Power Module Packaging Market Report

Published Date: 31 January 2026 | Report Code: power-module-packaging

Power Module Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Power Module Packaging market, offering insights into growth trends, regional performance, and technology advancements from 2023 to 2033.

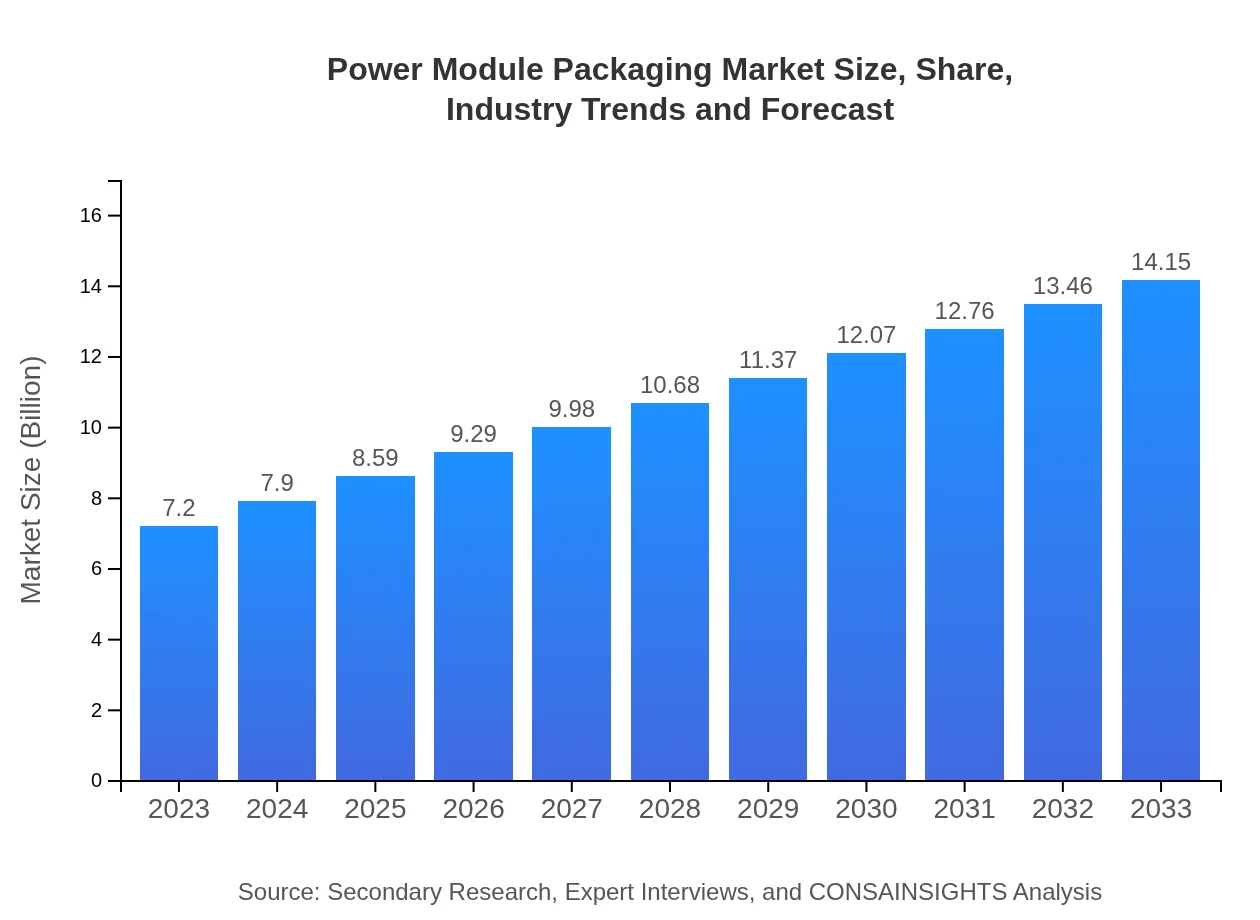

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.15 Billion |

| Top Companies | Infineon Technologies AG, Texas Instruments Inc., STMicroelectronics N.V., Mitsubishi Electric Corporation |

| Last Modified Date | 31 January 2026 |

Power Module Packaging Market Overview

Customize Power Module Packaging Market Report market research report

- ✔ Get in-depth analysis of Power Module Packaging market size, growth, and forecasts.

