Preparative And Process Chromatography Market Report

Published Date: 31 January 2026 | Report Code: preparative-and-process-chromatography

Preparative And Process Chromatography Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Preparative and Process Chromatography market, analyzing trends, forecasts, and key players from 2023 to 2033.

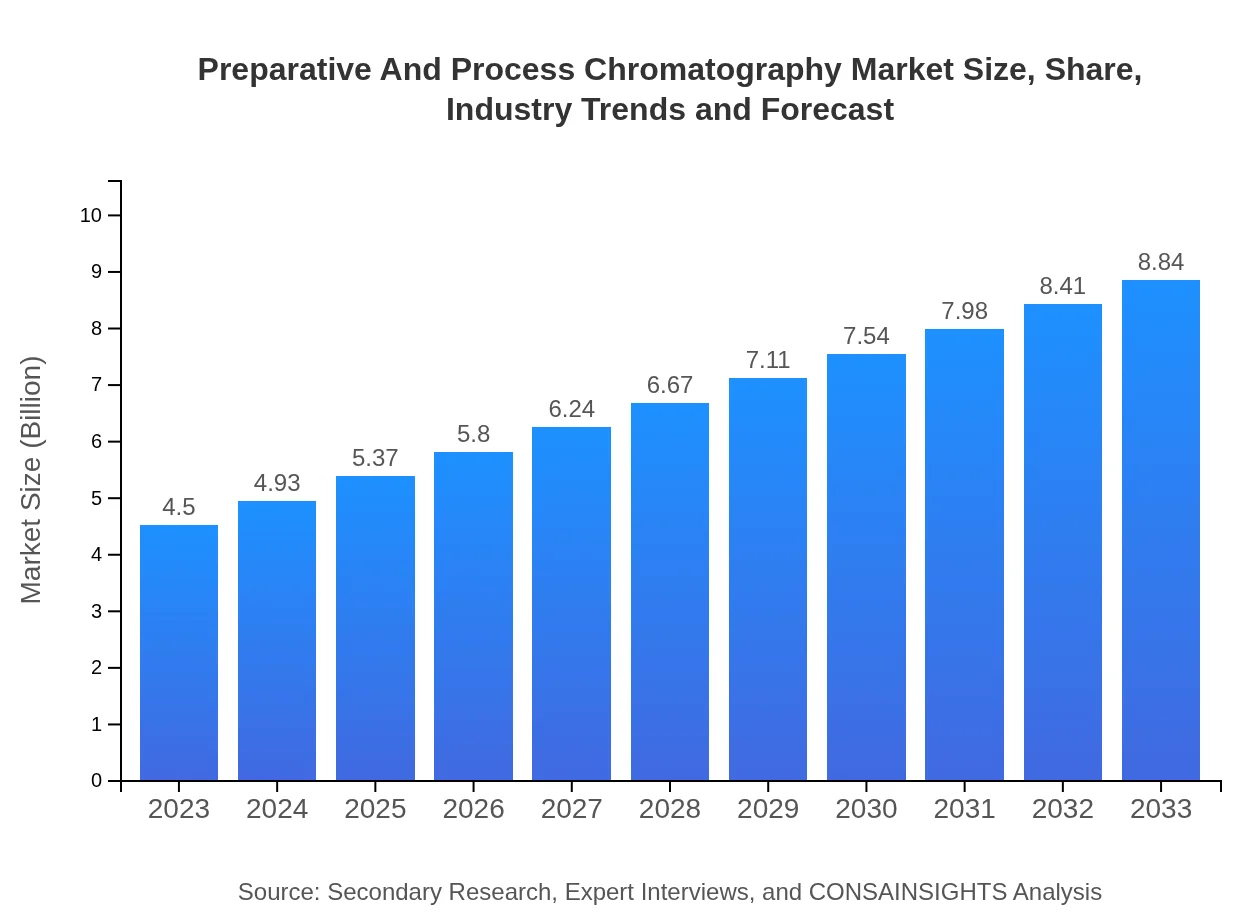

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Merck KGaA, PerkinElmer |

| Last Modified Date | 31 January 2026 |

Preparative And Process Chromatography Market Overview

Customize Preparative And Process Chromatography Market Report market research report

- ✔ Get in-depth analysis of Preparative And Process Chromatography market size, growth, and forecasts.

