Poultry Processing Equipment Market Report

Published Date: 22 January 2026 | Report Code: poultry-processing-equipment

Poultry Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Poultry Processing Equipment market, covering key insights, market dynamics, and growth forecasts from 2023 to 2033, helping stakeholders make informed decisions based on data-driven insights.

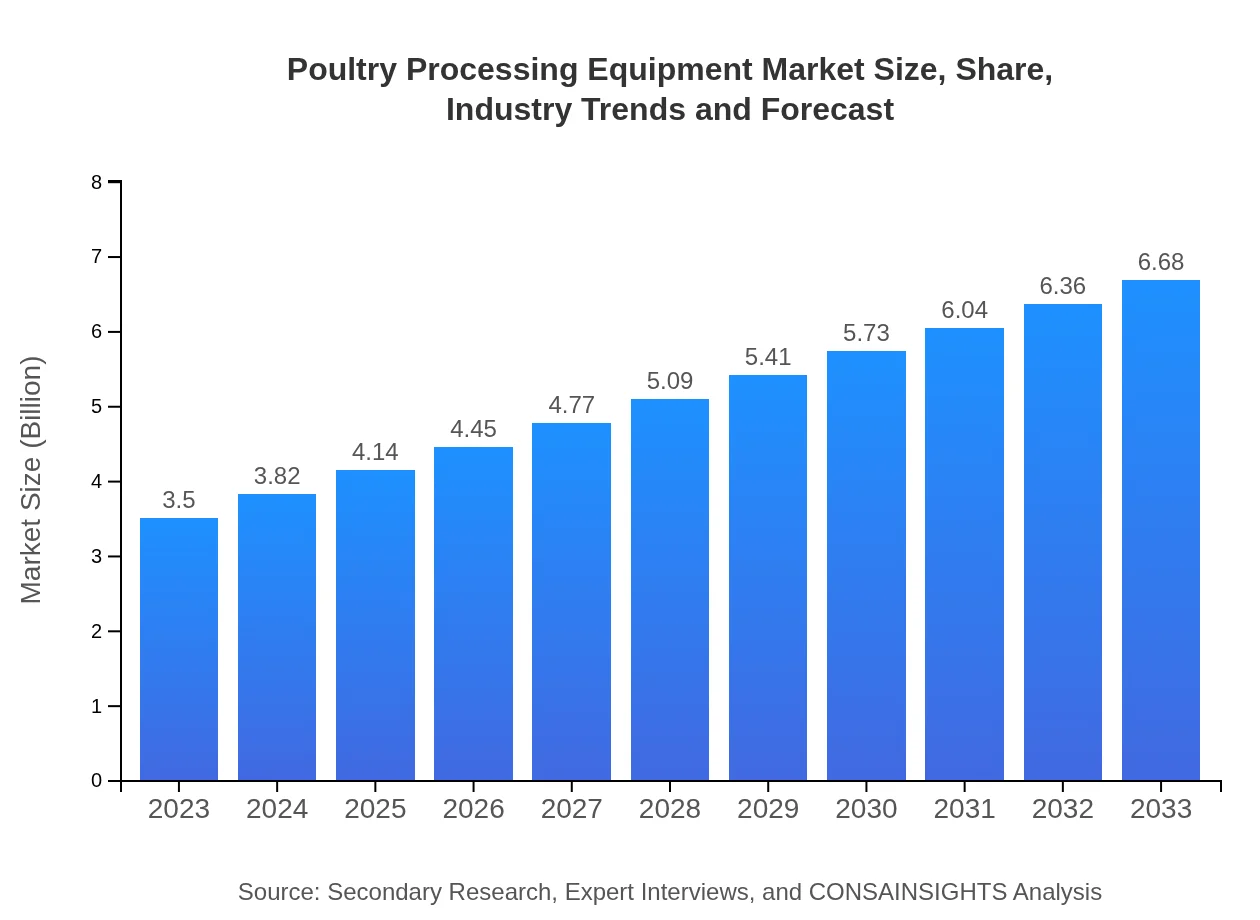

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $6.68 Billion |

| Top Companies | Marel, JBT Corporation, Bühler Group, Nutreco |

| Last Modified Date | 22 January 2026 |

Poultry Processing Equipment Market Overview

Customize Poultry Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Poultry Processing Equipment market size, growth, and forecasts.

