Power Management Integrated Circuit Market Report

Published Date: 31 January 2026 | Report Code: power-management-integrated-circuit

Power Management Integrated Circuit Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Power Management Integrated Circuit (PMIC) market, including market size, trends, and forecasts from 2023 to 2033, along with insights into regional dynamics, industry challenges, and competitive landscape.

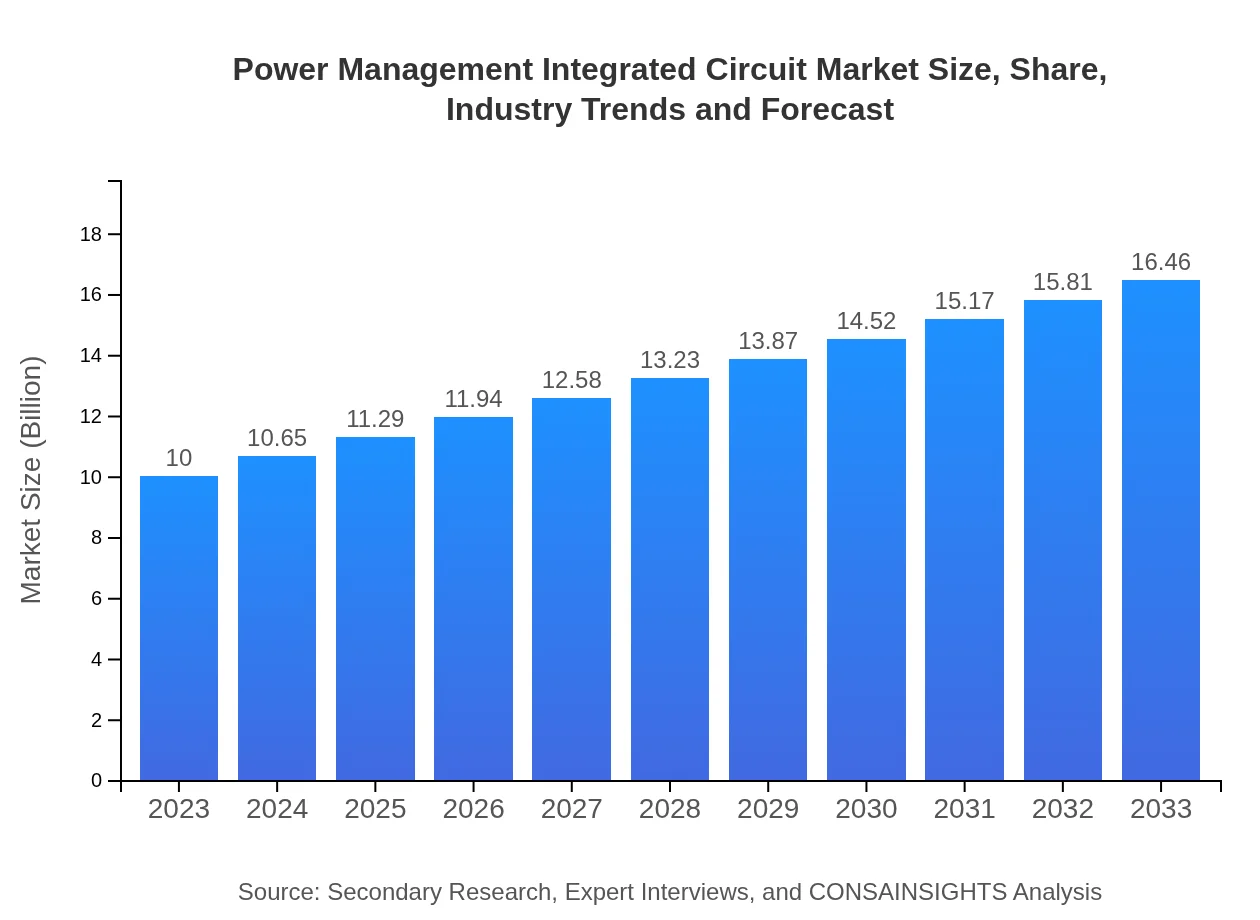

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Texas Instruments, Infineon Technologies, Dialog Semiconductor, ON Semiconductor, STMicroelectronics |

| Last Modified Date | 31 January 2026 |

Power Management Integrated Circuit Market Overview

Customize Power Management Integrated Circuit Market Report market research report

- ✔ Get in-depth analysis of Power Management Integrated Circuit market size, growth, and forecasts.

