Positron Emission Tomography Market Report

Published Date: 31 January 2026 | Report Code: positron-emission-tomography

Positron Emission Tomography Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Positron Emission Tomography (PET) market, covering market size, growth trends, regional insights, and advancements in technology from 2023 to 2033.

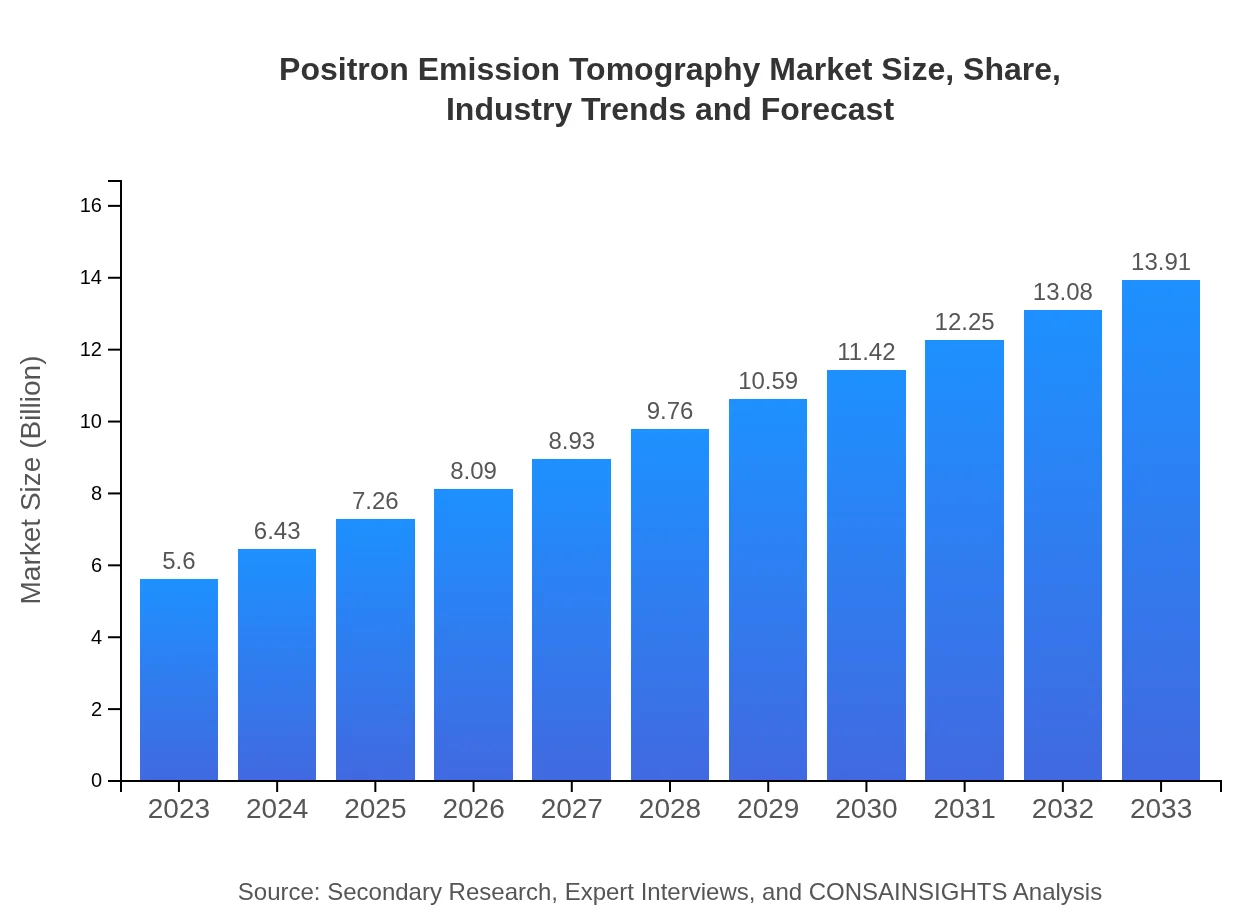

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Siemens Healthineers, General Electric (GE) Healthcare, Philips Healthcare, Canon Medical Systems, Elekta AB |

| Last Modified Date | 31 January 2026 |

Positron Emission Tomography Market Overview

Customize Positron Emission Tomography Market Report market research report

- ✔ Get in-depth analysis of Positron Emission Tomography market size, growth, and forecasts.

