Polyoxin Market Report

Published Date: 31 January 2026 | Report Code: polyoxin

Polyoxin Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Polyoxin market from 2023 to 2033, highlighting key insights, market trends, and forecasts. It covers market size, regional dynamics, industry analysis, and segmentation to offer a comprehensive view of the Polyoxin industry.

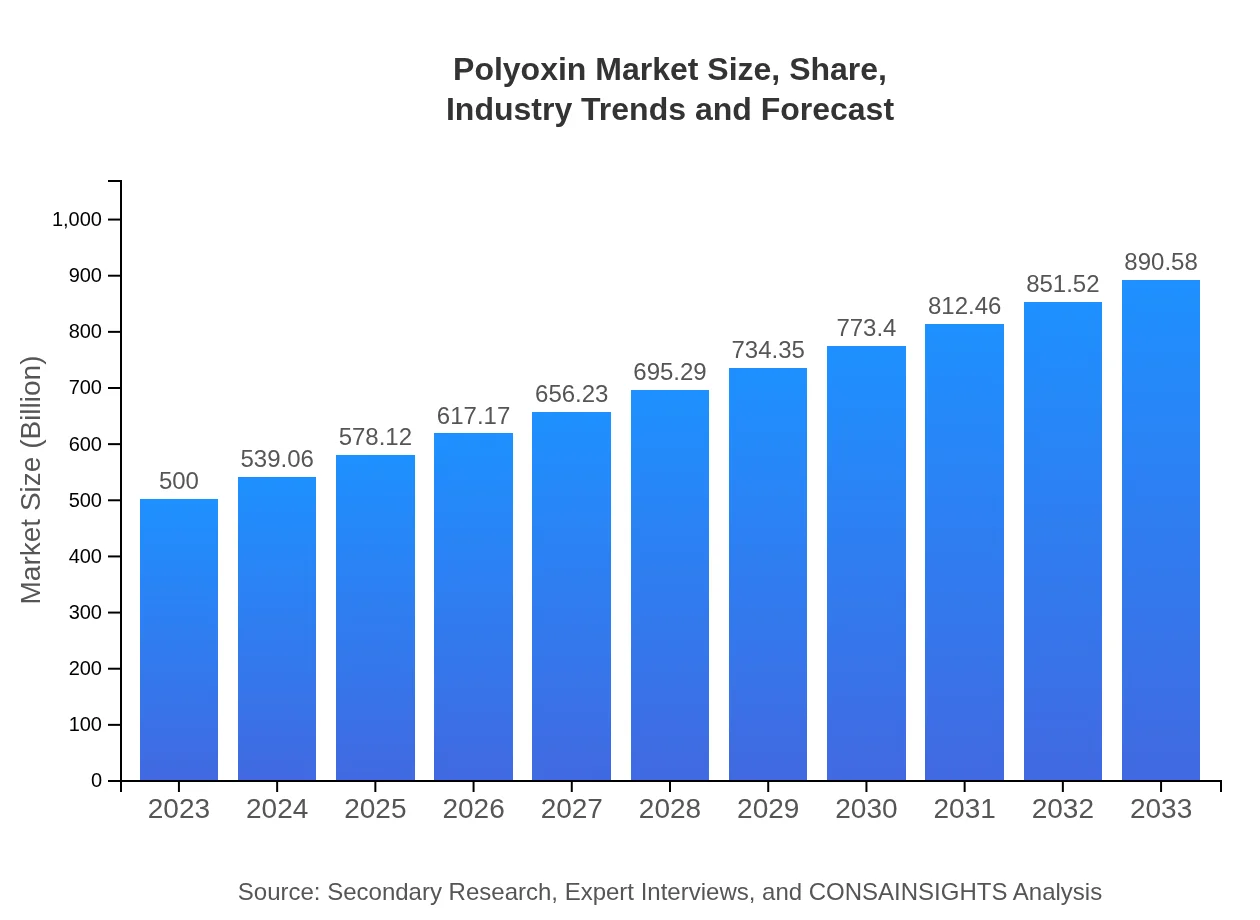

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $890.58 Million |

| Top Companies | BASF SE, FMC Corporation, Syngenta AG |

| Last Modified Date | 31 January 2026 |

Polyoxin Market Overview

Customize Polyoxin Market Report market research report

- ✔ Get in-depth analysis of Polyoxin market size, growth, and forecasts.