- ✔ Understand Preparative And Process Chromatography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Preparative And Process Chromatography

What is the Market Size & CAGR of Preparative And Process Chromatography market in 2023?

Preparative And Process Chromatography Industry Analysis

Preparative And Process Chromatography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Preparative And Process Chromatography Market Analysis Report by Region

Europe Preparative And Process Chromatography Market Report:

Europe’s market is projected to increase significantly, from $1.25 billion in 2023 to $2.45 billion by 2033. The stringent regulations in the pharmaceutical industry and heightened focus on quality control are key factors driving advancements in chromatography technologies in this region.Asia Pacific Preparative And Process Chromatography Market Report:

In the Asia-Pacific region, the market is projected to grow from $0.87 billion in 2023 to $1.72 billion by 2033, driven by increasing demand for pharmaceuticals and biotechnology services due to a burgeoning population and healthcare improvements. Investments in research and development in countries like China and India are also enhancing market potential.North America Preparative And Process Chromatography Market Report:

North America, holding the largest market share, is expected to grow from $1.48 billion in 2023 to $2.90 billion by 2033. The region benefits from established healthcare infrastructure, biotechnology advancements, and strong research institutions which contribute to the demand for preparative chromatography.South America Preparative And Process Chromatography Market Report:

South America is witnessing moderate growth, with market size escalating from $0.30 billion in 2023 to $0.59 billion by 2033, due to rising investments in pharmaceutical production and increased adoption of advanced technologies in lab settings.Middle East & Africa Preparative And Process Chromatography Market Report:

The Middle East and Africa region will expand from $0.60 billion in 2023 to $1.18 billion by 2033, spurred by increasing investments in healthcare services and pharmaceuticals, as well as the growing emphasis on research and development.Tell us your focus area and get a customized research report.