- ✔ Understand Positron Emission Tomography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Positron Emission Tomography

What is the Market Size & CAGR of Positron Emission Tomography market in 2023 and 2033?

Positron Emission Tomography Industry Analysis

Positron Emission Tomography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Positron Emission Tomography Market Analysis Report by Region

Europe Positron Emission Tomography Market Report:

The European Positron Emission Tomography market is anticipated to grow from $1.38 billion in 2023 to $3.42 billion by 2033. The presence of prominent market players, along with robust healthcare frameworks in countries like Germany and France, supports this expansion. Moreover, ongoing research & development activities are pivotal for market growth.Asia Pacific Positron Emission Tomography Market Report:

The Asia-Pacific region is projected to grow from $1.09 billion in 2023 to $2.70 billion by 2033, owing to increasing healthcare investments, rising awareness about early diagnosis, and improvements in healthcare infrastructure across countries like China and India. Additionally, the growing elderly population is expected to escalate the demand for PET scans.North America Positron Emission Tomography Market Report:

North America is currently the largest market, expected to advance from $2.08 billion in 2023 to $5.16 billion in 2033. Factors such as advanced healthcare infrastructure, high expenditure on medical imaging technologies, and strong research activities contribute to this growth, alongside the increasing burden of diseases requiring advanced imaging techniques.South America Positron Emission Tomography Market Report:

In South America, the PET market is set to expand from $0.39 billion in 2023 to $0.96 billion by 2033. The growing prevalence of chronic diseases, alongside government initiatives to enhance imaging services in healthcare facilities, aids in this growth. However, economic constraints may pose challenges in certain countries.Middle East & Africa Positron Emission Tomography Market Report:

The Middle East and Africa market is projected to increase from $0.68 billion in 2023 to $1.68 billion by 2033. Growth is driven by improving healthcare systems, increased funding for medical establishments, and rising diseases requiring accurate diagnoses. However, disparities in healthcare access may limit growth in certain regions.Tell us your focus area and get a customized research report.

