Polyphthalamide Market Report

Published Date: 02 February 2026 | Report Code: polyphthalamide

Polyphthalamide Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Polyphthalamide market from 2023 to 2033, covering market size, growth potential, key trends, regional insights, and competitive landscape, providing valuable data for industry stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

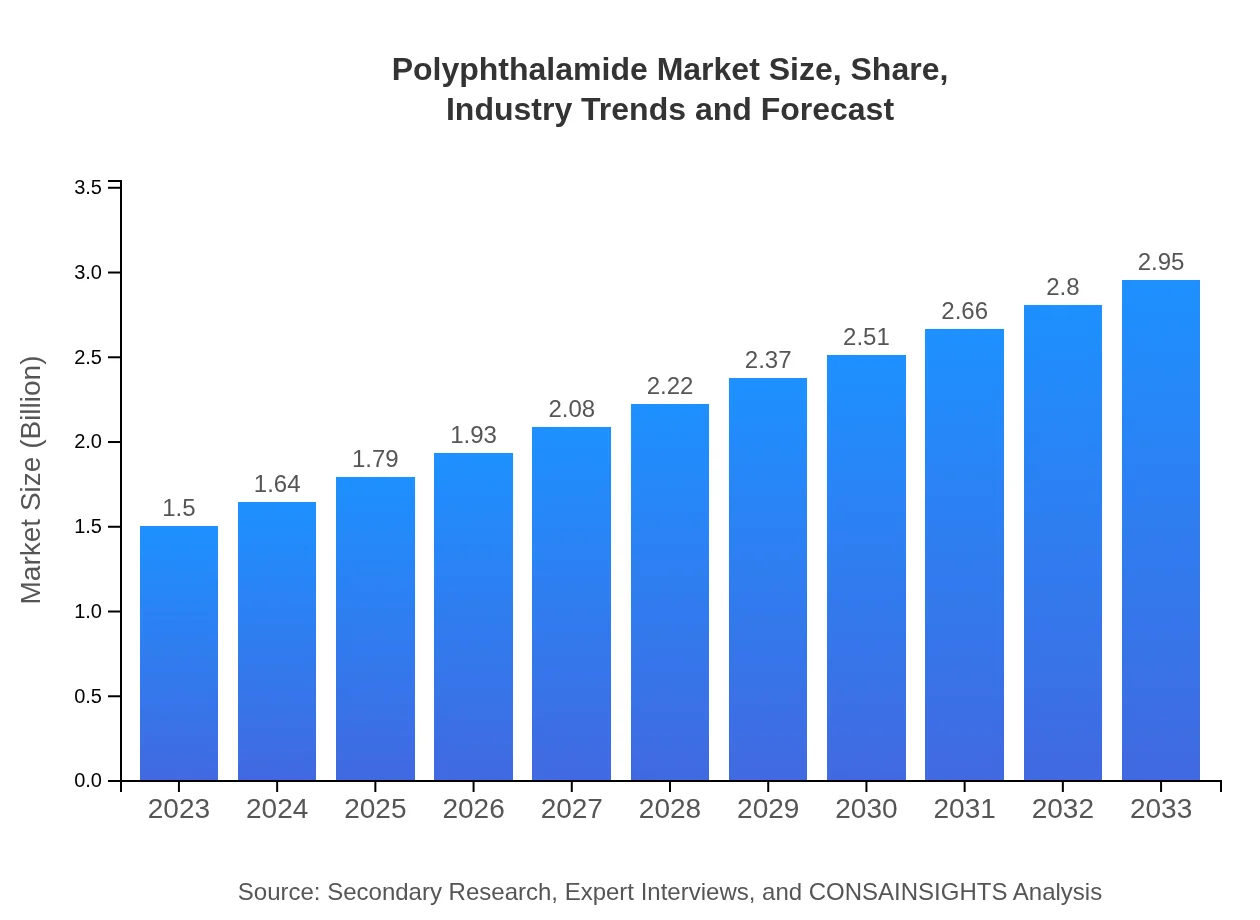

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | DuPont, BASF, Solvay, Mitsubishi Chemical |

| Last Modified Date | 02 February 2026 |

Polyphthalamide Market Overview

Customize Polyphthalamide Market Report market research report

- ✔ Get in-depth analysis of Polyphthalamide market size, growth, and forecasts.

