Potash Ores Market Report

Published Date: 02 February 2026 | Report Code: potash-ores

Potash Ores Market Size, Share, Industry Trends and Forecast to 2033

This report covers the Potash Ores market including an overview of the current trends, market size, segmentation, and analysis through to the year 2033, providing insights into key players and future forecasts.

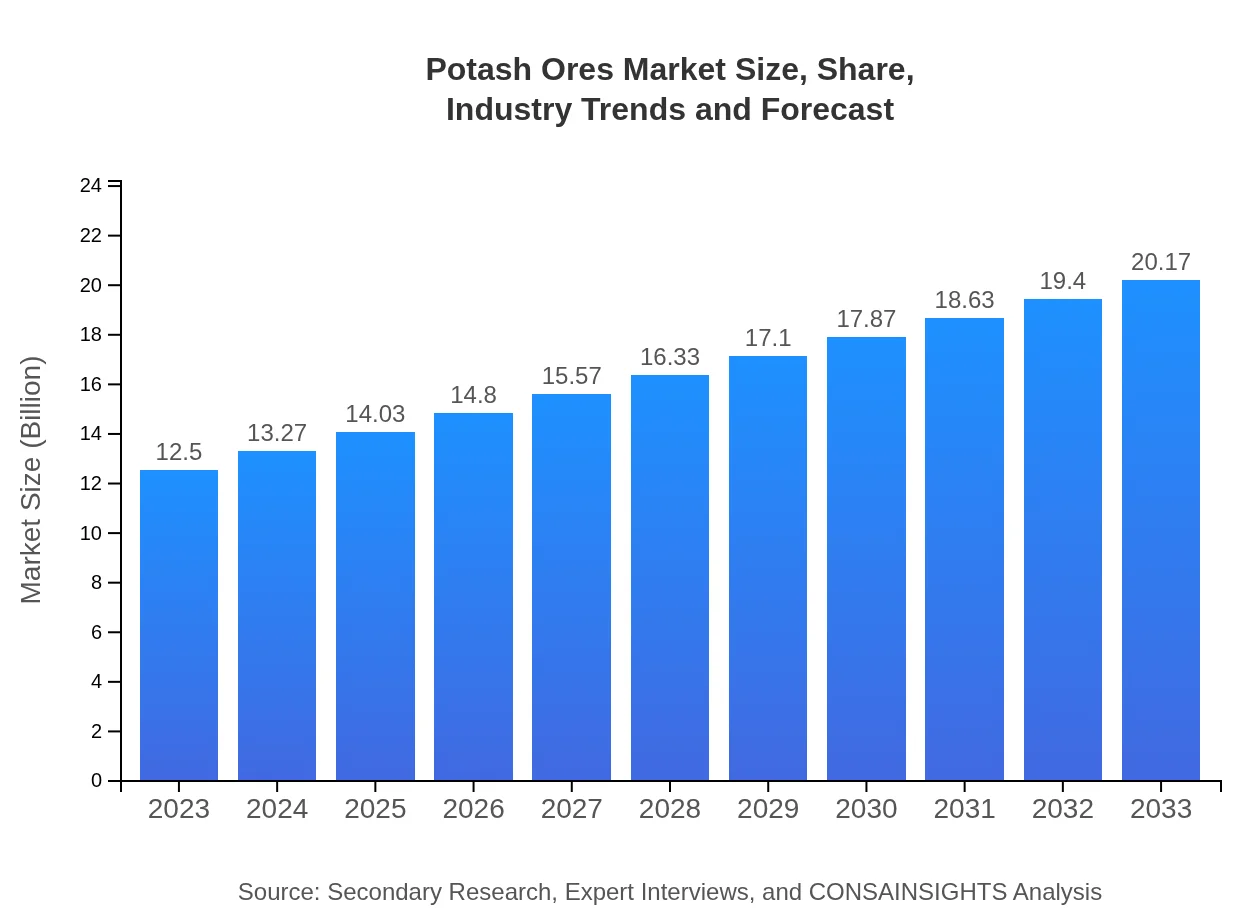

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $20.17 Billion |

| Top Companies | Nutrien Ltd., The Mosaic Company, K+S AG, Israel Chemicals Ltd. |

| Last Modified Date | 02 February 2026 |

Potash Ores Market Overview

Customize Potash Ores Market Report market research report

- ✔ Get in-depth analysis of Potash Ores market size, growth, and forecasts.