- ✔ Understand Poultry Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Poultry Processing Equipment

What is the Market Size & CAGR of Poultry Processing Equipment market in 2023?

Poultry Processing Equipment Industry Analysis

Poultry Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Poultry Processing Equipment Market Analysis Report by Region

Europe Poultry Processing Equipment Market Report:

Europe’s market size is forecasted to grow from $0.98 billion in 2023 to $1.87 billion by 2033. Increasing consumer demand for poultry and meat alternatives, alongside regulatory compliance driven innovations, are key growth drivers.Asia Pacific Poultry Processing Equipment Market Report:

The Asia-Pacific region accounts for a market size of approximately $0.67 billion in 2023 and is projected to grow to $1.27 billion by 2033. Factors driving this growth include rising populations, increasing poultry consumption, and investments in processing technologies from emerging economies like China and India.North America Poultry Processing Equipment Market Report:

North America is projected to lead the market with a size of about $1.26 billion in 2023, growing to $2.41 billion by 2033. The boom in poultry production and advanced processing techniques, predominately in the U.S., catalyze this growth.South America Poultry Processing Equipment Market Report:

In South America, the poultry processing equipment market is valued at $0.12 billion in 2023, expected to rise to $0.24 billion by 2033. The region benefits from a growing export market and increasing domestic demand for poultry products.Middle East & Africa Poultry Processing Equipment Market Report:

The Middle East and Africa are expected to see growth from $0.47 billion in 2023 to $0.89 billion by 2033. Urbanization and rising disposable incomes are enhancing meat consumption, stimulating the poultry processing equipment sector.Tell us your focus area and get a customized research report.

