Premium Alcoholic Beverages Market Report

Published Date: 31 January 2026 | Report Code: premium-alcoholic-beverages

Premium Alcoholic Beverages Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Premium Alcoholic Beverages market from 2023 to 2033, covering market size, growth rates, regional dynamics, industry trends, and detailed insights into product and consumer segments.

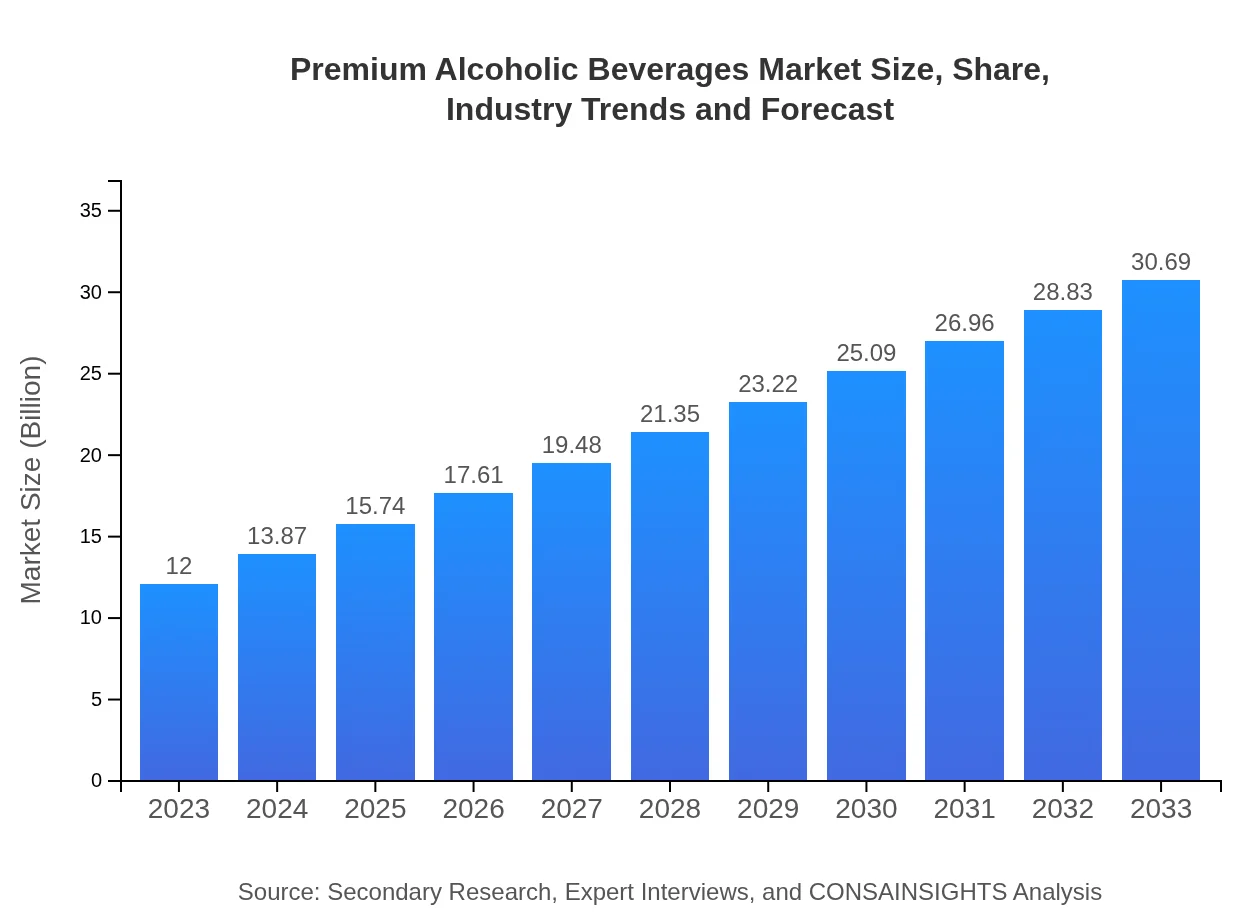

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Constellation Brands, Diageo, Pernod Ricard, Moët Hennessy Louis Vuitton, Anheuser-Busch InBev |

| Last Modified Date | 31 January 2026 |

Premium Alcoholic Beverages Market Overview

Customize Premium Alcoholic Beverages Market Report market research report

- ✔ Get in-depth analysis of Premium Alcoholic Beverages market size, growth, and forecasts.

