Pre Terminated Systems Market Report

Published Date: 31 January 2026 | Report Code: pre-terminated-systems

Pre Terminated Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pre Terminated Systems market from 2023 to 2033, offering insights into market size, growth trends, regional analyses, and technology advancements that shape the industry landscape.

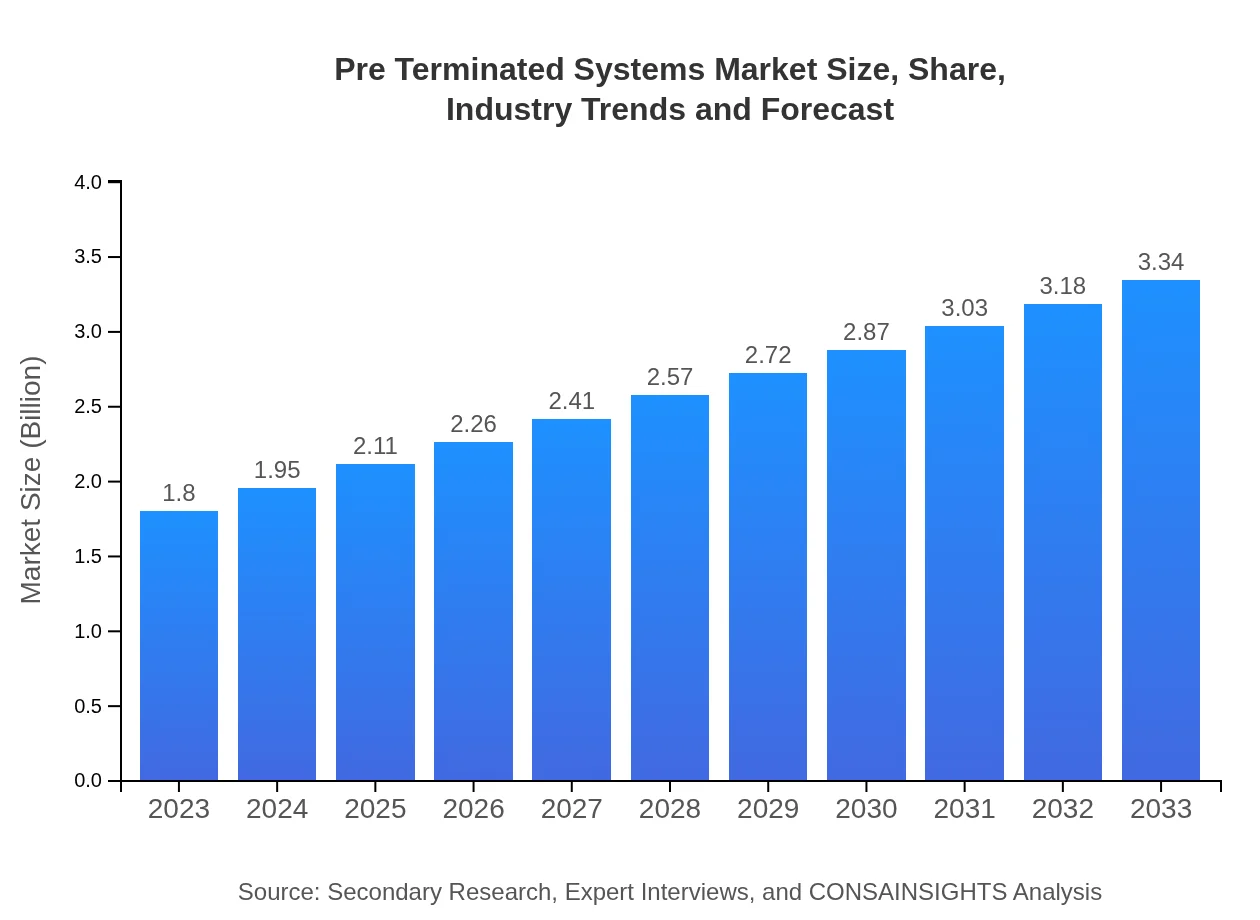

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Corning Incorporated, CommScope Holding Company, Inc., Belden Inc., Prysmian Group |

| Last Modified Date | 31 January 2026 |

Pre Terminated Systems Market Overview

Customize Pre Terminated Systems Market Report market research report

- ✔ Get in-depth analysis of Pre Terminated Systems market size, growth, and forecasts.

