Prepaid Card Market Report

Published Date: 31 January 2026 | Report Code: prepaid-card

Prepaid Card Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the prepaid card market covering market size, growth forecast, and trends from 2023 to 2033, alongside comprehensive regional insights and industry dynamics.

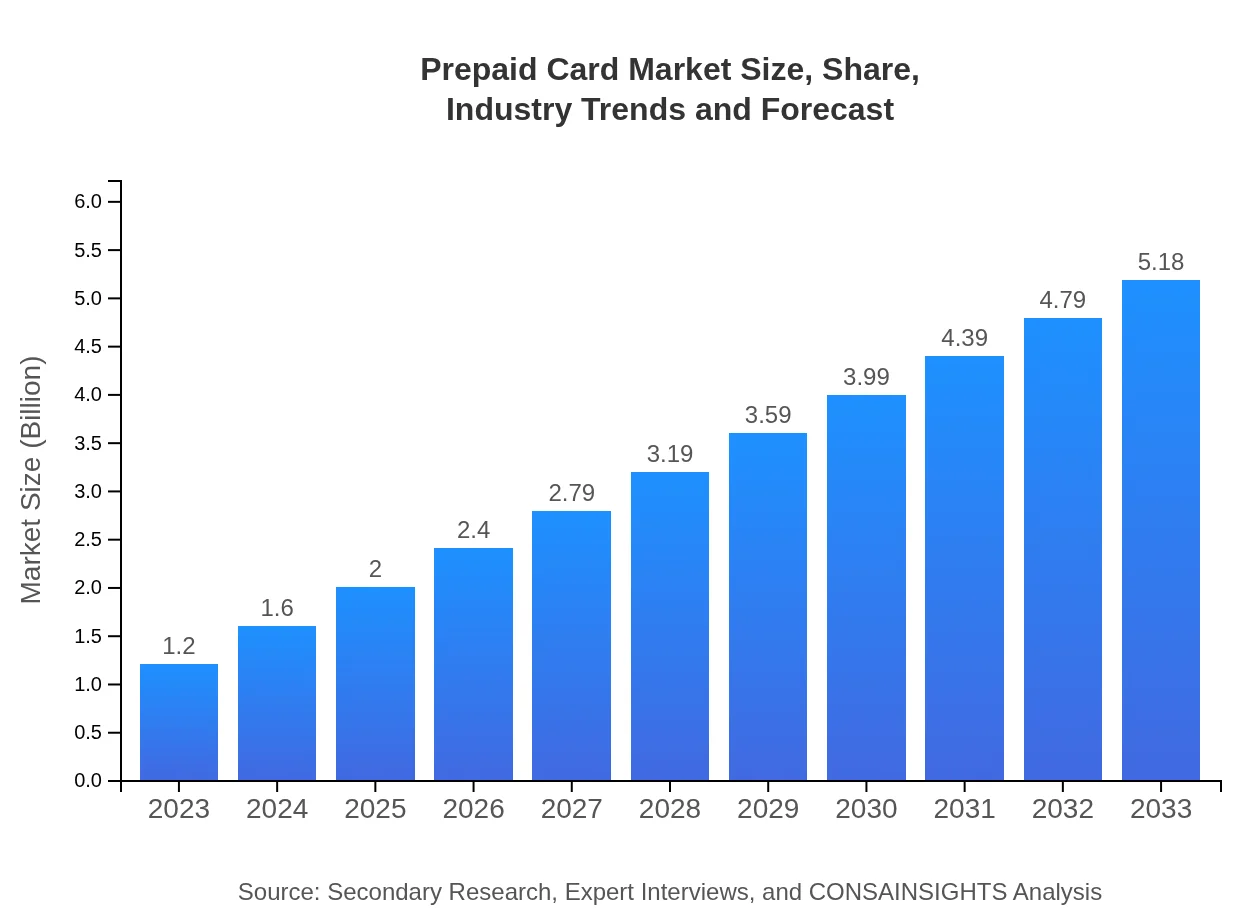

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $5.18 Trillion |

| Top Companies | Mastercard, Visa, American Express, NetSpend, Green Dot Corporation |

| Last Modified Date | 31 January 2026 |

Prepaid Card Market Overview

Customize Prepaid Card Market Report market research report

- ✔ Get in-depth analysis of Prepaid Card market size, growth, and forecasts.