- ✔ Understand Polyoxin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polyoxin

What is the Market Size & CAGR of Polyoxin market in 2023?

Polyoxin Industry Analysis

Polyoxin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polyoxin Market Analysis Report by Region

Europe Polyoxin Market Report:

In Europe, the Polyoxin market is anticipated to rise from $164.85 million in 2023 to $293.62 million by 2033. The European Union's commitment to sustainability aligns with the rising demand for bio-based pesticides. Increased consumer pressure for organic produce has resulted in higher adoption rates of Polyoxin.Asia Pacific Polyoxin Market Report:

In the Asia Pacific region, the Polyoxin market is projected to grow from $93.45 million in 2023 to $166.45 million by 2033. Countries like China and India are rapidly adopting biofungicides due to increasing pest resistance, thus driving market growth. The rise of organic farming practices in this region also supports the market's expansion.North America Polyoxin Market Report:

North America, with a market size of $166.85 million in 2023, is forecasted to reach $297.19 million by 2033. The United States leads in organic farming efforts, providing a significant boost to the Polyoxin market. Consumer preferences for organic produce and stringent regulations on chemical pesticides are fuelling this growth.South America Polyoxin Market Report:

The South American market for Polyoxin is expected to increase from $26.50 million to $47.20 million over the next decade. Brazil and Argentina are key players, focusing on sustainable agricultural practices. The demand for effective crop protection in the face of climate change resilience plays a significant role in this market's growth.Middle East & Africa Polyoxin Market Report:

The Middle East and Africa Polyoxin market is projected to grow from $48.35 million to $86.12 million from 2023 to 2033. With growing investment in modern agricultural techniques and rising awareness of sustainable practices, countries in this region are seeing an uptick in Polyoxin utilization.Tell us your focus area and get a customized research report.

