Pork Meat Market Report

Published Date: 31 January 2026 | Report Code: pork-meat

Pork Meat Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the pork meat market from 2023 to 2033. It includes insights into market size, trends, segmentation, regional analyses, and forecasts, aimed at enhancing understanding of this crucial sector within the food industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

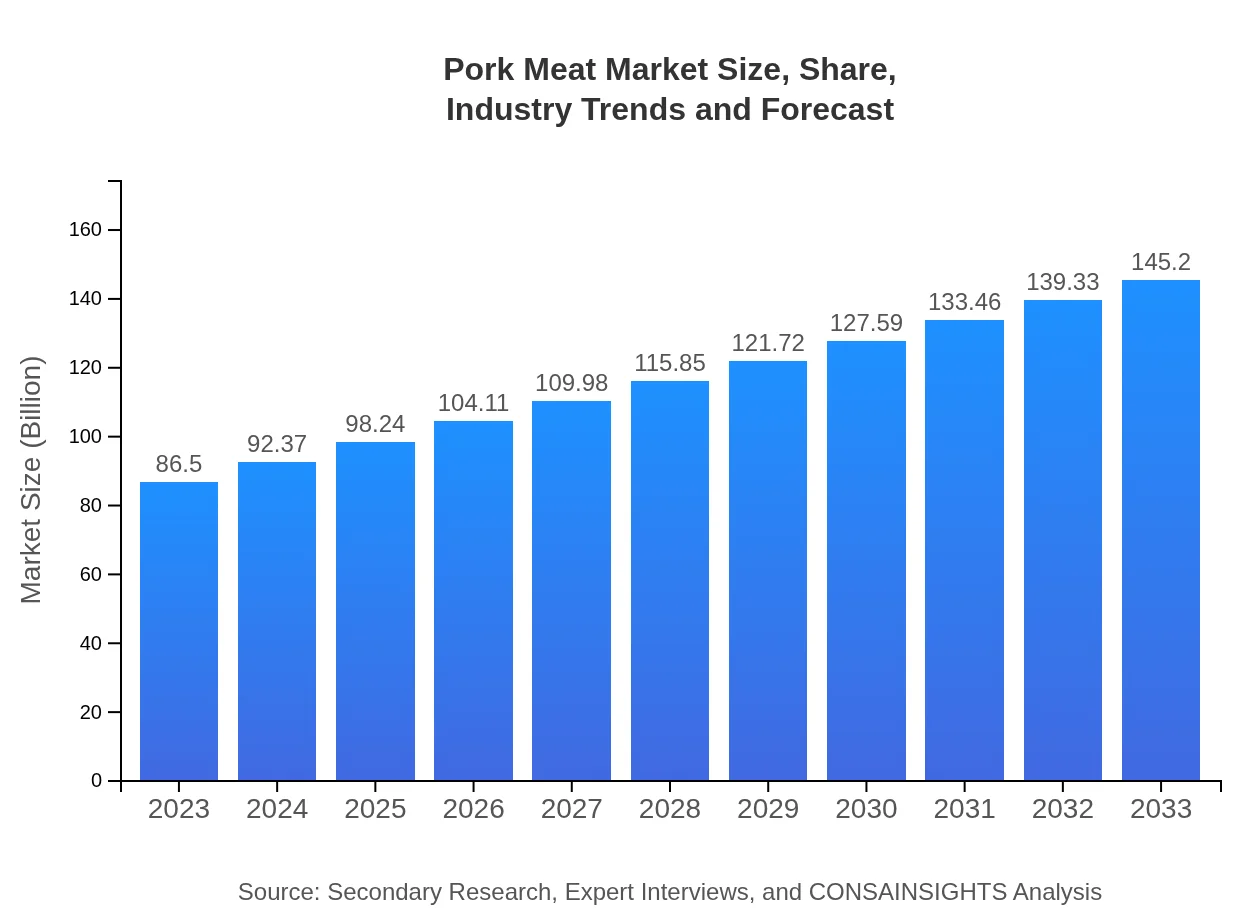

| 2023 Market Size | $86.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $145.20 Billion |

| Top Companies | Smithfield Foods, Inc., WH Group, Tyson Foods, Inc. |

| Last Modified Date | 31 January 2026 |

Pork Meat Market Overview

Customize Pork Meat Market Report market research report

- ✔ Get in-depth analysis of Pork Meat market size, growth, and forecasts.

