Power Device Analyzer Market Report

Published Date: 31 January 2026 | Report Code: power-device-analyzer

Power Device Analyzer Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Power Device Analyzer market, covering trends, size, and regional development from 2023 to 2033. Key insights include market segmentation, technological advancements, and a forecast of future growth trajectories.

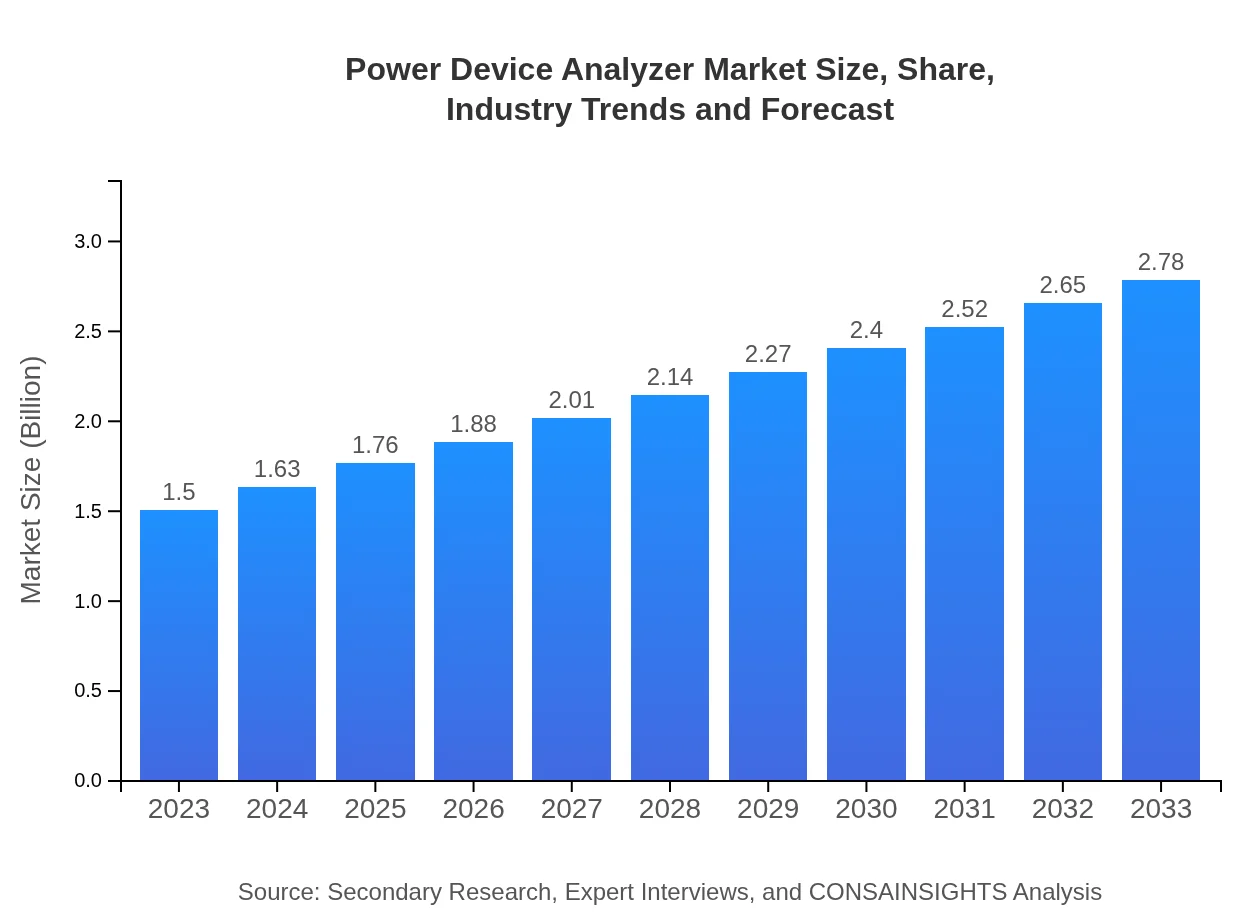

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Texas Instruments, Fluke Corporation, Keysight Technologies, Chroma ATE Inc., Hioki E.E. Corporation |

| Last Modified Date | 31 January 2026 |

Power Device Analyzer Market Overview

Customize Power Device Analyzer Market Report market research report

- ✔ Get in-depth analysis of Power Device Analyzer market size, growth, and forecasts.

