Power Distribution Unit Market Report

Published Date: 31 January 2026 | Report Code: power-distribution-unit

Power Distribution Unit Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Power Distribution Unit (PDU) market, highlighting current trends, regional insights, future forecasts between 2023 and 2033, and detailed segmentation across various industries and configurations.

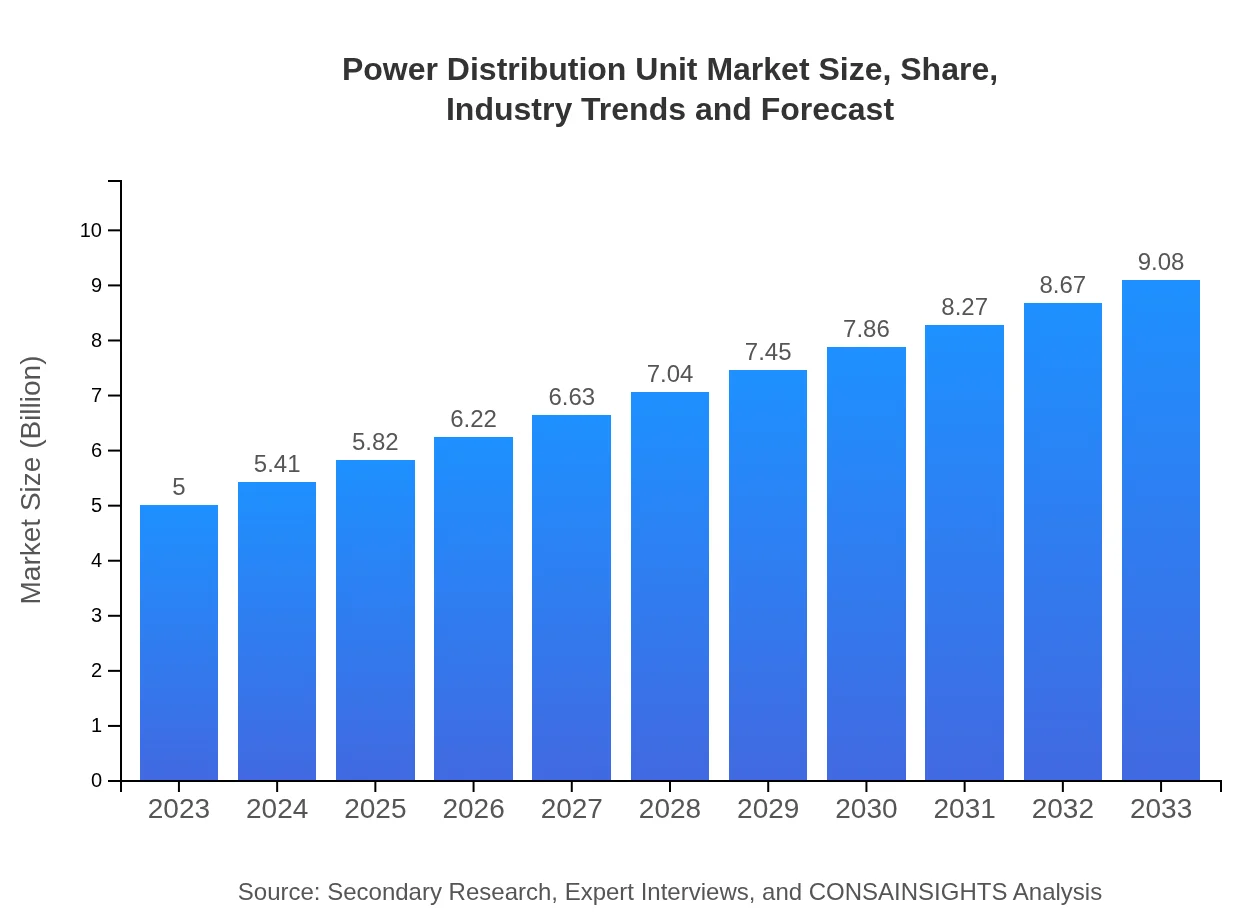

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Schneider Electric, Eaton Corporation, Vertiv, Tripp Lite, CyberPower Systems |

| Last Modified Date | 31 January 2026 |

Power Distribution Unit Market Overview

Customize Power Distribution Unit Market Report market research report

- ✔ Get in-depth analysis of Power Distribution Unit market size, growth, and forecasts.

