Poultry Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: poultry-diagnostics

Poultry Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Poultry Diagnostics market, including insights on market size, industry trends, regional assessments, and future forecasts from 2023 to 2033.

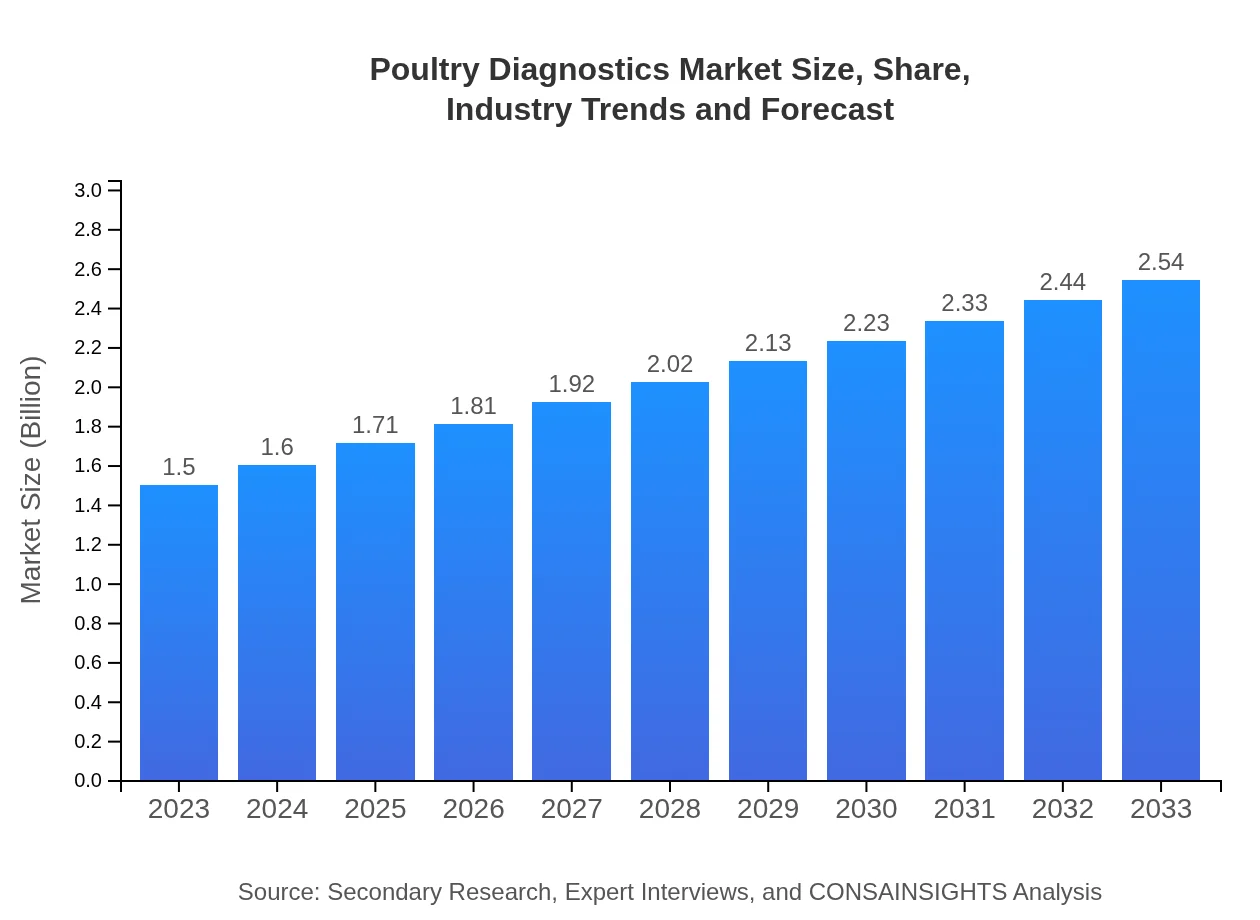

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $2.54 Billion |

| Top Companies | Zoetis Inc., IDEXX Laboratories, Inc., Neogen Corporation, Merck Animal Health, Heska Corporation |

| Last Modified Date | 31 January 2026 |

Poultry Diagnostics Market Overview

Customize Poultry Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Poultry Diagnostics market size, growth, and forecasts.