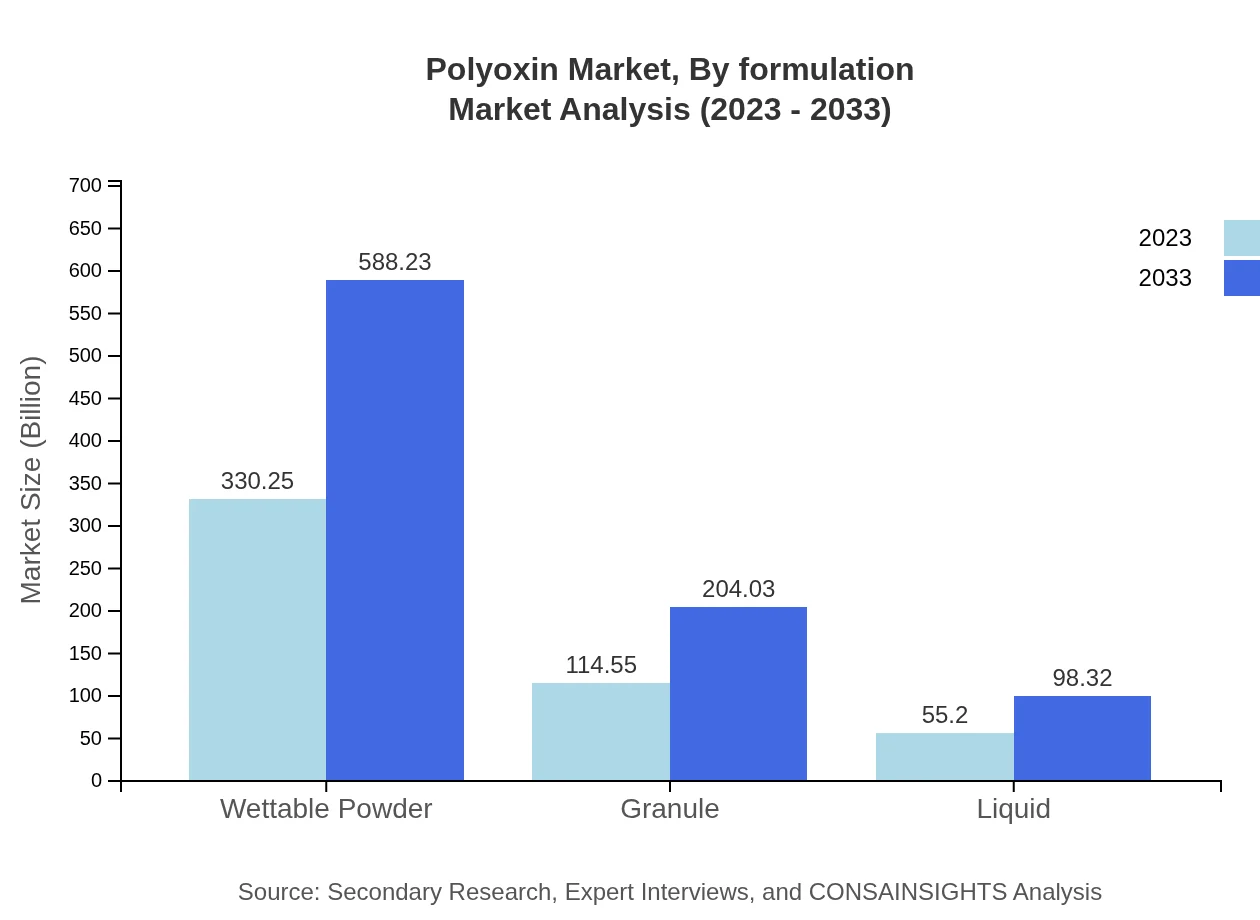

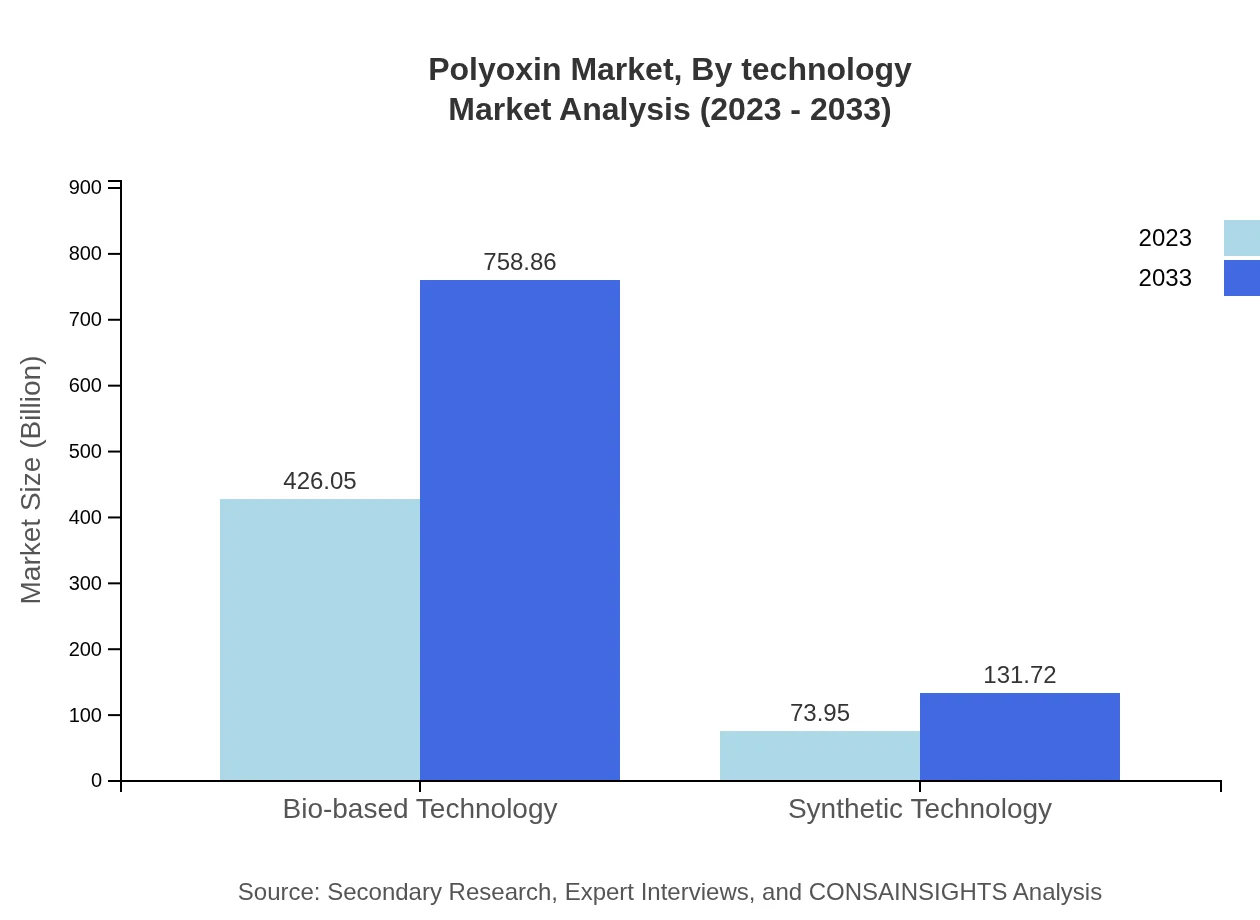

Polyoxin Market Analysis By Formulation

The Polyoxin market by formulation is divided into bio-based and synthetic technology. The bio-based segment dominated in 2023, with a market size of $426.05 million expected to grow to $758.86 million by 2033, indicating a clear consumer preference for natural solutions. The synthetic segment offers alternative formulations, contributing $73.95 million in 2023 and expected to reach $131.72 million, appealing to specific agricultural needs.

