Population Health Management Market Report

Published Date: 31 January 2026 | Report Code: population-health-management

Population Health Management Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Population Health Management market, covering trends, forecasts, and insights from 2023 to 2033. It evaluates market size, growth potential, and key players in the industry.

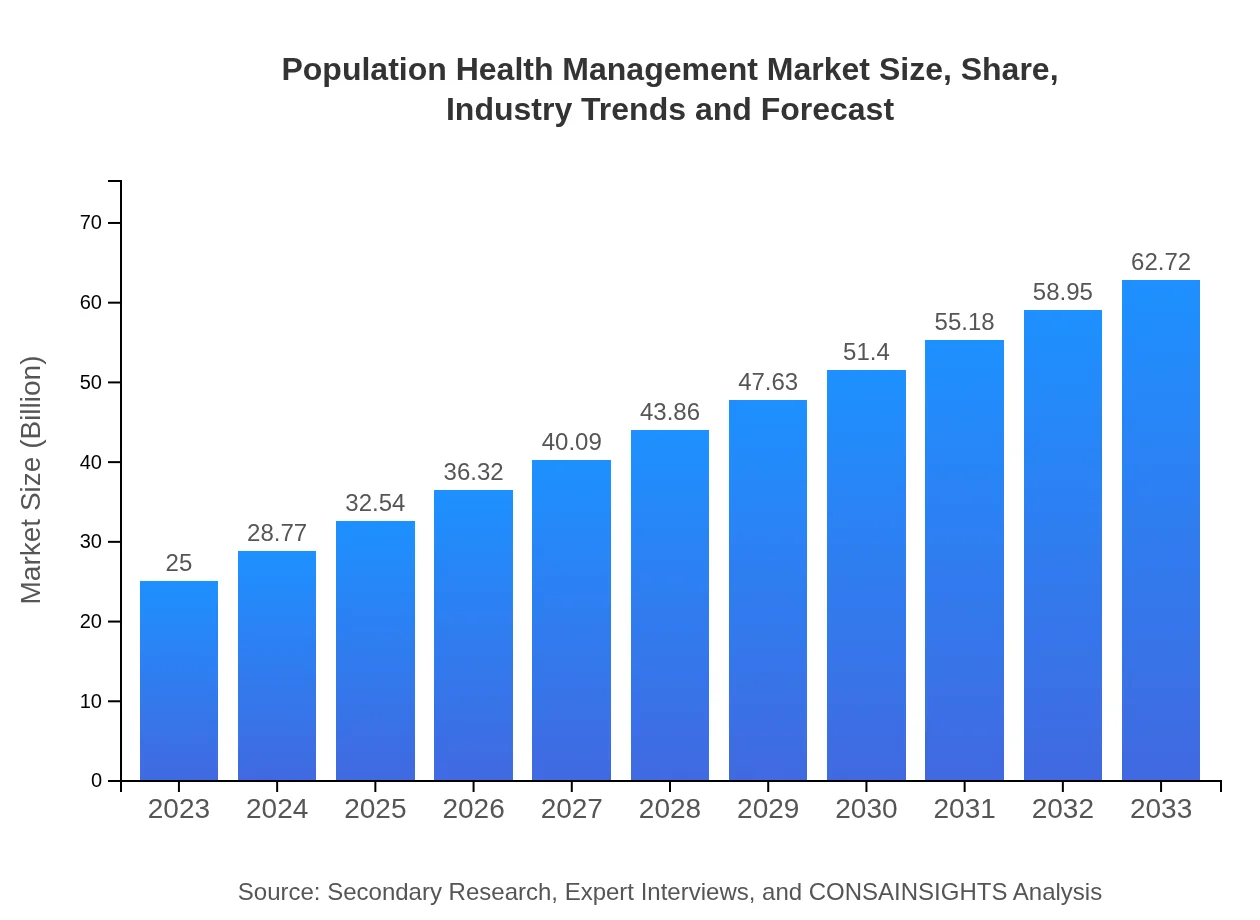

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $62.72 Billion |

| Top Companies | Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, Optum |

| Last Modified Date | 31 January 2026 |

Population Health Management Market Overview

Customize Population Health Management Market Report market research report

- ✔ Get in-depth analysis of Population Health Management market size, growth, and forecasts.

