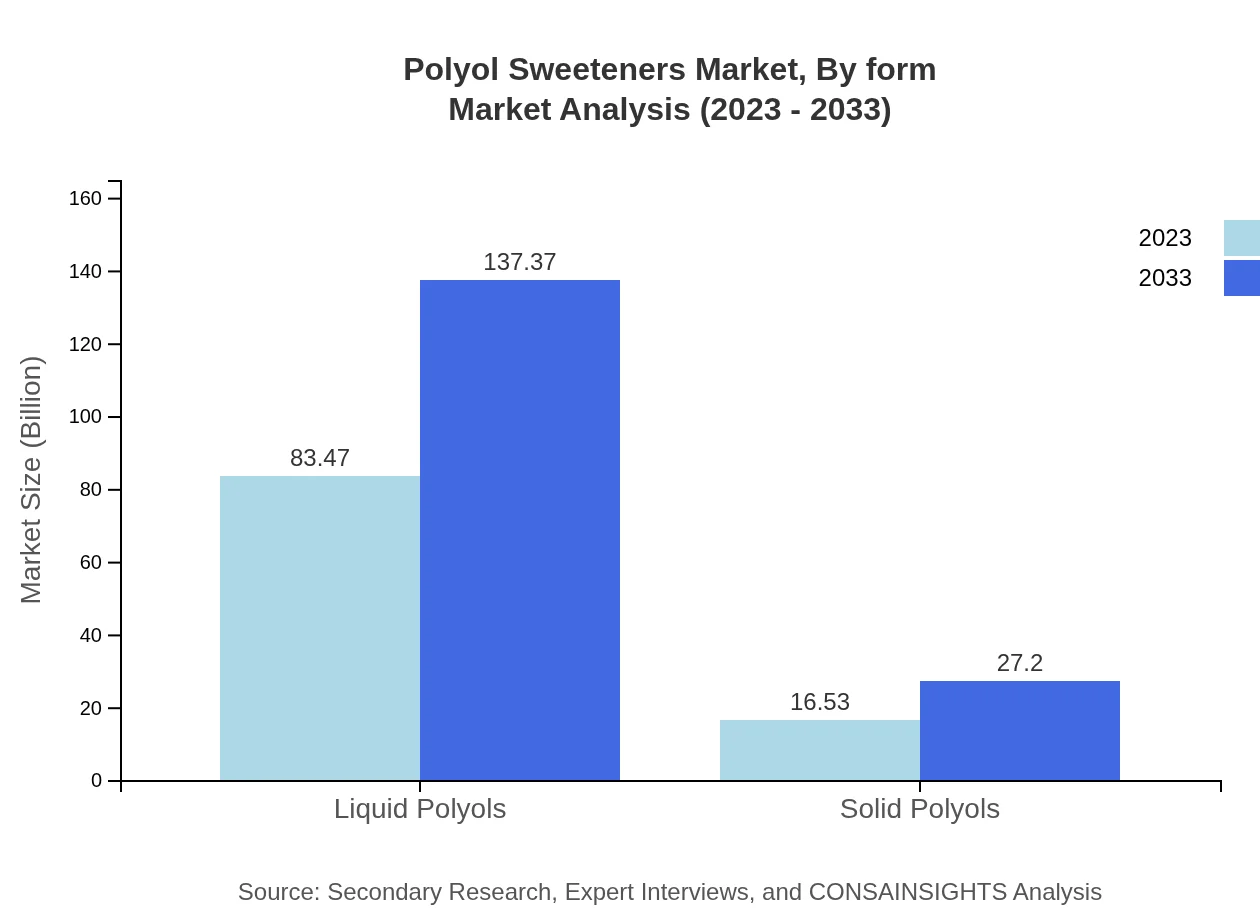

Polyol Sweeteners Market Analysis By Type

The Polyol Sweeteners market by type includes segments like Liquid Polyols and Solid Polyols. The Liquid Polyols segment is anticipated to flourish, rising from $83.47 billion in 2023 to $137.37 billion by 2033, driven by their widespread incorporation in food products. Conversely, Solid Polyols are expected to grow from $16.53 billion to $27.20 billion, with significant applications mainly in confectionery.