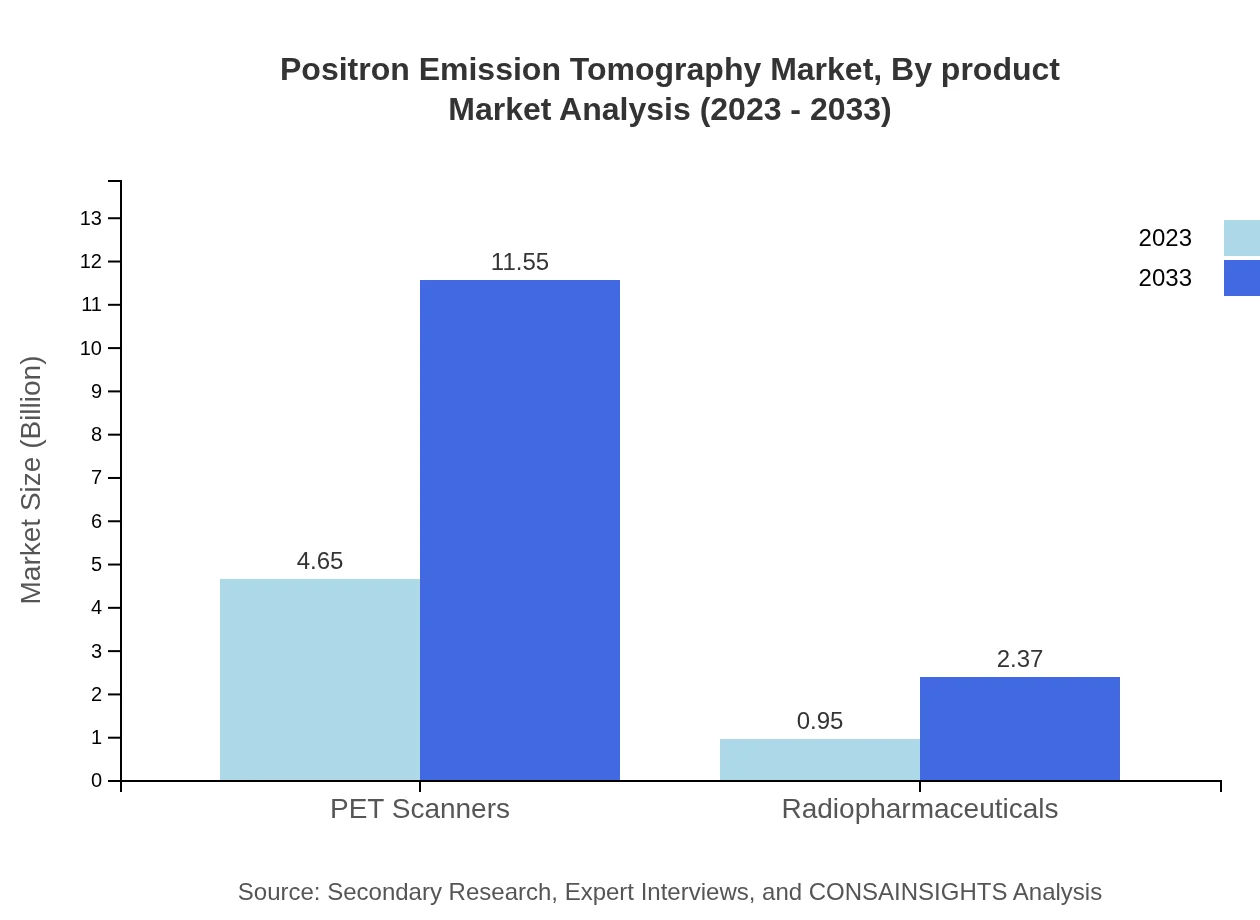

Positron Emission Tomography Market Analysis By Product

In the product segment, PET scanners dominate with a market size of $4.65 billion in 2023, projected to reach $11.55 billion by 2033. Radiopharmaceuticals, earning $0.95 billion in 2023, are expected to grow to $2.37 billion in the same timeframe, indicating significant reliance on both technology types for effective imaging.