- ✔ Understand Population Health Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Population Health Management

What is the Market Size & CAGR of Population Health Management market in 2023?

Population Health Management Industry Analysis

Population Health Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Population Health Management Market Analysis Report by Region

Europe Population Health Management Market Report:

Europe's Population Health Management market was valued at approximately USD 6.08 billion in 2023, with projections predicting growth to USD 15.25 billion by 2033. The emphasis on preventive healthcare and data-driven approaches to managing population health is driving this expansion.Asia Pacific Population Health Management Market Report:

In the Asia Pacific region, the Population Health Management market size was approximately USD 4.82 billion in 2023 and is expected to grow to about USD 12.10 billion by 2033, driven by improved healthcare infrastructure and increased emphasis on population health initiatives.North America Population Health Management Market Report:

North America dominates the Population Health Management market with a size of USD 9.56 billion in 2023, anticipated to escalate to USD 23.99 billion by 2033. Factors contributing to this growth include technological advancements, increased adoption of health IT solutions, and supportive government policies.South America Population Health Management Market Report:

For South America, the market was valued at around USD 1.21 billion in 2023, with projections to reach USD 3.02 billion by 2033. Growing healthcare investments and evolving regulations supporting public health initiatives are key factors fueling growth.Middle East & Africa Population Health Management Market Report:

In the Middle East and Africa, the market size was around USD 3.33 billion in 2023, expected to reach approximately USD 8.35 billion by 2033. Growing healthcare expenditure and initiatives to improve healthcare delivery systems are pivotal in this region's market growth.Tell us your focus area and get a customized research report.

