Position Sensor Market Report

Published Date: 31 January 2026 | Report Code: position-sensor

Position Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Position Sensor market from 2023 to 2033. It provides insights on market trends, size, segmentation, regional analysis, and forecasts, catering to industry stakeholders and decision-makers.

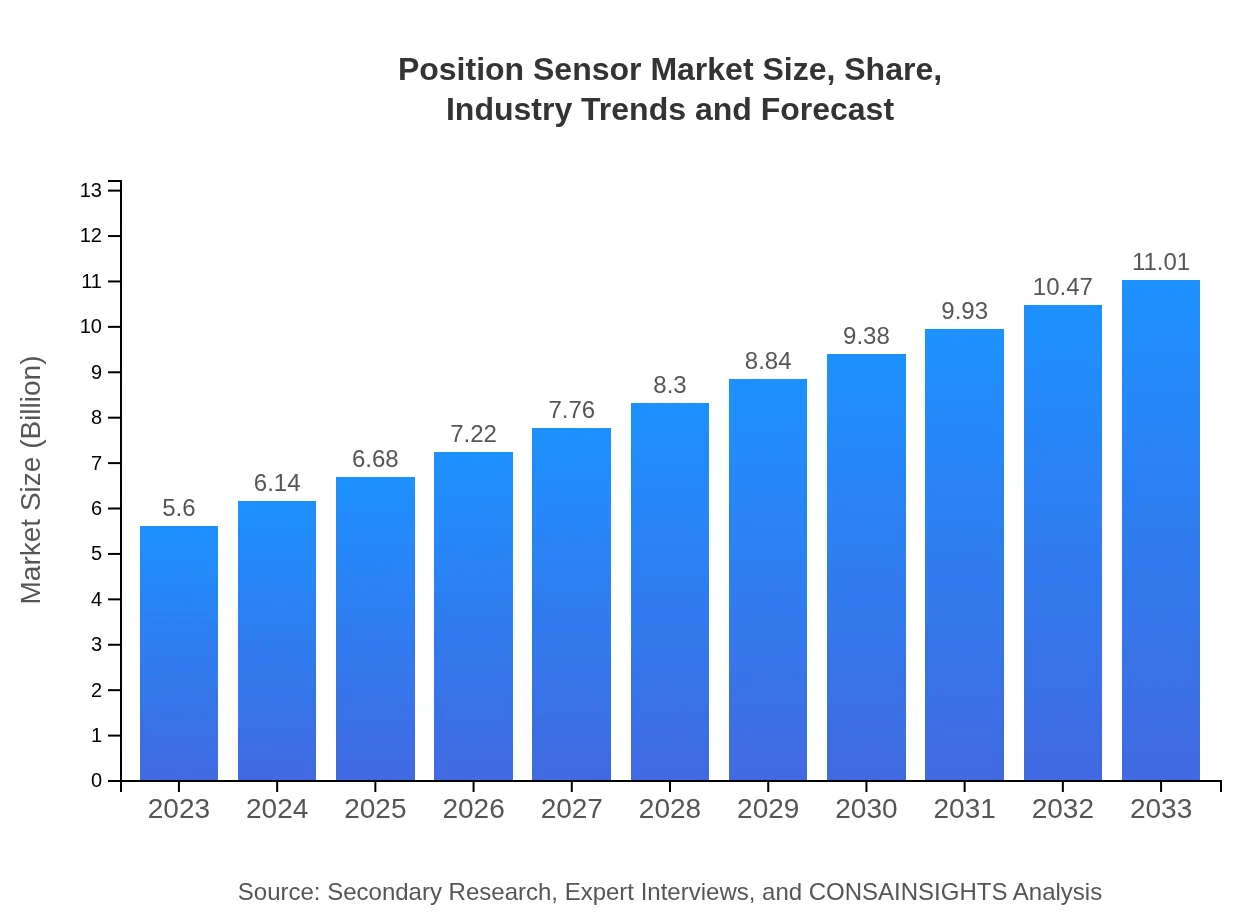

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Rockwell Automation, Inc., TE Connectivity |

| Last Modified Date | 31 January 2026 |

Position Sensor Market Overview

Customize Position Sensor Market Report market research report

- ✔ Get in-depth analysis of Position Sensor market size, growth, and forecasts.