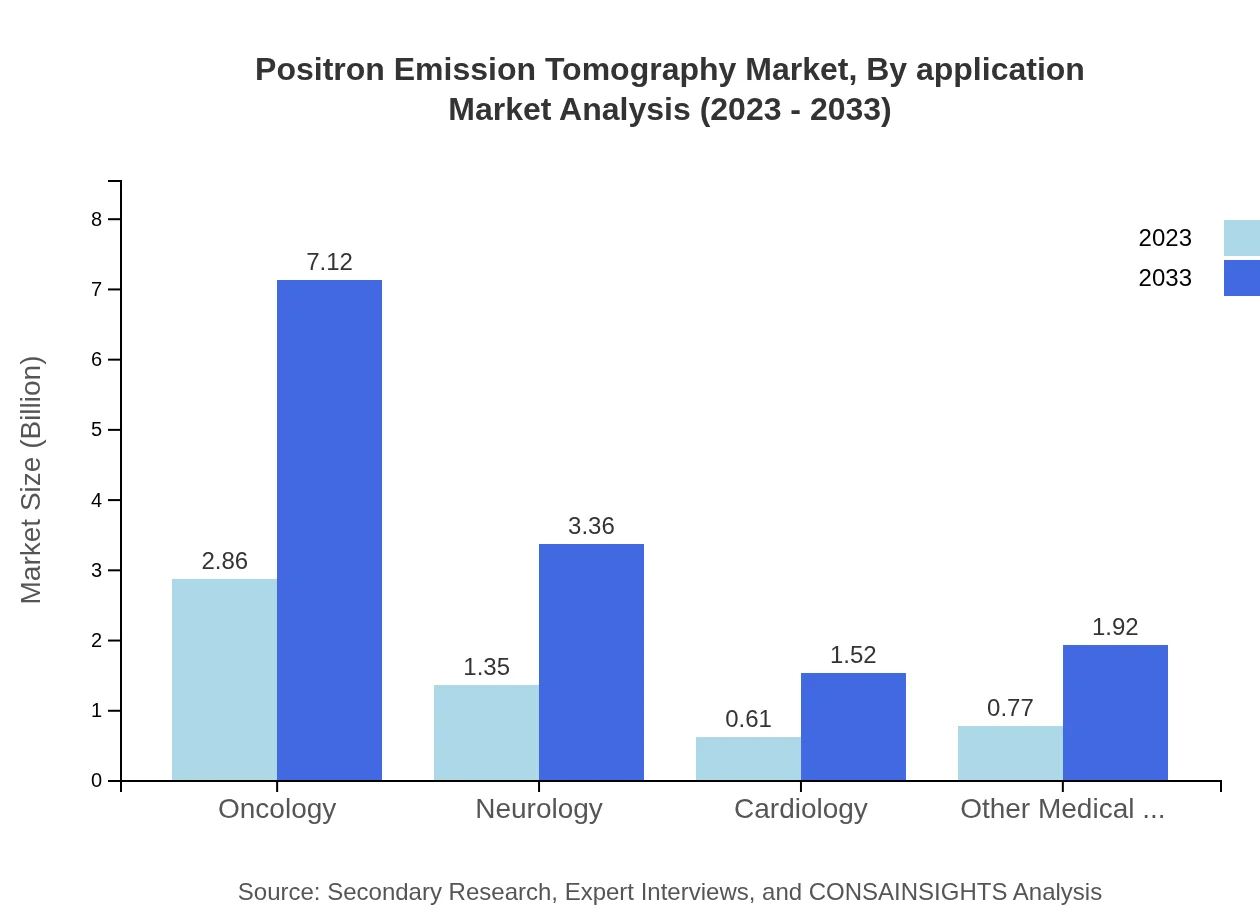

Positron Emission Tomography Market Analysis By Application

The application segment is led by oncology, which represented $2.86 billion in 2023 and is expected to reach $7.12 billion by 2033. Neurology follows with a market size of $1.35 billion, growing to $3.36 billion, reflecting the current trends in diagnostic imaging towards cancer and neurological diseases.