- ✔ Understand Pork Meat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pork Meat

What is the Market Size & CAGR of Pork Meat market in 2033?

Pork Meat Industry Analysis

Pork Meat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pork Meat Market Analysis Report by Region

Europe Pork Meat Market Report:

Europe's pork meat market size stands at $28.29 billion in 2023, with expectations to grow to $47.50 billion by 2033. The region emphasizes food quality and provenance, leading to high standards in animal welfare and meat processing. Countries like Germany and Spain are significant contributors to this market, with increasing focus on health-conscious products influencing consumer choices.Asia Pacific Pork Meat Market Report:

The Asia Pacific region is a key player in the pork meat market, with a market size of $13.31 billion in 2023, projected to grow to $22.35 billion by 2033. Countries like China and Vietnam are notable for their high pork consumption, driven by culinary traditions and population density. The region's growth is also supported by advancements in meat processing technology and an increasing trend towards sustainable practices among producers.North America Pork Meat Market Report:

North America's pork meat market, valued at $31.92 billion in 2023, is expected to reach $53.58 billion by 2033. The United States and Canada dominate this market, supported by a strong agricultural infrastructure and a growing appetite for processed pork products. Innovations in technology are enhancing production efficiency, paving the way for sustained growth in this region.South America Pork Meat Market Report:

In South America, the pork meat market is valued at $8.03 billion in 2023, with a projected increase to $13.47 billion by 2033. Brazil is the largest market in the region, benefiting from robust export opportunities and rising domestic demand. The industry is increasingly adopting modern farming techniques to improve efficiency and meet safety standards.Middle East & Africa Pork Meat Market Report:

The Middle East and Africa pork meat market is smaller, valued at $4.95 billion in 2023, estimated to grow to $8.31 billion by 2033. The growth is driven by the rising population and urbanization. However, cultural dietary restrictions pose unique challenges and opportunities for tailored product offerings. Countries like South Africa are witnessing gradual shifts in meat consumption patterns.Tell us your focus area and get a customized research report.

