Precision Planting Market Report

Published Date: 02 February 2026 | Report Code: precision-planting

Precision Planting Market Size, Share, Industry Trends and Forecast to 2033

This market report analyzes the Precision Planting industry, providing insights into market size, trends, regional dynamics, and technological advancements from 2023 to 2033.

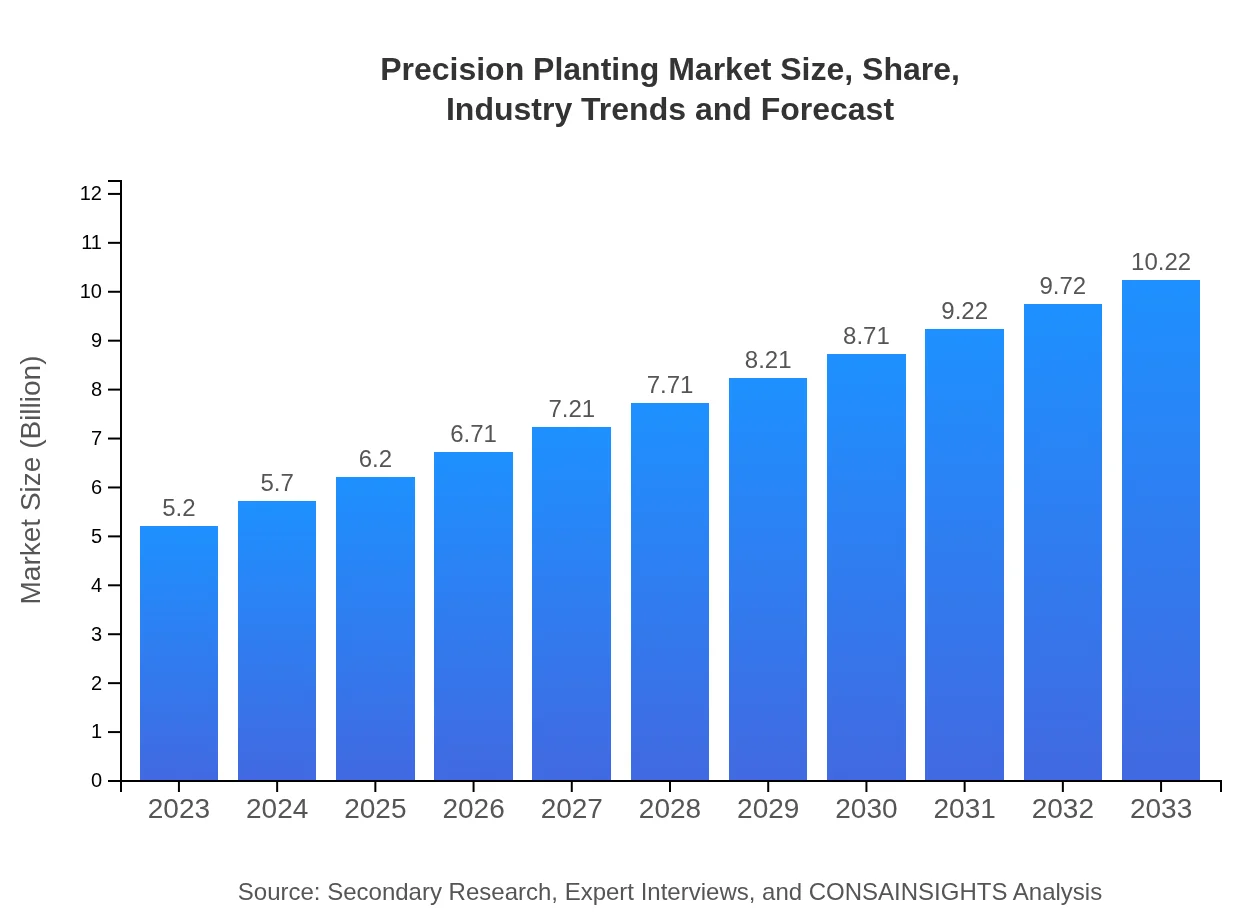

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | John Deere, AG Leader Technology, Trimble, Case IH |

| Last Modified Date | 02 February 2026 |

Precision Planting Market Overview

Customize Precision Planting Market Report market research report

- ✔ Get in-depth analysis of Precision Planting market size, growth, and forecasts.