- ✔ Understand Polyphthalamide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polyphthalamide

What is the Market Size & CAGR of Polyphthalamide market in 2023?

Polyphthalamide Industry Analysis

Polyphthalamide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polyphthalamide Market Analysis Report by Region

Europe Polyphthalamide Market Report:

The European Polyphthalamide market is anticipated to grow from USD 0.54 billion in 2023 to USD 1.06 billion by 2033. As industries strive for lightweight solutions and increased sustainability, PPA's role in auto and aerospace sectors becomes crucial, along with regulatory pressures pushing for greener alternatives.Asia Pacific Polyphthalamide Market Report:

In Asia Pacific, the Polyphthalamide market is projected to grow from USD 0.27 billion in 2023 to USD 0.53 billion by 2033. The rapid industrialization and increasing automotive production in countries like China and India significantly boost demand. The region's commitment to advancing technology and infrastructure is expected to further support market growth.North America Polyphthalamide Market Report:

North America is a key market with growth expected from USD 0.51 billion in 2023 to USD 1.00 billion by 2033. The region's focus on automotive and electronics industries drives innovation in material usage, fostering growth as manufacturers seek superior materials for performance applications.South America Polyphthalamide Market Report:

The South American market for Polyphthalamide remains minimal, with values remaining stagnant around USD 0.00 billion due to limited industrial applications and high import costs. However, growth opportunities may arise from increased focus on renewable energy and automotive manufacturing in countries such as Brazil and Argentina.Middle East & Africa Polyphthalamide Market Report:

The Middle East and Africa segment shows growth from USD 0.18 billion in 2023 to USD 0.35 billion by 2033. This growth is driven by rising investments in the oil and gas sector and increasing demand for high-performance materials in construction, signaling robust potential amid regional economic diversification efforts.Tell us your focus area and get a customized research report.