- ✔ Understand Power Distribution Unit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Power Distribution Unit

What is the Market Size & CAGR of Power Distribution Unit market in 2023?

Power Distribution Unit Industry Analysis

Power Distribution Unit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Power Distribution Unit Market Analysis Report by Region

Europe Power Distribution Unit Market Report:

In Europe, the market for Power Distribution Units is expected to grow from $1.26 billion in 2023 to $2.28 billion by 2033. The region is focusing on enhancing energy efficiency and adopting renewable energy solutions, resulting in higher investments in modernized power management solutions. Countries like Germany, the UK, and France are spearheading these initiatives.Asia Pacific Power Distribution Unit Market Report:

In the Asia Pacific region, the Power Distribution Unit market is projected to grow from $0.97 billion in 2023 to approximately $1.76 billion in 2033. The increasing number of data centers and investment in IT infrastructure across countries like China and India are major growth drivers. Additionally, the proliferation of cloud services and digital transformation initiatives push demand for efficient power solutions.North America Power Distribution Unit Market Report:

North America leads the Power Distribution Unit market, with an estimated market size of $1.94 billion in 2023, anticipated to increase to $3.53 billion by 2033. The region's advanced infrastructure, high internet penetration, and rapid digitalization initiatives among enterprises and government sectors are critical factors fueling this growth.South America Power Distribution Unit Market Report:

The South American market for Power Distribution Units is expected to experience moderate growth, moving from $0.31 billion in 2023 to $0.57 billion by 2033. Economic recovery and increasing investments in technology and telecommunications contribute to this growth, alongside a rising demand for reliable power management solutions in urban areas.Middle East & Africa Power Distribution Unit Market Report:

The Middle East and Africa represent a growing market, expected to reach $0.94 billion by 2033, up from $0.52 billion in 2023. The region is witnessing a surge in infrastructure projects and investments in smart cities, alongside an increased need for reliable energy solutions in emerging markets.Tell us your focus area and get a customized research report.