- ✔ Understand Premium Alcoholic Beverages's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Premium Alcoholic Beverages

What is the Market Size & CAGR of Premium Alcoholic Beverages market in 2023?

Premium Alcoholic Beverages Industry Analysis

Premium Alcoholic Beverages Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Premium Alcoholic Beverages Market Analysis Report by Region

Europe Premium Alcoholic Beverages Market Report:

Europe is a traditional market for premium alcoholic beverages, expected to grow from $4.15 billion in 2023 to $10.63 billion by 2033. The region’s rich heritage of winemaking and artisanal spirits enriches the market, and consumer preferences for local and organic products further strengthen it.Asia Pacific Premium Alcoholic Beverages Market Report:

The Asia Pacific region is expected to witness significant growth in the Premium Alcoholic Beverages market, projected to reach $5.70 billion by 2033 from $2.23 billion in 2023. This growth is driven by rising disposable incomes, a burgeoning middle class, and increased acceptance of premium alcoholic beverages among younger consumers.North America Premium Alcoholic Beverages Market Report:

North America holds a significant share of the Premium Alcoholic Beverages market, forecasted to escalate from $3.98 billion in 2023 to $10.18 billion by 2033. This region benefits from a well-established distribution network and strong brand loyalty among consumers, coupled with a high prevalence of craft beverage culture.South America Premium Alcoholic Beverages Market Report:

In South America, the market is relatively smaller, with projections showing growth from $0.12 billion in 2023 to $0.30 billion by 2033. Economic challenges hinder immediate growth, but a rise in international tourism and premium product offerings is expected to drive demand.Middle East & Africa Premium Alcoholic Beverages Market Report:

The Middle East and Africa region is projected to show a rise from $1.52 billion in 2023 to $3.89 billion by 2033. Increasing tourism and changes in regulations regarding alcohol consumption are expected to drive growth in premium segments.Tell us your focus area and get a customized research report.