- ✔ Understand Position Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Position Sensor

What is the Market Size & CAGR of Position Sensor market in 2023?

Position Sensor Industry Analysis

Position Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Position Sensor Market Analysis Report by Region

Europe Position Sensor Market Report:

The European Position Sensor market stands at $1.79 billion in 2023, anticipated to rise to $3.51 billion by 2033. The region's commitment to technological innovation and the adoption of IoT further propel growth.Asia Pacific Position Sensor Market Report:

In 2023, the Position Sensor market in Asia Pacific is valued at $1.06 billion, projected to grow to $2.09 billion by 2033. The region benefits from high industrial activity, especially in manufacturing and automotive sectors. Rapid urbanization and technological advancements are significant growth drivers.North America Position Sensor Market Report:

North America leads the market with a size of $2.13 billion in 2023, expected to expand to $4.18 billion by 2033. A strong automotive sector, coupled with a focus on advanced manufacturing technologies, enhances market prospects.South America Position Sensor Market Report:

The South American market for Position Sensors is expected to grow from $0.22 billion in 2023 to $0.42 billion in 2033. Although the market is nascent, increasing investments in industrial automation help bolster growth in the region.Middle East & Africa Position Sensor Market Report:

The MEA region shows a market growth from $0.41 billion in 2023 to $0.81 billion by 2033. Increased automation in oil and gas industries and investments in smart technologies are the key driving factors.Tell us your focus area and get a customized research report.