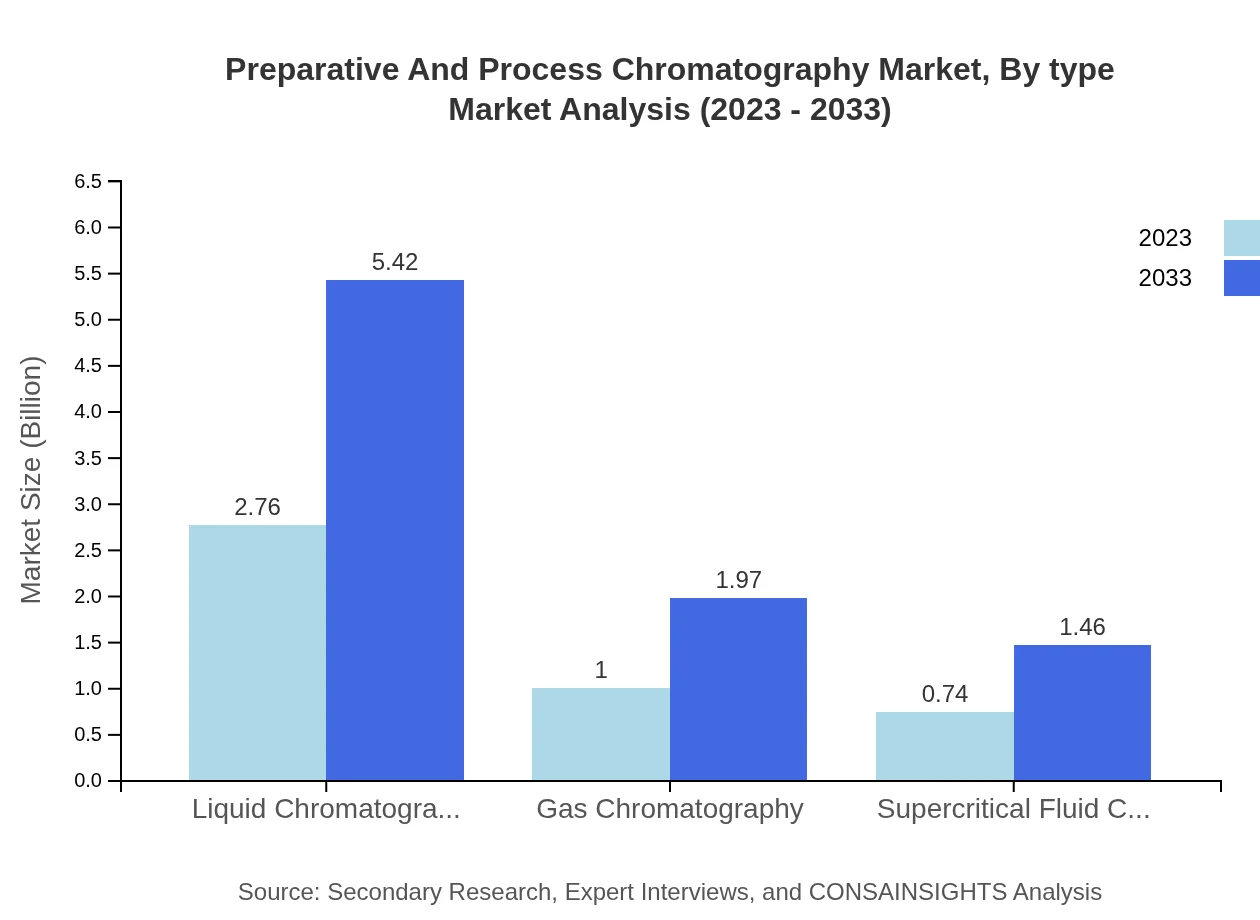

Preparative And Process Chromatography Market Analysis By Type

The market is categorized into Liquid Chromatography, Gas Chromatography, and Supercritical Fluid Chromatography. Liquid Chromatography dominates the segment, with a market size of $2.76 billion in 2023, expected to grow to $5.42 billion by 2033, holding a 61.23% share. Gas Chromatography is projected to rise from $1.00 billion to $1.97 billion, while Supercritical Fluid Chromatography is expected to grow from $0.74 billion to $1.46 billion, indicating a growing preference for diverse separation methods.