- ✔ Understand Power Device Analyzer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Power Device Analyzer

What is the Market Size & CAGR of Power Device Analyzer market in 2023?

Power Device Analyzer Industry Analysis

Power Device Analyzer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

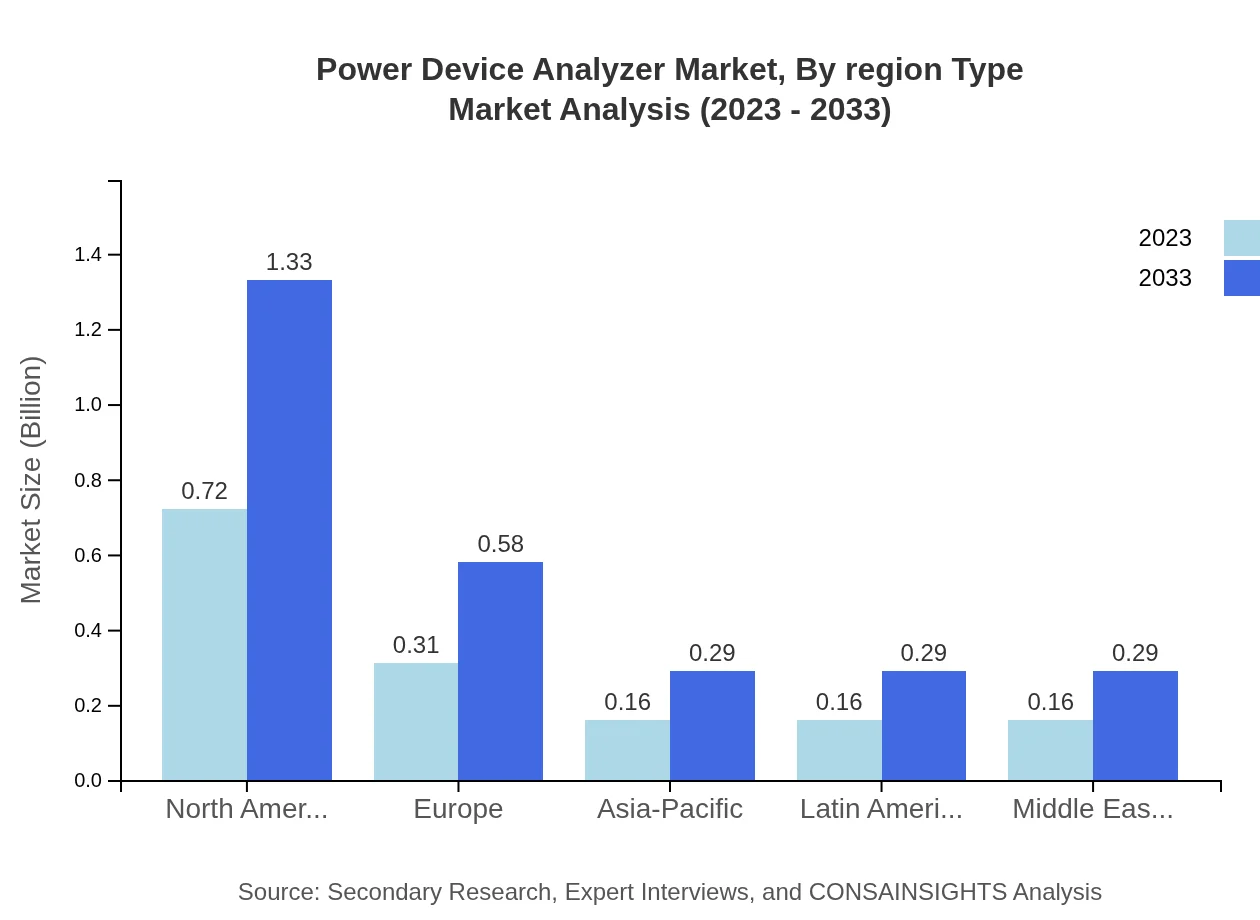

Power Device Analyzer Market Analysis Report by Region

Europe Power Device Analyzer Market Report:

