Precision Farming Software Market Report

Published Date: 02 February 2026 | Report Code: precision-farming-software

Precision Farming Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Precision Farming Software market from 2023 to 2033, offering insights into market trends, size, and growth forecast. It provides detailed analysis segmented by technology, application, user types, and regional dynamics.

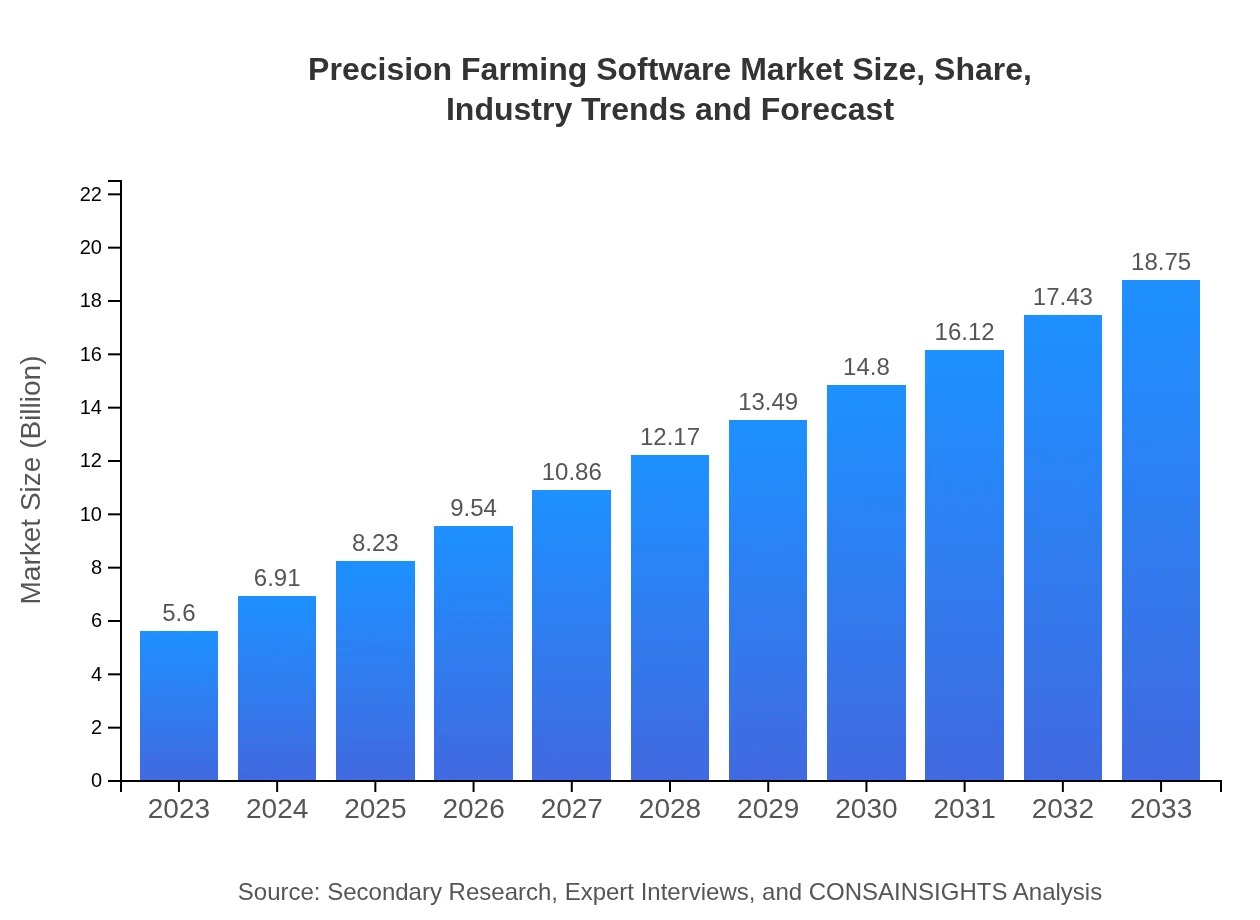

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $18.75 Billion |

| Top Companies | Trimble Inc., Monsanto Company, Farmers Edge, AG Leader Technology, John Deere |

| Last Modified Date | 02 February 2026 |

Precision Farming Software Market Overview

Customize Precision Farming Software Market Report market research report

- ✔ Get in-depth analysis of Precision Farming Software market size, growth, and forecasts.