- ✔ Understand Poultry Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Poultry Diagnostics

What is the Market Size & CAGR of Poultry Diagnostics market in 2023?

Poultry Diagnostics Industry Analysis

Poultry Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Poultry Diagnostics Market Analysis Report by Region

Europe Poultry Diagnostics Market Report:

Europe's poultry diagnostics market is projected to grow from $0.51 billion in 2023 to $0.86 billion by 2033, supported by technological advancements in diagnostic methods and stringent food safety regulations.Asia Pacific Poultry Diagnostics Market Report:

In 2023, the Asia Pacific region is expected to hold a market size of $0.26 billion, projected to grow to $0.44 billion by 2033. Rising poultry consumption and government initiatives for animal health drive the demand for diagnostics in countries like China and India.North America Poultry Diagnostics Market Report:

North America exhibits a robust market size of $0.51 billion in 2023, predicted to increase to $0.87 billion by 2033. This growth is bolstered by advanced healthcare regulations and a focus on biosecurity measures across the poultry sector.South America Poultry Diagnostics Market Report:

The South American poultry diagnostics market is anticipated to grow from $0.06 billion in 2023 to $0.10 billion in 2033, driven by increased poultry farming and a focus on disease management in countries like Brazil.Middle East & Africa Poultry Diagnostics Market Report:

The market in the Middle East and Africa is estimated at $0.16 billion for 2023, with expectations of reaching $0.28 billion by 2033. Growth is driven by increasing poultry production and rising health consciousness among consumers.Tell us your focus area and get a customized research report.