- ✔ Understand Potash Ores's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Potash Ores

What is the Market Size & CAGR of Potash Ores market in 2023?

Potash Ores Industry Analysis

Potash Ores Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Potash Ores Market Analysis Report by Region

Europe Potash Ores Market Report:

The European potash market was valued at $3.61 billion in 2023, and it's anticipated to expand to $5.83 billion by 2033. Regulatory frameworks focusing on environmental sustainability and increasing demand for organic fertilizers are significant growth drivers.Asia Pacific Potash Ores Market Report:

In the Asia Pacific region, the market was valued at approximately $2.39 billion in 2023 and is projected to grow to $3.86 billion by 2033. Rapid urbanization and increasing agricultural productivity drive market growth, alongside supportive government policies promoting sustainable farming.North America Potash Ores Market Report:

In North America, the market size of potash ores stood at $4.61 billion in 2023, projected to reach $7.43 billion by 2033. The region is a major producer, with a focus on innovations in potash extraction and sustainable farming practices enhancing crop yields.South America Potash Ores Market Report:

The South American potash market was valued at $1.22 billion in 2023, expected to reach $1.96 billion by 2033. The region's fertile lands and growing demand for biofuels are pivotal to this growth, alongside investments in agricultural technology.Middle East & Africa Potash Ores Market Report:

For the Middle East and Africa, the market size is estimated at $0.67 billion in 2023, increasing to $1.08 billion by 2033. The growth is fueled by improved irrigation techniques and a rising demand for fertilizers in arid regions.Tell us your focus area and get a customized research report.