- ✔ Understand Power Management Integrated Circuit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Power Management Integrated Circuit

What is the Market Size & CAGR of Power Management Integrated Circuit market in 2023?

Power Management Integrated Circuit Industry Analysis

Power Management Integrated Circuit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Power Management Integrated Circuit Market Analysis Report by Region

Europe Power Management Integrated Circuit Market Report:

Europe's PMIC market is estimated to grow significantly from $2.97 billion in 2023 to $4.89 billion by 2033. The rise in green technology initiatives and the demand for energy-efficient electronic solutions play crucial roles in this growth.Asia Pacific Power Management Integrated Circuit Market Report:

The Asia Pacific region, valued at approximately $1.71 billion in 2023, is anticipated to reach $2.82 billion by 2033, reflecting a robust CAGR. The growth is largely driven by increasing consumer electronics production and the rising demand for electric vehicles in countries like China and Japan.North America Power Management Integrated Circuit Market Report:

North America remains a significant market, with a size of $3.89 billion in 2023 expected to grow to $6.41 billion by 2033. Factors such as a strong technology base, growing automotive electronics, and increasing investments in smart home technologies are propelling market growth.South America Power Management Integrated Circuit Market Report:

In South America, the PMIC market is projected to grow from $0.12 billion in 2023 to $0.20 billion by 2033. The growth potential is linked to expanding telecom infrastructure and rising adoption of consumer electronic devices.Middle East & Africa Power Management Integrated Circuit Market Report:

The Middle East and Africa market is expected to expand from $1.30 billion in 2023 to $2.14 billion by 2033. Growth in this region is fueled by increasing investments in infrastructure, telecommunications, and renewable energy projects.Tell us your focus area and get a customized research report.