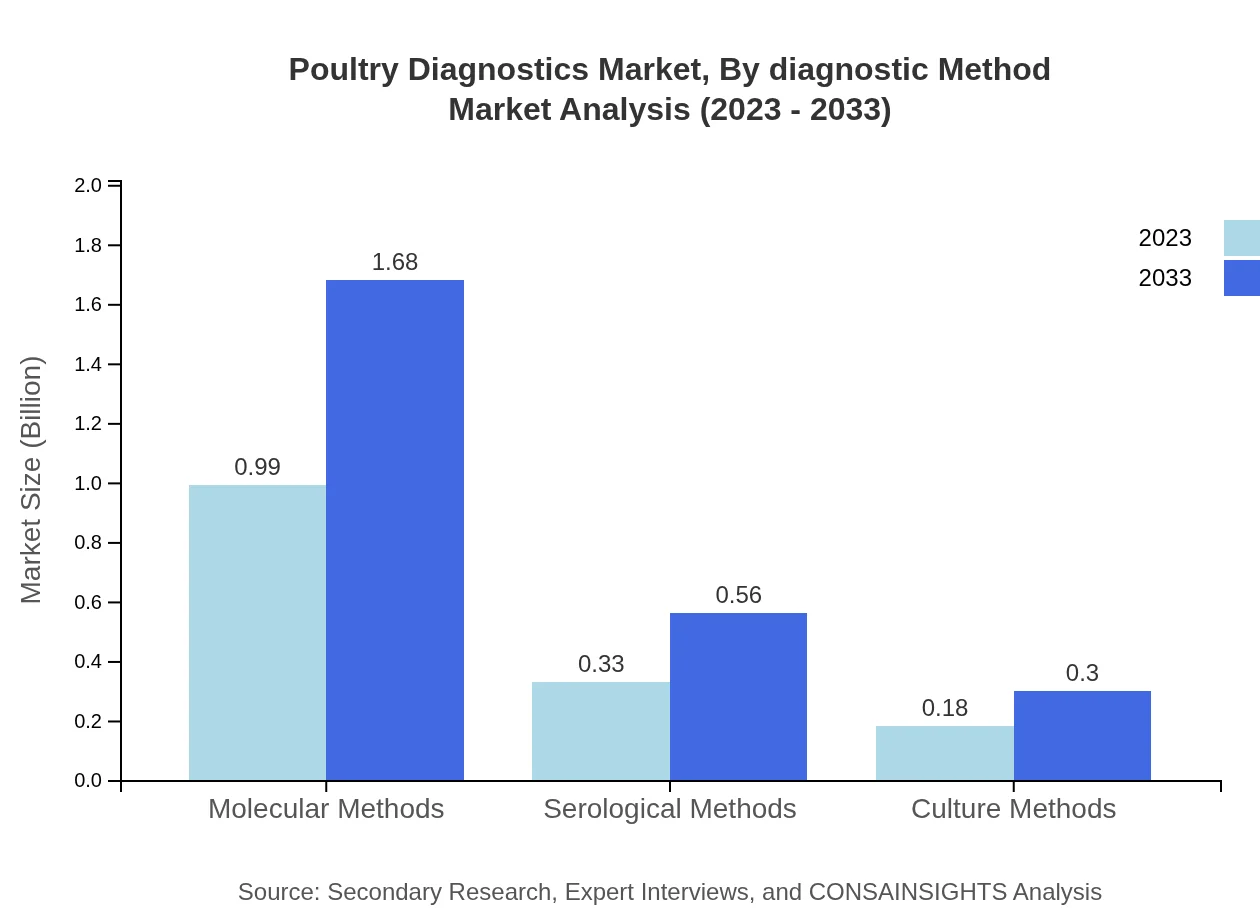

Poultry Diagnostics Market Analysis By Diagnostic Method

By diagnostic methods, the market is dominated by molecular methods, expected to grow from $0.99 billion in 2023 to $1.68 billion by 2033, capturing a 66% market share. Serological methods follow, indicating importance, with growth from $0.33 billion to $0.56 billion. Culture methods maintain a steady position with a share of about 12%.

