Power Substation Automation And Integration Market Report

Published Date: 22 January 2026 | Report Code: power-substation-automation-and-integration

Power Substation Automation And Integration Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Power Substation Automation and Integration market from 2023 to 2033, covering market size, trends, regional performance, segmentation, and projections.

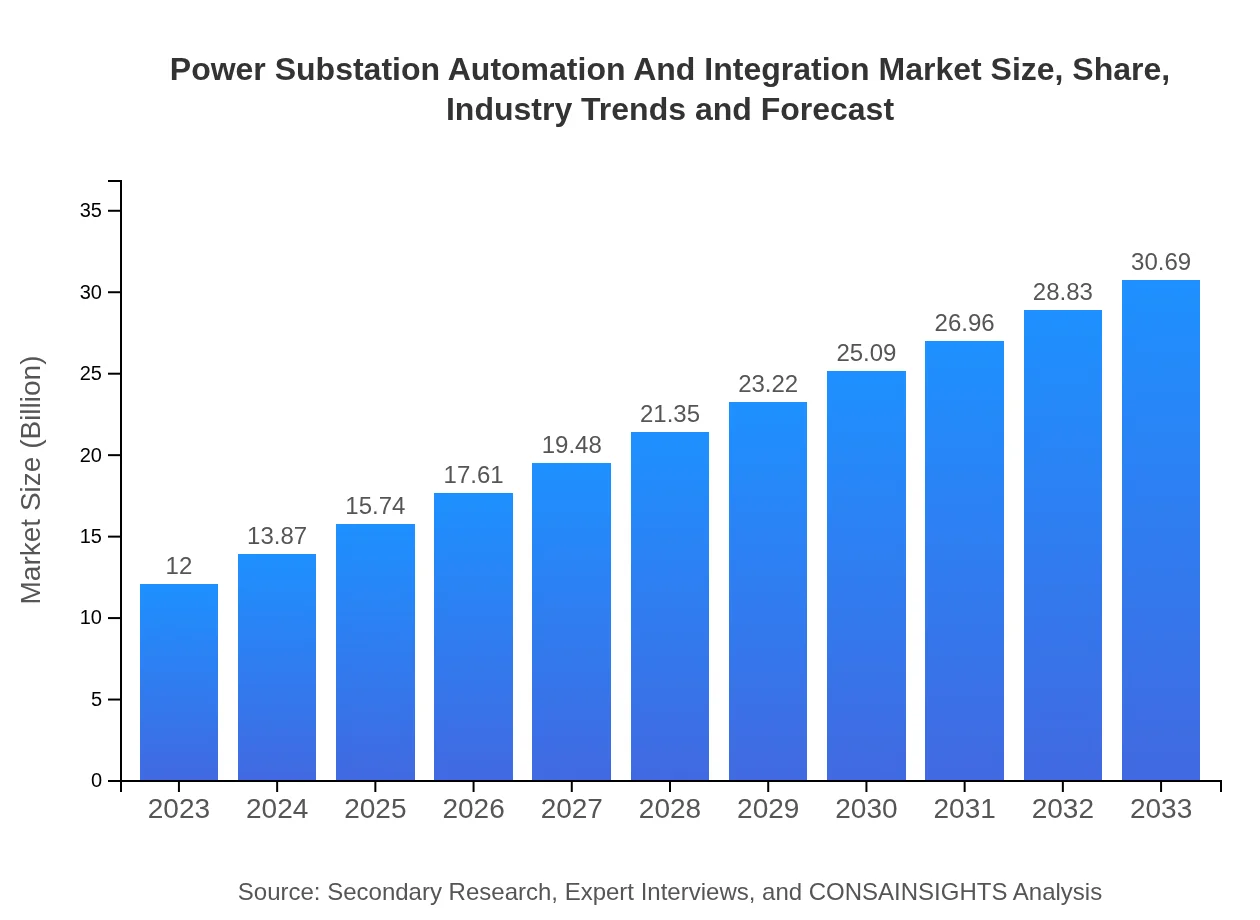

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Siemens AG, Schneider Electric, General Electric (GE), ABB Ltd, Emerson Electric Co., Mitsubishi Electric |

| Last Modified Date | 22 January 2026 |

Power Substation Automation And Integration Market Overview

Customize Power Substation Automation And Integration Market Report market research report

- ✔ Get in-depth analysis of Power Substation Automation And Integration market size, growth, and forecasts.