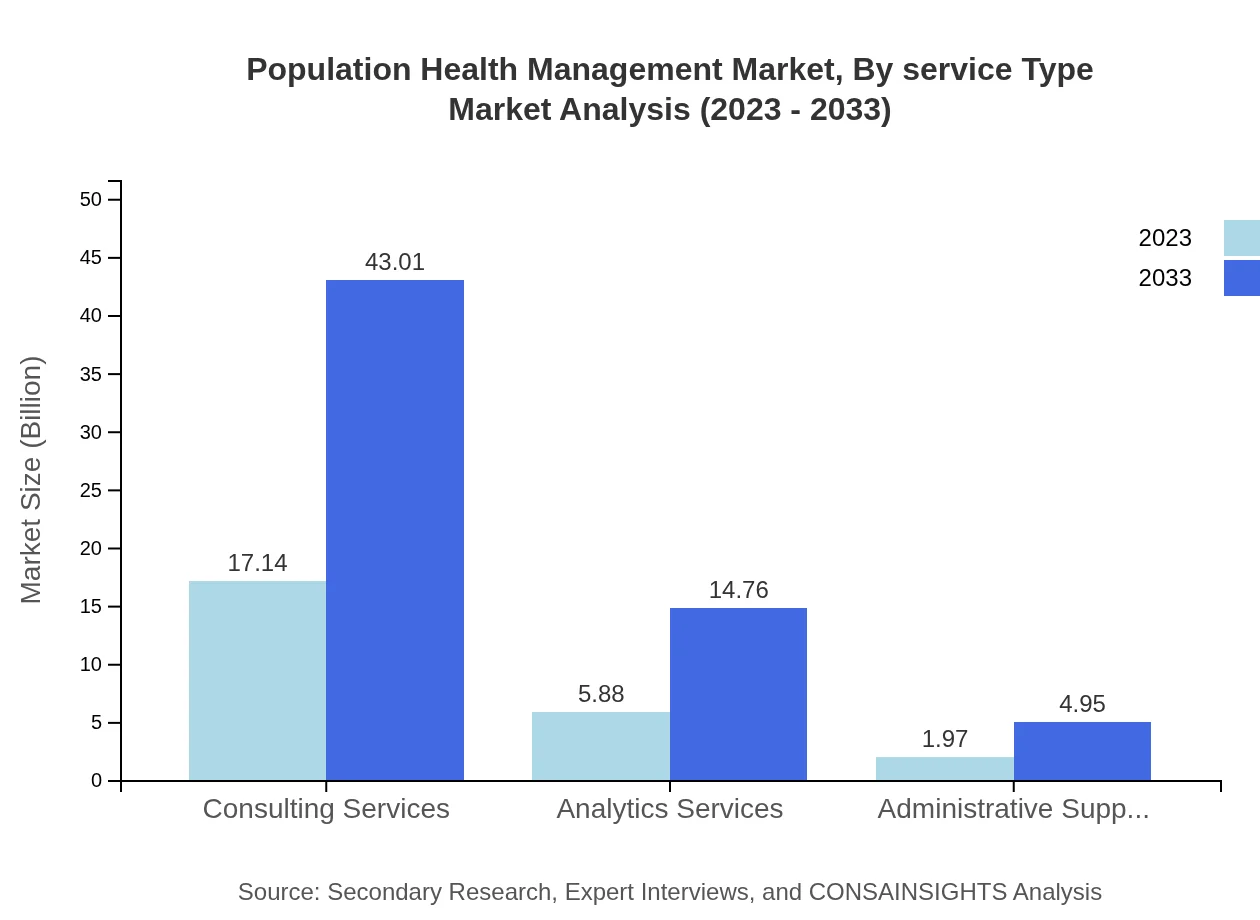

Population Health Management Market Analysis By Service Type

In 2023, the market for Healthcare Providers was valued at USD 17.14 billion and is forecasted to reach USD 43.01 billion by 2033, dominating with a 68.58% market share. Healthcare Payers followed at USD 5.88 billion in 2023, projected to grow to USD 14.76 billion by 2033, maintaining a 23.53% share. Pharmaceuticals recorded a smaller segment with a size of USD 1.97 billion in 2023, expected to rise to USD 4.95 billion by 2033, while Health IT Solutions, Consulting Services, and other segments are experiencing similar robust growth patterns.