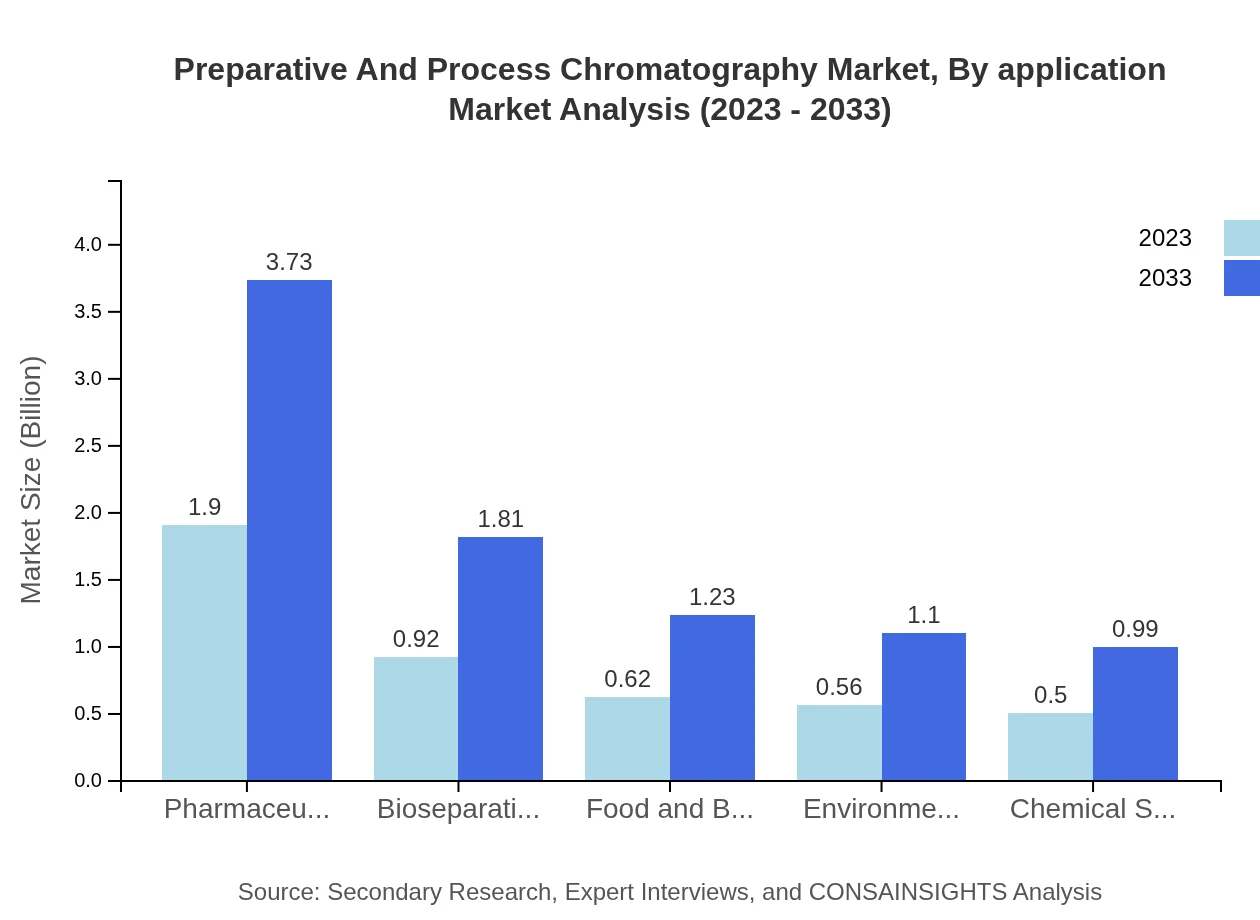

Preparative And Process Chromatography Market Analysis By Application

Applications of Preparative and Process Chromatography are diverse, targeting academia, pharmaceuticals, food and beverages, and environmental analysis. The pharmaceutical sector leads, accounting for over 42.12% of the market share in 2023, with expectations to grow due to rising drug development activities. Academic institutions follow closely, enhancing research capabilities and validation processes across various fields.