Europe's market is estimated to grow from $0.45 billion in 2023 to $0.83 billion by 2033, with key drivers including stringent energy regulations and advances in electrical testing technology. The EU's commitment to reducing carbon emissions continues to fuel demand for power device analyzers.Asia Pacific Power Device Analyzer Market Report:

The Asia Pacific market is expected to grow from $0.26 billion in 2023 to $0.48 billion by 2033, driven by increasing industrialization and investments in renewable energy infrastructure. Countries like China and India are leading the charge with significant government policies promoting energy efficiency.North America Power Device Analyzer Market Report:

North America remains a significant player, with a projected market size increase from $0.58 billion in 2023 to $1.08 billion by 2033. Growth in this region is largely influenced by technological advancements and an increased focus on renewable energy solutions and grid modernization.South America Power Device Analyzer Market Report:

In South America, the market is predicted to expand from $0.02 billion in 2023 to $0.04 billion by 2033. Although currently small, innovations in power management are gradually gaining traction, particularly in Brazil and Argentina, as they modernize their energy systems.Middle East & Africa Power Device Analyzer Market Report:

The Middle East and Africa will see growth from $0.19 billion in 2023 to $0.35 billion by 2033. Factors include rising investments in renewable energy projects and national strategies to enhance energy efficiency across diverse sectors.Tell us your focus area and get a customized research report.