- ✔ Understand Pre Terminated Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pre Terminated Systems

What is the Market Size & CAGR of Pre Terminated Systems market in 2023?

Pre Terminated Systems Industry Analysis

Pre Terminated Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pre Terminated Systems Market Analysis Report by Region

Europe Pre Terminated Systems Market Report:

Europe's market is forecasted to grow from USD 0.45 billion in 2023 to USD 0.83 billion by 2033. Sustainability initiatives and the EU’s push towards digital transformation are expected to drive this market forward.Asia Pacific Pre Terminated Systems Market Report:

The Asia Pacific region is projected to experience significant growth, with the market size expected to rise from USD 0.37 billion in 2023 to USD 0.69 billion by 2033. Rapid urbanization and the increasing deployment of telecommunications infrastructure, notably in developing economies such as India and China, are key growth drivers in this region.North America Pre Terminated Systems Market Report:

North America, being the largest market, is anticipated to expand from USD 0.70 billion in 2023 to USD 1.29 billion by 2033. The high prevalence of data centers and the push for advancements in telecom technologies are significant growth factors.South America Pre Terminated Systems Market Report:

In South America, the market is expected to grow from USD 0.11 billion in 2023 to USD 0.20 billion by 2033. The increasing demand for improved telecommunication networks and the expansion of data center infrastructure will enhance growth prospects in this region.Middle East & Africa Pre Terminated Systems Market Report:

The Middle East and Africa region will see its market size grow from USD 0.18 billion in 2023 to USD 0.33 billion by 2033, bolstered by increasing investments in telecommunications and smart city projects.Tell us your focus area and get a customized research report.

