Prepared Food Equipment Market Report

Published Date: 31 January 2026 | Report Code: prepared-food-equipment

Prepared Food Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Prepared Food Equipment market, covering key insights, statistical data, and forecasts from 2023 to 2033. It includes market size, growth factors, segmentation, regional performance, and trends shaping the industry.

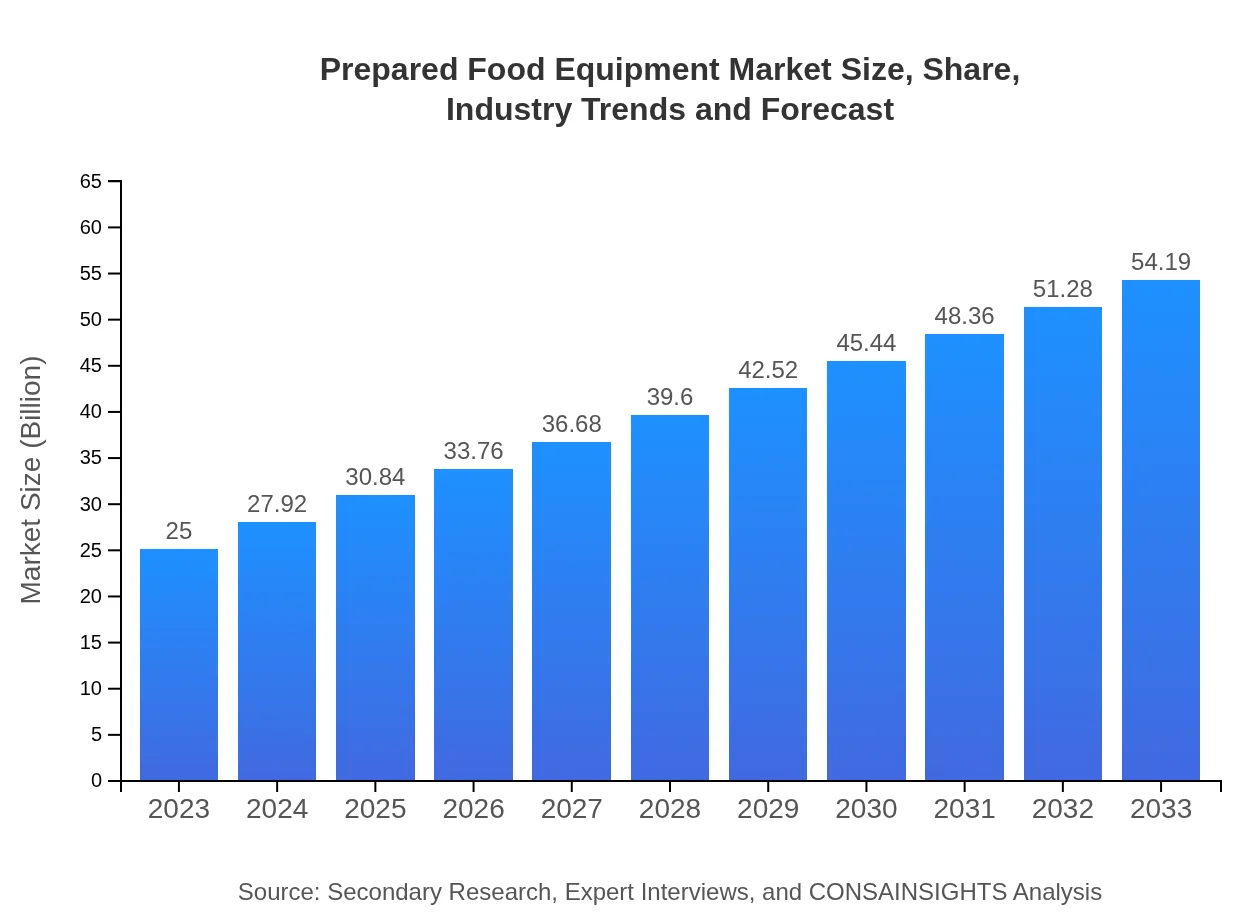

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $54.19 Billion |

| Top Companies | Ali Group, Middleby Corporation |

| Last Modified Date | 31 January 2026 |

Prepared Food Equipment Market Overview

Customize Prepared Food Equipment Market Report market research report

- ✔ Get in-depth analysis of Prepared Food Equipment market size, growth, and forecasts.