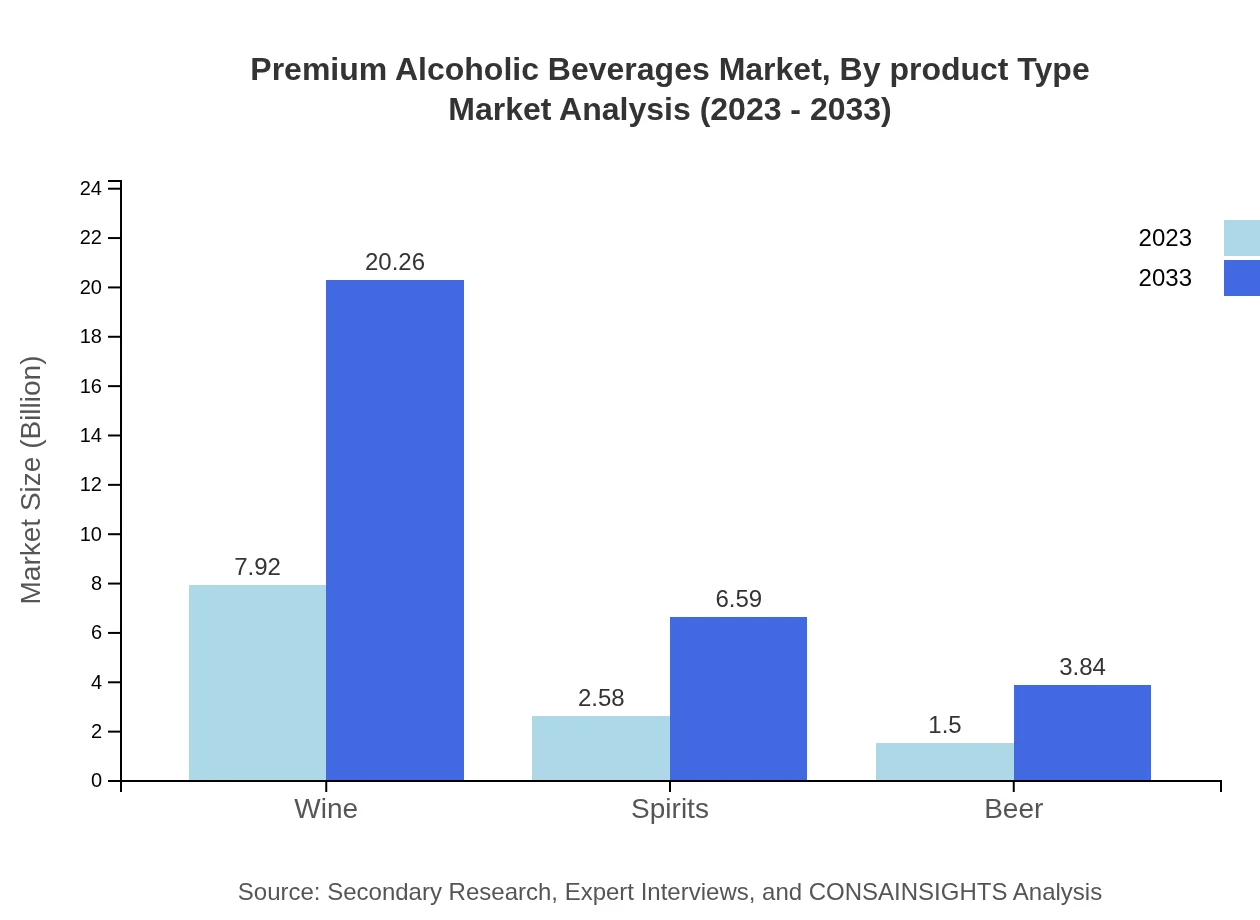

Premium Alcoholic Beverages Market Analysis By Product Type

In 2023, the wine sector is projected to account for $7.92 billion and maintain a 66.01% market share, increasing to $20.26 billion by 2033. The spirits segment is valued at $2.58 billion with a 21.47% share, expected to rise to $6.59 billion. Beer, while smaller at $1.50 billion with a share of 12.52%, is projected to grow steadily to $3.84 billion.