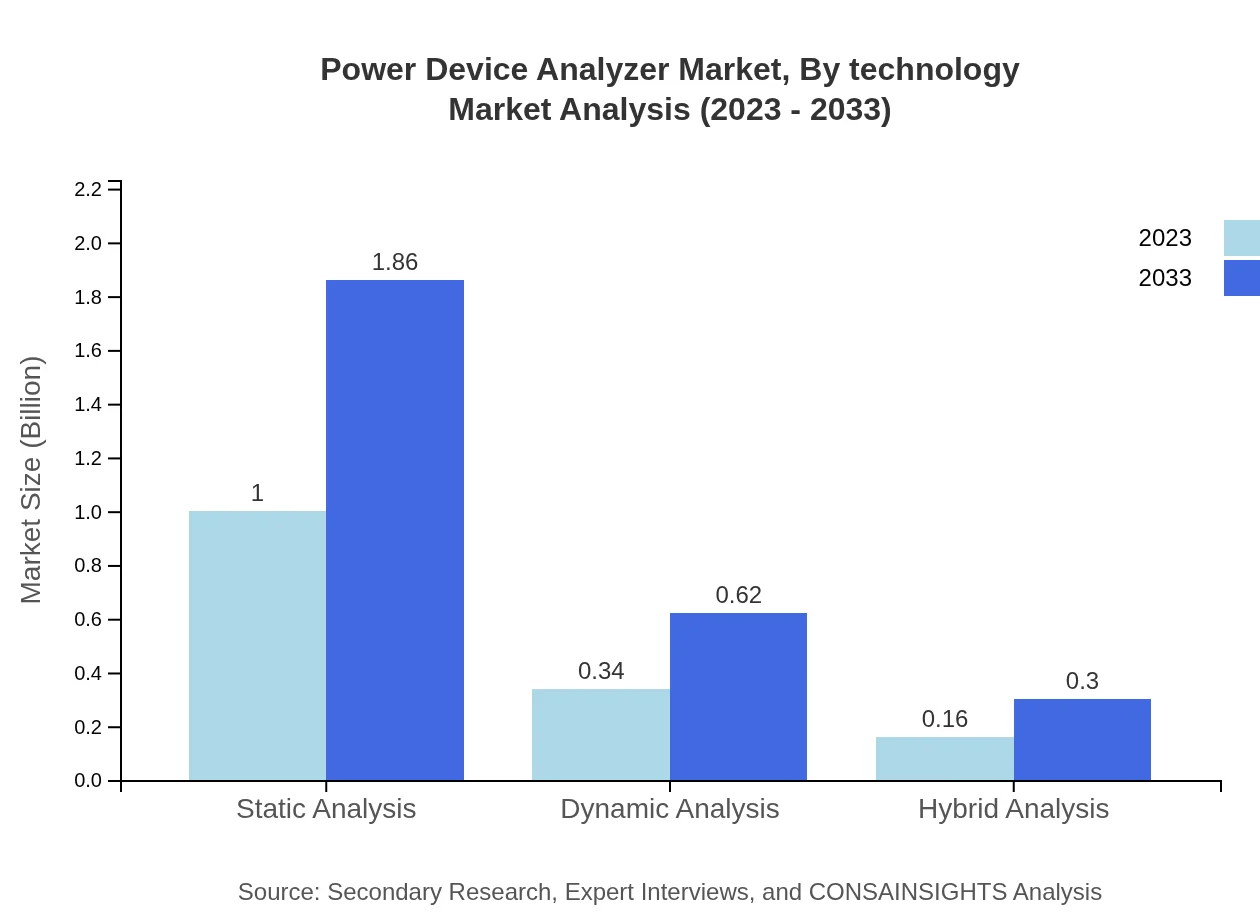

Power Device Analyzer Market Analysis By Technology

The segmentation by technology includes Static Analysis, Dynamic Analysis, and Hybrid Analysis. Static Analysis holds a significant market share of 66.8% in 2023 and is expected to maintain its position by 2033, reflecting its importance in extensive testing environments. Hybrid Analysis is gaining traction due to its comprehensive nature, expected to grow steadily over the forecast period.

