Preclinical In Vivo Imaging Market Report

Published Date: 31 January 2026 | Report Code: preclinical-in-vivo-imaging

Preclinical In Vivo Imaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Preclinical In Vivo Imaging market, exploring market size, growth forecasts, segmentation, and notable trends from 2023 to 2033.

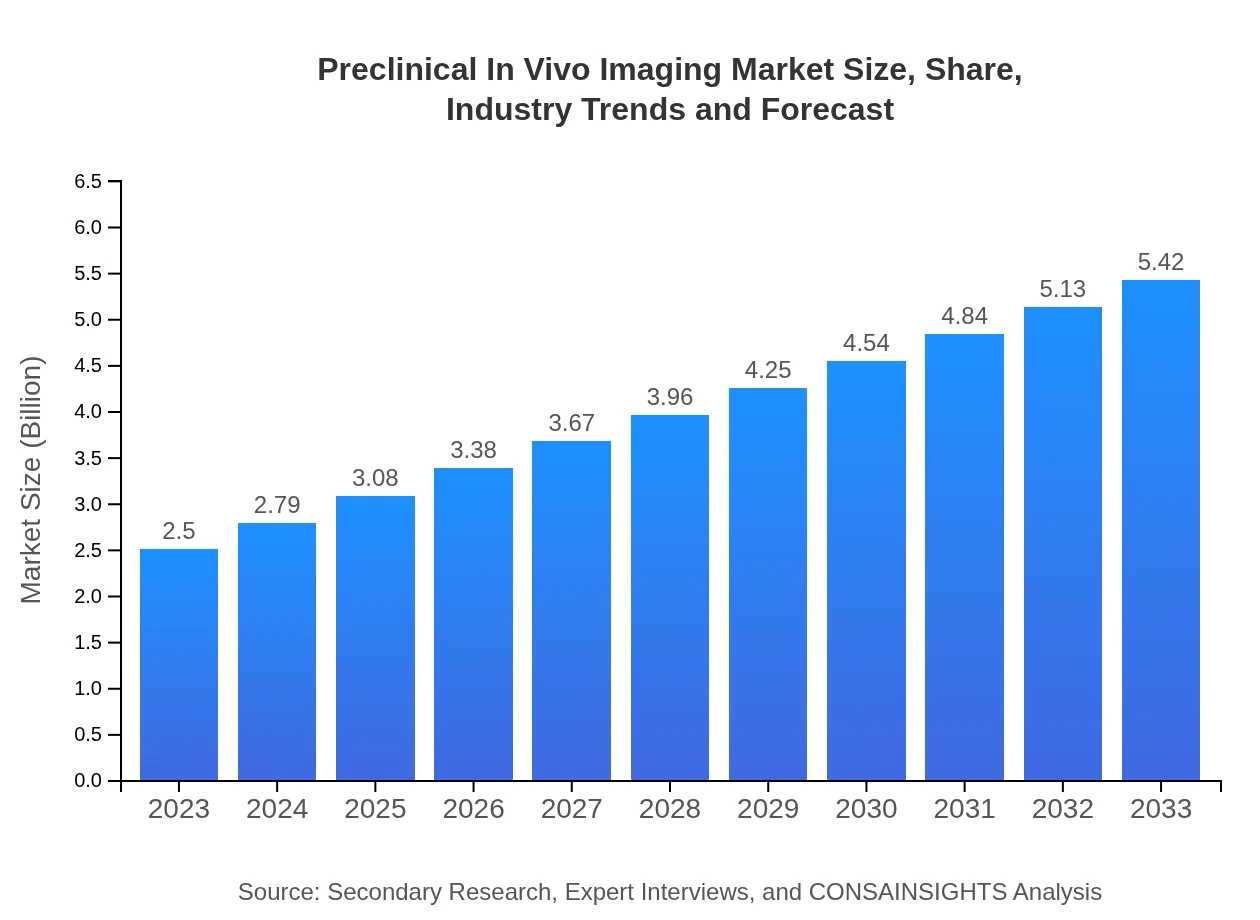

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Bruker Corporation, PerkinElmer, Inc., MI Labs, Topcon Corporation |

| Last Modified Date | 31 January 2026 |

Preclinical In Vivo Imaging Market Overview

Customize Preclinical In Vivo Imaging Market Report market research report

- ✔ Get in-depth analysis of Preclinical In Vivo Imaging market size, growth, and forecasts.