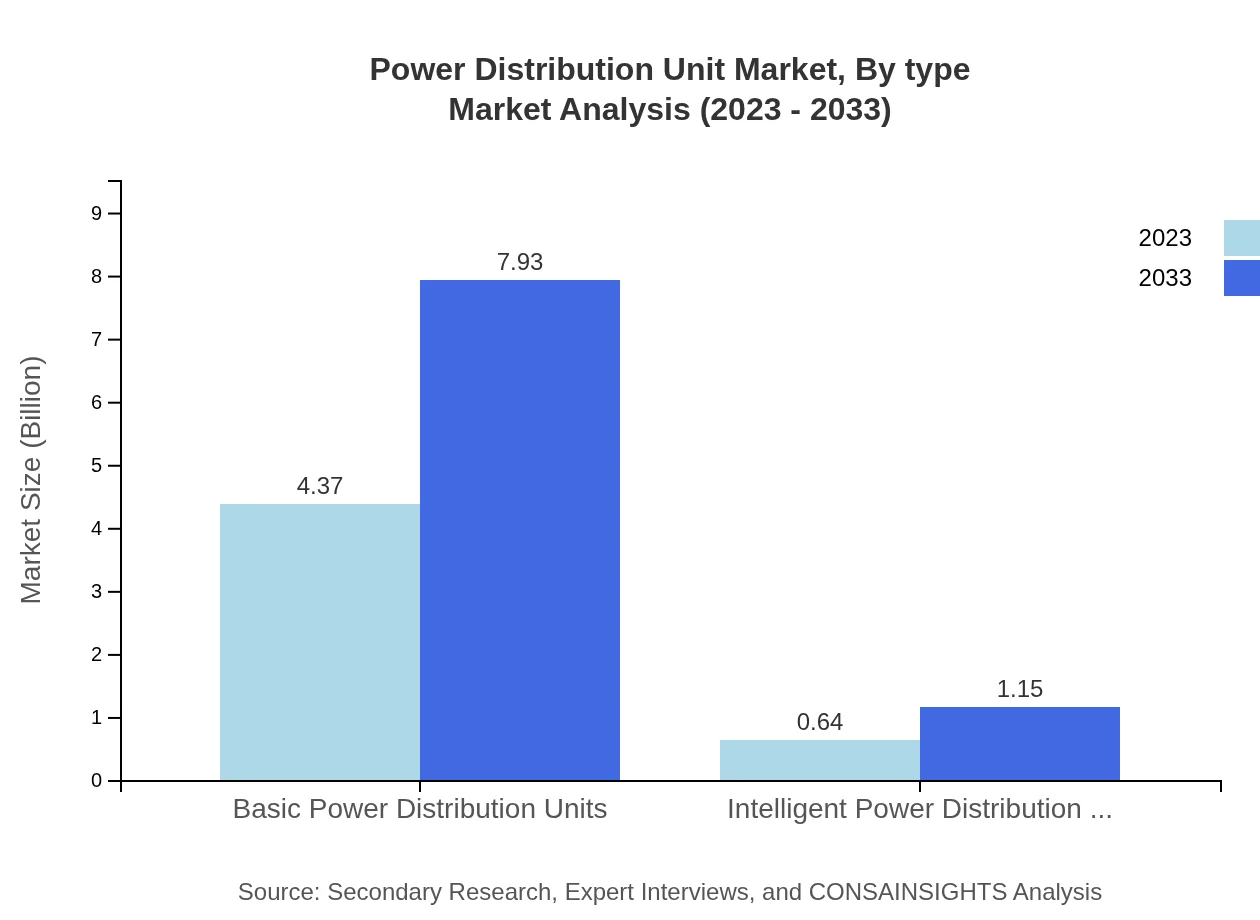

Power Distribution Unit Market Analysis By Type

The segment of Basic Power Distribution Units dominates the market with a size of $4.37 billion in 2023, expected to grow to $7.93 billion by 2033, maintaining a market share of 87.3%. Intelligent Power Distribution Units, though smaller, are also growing, moving from $0.64 billion in 2023 to approximately $1.15 billion in 2033, holding a 12.7% market share.