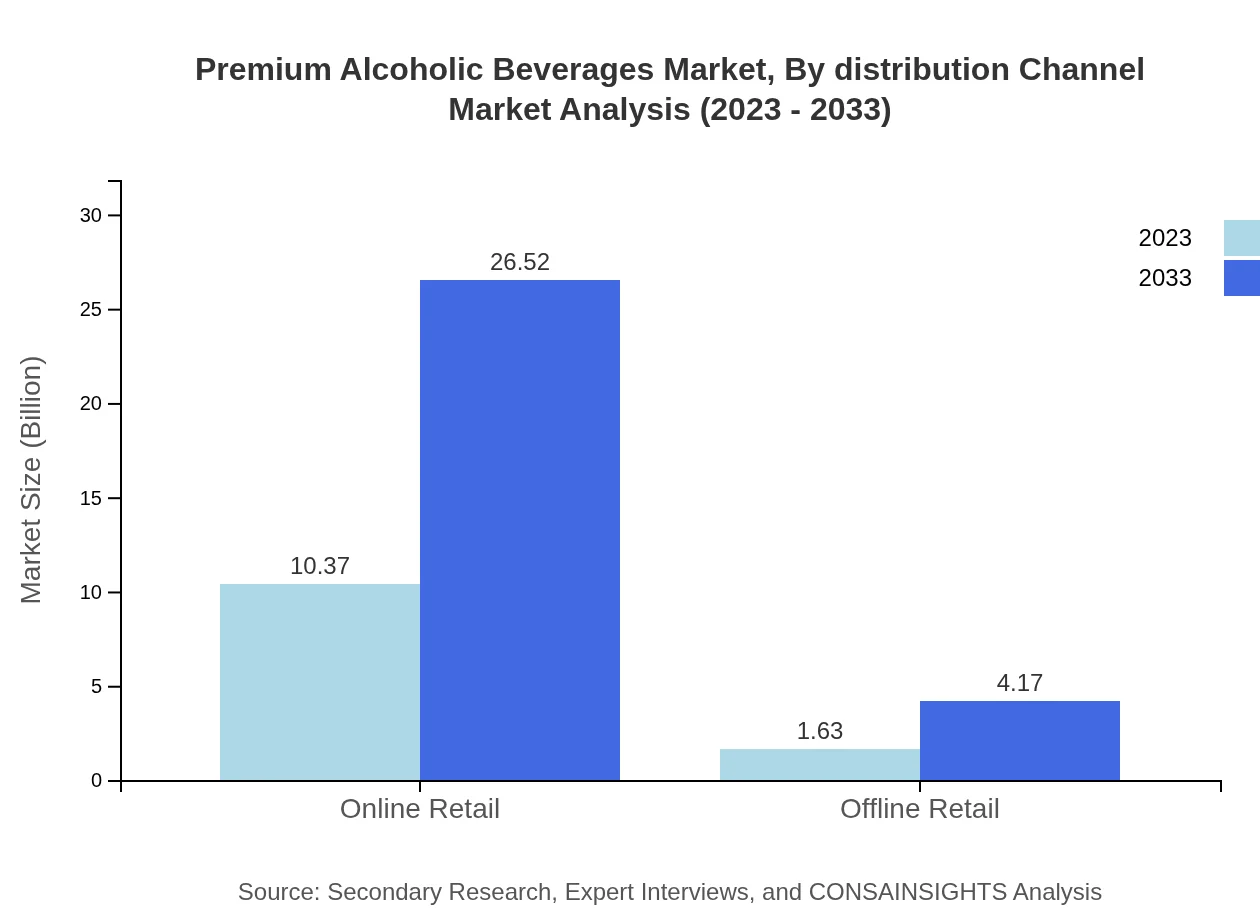

Premium Alcoholic Beverages Market Analysis By Distribution Channel

Online retail is transforming the Premium Alcoholic Beverages market with a projected growth from $10.37 billion in 2023 to $26.52 billion by 2033, commanding 86.4% of share. Offline retail shows a modest increase from $1.63 billion to $4.17 billion, which indicates a shift in consumer purchasing patterns.

