Positive Material Identification Market Report

Published Date: 22 January 2026 | Report Code: positive-material-identification

Positive Material Identification Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Positive Material Identification (PMI) market from 2023 to 2033. It covers market size, growth forecasts, industry trends, regional insights, segmentation, and key players in the industry.

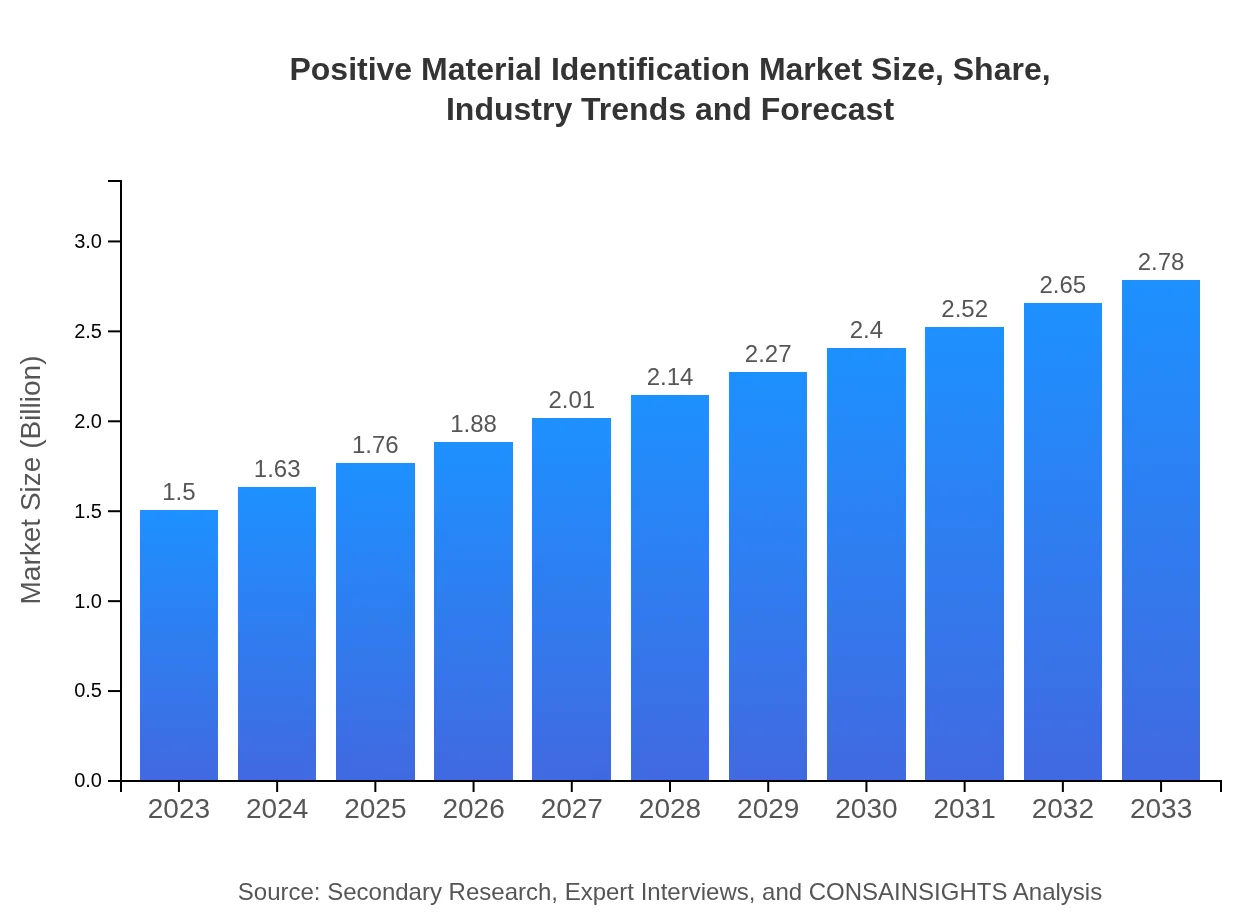

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Thermo Fisher Scientific, Hitachi High-Tech Corporation, Bruker Corporation, Olympus Corporation |

| Last Modified Date | 22 January 2026 |

Positive Material Identification Market Overview

Customize Positive Material Identification Market Report market research report

- ✔ Get in-depth analysis of Positive Material Identification market size, growth, and forecasts.