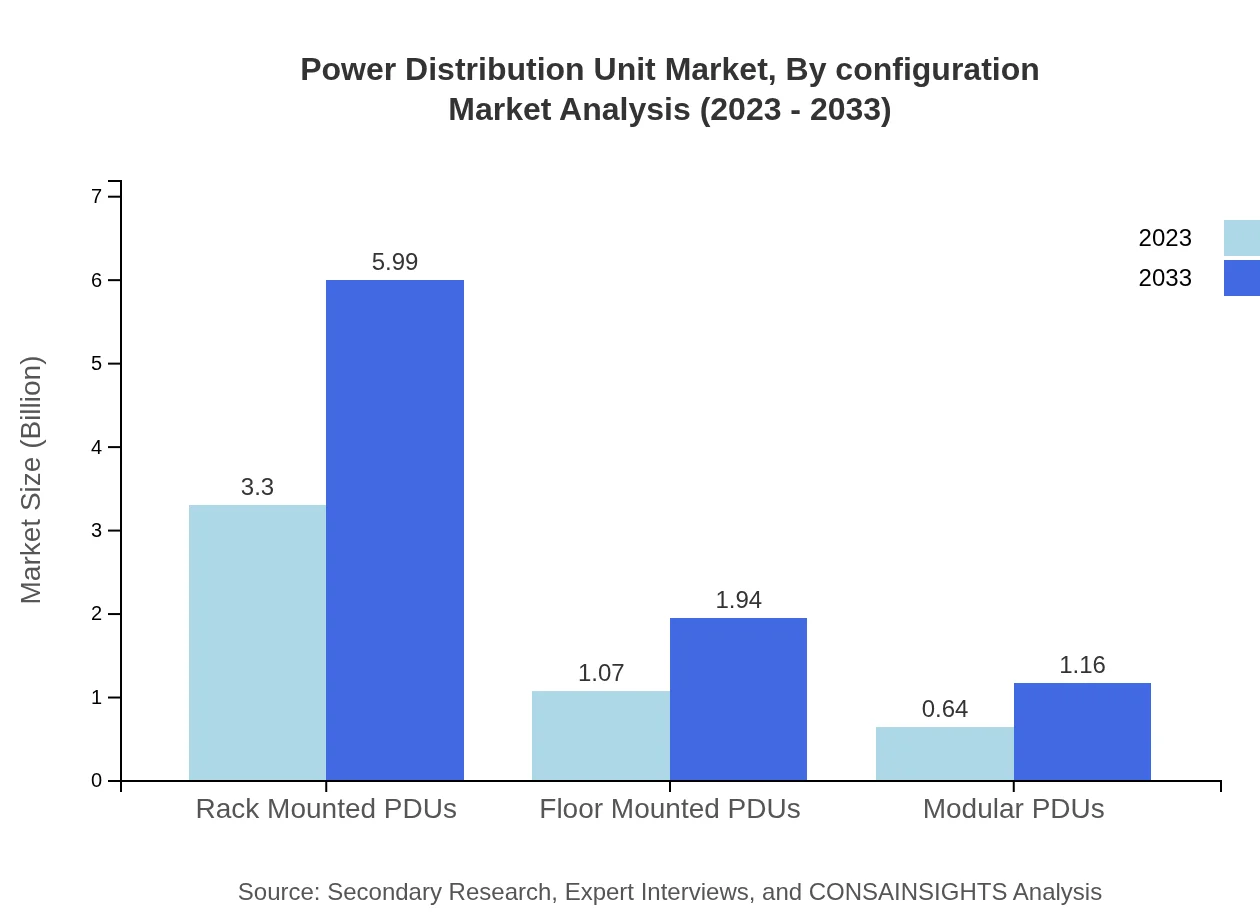

Power Distribution Unit Market Analysis By Configuration

Rack Mounted PDUs are crucial, with a market size growing from $3.30 billion in 2023 to $5.99 billion by 2033, representing 65.92% share. Floor Mounted PDUs also exhibit growth, increasing from $1.07 billion in 2023 to $1.94 billion by 2033 (21.31% share), while Modular PDUs will see an increase from $0.64 billion to $1.16 billion (12.77% share).

