Powered Surgical Instruments Market Report

Published Date: 31 January 2026 | Report Code: powered-surgical-instruments

Powered Surgical Instruments Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Powered Surgical Instruments market, including in-depth insights, trends, forecasts for the period 2023-2033, and a breakdown of market size, segmentation, and regional analysis.

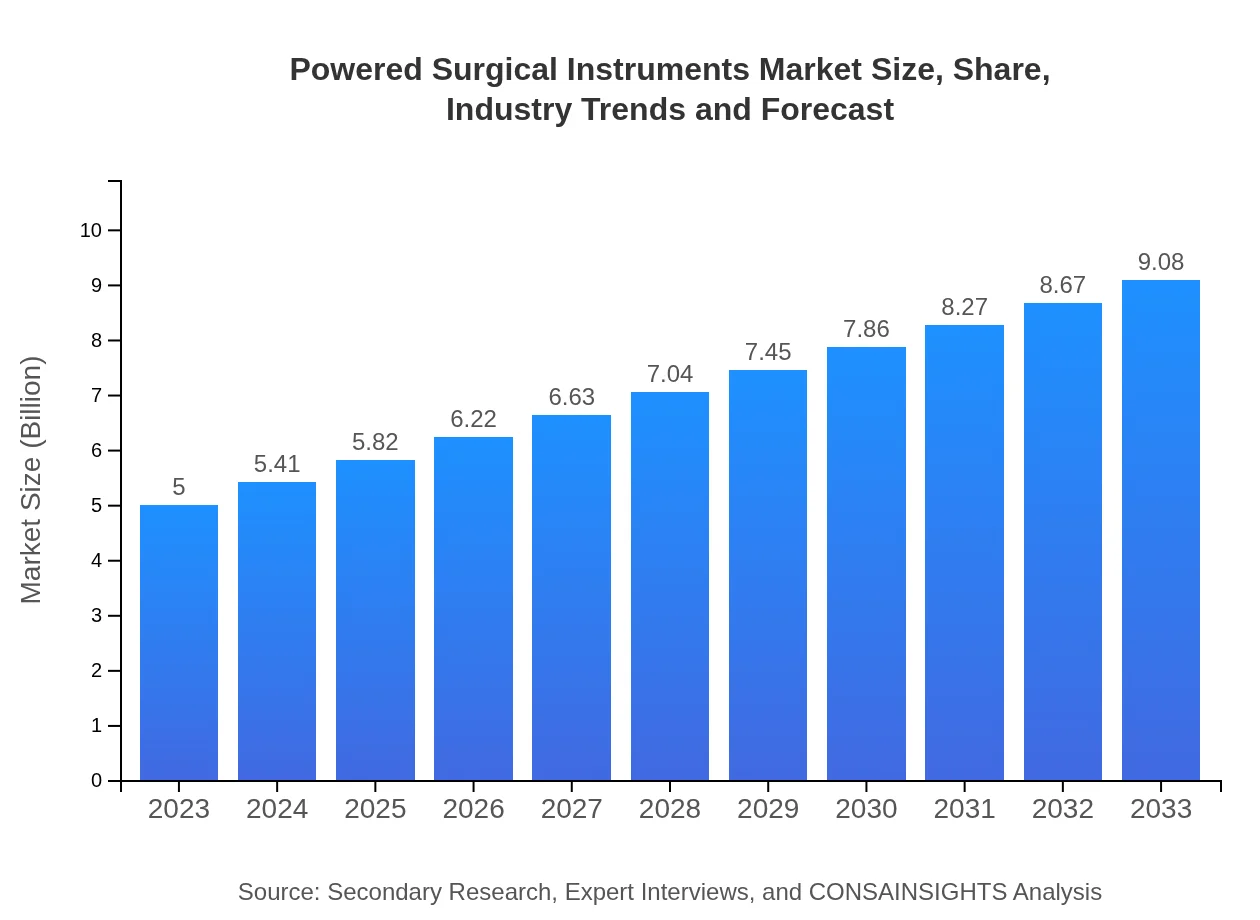

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Johnson & Johnson, Stryker Corporation, Medtronic , B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc. |

| Last Modified Date | 31 January 2026 |

Powered Surgical Instruments Market Overview

Customize Powered Surgical Instruments Market Report market research report

- ✔ Get in-depth analysis of Powered Surgical Instruments market size, growth, and forecasts.