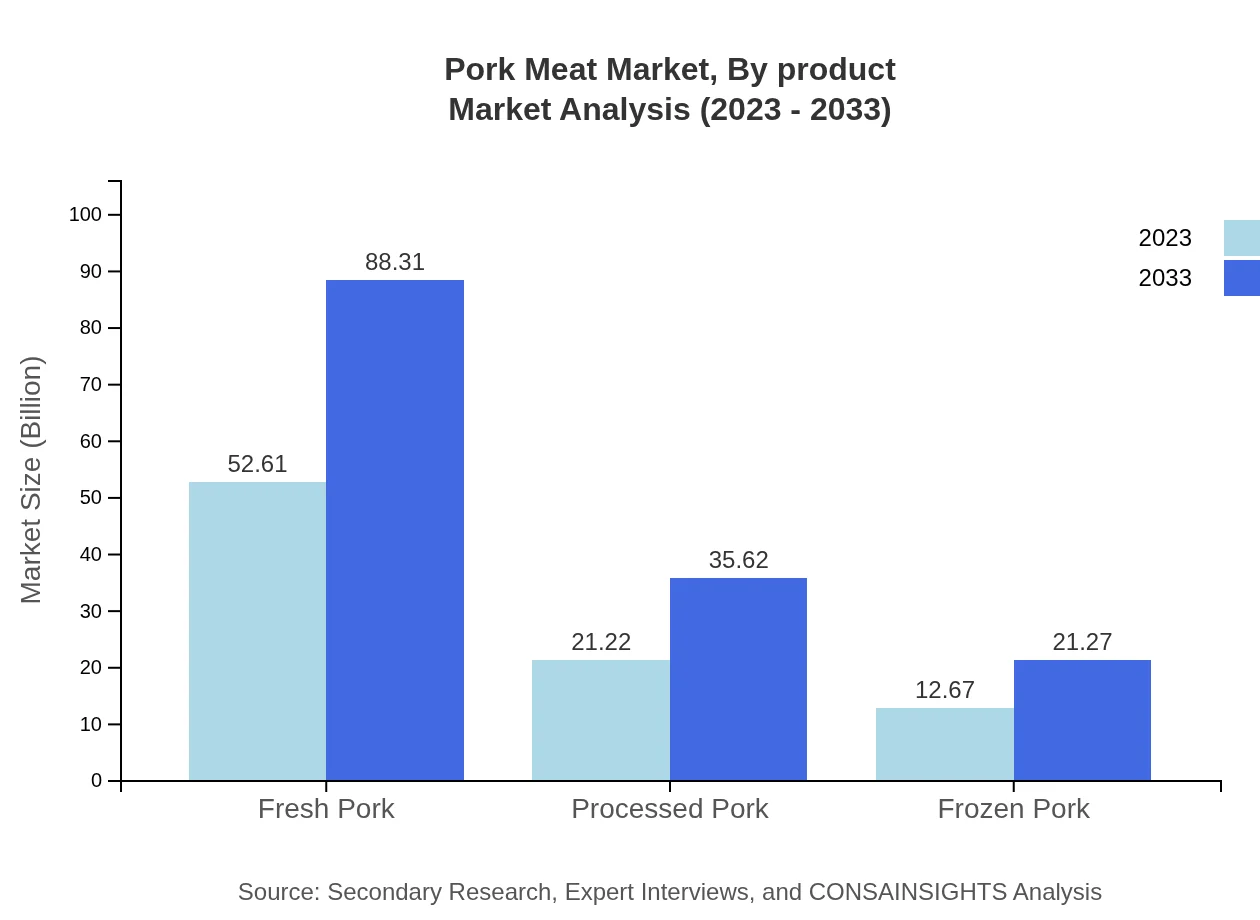

Pork Meat Market Analysis By Product

The pork meat market's major product segments include fresh pork, processed pork, and frozen pork. In 2023, the fresh pork market is valued at $52.61 billion, projected to grow to $88.31 billion by 2033, accounting for 60.82% market share throughout the period. Processed pork, valued at $21.22 billion in 2023, is expected to reach $35.62 billion by 2033, holding a 24.53% share. Lastly, the frozen pork market, valued at $12.67 billion in 2023, is anticipated to grow to $21.27 billion by 2033, with a share of 14.65%.