- ✔ Understand Power Module Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Power Module Packaging

What is the Market Size & CAGR of Power Module Packaging market in 2033?

Power Module Packaging Industry Analysis

Power Module Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Power Module Packaging Market Analysis Report by Region

Europe Power Module Packaging Market Report:

In Europe, the market is poised to expand from $1.96 billion in 2023 to $3.84 billion by 2033. Stricter environmental regulations and a substantial push towards electrification in industries will significantly contribute to this growth.Asia Pacific Power Module Packaging Market Report:

In the Asia Pacific region, the market is expected to grow from $1.55 billion in 2023 to $3.04 billion by 2033. This growth is driven by robust manufacturing bases, increased adoption of electric vehicles, and significant investments in renewable energy technologies.North America Power Module Packaging Market Report:

North America will see growth from $2.57 billion in 2023 to $5.05 billion by 2033, largely fueled by technological advancements, the increase in electric vehicle production, and a growing demand for higher efficiency power modules in various sectors.South America Power Module Packaging Market Report:

The South American market is projected to expand from $0.30 billion in 2023 to $0.60 billion by 2033. Factors influencing this growth include increasing urbanization and governmental incentives promoting renewable energy and energy-efficient technologies.Middle East & Africa Power Module Packaging Market Report:

The Middle East and Africa market is anticipated to grow from $0.82 billion in 2023 to $1.62 billion by 2033, driven by increased investments in power infrastructure and the push towards renewable energy solutions.Tell us your focus area and get a customized research report.