- ✔ Understand Precision Planting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Precision Planting

What is the Market Size & CAGR of Precision Planting market in 2023?

Precision Planting Industry Analysis

Precision Planting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Precision Planting Market Analysis Report by Region

Europe Precision Planting Market Report:

Europe’s Precision Planting market is projected to rise from $1.73 billion in 2023 to $3.39 billion by 2033. Enhanced awareness about sustainable farming practices and favorable government policies pushing for precision agriculture adoption play pivotal roles in driving growth.Asia Pacific Precision Planting Market Report:

In the Asia-Pacific region, the Precision Planting market is expected to grow from $0.98 billion in 2023 to $1.93 billion by 2033, reflecting an increasing adoption of precision farming techniques. The rise in population and subsequent food demand drive farmers to utilize advanced technologies for better yield.North America Precision Planting Market Report:

North America is a leading region for Precision Planting, with the market valued at $1.72 billion in 2023 and anticipated to reach $3.38 billion by 2033. The presence of established agriculture technology firms and a culture of innovation significantly contribute to market growth.South America Precision Planting Market Report:

South America’s market is expected to expand from a modest $0.06 billion in 2023 to $0.12 billion by 2033. The region, renowned for its vast agricultural land, is gradually recognizing the benefits of precision planting, although market penetration remains low.Middle East & Africa Precision Planting Market Report:

In the Middle East and Africa, the market for Precision Planting is advancing from $0.71 billion in 2023 to $1.39 billion by 2033. The increasing focus on food security and efficient agricultural practices is essential for the region's growth.Tell us your focus area and get a customized research report.