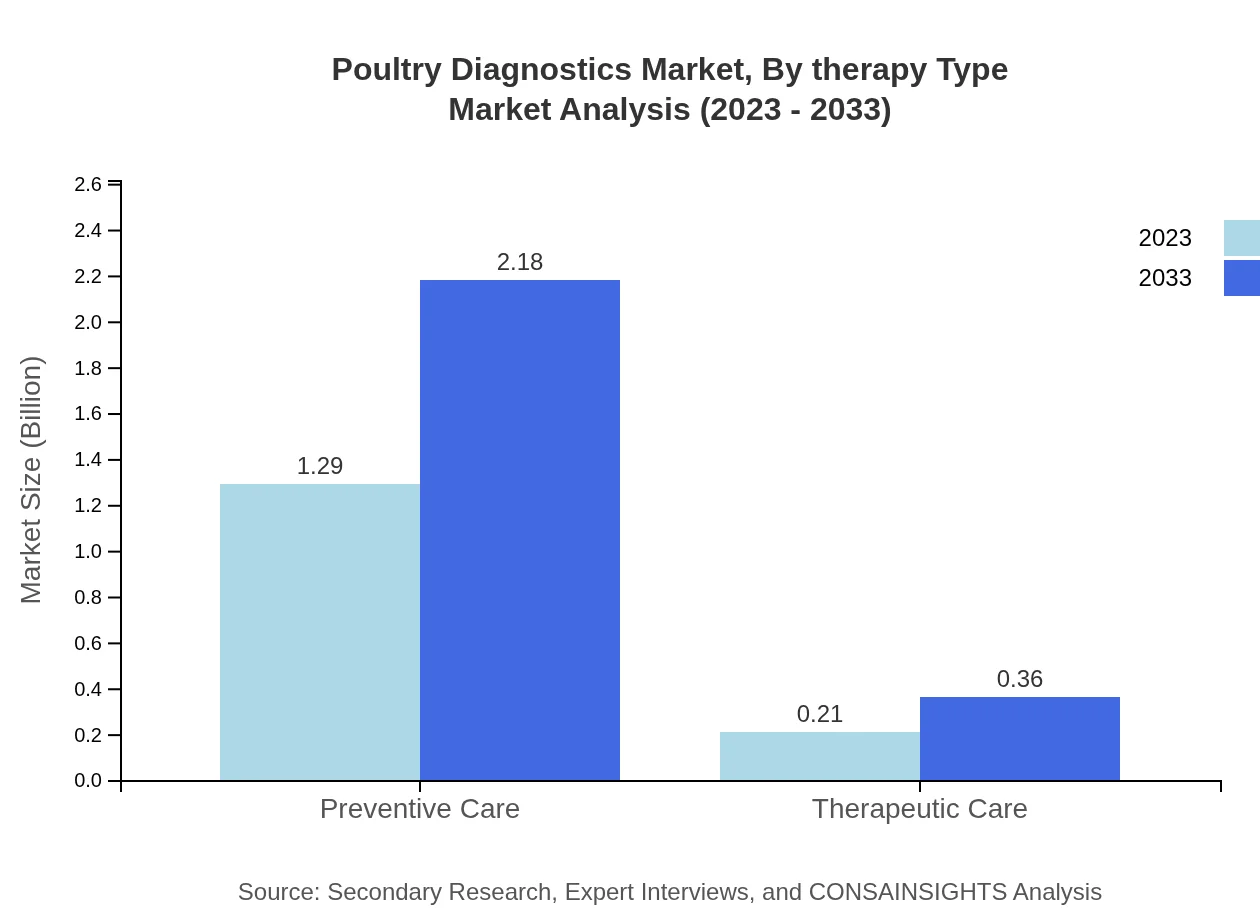

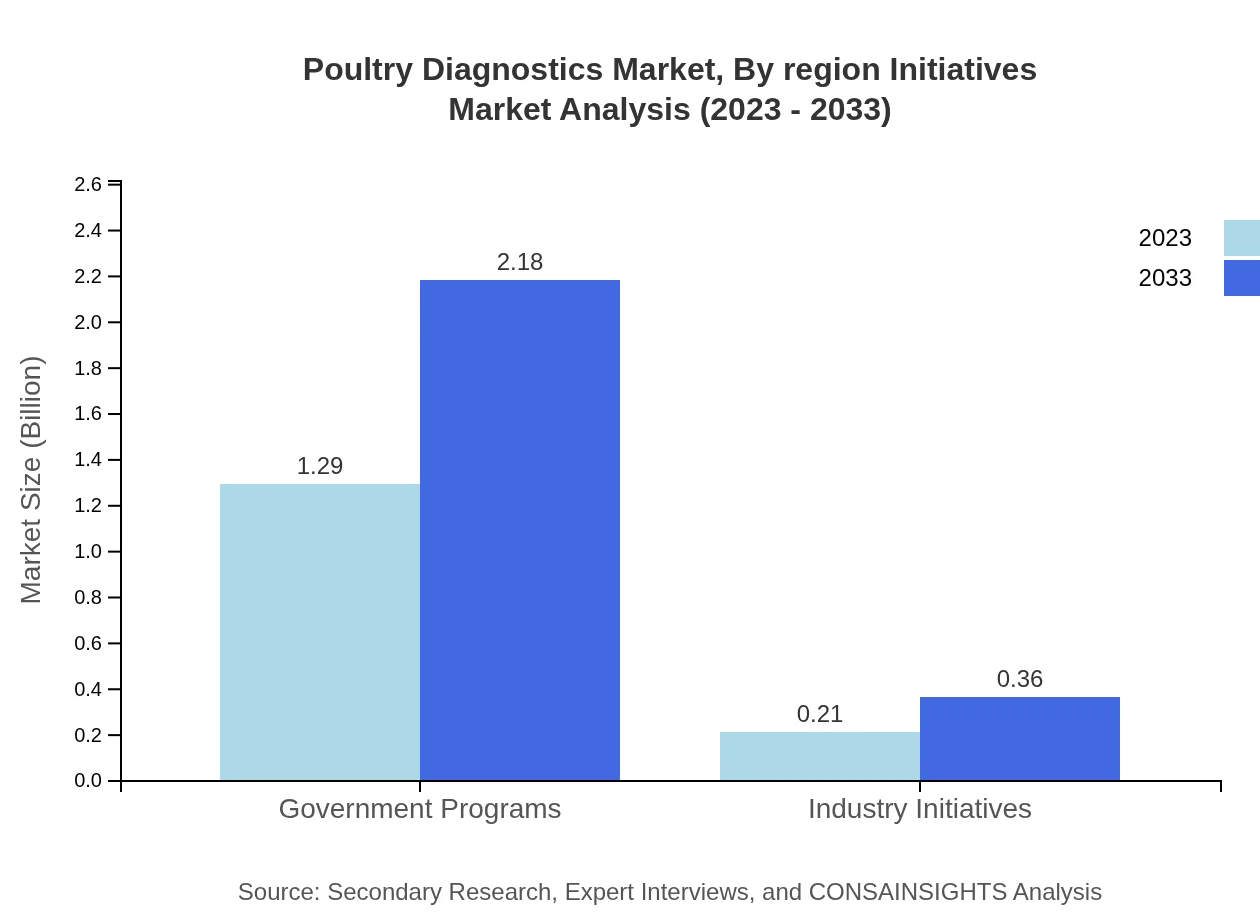

Poultry Diagnostics Market Analysis By Therapy Type

In terms of therapy, preventive care holds a significant share of 86% in 2023, increasing in value from $1.29 billion to $2.18 billion by 2033. Therapeutic care accounts for a smaller yet vital share at 14%, expected to reach $0.36 billion by 2033.

