Polyphenol Market Report

Published Date: 31 January 2026 | Report Code: polyphenol

Polyphenol Market Size, Share, Industry Trends and Forecast to 2033

This report presents an extensive analysis of the Polyphenol market, providing insights on market size, growth forecasts from 2023 to 2033, industry trends, regional dynamics, and competitive landscape.

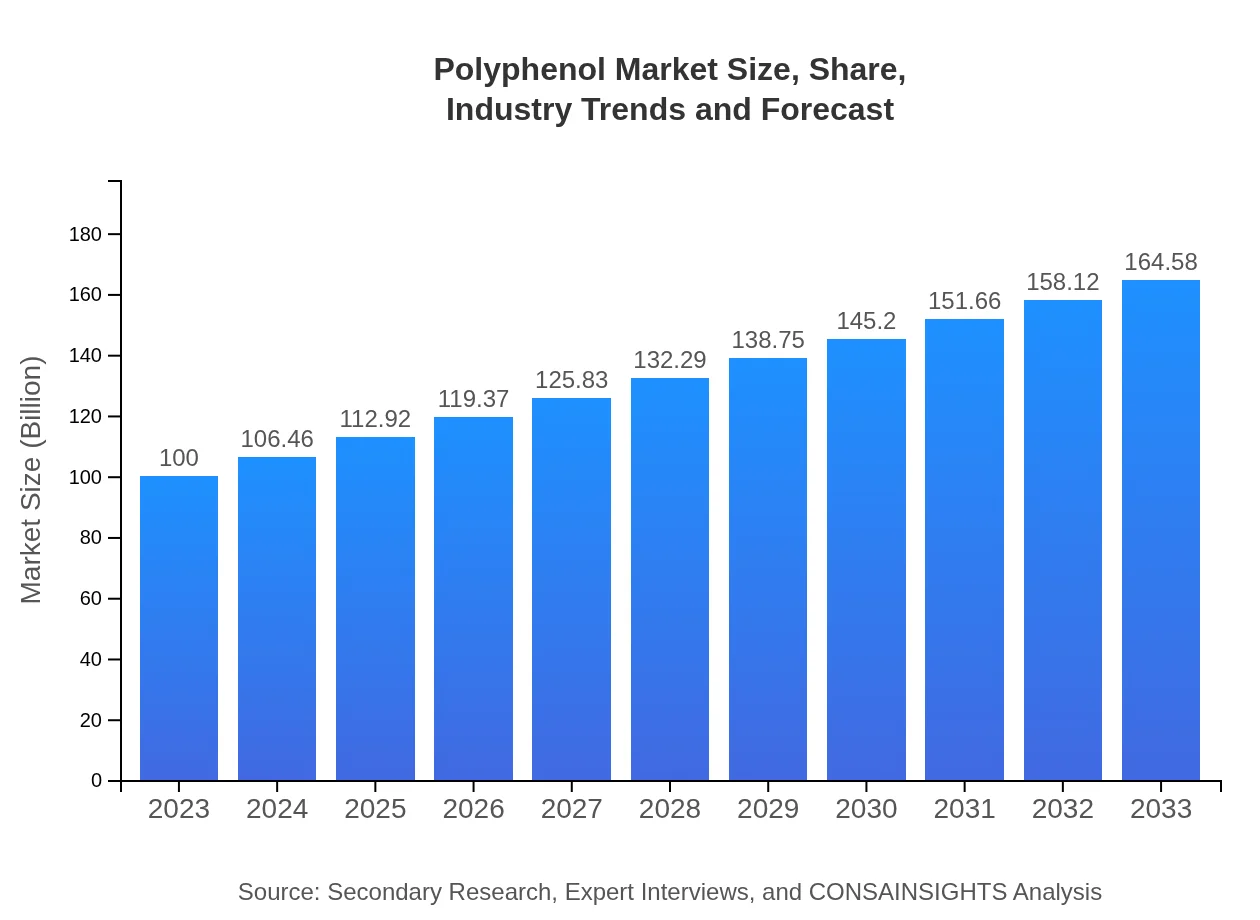

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Polyphenols, Inc., Kemin Industries, Inc., DSM Nutritional Products, BASF SE |

| Last Modified Date | 31 January 2026 |

Polyphenol Market Overview

Customize Polyphenol Market Report market research report

- ✔ Get in-depth analysis of Polyphenol market size, growth, and forecasts.