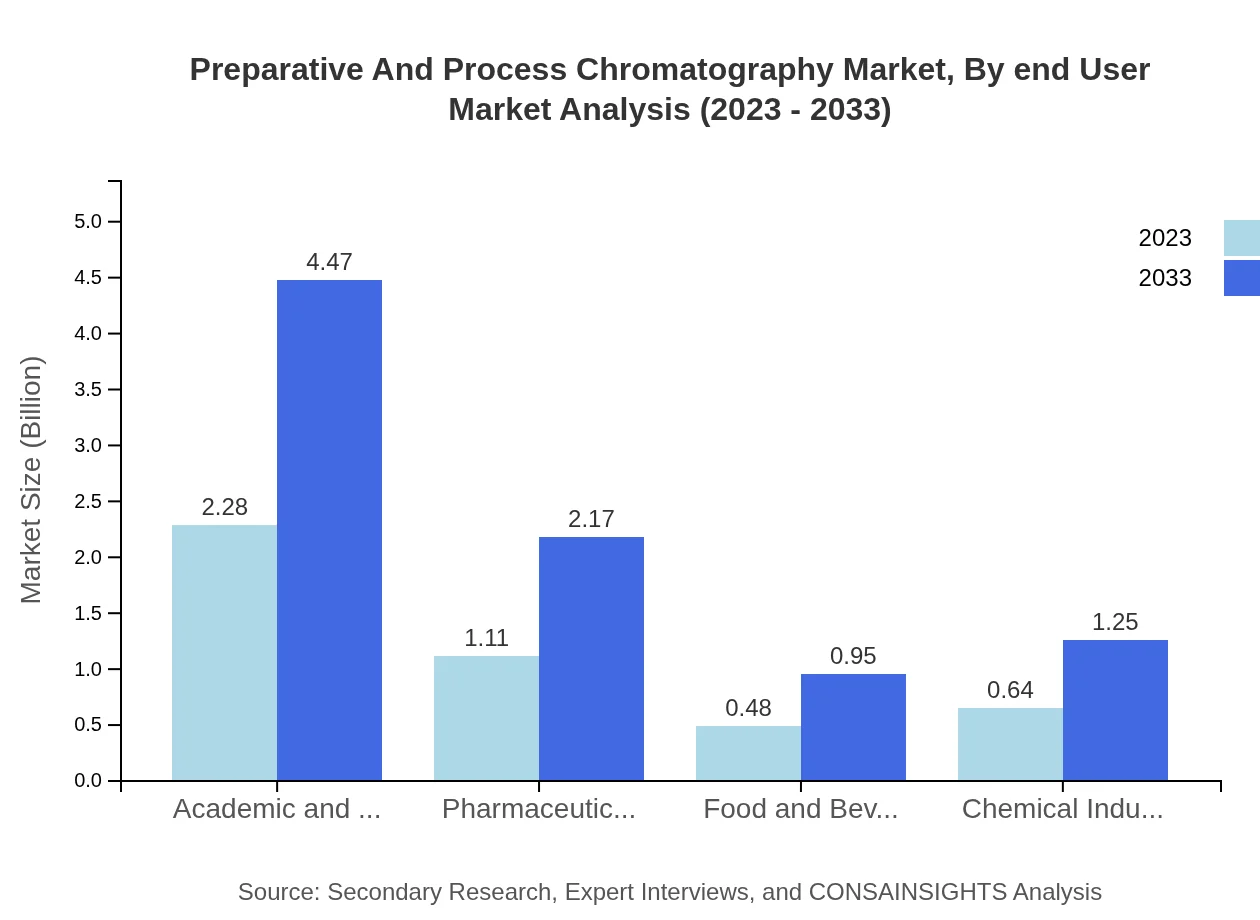

Preparative And Process Chromatography Market Analysis By End User

End-users of the Preparative and Process Chromatography market include pharmaceutical companies, biotech firms, academic, and research institutions. Pharmaceutical and biotech companies comprise the largest market segment, making up 24.56% of the market share in 2023. The academic sector is also critical, utilizing chromatography for innovative research and development.

