Power Amplifier Market Report

Published Date: 31 January 2026 | Report Code: power-amplifier

Power Amplifier Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Power Amplifier market, covering key insights, trends, segments, and regional performance from 2023 to 2033.

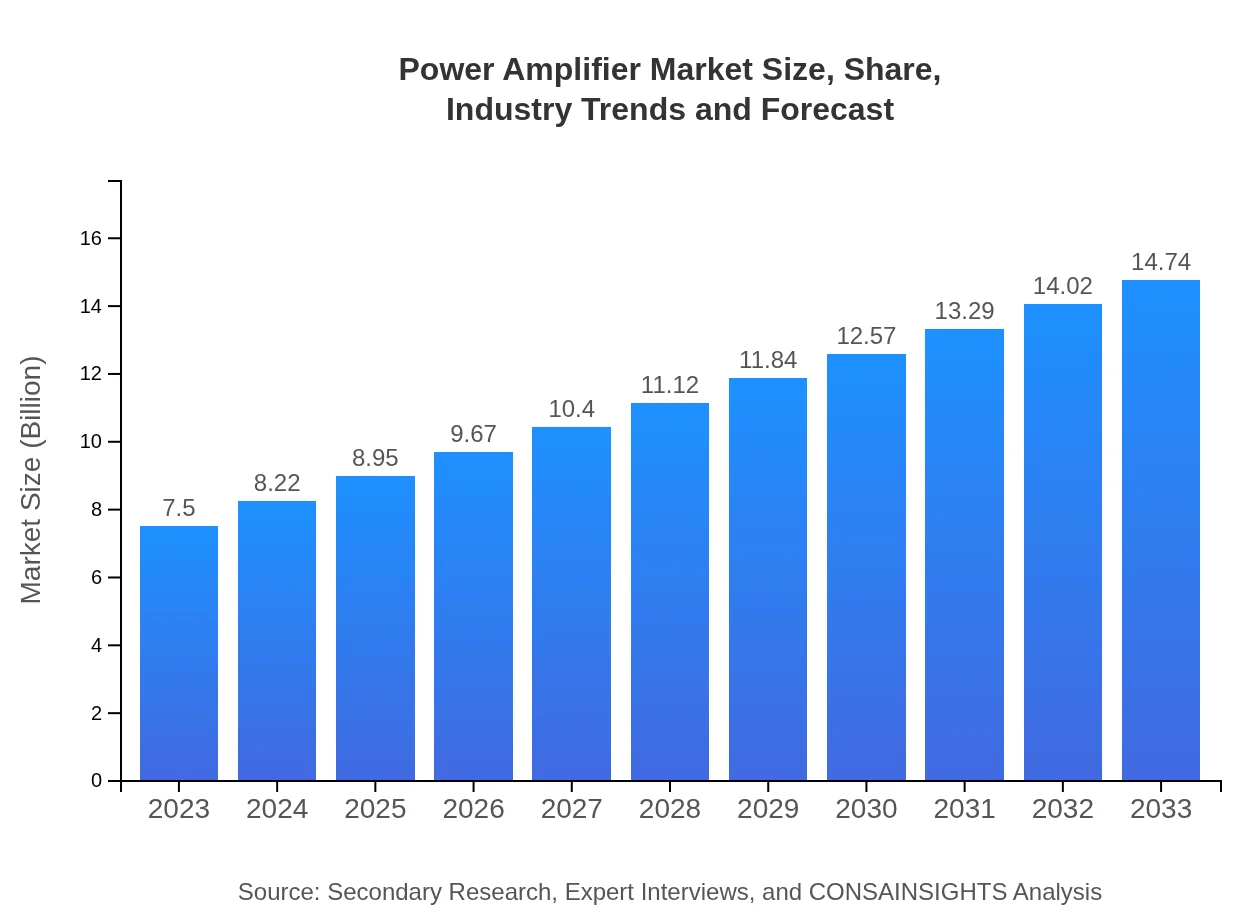

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.74 Billion |

| Top Companies | Qualcomm , Broadcom Inc., Texas Instruments |

| Last Modified Date | 31 January 2026 |

Power Amplifier Market Overview

Customize Power Amplifier Market Report market research report

- ✔ Get in-depth analysis of Power Amplifier market size, growth, and forecasts.