- ✔ Understand Power Substation Automation And Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Power Substation Automation And Integration

What is the Market Size & CAGR of Power Substation Automation And Integration market in 2023?

Power Substation Automation And Integration Industry Analysis

Power Substation Automation And Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Power Substation Automation And Integration Market Analysis Report by Region

Europe Power Substation Automation And Integration Market Report:

Europe's market is poised for substantial growth, escalating from $3.83 billion in 2023 to $9.80 billion in 2033, driven by stringent regulations promoting energy efficiency and investments in renewable energy integration into the electricity grid.Asia Pacific Power Substation Automation And Integration Market Report:

The Asia Pacific region is expected to witness significant growth, with market size projected to rise from $2.15 billion in 2023 to $5.49 billion in 2033. This growth is driven by rapid industrialization, urban development, and extensive investments in power infrastructure, especially in countries like China and India.North America Power Substation Automation And Integration Market Report:

North America is expected to lead the market with an increase from $4.45 billion in 2023 to $11.38 billion by 2033. The growth is primarily attributable to technological advancements, government initiatives toward smart grid implementations, and aging infrastructure requiring upgrades.South America Power Substation Automation And Integration Market Report:

In South America, the market size is anticipated to grow from $0.08 billion in 2023 to $0.20 billion by 2033. The region faces unique challenges such as economic volatility but also opportunities due to increasing demand for reliable electricity in remote areas.Middle East & Africa Power Substation Automation And Integration Market Report:

The Middle East and Africa market is expected to grow from $1.50 billion in 2023 to $3.83 billion in 2033, fueled by ongoing infrastructural projects and a rising focus on digital transformation in the power sector.Tell us your focus area and get a customized research report.