- ✔ Understand Prepaid Card's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Prepaid Card

What is the Market Size & CAGR of Prepaid Card market in 2023?

Prepaid Card Industry Analysis

Prepaid Card Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Prepaid Card Market Analysis Report by Region

Europe Prepaid Card Market Report:

In Europe, the market is projected to grow from $0.34 billion in 2023 to $1.46 billion by 2033. Factors such as the increasing regulatory focus on cashless transactions and the popularity of gift cards among consumers fuel this market's expansion.Asia Pacific Prepaid Card Market Report:

In the Asia Pacific region, the market in 2023 is valued at $0.25 billion and is expected to grow to $1.08 billion by 2033. Major factors driving this growth include a burgeoning middle class, increased smartphone penetration, and rising e-commerce activities which are bolstering the demand for prepaid cards.North America Prepaid Card Market Report:

North America represents a well-established market, with the 2023 valuation at $0.39 billion, projected to surge to $1.68 billion by 2033. Key drivers include the widespread acceptance of prepaid solutions by both consumers and businesses, alongside innovations in financial technology.South America Prepaid Card Market Report:

The South American prepaid card market, valued at $0.09 billion in 2023, is anticipated to reach $0.38 billion by 2033. Growth is being propelled by greater financial inclusion initiatives and the adoption of digital payment solutions across the region.Middle East & Africa Prepaid Card Market Report:

The Middle East and Africa market for prepaid cards is expected to grow from $0.14 billion in 2023 to $0.59 billion by 2033. The rise in mobile banking and digital payment adoption within a young demographic is paving the way for future growth in this sector.Tell us your focus area and get a customized research report.