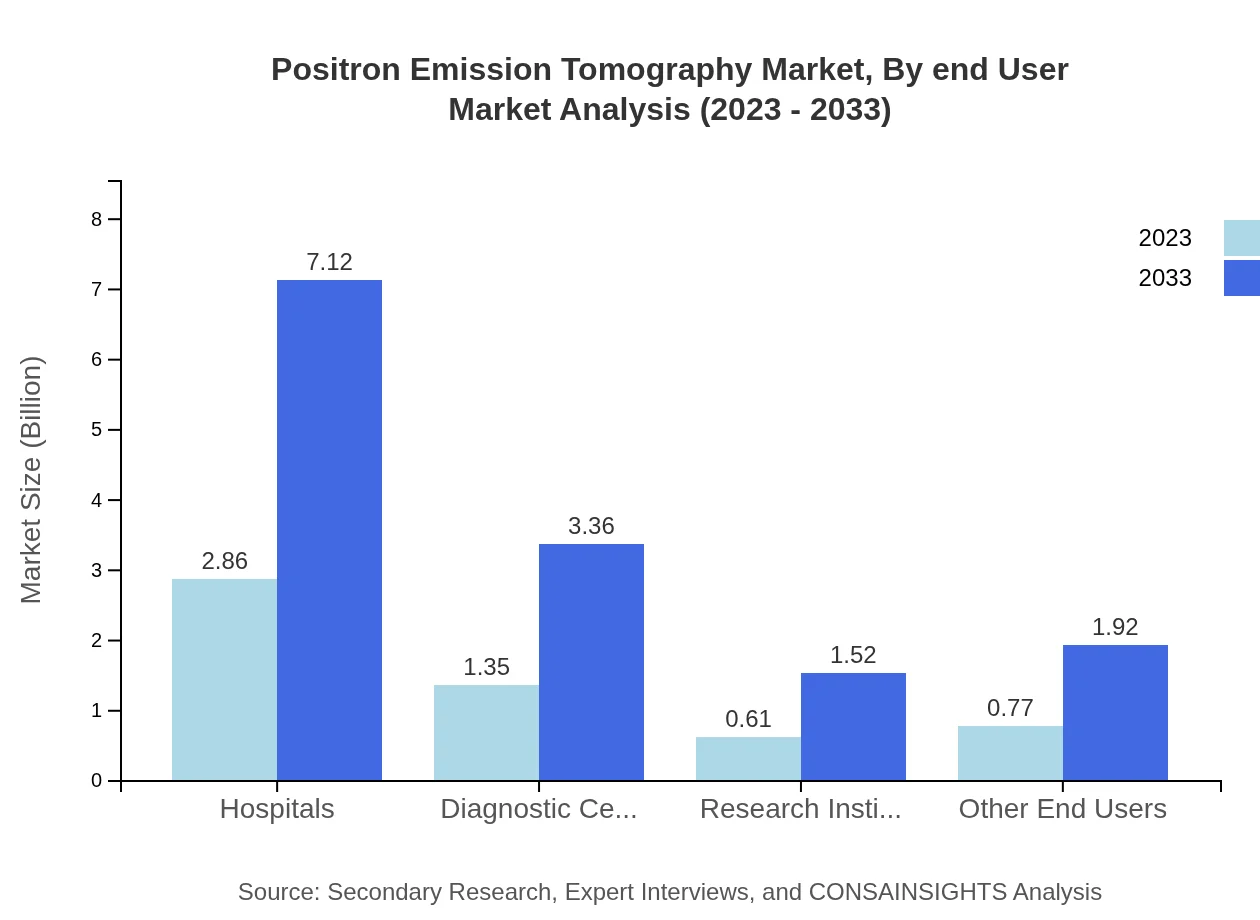

Positron Emission Tomography Market Analysis By End User

Hospitals hold a significant share in the end-user segment with a market size of $2.86 billion in 2023, anticipated to grow to $7.12 billion by 2033. Diagnostic centers also remain vital, showing growth from $1.35 billion to $3.36 billion, underlining their importance in providing accessible imaging solutions.