- ✔ Understand Precision Farming Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Precision Farming Software

What is the Market Size & CAGR of Precision Farming Software market in 2023?

Precision Farming Software Industry Analysis

Precision Farming Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Precision Farming Software Market Analysis Report by Region

Europe Precision Farming Software Market Report:

Europe's market is expected to witness robust growth, rising from USD 1.40 billion in 2023 to USD 4.68 billion by 2033. The European Union’s regulations on sustainable agriculture and financial support for innovative farming technologies enhance market dynamics.Asia Pacific Precision Farming Software Market Report:

The Asia Pacific region holds substantial market potential for Precision Farming Software, with a market size projected to grow from USD 1.13 billion in 2023 to USD 3.77 billion by 2033. Significant investments in agricultural technology by countries like China and India, coupled with a large farming population, drive this growth.North America Precision Farming Software Market Report:

North America dominates the Precision Farming Software market, projected to increase from USD 1.95 billion in 2023 to USD 6.53 billion by 2033. The region's high degree of technological integration within farming practices is supported by strong investment in agritech startups and initiatives aimed at sustainability.South America Precision Farming Software Market Report:

In South America, the market for Precision Farming Software is anticipated to expand from USD 0.52 billion in 2023 to USD 1.76 billion by 2033. The adoption of advanced farming techniques is spurred by the necessity for efficient crop production in fertile agricultural zones.Middle East & Africa Precision Farming Software Market Report:

The Middle East and Africa market for Precision Farming Software is projected to grow from USD 0.60 billion in 2023 to USD 2.01 billion by 2033. The need for improved water management and optimization of agricultural output in arid regions drives the adoption of precision farming technologies.Tell us your focus area and get a customized research report.