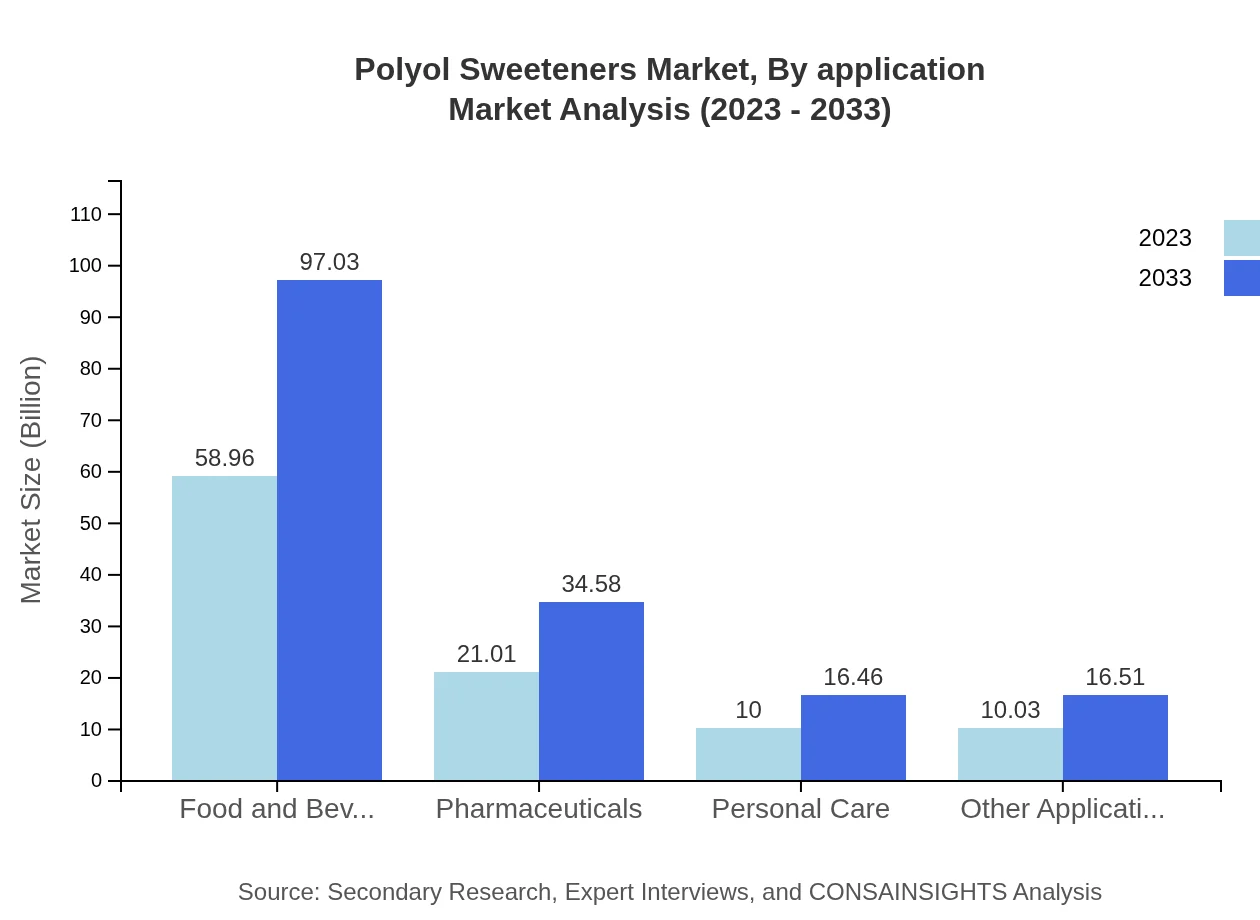

Polyol Sweeteners Market Analysis By Application

Food and Beverage remains the key application area for Polyol Sweeteners, predicted to grow from $58.96 billion in 2023 to $97.03 billion in 2033. Other significant applications include pharmaceuticals, which are forecasted to increase from $21.01 billion to $34.58 billion. This growth indicates a trend towards incorporating these sweeteners into healthier product lines.

Polyol Sweeteners Market Analysis By Form

Polyol Sweeteners can be categorized by form into solutions and powders, with a significant preference for powders due to their versatility in food applications. This segment is expected to witness stable growth fueled by the rising demand for customizable food ingredient solutions.