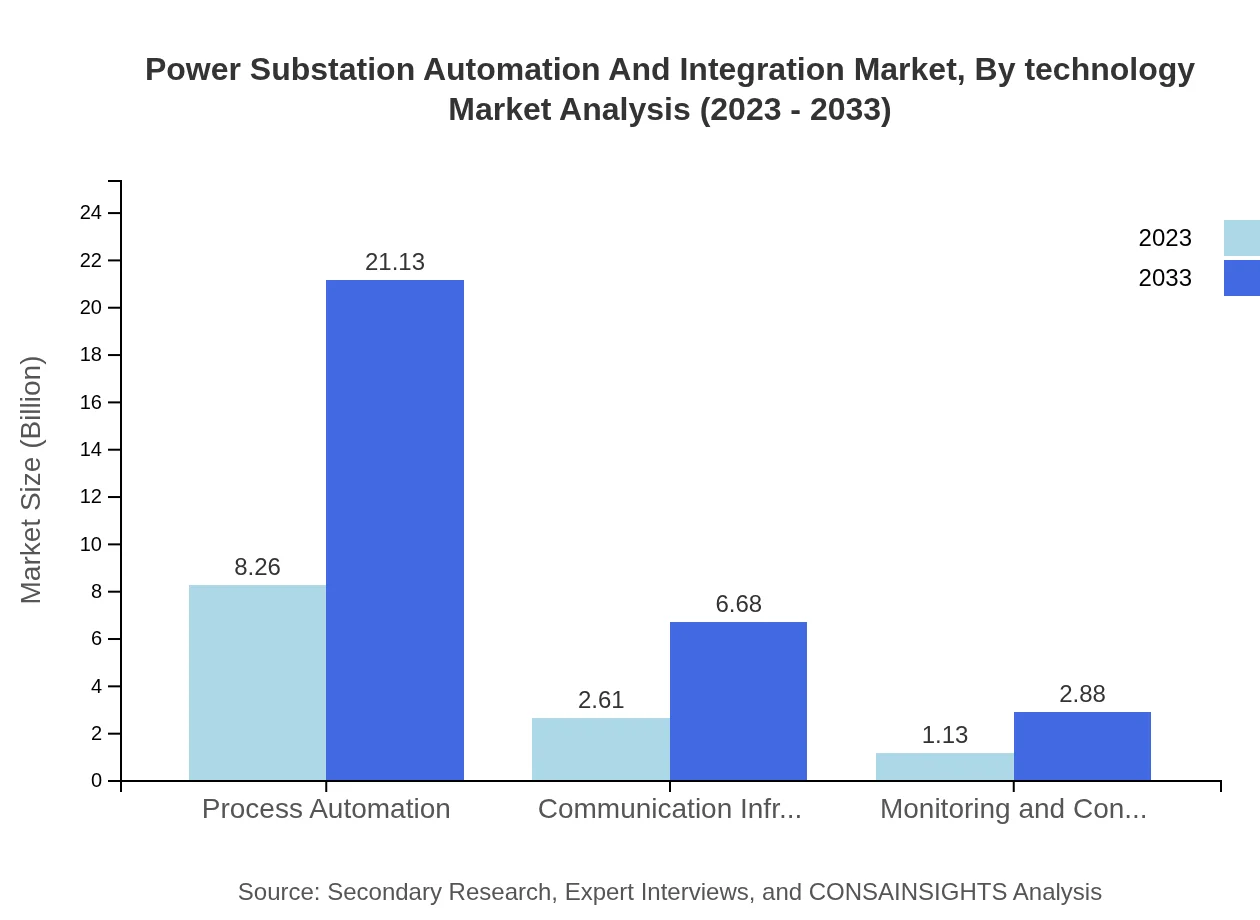

Power Substation Automation And Integration Market Analysis By Technology

The technology segment is dominated by hardware solutions, accounting for a market size of $8.26 billion in 2023 and projected to reach $21.13 billion by 2033, supported by a 68.84% market share. Software follows with $2.61 billion growing to $6.68 billion, while services will see an increase from $1.13 billion to $2.88 billion.