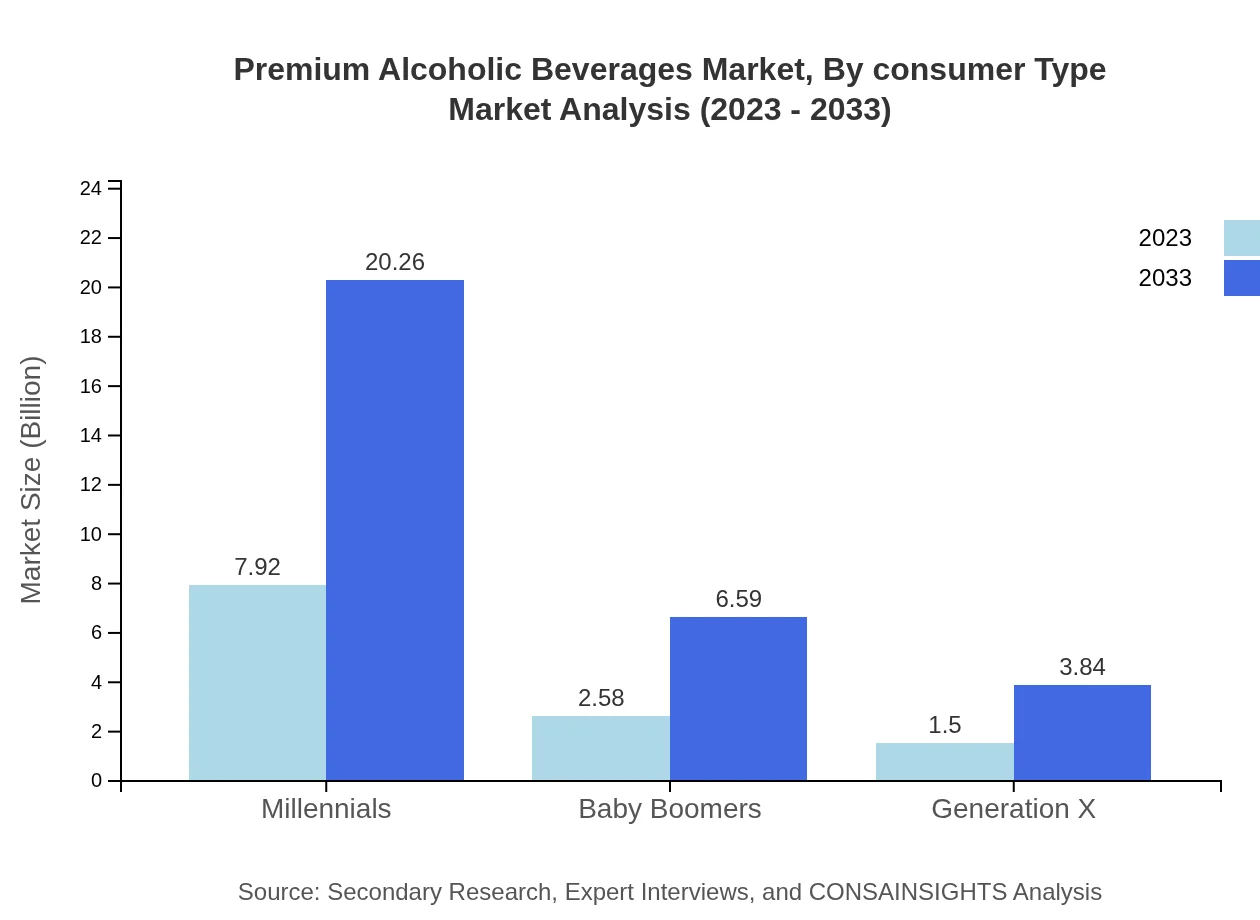

Premium Alcoholic Beverages Market Analysis By Consumer Type

Different consumer demographics show varying sizes and shares. Millennials are projected to maintain a 66.01% market share, growing from $7.92 billion to $20.26 billion by 2033. Baby boomers represent a significant market at $2.58 billion with a 21.47% share, while Generation X, at $1.50 billion and a 12.52% share, is expected to grow as well.