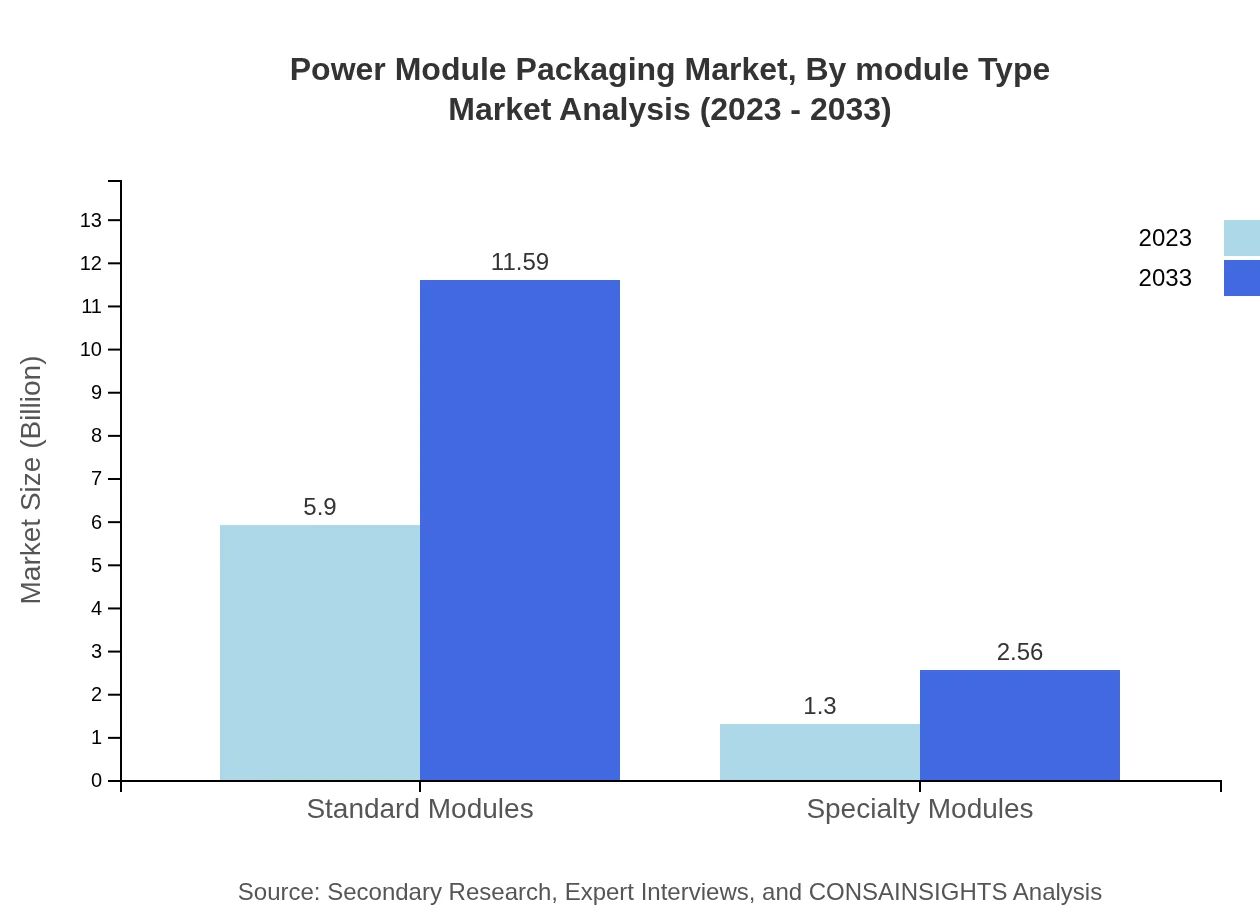

Power Module Packaging Market Analysis By Module Type

The Power Module Packaging market, by module type, includes standard and specialty modules. The standard modules dominate the market with a share of 81.91% in 2023, growing from $5.90 billion to $11.59 billion by 2033. In contrast, specialty modules represent 18.09% of the market, with growth projected from $1.30 billion to $2.56 billion during the same period.