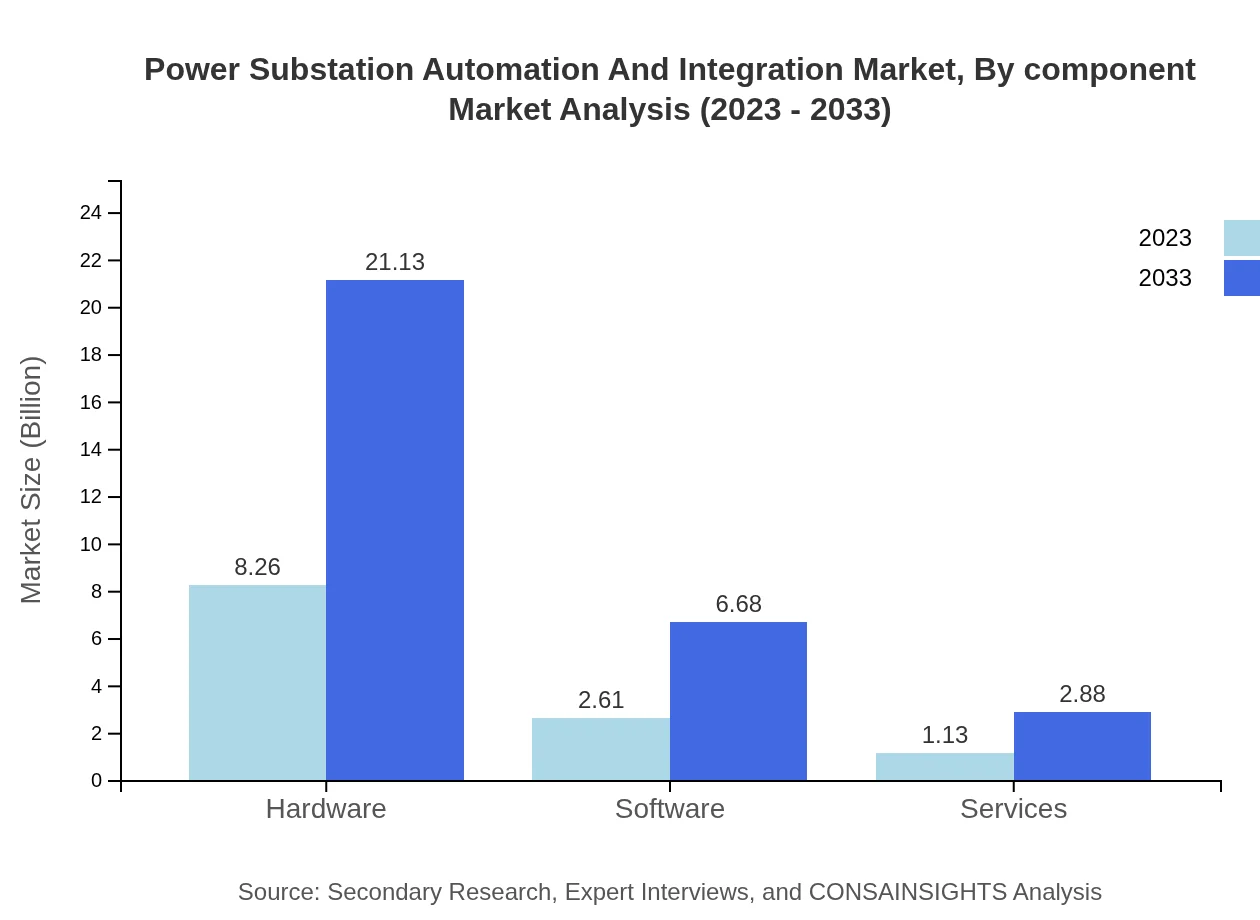

Power Substation Automation And Integration Market Analysis By Component

The component analysis shows that monitoring and control systems account for a significant share, valued at $1.13 billion in 2023, projected to reach $2.88 billion in 2033. In contrast, communication infrastructure is witnessing growth, reflecting the shift towards digital communication protocols necessary for automation.