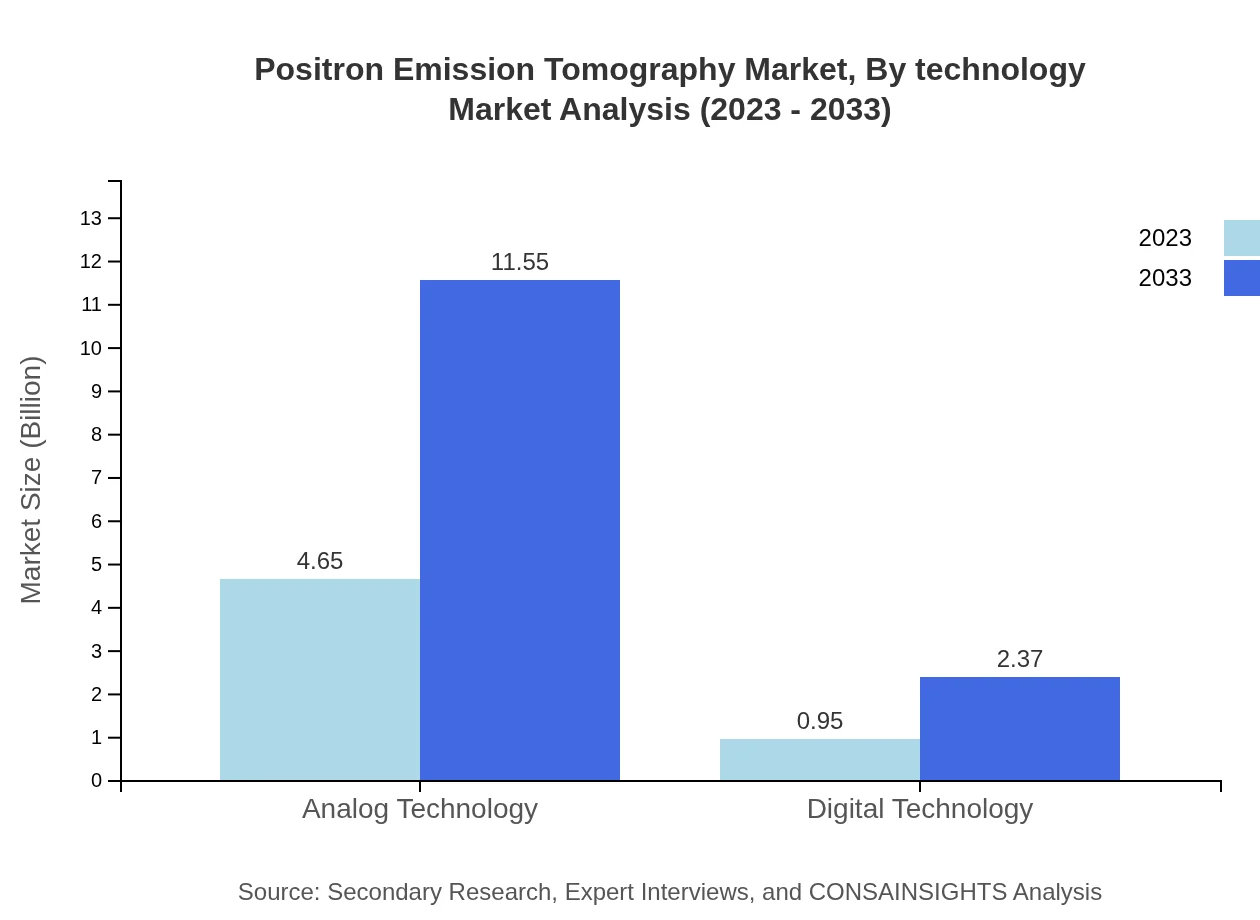

Positron Emission Tomography Market Analysis By Technology

Digital technology within the PET market represents $0.95 billion, expected to grow to $2.37 billion by 2033, highlighting the shift towards advanced imaging technologies. Conversely, analog technology retains a consistent market share reflecting ongoing reliance on established systems.