- ✔ Understand Polyphenol's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polyphenol

What is the Market Size & CAGR of Polyphenol market in 2023?

Polyphenol Industry Analysis

Polyphenol Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polyphenol Market Analysis Report by Region

Europe Polyphenol Market Report:

European polyphenol market is projected to expand from USD 32.04 billion in 2023 to USD 52.73 billion by 2033. The region is known for its stringent regulations on food safety and high demand for functional food and beverages, driving the market for polyphenol ingredients.Asia Pacific Polyphenol Market Report:

In the Asia Pacific region, the Polyphenol market is projected to grow from USD 18.56 billion in 2023 to USD 30.55 billion by 2033. The rise in health consciousness and increased consumption of green tea and plant-based products are key growth drivers. Countries like China and Japan are leading the demand due to their traditional consumption patterns of polyphenol-rich foods.North America Polyphenol Market Report:

North America holds a significant share of the Polyphenol market, with the size expected to rise from USD 36.23 billion in 2023 to USD 59.63 billion by 2033. The growing tendency towards preventive healthcare and the expanding dietary supplements market greatly contribute to this growth, driven by an active consumer base investing in health.South America Polyphenol Market Report:

The South American market for Polyphenols, although smaller, is expected to increase from USD 0.58 billion in 2023 to USD 0.95 billion by 2033. The region's emphasis on natural and organic products provides a favorable environment for polyphenol applications in food and nutraceuticals.Middle East & Africa Polyphenol Market Report:

The Polyphenol market in the Middle East and Africa is anticipated to grow from USD 12.59 billion in 2023 to USD 20.72 billion by 2033. Increased awareness of health benefits and a growing trend towards natural ingredients in food and cosmetics are propelling the market growth.Tell us your focus area and get a customized research report.