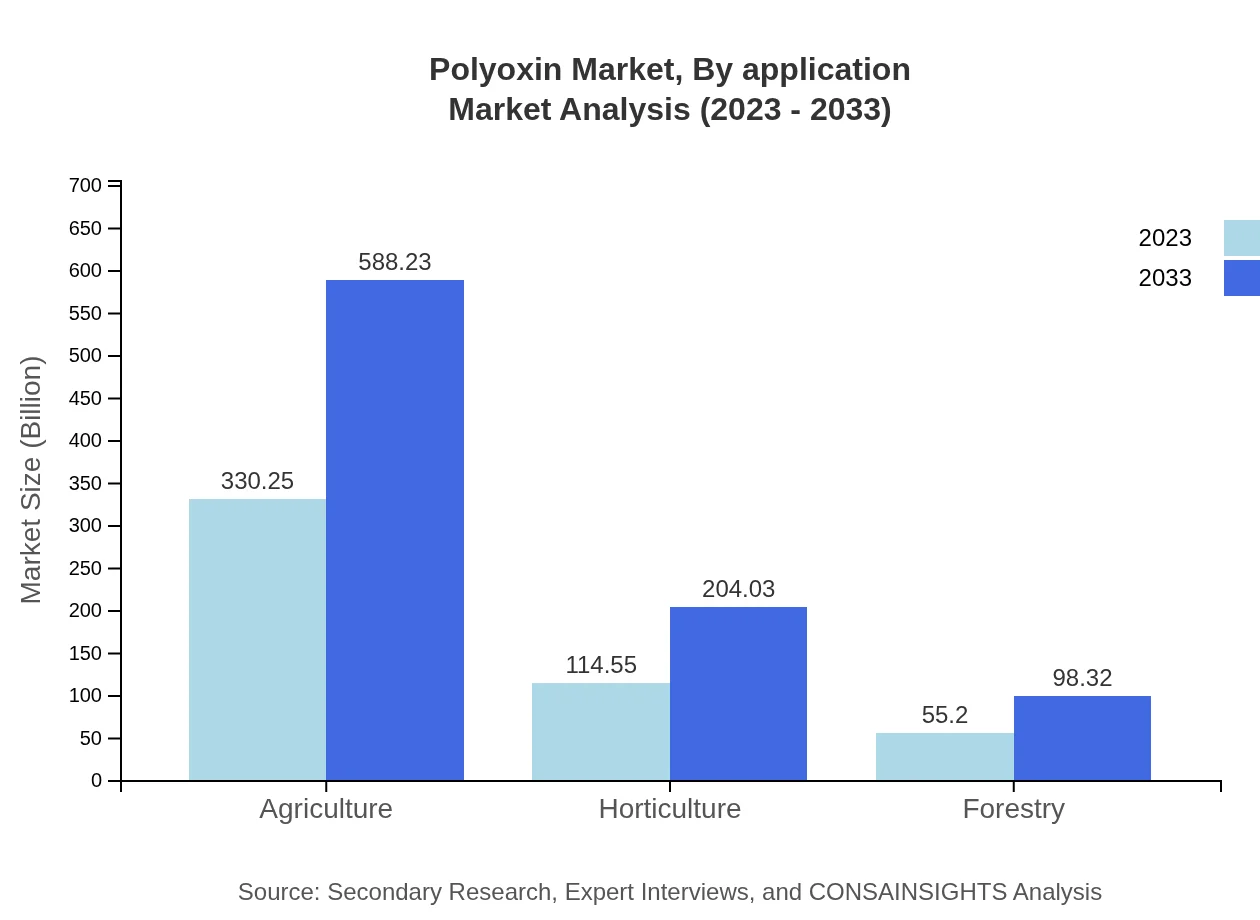

Polyoxin Market Analysis By Application

The Polyoxin market by application includes agriculture, horticulture, and forestry. The agriculture segment leads with $330.25 million in 2023, growing to $588.23 million by 2033, reflecting increased crop disease management needs. Horticulture and forestry segments also showcase growth potential, driven by ornamental plant care and sustainable forestry practices, respectively.