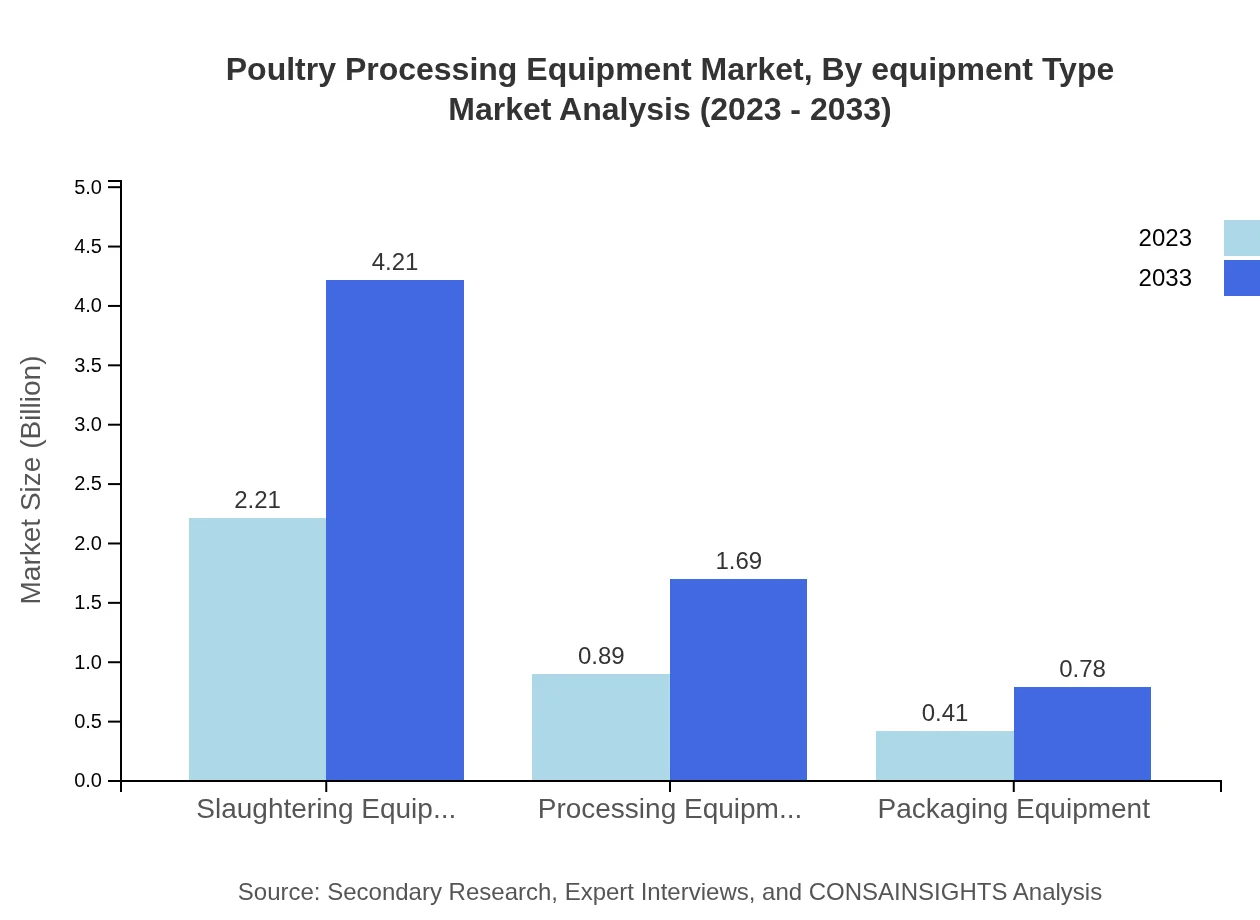

Poultry Processing Equipment Market Analysis By Equipment Type

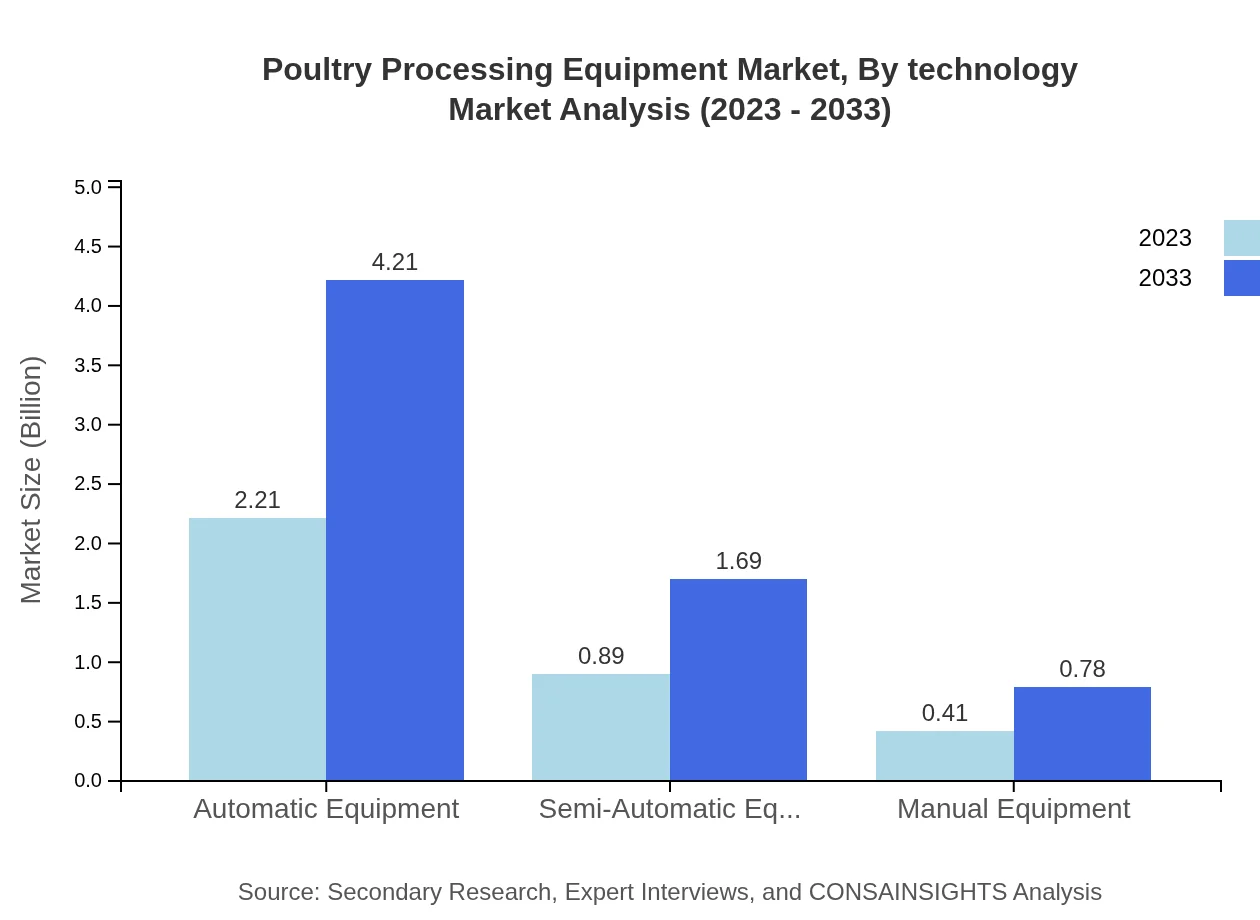

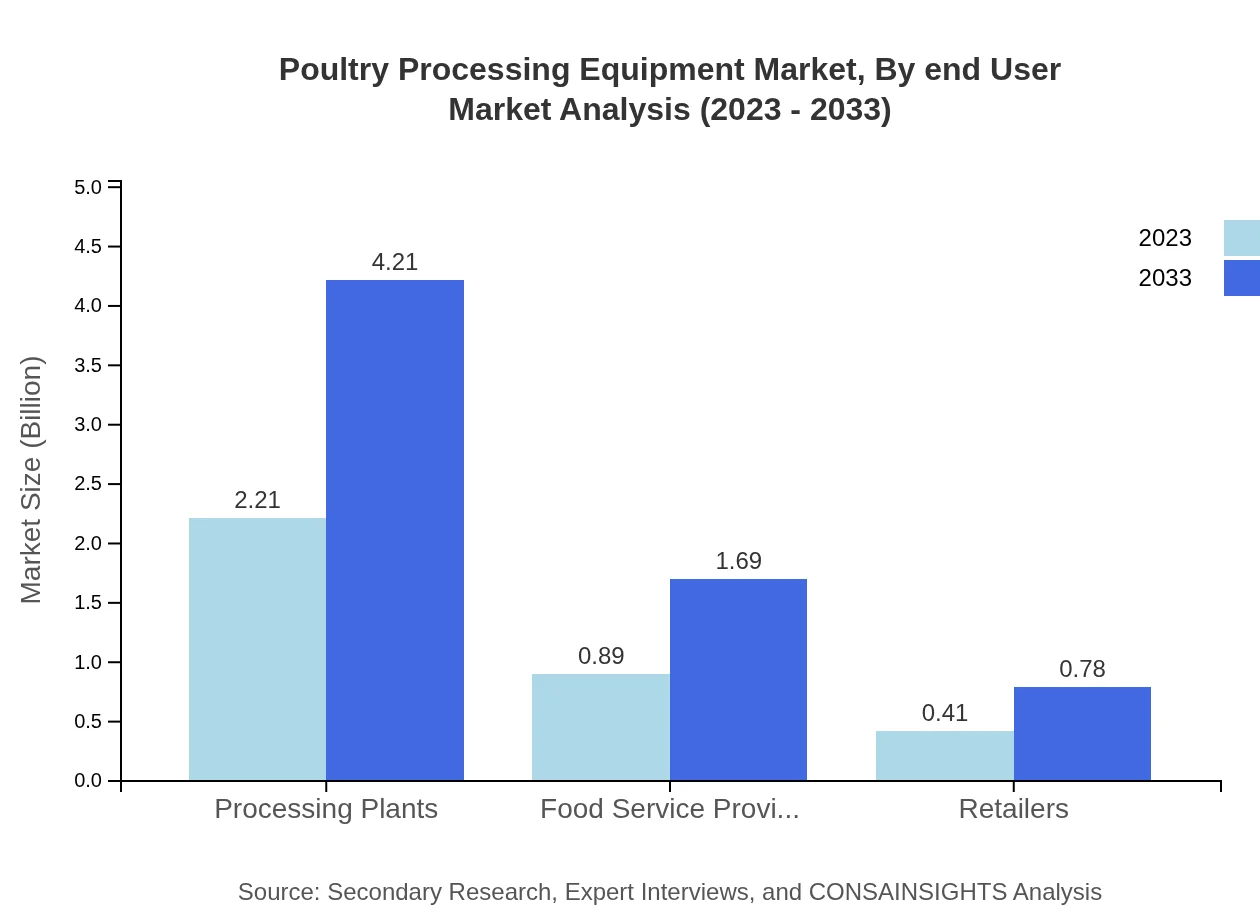

In 2023, processing plants generate a market size of $2.21 billion, expected to increase to $4.21 billion by 2033, holding 63.03% market share consistently. Food service providers and retailers contribute with sizes of $0.89 billion and $0.41 billion in 2023 respectively, with each segment expected to grow to $1.69 billion and $0.78 billion by 2033, retaining respective shares of 25.31% and 11.66%. Automatic equipment dominates the market with a projected size of $2.21 billion in 2023, also growing to $4.21 billion by 2033. The semi-automatic and manual equipment segments follow at $0.89 billion and $0.41 billion respectively, as the demand for efficient processing methods rises.

Poultry Processing Equipment Market Analysis By Technology

Automation remains the forefront technology in the poultry processing equipment market, with a significant focus on semi-automated processing systems. The integration of Internet of Things (IoT) in equipment is trending, allowing for real-time monitoring and analysis. Innovations like smart sensors and artificial intelligence for operational consistency are also impacting market dynamics positively.