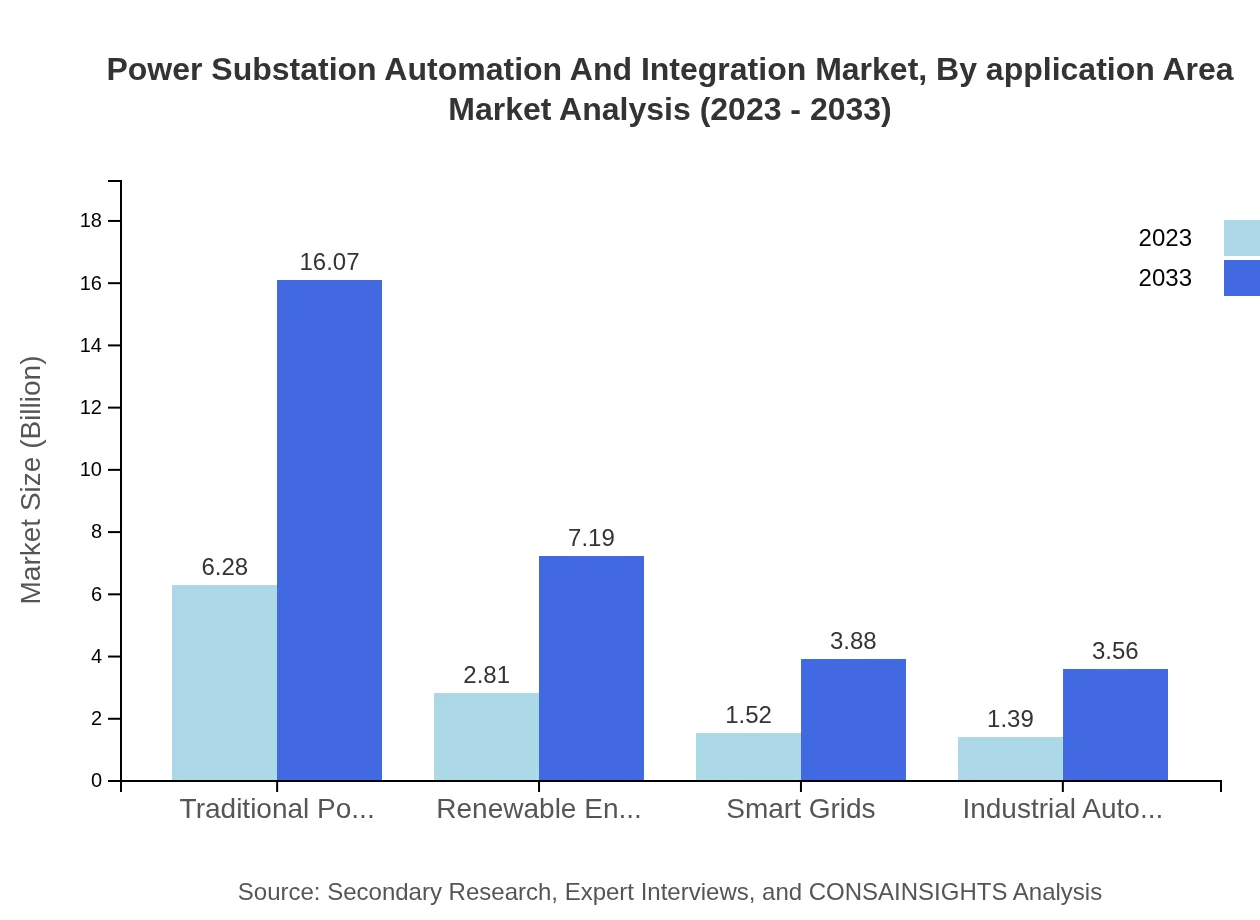

Power Substation Automation And Integration Market Analysis By Application Area

Traditional power plants remain dominant, valued at $6.28 billion in 2023 and forecasted to reach $16.07 billion by 2033, while renewable energy sources will rise from $2.81 billion to $7.19 billion, demonstrating the sector's shift towards sustainability.