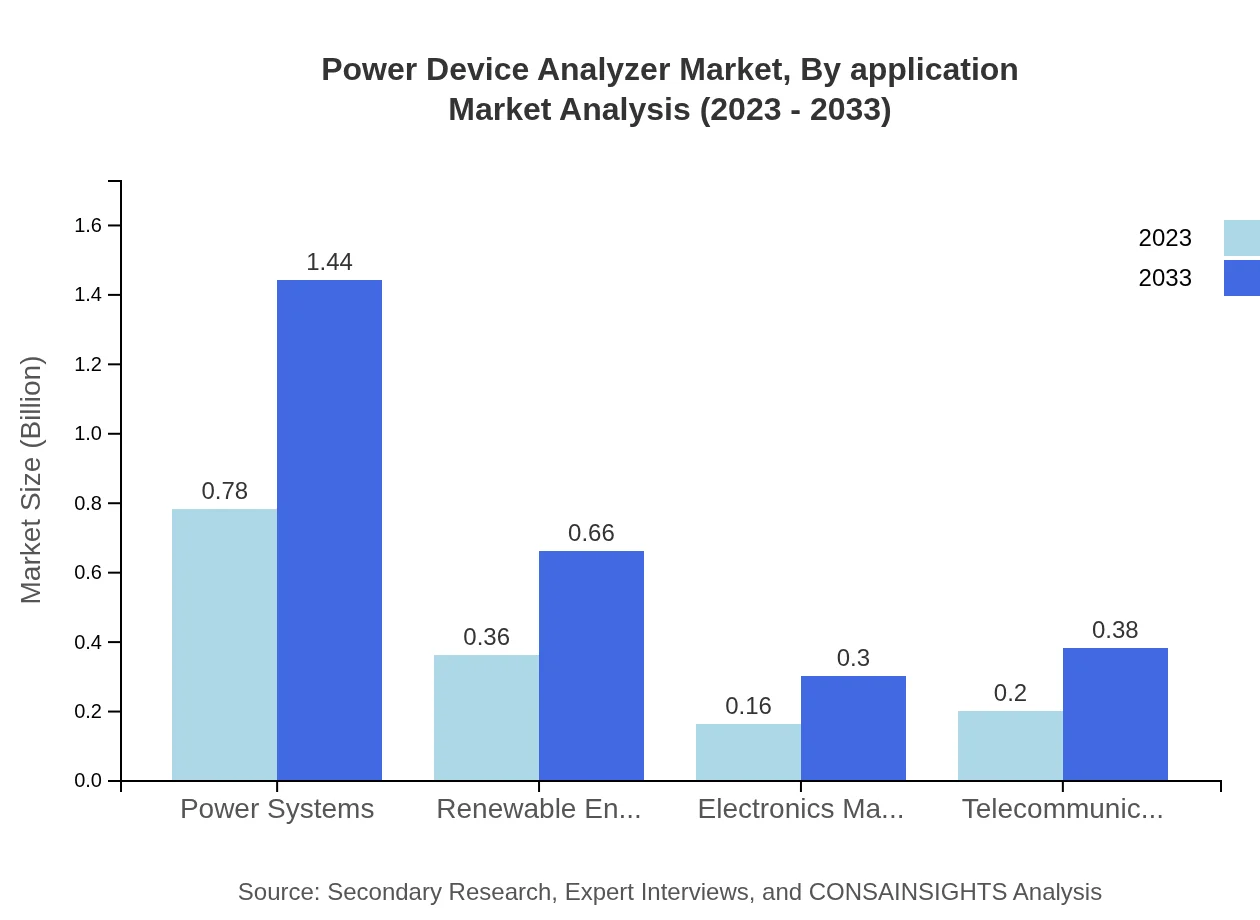

Power Device Analyzer Market Analysis By Application

Applications of power device analyzers include Utilities, Industrial, Commercial, and Residential. The Utilities segment leads with a 51.87% market share in 2023, emphasizing the critical role of power stability and management in larger infrastructures. Industrial applications also show promise with expected growth, driven by increased manufacturing and automation.