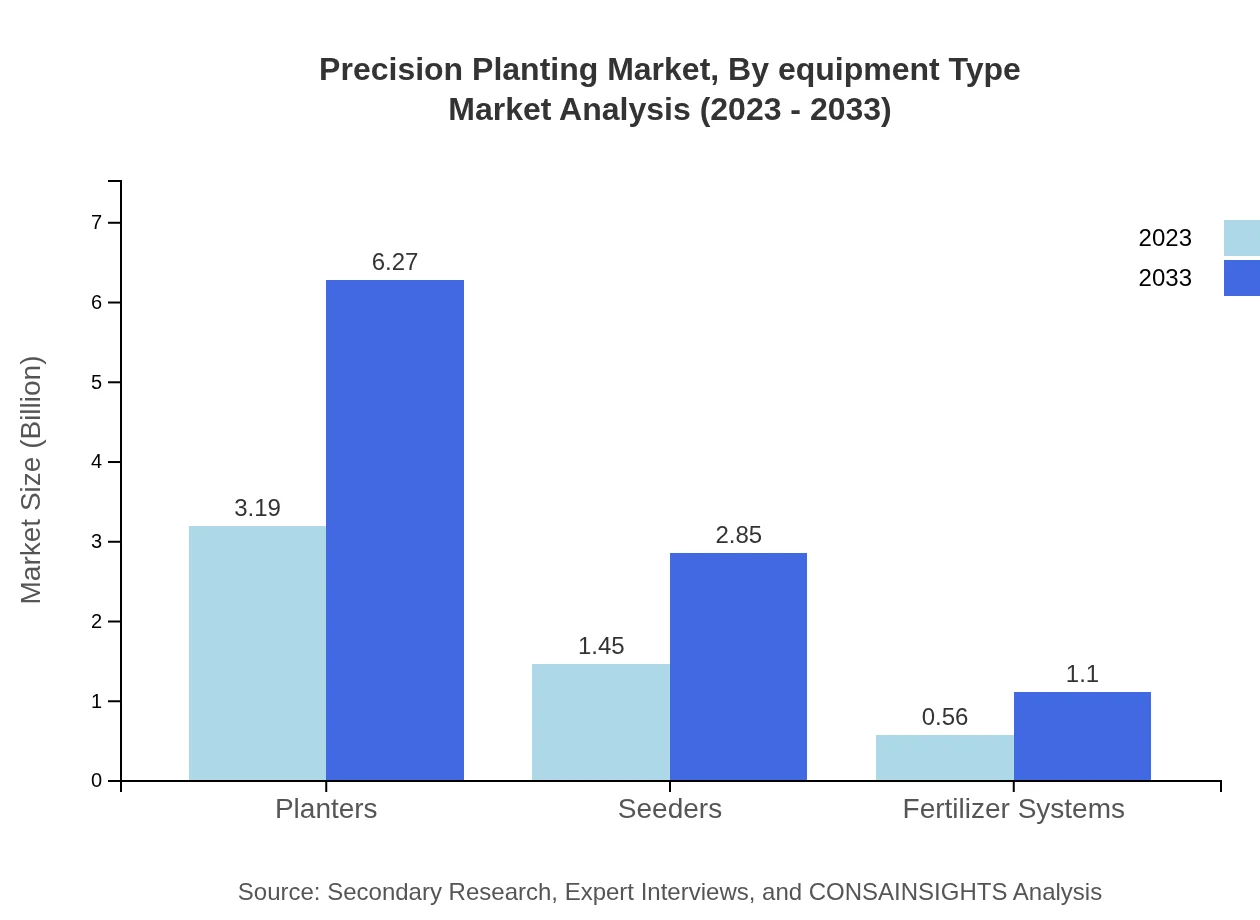

Precision Planting Market Analysis By Equipment Type

The equipment segment for Precision Planting is dominated by planters and seeders, which together account for over 80% of the market share. Increased demand for automatic sensors has also contributed significantly to market revenues. In 2023, planters generated $3.19 billion, with a similar projection expected in 2033.