- ✔ Understand Powered Surgical Instruments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Powered Surgical Instruments

What is the Market Size & CAGR of Powered Surgical Instruments market in 2023?

Powered Surgical Instruments Industry Analysis

Powered Surgical Instruments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Powered Surgical Instruments Market Analysis Report by Region

Europe Powered Surgical Instruments Market Report:

Europe's market was valued at $1.36 billion in 2023, with projections indicating growth to $2.47 billion by 2033. Factors include a growing elderly population, increased surgical volumes, and rising healthcare spending.Asia Pacific Powered Surgical Instruments Market Report:

In 2023, the Asia Pacific region's market size was valued at $0.95 billion, projected to grow to $1.73 billion by 2033. Rising healthcare investments, increasing patient populations, and the growing adoption of advanced surgical technologies drive this growth.North America Powered Surgical Instruments Market Report:

North America leads the market with a valuation of $1.93 billion in 2023, projected to grow to $3.51 billion by 2033. The presence of advanced healthcare facilities, technological advancements, and a high prevalence of chronic diseases stimulate market growth.South America Powered Surgical Instruments Market Report:

The South American market was valued at $0.16 billion in 2023 and is expected to reach $0.29 billion by 2033. Factors such as improving healthcare infrastructure and an increase in surgical procedures are contributing to this growth.Middle East & Africa Powered Surgical Instruments Market Report:

The Middle East and Africa market size was $0.59 billion in 2023 and is expected to reach $1.08 billion by 2033. The growing demand for advanced surgical tools and the development of healthcare systems are key drivers.Tell us your focus area and get a customized research report.