- ✔ Understand Power Amplifier's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Power Amplifier

What is the Market Size & CAGR of Power Amplifier market in 2023 and 2033?

Power Amplifier Industry Analysis

Power Amplifier Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Power Amplifier Market Analysis Report by Region

Europe Power Amplifier Market Report:

Europe's market for Power Amplifiers is expected to grow from $2.16 billion in 2023 to $4.24 billion by 2033. Factors such as stringent regulations regarding energy efficiency and a shift toward more sustainable technologies are driving innovations in amplifier designs. The region's focus on renewable energy sources and electric vehicles is also boosting demand across various applications, particularly in automotive and telecommunications.Asia Pacific Power Amplifier Market Report:

In the Asia-Pacific region, the market for Power Amplifiers is projected to grow from $1.50 billion in 2023 to $2.96 billion by 2033. The growth is primarily fueled by the increasing demand for consumer electronics and the expansion of telecommunications infrastructure. Countries like China, India, and Japan are leading the charge, with substantial investments in 5G technology and smart city projects, thereby increasing the need for advanced power amplification solutions.North America Power Amplifier Market Report:

North America holds a significant share of the Power Amplifier market, with a projected increase from $2.50 billion in 2023 to $4.90 billion by 2033. The region's advanced telecommunications infrastructure and high demand for innovative consumer electronics are key growth drivers. Additionally, leading companies in the U.S. tech industry are investing heavily in R&D for power amplification technologies, securing the region's competitive edge.South America Power Amplifier Market Report:

South America's Power Amplifier market is expected to grow from $0.73 billion in 2023 to $1.43 billion by 2033. This growth can be attributed to the increasing penetration of mobile networks and the rising consumption of consumer electronics. Investment in infrastructure, particularly in Brazil and Argentina, will further bolster demand for efficient Power Amplifiers across communication platforms.Middle East & Africa Power Amplifier Market Report:

The Middle East and Africa market for Power Amplifiers is anticipated to grow from $0.62 billion in 2023 to $1.21 billion by 2033. The expansion of mobile networks and increased investment in broadcasting infrastructure are key contributors to this growth. Countries like the UAE and South Africa are leading in telecom upgrades, enhancing the demand for cost-effective, reliable Power Amplifiers in both commercial and industrial applications.Tell us your focus area and get a customized research report.