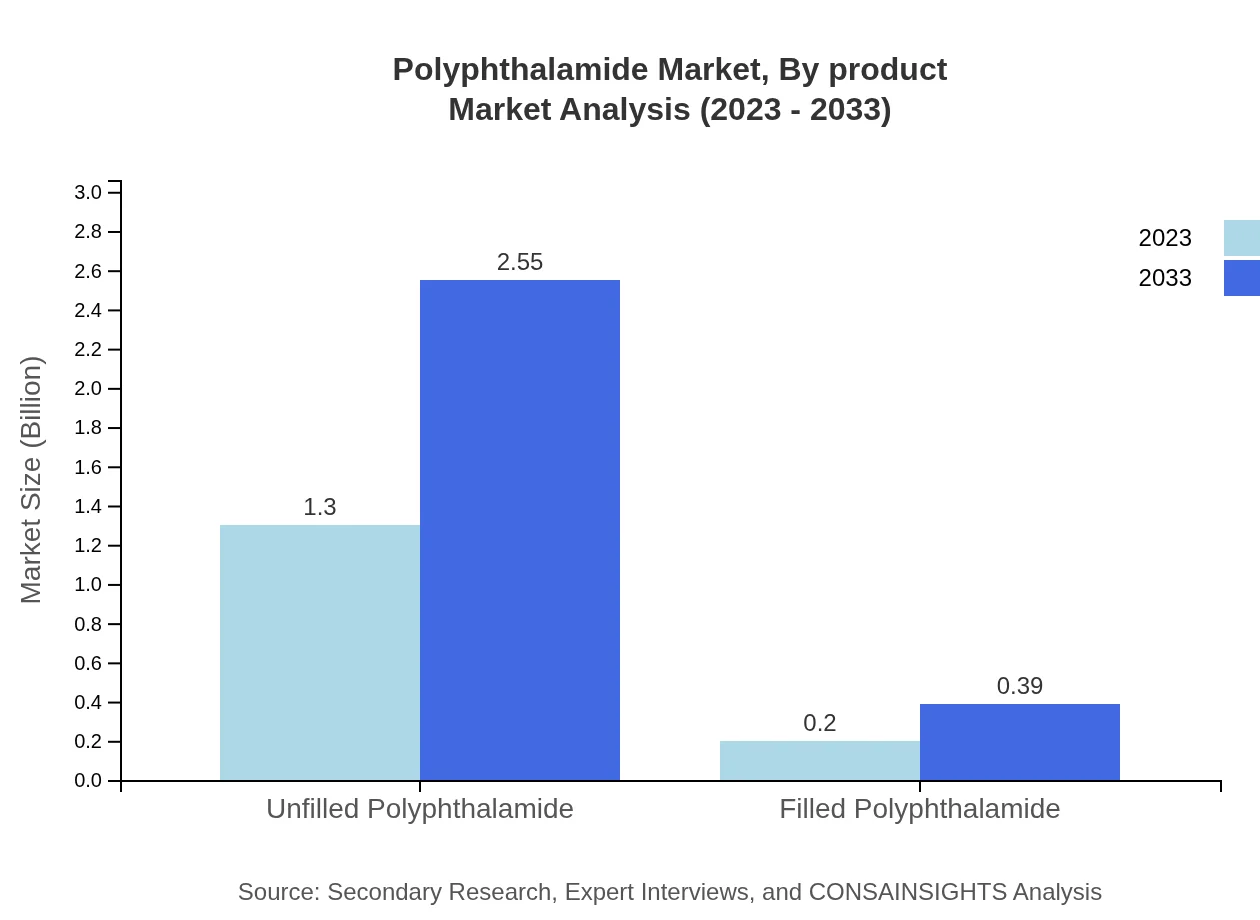

Polyphthalamide Market Analysis By Product

The market for unfilled Polyphthalamide is valued at USD 1.30 billion in 2023, expected to reach USD 2.55 billion by 2033, maintaining a share of 86.61%. Filled Polyphthalamide, while smaller at USD 0.20 billion in 2023, is anticipated to grow to USD 0.39 billion, capturing 13.39% market share as industries seek enhanced performance capabilities.