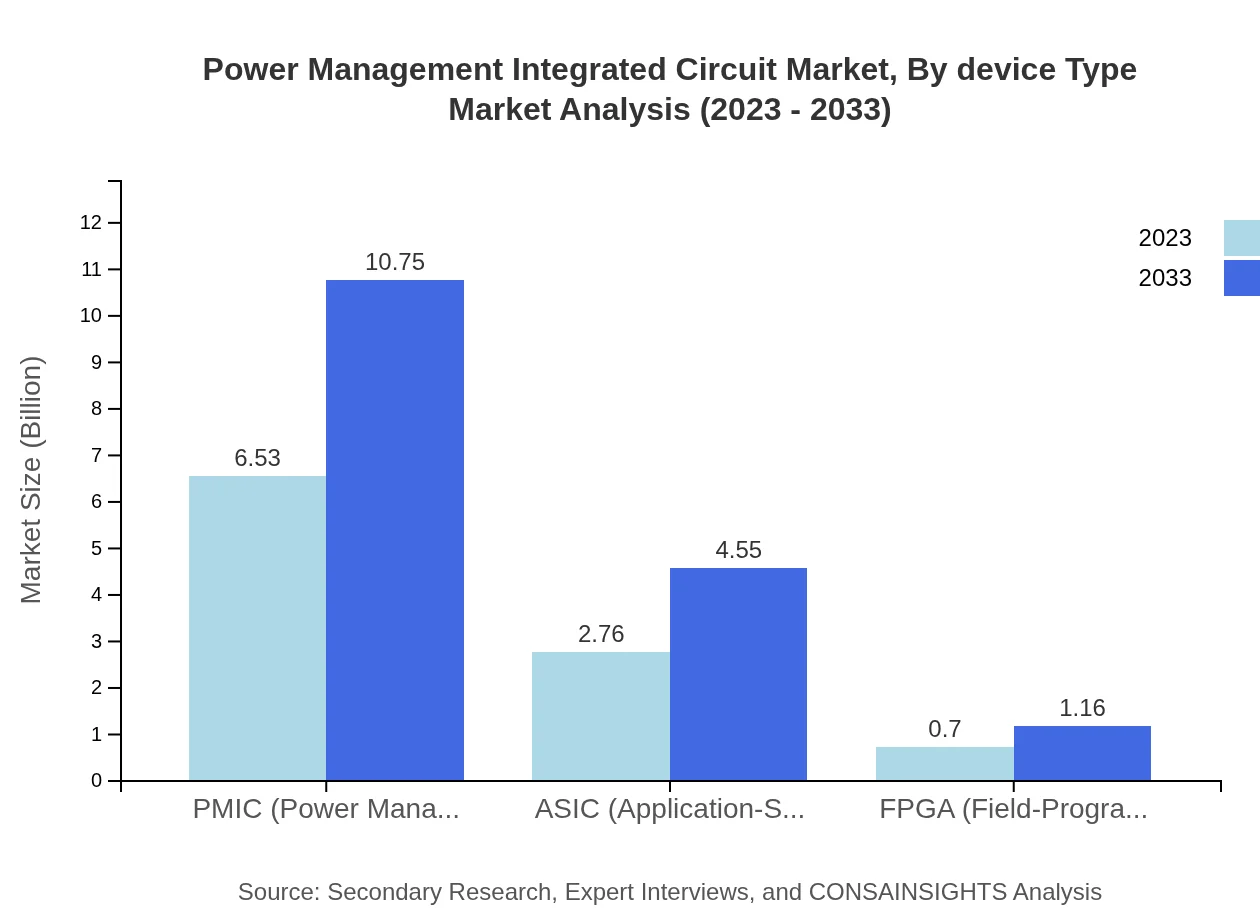

Power Management Integrated Circuit Market Analysis By Device Type

The PMIC market is dominated by Linear Regulators, which accounted for $6.53 billion in 2023 and are projected to reach $10.75 billion by 2033. This segment forms a significant share of the market due to their widespread application in consumer electronics. Switching Regulators follow closely, beginning at $2.76 billion and expected to increase to $4.55 billion in the same timeframe. Hybrid Regulators are also gaining traction, with growth from $0.70 billion to $1.16 billion, thanks to their ability to integrate multiple power management functions.