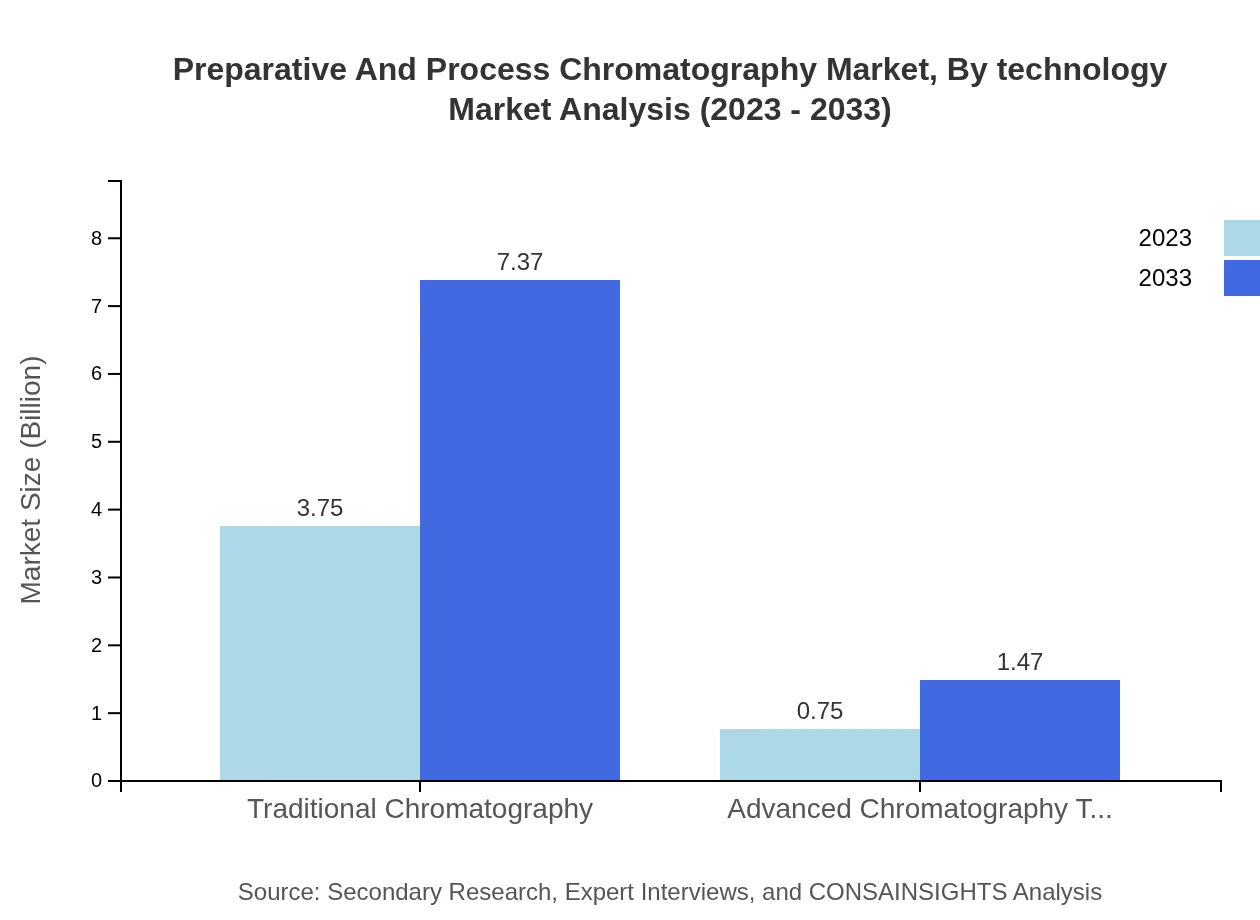

Preparative And Process Chromatography Market Analysis By Technology

Innovations in chromatography technologies such as automation and advanced data acquisition systems are critical for future growth. Techniques like advanced liquid chromatography and several novel applications are set to propel this evolution, enabling quicker, more accurate separations and analyses.