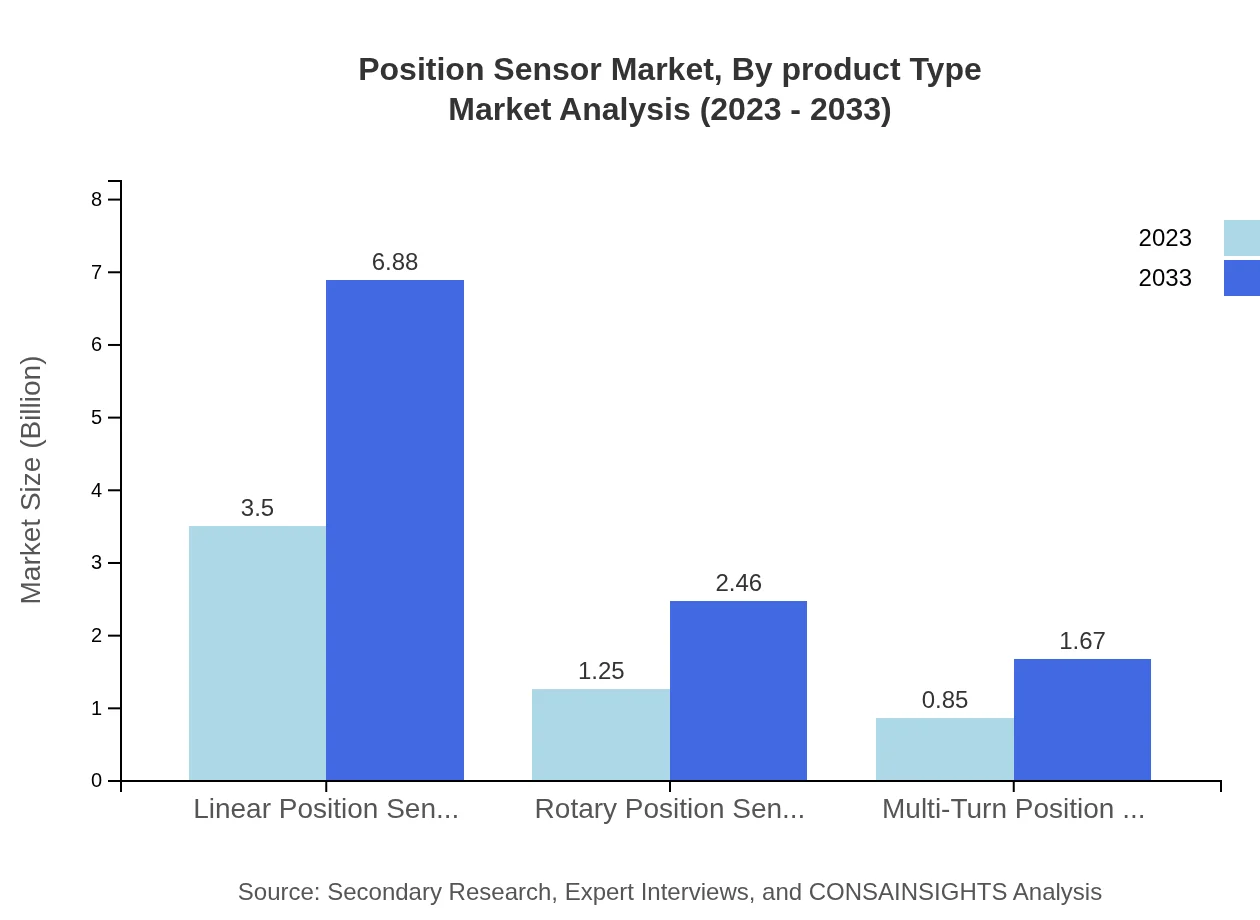

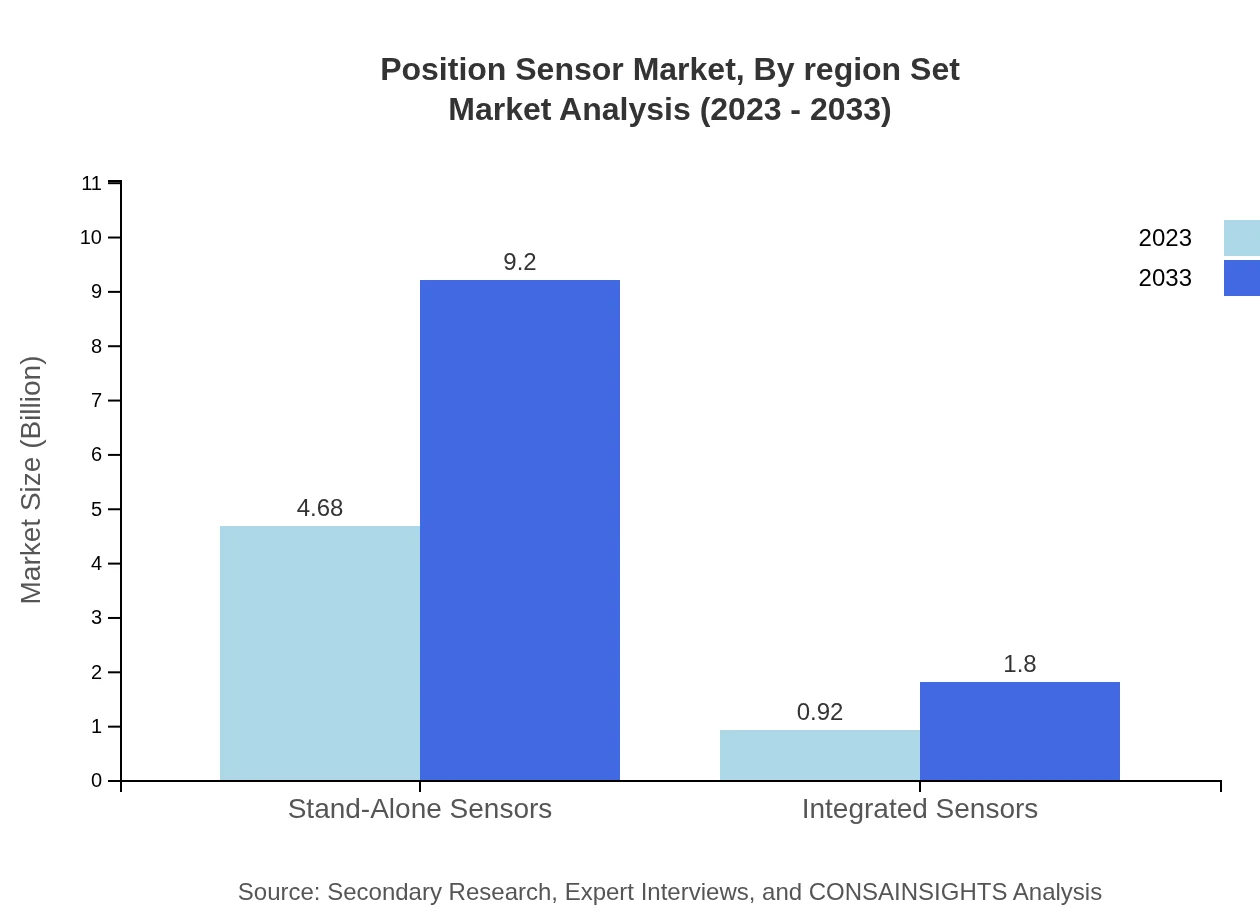

Position Sensor Market Analysis By Product Type

The Stand-Alone Sensors segment dominates the market with a size of $4.68 billion in 2023, growing to $9.20 billion by 2033, holding 83.61% market share. Linear Position Sensors follow, valued at $3.50 billion in 2023 and expected to reach $6.88 billion by 2033, capturing 62.51%. Rotary Position Sensors are projected to grow from $1.25 billion to $2.46 billion.