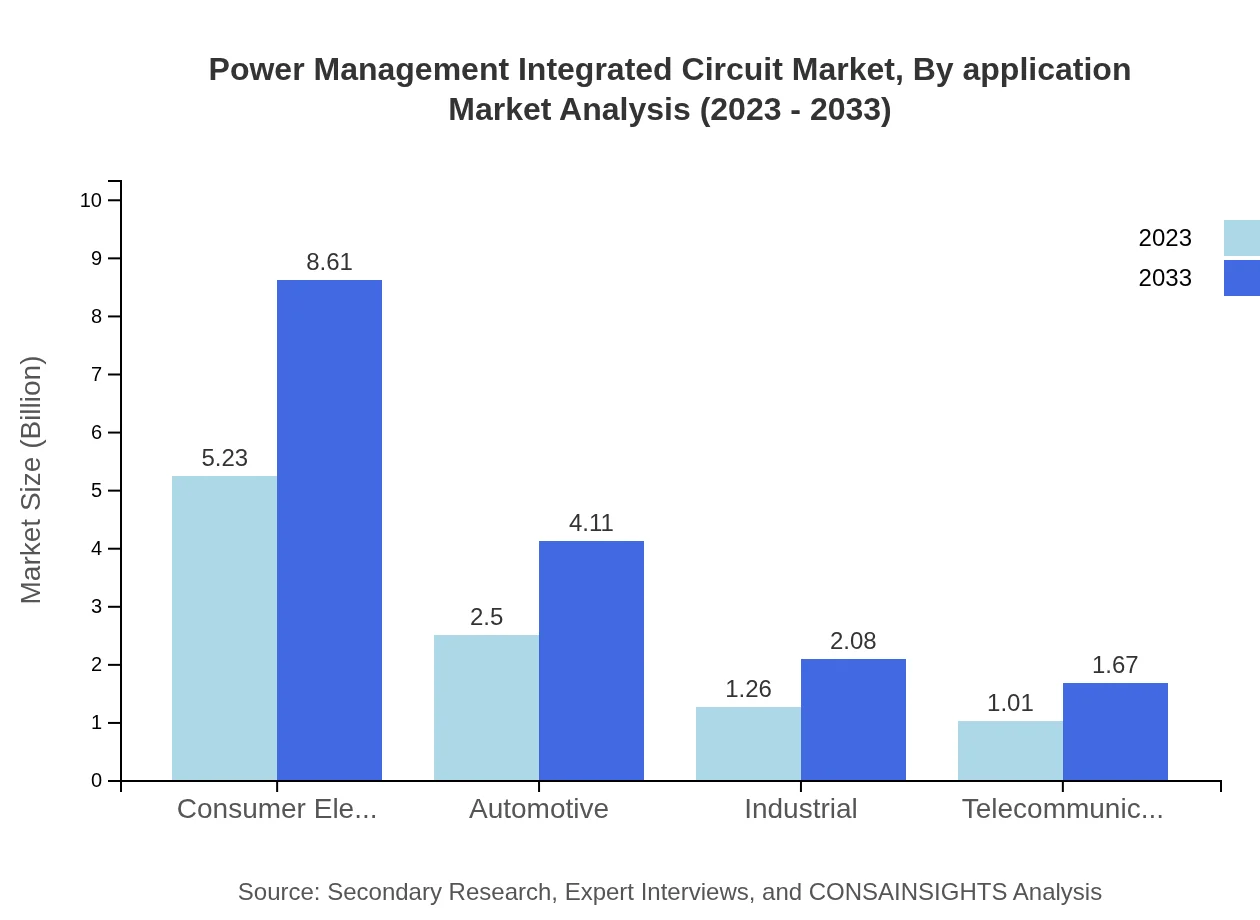

Power Management Integrated Circuit Market Analysis By Application

Consumer Electronics dominate the application segment, with a market size of $5.23 billion in 2023, predicted to grow to $8.61 billion by 2033. The automotive sector, valued at $2.50 billion, is projected to reach $4.11 billion, highlighting the rising integration of PMICs in electric vehicles. Industrial applications contribute significantly, expected to grow from $1.26 billion to $2.08 billion, driven by automation and IoT applications.