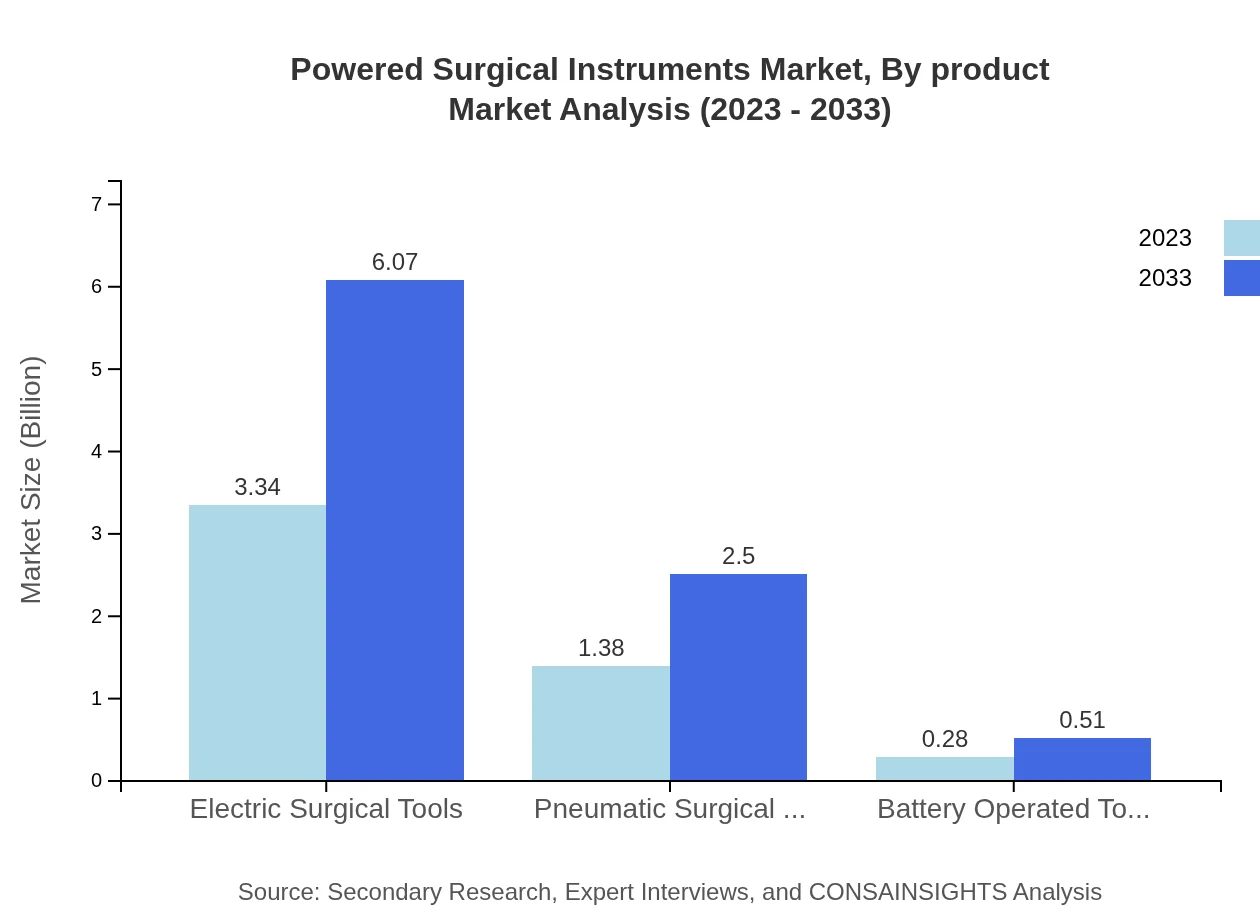

Powered Surgical Instruments Market Analysis By Product

The primary products within the Powered Surgical Instruments market include electric surgical tools, which dominated with a market size of $3.34 billion in 2023 and are projected to grow to $6.07 billion by 2033. Pneumatic surgical tools were valued at $1.38 billion in 2023, with expectations of reaching $2.50 billion by 2033. Battery-operated tools also show growth potential, expanding from $0.28 billion in 2023 to $0.51 billion in 2033, emphasizing a shift towards more versatile and efficient surgical tools.