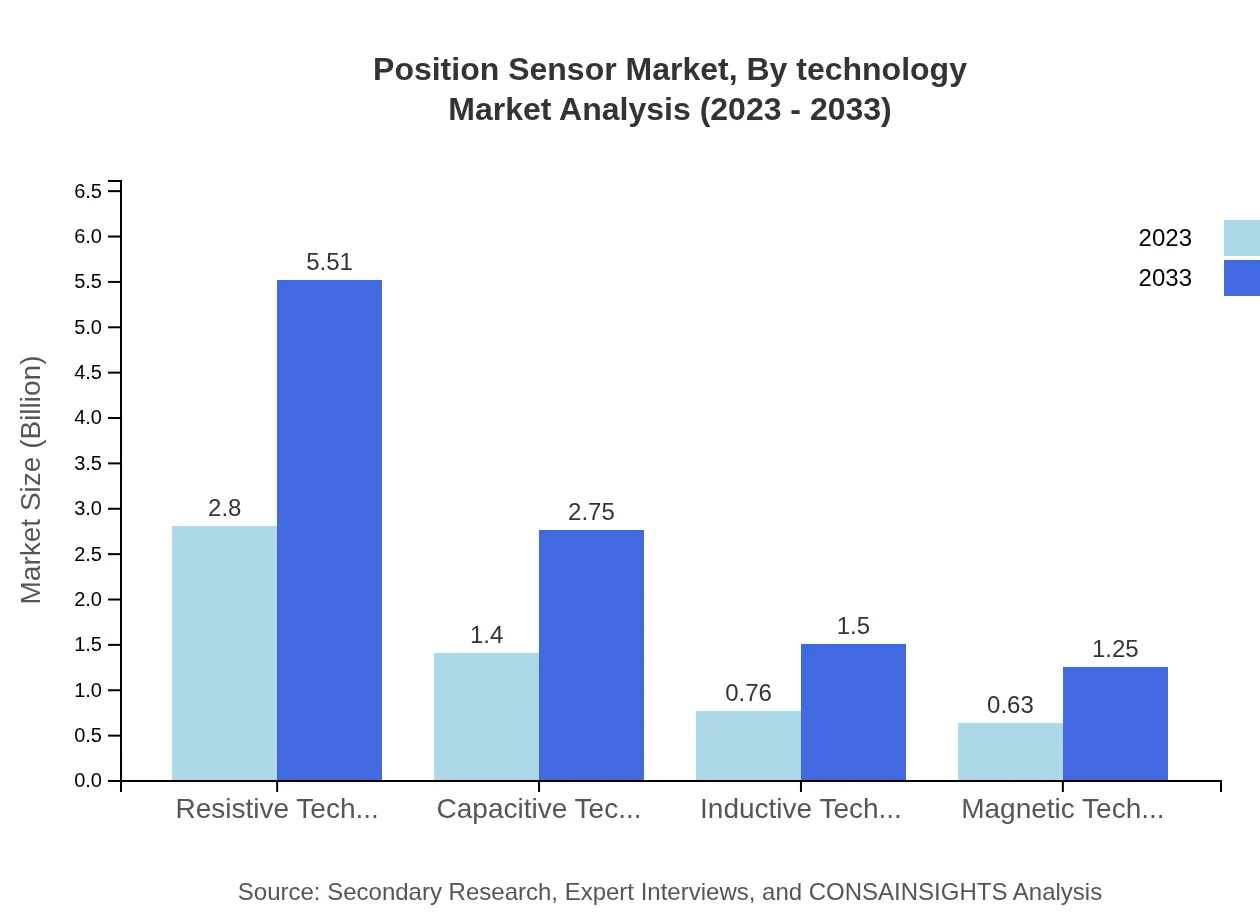

Position Sensor Market Analysis By Technology

Resistive Technologies lead with $2.80 billion in 2023, expected to maintain a 50.04% share. Capacitive Technologies, at $1.40 billion, make up 24.99% and are predicted to grow significantly, thanks to rising automotive applications. Inductive and Magnetic Technologies also offer substantial growth opportunities.