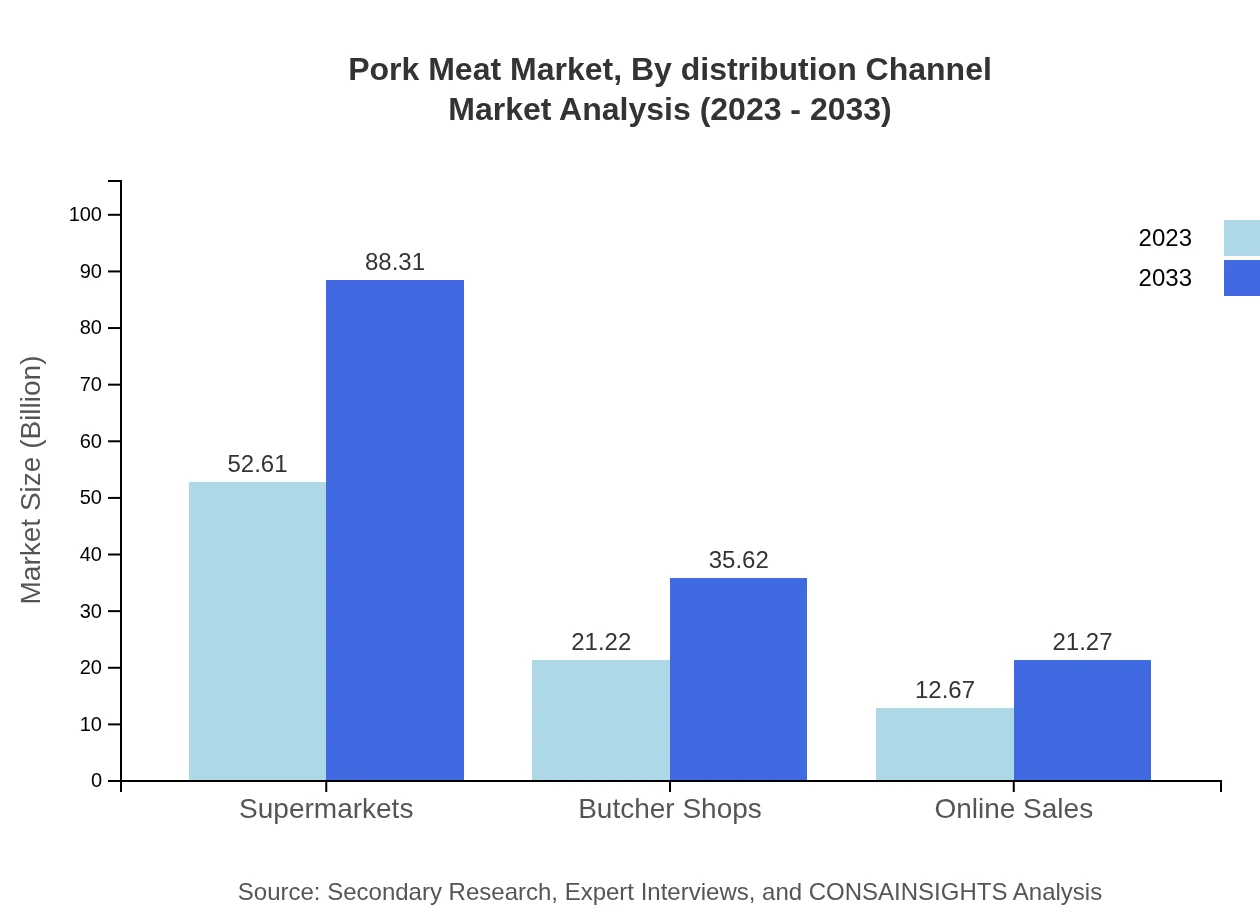

Pork Meat Market Analysis By Distribution Channel

Analyzing distribution channels, supermarkets account for the significant share, with a market size of $52.61 billion in 2023, projected to reach $88.31 billion by 2033 (60.82% share). Butcher shops are another key channel, estimated at $21.22 billion in 2023, growing to $35.62 billion by 2033 (24.53% share). Online sales, valuing $12.67 billion in 2023, are also emerging, with projections reaching $21.27 billion by 2033 (14.65% share).