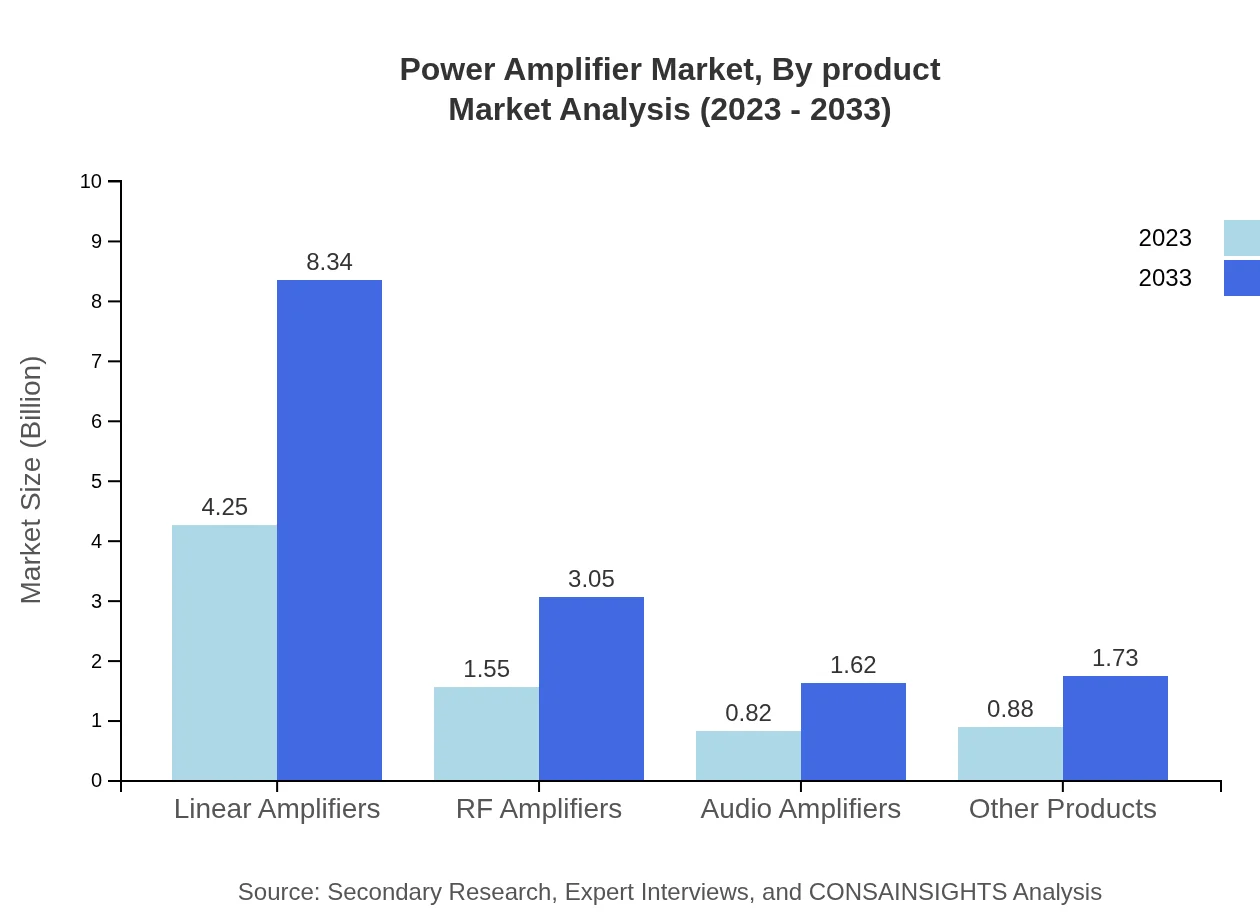

Power Amplifier Market Analysis By Product

Overall, the Linear Amplifiers segment is set to grow from $4.25 billion in 2023 to $8.34 billion in 2033, holding a steady market share of 56.6%. The RF Amplifiers segment is also notable, expanding from $1.55 billion to $3.05 billion during the same period, representing 20.7% market share. Audio Amplifiers, while smaller, are projected to double their value, from $0.82 billion to $1.62 billion, holding a 10.99% share.