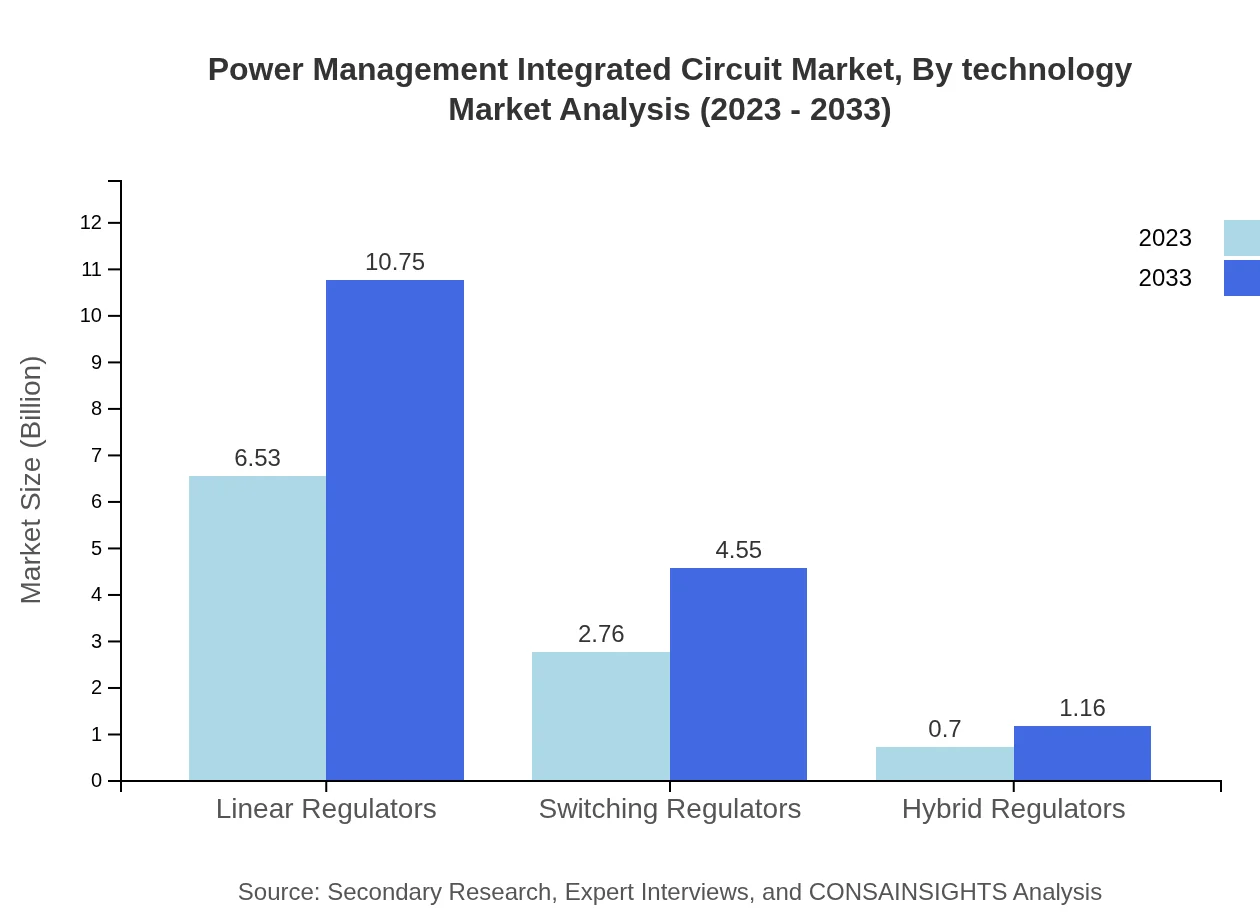

Power Management Integrated Circuit Market Analysis By Technology

In terms of technology, PMICs based on ASICs are projected to reach $4.55 billion by 2033 from $2.76 billion in 2023, whereas FPGA-based PMICs are expected to grow from $0.70 billion to $1.16 billion. Increasing demand for customizable solutions drives the ASIC segment's growth. Direct sales channels remain prevalent in distribution, with a growth forecast from $6.53 billion to $10.75 billion, accounting for a significant market share.