- ✔ Understand Prepared Food Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Prepared Food Equipment

What is the Market Size & CAGR of Prepared Food Equipment market in 2023?

Prepared Food Equipment Industry Analysis

Prepared Food Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Prepared Food Equipment Market Analysis Report by Region

Europe Prepared Food Equipment Market Report:

In Europe, the market is projected to grow from $6.69 billion in 2023 to $14.51 billion by 2033. The region is witnessing a surge in demand for energy-efficient and automated food equipment, driven by sustainability initiatives and a growing awareness of health and nutrition.Asia Pacific Prepared Food Equipment Market Report:

In 2023, the Prepared Food Equipment market in the Asia Pacific region is valued at approximately $4.97 billion, expected to grow to $10.78 billion by 2033. The rise in population, urbanization, and an increasing trend toward ready-to-eat meals is boosting demand for advanced food processing equipment in countries like China and India.North America Prepared Food Equipment Market Report:

The North American Prepared Food Equipment market is one of the largest, valued at $9.39 billion in 2023, with expectations to reach $20.36 billion by 2033. The growth can be attributed to technological advancements and a strong emphasis on food safety regulations enhancing demand across various sectors.South America Prepared Food Equipment Market Report:

The South American Prepared Food Equipment market is estimated to be worth $1.28 billion in 2023 and is projected to double to $2.78 billion by 2033. The growth is driven by the increasing investment in the food service sector and changing consumer preferences toward quick-service restaurants.Middle East & Africa Prepared Food Equipment Market Report:

The Prepared Food Equipment market in the Middle East and Africa is estimated at $2.66 billion in 2023, with projections to reach $5.77 billion by 2033. The growth is fueled by rapid urbanization, increasing food consumption, and expansion in the hospitality sector.Tell us your focus area and get a customized research report.