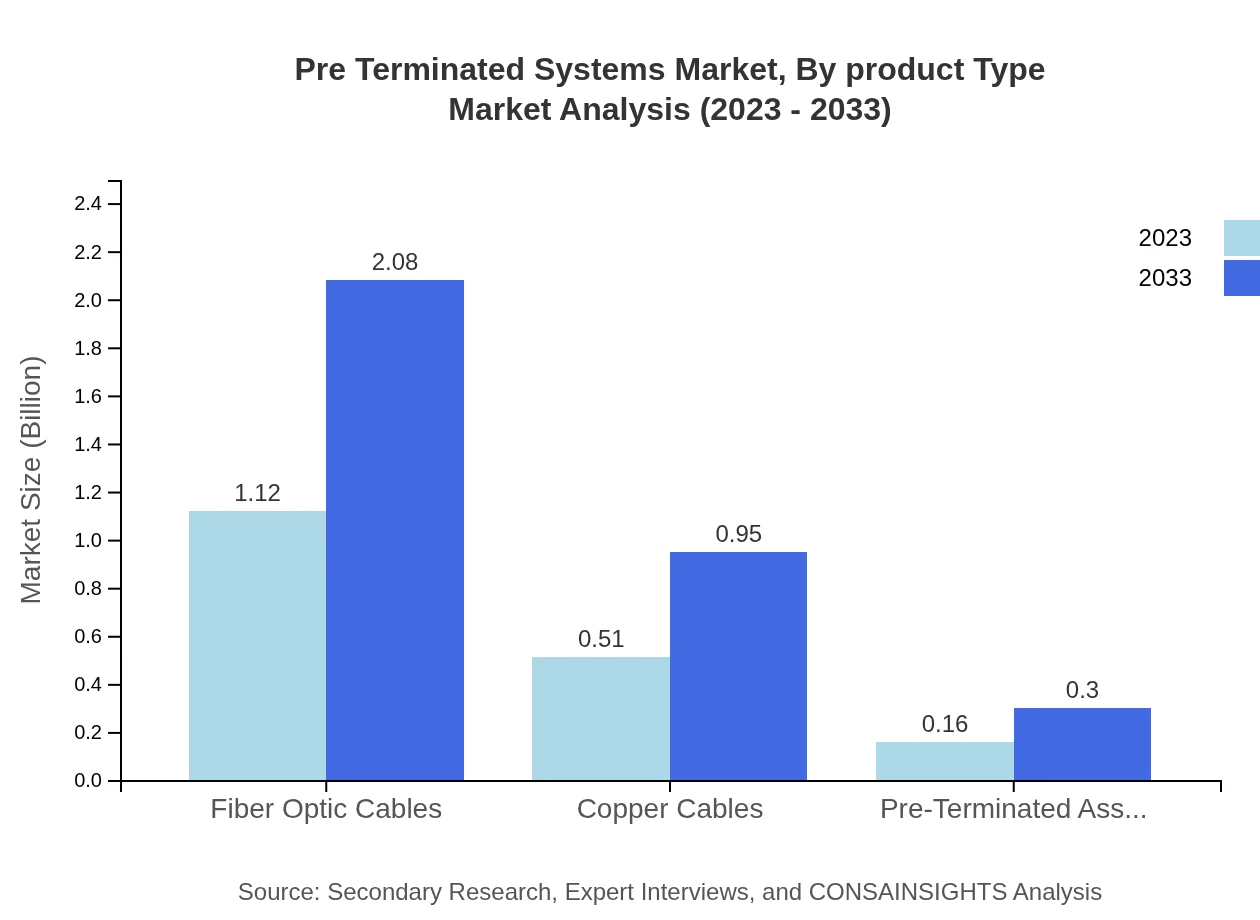

Pre Terminated Systems Market Analysis By Product Type

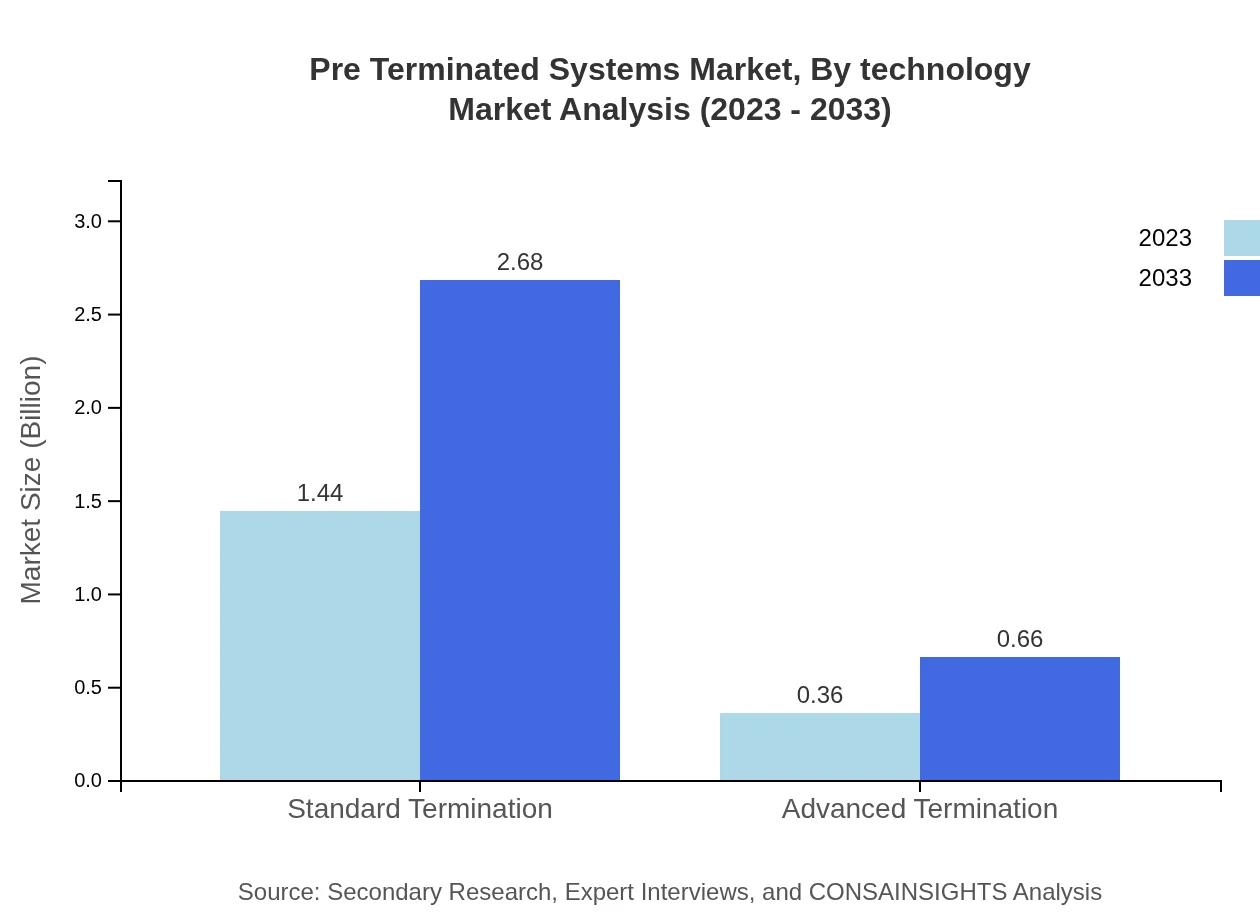

The Pre Terminated Systems market is significantly driven by the product type. In 2023, the Standard Termination segment leads with a market size of USD 1.44 billion, projected to reach USD 2.68 billion by 2033. Other notable segments include Fiber Optic Cables, which are expected to grow from USD 1.12 billion to USD 2.08 billion in the same period, showcasing the shift towards higher capacity systems.