- ✔ Understand Positive Material Identification's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Positive Material Identification

What is the Market Size & CAGR of Positive Material Identification market in 2023?

Positive Material Identification Industry Analysis

Positive Material Identification Market Segmentation and Scope

Tell us your focus area and get a customized research report.

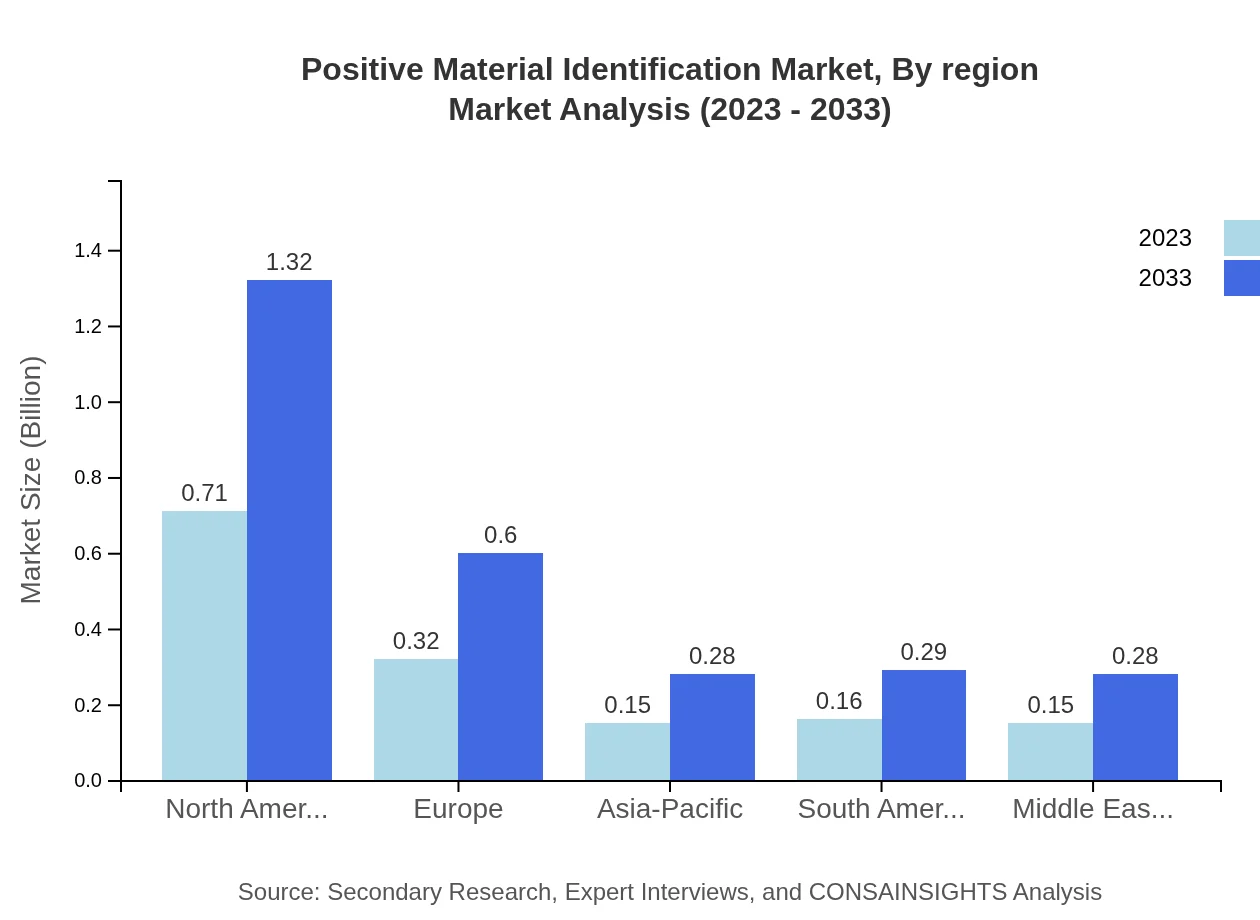

Positive Material Identification Market Analysis Report by Region

Europe Positive Material Identification Market Report:

The PMI market in Europe is expected to grow from $0.37 billion in 2023 to $0.68 billion by 2033. The region's robust aerospace and automotive industries, combined with stringent compliance regulations, foster substantial demand for advanced PMI solutions.Asia Pacific Positive Material Identification Market Report:

In the Asia Pacific region, the PMI market is projected to grow from $0.32 billion in 2023 to $0.60 billion by 2033. This growth is attributed to rapid industrialization, increasing manufacturing activities, and stringent regulatory measures that enforce material testing. High-key manufacturing countries, including China and India, are major contributors to this market growth.North America Positive Material Identification Market Report:

In North America, particularly the US and Canada, the market size is forecasted to grow from $0.57 billion in 2023 to $1.05 billion in 2033. This region leads in technological advancements and a strong focus on safety regulations, which underpins the growth of PMI technologies across various industries.South America Positive Material Identification Market Report:

The South American PMI market is expected to expand from $0.06 billion in 2023 to $0.11 billion by 2033. The growth is driven by increased awareness regarding material quality and compliance, particularly in construction and mining sectors, urging businesses to adopt more robust material testing measures.Middle East & Africa Positive Material Identification Market Report:

The Middle East and Africa region anticipates growth from $0.18 billion in 2023 to $0.34 billion by 2033. Increasing investments in infrastructure development and a rising focus on quality assurance are key factors driving the PMI market in this region.Tell us your focus area and get a customized research report.