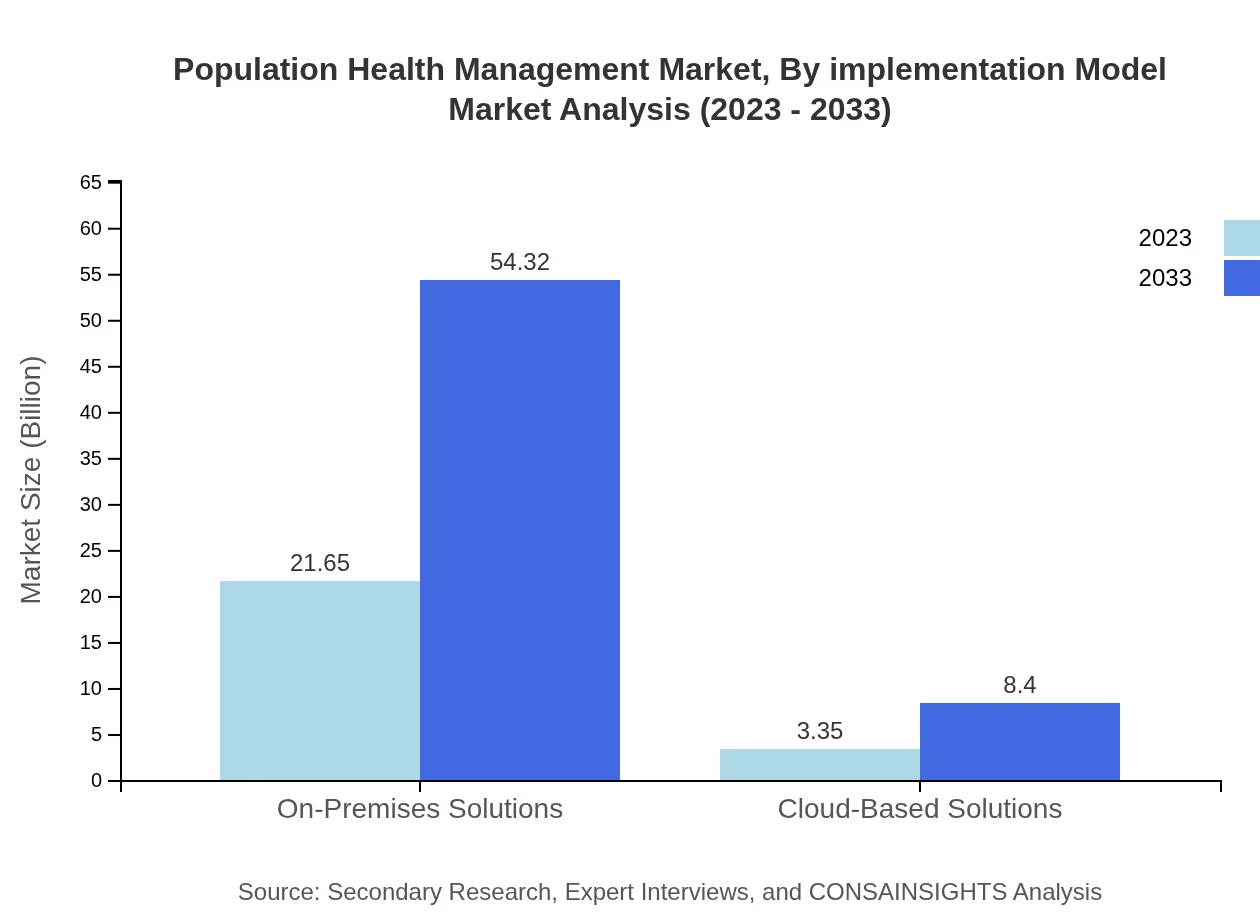

Population Health Management Market Analysis By Implementation Model

The implementation model segment is crucial, with On-Premises Solutions reaching a market size of USD 21.65 billion in 2023, anticipated to grow to USD 54.32 billion by 2033, holding an 86.61% market share. Cloud-Based Solutions are forecast to grow from USD 3.35 billion in 2023 to USD 8.40 billion by 2033, representing a growing acceptance of technology-driven remote health services.