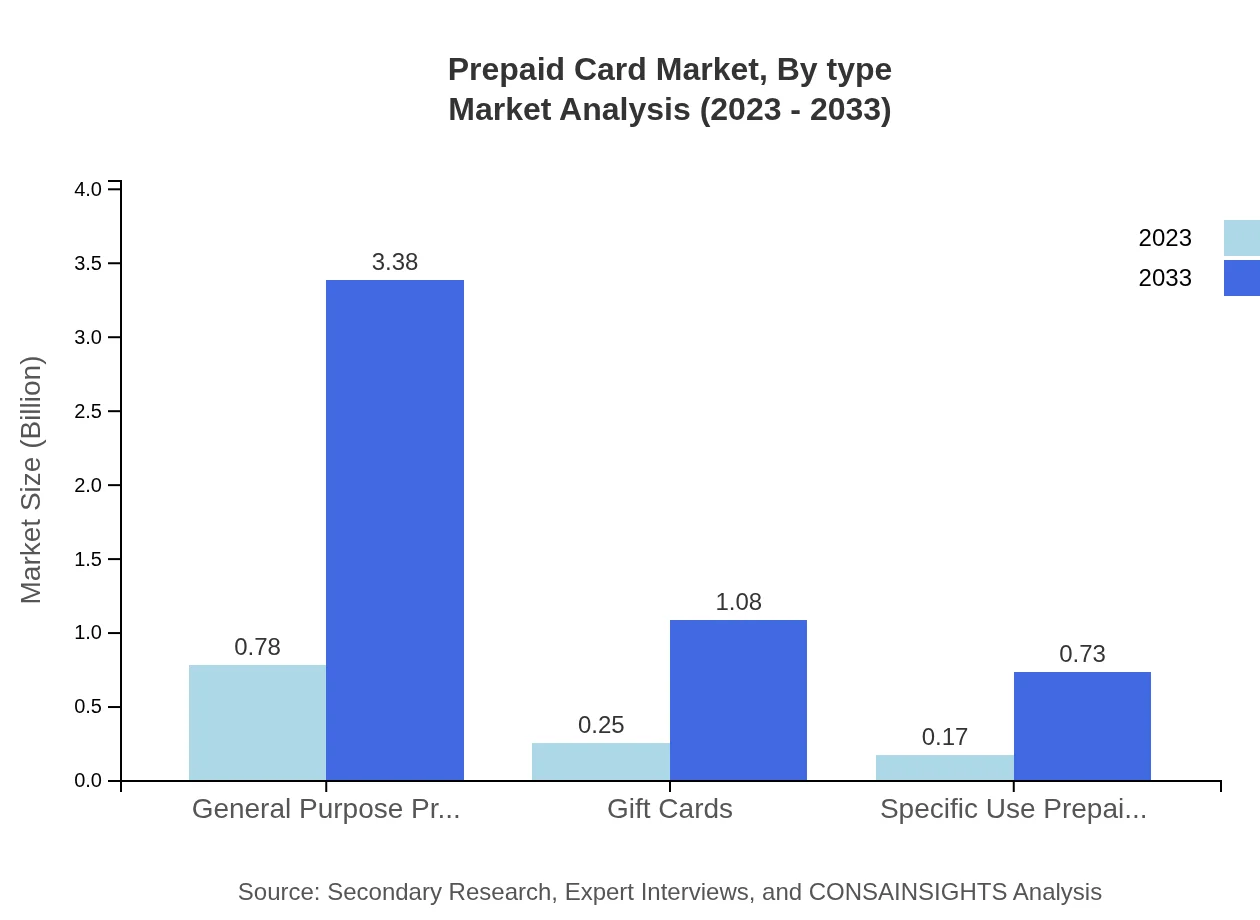

Prepaid Card Market Analysis By Type

The market is dominated by general-purpose prepaid cards, projected to reach $3.38 billion from $0.78 billion from 2023 to 2033, holding a robust market share. Gift cards also show substantial growth, increasing from $0.25 billion to $1.08 billion. Specific-use cards, such as transportation and healthcare, remain a smaller yet growing segment, driven by niche applications.