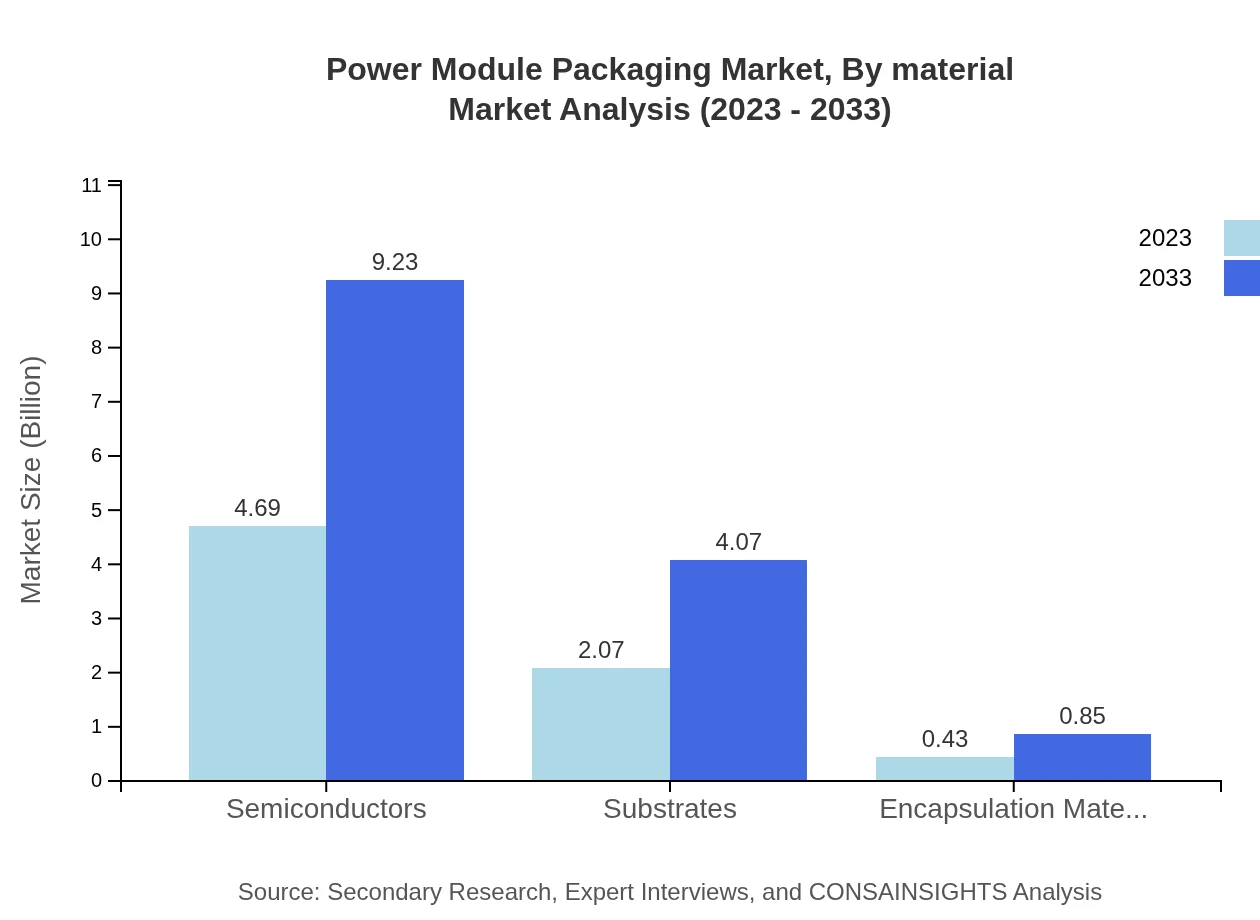

Power Module Packaging Market Analysis By Material

The market can be segmented by material into several categories, including substrates, encapsulation materials, and thermal management solutions. Substrates are pivotal, valued at $2.07 billion in 2023 and expected to reach $4.07 billion by 2033, accounting for 28.77% of the market share. Encapsulation materials and thermal management solutions hold 6.03% market share each.