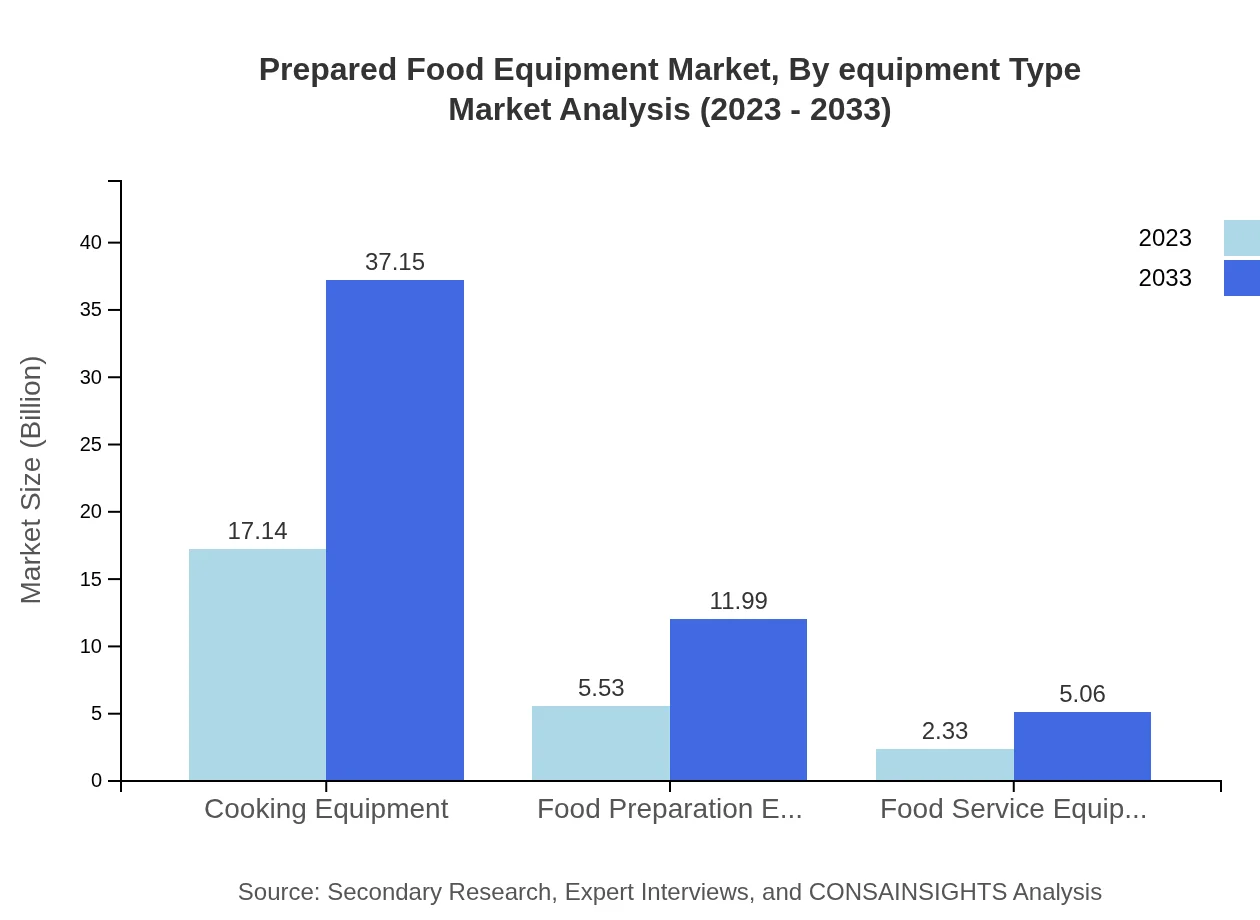

Prepared Food Equipment Market Analysis By Equipment Type

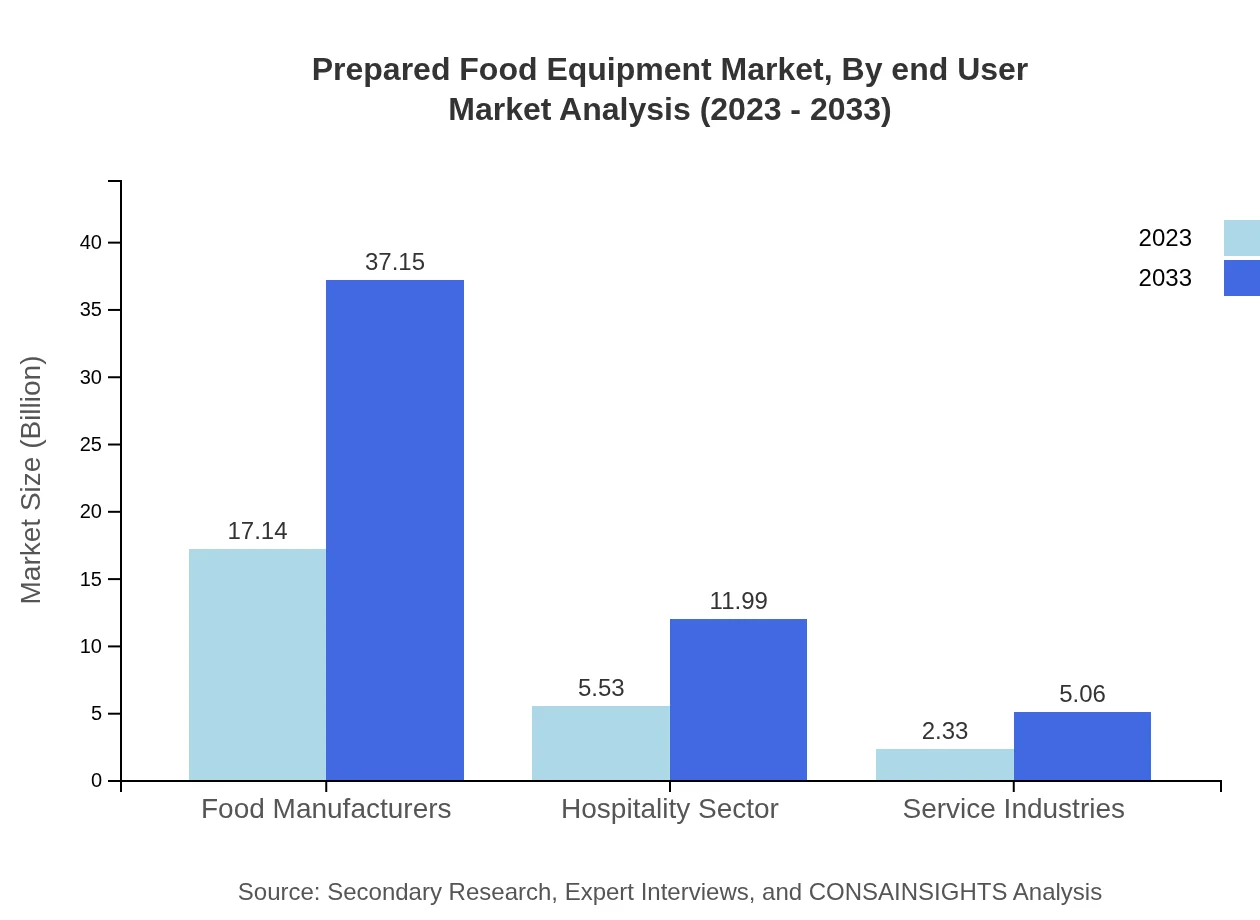

The food manufacturers segment dominates the Prepared Food Equipment market, expected to grow from $17.14 billion in 2023 to $37.15 billion by 2033, accounting for 68.55% market share. Other notable segments include the hospitality sector experiencing growth from $5.53 billion to $11.99 billion, reflecting a strong market interest among restaurants and catering services.