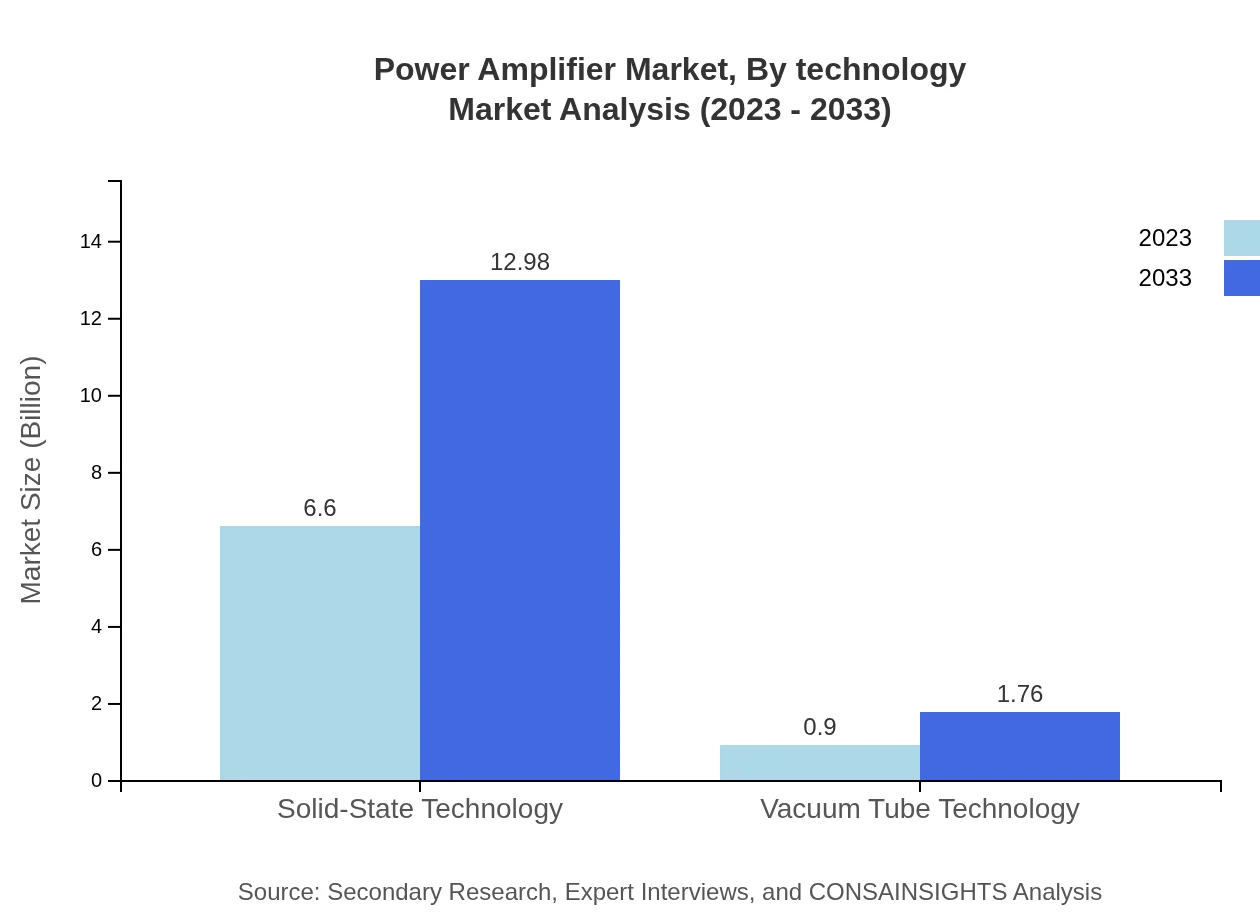

Power Amplifier Market Analysis By Technology

Solid-State Technology continues to dominate the Power Amplifier market with a valuation of $6.60 billion in 2023, expected to reach $12.98 billion by 2033, capturing approximately 88.03% of the market. Conversely, Vacuum Tube Technology, currently at $0.90 billion, is anticipated to grow to $1.76 billion with an 11.97% market share, highlighting its niche applications primarily in high-end audio and broadcasting.