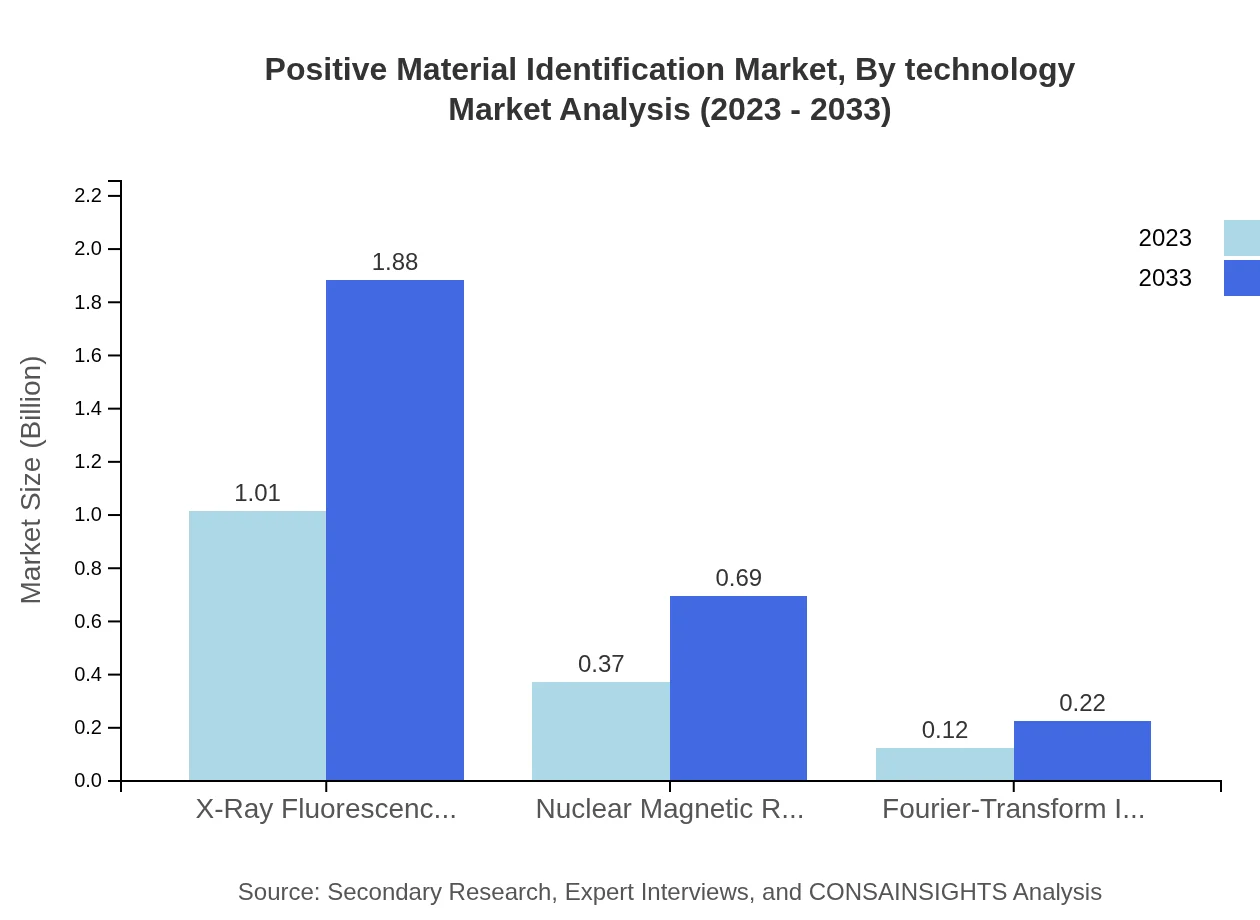

Positive Material Identification Market Analysis By Technology

The PMI market is significantly impacted by various technologies, with X-Ray Fluorescence (XRF) accounting for a substantial market share and anticipated growth from $1.01 billion in 2023 to $1.88 billion by 2033. Nuclear Magnetic Resonance (NMR) follows with a projected growth from $0.37 billion to $0.69 billion between 2023 and 2033. Other technologies such as FTIR also play a vital role in niche applications.