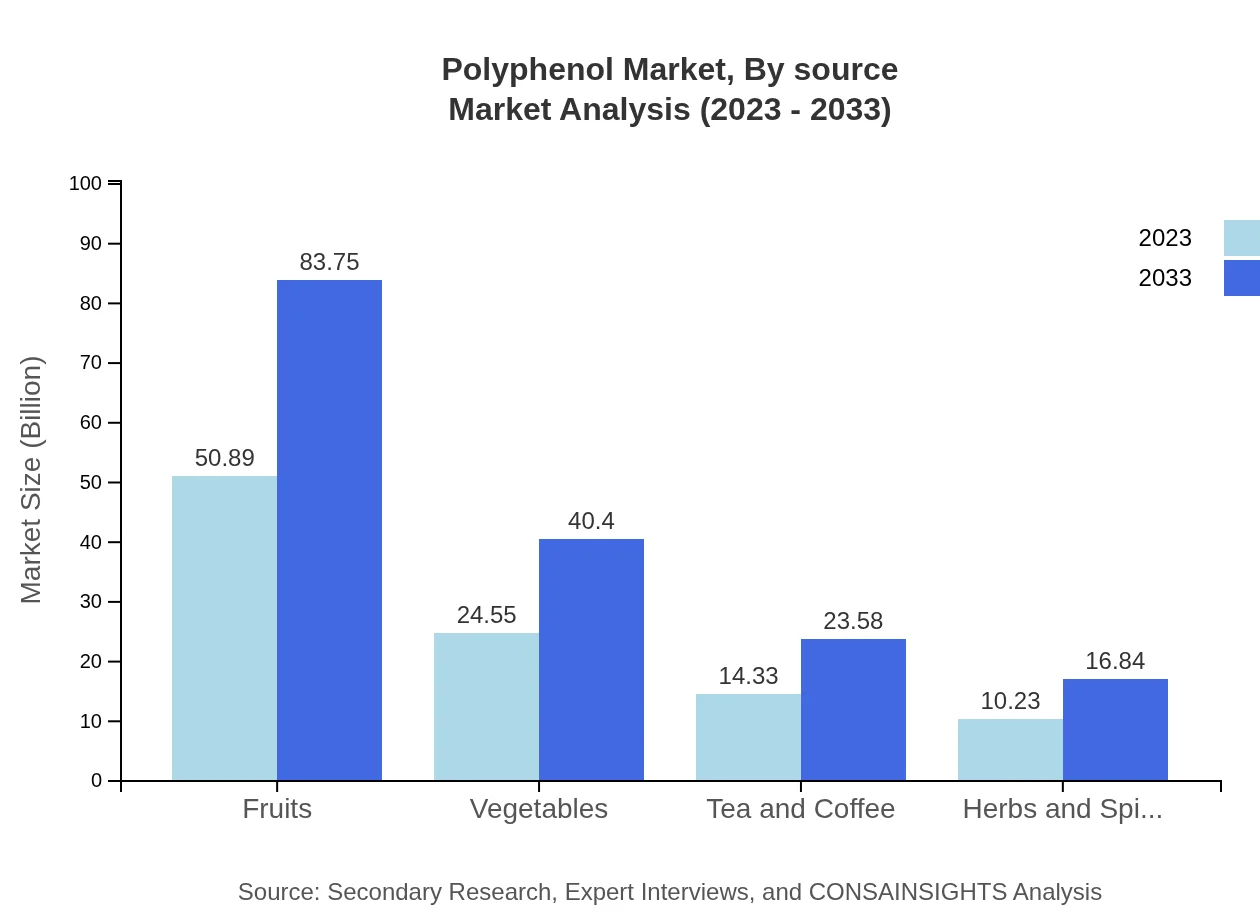

Polyphenol Market Analysis By Source

The Polyphenol market by source is dominated by fruits, contributing significantly to the overall market with a size of USD 50.89 billion in 2023, increasing to USD 83.75 billion by 2033. Other notable sources include vegetables, which account for USD 24.55 billion currently and are expected to reach USD 40.40 billion. Tea and coffee account for USD 14.33 billion and are projected to grow correspondingly. Herbs and spices contribute USD 10.23 billion, targeting niche applications in health and wellness.