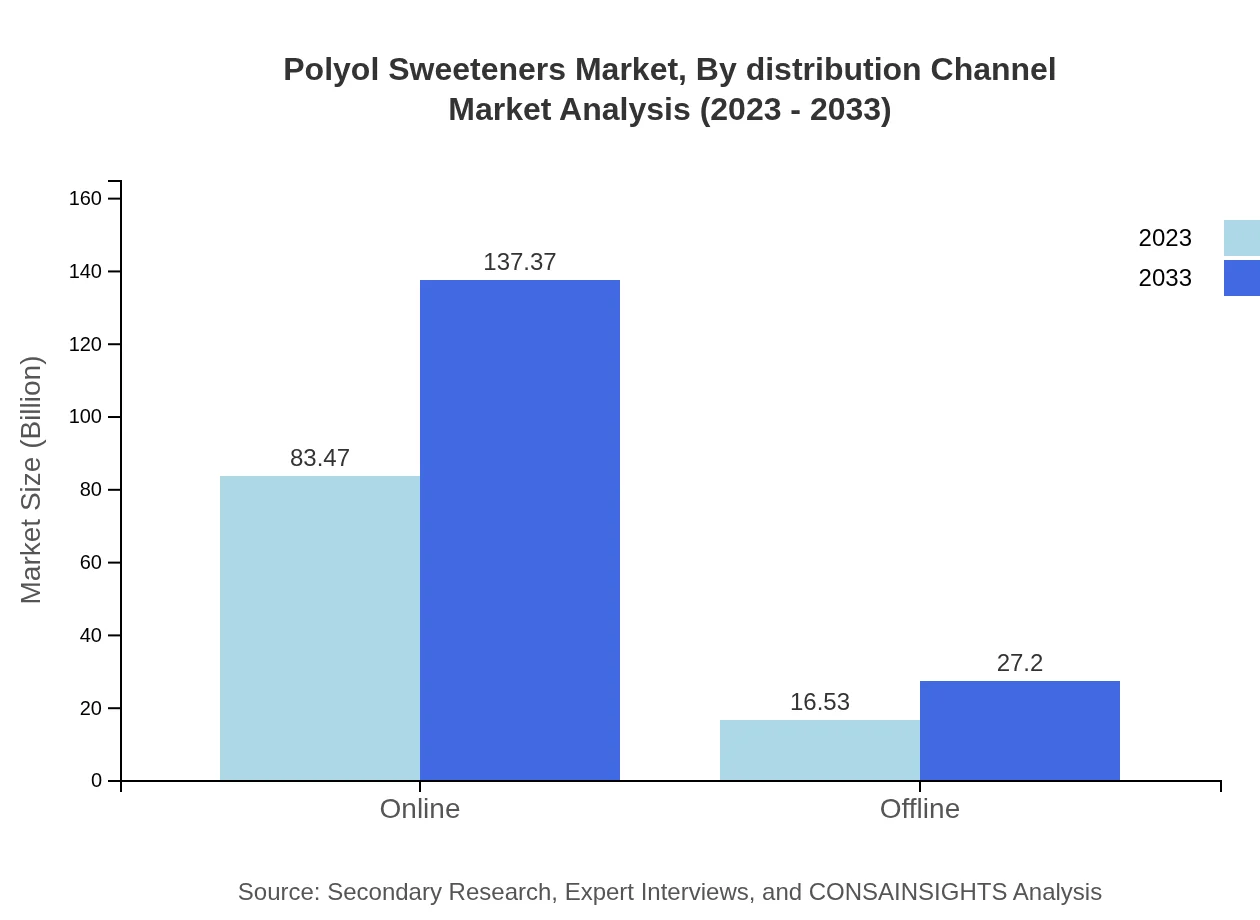

Polyol Sweeteners Market Analysis By Distribution Channel

The distribution channels are segmented into online and offline. The online segment is projected to increase markedly from $83.47 billion in 2023 to $137.37 billion by 2033, reflecting changing shopping behaviors. The offline segment, primarily consisting of brick-and-mortar stores, is set to grow from $16.53 billion to $27.20 billion, highlighting robust demand in traditional retail.

Polyol Sweeteners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polyol Sweeteners Industry

Archer Daniels Midland Company (ADM):

A leading global supplier of food ingredients and beverages, ADM has a robust portfolio in the production and distribution of Polyol Sweeteners, enhancing food product formulations.Cargill, Incorporated:

Cargill is a major player in the global food industry, providing a variety of Polyol Sweeteners designed to meet consumer demand for healthier options.Daesang Corporation:

Daesang is recognized for its commitment to innovation and sustainable practices in the production of polyols, catering to health-conscious consumers.Mitsubishi Shoji Foodtech Co. Ltd.:

As a top producer of food ingredients in Japan, Mitsubishi Shoji focuses on advancing Polyol Sweeteners technology, enhancing their market reach.Tate & Lyle PLC:

With a strong emphasis on product development and sustainability, Tate & Lyle actively participates in the Polyol Sweeteners market, offering unique solutions to manufacturers.We're grateful to work with incredible clients.

FAQs

What is the market size of polyol Sweeteners?

The polyol sweeteners market is projected to grow from $100 million in 2023 to a significant value by 2033, with a compound annual growth rate (CAGR) of 5%. This growth signifies increased demand across various applications and regions.

What are the key market players or companies in the polyol Sweeteners industry?

Key players in the polyol sweeteners market include major global manufacturers that specialize in food ingredients and sweetening agents. These companies lead the market through innovations and expansions in product offerings to meet diverse consumer needs.

What are the primary factors driving the growth in the polyol sweeteners industry?

The growth in the polyol sweeteners industry is primarily driven by increasing health consciousness among consumers, a rising demand for low-calorie sweeteners, and the expansion of applications in the food and beverage sectors.

Which region is the fastest Growing in the polyol Sweeteners market?

The fastest-growing region in the polyol sweeteners market is North America, projected to expand from $37.92 million in 2023 to $62.41 million by 2033. This region leads due to rising health trends and increased consumption of low-sugar products.

Does ConsaInsights provide customized market report data for the polyol Sweeteners industry?

Yes, ConsaInsights offers customized market report data for the polyol-sweeteners industry, enabling clients to gain insights tailored to their specific needs. This includes detailed analysis and forecasts pertinent to various market segments.

What deliverables can I expect from this polyol Sweeteners market research project?

Deliverables from the polyol-sweeteners market research project typically include comprehensive reports featuring market size estimations, competitive landscape analysis, segment data, and regional growth forecasts.

What are the market trends of polyol Sweeteners?

Key trends in the polyol-sweeteners market include a shift towards healthier, low-calorie foods, increased innovation in sweetener formulation, and growing interest in sustainable sourcing and production methods among consumers and manufacturers.