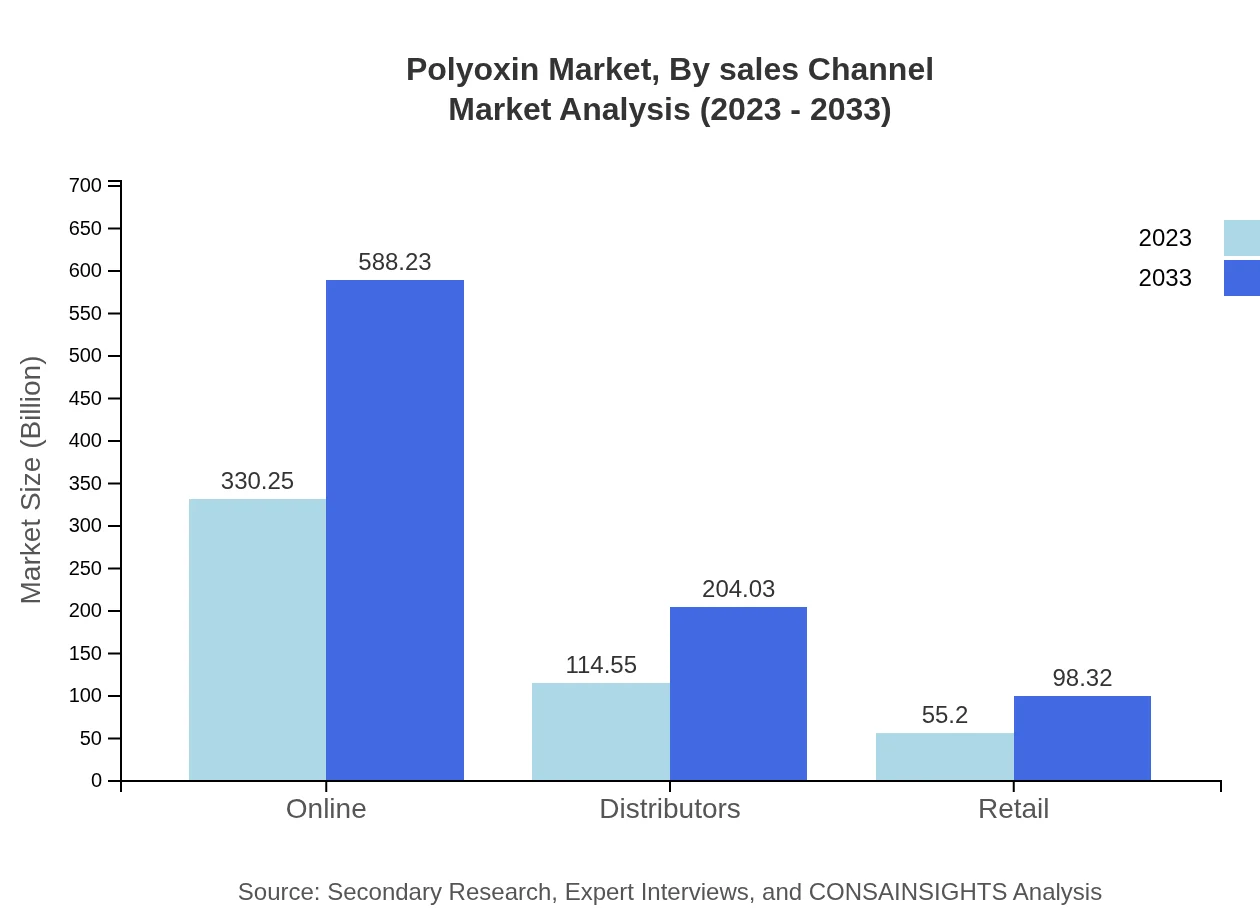

Polyoxin Market Analysis By Sales Channel

Under the sales channel segment, online and distributors dominate the market. Online sales are expected to increase from $330.25 million to $588.23 million, reflecting a shift towards e-commerce for agricultural products. Distributor channels, while significant, show a more modest growth trajectory from $114.55 million to $204.03 million.