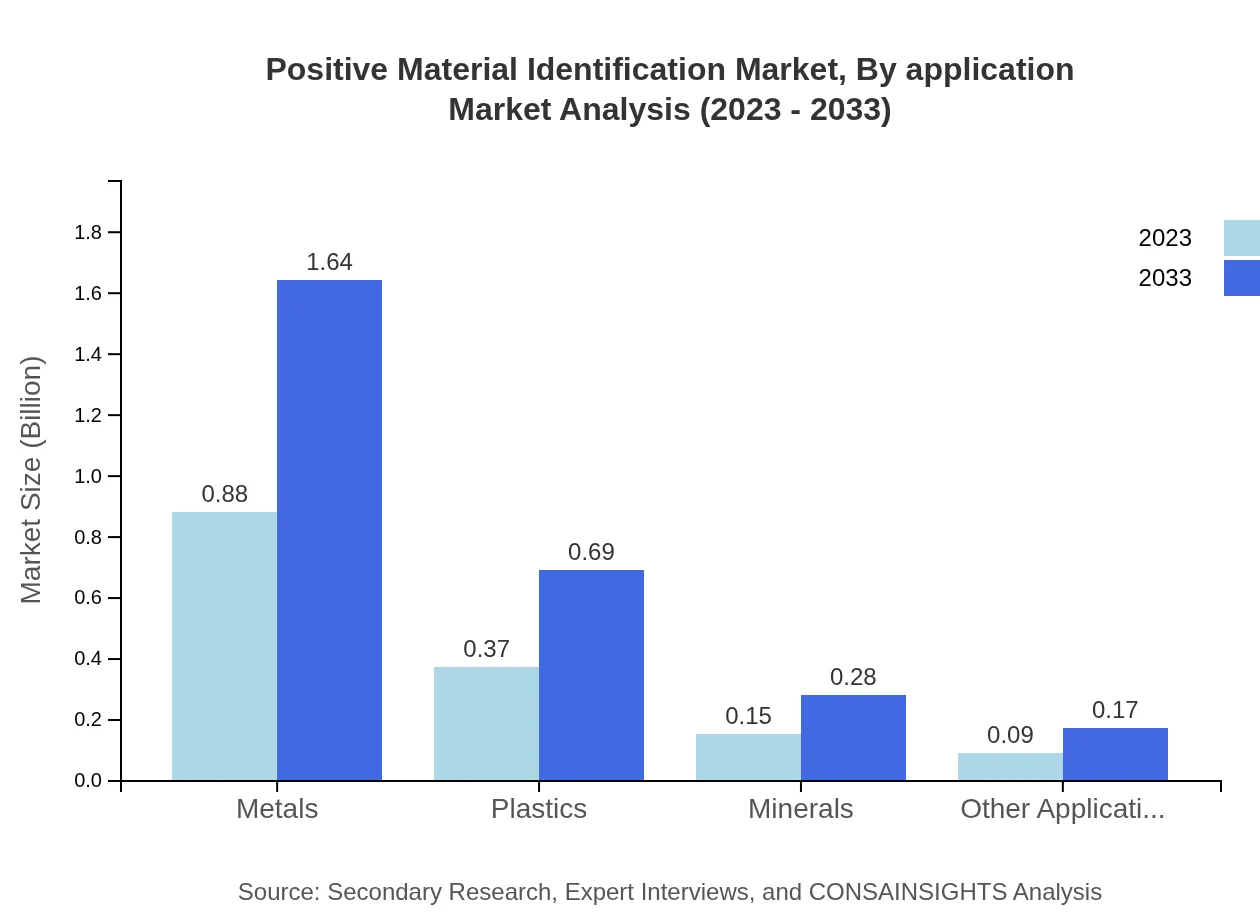

Positive Material Identification Market Analysis By Application

Applications in the PMI sector demonstrate diverse growth profiles. The construction industry leads with a market size of $0.71 billion in 2023 growing to $1.32 billion by 2033. Recycling follows closely with growth demanded to facilitate the sustainable use of materials. Industries such as aerospace, automotive, and manufacturing also contribute significantly to the market as they demand compliance with material specifications and safety standards.