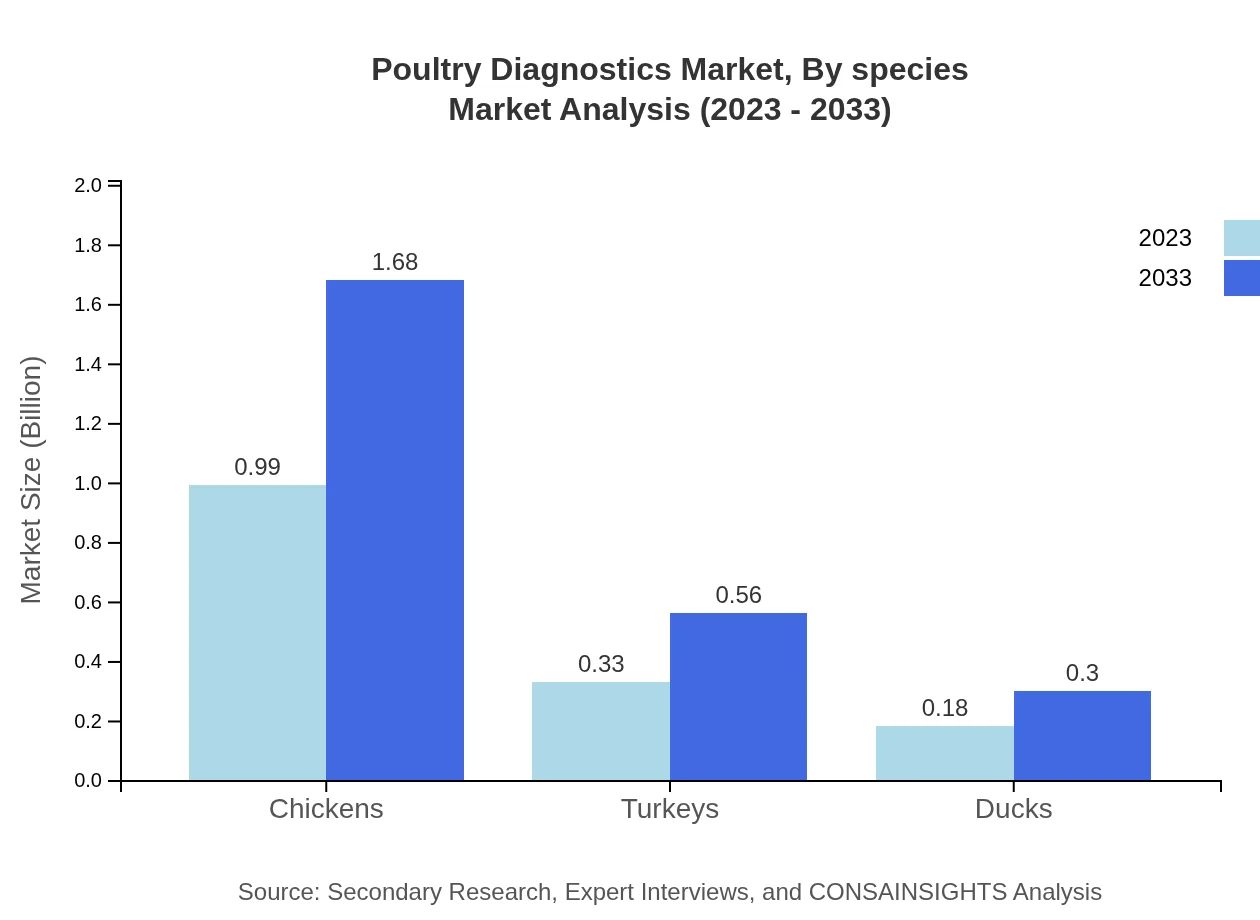

Poultry Diagnostics Market Analysis By Species

The chicken segment leads, constituting 66% of the market, with revenues expanding from $0.99 billion to $1.68 billion. Turkeys and ducks follow, with shares of 22% and 12%, respectively, showcasing diverse needs across poultry types.