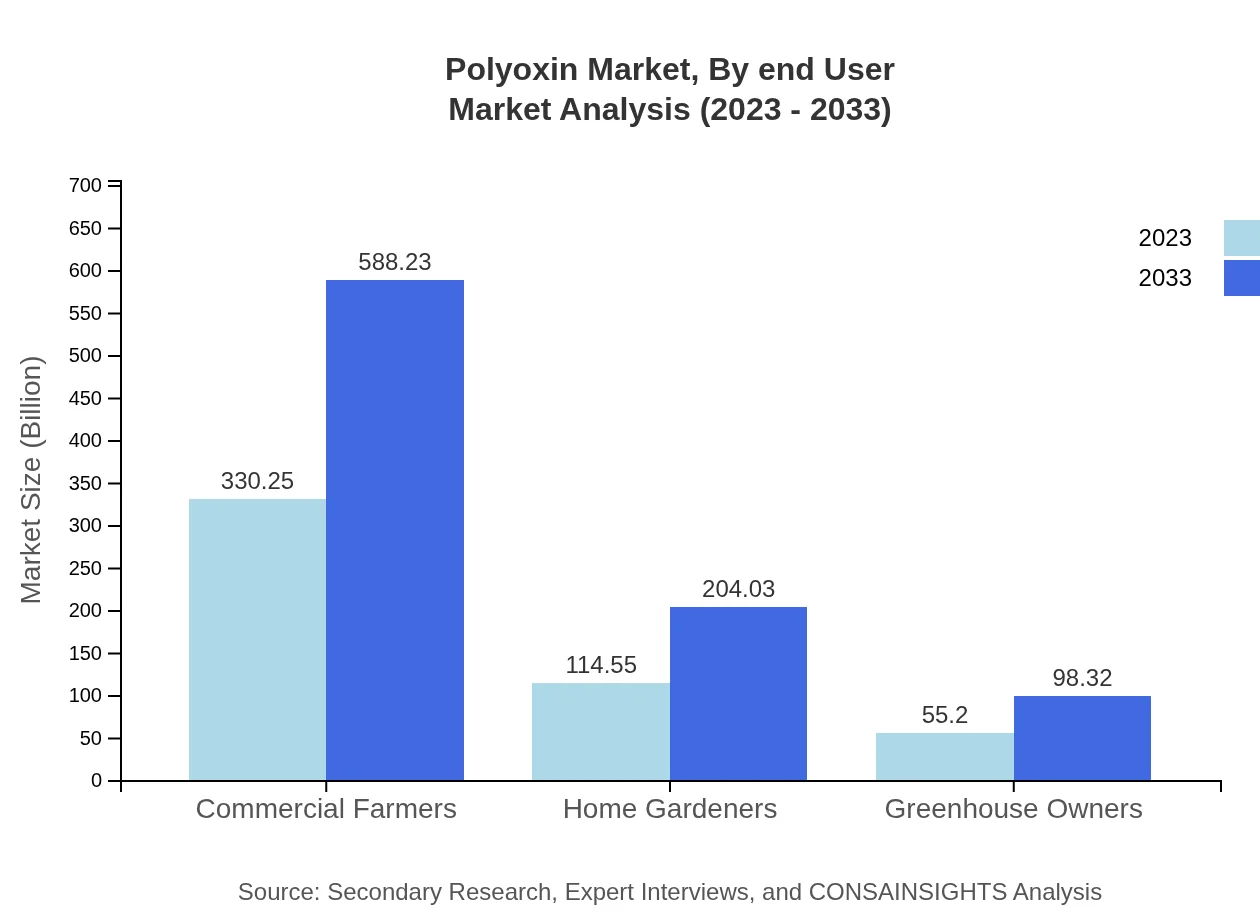

Polyoxin Market Analysis By End User

End-users of Polyoxin include commercial farmers, home gardeners, and greenhouse owners. Commercial farmers represent the largest segment, growing from $330.25 million to $588.23 million. The home gardener segment also sees significant growth, paralleling the organic gardening trend, expanding from $114.55 million to $204.03 million.

Polyoxin Market Analysis By Technology

The Polyoxin market by technology includes bio-based and synthetic technology, wherein bio-based technology constitutes a major share with $426.05 million in 2023 and a projected growth to $758.86 million by 2033. Synthetic technology supports traditional agricultural practices, expected to rise from $73.95 million to $131.72 million.

Polyoxin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polyoxin Industry

BASF SE:

BASF SE is a global leader in chemical and agricultural solutions, investing significantly in bio-based pesticides, including Polyoxin formulations, to drive innovative agricultural practices.FMC Corporation:

FMC Corporation is known for its advanced crop protection and innovative sustainable solutions, playing a vital role in developing and marketing Polyoxin products tailored to modern agricultural needs.Syngenta AG:

Syngenta AG is a major player in agrochemical solutions, dedicated to enhancing crop yields and developing environmentally friendly products, including Polyoxin, contributing to sustainable agriculture.We're grateful to work with incredible clients.

FAQs

What is the market size of Polyoxin?

The global Polyoxin market is currently valued at approximately $500 million, with a Compound Annual Growth Rate (CAGR) of 5.8% projected over the next decade, indicating strong growth potential.

What are the key market players or companies in the Polyoxin industry?

Key players in the Polyoxin market include major agricultural chemical companies and biotech firms, focusing on the production and development of biocontrol agents and fungicides tailored for sustainable agriculture.

What are the primary factors driving the growth in the Polyoxin industry?

The growth in the Polyoxin market is primarily driven by increasing demand for sustainable agriculture, regulations favoring eco-friendly solutions, and advancements in biocontrol technologies that enhance crop protection without affecting the environment.

Which region is the fastest Growing in the Polyoxin market?

The North American region is anticipated to be the fastest-growing in the Polyoxin market, with projections showing growth from $166.85 million in 2023 to $297.19 million by 2033, signifying substantial market opportunities.

Does ConsaInsights provide customized market report data for the Polyoxin industry?

Yes, ConsaInsights offers customized market reports for the Polyoxin industry, allowing clients to obtain tailored data and insights that fit their specific research needs and business objectives.

What deliverables can I expect from this Polyoxin market research project?

Deliverables from the Polyoxin market research project include detailed reports, data analysis, insights on market trends, competitive landscape overviews, and strategic recommendations to support informed decision-making.

What are the market trends of Polyoxin?

Current market trends for Polyoxin include the rising adoption of bio-based technologies, increasing preference for organic farming practices, and innovations in formulation technologies such as wettable powders and granules.