- ✔ Understand Preclinical In Vivo Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Preclinical In Vivo Imaging

What is the Market Size & CAGR of Preclinical In Vivo Imaging market in 2023?

Preclinical In Vivo Imaging Industry Analysis

Preclinical In Vivo Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Preclinical In Vivo Imaging Market Analysis Report by Region

Europe Preclinical In Vivo Imaging Market Report:

Europe's Preclinical In Vivo Imaging market is projected to grow from $0.84 billion in 2023 to $1.82 billion by 2033. The robust growth is supported by high research expenditure, regulatory support for drug development, and a rising number of research publications.Asia Pacific Preclinical In Vivo Imaging Market Report:

In the Asia Pacific region, the Preclinical In Vivo Imaging market was valued at $0.39 billion in 2023 and is projected to grow to $0.85 billion by 2033. Factors contributing to this growth include increasing research funding, growing prevalence of chronic diseases, and rising demand for advanced imaging modalities in research institutions.North America Preclinical In Vivo Imaging Market Report:

The North American market, leading in size, was valued at $0.90 billion in 2023 and is expected to reach $1.95 billion by 2033. The region's strong market position is driven by significant investments in biomedical research, presence of major pharmaceutical companies, and advanced technological innovations.South America Preclinical In Vivo Imaging Market Report:

In South America, the Preclinical In Vivo Imaging market is anticipated to grow from $0.23 billion in 2023 to $0.51 billion by 2033. This growth is attributed to expanding research activities within pharmaceutical sectors and increasing collaborations between academic institutions and industry players.Middle East & Africa Preclinical In Vivo Imaging Market Report:

The Middle East and Africa market is smaller, with an estimated value of $0.13 billion in 2023, expected to increase to $0.28 billion by 2033. The market is driven by increasing research initiatives and collaborations with global pharmaceutical companies, despite economic challenges.Tell us your focus area and get a customized research report.