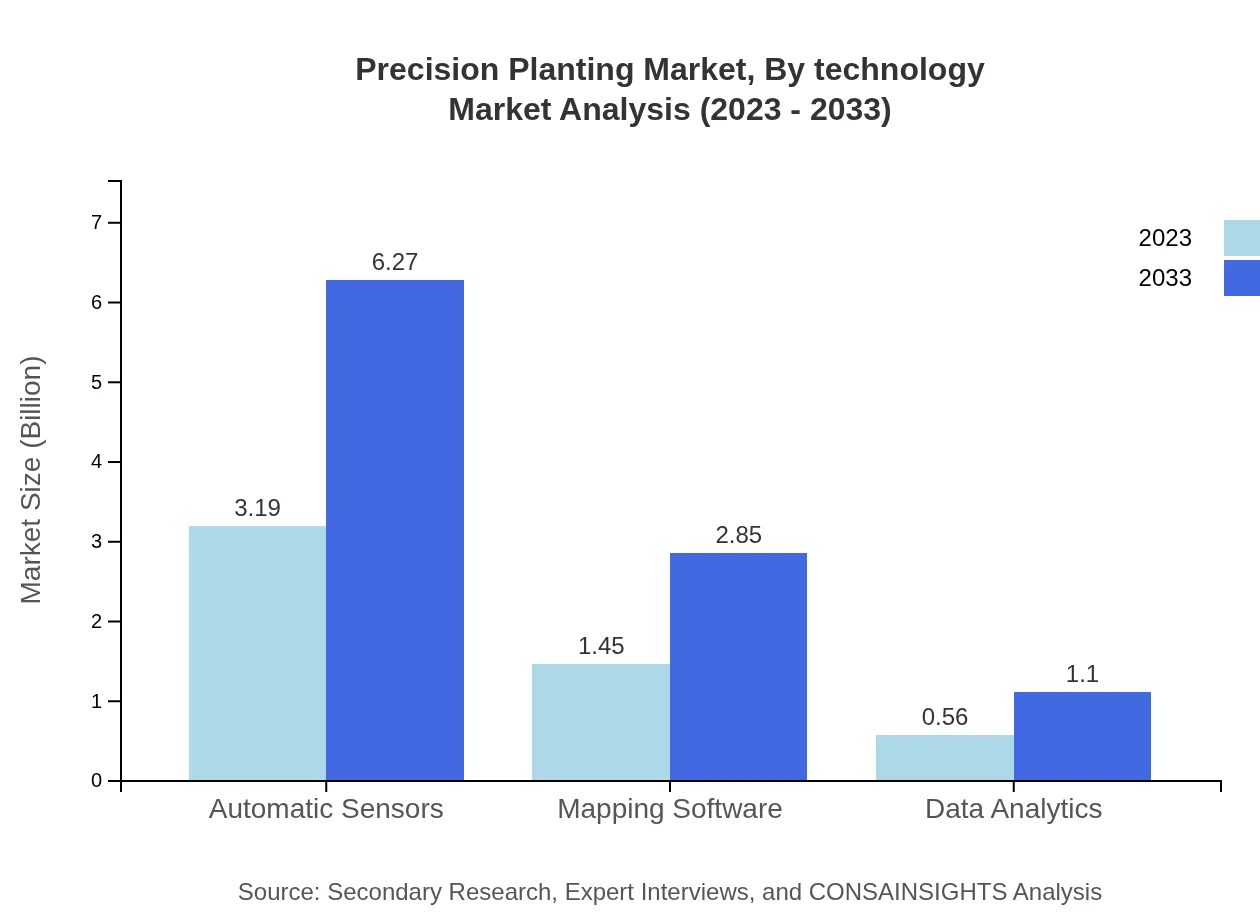

Precision Planting Market Analysis By Technology

Technology in Precision Planting primarily includes automatic sensors, mapping software, and data analytics. Automatic sensors lead the market with a share of 61.35% in 2023. Data analytics is also gaining traction as growers seek insights for improved decision-making.