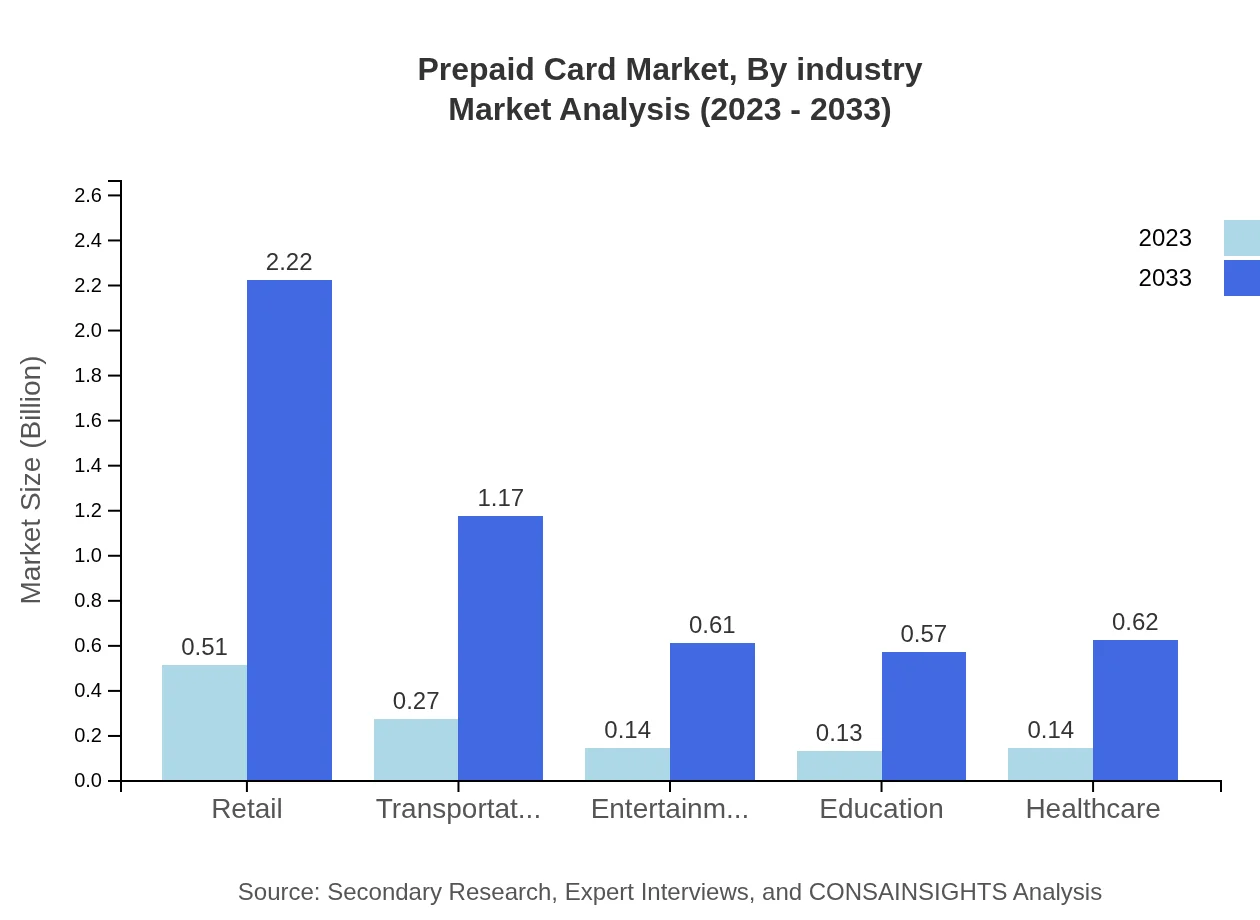

Prepaid Card Market Analysis By Industry

The retail and transportation sectors are the primary users of prepaid cards, facilitating consumer and employee transactions. The entertainment and education sectors are ongoing growth areas due to increasing flexibility in payment methods. Government agencies are increasingly adopting prepaid cards for benefits distribution.