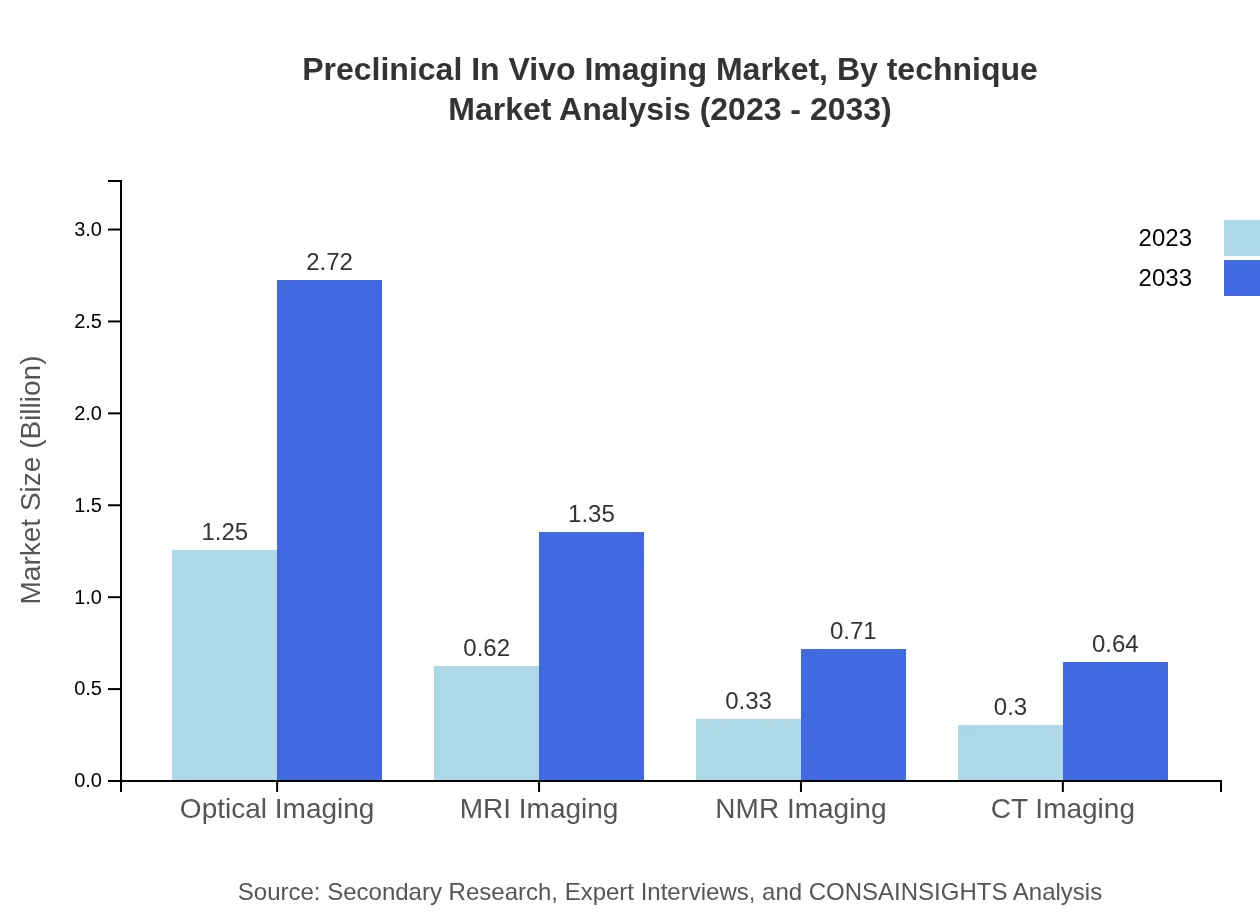

Preclinical In Vivo Imaging Market Analysis By Technique

The technique segment is dominated by Optical Imaging, expected to maintain a market size of $1.25 billion in 2023 and reach $2.72 billion by 2033. Other notable techniques include MRI and NMR Imaging, capturing significant market shares due to their essential roles in diagnosis and research applications. Each imaging technique offers distinct advantages based on sensitivity, resolution, and specific applications in various biomedical fields.