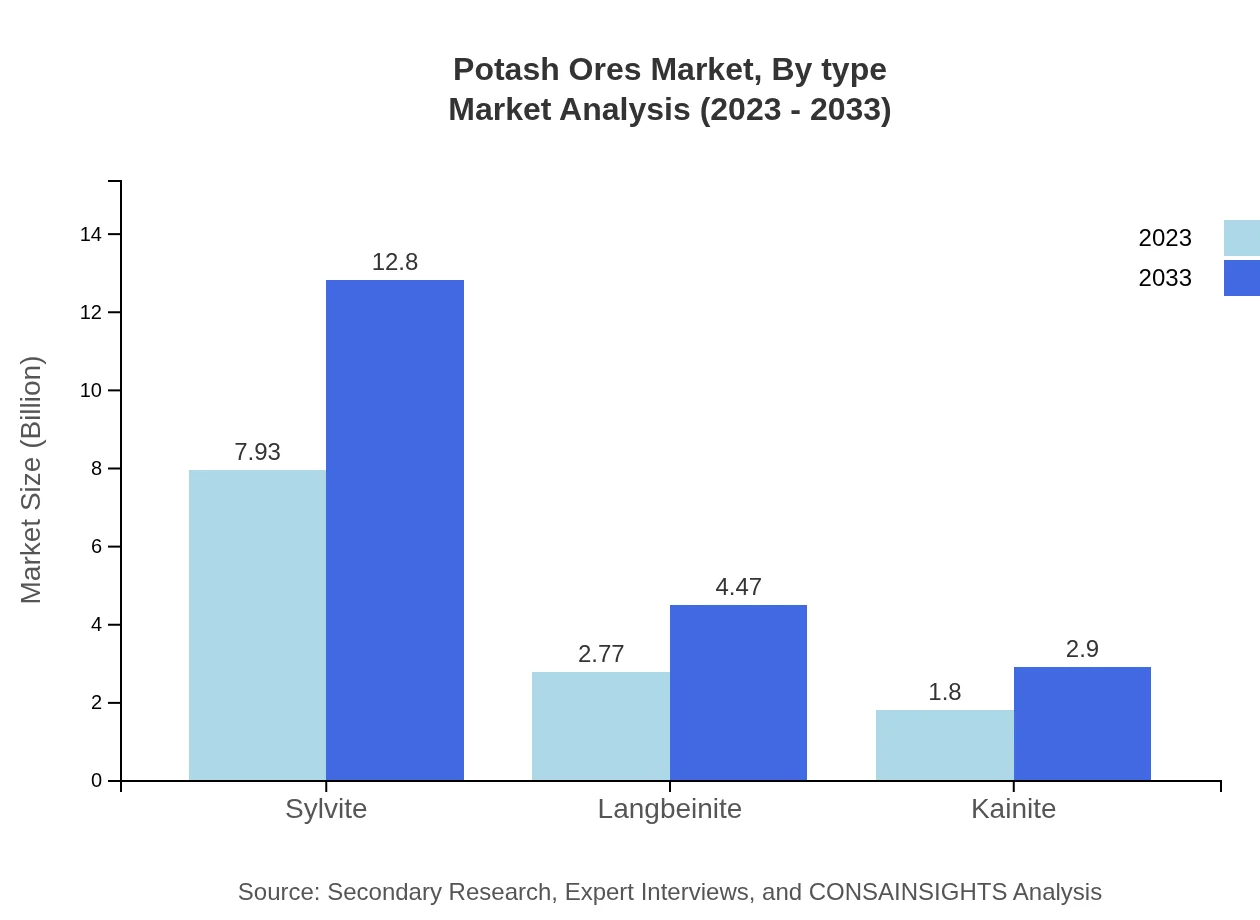

Potash Ores Market Analysis By Type

The potash ores market by type includes Sylvite, Langbeinite, and Kainite. Sylvite dominates the market, accounting for a significant share valued at approximately $7.93 billion in 2023 and projected to reach $12.80 billion by 2033. Langbeinite follows closely, with a market value of $2.77 billion in 2023, expected to grow to $4.47 billion by 2033.