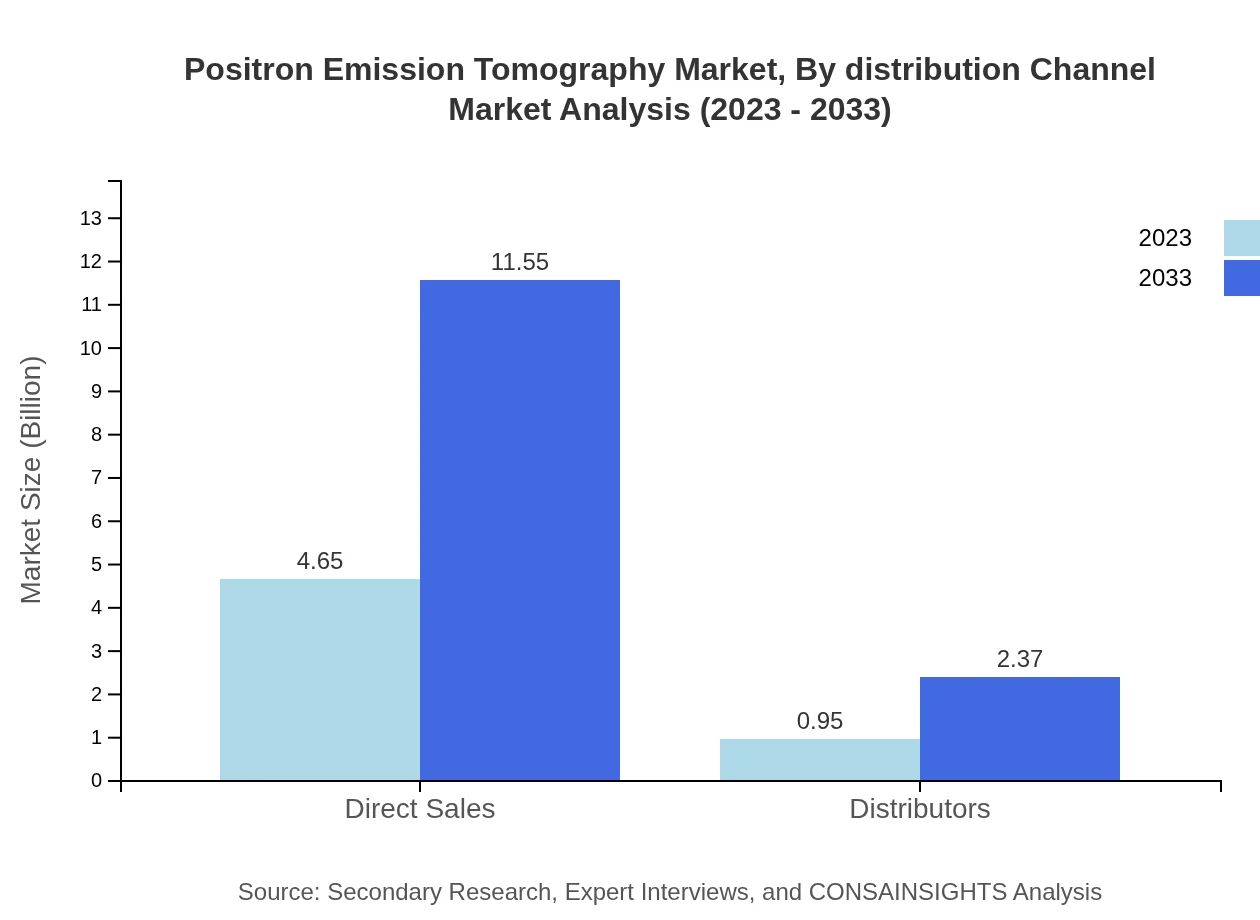

Positron Emission Tomography Market Analysis By Distribution Channel

Direct sales dominate the distribution channel segment, with a market size of $4.65 billion in 2023, forecasted to reach $11.55 billion by 2033. Distributors also play a significant role, projected to grow from $0.95 billion to $2.37 billion, ensuring reach into various healthcare facilities.

Positron Emission Tomography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Positron Emission Tomography Industry

Siemens Healthineers:

Siemens Healthineers is a leading developer of medical imaging equipment, known for its innovative PET/CT systems that enhance image quality and diagnostic capabilities.General Electric (GE) Healthcare:

GE Healthcare specializes in medical technologies including PET systems, focusing on improving patient outcomes through state-of-the-art imaging solutions.Philips Healthcare:

Philips Healthcare is renowned for its advanced imaging technologies, including PET systems, significantly contributing to non-invasive diagnostic imaging.Canon Medical Systems:

Canon Medical Systems develops comprehensive imaging solutions, and their PET systems are pivotal in advancing diagnostic capabilities within the healthcare sector.Elekta AB:

Elekta focuses on providing innovative solutions in medical technology, enhancing the PET market's growth through advanced imaging capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of positron Emission Tomography?

The positron-emission-tomography market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 9.2%, indicating significant growth potential through 2033 as advancements in technology enhance diagnostic capabilities.

What are the key market players or companies in this positron Emission Tomography industry?

Key players in the positron-emission-tomography industry include major companies like Siemens Healthineers, GE Healthcare, Philips, and Canon Medical Systems, which are often leading in innovation and market share through advanced imaging technologies.

What are the primary factors driving the growth in the positron Emission Tomography industry?

Factors driving growth include increasing prevalence of cancer, advancements in imaging technologies, rise in demand for early diagnosis, and growth in healthcare expenditure, particularly in therapeutic areas like oncology and neurology.

Which region is the fastest Growing in the positron Emission Tomography?

The Asia-Pacific region is the fastest-growing market for positron-emission-tomography, expected to scale from $1.09 billion in 2023 to $2.70 billion by 2033, primarily due to rapid healthcare advancements and a growing patient population.

Does ConsaInsights provide customized market report data for the positron Emission Tomography industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the positron-emission-tomography industry, ensuring insights that align with market trends and individual business strategies.

What deliverables can I expect from this positron Emission Tomography market research project?

Expect comprehensive deliverables including detailed market analysis reports, growth forecasts, competitive landscape insights, and actionable recommendations specific to the positron-emission-tomography market segments.

What are the market trends of positron Emission Tomography?

Major trends include increasing utilization of PET scanners, advances in digital technologies, and a growing focus on oncology applications, alongside rising collaborations and partnerships for enhanced product development.