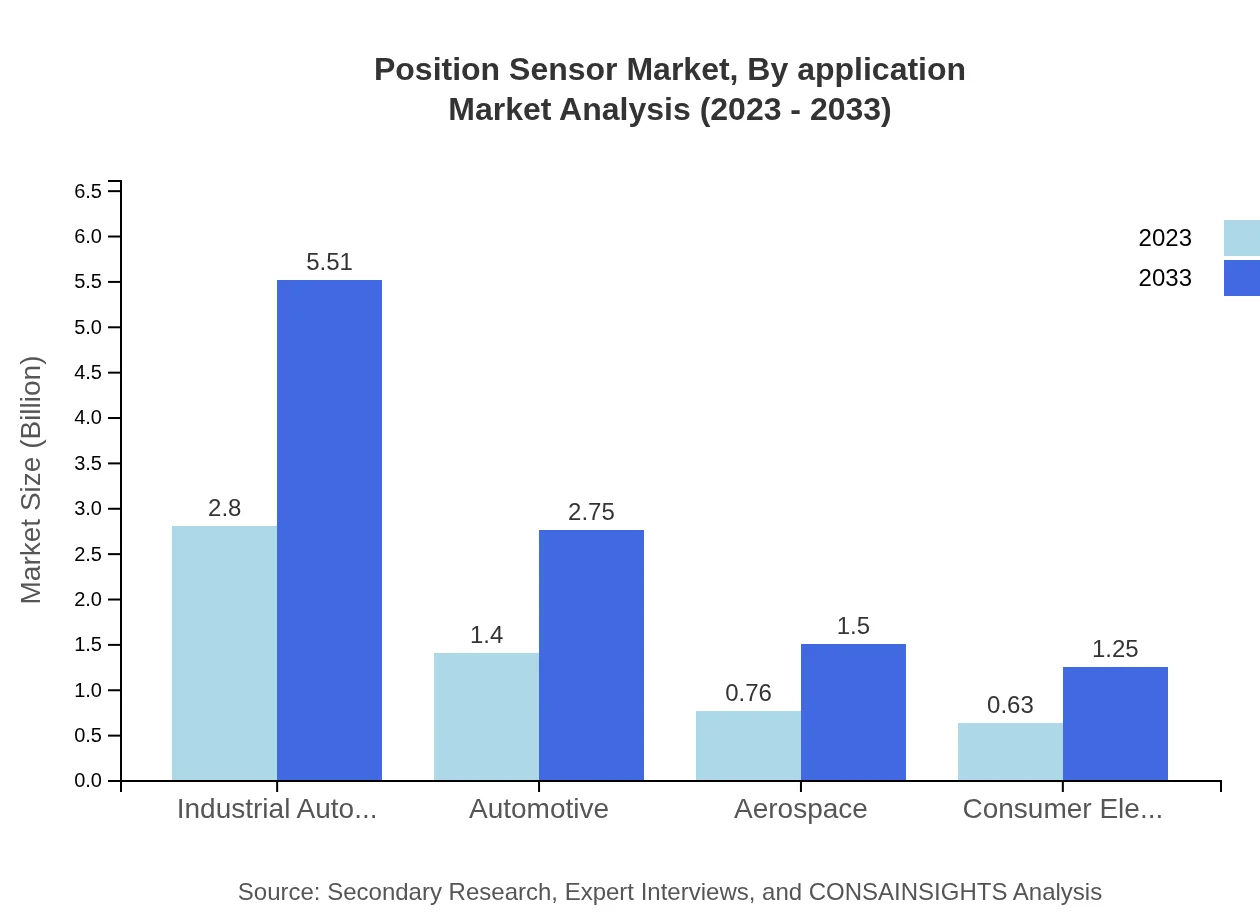

Position Sensor Market Analysis By Application

Industrial Automation is the largest application segment, at $2.80 billion in 2023, maintaining a 50.04% share with a forecast to hit $5.51 billion. The Automotive sector, with $1.40 billion, views steady growth; Aerospace and Healthcare are also critical applications, reaching $0.76 billion and $0.76 billion, respectively, bolstered by advancements in technology.