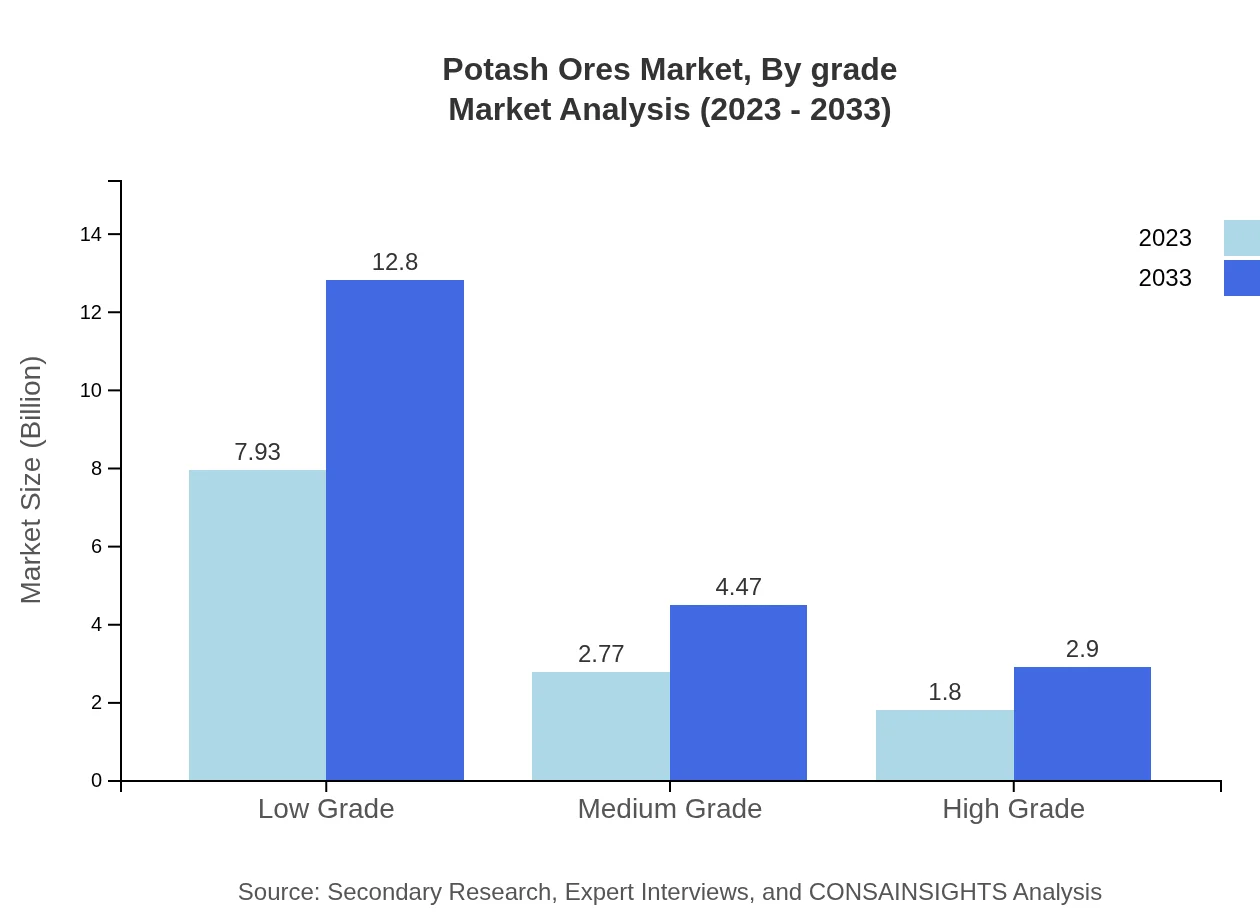

Potash Ores Market Analysis By Grade

In the Potash Ores market by grade segmentation, Low Grade, Medium Grade, and High Grade represent essential categories. Low Grade is expected to dominate with $7.93 billion in 2023, increasing to $12.80 billion in 2033, while Medium Grade is projected to reach $4.47 billion in the same period.