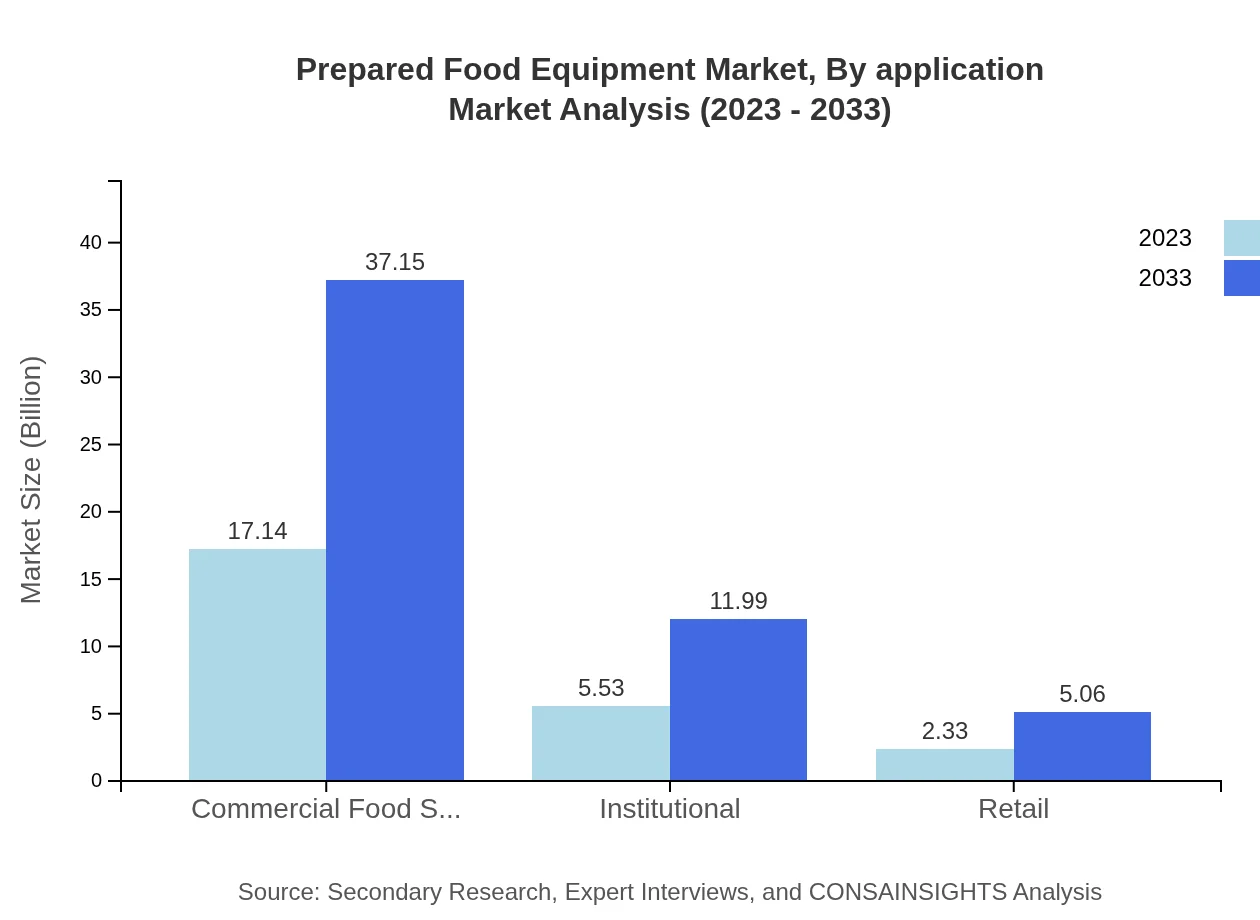

Prepared Food Equipment Market Analysis By Application

In the application segment, the commercial food service dominates the market, with a size expected to grow from $17.14 billion in 2023 to $37.15 billion by 2033, commanding a substantial share of the market. Institutions and retail are also contributing sectors, indicating a diversified demand for food equipment across various applications.