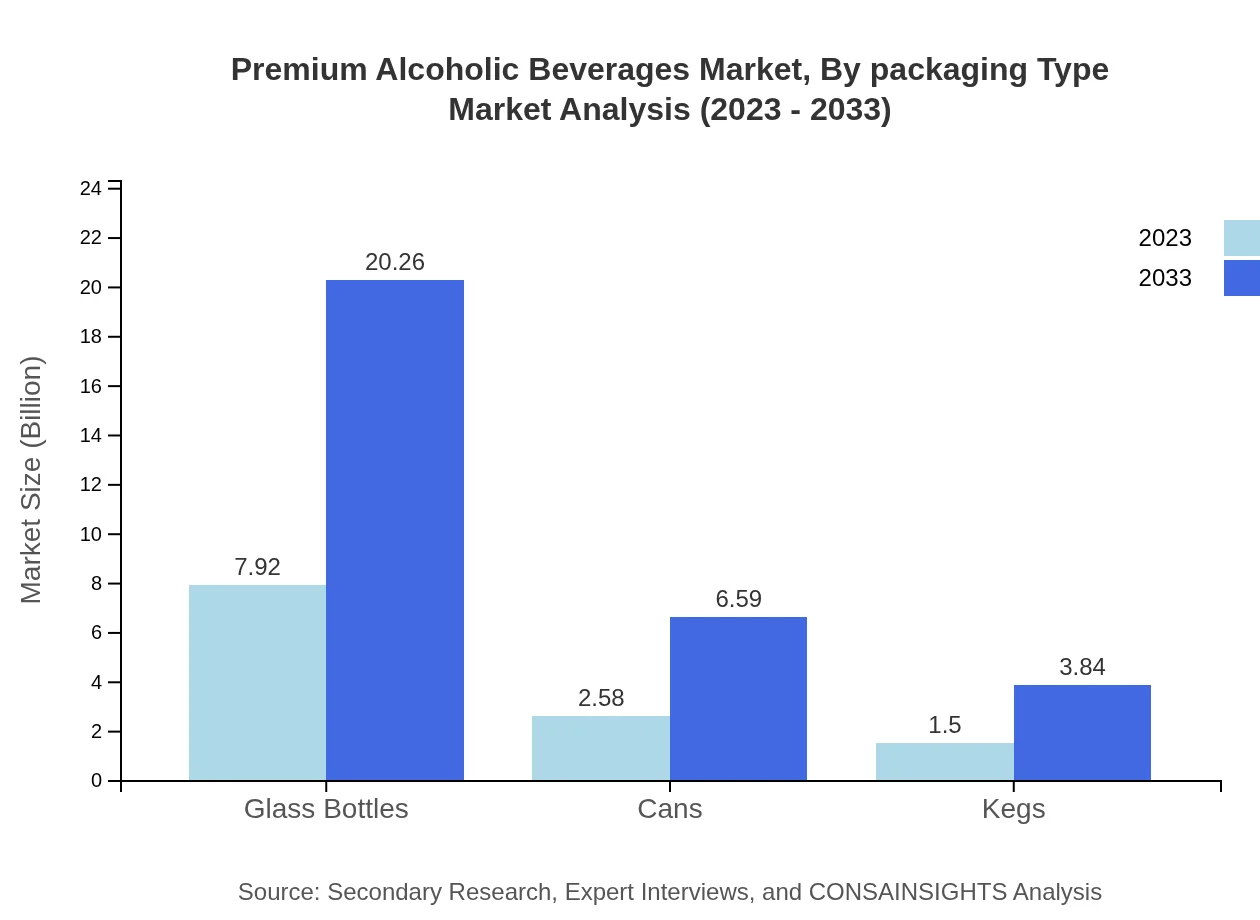

Premium Alcoholic Beverages Market Analysis By Packaging Type

Glass bottles dominate the market with $7.92 billion in revenue, representing a 66.01% share. Cans generate $2.58 billion (21.47% share), with their appeal among younger consumers rising. Kegs constitute the remaining share, with $1.50 billion and a 12.52% share.

Premium Alcoholic Beverages Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Premium Alcoholic Beverages Industry

Constellation Brands:

A leading global producer and marketer of beverage alcohol with a diverse portfolio of premium wines, beers and spirits.Diageo:

A multinational beverage alcohol company, producing a wide range of spirits, including Scotch whisky and premium liquors.Pernod Ricard:

A French company known for its premium wines and spirits, including brands like Chivas Regal and Absolut vodka.Moët Hennessy Louis Vuitton:

Luxury spirits and wine division of LVMH, famous for high-end champagnes and spirits.Anheuser-Busch InBev:

The largest beer company globally, offering both global and local premium beer products.We're grateful to work with incredible clients.

FAQs

What is the market size of premium Alcoholic Beverages?

The premium alcoholic beverages market is currently valued at approximately $12 billion. Projected to experience a notable growth, the market is expected to witness a CAGR of 9.5% over the next decade, reflecting significant consumer interest.

What are the key market players or companies in this premium Alcoholic Beverages industry?

Key players in the premium alcoholic beverages industry include renowned brands in wine, spirits, and beer segments, such as Diageo, Moët Hennessy, and Constellation Brands. Their innovative offerings and strong market presence drive competitive dynamics in this lucrative segment.

What are the primary factors driving the growth in the premium Alcoholic Beverages industry?

Growth is primarily driven by increasing disposable incomes, changing consumer preferences towards premium quality products, and rising urbanization. Additionally, the influence of social media on alcohol consumption trends has further accelerated demand for premium beverages.

Which region is the fastest Growing in the premium Alcoholic Beverages?

The Asia Pacific region is the fastest-growing market for premium alcoholic beverages, projected to grow from $2.23 billion in 2023 to $5.70 billion by 2033. This growth is supported by an increasing young population and rising disposable incomes.

Does ConsaInsights provide customized market report data for the premium Alcoholic Beverages industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the premium alcoholic beverages industry. These reports offer in-depth insights, allowing businesses to make informed decisions based on specific market dynamics.

What deliverables can I expect from this premium Alcoholic Beverages market research project?

Expect deliverables that include comprehensive analytical reports, market forecasts, segmentation data, competitor analysis, and key consumer insights. These will provide a thorough understanding of market trends and growth opportunities in the premium sector.

What are the market trends of premium Alcoholic Beverages?

Current market trends indicate a shift towards premiumization, with consumers favoring high-quality, artisanal products. Additionally, sustainable and eco-friendly practices are gaining traction, influencing purchasing decisions in the premium alcoholic beverage market.