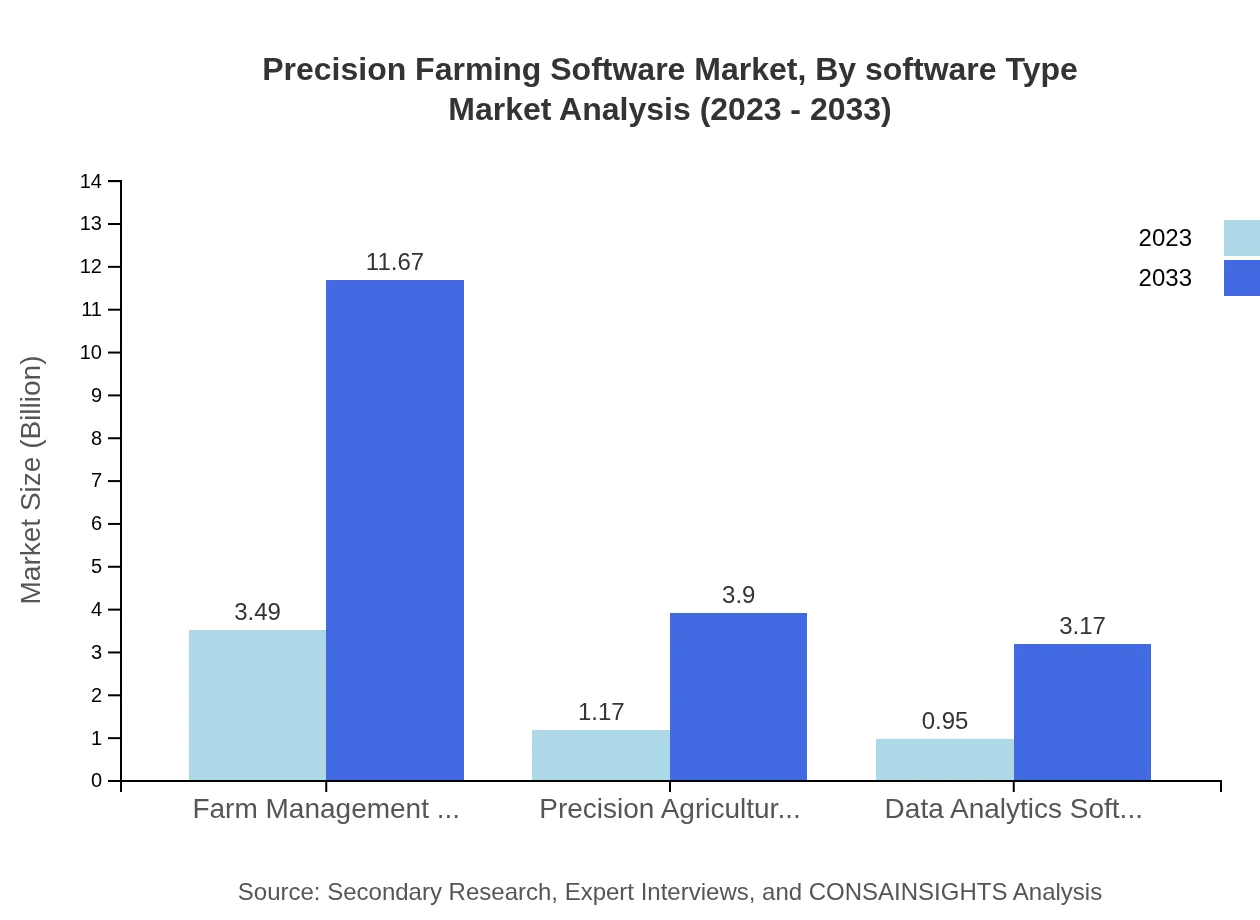

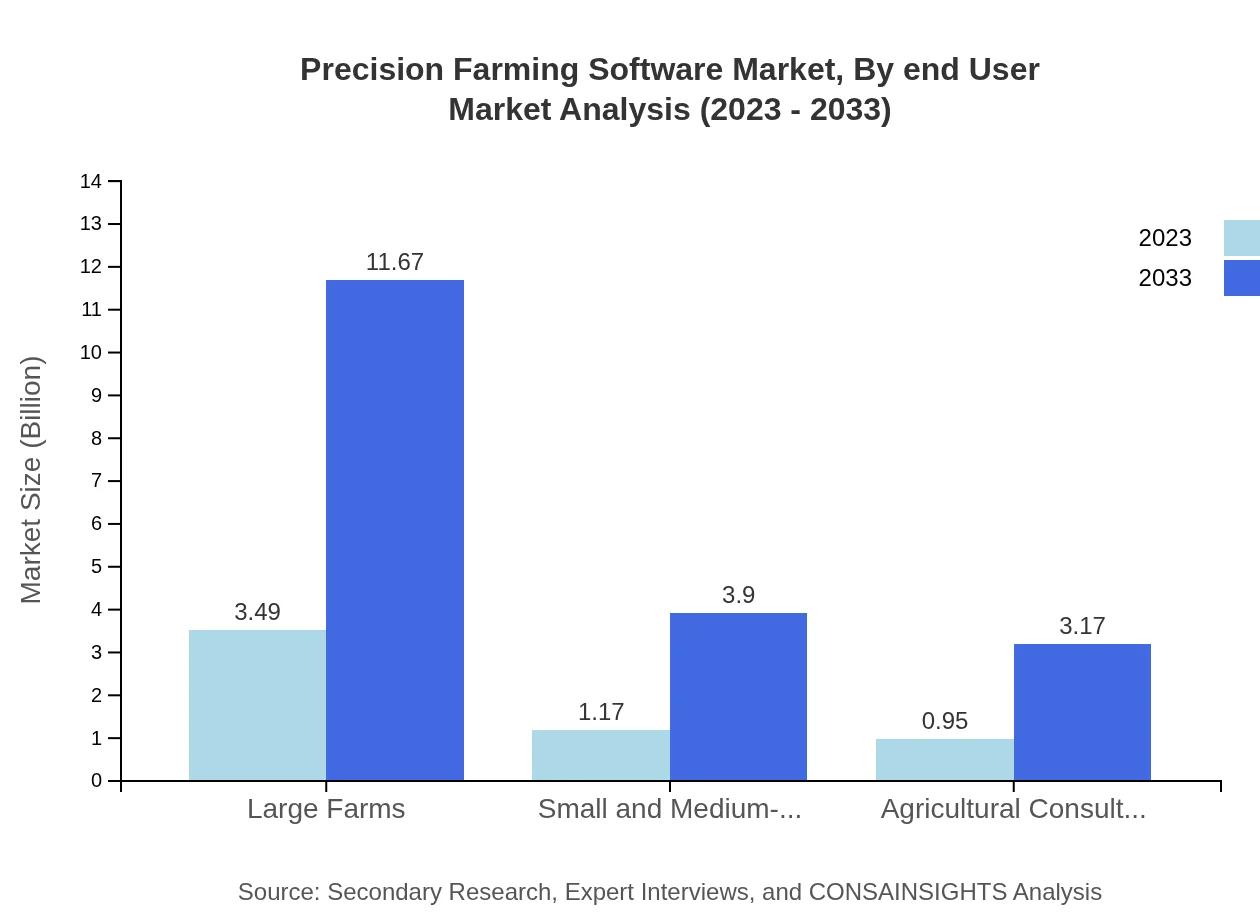

Precision Farming Software Market Analysis By Software Type

The software segment plays a pivotal role in the Precision Farming Software market. Large farms contribute significantly, with a market size of USD 3.49 billion in 2023, expected to grow to USD 11.67 billion by 2033, holding a share of 62.27%. In contrast, small and medium-sized farms are projected to grow from USD 1.17 billion to USD 3.90 billion, maintaining a market share of 20.81%. Agricultural consultants also represent a vital segment, expanding from USD 0.95 billion to USD 3.17 billion, with a share of 16.92%.