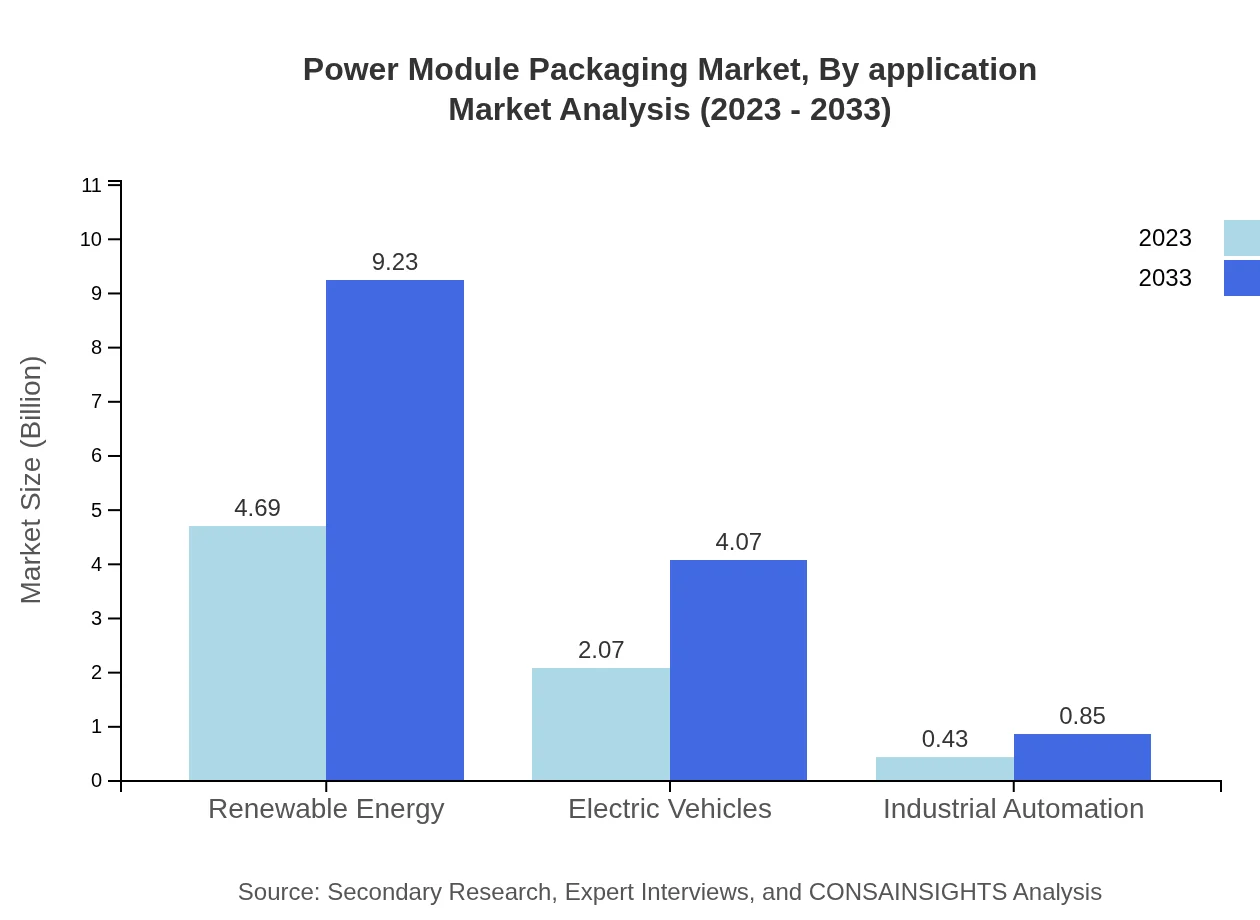

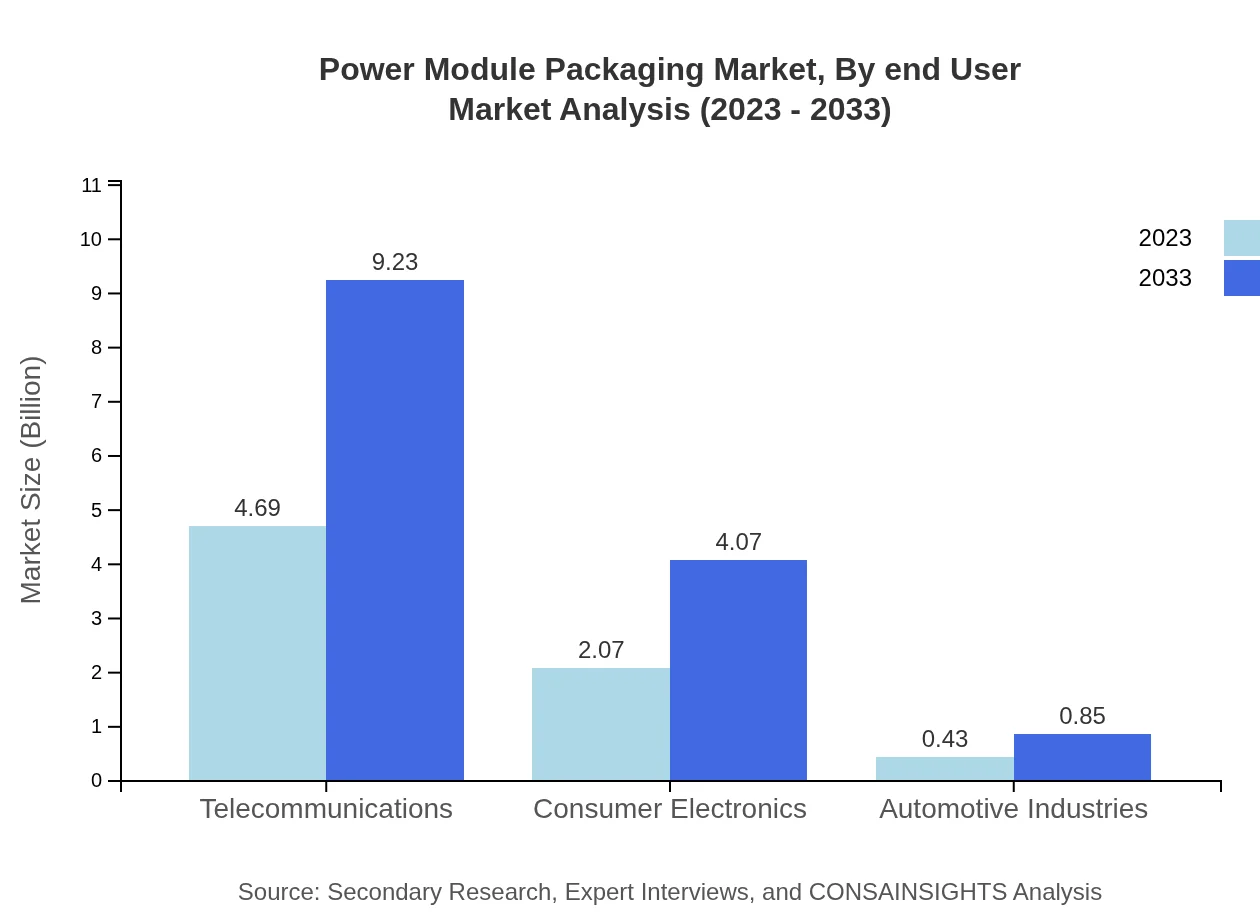

Power Module Packaging Market Analysis By Application

Applications of power module packaging span various sectors including telecommunications, consumer electronics, and automotive industries. Telecommunications is anticipated to retain a significant market share of 65.2%, increasing from $4.69 billion to $9.23 billion by 2033, while automotive applications are set to grow from $0.43 billion to $0.85 billion.