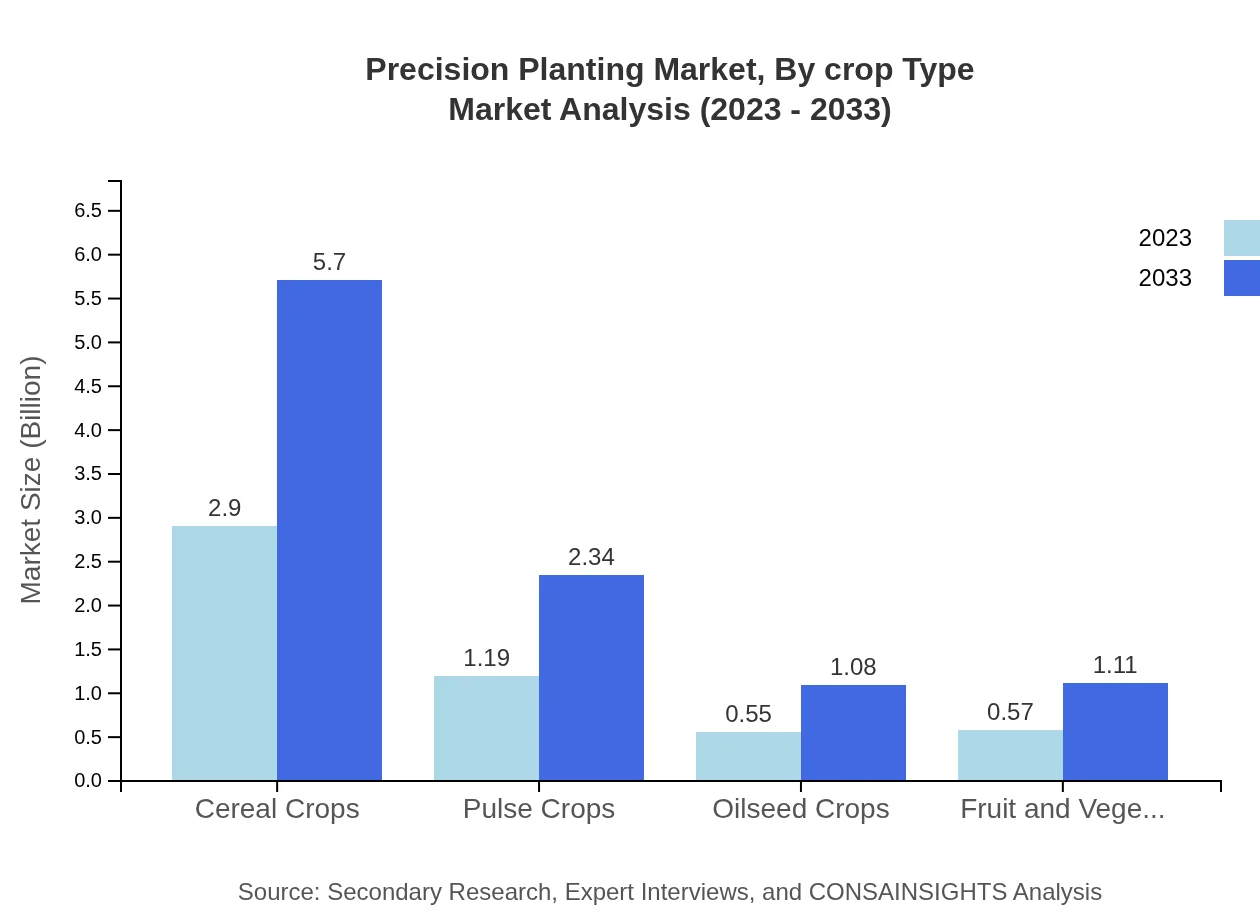

Precision Planting Market Analysis By Crop Type

Cereal crops dominate the Precision Planting segment with a market share of 55.73% in 2023. Other crop types include pulse crops, oilseed crops, and fruit/vegetable crops, which are steadily gaining ground as demand for diverse farming practices increases.