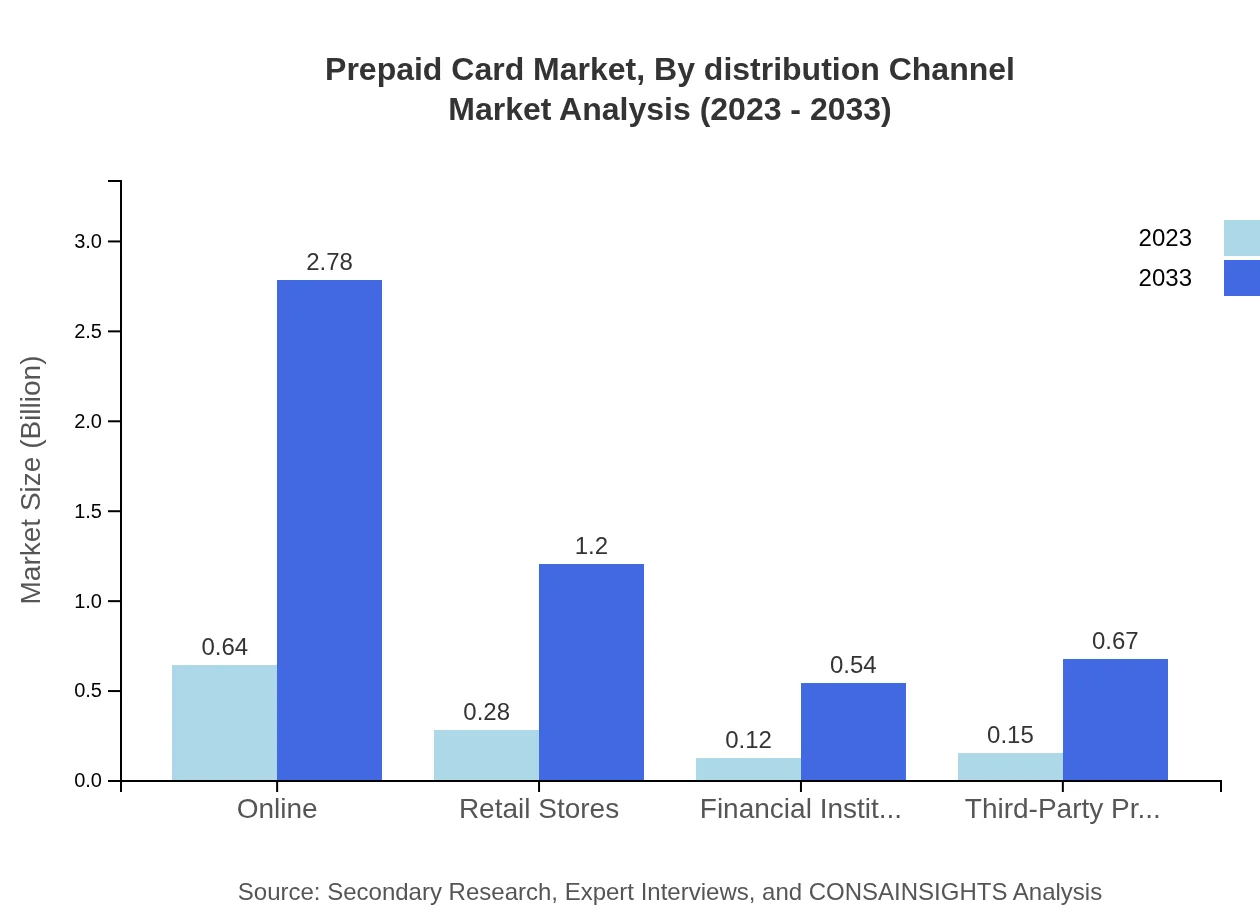

Prepaid Card Market Analysis By Distribution Channel

Online channels significantly outperform physical retail stores, with an expected move from $0.64 billion to $2.78 billion by 2033. Digital transactions are rapidly becoming a preferred choice due to convenience, indicating an increased migration towards e-commerce.