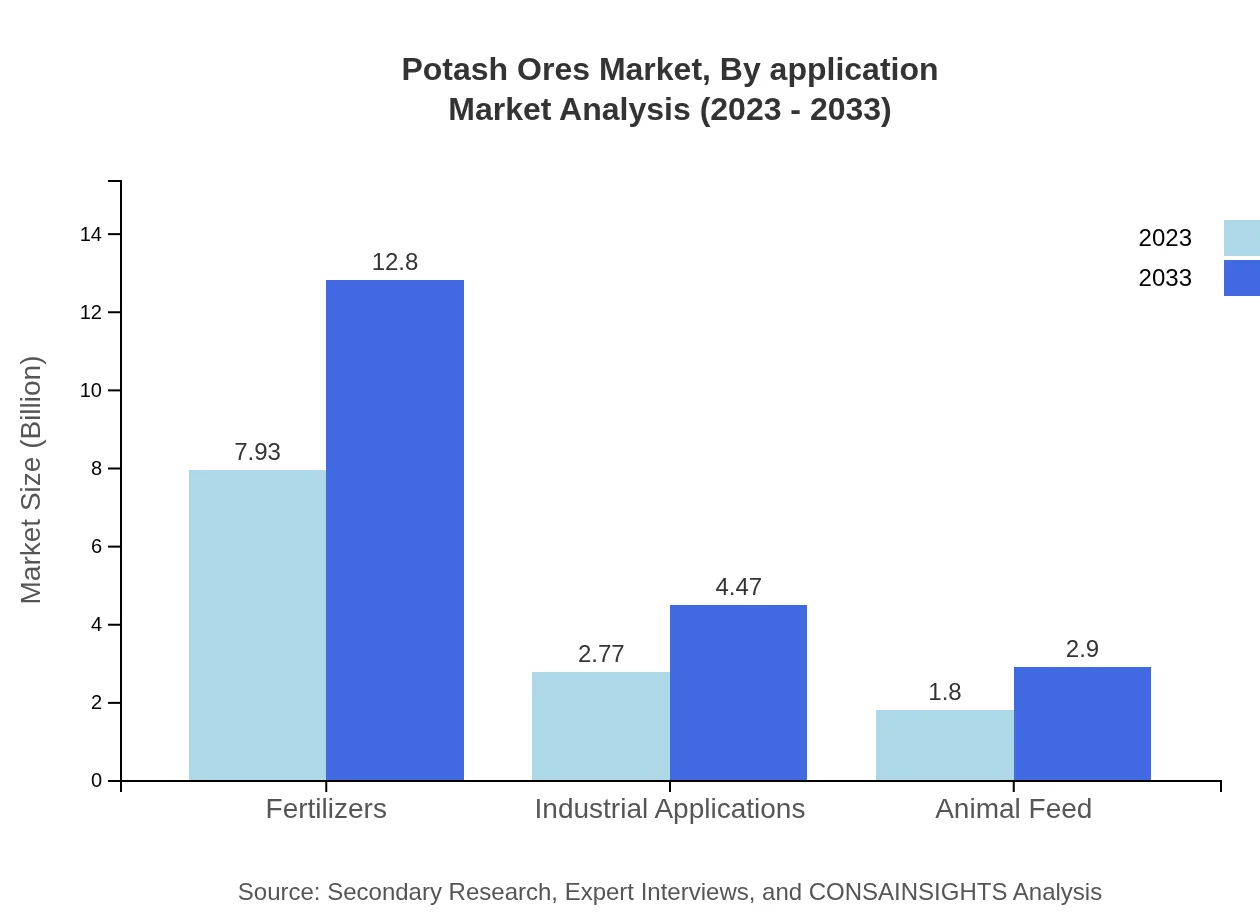

Potash Ores Market Analysis By Application

The primary applications for potash ores include fertilizers, industrial applications, and animal feed. Fertilizers account for a dominant share, with a market size of $7.93 billion in 2023, anticipated to grow to $12.80 billion by 2033, highlighting its significance in agricultural productivity.