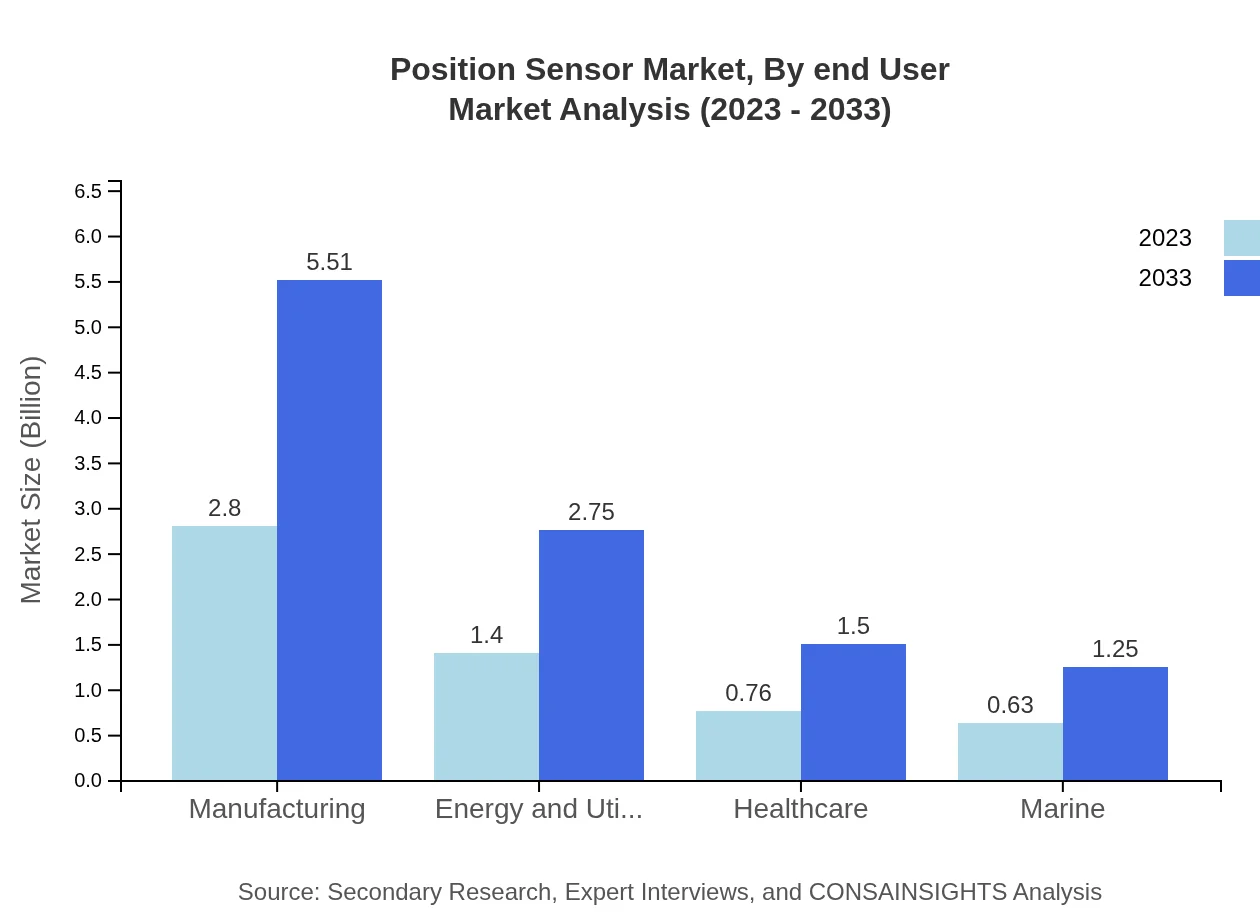

Position Sensor Market Analysis By End User

The Manufacturing sector is anticipated to remain a key end-user, significantly increasing from $2.80 billion in 2023 to $5.51 billion by 2033. Energy and Utilities also hold a significant position at $1.40 billion, while Healthcare applications, valued at $0.76 billion, are expected to benefit from increased healthcare automation.

Position Sensor Market Analysis By Region Set

Production-based segmentation shows comprehensive regional analysis, highlighting varying growth prospects. North America holds a significant share, backed by technological advancements in sensor technologies. Europe is growing notably, driven by sustainable initiatives and the automotive sector's demands.

Position Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Position Sensor Industry

Honeywell International Inc.:

Honeywell is a leading provider of position sensors, offering innovative solutions for aerospace and industrial applications, recognized for its commitment to quality and technological advancement.Siemens AG:

Siemens AG specializes in industrial automation solutions, including position sensors, known for integrating advanced technologies into manufacturing processes to enhance operational efficiency.Rockwell Automation, Inc.:

Rockwell Automation develops comprehensive solutions for industrial automation, including position sensors, which are paramount in optimizing production and manufacturing processes.TE Connectivity:

TE Connectivity focuses on sensor connectivity solutions and offers a wide portfolio of position sensors utilized across various industries for accurate positioning and automation.We're grateful to work with incredible clients.

FAQs

What is the market size of position Sensor?

The global position sensor market is valued at 5.6 billion in 2023 and is projected to grow at a CAGR of 6.8% through 2033, expanding the market size significantly as demand increases across various applications.

What are the key market players or companies in this position Sensor industry?

Key players in the position sensor market include leading firms known for innovation and product excellence, contributing to advancements in technologies, which are essential to meet the growing demand across multiple sectors.

What are the primary factors driving the growth in the position Sensor industry?

The growth in the position sensor industry is driven primarily by technological advancements, increased automation in manufacturing, the demand for precise positioning in robotics, and a growing emphasis on efficiency in industrial applications.

Which region is the fastest Growing in the position Sensor?

The North America region exhibits the fastest growth in the position sensor market, expected to grow from 2.13 billion in 2023 to 4.18 billion by 2033, driven by technological innovations and heavy investments in automation.

Does ConsaInsights provide customized market report data for the position Sensor industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the position sensor industry, ensuring clients receive detailed insights that align with their strategic objectives and market requirements.

What deliverables can I expect from this position Sensor market research project?

Expect comprehensive deliverables including detailed market analysis reports, segment trends, competitive landscape assessments, forecasts, and customized recommendations that align with business goals in the position sensor sector.

What are the market trends of position Sensor?

Current trends in the position sensor market include an increasing reliance on industrial automation, a shift toward smart and connected devices, and a rise in the application of sensors across diverse sectors, particularly in healthcare and automotive.