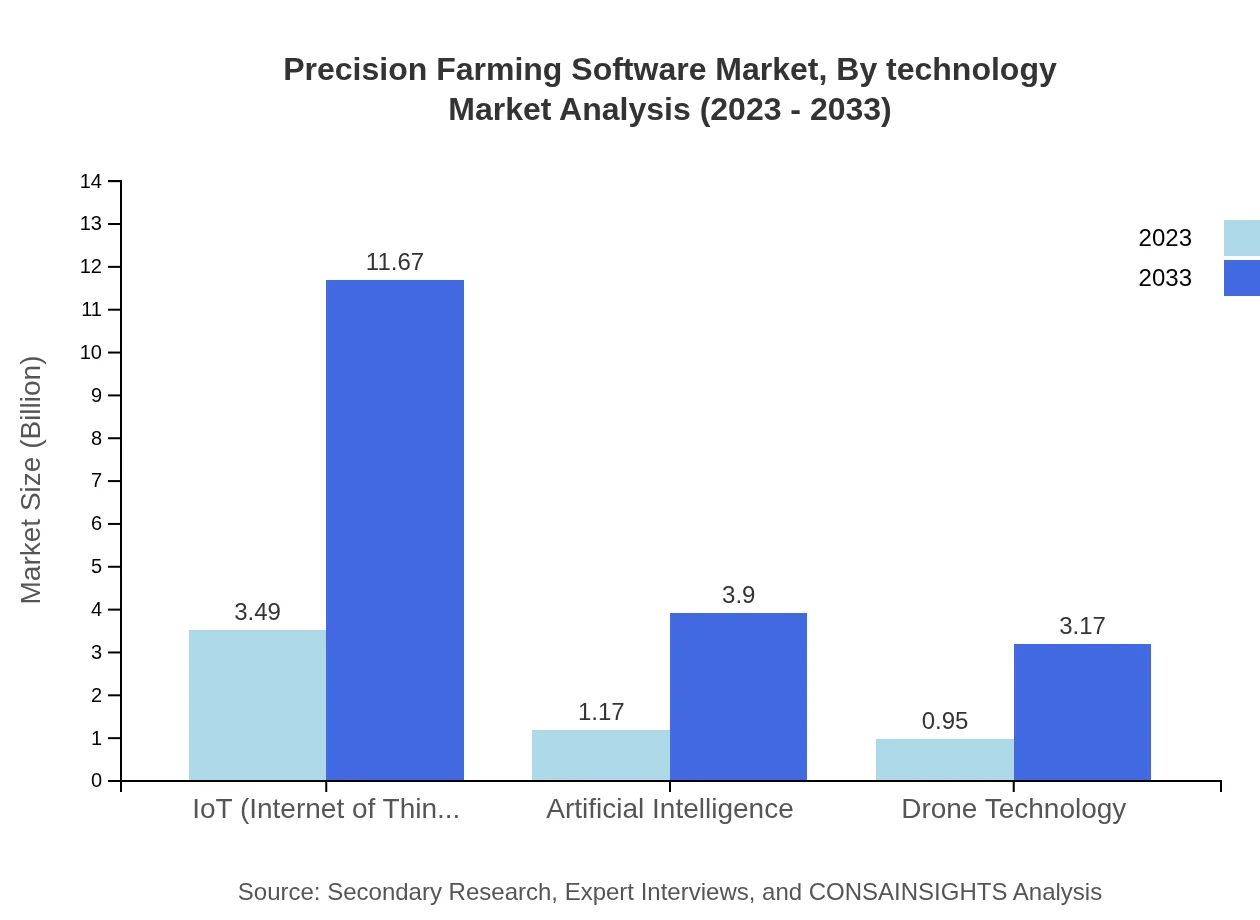

Precision Farming Software Market Analysis By Technology

Emerging technologies such as IoT, AI, and drone technology are transforming the Precision Farming Software landscape. IoT technology, for instance, is projected to grow from USD 3.49 billion in 2023 to USD 11.67 billion by 2033, comprising 62.27% of the market. Similarly, drone technology is expected to expand from USD 0.95 billion to USD 3.17 billion. The rising interest in AI applications within agriculture, from USD 1.17 billion to USD 3.90 billion, intensifies competition among technology providers in the agricultural sector.