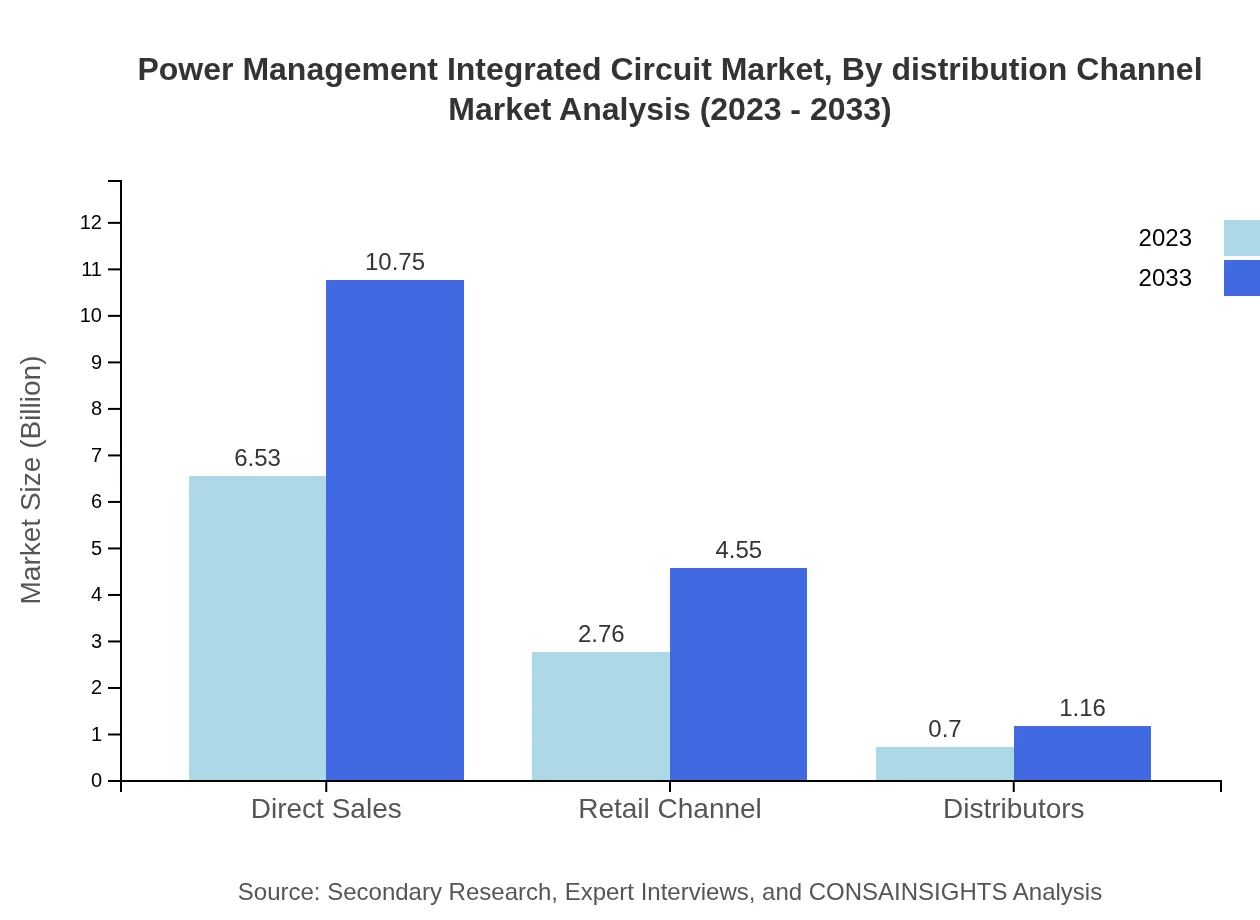

Power Management Integrated Circuit Market Analysis By Distribution Channel

The distribution channel segmentation highlights direct sales as a major contributor, reaching $10.75 billion by 2033 from $6.53 billion in 2023. Retail channels and distributors play crucial roles, growing steadily to $4.55 billion and $1.16 billion, respectively, as more consumers turn towards online and retail shopping for PMIC solutions.

Power Management Integrated Circuit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Power Management Integrated Circuit Industry

Texas Instruments:

A global leader in power management solutions, Texas Instruments offers an extensive range of PMIC products that cater to various applications including automotive, communication, and consumer electronics.Infineon Technologies:

Infineon is known for its innovative PMICs, promoting energy efficiency and sustainability in applications ranging from renewable energy to electric mobility.Dialog Semiconductor:

Dialog specializes in highly integrated PMICs that deliver industry-leading power efficiency and performance, particularly for consumer applications.ON Semiconductor:

Focused on energy-efficient solutions, ON Semiconductor's PMIC offerings are widely used across different sectors including automotive, communications, and industrial applications.STMicroelectronics:

STMicroelectronics is a significant player in the PMIC market, providing a broad portfolio of power management solutions that enhance operational efficiency and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of Power Management Integrated Circuit?

The global Power Management Integrated Circuit market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5% from its current size of around $6.65 billion in 2023.

What are the key market players or companies in the Power Management Integrated Circuit industry?

Key players in the Power Management Integrated Circuit industry include Texas Instruments, Analog Devices, ON Semiconductor, Infineon Technologies, and NXP Semiconductors, who dominate with innovative products and robust market strategies.

What are the primary factors driving the growth in the Power Management Integrated Circuit industry?

Growth in the Power Management Integrated Circuit industry is driven by increasing demand for energy-efficient solutions, rising consumer electronics usage, automotive electrification, and advancements in IoT technology, contributing significantly to the market's expansion.

Which region is the fastest Growing in the Power Management Integrated Circuit?

The fastest-growing region in the Power Management Integrated Circuit market is North America, projected to grow from $3.89 billion in 2023 to $6.41 billion in 2033, depicting a significant increase due to technological innovations and industrial demands.

Does ConsaInsights provide customized market report data for the Power Management Integrated Circuit industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing clients with in-depth analysis, insights, and data that reflect the dynamics of the Power Management Integrated Circuit industry.

What deliverables can I expect from this Power Management Integrated Circuit market research project?

Deliverables from the Power Management Integrated Circuit market research project typically include detailed market analysis reports, segmentation data, trends forecast, competitive landscape insights, and actionable recommendations for stakeholders.

What are the market trends of Power Management Integrated Circuit?

Current market trends in the Power Management Integrated Circuit sector include the increasing integration of smart technology in devices, a rise in demand for renewable energy solutions, and the growing importance of energy-efficient products across all sectors.