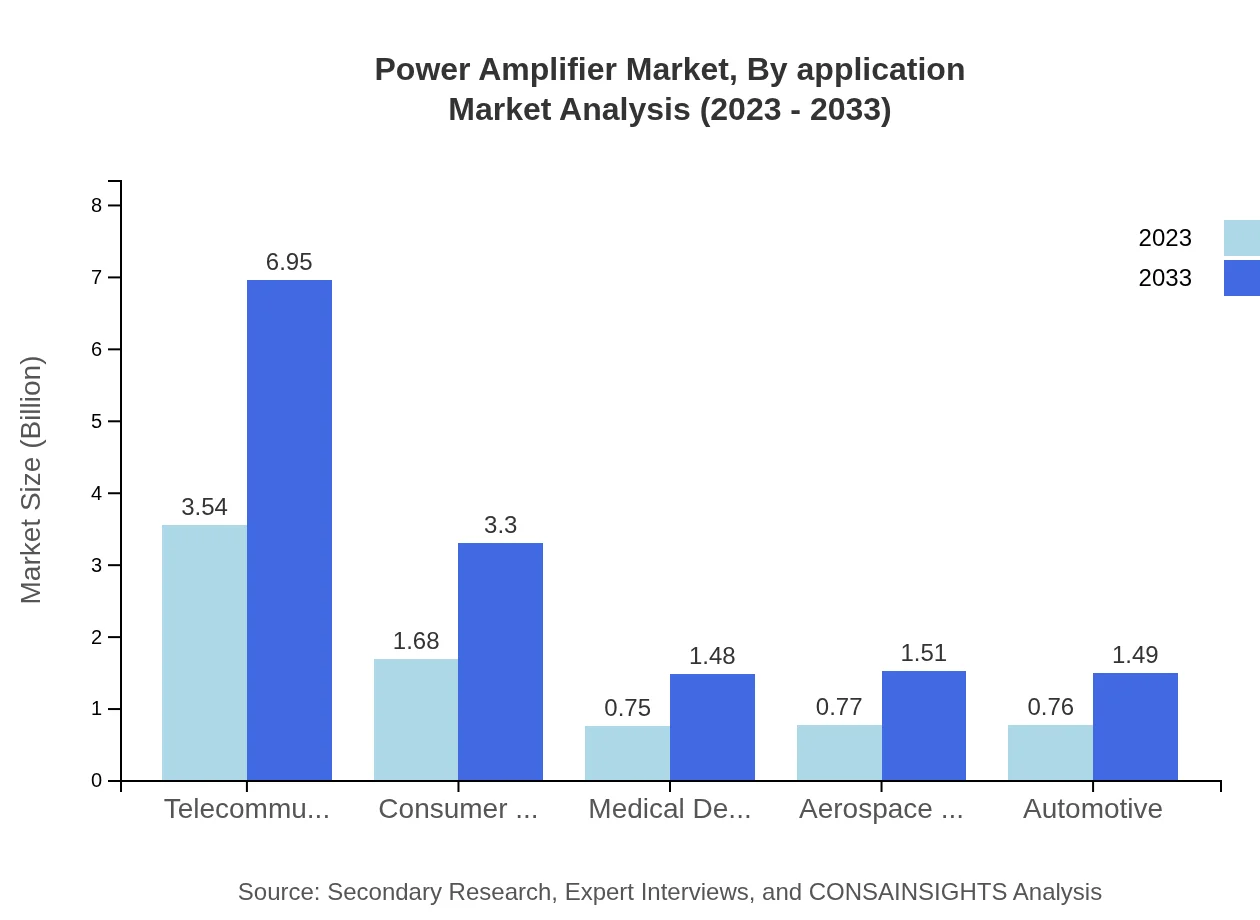

Power Amplifier Market Analysis By Application

Telecommunications constitute the largest application segment, expected to grow from $3.54 billion in 2023 to $6.95 billion by 2033, comprising 47.14% of the market share. Consumer Electronics also shows robust potential, expanding from $1.68 billion to $3.30 billion, holding a 22.42% share. Other sectors such as Medical Devices and Aerospace & Defense are smaller in comparison but contribute significantly to innovation and specialized applications.