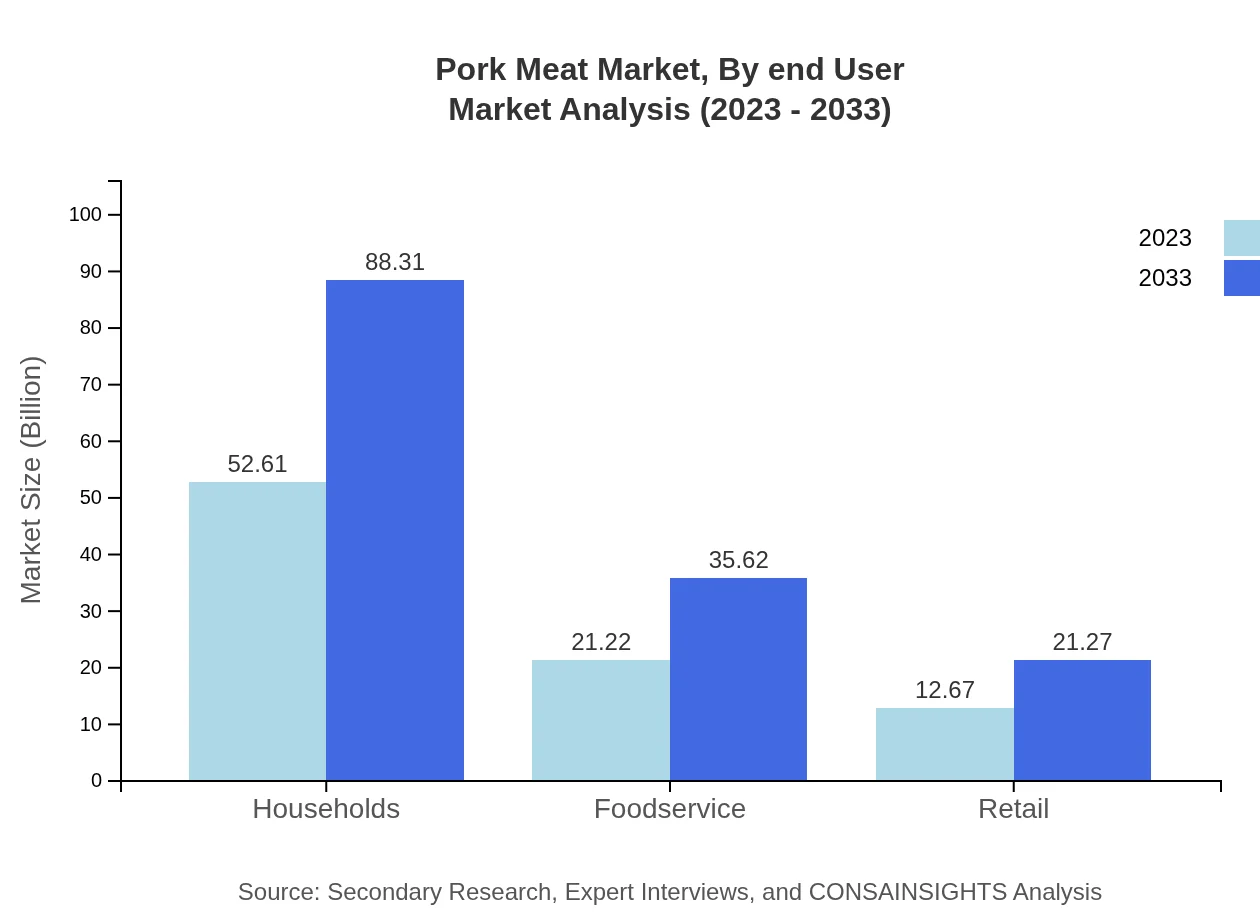

Pork Meat Market Analysis By End User

In terms of end-users, households remain the largest segment, reflecting a market size of $52.61 billion in 2023, anticipated to grow to $88.31 billion by 2033 (60.82% share). The food service channel, valued at $21.22 billion in 2023, is projected to grow to $35.62 billion by 2033 (24.53% share). Retail distribution is also expected to see growth, reflecting a market size of $12.67 billion in 2023, increasing to $21.27 billion by 2033 (14.65% share).