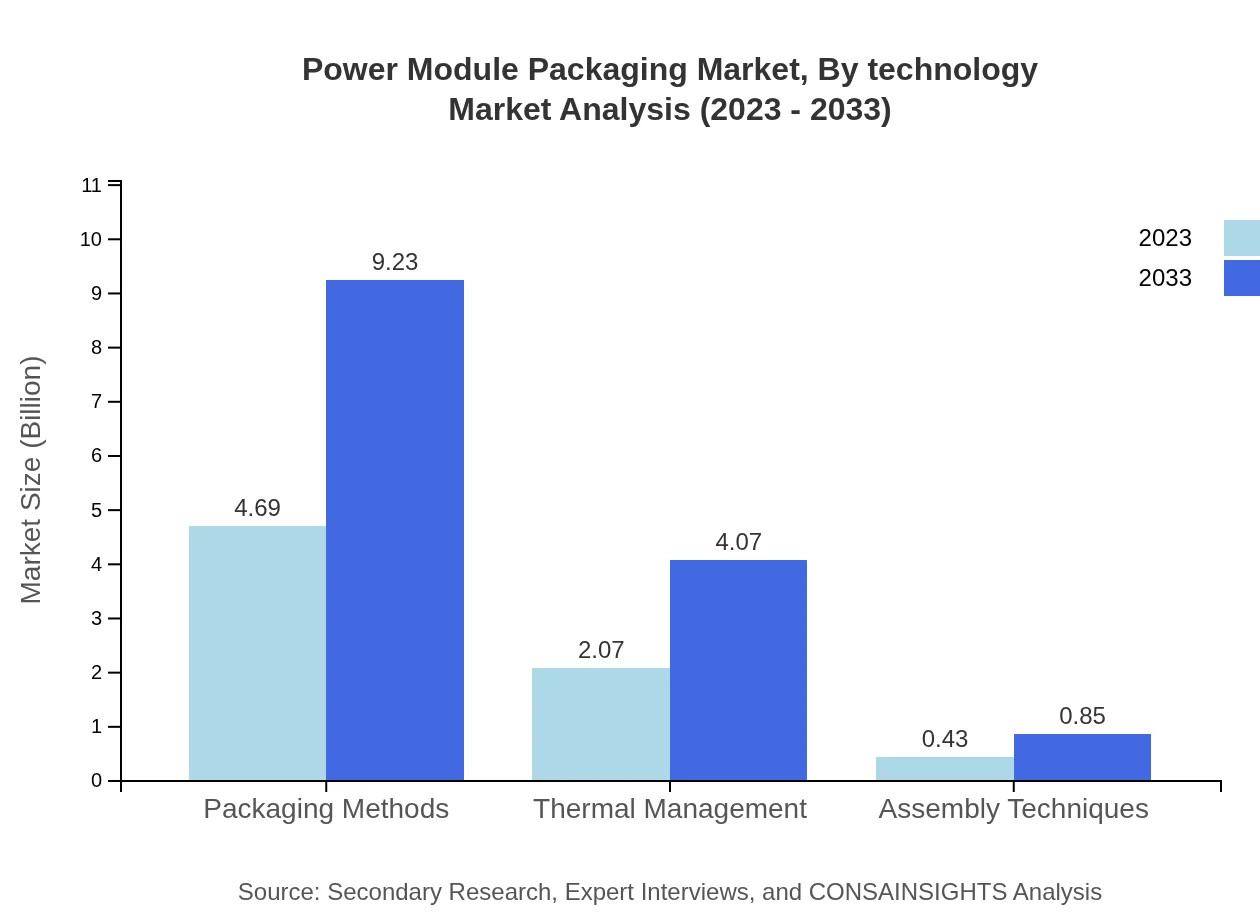

Power Module Packaging Market Analysis By Technology

Technological advancements in power modules include innovative encapsulation techniques, thermal management technologies, and integration of IoT capabilities. These developments not only enhance module performance but also reduce costs and improve manufacturing efficiencies, increasing market competitiveness.

Power Module Packaging Market Analysis By End User

End-user industries such as renewable energy and electric vehicles are significant contributors to market growth. The renewable energy sector represents a substantial portion, driven by the increasing focus on sustainability and innovative power management solutions in applications like solar and wind energy systems.

Power Module Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Power Module Packaging Industry

Infineon Technologies AG:

A leader in semiconductor solutions, Infineon specializes in power semiconductors and modules, contributing to energy efficiency.Texas Instruments Inc.:

Known for its diverse range of electronics, Texas Instruments significantly influences the power module market through its innovative packaging technologies.STMicroelectronics N.V.:

Offering a wide array of power modules and compelling solutions, STMicroelectronics is at the forefront of the industry's transformation towards energy-efficient technologies.Mitsubishi Electric Corporation:

Mitsubishi Electric is recognized for its comprehensive portfolio in power systems, including advanced power module packaging solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of power Module Packaging?

The global power-module-packaging market is valued at approximately $7.2 billion in 2023, with a projected CAGR of 6.8%. By 2033, the market is expected to expand significantly, reflecting an ongoing demand and integration of advanced packaging solutions.

What are the key market players or companies in this power Module Packaging industry?

Key players in the power-module-packaging industry include Texas Instruments, Infineon Technologies, and STMicroelectronics. Each of these companies plays a crucial role in advancing technologies and innovations, positioning themselves as leaders in the market for power module packaging.

What are the primary factors driving the growth in the power Module Packaging industry?

Growth in the power-module-packaging industry is primarily driven by advances in telecommunications, increasing demand for consumer electronics, and the rise of electric vehicles. Additionally, the push for renewable energy sources is enhancing the need for efficient packaging solutions.

Which region is the fastest Growing in the power Module Packaging?

The fastest-growing region in the power-module-packaging market is North America, projected to rise from $2.57 billion in 2023 to $5.05 billion by 2033. Rapid technological advancements and a growing focus on electric vehicles drive this market expansion in the region.

Does ConsaInsights provide customized market report data for the power Module Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the power-module-packaging industry. This ensures that stakeholders receive relevant insights that align with their strategic objectives and market positioning.

What deliverables can I expect from this power Module Packaging market research project?

From the power-module-packaging market research project, clients can expect detailed reports covering market trends, competitive analysis, segment insights, and forecasts. Additionally, data visualizations and actionable recommendations will be included for informed decision-making.

What are the market trends of power Module Packaging?

Market trends in the power-module-packaging industry include the increasing adoption of standard modules, which hold an 81.91% share, and a shift towards specialty modules. Enhanced thermal management and assembly techniques are also becoming critical factors influencing design innovations.