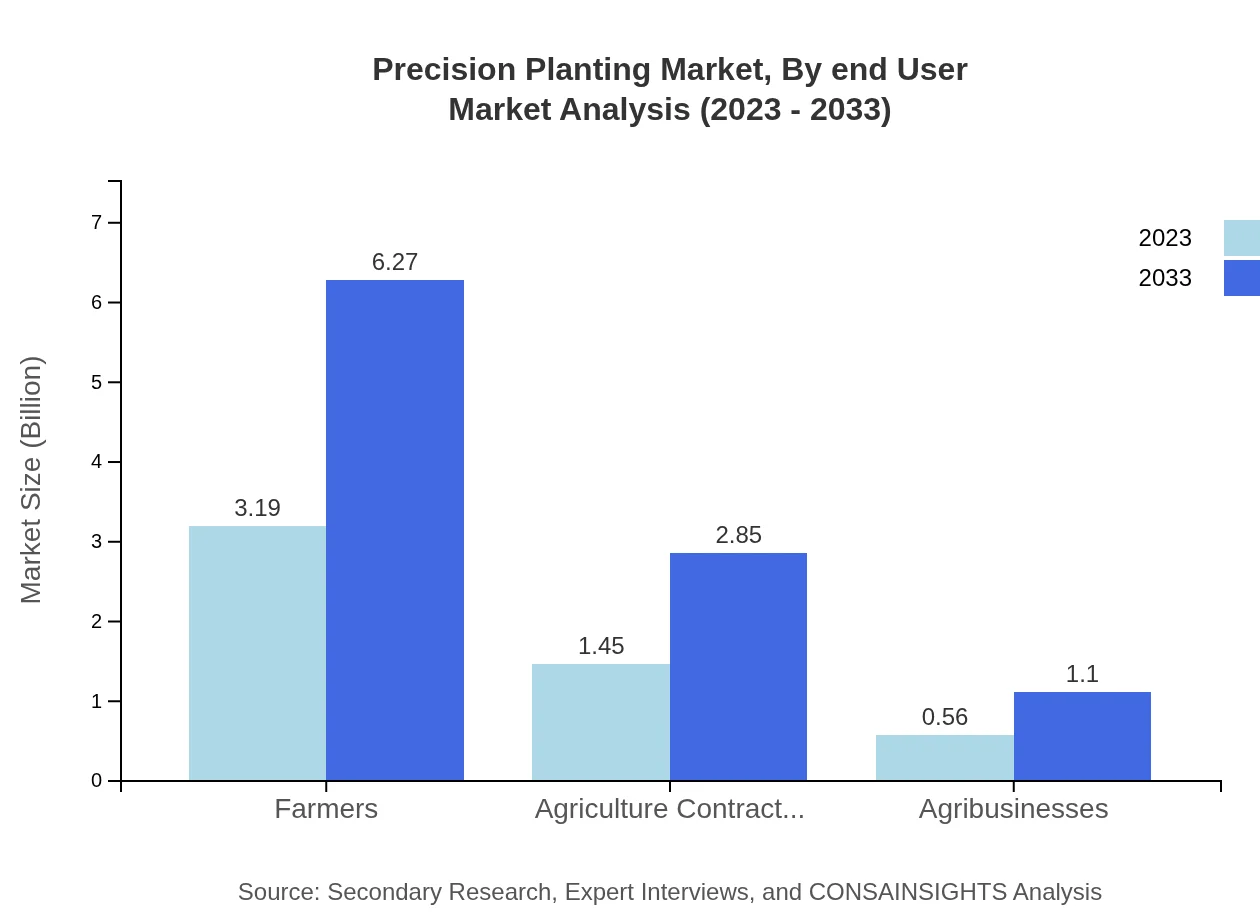

Precision Planting Market Analysis By End User

Farmers constitute the largest segment, contributing significantly to market size with a projected market value of $3.19 billion in 2023. Agricultural contractors and agribusinesses follow, with growing interest in precision technologies to boost efficiency.