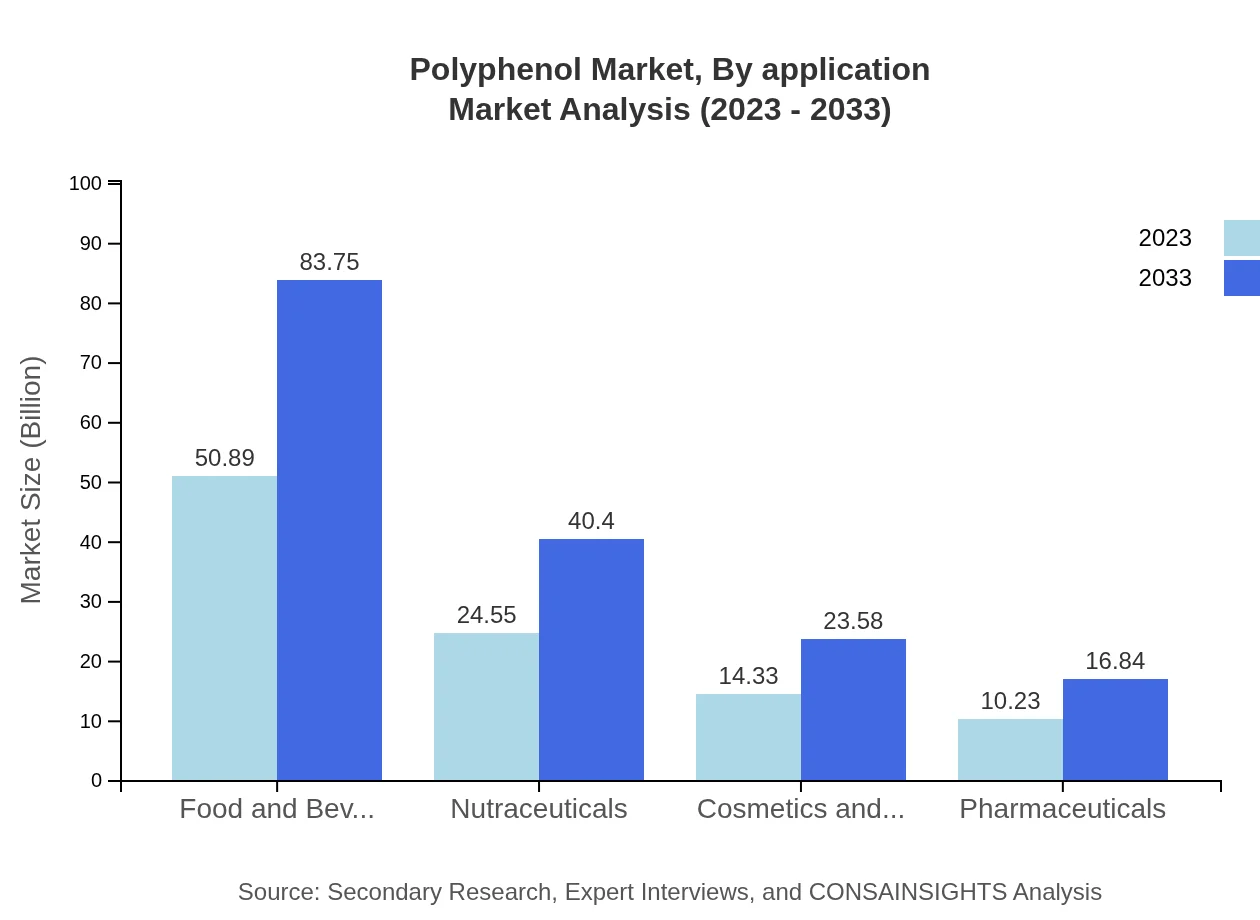

Polyphenol Market Analysis By Application

In terms of application, the food and beverages segment is the largest, with a market size of USD 50.89 billion in 2023 and expected to grow to USD 83.75 billion by 2033. The healthcare industry follows with a current market size of USD 28.69 billion, projected to reach USD 47.22 billion. Other applications including cosmetics and nutraceuticals also contribute to market diversity. The increased demand for clean-label products and awareness of health benefits significantly influence growth across all application segments.