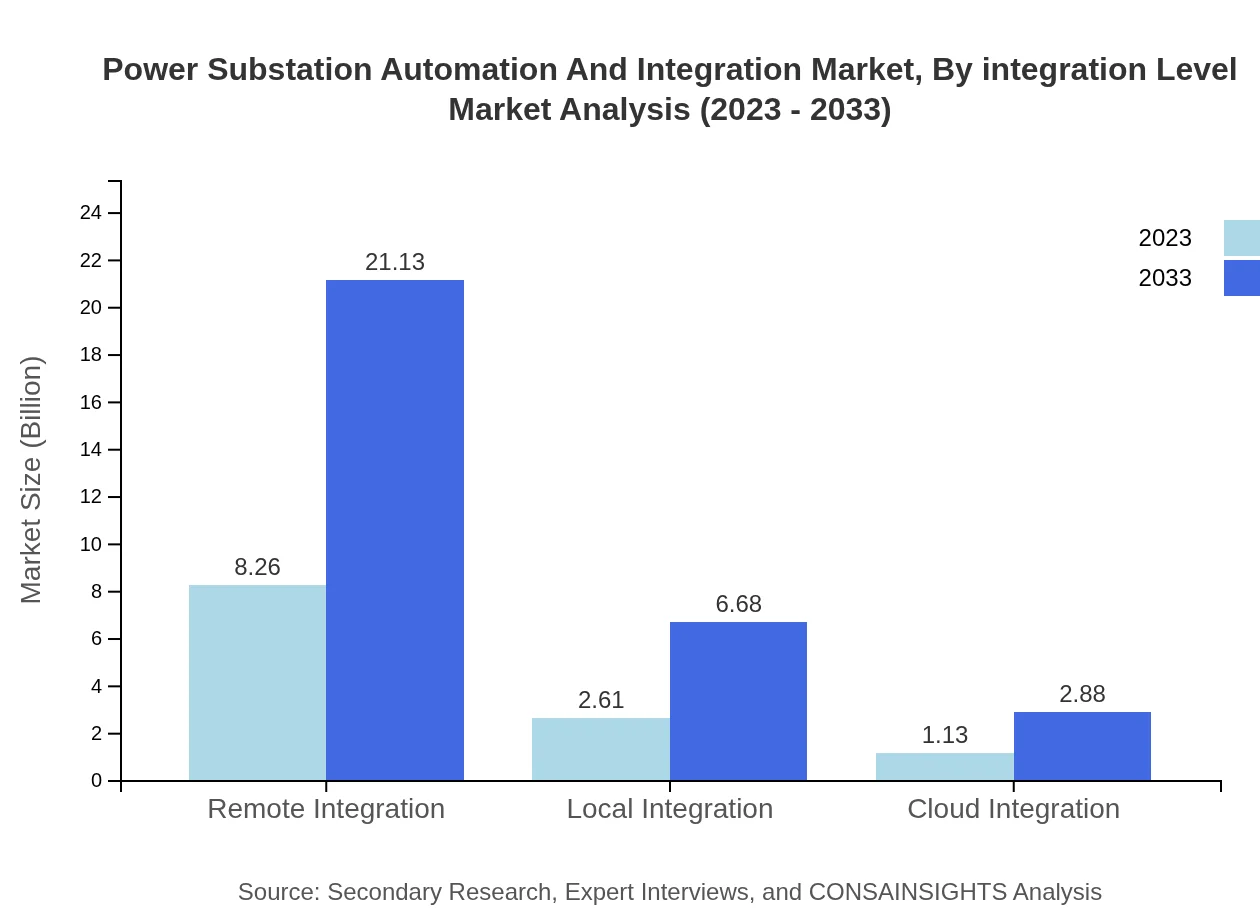

Power Substation Automation And Integration Market Analysis By Integration Level

Remote integration currently leads the market with $8.26 billion in 2023, expanding to $21.13 billion by 2033, highlighting the industry's focus on remote management solutions. Local and cloud integration also show steady growth, catering to user needs for flexibility and scalability.

Power Substation Automation And Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Power Substation Automation And Integration Industry

Siemens AG:

A leading technology company providing advanced solutions for energy distribution and automation, Siemens integrates digital technologies into substations.Schneider Electric:

An expert in energy management and automation solutions, Schneider Electric offers diverse products and services enhancing operational efficiency in power sectors.General Electric (GE):

Renowned for its innovative energy solutions, GE focuses on digitizing power infrastructure, facilitating smarter automation in substations.ABB Ltd:

A global leader in power and automation technologies, ABB is known for developing pioneering substation automation solutions worldwide.Emerson Electric Co.:

Provides automation solutions that increase productivity and efficiency, addressing the changing dynamics of electricity generation and distribution.Mitsubishi Electric:

Offers comprehensive automation solutions for power systems with a strong emphasis on renewable energy integration.We're grateful to work with incredible clients.

FAQs

What is the market size of power Substation Automation And Integration?

The global power substation automation and integration market is valued at approximately $12 billion in 2023, with a projected CAGR of 9.5% through 2033, indicating significant growth as technology advancements continue.

What are the key market players or companies in this power Substation Automation And Integration industry?

Key players in the power substation automation and integration market include Siemens, ABB, Schneider Electric, General Electric, and Eaton. These companies are leaders due to their innovative technology solutions and extensive market reach.

What are the primary factors driving the growth in the power Substation Automation And Integration industry?

The growth drivers for this industry include increasing demand for reliable power supply, advancements in smart grid technology, investment in renewable energy sources, and the need for operational efficiency in power management systems.

Which region is the fastest Growing in the power Substation Automation And Integration?

The Asia-Pacific region is the fastest-growing market for power substation automation and integration. It is projected to grow from $2.15 billion in 2023 to $5.49 billion by 2033, driven by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the power Substation Automation And Integration industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the power substation automation and integration industry, ensuring clients receive relevant insights for informed decision-making.

What deliverables can I expect from this power Substation Automation And Integration market research project?

Deliverables from the market research project will include comprehensive market analysis reports, forecasts by segment and region, competitive landscape overview, and actionable insights tailored to strategic planning.

What are the market trends of power Substation Automation And Integration?

Current trends in the power substation automation and integration market include increased investment in renewable energy technologies, adoption of IoT for system efficiency, and growing emphasis on cybersecurity measures within automation systems.