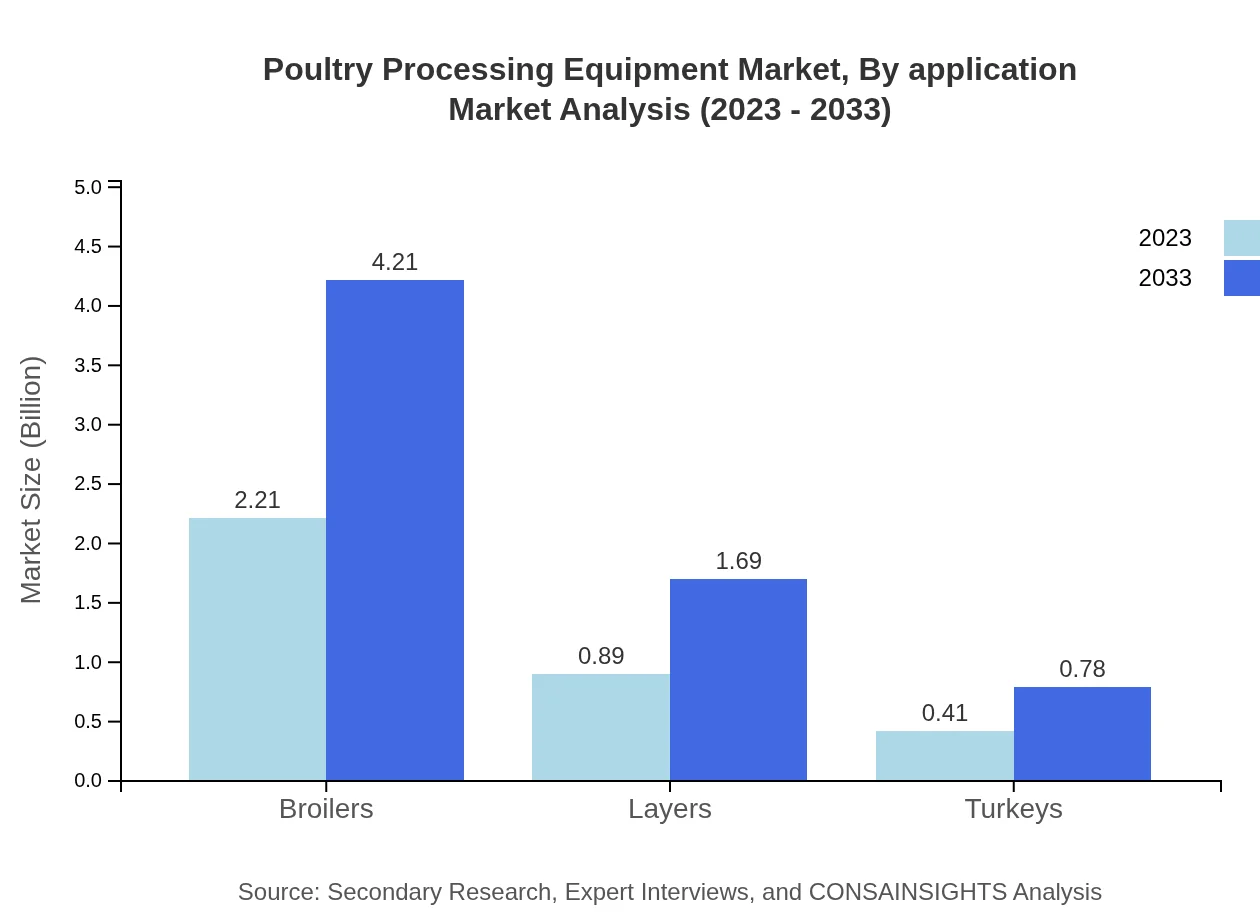

Poultry Processing Equipment Market Analysis By Application

The primary applications of poultry processing equipment revolve around slaughtering, processing, and packaging. Slaughtering equipment, generating a size of $2.21 billion in 2023, is vital, while processing equipment with a size of $0.89 billion is also significant. Packaging remains essential as the final stage, safeguarding product quality and increasing shelf life, with a market size of $0.41 billion in 2023.

Poultry Processing Equipment Market Analysis By End User

The primary end-users of poultry processing equipment include large processing plants, food service chains, and independent retailers. Processing plants dominate market share, while the food service sector is rapidly growing due to the rise in fast food consumption and convenience foods. Retailers also enhance their market presence by investing in more efficient processing equipment.

Poultry Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Poultry Processing Equipment Industry

Marel:

Marel is a global leader in food processing technology, known for its innovative solutions that enable food producers to reduce costs and increase productivity. Their advanced poultry processing systems are recognized for efficiency and meeting global standards.JBT Corporation:

JBT Corporation specializes in innovative technology solutions for the food industry, including advanced poultry processing equipment. Their focus on automation and food safety has set them as a crucial player in the market.Bühler Group:

The Bühler Group is renowned for its processing solutions in various sectors, including poultry. Their machinery provides sustainable solutions that enhance productivity and overall efficiency in poultry processing.Nutreco:

Nutreco is recognized for its comprehensive solutions in animal feed and nutrition, which complements poultry processing through improved animal health leading to better quality meat production.We're grateful to work with incredible clients.

FAQs

What is the market size of poultry Processing Equipment?

The poultry processing equipment market is projected to grow from $3.5 billion in 2023 to a substantial figure by 2033, with a CAGR of 6.5%. This growth signifies increasing investment in advanced solutions across the poultry processing sector.

What are the key market players or companies in the poultry Processing Equipment industry?

Key players in the poultry processing equipment industry include Tyson Foods, Marel, and JBT Corporation. These companies dominate the market with innovative technologies, enhancing operational efficiency and product quality, ultimately driving market competition.

What are the primary factors driving the growth in the poultry Processing Equipment industry?

The growth of the poultry processing equipment market is driven by increased demand for poultry products, technological advancements, and the need for efficient processing solutions that reduce costs and improve safety standards, thus ensuring consumer satisfaction.

Which region is the fastest Growing in the poultry Processing Equipment?

The fastest-growing region in the poultry processing equipment market is Asia Pacific, projected to expand from $0.67 billion in 2023 to $1.27 billion by 2033. This growth is fueled by rising production capabilities and increased poultry consumption in the region.

Does ConsaInsights provide customized market report data for the poultry Processing Equipment industry?

Yes, ConsaInsights offers tailored market report data for the poultry processing equipment industry. Customization ensures reports meet specific client needs related to market size, forecasts, and comprehensive regional analyses tailored to individual business interests.

What deliverables can I expect from this poultry Processing Equipment market research project?

Deliverables from the poultry processing equipment market research project include detailed market analysis, growth projections, competitive landscape assessments, and comprehensive segment insights, ensuring clients have actionable intelligence for strategic decision-making.

What are the market trends of poultry Processing Equipment?

Current market trends in poultry processing equipment include automation, enhanced food safety measures, and sustainable practices. These trends reflect shifting consumer preferences for quality and efficiency in production processes, influencing investment decisions widely.