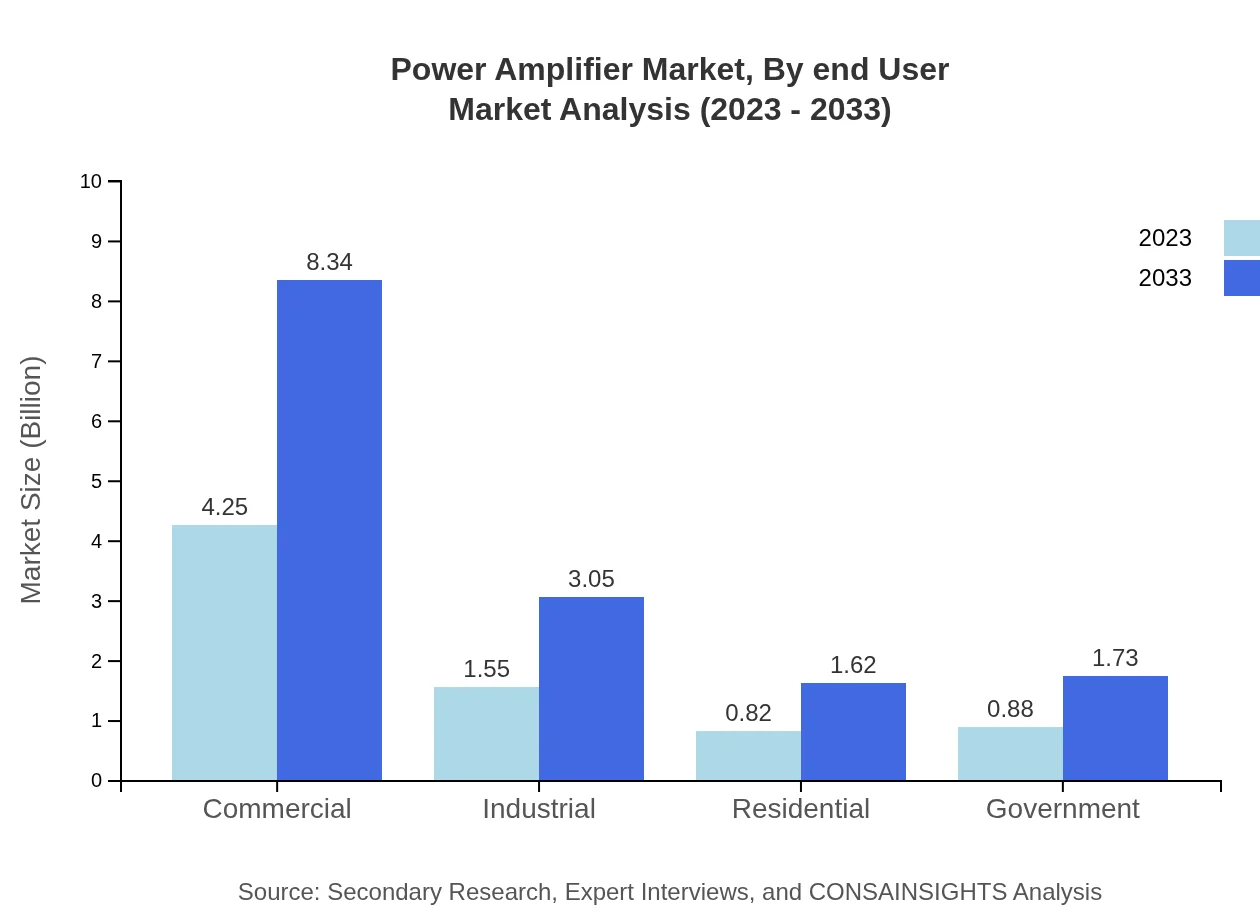

Power Amplifier Market Analysis By End User

The Commercial sector dominates with sales rising from $4.25 billion in 2023 to $8.34 billion by 2033, retaining a strong market share. The Industrial segment is also significant, climbing from $1.55 billion to $3.05 billion, alongside Residential and Government applications, wherein modest growth is expected, yet crucial in applications requiring reliable power amplification solutions.

Power Amplifier Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Power Amplifier Industry

Qualcomm :

Qualcomm is a leading semiconductor company known for pioneering digital communications and state-of-the-art RF power amplifiers, driving advancements in 4G and 5G technologies.Broadcom Inc.:

Broadcom Inc. provides a broad range of digital and analog semiconductor solutions, including high-performance RF amplifiers for telecommunications and varied consumer electronics applications.Texas Instruments:

Texas Instruments is a key player in the Power Amplifier market, focusing on innovations in analog and embedded processing technologies catering to both commercial and industrial users.We're grateful to work with incredible clients.

FAQs

What is the market size of power Amplifier?

The global power amplifier market is valued at approximately $7.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033.

What are the key market players or companies in this power Amplifier industry?

The power amplifier market features major players such as NXP Semiconductors, Texas Instruments, Qualcomm, Broadcom, and Infineon Technologies, which are known for their innovation and product portfolio in this sector.

What are the primary factors driving the growth in the power Amplifier industry?

Key growth drivers include the increasing demand for wireless communication technologies, advancements in audio and video applications, and the rise of smartphones and IoT devices, enhancing the need for efficient power amplifiers.

Which region is the fastest Growing in the power Amplifier market?

The Asia Pacific region is the fastest-growing market, projected to expand from $1.50 billion in 2023 to $2.96 billion by 2033, driven by increased consumer electronics production and telecommunications infrastructure development.

Does ConsaInsights provide customized market report data for the power Amplifier industry?

Yes, ConsaInsights offers customized market report data for the power amplifier industry, tailored to meet specific client needs, ensuring comprehensive insights on market trends and opportunities.

What deliverables can I expect from this power Amplifier market research project?

Expected deliverables include detailed market analysis reports, segment breakdowns, competitive landscape assessments, growth forecasts, and actionable insights to guide strategic decision-making.

What are the market trends of power Amplifier?

Current trends in the power amplifier market include the shift towards solid-state technology, increased reliance on RF amplifiers for telecommunications, and the growth of energy-efficient amplifier designs.