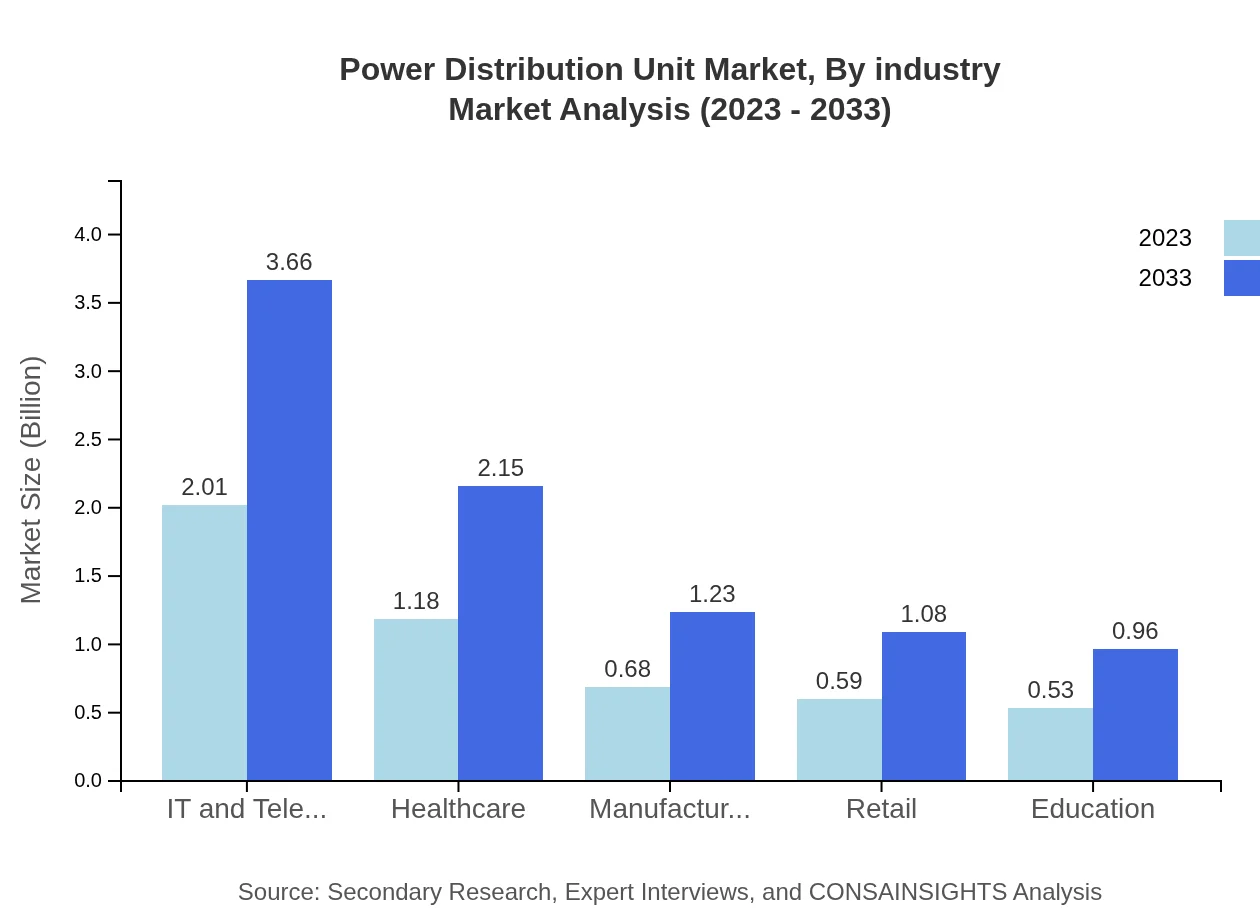

Power Distribution Unit Market Analysis By Industry

The IT and Telecom sector leads with a market size of $2.01 billion in 2023, expected to rise to $3.66 billion by 2033 (40.25% share). Healthcare follows with $1.18 billion growing to $2.15 billion (23.68% share), alongside Manufacturing ($0.68 billion to $1.23 billion, 13.59% share) and Cloud Computing ($2.56 billion to $4.65 billion, 51.22% share).