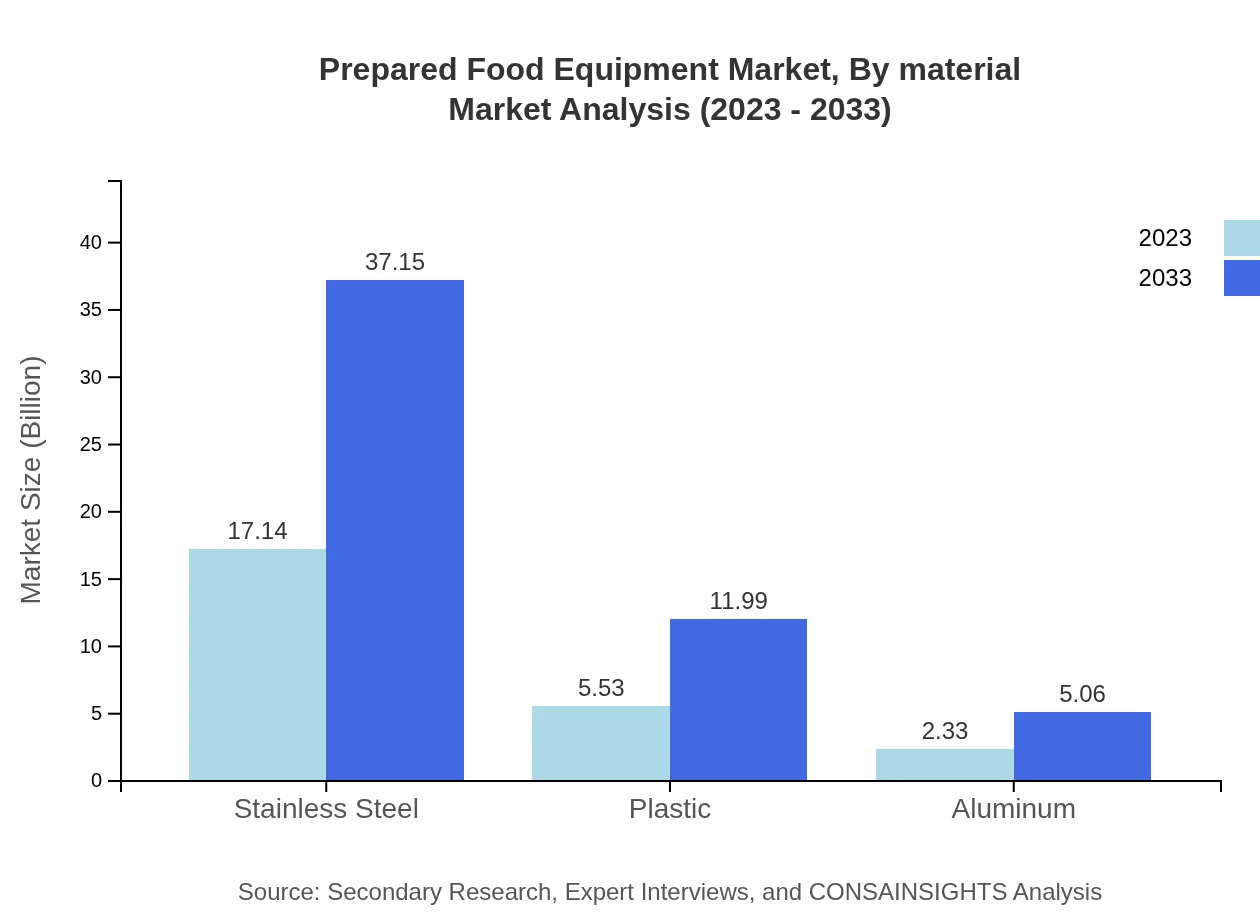

Prepared Food Equipment Market Analysis By Material

The material segment sees stainless steel leading the market, growing from $17.14 billion in 2023 to $37.15 billion by 2033, representing 68.55% of the market share. Plastic and aluminum are also significant materials, expected to grow due to benefits like cost-effectiveness and durability.