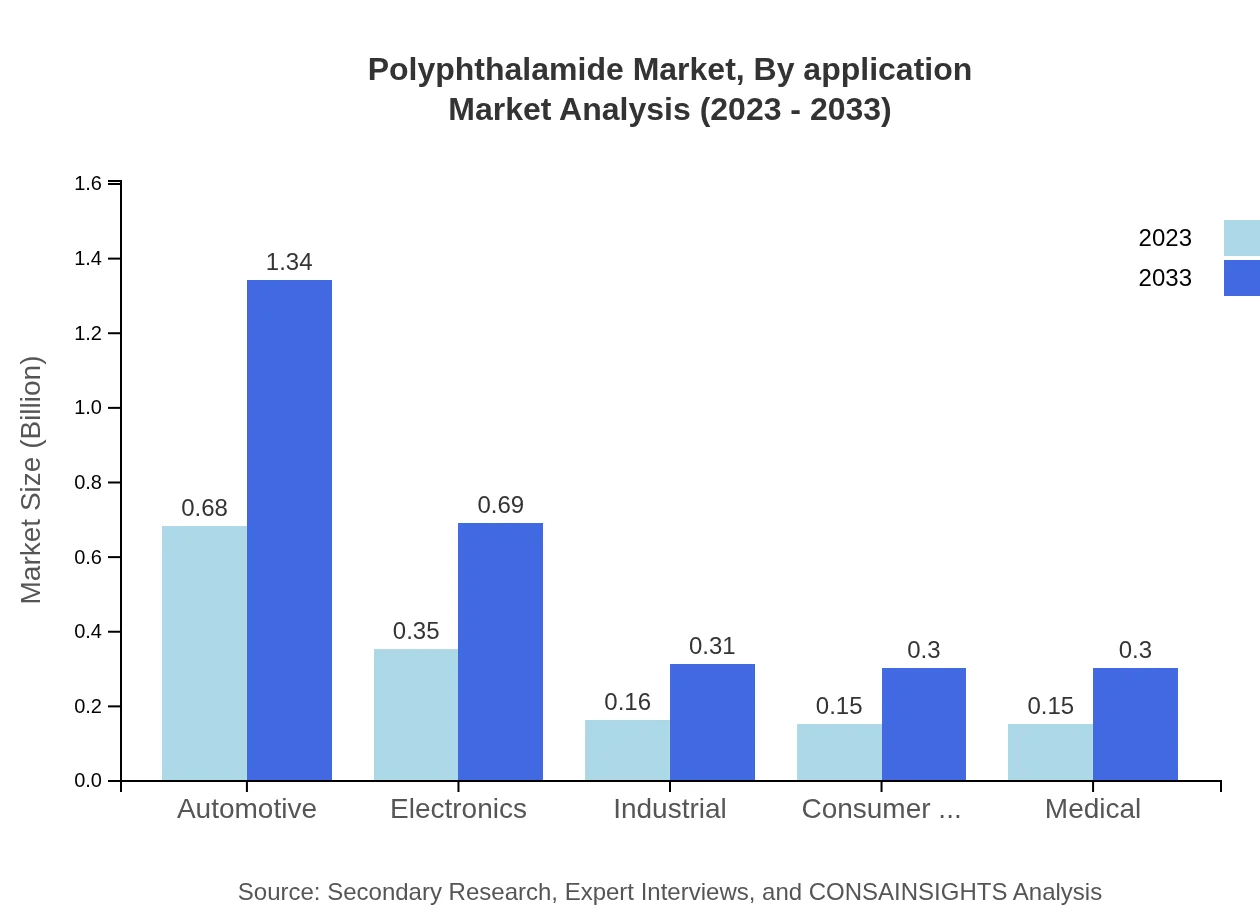

Polyphthalamide Market Analysis By Application

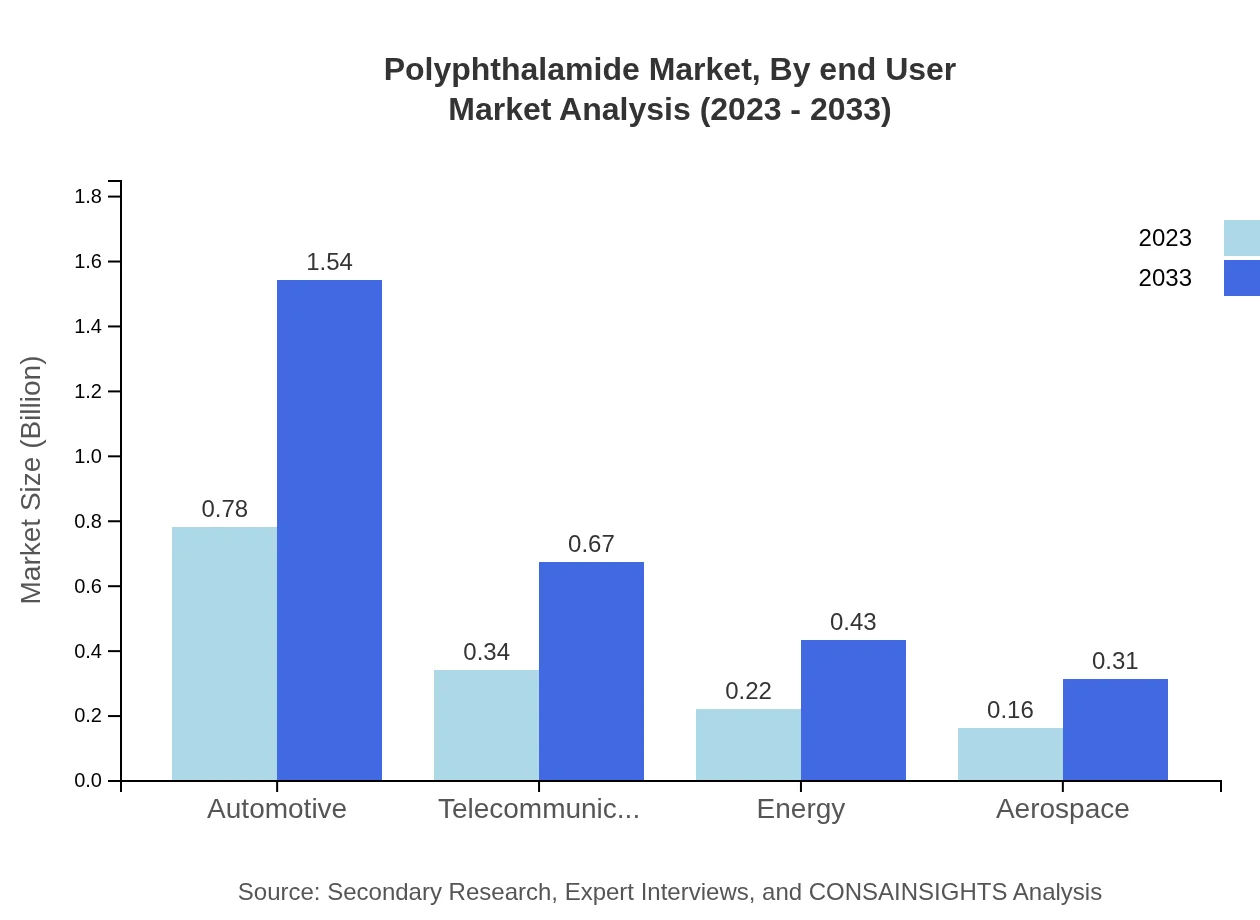

In terms of application, the automotive sector holds the largest share at USD 0.78 billion in 2023, projected to grow to USD 1.54 billion, capturing 52.27% of the market. The telecommunications application is also notable, with values rising from USD 0.34 billion to USD 0.67 billion, representing a 22.74% share. Other applications include aerospace, energy, and consumer goods, each contributing to overall growth.

Polyphthalamide Market Analysis By End User

The automotive end-user industry continues to lead in consumption, with a current market value of USD 0.68 billion, set to reach USD 1.34 billion, accounting for 45.47%. Appliances and electronics also reflect strong market presence, emphasizing the versatility of Polyphthalamide across crucial sectors.