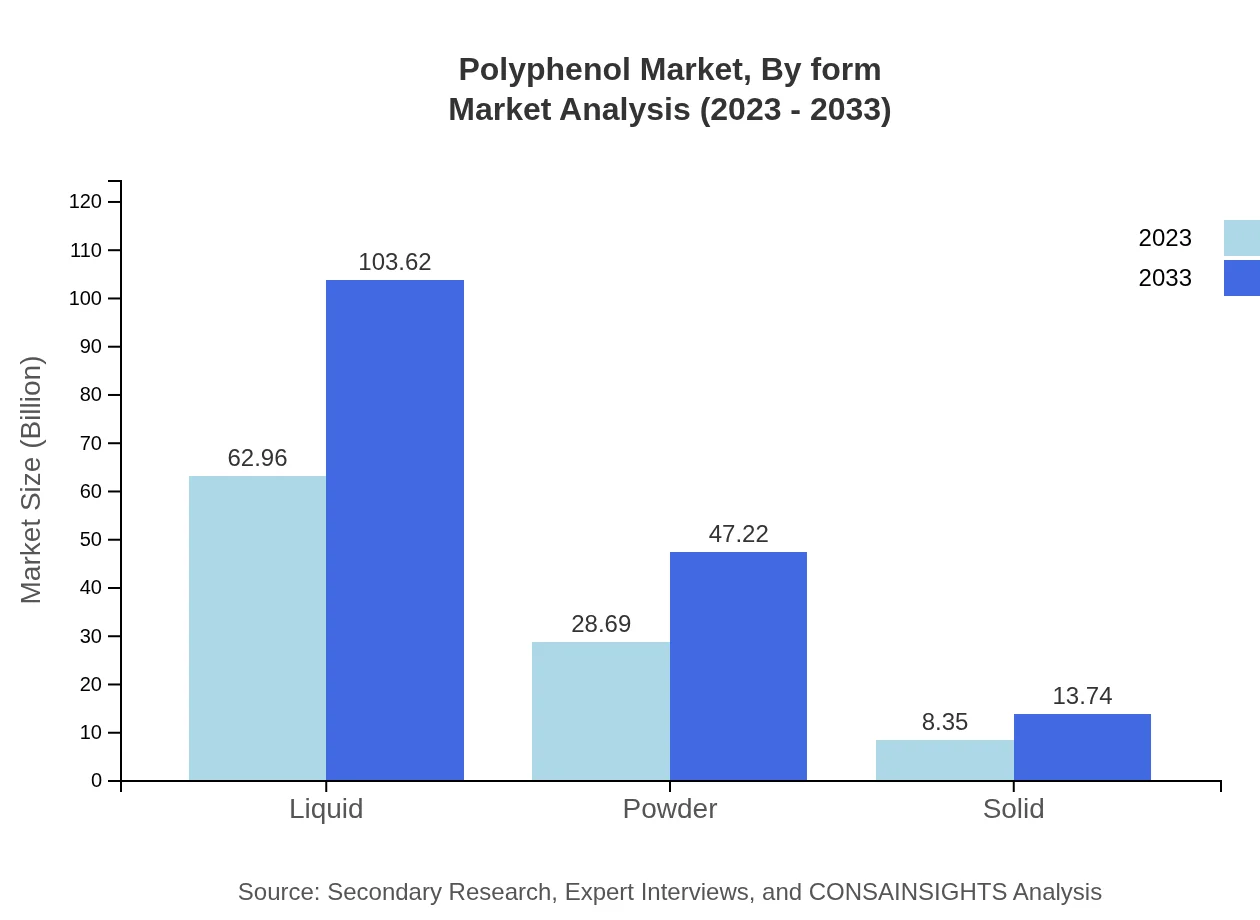

Polyphenol Market Analysis By Form

The Polyphenol market by form is classified into liquid, powder, and solid forms. As of 2023, the liquid segment dominates the market with a size of USD 62.96 billion, expected to be USD 103.62 billion by 2033. Powdered forms are also growing rapidly, moving from USD 28.69 billion to USD 47.22 billion, with solid forms lagging at USD 8.35 billion and increasing to USD 13.74 billion. These trends reflect consumer preferences towards versatile formulations in various products.