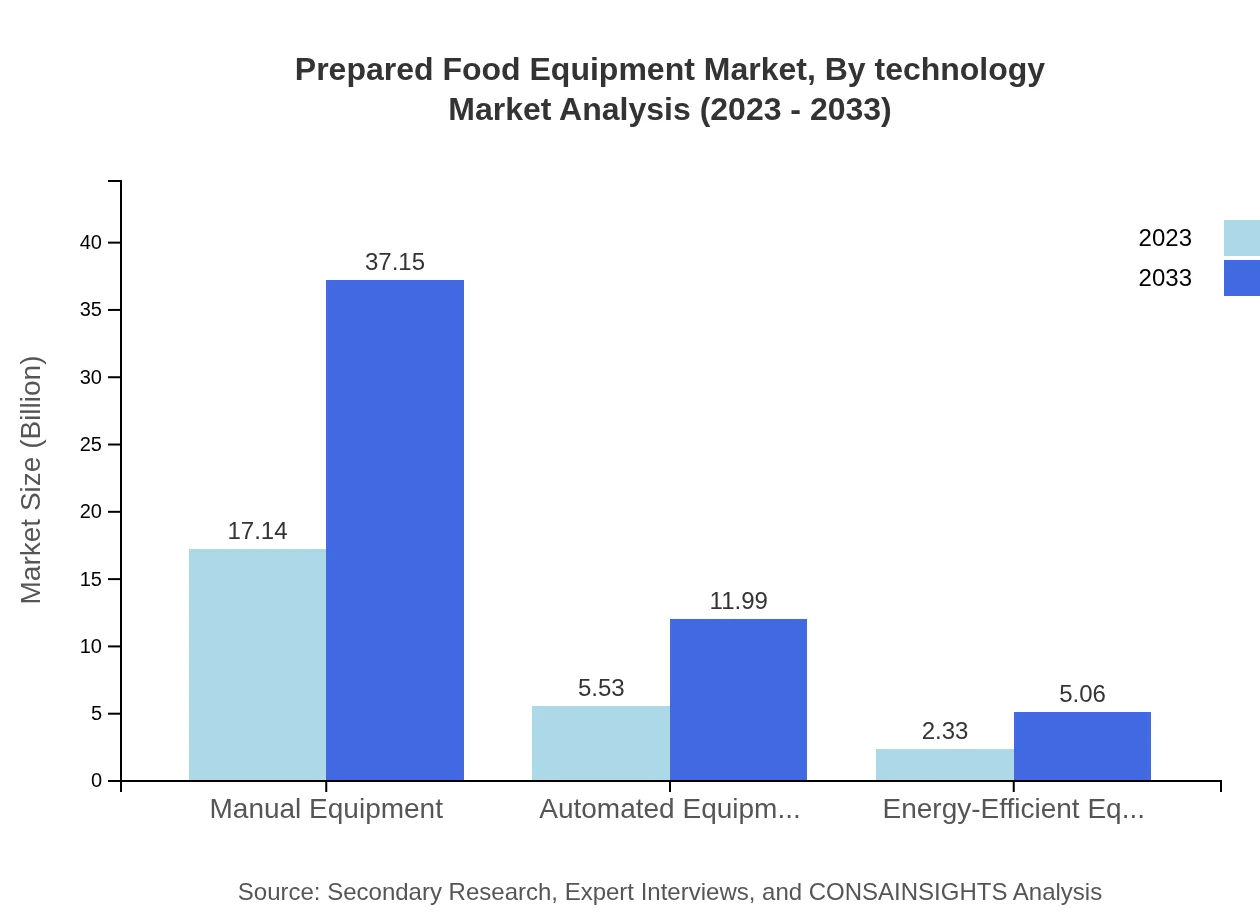

Prepared Food Equipment Market Analysis By Technology

The trend toward energy-efficient equipment is gaining traction, predicted to grow from $2.33 billion in 2023 to $5.06 billion by 2033. The adoption of automated solutions is also increasing, as businesses aim to optimize operations and reduce labor costs.

Prepared Food Equipment Market Analysis By End User

The food manufacturers sector continues to be the largest end-user, with market growth from $17.14 billion to $37.15 billion, representing 68.55% of the market share. The hospitality sector and service industries are also critical end-users, demonstrating a growing need for efficient food preparation and service solutions.

Prepared Food Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Prepared Food Equipment Industry

Ali Group:

A leading global provider of food service equipment, Ali Group's extensive product portfolio includes cooking appliances, refrigeration, and food preparation equipment, known for innovation and quality.Middleby Corporation:

Middleby Corporation specializes in commercial food service equipment, offering advanced cooking technologies and automation solutions that enhance food preparation efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of prepared Food Equipment?

The prepared food equipment market is projected to reach approximately $25 billion by 2033, with a robust CAGR of 7.8% from 2023. This indicates significant growth potential in the sector, driven by increasing demand for convenient food solutions.

What are the key market players or companies in this prepared Food Equipment industry?

Key players in the prepared food equipment industry include major manufacturers and suppliers who are leaders in technology and innovation. Many of these companies focus on sustainability and automation to meet evolving consumer demands.

What are the primary factors driving the growth in the prepared Food Equipment industry?

Drivers of growth in the prepared food equipment industry include rising consumer demand for convenience, technological advancements, an increase in food service establishments, and the growing emphasis on food safety and efficiency in production processes.

Which region is the fastest Growing in the prepared Food Equipment?

The North America region is the fastest-growing in the prepared food equipment market, projected to grow from $9.39 billion in 2023 to $20.36 billion in 2033, highlighting its increasing demand for advanced food processing solutions.

Does ConsInsights provide customized market report data for the prepared Food Equipment industry?

Yes, ConsInsights offers customized market report data tailored to meet specific needs within the prepared food equipment industry, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this prepared Food Equipment market research project?

Deliverables from the prepared food equipment market research project typically include comprehensive reports, detailed market analysis, trend forecasts, segment breakdowns, and strategic recommendations based on the latest data.

What are the market trends of prepared Food Equipment?

Market trends in prepared food equipment include a shift toward automation, increased focus on energy efficiency, the rise in demand for packaged food solutions, and innovations in health-oriented products that cater to changing consumer preferences.