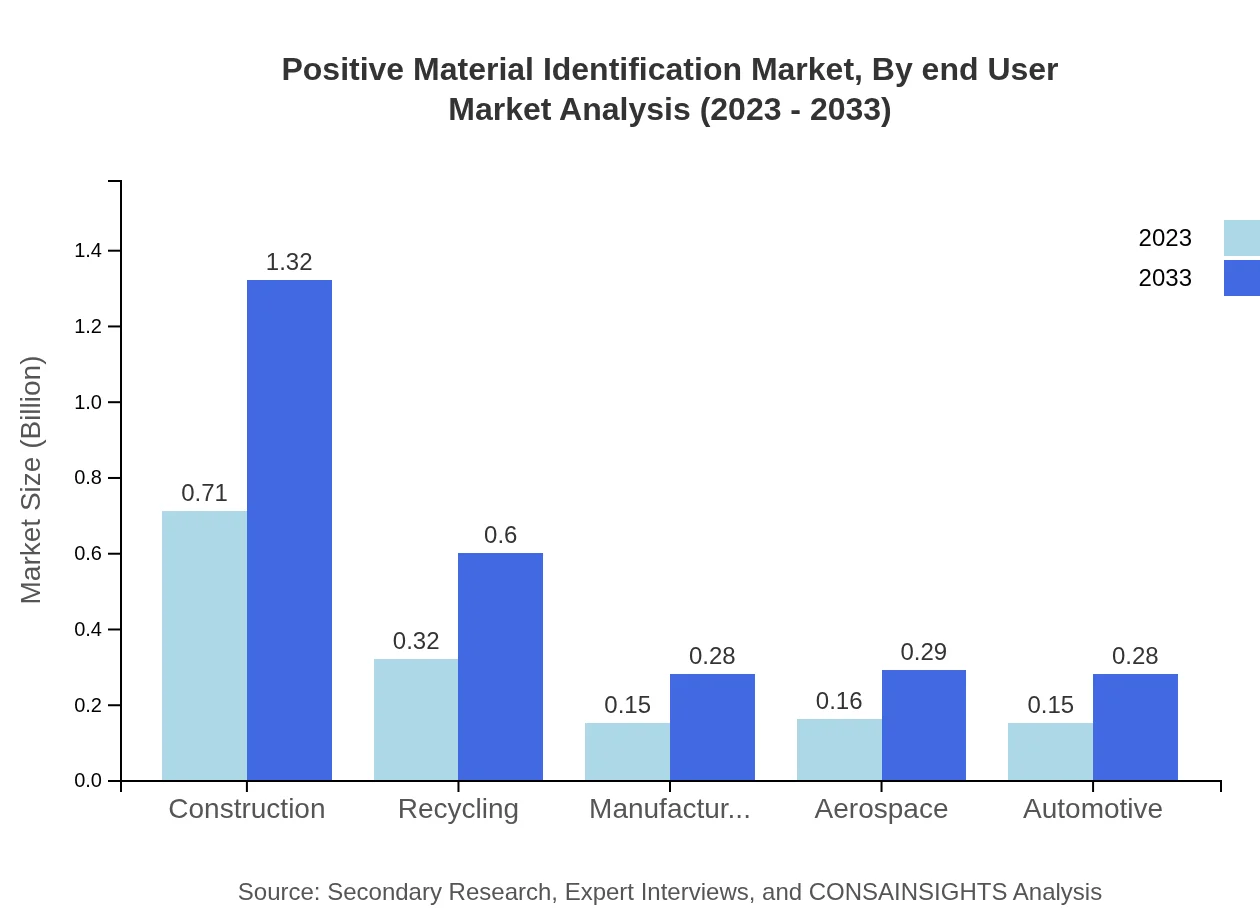

Positive Material Identification Market Analysis By End User

End-user segmentation shows varying growth dynamics. The construction market segment represents the largest share, driven by high demand for quality and safety compliance in construction projects. Other substantial segments include aerospace and automotive industries, where adherence to material standards is paramount for operational safety and efficiency.

Positive Material Identification Market Analysis By Region

The region-specific analysis indicates that North America and Europe hold dominant positions in the PMI market share, driven by established industries and regulatory frameworks that demand thorough material testing. The Asia Pacific market is rapidly expanding, fueled by an increase in manufacturing capacity and industrial activity.

Positive Material Identification Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Positive Material Identification Industry

Thermo Fisher Scientific:

A leader in analytical instrumentation, Thermo Fisher provides an extensive range of PMI solutions leveraging advanced technology for various industries.Hitachi High-Tech Corporation:

Hitachi is recognized for its innovative PMI technologies, particularly in material analysis and compliance markets.Bruker Corporation:

Bruker offers comprehensive solutions for PMI, enhancing the analytical accuracy in materials testing across sectors.Olympus Corporation:

Olympus is a pioneer in manufacturing nondestructive testing equipment, significantly contributing to the PMI market.We're grateful to work with incredible clients.

FAQs

What is the market size of positive Material Identification?

The Positive Material Identification market was valued at $1.5 billion in 2023, with a projected CAGR of 6.2% up to 2033. This growth reflects the increasing need for safety and compliance in various industries.

What are the key market players or companies in this positive Material Identification industry?

Key players in the Positive Material Identification industry include renowned companies specializing in testing and analysis technologies. These companies lead the market through innovative solutions and cutting-edge technologies that enhance material verification processes.

What are the primary factors driving the growth in the positive Material Identification industry?

Growth in the Positive Material Identification industry is driven by increasing regulations in safety standards, evolving manufacturing practices, and a heightened focus on quality assurance. These factors necessitate reliable identification methods across various sectors.

Which region is the fastest Growing in the positive Material Identification?

North America is the fastest-growing region in the Positive Material Identification market, projected to grow from $0.57 billion in 2023 to $1.05 billion by 2033. Its robust industrial backdrop underpins this growth.

Does ConsaInsights provide customized market report data for the positive Material Identification industry?

Yes, ConsaInsights offers tailored market report data for the Positive Material Identification industry. Custom reports provide businesses with insights specific to their needs, ensuring informed strategic decisions based on the latest market trends.

What deliverables can I expect from this positive Material Identification market research project?

From the Positive Material Identification market research project, clients can expect comprehensive reports, market forecasts, competitive analysis, and detailed segmentations, enabling an in-depth understanding of trends and opportunities in the market.

What are the market trends of positive Material Identification?

Market trends in Positive Material Identification include technological advancements, increased use of mobile and portable devices for testing, and a growing emphasis on sustainability in testing materials across various industries.