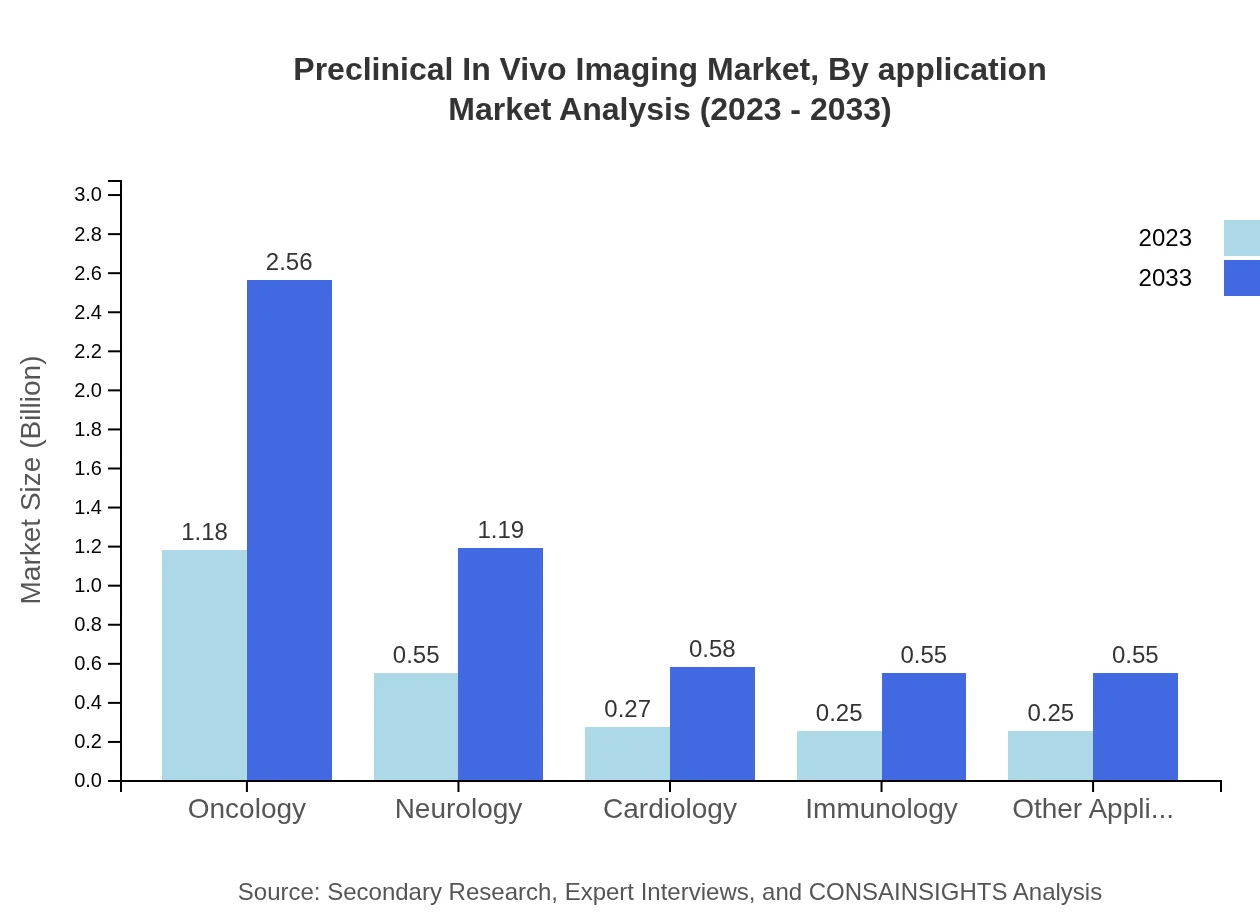

Preclinical In Vivo Imaging Market Analysis By Application

The application sector is leadingly occupied by Oncology, with a market size of $1.18 billion in 2023 and a projected growth to $2.56 billion by 2033. Neurology also represents a critical application area with significant growth potential. Enhanced imaging technologies drive advancements in these fields, supporting better detection, monitoring, and treatment assessments.