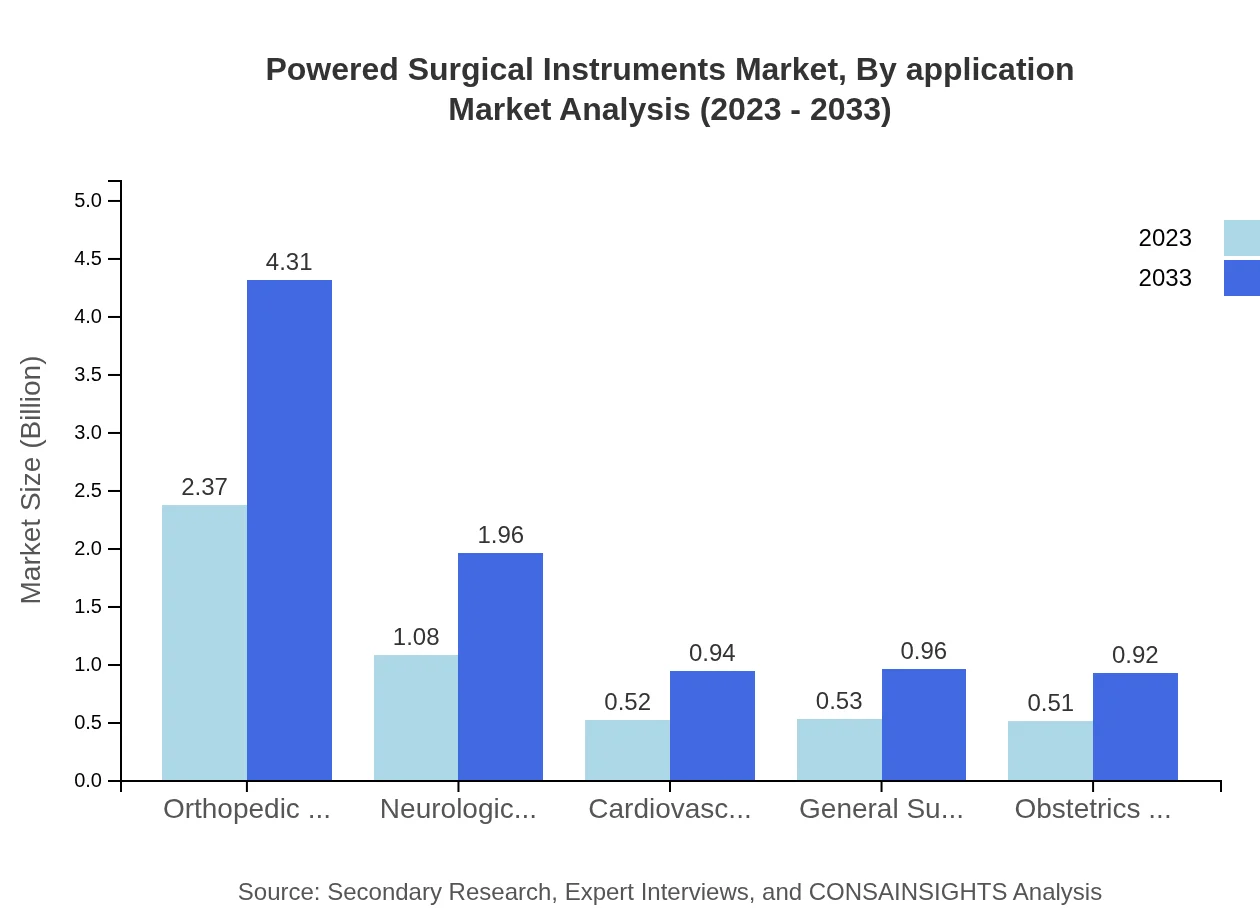

Powered Surgical Instruments Market Analysis By Application

Application segments of the Powered Surgical Instruments market include orthopedic surgery valued at $2.37 billion in 2023 and expected to reach $4.31 billion by 2033. Neurological surgery accounted for $1.08 billion in 2023, growing to $1.96 billion. Cardiovascular and general surgery are also notable applications, indicating the broad applicability of powered instruments across surgical procedures.