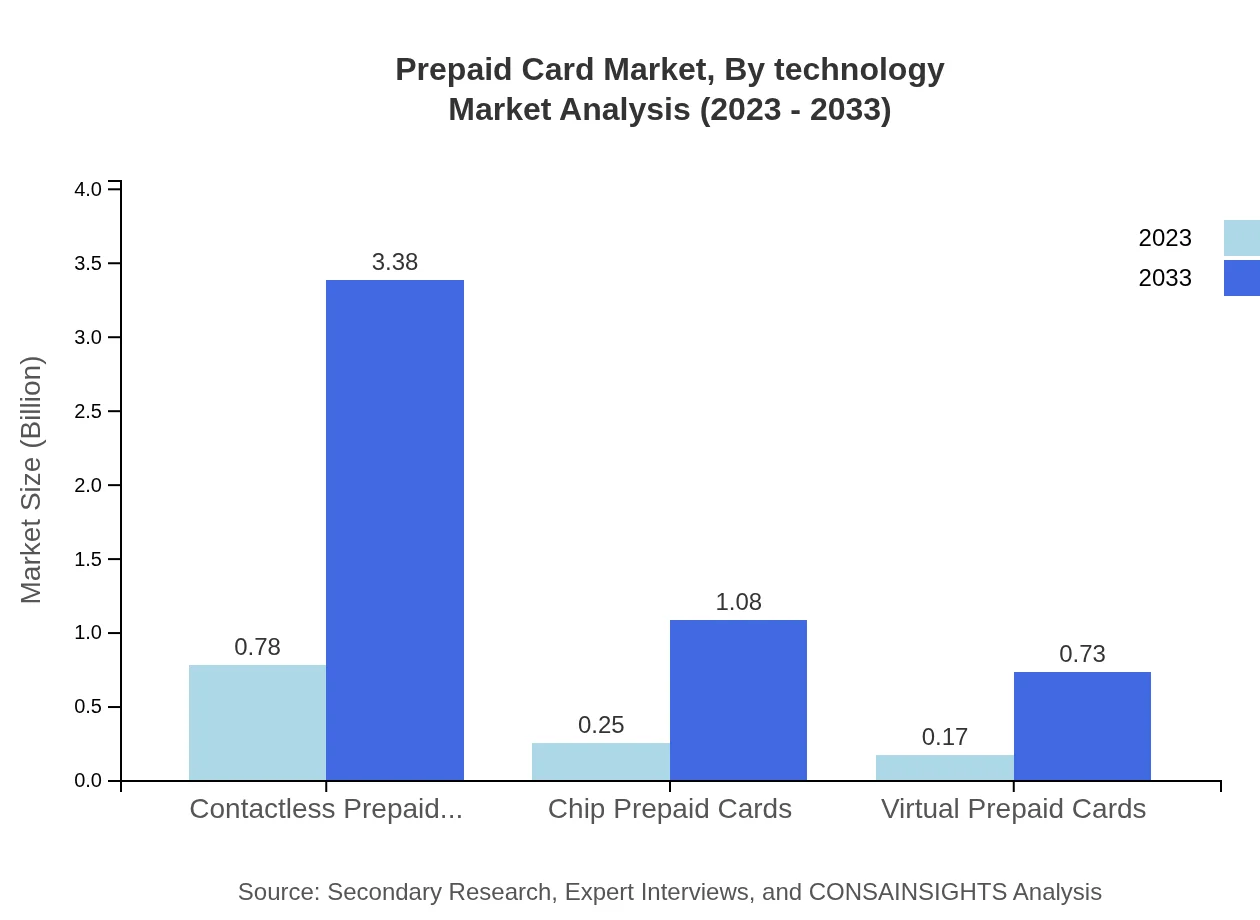

Prepaid Card Market Analysis By Technology

Innovations in technology, such as contactless and virtual prepaid cards, are changing the landscape. Contactless cards are expected to maintain a steady market share and grow significantly as consumers seek faster transaction options.