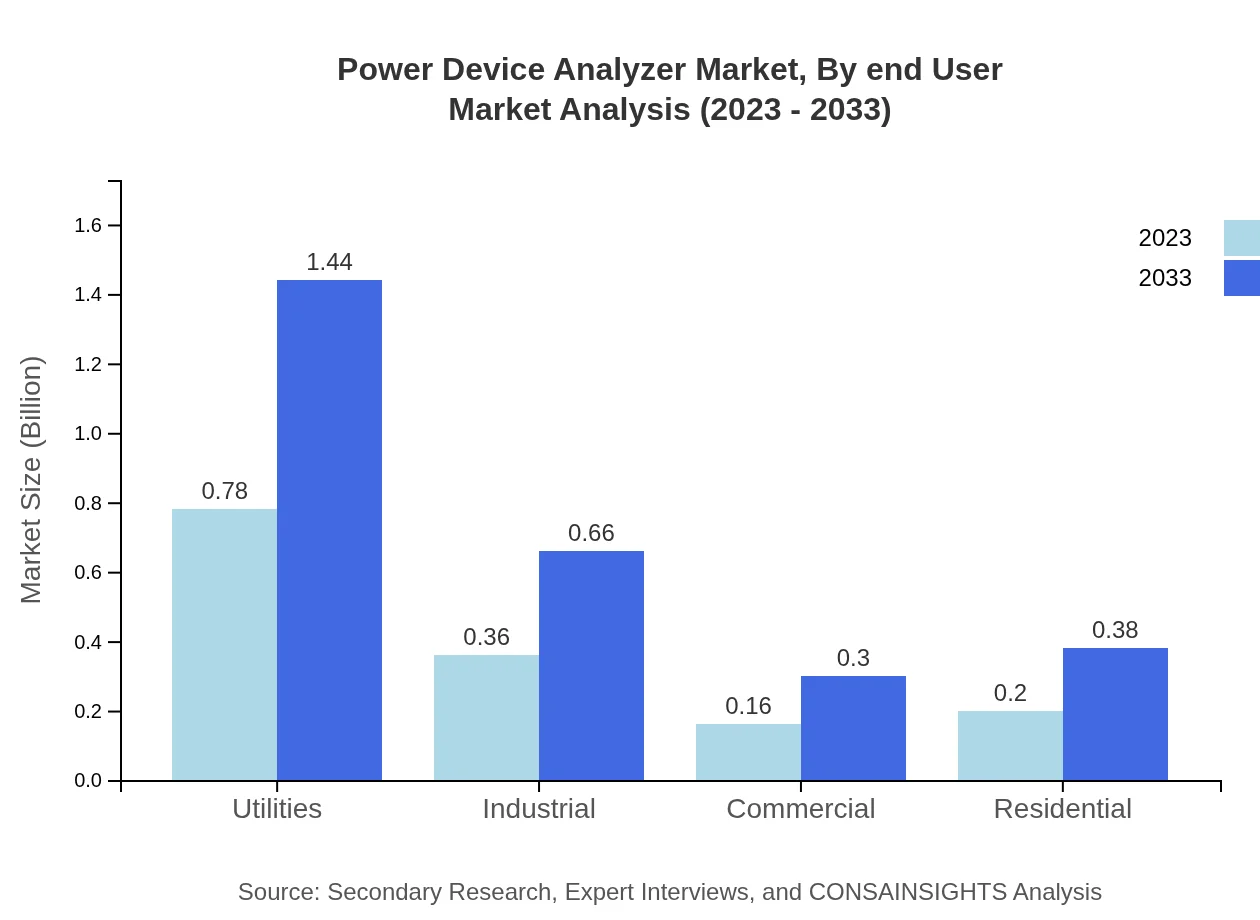

Power Device Analyzer Market Analysis By End User

End-user analysis highlights Utilities as the dominant sector, followed by Industrial and Electronics Manufacturing. The Telecommunications sector reflects a growing need for power analyzers as operators seek to optimize energy use and improve service delivery.

Power Device Analyzer Market Analysis By Region Type

Region-wise analysis indicates North America and Europe as leaders due to stringent regulations and higher expenditure on power equipment. The Asia Pacific is rapidly gaining structural growth owing to governmental initiatives supporting advanced power measurement technologies.

Power Device Analyzer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Power Device Analyzer Industry

Texas Instruments:

A renowned semiconductor company that provides a range of power electronics and testing solutions catering to diverse industrial applications.Fluke Corporation:

Utilities and industrial sectors heavily rely on Fluke’s innovative power analyzers known for their accuracy and robustness in energy measurement.Keysight Technologies:

Keysight is known for providing advanced electronic design and test solutions, including power analyzers suited for high-performance applications.Chroma ATE Inc.:

A leader in switching power supply testing and energy measurement, Chroma supplies a broad range of power device analyzers for the renewable energy sector.Hioki E.E. Corporation:

Specializes in electrical measuring instruments and has gained traction in the power analyzer market with innovative and high-quality products.We're grateful to work with incredible clients.

FAQs

What is the market size of Power Device Analyzer?

The global Power Device Analyzer market is currently valued at approximately $1.5 billion and is expected to grow at a CAGR of 6.2% from 2023 to 2033, driven by increased demand for efficient energy management.

What are the key market players or companies in the Power Device Analyzer industry?

The Power Device Analyzer industry features several leading companies including Fluke Corporation, Schneider Electric, ABB, and Keysight Technologies. These companies are recognized for their innovative solutions and significant contributions to the market's advancement.

What are the primary factors driving the growth in the Power Device Analyzer industry?

Key drivers for the Power Device Analyzer market include the rising demand for energy efficiency solutions, increased adoption of renewable energy, and advancements in smart grid technology. These factors stimulate growth and the need for precise power analysis.

Which region is the fastest Growing in the Power Device Analyzer market?

North America is currently the fastest-growing region in the Power Device Analyzer market, expected to increase its market size from $0.58 billion in 2023 to $1.08 billion by 2033, highlighting its expanding energy sector and technological developments.

Does ConsaInsights provide customized market report data for the Power Device Analyzer industry?

Yes, ConsaInsights offers tailored market reports for the Power Device Analyzer industry, accommodating specific research needs, stakeholder requests, and detailed insights into particular segments or regions of interest.

What deliverables can I expect from this Power Device Analyzer market research project?

Deliverables from the Power Device Analyzer market research project include a comprehensive market analysis report, forecasts, insights on key trends, competitive landscape evaluations, and sector-specific performance evaluations.

What are the market trends of Power Device Analyzer?

Current trends in the Power Device Analyzer market include enhanced focus on smart technologies, integration with IoT, a shift toward automation in energy management, and stronger regulatory mandates for energy efficiency across various industries.