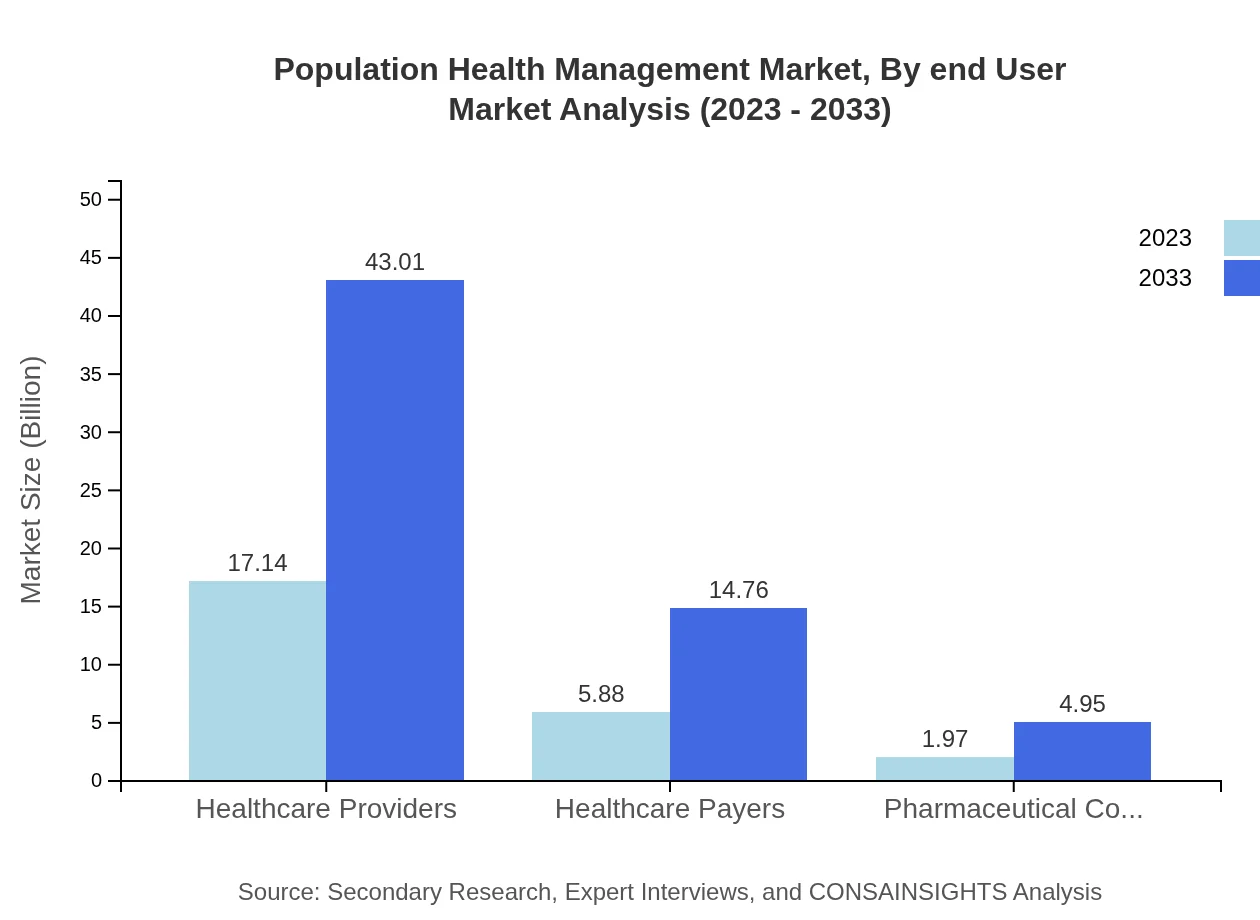

Population Health Management Market Analysis By End User

The end-user analysis indicates that healthcare providers are leading with a substantial investment in Population Health Management solutions, reflective of their role in managing patient outcomes. Payers are also increasingly adopting these models to enhance their service efficiency. Integration into systems by pharmaceutical companies is witnessing a rise, highlighting the collaborative nature of enhancing public health goals.