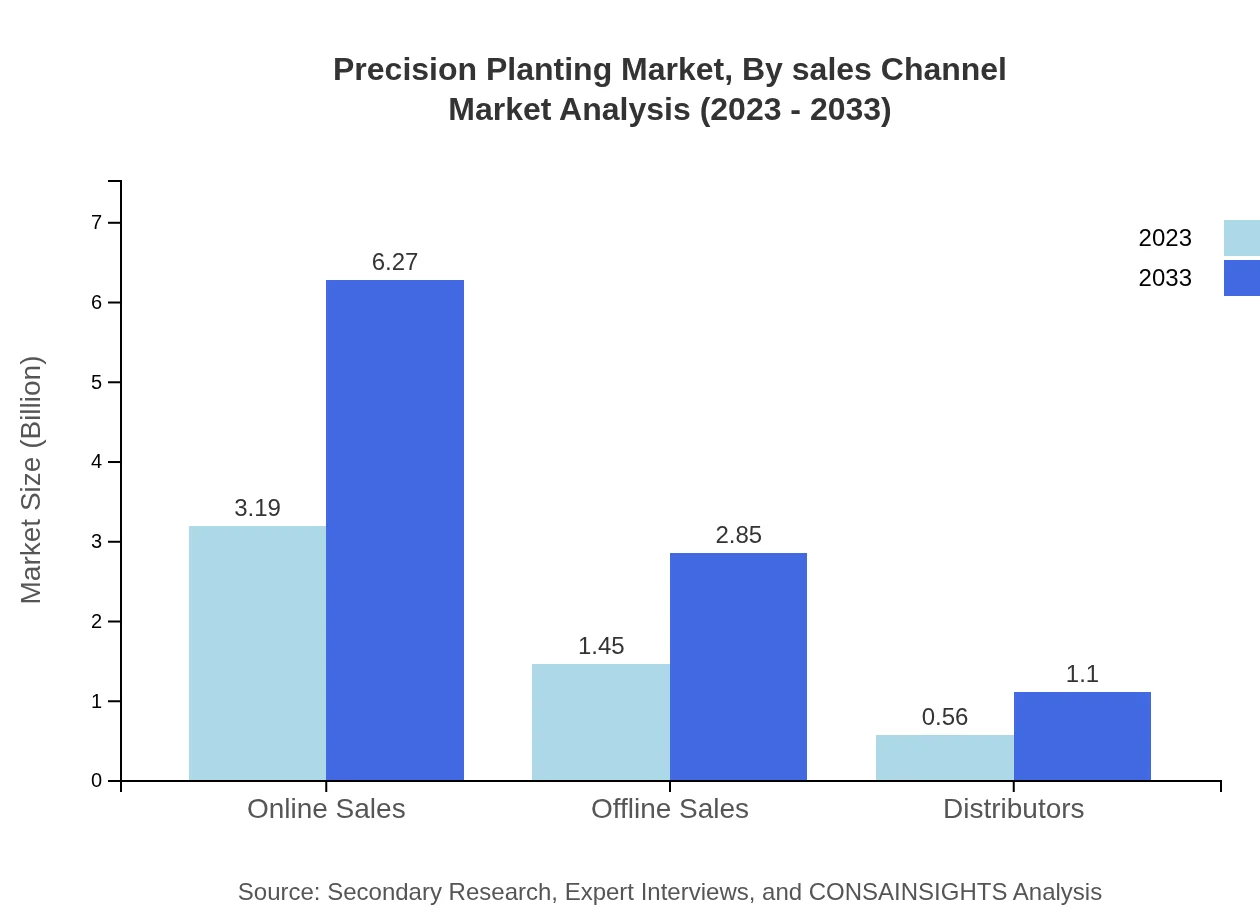

Precision Planting Market Analysis By Sales Channel

Online sales channels dominate the Precision Planting market with a share of 61.35% in 2023. In response to the digital shift, companies are increasingly prioritizing e-commerce platforms to reach their customers.

Precision Planting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Precision Planting Industry

John Deere:

A pioneer in agricultural machinery, John Deere provides innovative planting solutions that leverage technology for efficiency and better crop yields.AG Leader Technology:

AG Leader Technology specializes in precision agriculture hardware and software, helping farmers implement data-driven decision-making in their planting practices.Trimble:

Trimble offers advanced GPS technology and software to enhance precision farming, providing farmers with tools to optimize their planting processes.Case IH:

Case IH is known for its efficient planting equipment that integrates cutting-edge technology, focusing on enhancing productivity and minimizing costs.We're grateful to work with incredible clients.

FAQs

What is the market size of precision planting?

The precision planting market is projected to grow from $5.2 billion in 2023 to significant figures by 2033, with a CAGR of 6.8%. This growth indicates increasing adoption of precision agriculture technologies across the globe.

What are the key market players or companies in this precision planting industry?

Key players in the precision planting market include major agricultural technology firms and innovative startups focusing on Precision Agriculture. Notable companies may extend from equipment manufacturers to software developers, driving advancements in planting technology.

What are the primary factors driving the growth in the precision planting industry?

The growth in precision planting is driven by rising demand for sustainable farming practices, technological advancements in planting equipment, and increasing crop yields. Moreover, the growing awareness of resource optimization further fuels industry expansion.

Which region is the fastest Growing in precision planting?

In the precision planting market, Europe is set to witness rapid growth, expanding from a market size of $1.73 billion in 2023 to $3.39 billion by 2033. North America follows closely, reflecting strong agricultural investments and adoption of technology.

Does ConsaInsights provide customized market report data for the precision planting industry?

Yes, ConsaInsights offers tailored market report data for the precision planting industry, ensuring businesses can access specific insights, trends, and forecasts based on unique requirements and market focus.

What deliverables can I expect from this precision planting market research project?

From the precision planting market research project, expect comprehensive reports including market analysis, segment breakdowns, competitive landscape, and forecasts for growth, providing stakeholders with valuable data to drive strategic decisions.

What are the market trends of precision planting?

Current trends in the precision planting market include increased reliance on data analytics, growth in automated planting equipment usage, and a focus on sustainability. Innovations in AI and IoT significantly shape operational efficiencies and productivity.