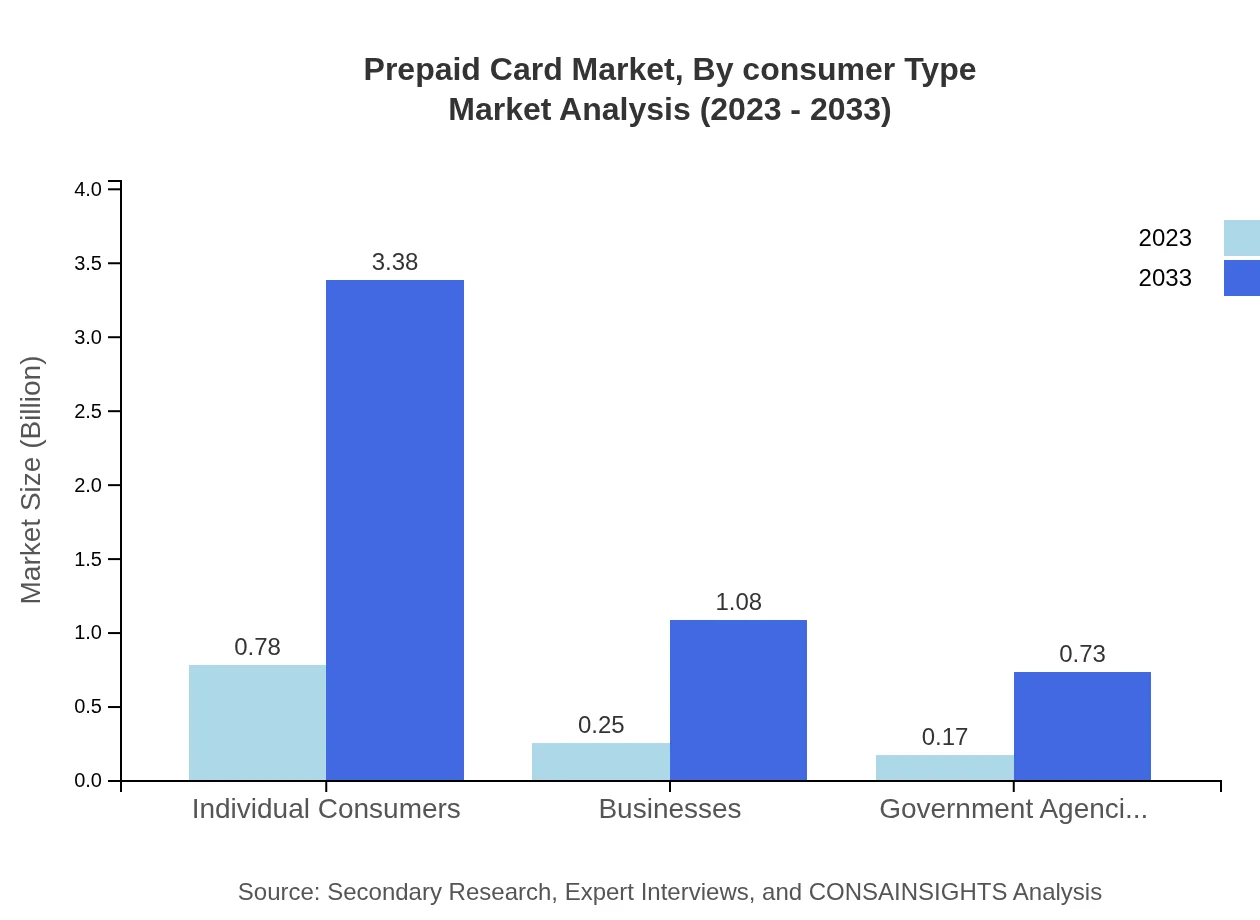

Prepaid Card Market Analysis By Consumer Type

Individual consumers represent the stronghold of the prepaid card market, anticipated to grow from $0.78 billion to $3.38 billion by 2033. Businesses are also increasing their use of prepaid cards for employee compensation and incentive programs, underscoring the card's versatility.

Prepaid Card Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Prepaid Card Industry

Mastercard:

A leading global payment technology company, Mastercard offers various prepaid card solutions aimed at consumers and businesses, enhancing cashless transactions worldwide.Visa:

Visa is a prominent player in the prepaid card market, providing innovative solutions that cater to digital payment needs. Their extensive global network allows ease of use for prepaid cardholders.American Express:

American Express provides a range of prepaid cards focusing on customer service and benefits, aimed at both personal and business users to promote cashless activity.NetSpend:

A pioneer in prepaid debit cards, NetSpend provides advanced solutions that enhance consumer financial management and encourage responsible spending.Green Dot Corporation:

Green Dot offers a wide range of prepaid card services and specializes in providing banking-like services to unbanked consumers, driving financial inclusion.We're grateful to work with incredible clients.

FAQs

What is the market size of prepaid Card?

The prepaid card market is valued at approximately $1.2 trillion in 2023 and is projected to grow at a CAGR of 15%, reaching significant market expansion by 2033.

What are the key market players or companies in this prepaid card industry?

Key players in the prepaid card industry include major financial institutions, fintech companies, and banks that offer prepaid card solutions. These entities dominate the market through innovative offerings and extensive distribution networks.

What are the primary factors driving the growth in the prepaid card industry?

Drivers of market growth include increasing digital transactions, the rise in e-commerce, consumer preference for cash alternatives, and the expansion of payment solutions offered by businesses and financial institutions.

Which region is the fastest Growing in the prepaid card?

Asia Pacific is identified as the fastest-growing region, with market growth from $0.25 billion in 2023 to $1.08 billion by 2033, reflecting an increasing adoption of prepaid cards.

Does ConsaInsights provide customized market report data for the prepaid card industry?

Yes, ConsaInsights specializes in delivering customized market reports for the prepaid card industry, tailored to address specific business needs and strategic objectives.

What deliverables can I expect from this prepaid card market research project?

Expect detailed market analysis, segmentation data, competitive analysis, regional insights, and forecasts to enhance strategic decision-making for your business in the prepaid card market.

What are the market trends of prepaid card?

Current trends include the rising use of contactless prepaid cards, growth in virtual prepaid cards, enhanced security features, and increasing adoption among individual consumers and businesses alike.