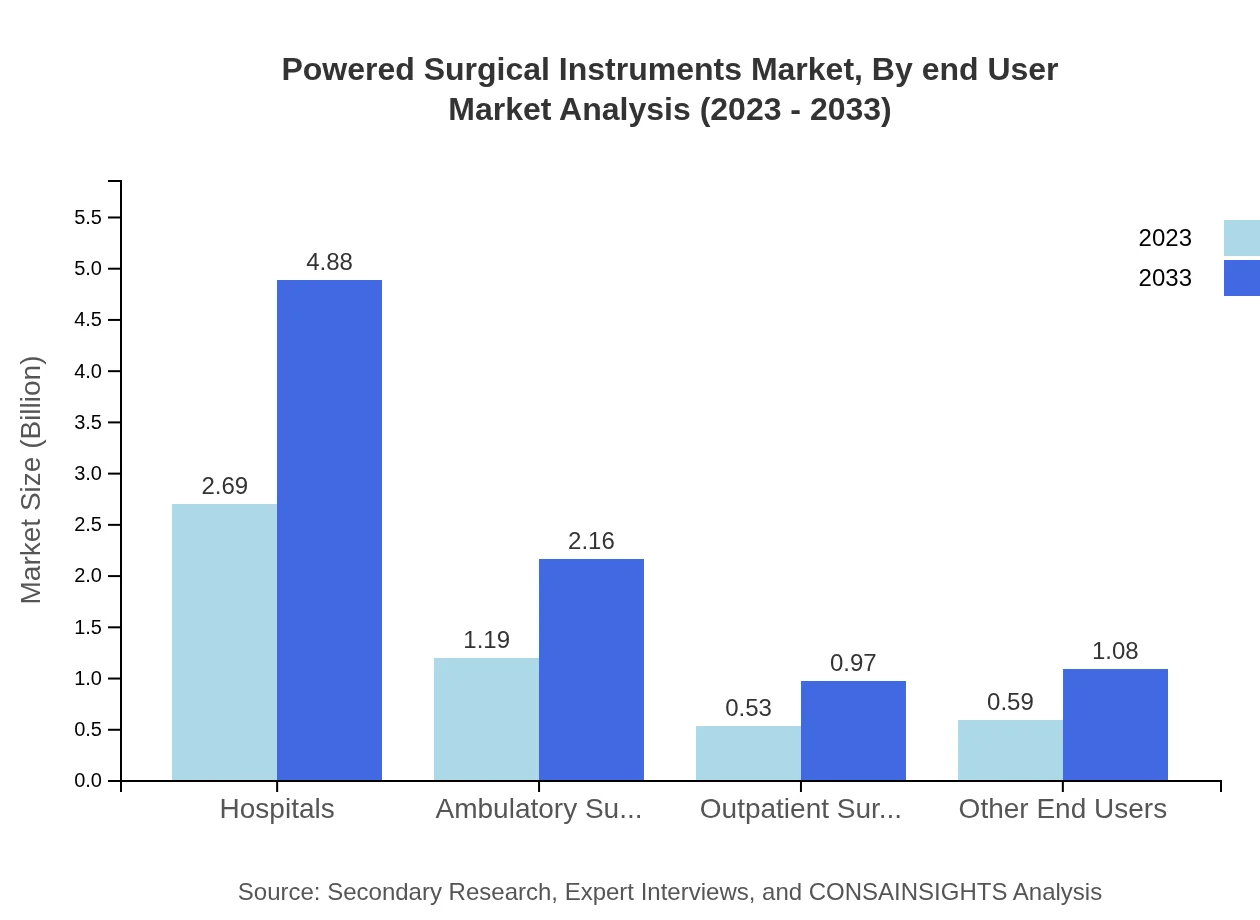

Powered Surgical Instruments Market Analysis By End User

The hospital sector is the largest end-user for powered surgical instruments, accounting for $2.69 billion in 2023 and projected to grow to $4.88 billion by 2033. Ambulatory surgical centers and outpatient surgery centers are significant user segments, with their markets valued at $1.19 billion and $0.53 billion in 2023, respectively, indicating a growing trend in outpatient surgical procedures.