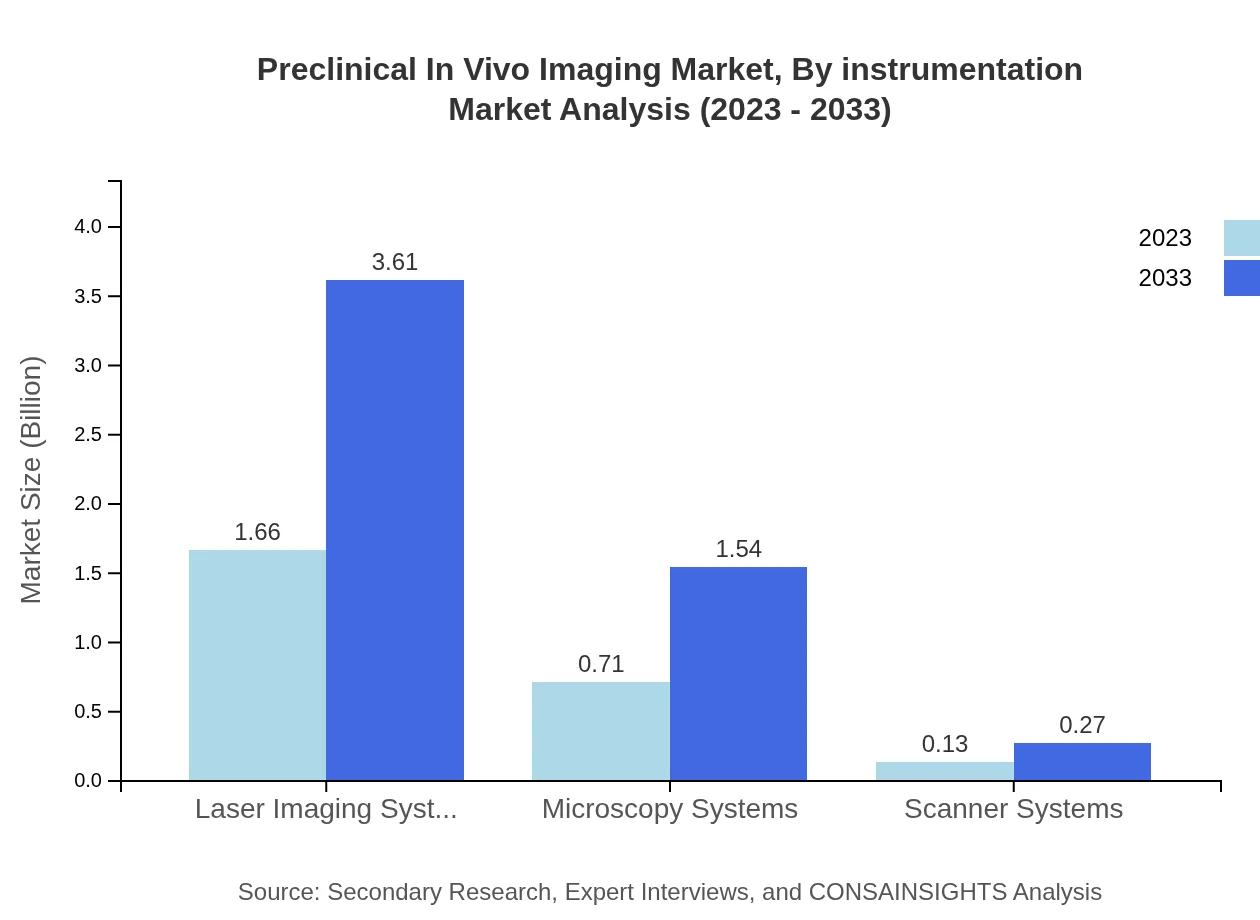

Preclinical In Vivo Imaging Market Analysis By Instrumentation

Laser Imaging Systems hold the largest market share in instrumentation, anticipated to grow from $1.66 billion in 2023 to $3.61 billion by 2033. The increasing preference for high-resolution imaging systems that permit real-time analysis underlines the importance of this instrumentation category in research and clinical settings.