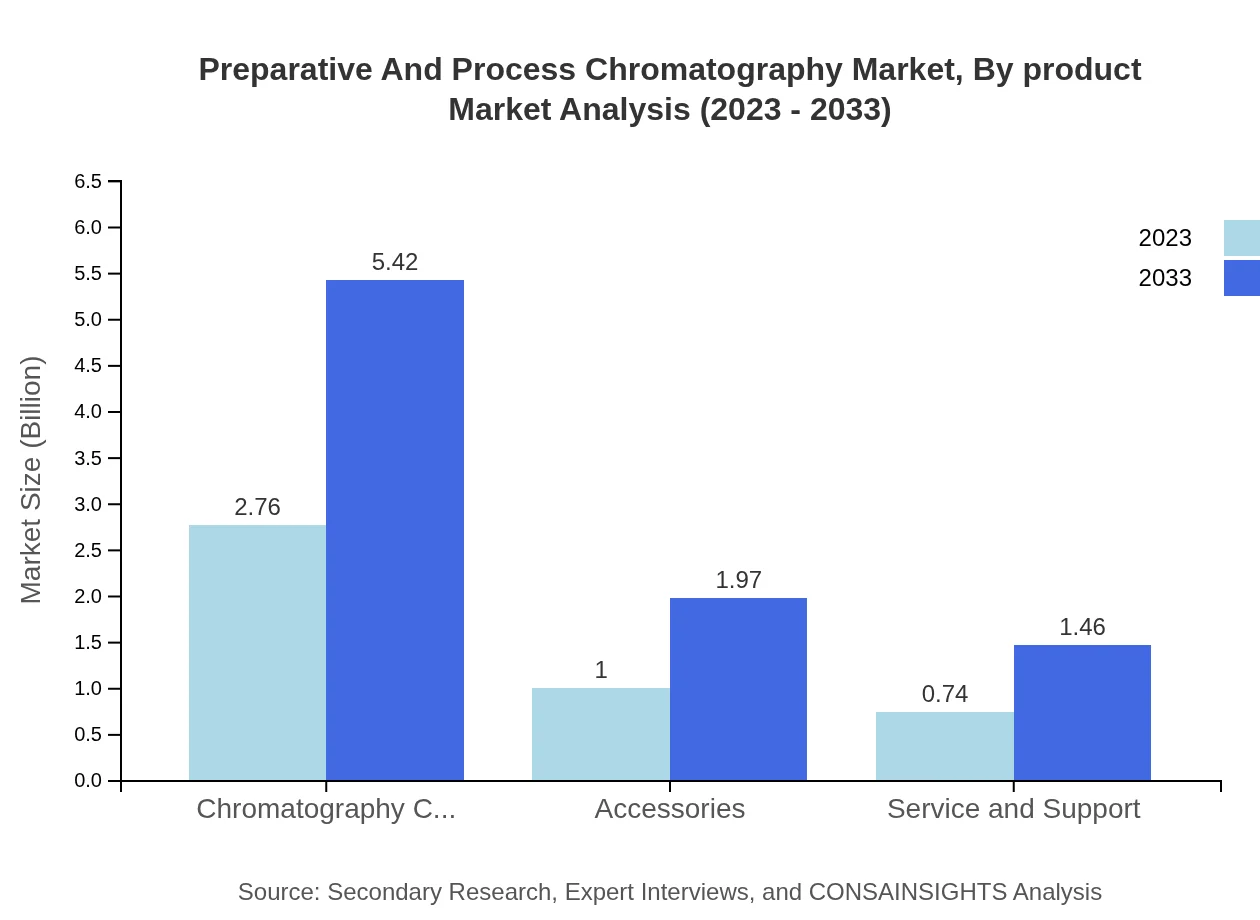

Preparative And Process Chromatography Market Analysis By Product

The product segment includes chromatography columns, various accessories, and service and support systems, which are crucial for ensuring the efficiency and operational capabilities of chromatographic systems. Instrumentation and consumables form a significant part of market revenues, emphasizing the importance of continued technological support.

Preparative And Process Chromatography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Preparative And Process Chromatography Industry

Agilent Technologies:

A leader in analytical instruments, Agilent offers innovative chromatography systems essential for separation processes in varied industries.Thermo Fisher Scientific:

Thermo Fisher provides chromatography solutions that enhance productivity and accuracy in laboratories across pharmaceuticals and academia.Waters Corporation:

Waters specializes in providing advanced liquid chromatography systems that support complex separations in research and quality assurance.Merck KGaA:

Merck is a key player in the chromatography domain, delivering essential materials and systems that streamline laboratory processes.PerkinElmer:

With a focus on environmental monitoring, PerkinElmer supplies innovative separation technologies that benefit sectors including pharmaceuticals and agriculture.We're grateful to work with incredible clients.

FAQs

What is the market size of preparative And Process Chromatography?

The global preparative and process chromatography market is projected to reach approximately $4.5 billion by 2033, growing at a CAGR of 6.8%. This growth reflects the increasing demand for efficient separation techniques across various industries.

What are the key market players or companies in this preparative And Process Chromatography industry?

Key players in the preparative and process chromatography market include major companies like Agilent Technologies, Merck KGaA, and Waters Corporation. These companies innovate continuously to offer advanced solutions in chromatography technologies.

What are the primary factors driving the growth in the preparative And Process Chromatography industry?

The growth in the preparative and process chromatography market is driven by factors such as increasing demand for pharmaceuticals, advancements in chromatography technology, and the growing focus on environmental analysis, ensuring effective separation and purification processes.

Which region is the fastest Growing in the preparative And Process Chromatography?

Europe is the fastest-growing region in the preparative and process chromatography market, projected to grow from $1.25 billion in 2023 to $2.45 billion by 2033, demonstrating a strong demand for advanced analytical methods.

Does ConsaInsights provide customized market report data for the preparative And Process Chromatography industry?

Yes, ConsaInsights offers customized market report data tailored to the preparative and process chromatography industry, allowing clients to address specific needs and obtain insights relevant to their business objectives.

What deliverables can I expect from this preparative And Process Chromatography market research project?

Expected deliverables from the preparative and process chromatography market research project include comprehensive market analysis, insights on competitive landscape, growth forecasts, and detailed regional and segment data to assist strategic decision-making.

What are the market trends of preparative And Process Chromatography?

Current trends in the preparative and process chromatography market include an increasing preference for automation, emerging technologies like supercritical fluid chromatography, and the integration of advanced analytical techniques driven by stringent regulatory requirements.