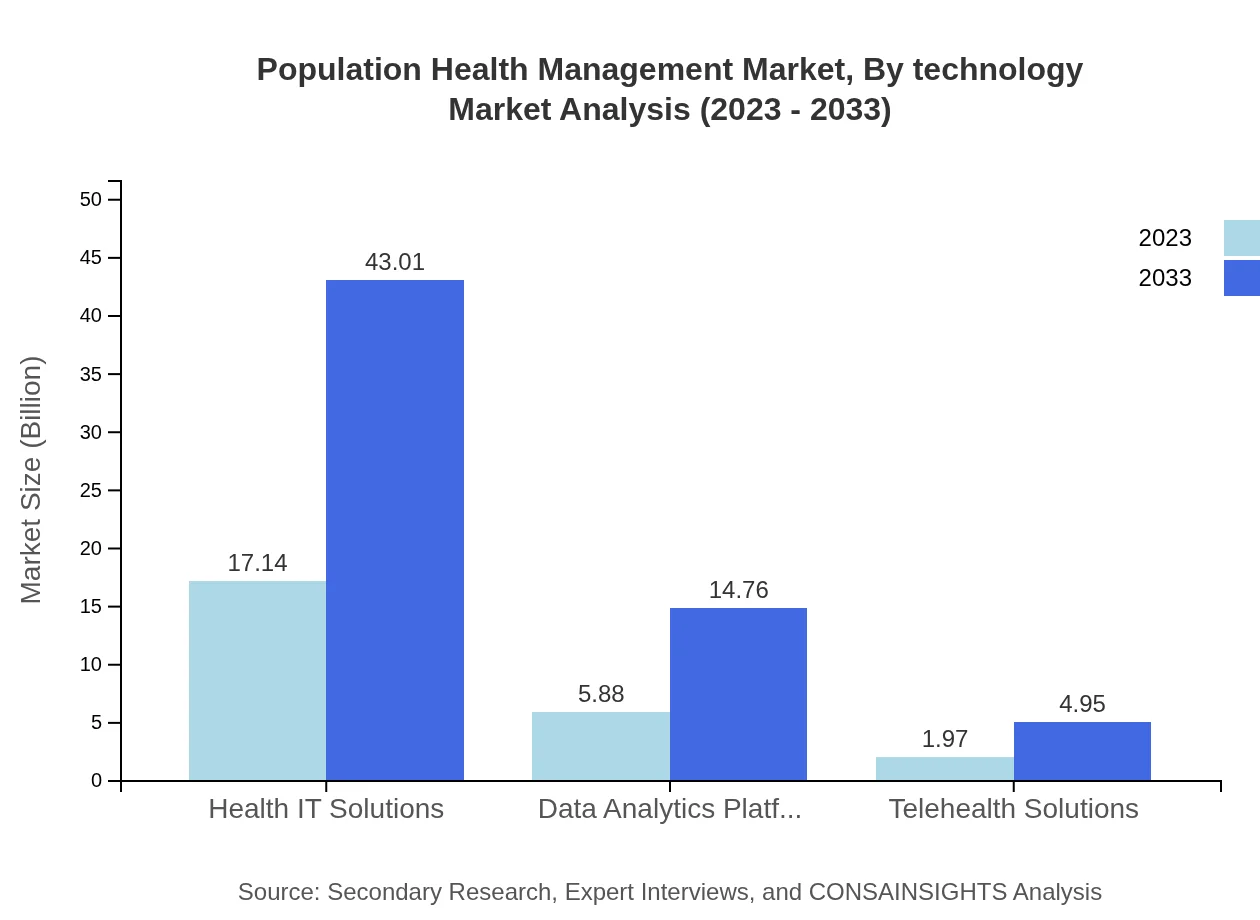

Population Health Management Market Analysis By Technology

Market trends show a significant shift towards digital technologies, including data analytics platforms and telehealth solutions, which are expected to grow steadily to meet the increasing demand for connected healthcare services. This trend underlines the importance of real-time data and analytics in strategic decision-making within health management frameworks.

Population Health Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Population Health Management Industry

Cerner Corporation:

Cerner Corporation specializes in health information technology solutions, offering systems designed for healthcare organizations to improve clinical and operational outcomes through better data management and analytics.Epic Systems Corporation:

Epic Systems is a key player in the electronic health records (EHR) system space, providing a comprehensive suite of applications that facilitate efficient patient information management and outreach initiatives.Allscripts Healthcare Solutions:

Allscripts offers solutions aimed at healthcare providers to enhance patient engagement and care coordination, focusing on population health management tools.Optum:

Optum, part of UnitedHealth Group, provides population health management solutions that leverage technology and data analytics to improve health outcomes for populations of patients.We're grateful to work with incredible clients.

FAQs

What is the market size of Population Health Management?

The Population Health Management market is valued at approximately $25 billion in 2023, with a projected CAGR of 9.3% from 2023 to 2033, indicating strong growth potential over the next decade.

What are the key market players or companies in this Population Health Management industry?

Key players in the Population Health Management industry include major healthcare providers, payers, healthcare IT companies, data analytics firms, and consulting service providers that are at the forefront of transforming healthcare delivery.

What are the primary factors driving the growth in the Population Health Management industry?

Growth in this sector is driven by increased adoption of digital technologies, a focus on preventative care, rising healthcare costs, government incentives for value-based care, and an emphasis on improving patient outcomes through data analytics.

Which region is the fastest Growing in the Population Health Management?

North America holds the largest market share in Population Health Management, expected to grow from $9.56 billion in 2023 to $23.99 billion by 2033, followed by significant growth in Europe and Asia Pacific, indicating a trend toward improved health management.

Does ConsaInsights provide customized market report data for the Population Health Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Population Health Management industry, providing insights into local markets, competitive landscape, and emerging trends.

What deliverables can I expect from this Population Health Management market research project?

Deliverables include detailed market analysis reports, segment insights, competitive landscape assessments, growth forecasts, and strategic recommendations tailored to your business needs within the Population Health Management sector.

What are the market trends of Population Health Management?

Current trends include the integration of advanced analytics in healthcare management, increased use of telehealth services, a shift towards value-based care models, and growing investments in health IT solutions to enhance patient engagement.