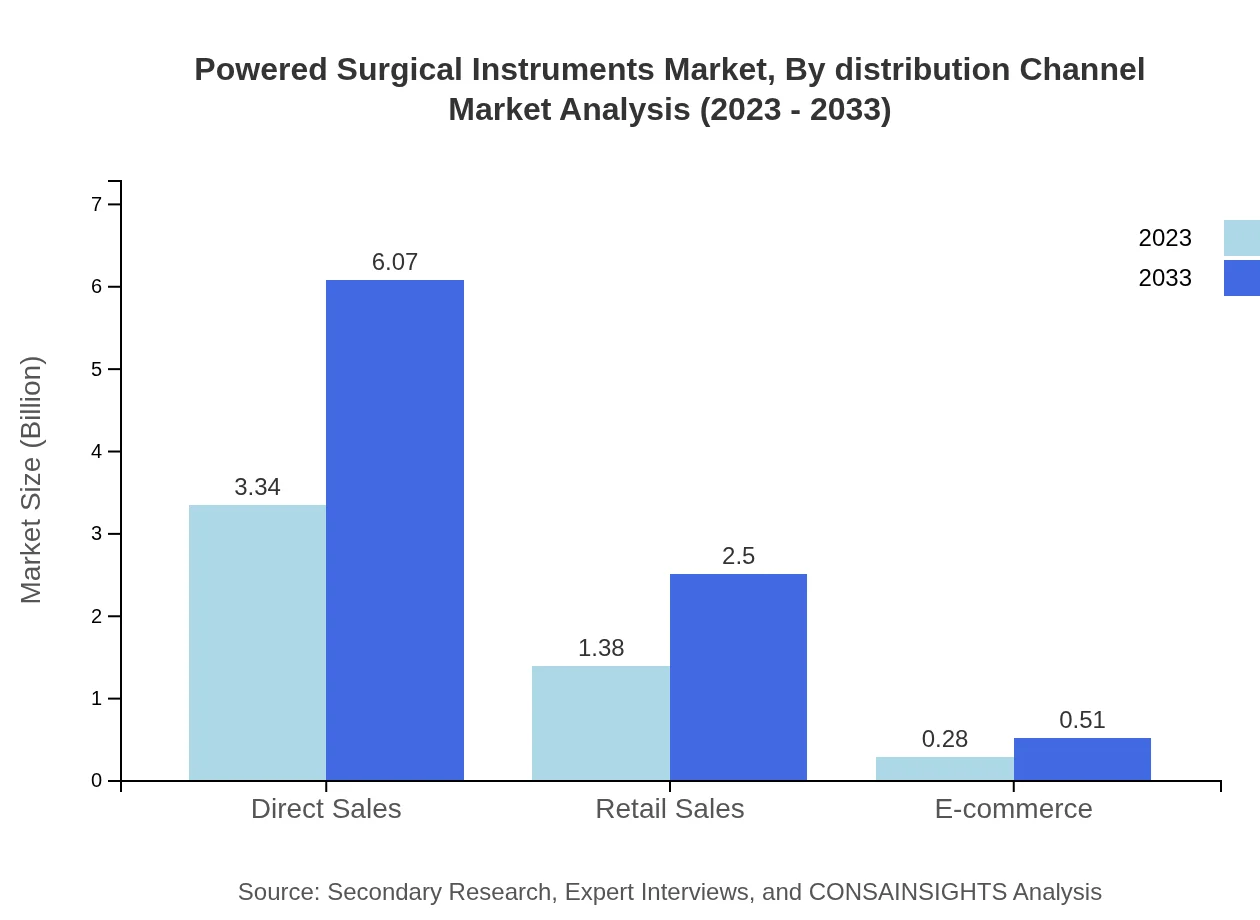

Powered Surgical Instruments Market Analysis By Distribution Channel

Distribution channels include direct sales, retail sales, and e-commerce. Direct sales dominate with a market size of $3.34 billion in 2023, projected to grow to $6.07 billion. Retail sales are expected to grow from $1.38 billion to $2.50 billion, while the e-commerce segment, although smaller, shows potential growth from $0.28 billion to $0.51 billion, reflecting changing purchasing habits in the healthcare industry.

Powered Surgical Instruments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Powered Surgical Instruments Industry

Johnson & Johnson:

A leading player in the global healthcare sector, Johnson & Johnson is renowned for its innovative surgical instruments and advanced technologies focusing on improving patient outcomes.Stryker Corporation:

Stryker is known for its cutting-edge powered surgical instruments, providing a wide range of solutions in orthopedic surgeries and trauma care.Medtronic :

Medtronic specializes in creating advanced surgical technologies, including powered instruments, to enhance surgical performance and patient safety.B. Braun Melsungen AG:

This company offers an extensive range of powered surgical instruments and focuses on user safety and instrument effectiveness.Zimmer Biomet Holdings, Inc.:

Zimmer Biomet provides specialized powered instruments primarily for orthopedic surgery, emphasizing innovative solutions and surgical efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of powered Surgical Instruments?

The powered surgical instruments market is currently valued at approximately $5 billion and is projected to experience a CAGR of 6% during the forecast period of 2023 to 2033.

What are the key market players or companies in this powered Surgical Instruments industry?

Key players in the powered surgical instruments market include recognized companies like Medtronic, Stryker Corporation, Siemens Healthineers, and Johnson & Johnson, which consistently innovate and enhance their product offerings.

What are the primary factors driving the growth in the powered Surgical Instruments industry?

Growth in this industry is primarily driven by technological advancements, rising demand for minimally invasive surgeries, an increasing aging population, and improved healthcare infrastructure across various regions.

Which region is the fastest Growing in the powered Surgical Instruments?

North America is expected to be the fastest-growing region, with the market size escalating from $1.93 billion in 2023 to a projected $3.51 billion by 2033, indicating significant growth potential.

Does ConsaInsights provide customized market report data for the powered Surgical Instruments industry?

Yes, Consainsights offers customized market report data for the powered surgical instruments industry, allowing clients to tailor reports to specific needs and focus areas for enhanced decision-making.

What deliverables can I expect from this powered Surgical Instruments market research project?

Deliverables from the powered surgical instruments market research project typically include detailed market analysis reports, competitive landscape assessments, regional and segment data insights, and growth forecasts over the projected period.

What are the market trends of powered Surgical Instruments?

Current trends include the rise in electric surgical tools usage, indicating a shift towards innovative technologies, along with increasing preferences for outpatient procedures and the utilization of e-commerce in surgical equipment distribution.