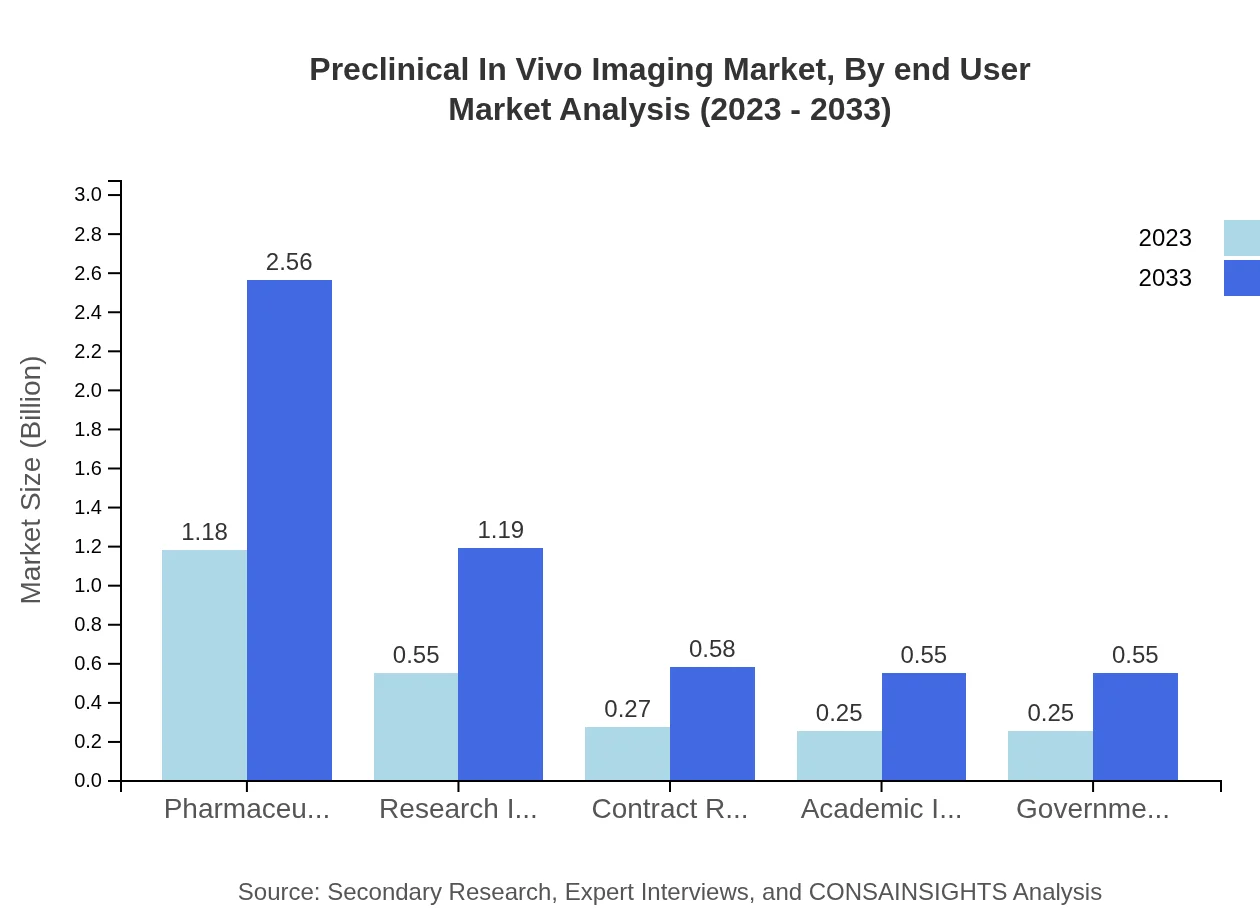

Preclinical In Vivo Imaging Market Analysis By End User

Pharmaceutical Companies lead the end-user segment, commanding a significant market size of $1.18 billion in 2023, expected to rise to $2.56 billion by 2033. Furthermore, Research Institutes contribute significantly, aided by increased focus on drug discovery and collaboration with pharmaceutical entities.

Preclinical In Vivo Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Preclinical In Vivo Imaging Industry

Bruker Corporation:

A leading provider of preclinical imaging systems, Bruker combines advanced imaging modalities with a robust portfolio for bioimaging research.PerkinElmer, Inc.:

Specializing in imaging systems for diagnostic and preclinical applications, PerkinElmer develops innovative solutions that push boundaries in life sciences.MI Labs:

MI Labs offers an advanced suite of imaging technologies designed for in vivo studies, enabling high-resolution imaging crucial for academic and pharmaceutical research.Topcon Corporation:

Topcon is recognized for its optical imaging systems and innovative solutions that enhance research capabilities across multiple platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of preclinical In Vivo Imaging?

The preclinical in vivo imaging market is estimated to be valued at approximately $2.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.8% over the next decade.

What are the key market players or companies in this preclinical In Vivo Imaging industry?

Key players in this industry include major pharmaceutical companies, research institutes, contract research organizations (CROs), and academic institutions, all contributing to advancements in imaging technologies and methodologies.

What are the primary factors driving the growth in the preclinical In Vivo Imaging industry?

Growth in this industry is driven by increased R&D investment in pharmaceuticals, the rising demand for innovative imaging technologies, and the need for efficient drug discovery and development processes.

Which region is the fastest Growing in the preclinical In Vivo Imaging?

The Asia-Pacific region is the fastest-growing market, projected to expand from $0.39 billion in 2023 to $0.85 billion in 2033, reflecting significant advancements in research capabilities and funding.

Does ConsaInsights provide customized market report data for the preclinical In Vivo Imaging industry?

Yes, ConsaInsights offers tailored market report data on preclinical in vivo imaging, allowing clients to obtain specific insights and projections relevant to their interests and strategies.

What deliverables can I expect from this preclinical In Vivo Imaging market research project?

Clients can expect comprehensive market analyses, competitive landscape assessments, trend evaluations, growth forecasts, and customized insights to inform strategic decisions in the preclinical in vivo imaging sector.

What are the market trends of preclinical In Vivo Imaging?

Current trends include increased utilization of optical imaging technologies, rising adoption of innovative imaging methodologies among pharmaceutical firms, and focused investments in imaging system advancements tailored for preclinical studies.