Pre Terminated Systems Market Analysis By Application Field

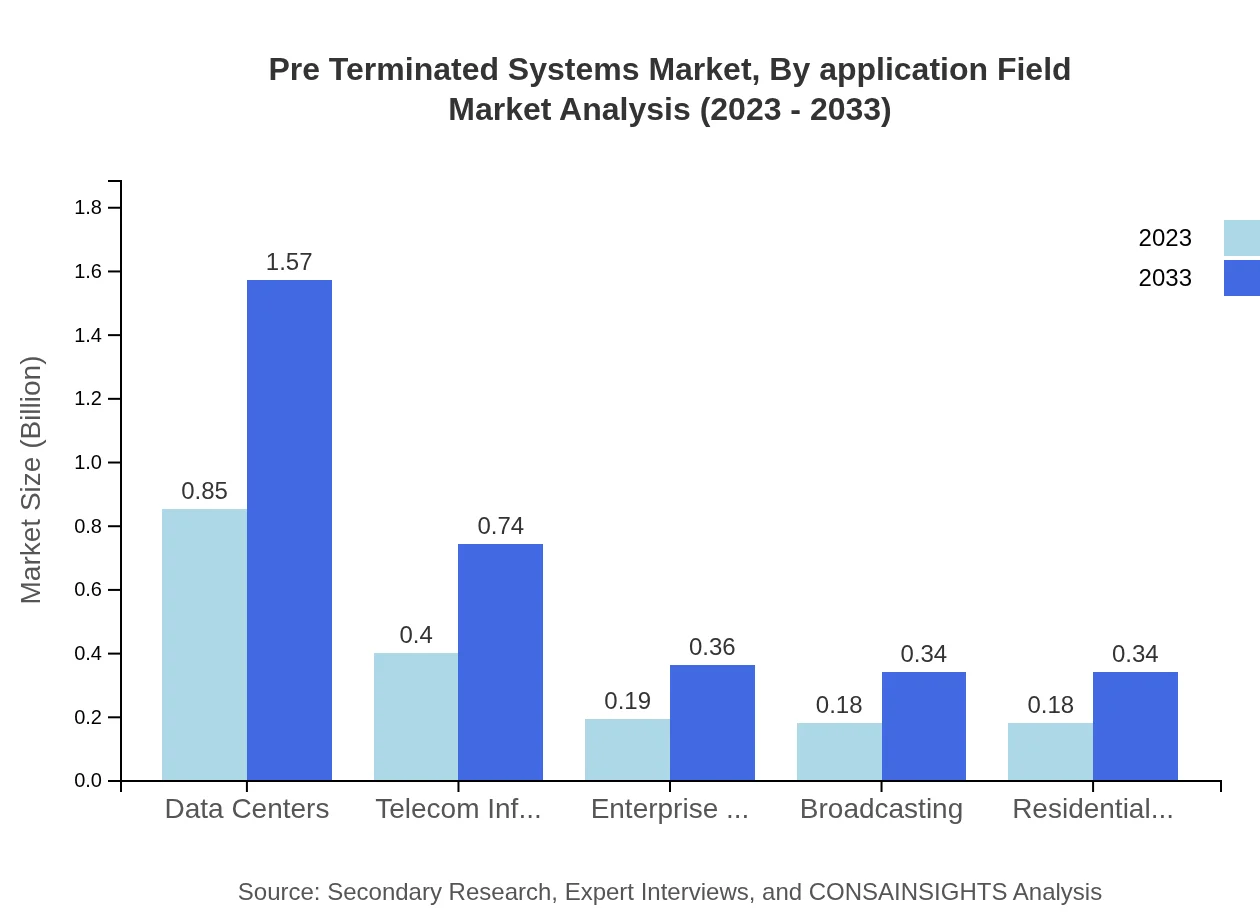

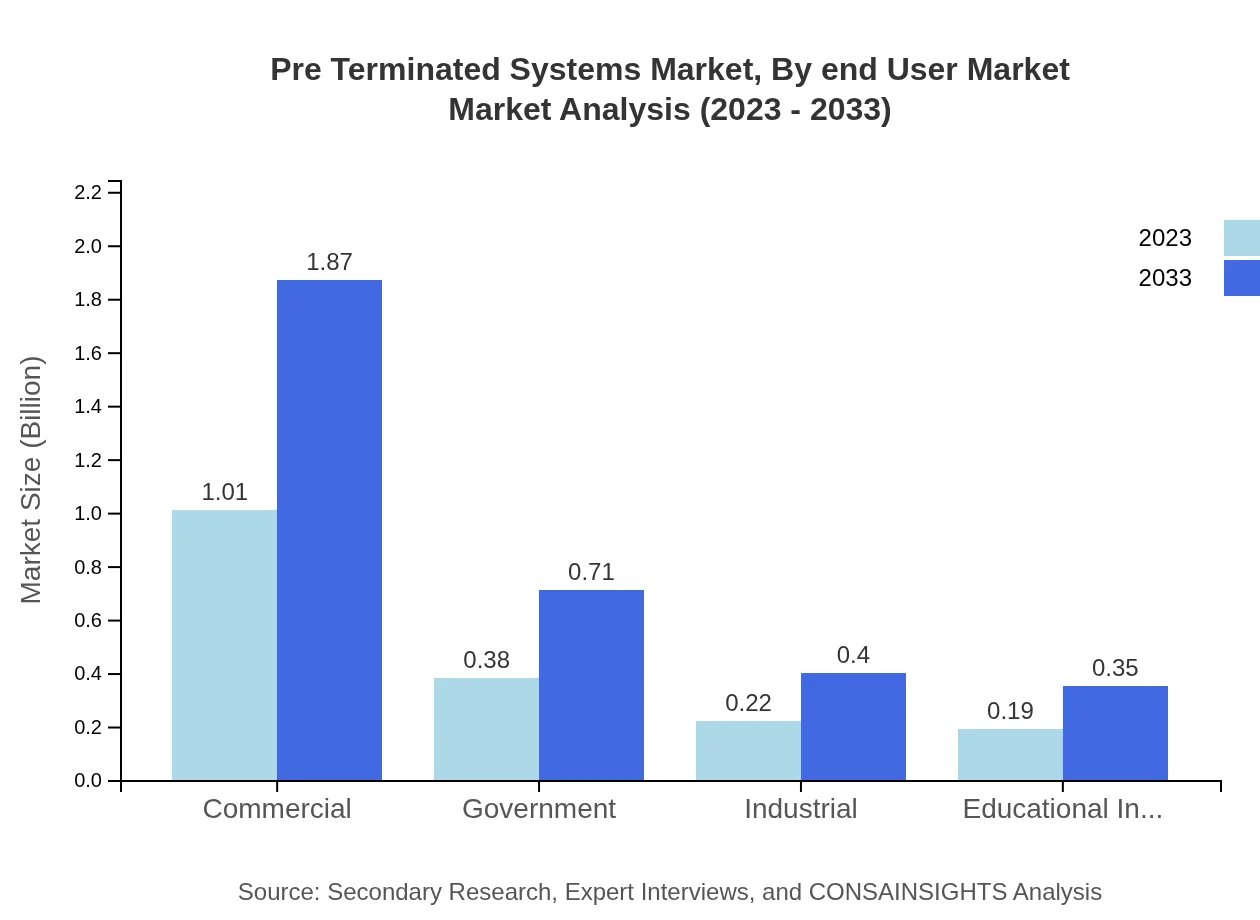

In 2023, the commercial sector accounts for the largest share, with a market size of USD 1.01 billion, expected to increase to USD 1.87 billion by 2033. Data centers are also gaining traction, with a growth from USD 0.85 billion to USD 1.57 billion, reflecting increasing investments in digital infrastructure.

Pre Terminated Systems Market Analysis By Technology

Technological innovation plays a crucial role in shaping the Pre Terminated Systems market. The integration of smart technologies is enhancing system performance, while advancements in fiber optics are expanding capabilities, making installations faster and more efficient.

Pre Terminated Systems Market Analysis By End User Market

The enterprise segment leads with a notable market size in 2023 at USD 0.19 billion, projected to reach USD 0.36 billion by 2033. Educational institutions also represent a vital segment, with ongoing investments in infrastructure driving demand for Pre Terminated Systems.