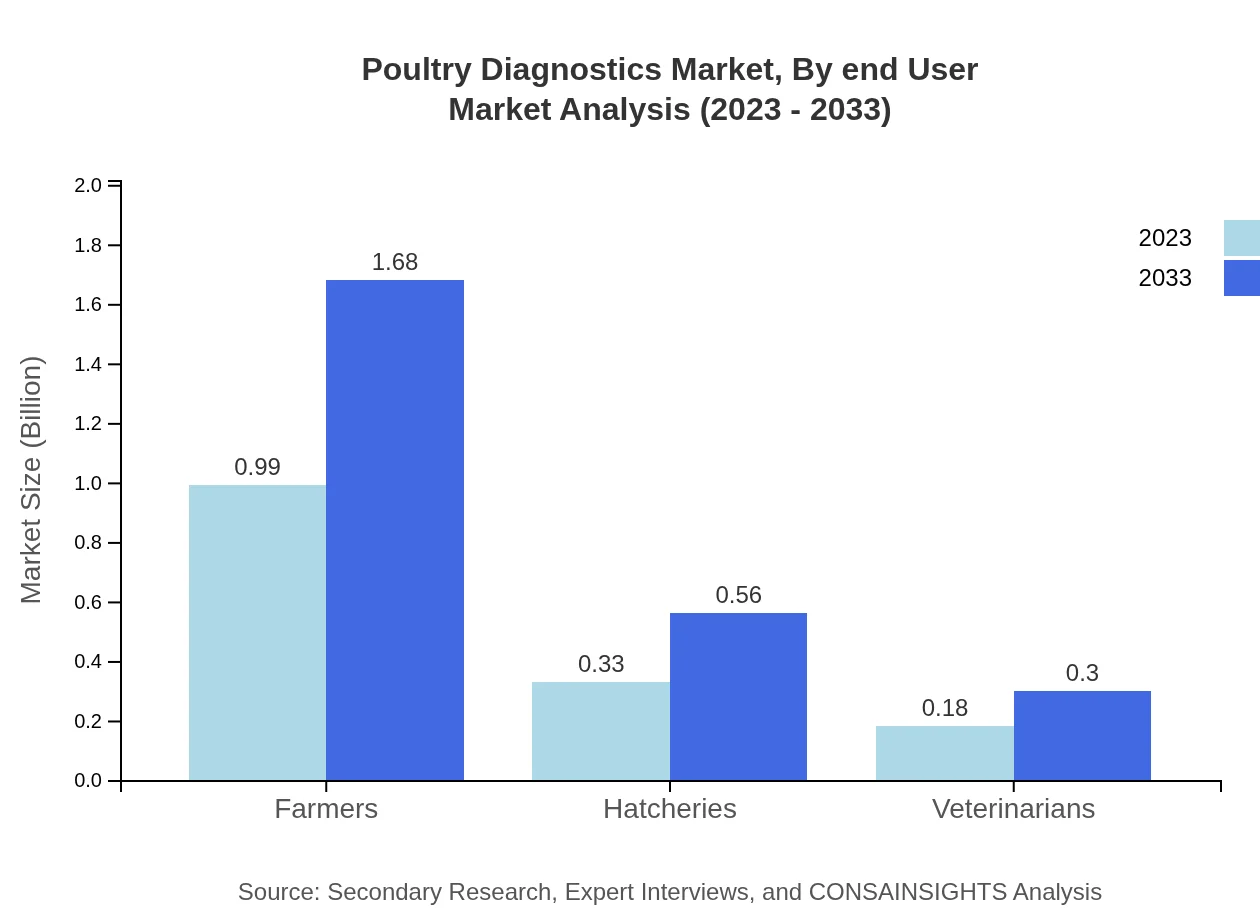

Poultry Diagnostics Market Analysis By End User

Farmers represent the largest segment, accounting for 66% of the market, with values growing from $0.99 billion to $1.68 billion. Hatcheries and veterinarians contribute significantly, with shares of 22% and 12% respectively, highlighting the broad engagement across the industry.

Poultry Diagnostics Market Analysis By Region Initiatives

Regional initiatives, particularly government programs for biosecurity and disease control, are pivotal, representing around 86% of the market. This includes targeted interventions in North America and Europe, which set stringent health standards.

Poultry Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Poultry Diagnostics Industry

Zoetis Inc.:

A global leader in animal health, providing innovative diagnostic products and services that enhance the health and performance of animals.IDEXX Laboratories, Inc.:

Specializes in pet healthcare and veterinary diagnostics, offering comprehensive solutions for poultry health management.Neogen Corporation:

Focused on food safety and animal health, Neogen provides extensive diagnostic tests for poultry pathogens.Merck Animal Health:

A division of Merck & Co., dedicated to animal health with a range of diagnostics and preventive products for poultry.Heska Corporation:

Developing advanced diagnostic products for animal health to help poultry veterinarians in disease management and prevention.We're grateful to work with incredible clients.

FAQs

What is the market size of poultry diagnostics?

The global poultry diagnostics market is projected to reach a size of $1.5 billion by 2033, growing at a CAGR of 5.3% from its current size. This growth reflects increasing investments in poultry health and disease management.

What are the key market players or companies in the poultry diagnostics industry?

Key players in the poultry diagnostics market include major companies specializing in veterinary diagnostics, biotechnology firms, and pharmaceutical manufacturers focused on poultry health solutions. Their innovations drive advancements in diagnostic tests and technologies, enhancing production efficiency.

What are the primary factors driving the growth in the poultry diagnostics industry?

The growth of the poultry diagnostics industry is driven by increasing global poultry production, rising consumer demand for poultry products, and a growing awareness of poultry diseases. Additionally, advancements in diagnostic technologies and governmental support also contribute significantly to market expansion.

Which region is the fastest Growing in the poultry diagnostics market?

The Asia-Pacific region emerges as the fastest-growing market for poultry diagnostics, with market size expected to grow from $0.26 billion in 2023 to $0.44 billion by 2033. This growth is driven by rising poultry farming practices in countries like China and India.

Does ConsaInsights provide customized market report data for the poultry diagnostics industry?

Yes, ConsaInsights offers customized market reports tailored to clients' specific needs in the poultry diagnostics industry. This includes analyses based on particular regions, market segments, and emerging trends to provide strategic insights for better decision-making.

What deliverables can I expect from this poultry diagnostics market research project?

Deliverables from the poultry diagnostics market research project include comprehensive market analysis reports, trend forecasts, competitive analysis, regional insights, and detailed segment data. Clients can expect actionable recommendations based on thorough evaluations of the market landscape.

What are the market trends of poultry diagnostics?

Current trends in the poultry diagnostics market include increased demand for molecular diagnostic methods and a shift towards preventative care strategies. The use of advanced technology in diagnostics, such as real-time monitoring systems, is also gaining momentum, enhancing disease management.