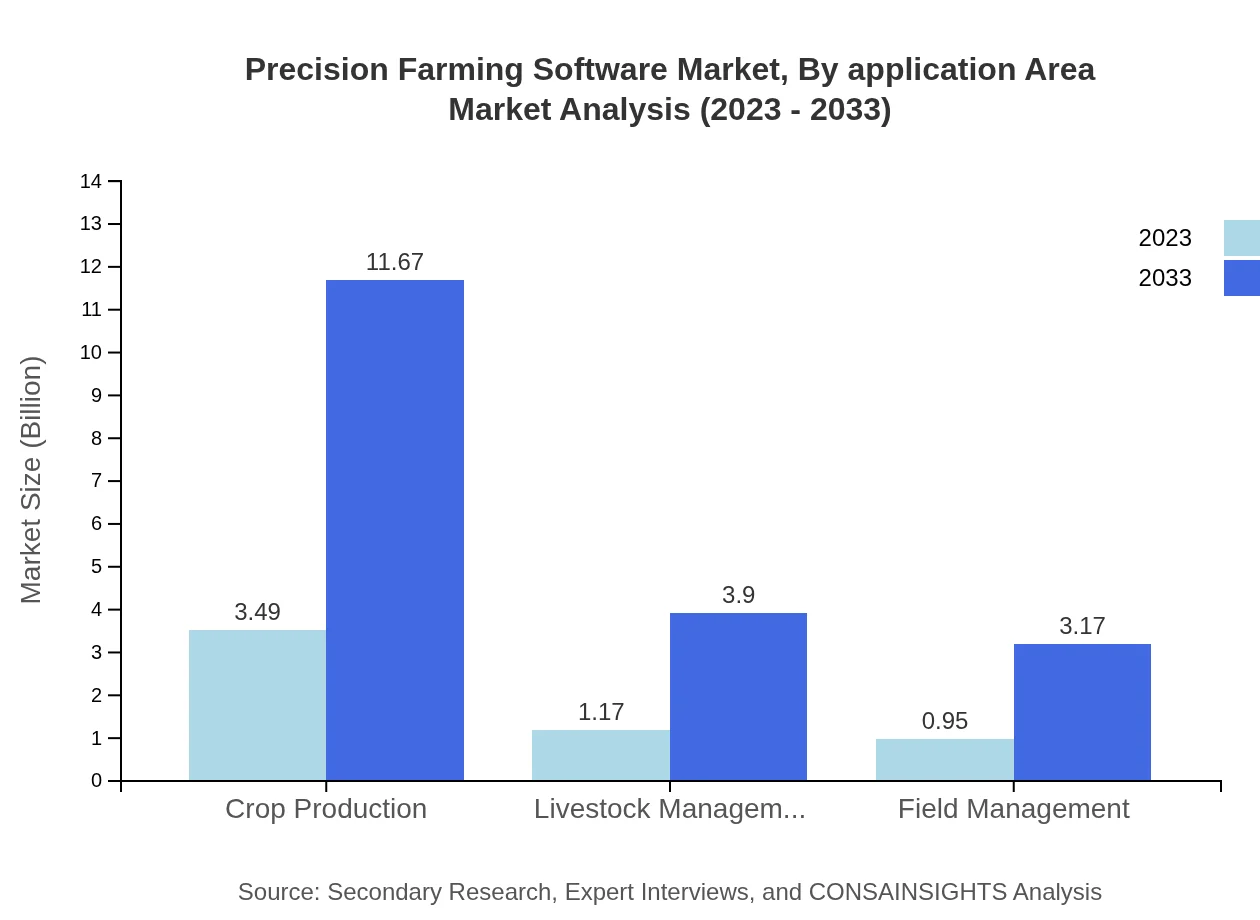

Precision Farming Software Market Analysis By Application Area

The key application areas in the Precision Farming Software market include crop production, field management, and livestock management. Crop production is estimated to generate USD 3.49 billion in 2023, growing to USD 11.67 billion by 2033, indicating its crucial role in optimizing yields through technology. Livestock management is also gaining traction, expected to rise from USD 1.17 billion to USD 3.90 billion during the same period, reflecting an increased focus on integrating livestock data management.