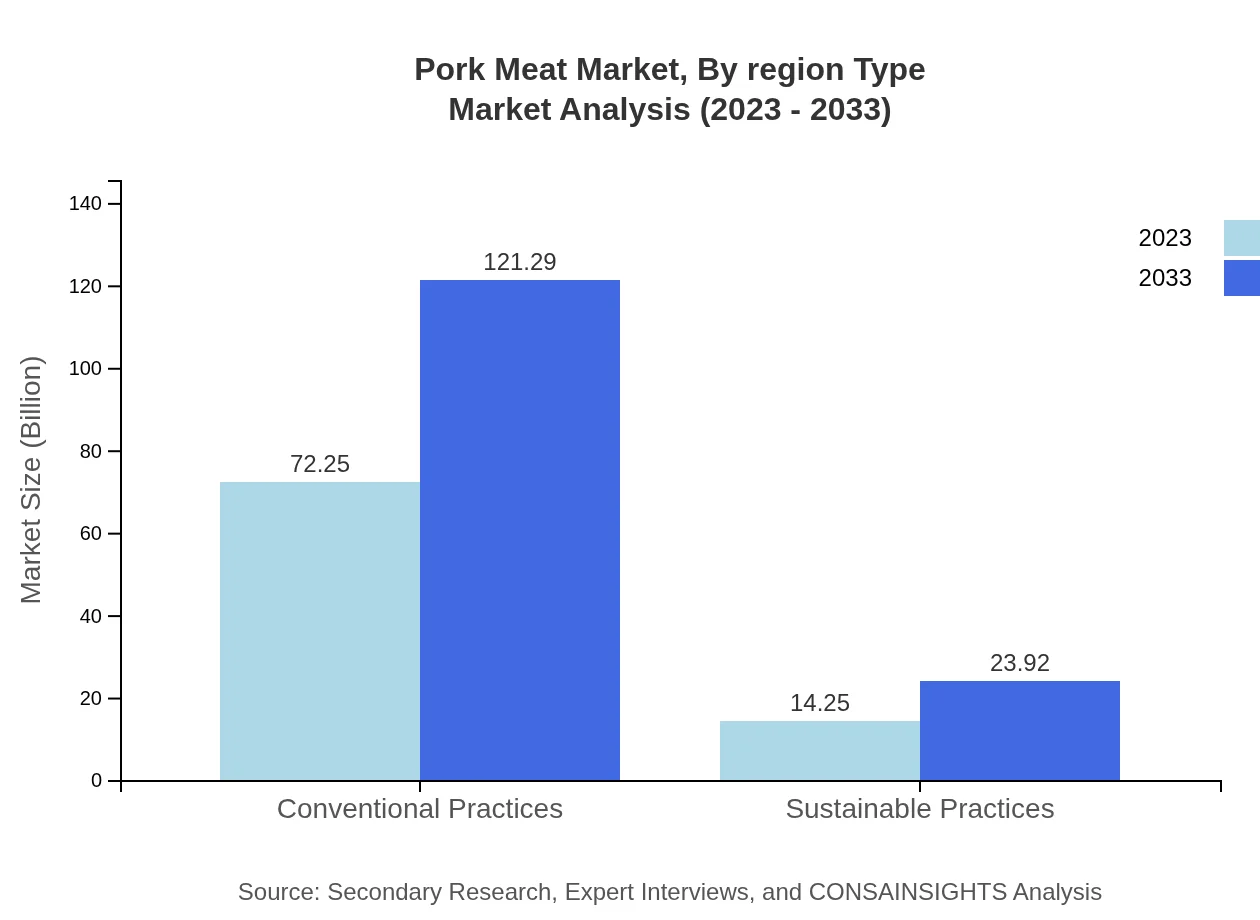

Pork Meat Market Analysis By Region Type

The analysis across regions shows conventional practices dominating production, valued at $72.25 billion in 2023 and expected to reach $121.29 billion by 2033 (83.53% share). Sustainable practices, while smaller, show promise, with a market size of $14.25 billion in 2023 projected at $23.92 billion by 2033 (16.47% share). This dual approach indicates both consumer demand for ethical sourcing and traditional methods remaining firmly entrenched.

Pork Meat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pork Meat Industry

Smithfield Foods, Inc.:

A leading pork processor in the United States, known for high-quality pork products and innovation in food safety and sustainability.WH Group:

China's largest pork producer, owning the Smithfield brand. WH Group plays a major role in the global pork market, ensuring supply chain efficiency.Tyson Foods, Inc.:

An influential player in the meat industry, Tyson specializes in the production of a wide range of protein products, including pork, catering to domestic and international markets.We're grateful to work with incredible clients.

FAQs

What is the market size of pork Meat?

The global pork meat market size is projected to reach approximately $86.5 billion by 2033, growing at a CAGR of 5.2% from 2023. This growth is driven by increasing consumption and demand within both domestic and international markets.

What are the key market players or companies in this pork Meat industry?

Key players in the pork meat industry include major companies such as Smithfield Foods, JBS S.A., WH Group, and Tyson Foods. These companies maintain significant market shares and influence trends through production, innovation, and distribution in various regions.

What are the primary factors driving the growth in the pork Meat industry?

Factors driving growth in the pork meat industry include rising global protein demand, urbanization trends leading to increased meat consumption, and innovative processing techniques that enhance product variety and availability. Sustainability practices also play a crucial role.

Which region is the fastest Growing in the pork Meat market?

North America currently stands as the fastest-growing region in the pork meat market, with projected growth from $31.92 billion in 2023 to $53.58 billion by 2033. This growth is fueled by rising consumer demand and robust supply chains.

Does ConsaInsights provide customized market report data for the pork Meat industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the pork-meat industry, allowing businesses to obtain insights relevant to their operational needs, market entry strategies, and competitive analysis.

What deliverables can I expect from this pork Meat market research project?

Expected deliverables from the pork meat market research project include comprehensive market analysis reports, regional insights, competitive landscape reviews, trend evaluations, and tailored recommendations for strategic decision-making.

What are the market trends of pork Meat?

Current trends in the pork meat market include increasing consumer preferences for sustainable and organic products, growth in online sales channels, and a shift towards convenience-driven offerings in both retail and foodservice sectors.