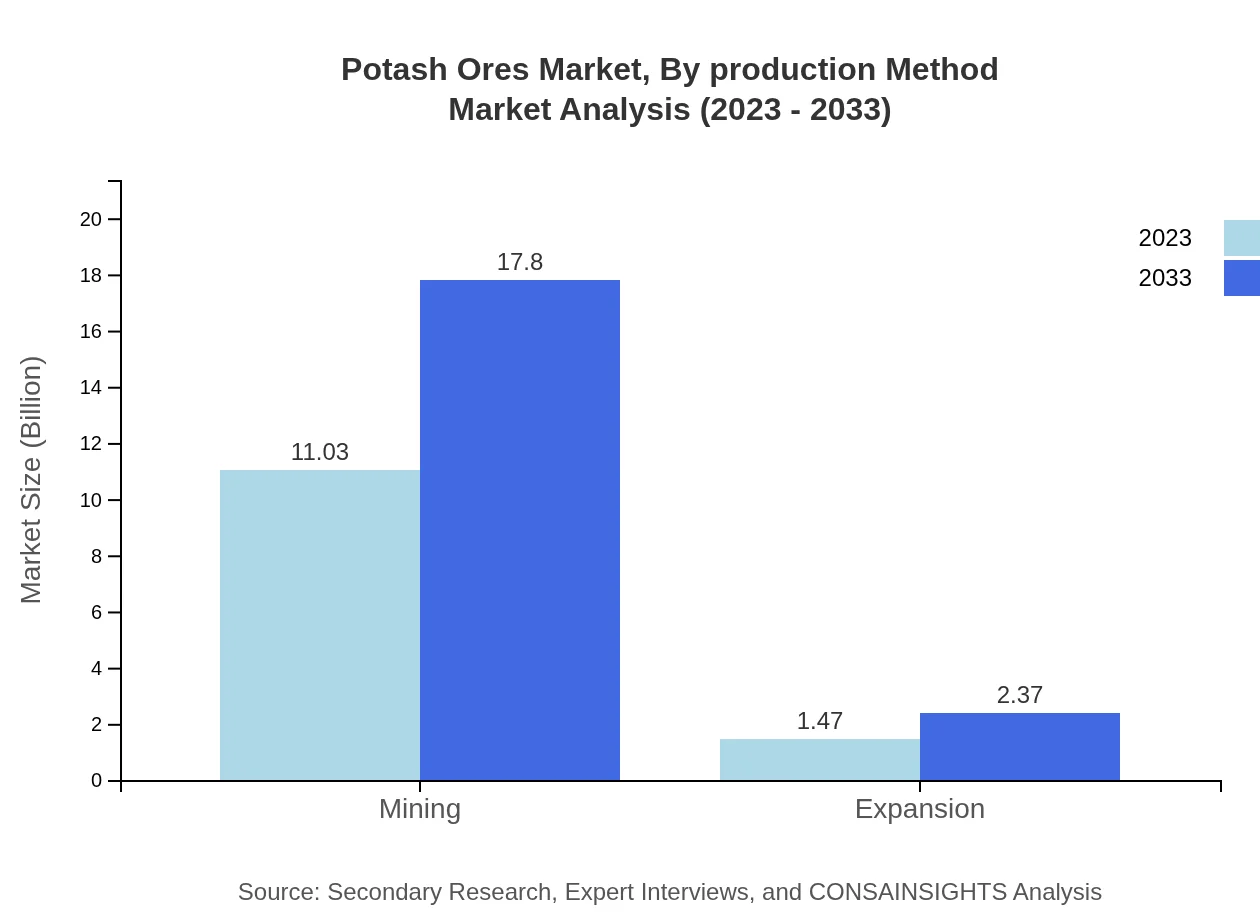

Potash Ores Market Analysis By Production Method

Production methods in the Potash Ores market significantly impact output efficiency and profitability. Mining remains the predominant method, holding an 88.27% market share in 2023 and anticipated to rise alongside increasing demand for efficient extraction technologies.