Pre Terminated Systems Market Analysis By Distribution Channel

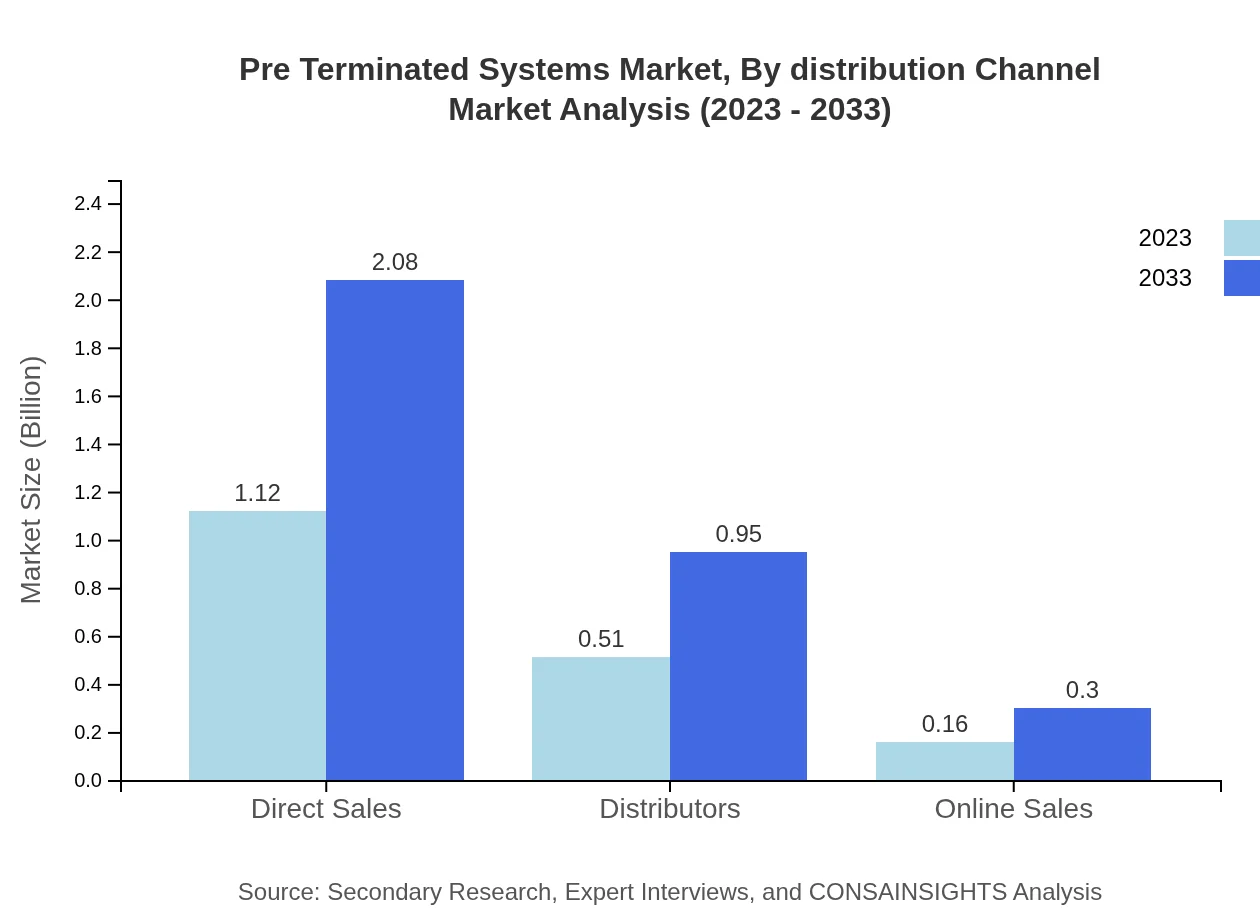

The distribution channel landscape includes direct sales, distributors, and online sales. Direct sales capture a significant market share at 62.44% in 2023, which illustrates the importance of established relationships in the industry.

Pre Terminated Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pre Terminated Systems Industry

Corning Incorporated:

A global leader in materials science, Corning produces a wide range of fiber optic technology and offers innovative pre-terminated solutions for various telecommunications applications.CommScope Holding Company, Inc.:

CommScope provides premier networking and cabling solutions designed for high-performance networks, including advanced pre-terminated systems for data centers and enterprise applications.Belden Inc.:

Specializes in networking and connectivity products, Belden is known for its high-quality pre-terminated cabling systems used across diverse industries, enhancing connectivity and efficiency.Prysmian Group:

With a strong global presence, Prysmian Group focuses on innovative cabling solutions, including pre-terminated systems that optimize installation processes in various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of pre Terminated Systems?

The pre-terminated systems market is currently valued at approximately $1.8 billion, with a projected CAGR of 6.2% from 2023 to 2033. This growth indicates a strong demand for efficient, ready-to-install connectivity solutions across multiple sectors.

What are the key market players or companies in this pre Terminated Systems industry?

Key players in the pre-terminated systems industry include Schneider Electric, Legrand, and CommScope, among others. These companies lead in innovation and supply, significantly impacting the global market's direction and competitive landscape.

What are the primary factors driving the growth in the pre Terminated Systems industry?

Growth factors in the pre-terminated systems industry include increasing demand for high-speed data transmission, advancements in telecommunications infrastructure, and the need for faster and easier installation processes, which drive efficiency in various applications.

Which region is the fastest Growing in the pre Terminated Systems?

The North American region is expected to exhibit the fastest growth in the pre-terminated systems market, projected to increase from $0.70 billion in 2023 to $1.29 billion by 2033, reflecting a robust demand for advanced connectivity solutions.

Does ConsaInsights provide customized market report data for the pre Terminated Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the pre-terminated systems industry, providing detailed and actionable insights to assist businesses in strategic decision-making.

What deliverables can I expect from this pre Terminated Systems market research project?

Deliverables from the pre-terminated systems market research project include comprehensive reports, data analytics, market forecasts, and strategic recommendations based on current industry trends and competitive analysis.

What are the market trends of pre Terminated Systems?

Current trends in the pre-terminated systems market include increased adoption of fiber optic technologies, a rise in demand for standard and advanced termination products, and a focus on sustainability and energy efficiency in telecommunications infrastructure.