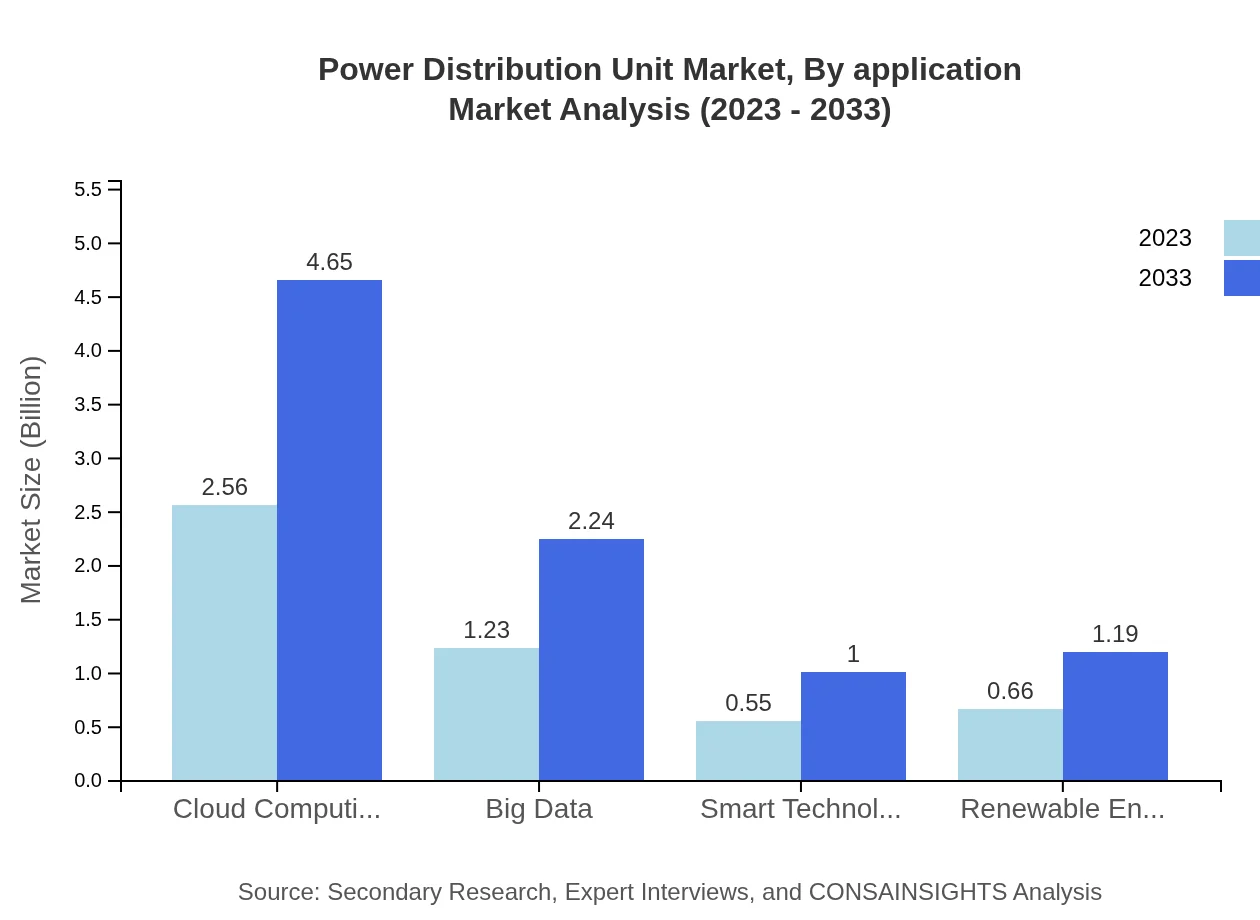

Power Distribution Unit Market Analysis By Application

In terms of applications, sectors such as Big Data ($1.23 billion to $2.24 billion, 24.65% share) and Renewable Energy ($0.66 billion to $1.19 billion, 13.1% share) also showcase strong growth prospects, reflecting the increasing dependency on data-driven solutions and sustainable power practices.

Power Distribution Unit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Power Distribution Unit Industry

Schneider Electric:

A global leader in energy management and automation, Schneider Electric offers comprehensive PDU solutions tailored for data centers and critical infrastructure, ensuring optimal power distribution and energy efficiency.Eaton Corporation:

With a focus on sustainable energy solutions, Eaton designs innovative PDUs that help enterprises manage power effectively, promote energy conservation, and ensure system reliability.Vertiv:

Vertiv specializes in infrastructure technologies for vital applications, providing PDUs designed for reliability, flexibility, and advanced management capabilities to support data centers and communications.Tripp Lite:

A trusted name in power protection, Tripp Lite delivers high-performance PDUs that cater to a wide range of industries, focusing on efficiency and reliability in power distribution.CyberPower Systems:

CyberPower Systems offers innovative PDU solutions that ensure maximum power distribution efficiency and are widely used in small to enterprise-level data centers.We're grateful to work with incredible clients.

FAQs

What is the market size of power Distribution Unit?

The global power distribution unit market is projected to reach $5 billion by 2033, growing at a CAGR of 6%. This growth reflects increasing demands in various sectors for reliable power management solutions.

What are the key market players or companies in this power Distribution Unit industry?

Key players in the power distribution unit industry include Schneider Electric, Siemens, and Vertiv. These companies dominate through innovation, product variety, and strategic partnerships, playing significant roles in market dynamics.

What are the primary factors driving the growth in the power Distribution Unit industry?

Growth in the power distribution unit industry is driven by rising energy demands, increasing data center constructions, and the expansion of renewable energy sources. Additionally, the adoption of smart technology is enhancing efficiency and reliability.

Which region is the fastest Growing in the power Distribution Unit market?

North America is the fastest-growing region in the power distribution unit market, with market size projected to grow from $1.94 billion in 2023 to $3.53 billion by 2033, fueled by technological advancements and increasing IT infrastructure.

Does ConsaInsights provide customized market report data for the power Distribution Unit industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the power distribution unit industry, allowing clients to gain insights into niche markets, consumer preferences, and emerging trends.

What deliverables can I expect from this power Distribution Unit market research project?

Clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, segment insights, competitive landscape, and actionable recommendations tailored to the power distribution unit industry.

What are the market trends of power Distribution Unit?

Current trends in the power distribution unit market include the shift towards intelligent PDUs, an increase in rack-mounted units, and growing demand in sectors such as cloud computing and big data analytics, reflecting technological advancements.