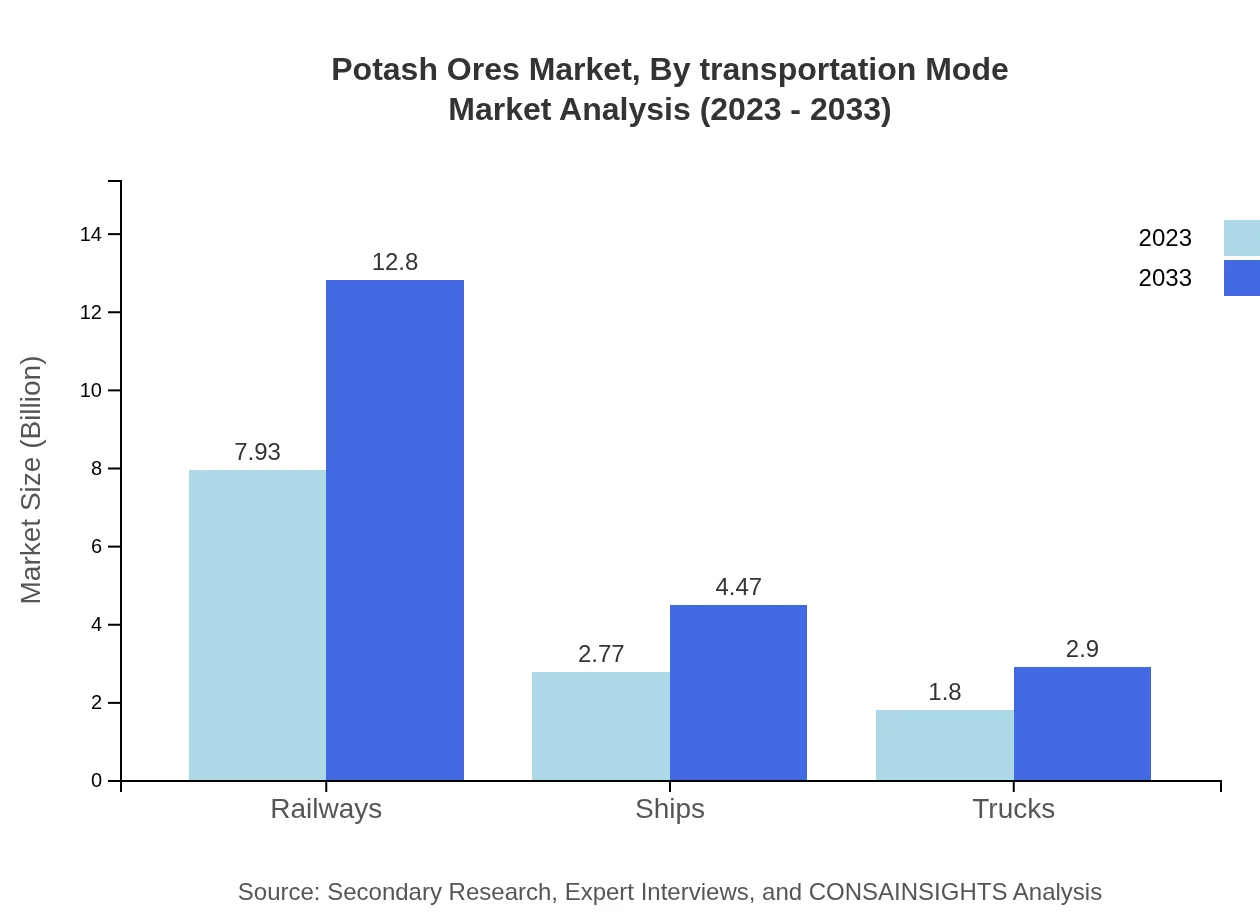

Potash Ores Market Analysis By Transportation Mode

Transportation modes for potash ores include railways, ships, and trucks. Railways hold a significant market segment, valued at $7.93 billion in 2023 and expected to grow to $12.80 billion by 2033, due to their effectiveness in bulk transport.

Potash Ores Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Potash Ores Industry

Nutrien Ltd.:

A leading global supplier of crop inputs and solutions, Nutrien operates several potash mines in Canada and plays a crucial role in enhancing agricultural production.The Mosaic Company:

The Mosaic Company specializes in the production of potash and phosphate fertilizers, focusing on enhancing yields and sustainability in crop production.K+S AG:

K+S AG is a recognized global player in the potash market, contributing significantly through sustainable mining practices and innovative fertilizer solutions.Israel Chemicals Ltd.:

Israel Chemicals Ltd. is a multifaceted company involved in the production of potash fertilizers and industrial products, integrating sustainable practices into their operations.We're grateful to work with incredible clients.

FAQs

What is the market size of potash Ores?

The global potash-ores market size was valued at approximately $12.5 billion in 2023, with a projected growth boasting a CAGR of 4.8% through 2033, indicating robust growth in the demand and consumption of potash-ores globally.

What are the key market players or companies in the potash Ores industry?

Key players in the potash-ores market include major companies involved in extraction, processing, and distribution such as Nutrien Ltd., The Mosaic Company, and Israel Chemicals Ltd. These companies dominate the landscape, significantly influencing market trends.

What are the primary factors driving the growth in the potash Ores industry?

The growth of the potash-ores industry is driven by increasing demand for fertilizers, rising agricultural productivity standards, and advancements in mining technologies. Additionally, the global push towards sustainable agriculture is fueling the demand for potash-based fertilizers.

Which region is the fastest Growing in the potash Ores?

Among regions, North America is identified as the fastest-growing market for potash-ores, with the market expected to expand from $4.61 billion in 2023 to $7.43 billion by 2033. This growth is attributed to increased agricultural activity and demand for fertilizers.

Does ConsaInsights provide customized market report data for the potash Ores industry?

Yes, ConsaInsights offers customized market report data for the potash-ores industry. Clients can request specific insights tailored to their needs, including focused analyses on market segments, regional developments, and competitive landscapes.

What deliverables can I expect from this potash Ores market research project?

Delivery from the potash-ores market research project typically includes a comprehensive report outlining market size, forecasts, trends, and competitive analysis, along with specific insights on segments like fertilizers, industrial applications, and regional developments.

What are the market trends of potash Ores?

Market trends for potash-ores indicate an increasing focus on sustainable agricultural practices, heightened demand for potassium-rich fertilizers, and advances in mining technologies. These trends collectively reflect a market moving towards resilience and efficiency in production.