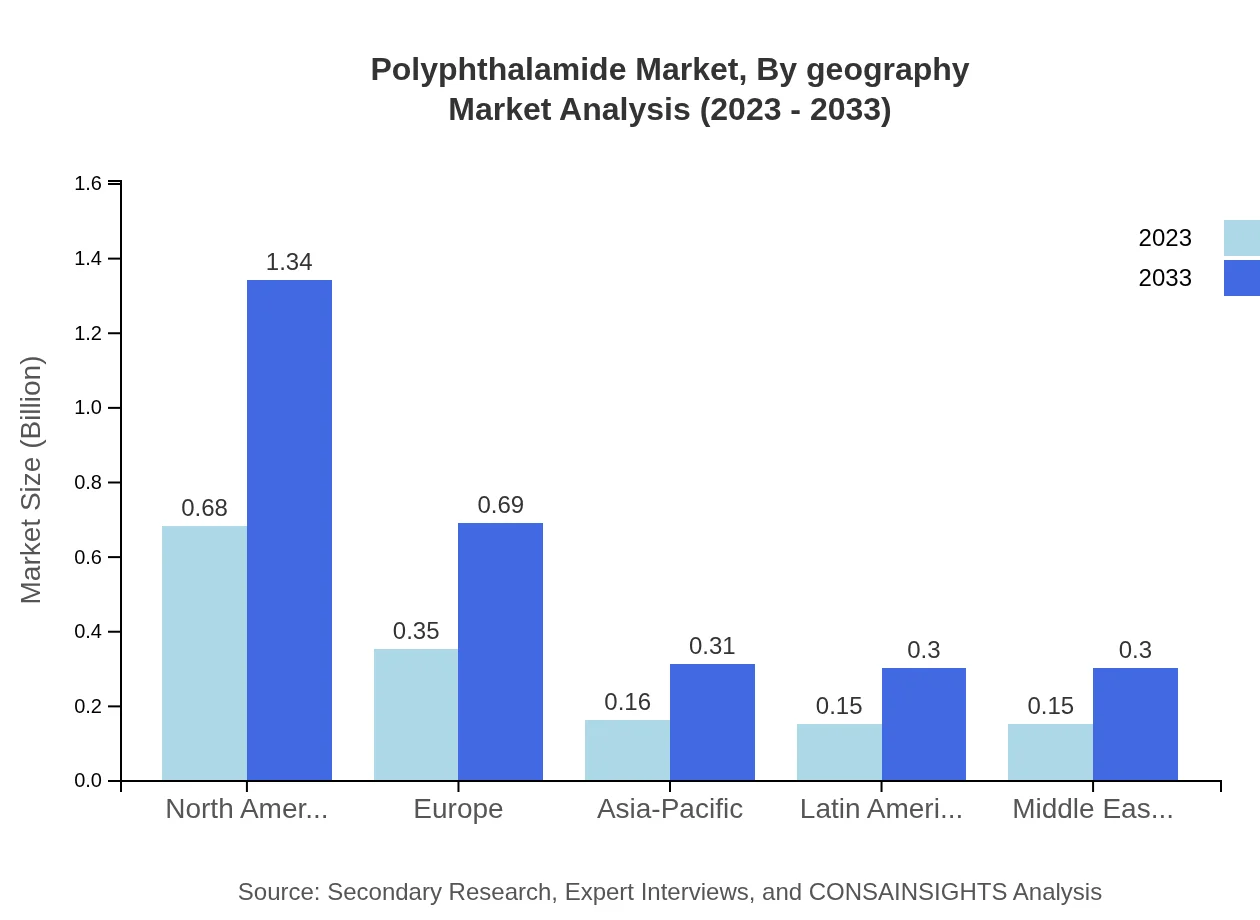

Polyphthalamide Market Analysis By Geography

Geographically, North America is a significant consumer with values growing from USD 0.68 billion to USD 1.34 billion, while Europe follows closely. The Asia Pacific region, though smaller in size compared to its counterparts, shows a rapid increase due to its burgeoning industrial base and expanding automotive sector.

Polyphthalamide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polyphthalamide Industry

DuPont:

A leading innovator in materials science, DuPont has significantly contributed to the development of PPA solutions, focusing on enhancing performance standards across industrial applications.BASF:

BASF is a global chemical company dedicated to sustainable solutions, and its advanced PPA products are employed in automotive, electronics, and aerospace applications to ensure high-performance standards.Solvay:

Known for high-quality advanced materials, Solvay leads in specialty polymers. The company's PPA products are recognized for their stability and efficiency in demanding environments.Mitsubishi Chemical:

Mitsubishi Chemical is a key player in the PPA market, providing innovative solutions for a wide range of applications from electronics to automotive sectors, focusing on quality and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of polyphthalamide?

The global polyphthalamide market is estimated to reach $1.5 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth indicates increasing demand across various industries including automotive and telecommunications.

What are the key market players or companies in this polyphthalamide industry?

Key players in the polyphthalamide industry include prominent companies such as BASF, DuPont, and DSM. These organizations are recognized for their innovative products and strong market positions, contributing significantly to the industry's growth trajectory.

What are the primary factors driving the growth in the polyphthalamide industry?

The growth in the polyphthalamide industry is driven by rising demand for high-performance materials in sectors like automotive and electronics. Innovations in polymer technology and the need for lightweight components further propel market expansion.

Which region is the fastest Growing in the polyphthalamide?

The fastest-growing region for polyphthalamide is Europe, projected to expand from $0.54 billion in 2023 to $1.06 billion by 2033. North America and Asia Pacific also show significant growth potential in this sector.

Does ConsaInsights provide customized market report data for the polyphthalamide industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the polyphthalamide industry. Clients can request specific analyses that address their unique business challenges and market insights.

What deliverables can I expect from this polyphthalamide market research project?

From the polyphthalamide market research project, you can expect comprehensive reports including market size, segment analysis, growth forecasts, and competitive landscape assessments, providing valuable insights for strategic decision-making.

What are the market trends of polyphthalamide?

Market trends for polyphthalamide indicate a shift towards unfilled types, projected to grow significantly. Additionally, growing applications in automotive and energy sectors are expected to enhance market dynamics over the next decade.