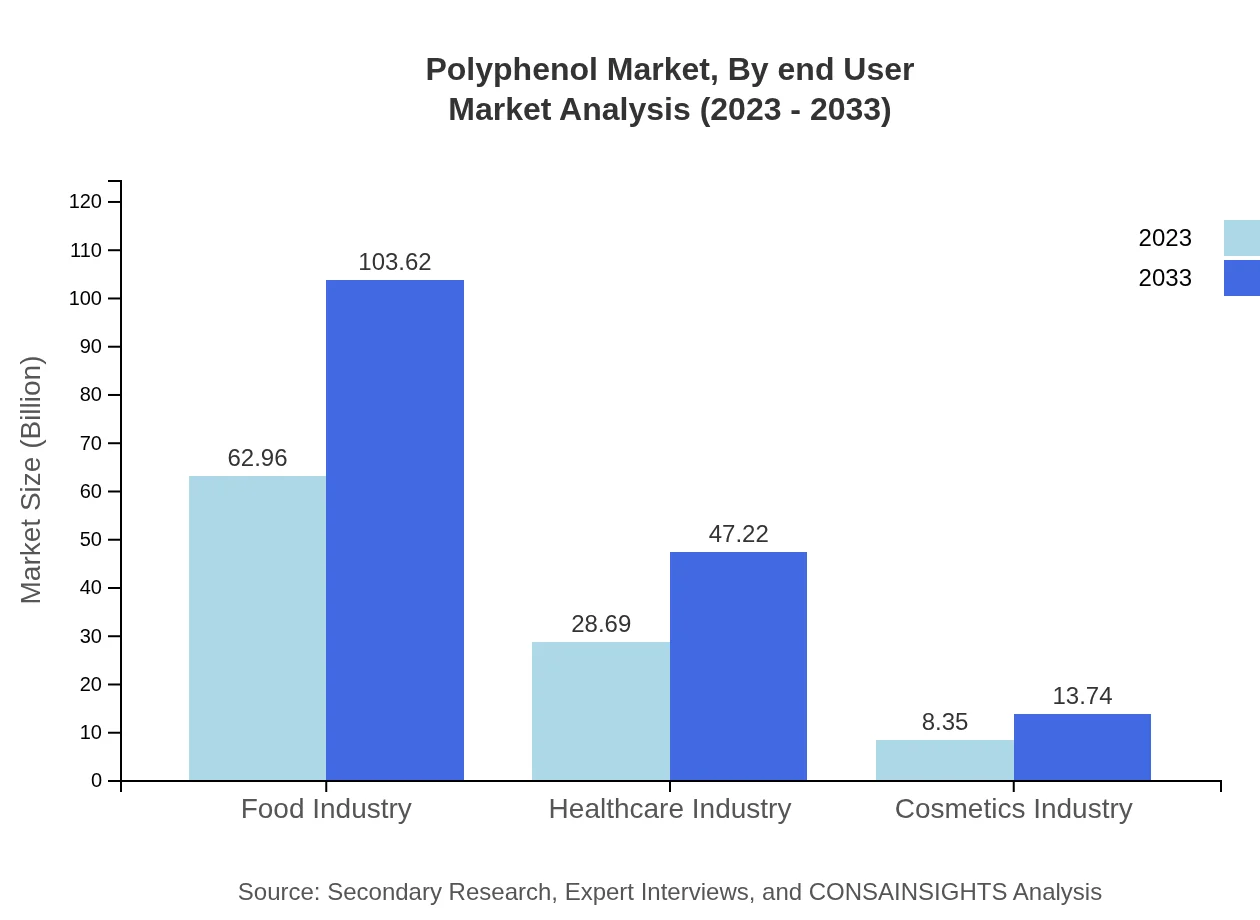

Polyphenol Market Analysis By End User

The Polyphenol market by end-user segments majorly includes the food industry, healthcare, and cosmetics industry among others. The food industry leads with a size of USD 62.96 billion and a similar projected growth trajectory. Healthcare stands at USD 28.69 billion and is expected to follow a robust growth pattern. Cosmetic applications also show promise, starting at USD 8.35 billion and moving towards USD 13.74 billion, reflecting the sector's increasing use of natural ingredients.

Polyphenol Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polyphenol Industry

Polyphenols, Inc.:

A leader in the extraction and supply of natural polyphenol compounds, committed to sustainable sourcing and innovative product development.Kemin Industries, Inc.:

Known for its range of nutritional ingredients, Kemin offers polyphenol extracts focused on health and wellness applications.DSM Nutritional Products:

A global health and nutrition company providing vital polyphenol-rich ingredients for fortified foods and supplements.BASF SE:

As a leading chemical company, BASF specializes in high-quality polyphenol production aimed at diverse applications, including food and cosmetics.We're grateful to work with incredible clients.

FAQs

What is the market size of polyphenol?

The polyphenol market size is estimated at USD 100 million in 2023, with a projected Compound Annual Growth Rate (CAGR) of 5%. The market is expected to expand significantly over the next decade.

What are the key market players or companies in this polyphenol industry?

Key players in the polyphenol industry include major companies such as Herbalife Nutrition Ltd, BASF SE, and Green Extracts. These organizations play significant roles in producing and supplying polyphenol products across various sectors.

What are the primary factors driving the growth in the polyphenol industry?

The growth in the polyphenol industry is primarily driven by increasing health consciousness, the demand for natural antioxidants, and the rising application of polyphenols in pharmaceuticals, nutraceuticals, and the food industry.

Which region is the fastest Growing in the polyphenol?

Among regions, North America is the fastest-growing market for polyphenol, projected to rise from USD 36.23 million in 2023 to USD 59.63 million by 2033. Following closely are Europe and Asia Pacific, exhibiting robust growth trajectories.

Does ConsaInsights provide customized market report data for the polyphenol industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the polyphenol industry. Clients can request segmented data and insights focused on unique market aspects and regional performance.

What deliverables can I expect from this polyphenol market research project?

From the polyphenol market research project, you can expect comprehensive reports detailing market size, growth forecasts, competitive analysis, trend evaluations, and regional insights, tailored to meet strategic business needs.

What are the market trends of polyphenol?

Current market trends in the polyphenol industry include a growing focus on plant-based ingredients, innovations in supplement formulations, and increased demand for polyphenol-rich foods in health-oriented diets.