Precision Farming Software Market Analysis By End User

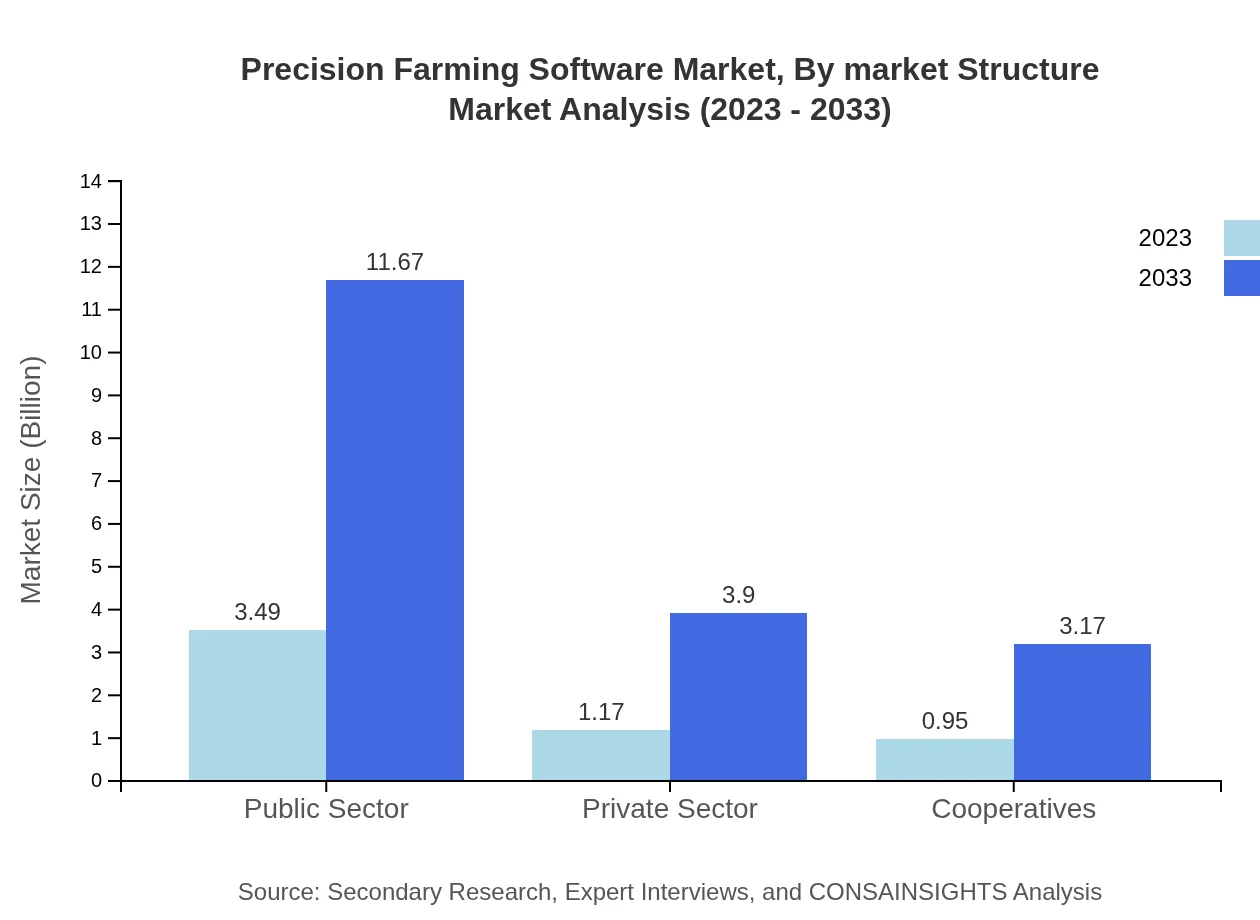

The end-user segment reveals diverse consumer bases including public and private sectors alongside cooperatives. The public sector is expected to maintain its dominance with a market size growth from USD 3.49 billion to USD 11.67 billion, holding a share of 62.27%. In parallel, the private sector and cooperatives are also projected to grow steadily, showing increased investment in precision agriculture initiatives.

Precision Farming Software Market Analysis By Market Structure

Market structure analysis highlights both rural and urban agricultural setups leveraging Precision Farming Software. The significant preference for structured market players, including established software providers, indicates a growing trend toward enhanced productivity across various farming environments. Farmers seek compatible solutions that cater to their specific operational needs, indicating a shift towards integrated farming systems.

Precision Farming Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Precision Farming Software Industry

Trimble Inc.:

A leader in precision agriculture solutions, Trimble offers agricultural software that enhances crop production efficiency, management, and farm data analysis.Monsanto Company:

Part of Bayer, Monsanto is influential in developing smart farming solutions, focusing on biotech and integrated digital platforms for better decision-making in agriculture.Farmers Edge:

Known for its robust farm management software, Farmers Edge integrates IoT and machine learning to optimize crop yields and resource use.AG Leader Technology:

AG Leader specializes in assisting farmers with precision agriculture technology, offering complete solutions for data collection, analysis, and farm management.John Deere:

A pioneer in agricultural equipment, John Deere also provides integrated software solutions to enhance farm productivity and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of precision Farming Software?

The precision farming software market is valued at $5.6 billion in 2023, with a projected CAGR of 12.3%. It aims to expand significantly, meeting the increasing demand for advanced agricultural technologies over the coming decade.

What are the key market players or companies in this precision Farming Software industry?

Key players in the precision farming software market include major agricultural technology firms like Trimble Inc., AG Leader Technology, and John Deere. Their innovations and solutions drive competitive dynamics and influence market developments.

What are the primary factors driving the growth in the precision Farming Software industry?

The growth of the precision farming software industry is driven by rising demand for food security, advancements in IoT and AI, increasing adoption of sustainable farming practices, and government initiatives supporting agricultural technology.

Which region is the fastest Growing in the precision Farming Software?

North America is the fastest-growing region in the precision farming software market, expected to rise from $1.95 billion in 2023 to $6.53 billion by 2033, reflecting strong investments and technological adoption in agriculture.

Does ConsaInsights provide customized market report data for the precision Farming Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the precision farming software industry, allowing clients to gain deeper insights and make informed strategic decisions.

What deliverables can I expect from this precision Farming Software market research project?

You can expect comprehensive market reports including data analysis, growth forecasts, competitive landscape assessments, and segment insights tailored to provide valuable information for decision-making in agriculture.

What are the market trends of precision Farming Software?

Market trends in precision farming software indicate a shift towards greater integration of data analytics, IoT, and drone technology. Adoption rates increase as farmers seek efficient, data-driven solutions for crop and livestock management.